BY ORDER OF THE

SECRETARY OF THE AIR FORCE

DEPARTMENT OF THE AIR FORCE

INSTRUCTION 64-117

19 MAY 2022

Acquisition

GOVERNMENT PURCHASE CARD

PROGRAM

COMPLIANCE WITH THIS PUBLICATION IS MANDATORY

ACCESSIBILITY: Publication and forms are available for downloading or ordering on the e-

Publishing website at https://e-publishing.af.mil

RELEASABILITY: There are no releasability restrictions on this publication.

OPR: SAF/AQCA Certified by: SAF/AQC

(Major General Cameron G. Holt)

Supersedes: AFI 64-117, 22 June 2018 Pages: 96

This publication implements Air Force Policy Directive (AFPD) 64-1, The Contracting System.

This publication provides guidance and procedures for the management of the Government

Purchase Card (GPC) program. It implements and supplements sections of the Department of

Defense (DoD) Government Charge Card Guide for Establishing and Managing Purchase,

Travel, and Fuel Card Programs (June 3, 2020, revised). Refer to the Department of Defense

Government Charge Card Guide for Establishing and Managing Purchase, Travel, and Fuel Card

programshttps://www.acq.osd.mil/asda/dpc/ce/pc/docs/guidesdocs/DoD_Govt_Charge_Card_Gu

ide_06_03-20.pdf if information is not discussed in this Department of the Air Force Instruction

(DAFI); if this DAFI is in conflict with the DoD GPC Policy, the DoD GPC Policy should be

followed. This DAFI applies to all DAF GPC purchases utilizing appropriated funds. (Reference

AFMAN 64-118, Air Force Nonappropriated Fund (NAF) Government Purchase Card program

for purchases using Nonappropriated Funds or DAFMAN 52-107, Chapel Tithes and Offerings

Fund (CTOF) Management for purchases using CTOF.). This publication applies to Department

of the Air Force civilian employees and uniformed members of the United States Space Force, the

Regular Air Force, Air Force Reserve, and Non-DAF tenant organizations issued GPCs or

convenience checks through a DAF contracting activity. This instruction does not apply to the Air

National Guard. Reference the Department of the Army Government Purchase Card Operating

Procedures for Air National Guard GPC related matters. This instruction requires the collection

and/or maintenance of information protected by the Privacy Act of 1974 authorized by Department

of Defense Directive (DoDI) 5400.11, DoD Privacy and Civil Liberties Programs. The applicable

SORN(s) [number and title] is (are) available at: http://dpclo.defense.gov/Privacy/SORNs.aspx.

2 DAFI64-117 19 MAY 2022

The applicable System of Record Notice Defense Manpower Data Center 02 DoD, Defense

Enrollment Eligibility Reporting Systems (DEERS), is available at:

http://dpclo.defense.gov/Privacy/SORNs.aspx. Ensure all records created as a result of

processes prescribed in this publication adhere to AFI 33-322, Records Management and

Information Governance program, and disposed in accordance with the Air Force Records

Disposition Schedule, which is located in the Air Force Records Information Management System.

Refer recommended changes and questions about this publication to the Office of Primary

Responsibility (OPR) using the AF Form 847, Recommendation for Change of Publication; route

AF Forms 847 from the field through the appropriate functional chain of command. This

publication may be supplemented at any level, but all Supplements must be routed to the OPR of

this publication for coordination prior to certification and approval. The authorities to waive

wing/unit level requirements in this publication are identified with a Tier (“T-0, T-1, T-2, T-3”)

number following the compliance statement. See Department of the Air Force Instruction (DAFI)

33-360, Publications and Forms Management, for a description of the authorities associated with

the Tier numbers. Submit requests for waivers through the chain of command to the appropriate

Tier waiver approval authority, or alternately, to the requestors commander for non-tiered

compliance items. Compliance with the attachments in this publication is mandatory. AF Form

679, Air Force Publication Compliance Item Waiver Request/Approval may be used. The use of

the name or mark of any specific manufacturer, commercial product, commodity, or service in this

publication does not imply endorsement by the DAF. Compliance with Attachment 2 of this

publication is mandatory.

SUMMARY OF CHANGES

This document has been substantially revised from AFI 64-117, Government Purchase Card

Program dated 22 June 2018 and needs to be completely reviewed. Major changes include

incorporating DoD Defense Pricing & Contract (DPC) eContracting updates as related to

SmartPay

®

3 (SP3) GSA Contract, Department of Defense SP3 Government-wide Commercial

Purchase Card Oversight, and Reporting – SP3 Transition Memorandums #1 through #12 and

inclusion of the United States Space Force (USSF).

Chapter 1—PROGRAM OVERVIEW 8

1.1. Overview. ................................................................................................................. 8

1.2. Purchase Card .......................................................................................................... 8

1.3. Purchase Card Uses. ................................................................................................ 8

1.4. Information Process. ................................................................................................ 8

Chapter 2—ROLES AND RESPONSIBILITIES 10

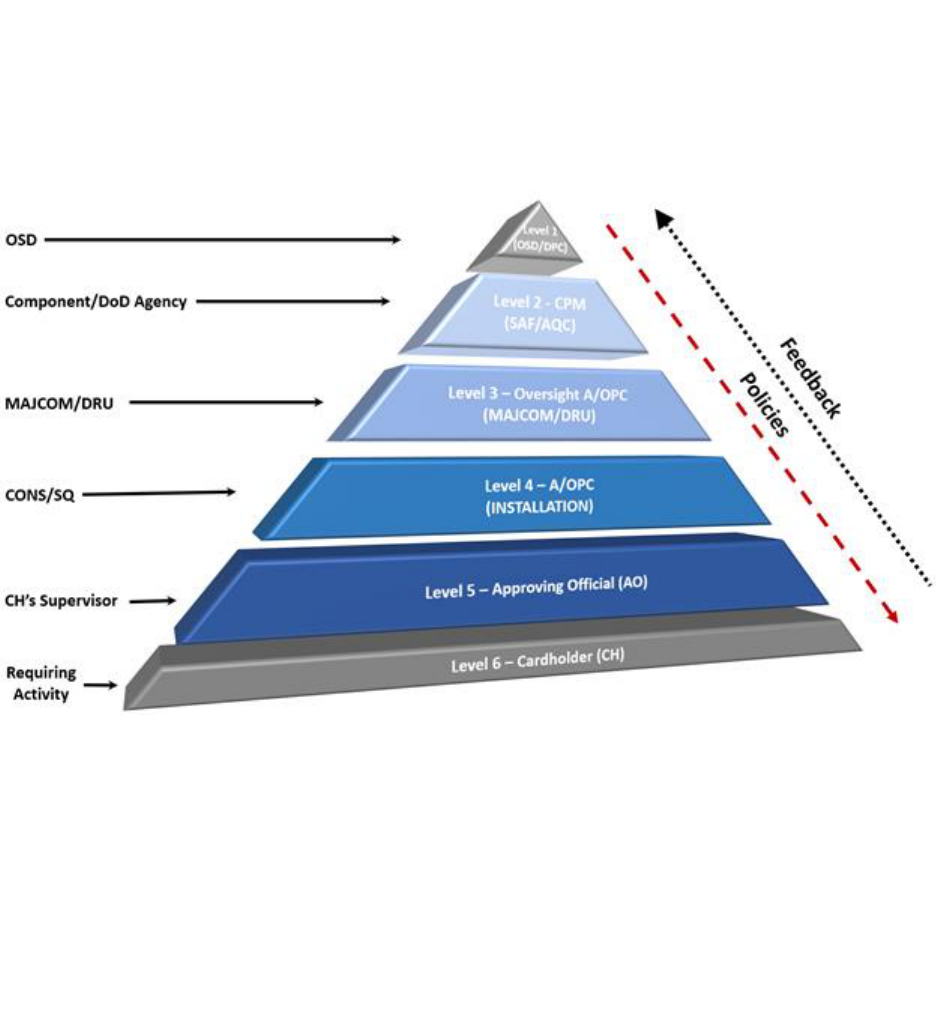

2.1. Program Structure. ................................................................................................... 10

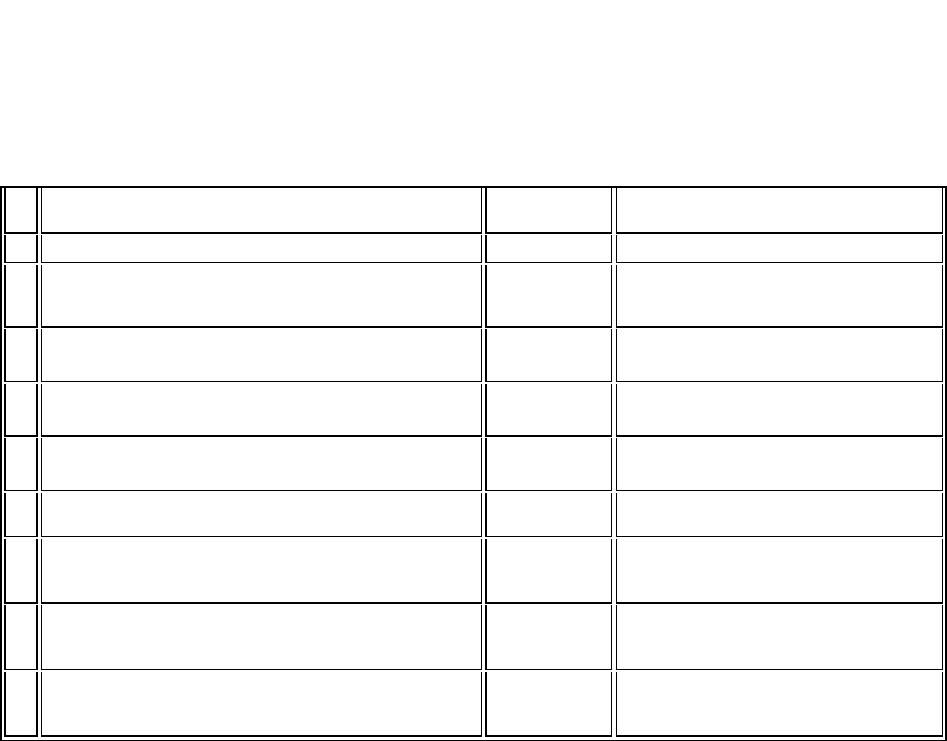

Figure 2.1. GPC Hierarchy. ........................................................................................................ 10

2.2. Responsibilities. ....................................................................................................... 10

2.3. The Card Issuing Bank (the bank) ........................................................................... 23

DAFI64-117 19 MAY 2022 3

Chapter 3—GOVERNMENT PURCHASE CARD SYSTEMS 24

3.1. MasterCard

®

Insights on Demand (IOD) by Oversight. .......................................... 24

3.2. ECARS. ................................................................................................................... 24

3.3. Federal Procurement Data System - Next Generation. ............................................ 24

3.4. The Card Issuing Bank’s Electronic Access System ............................................... 25

3.5. Defense Enterprise Accounting and Management System. ..................................... 25

3.6. Integrated Accounts Payable System. ...................................................................... 25

Chapter 4—TRAINING 26

4.1. Mandatory Training. ................................................................................................ 26

Table 4.1. DAF GPC Role Specific Training Requirements. ................................................... 27

4.2. Refresher Training ................................................................................................... 29

4.3. Optional Training. .................................................................................................... 29

Chapter 5—FUNDING, PAYMENT AND REBATES 30

5.1. Financial Management Requirements. ..................................................................... 30

5.2. AF Form 4009, Government Purchase Card Fund Cite Authorization. ................... 30

5.3. Funding. ................................................................................................................... 30

5.4. Reallocation. ............................................................................................................ 31

5.5. Reconciliation Issues. .............................................................................................. 31

5.6. Financial Management Certification of the Bank Statement for Payment. ............. 31

5.7. Defense Financial Accounting Services Processing. ............................................... 31

5.8. GPC Rebates/Credits. .............................................................................................. 32

5.9. 13th Month Billing Cycle. ....................................................................................... 33

5.10. Fiscal Year End Close-out Procedures .................................................................... 33

Chapter 6—GOVERNMENT PURCHASE CARD PROCESSES 35

6.1. Accounts. ................................................................................................................. 35

6.2. Termination or Closure of Accounts. ....................................................................... 36

6.3. Data Access by Non-Program Officials. .................................................................. 36

6.4. Bank Secrecy and Patriot Acts ................................................................................. 36

6.5. Records Management .............................................................................................. 37

6.6. Freedom of Information Act (FOIA) Requests. ....................................................... 37

Chapter 7—GOVERNMENT PURCHASE CARD USAGE 38

7.1. Authorized Use. ....................................................................................................... 38

4 DAFI64-117 19 MAY 2022

7.2. Continental United States (CONUS) Purchases for Overseas. ................................ 41

7.3. Outside the Continental United States (OCONUS) Purchases. ............................... 41

7.4. Merchant Category Code. ........................................................................................ 41

7.5. Order Management Log. .......................................................................................... 42

7.6. Pick Up (of items), Shipping, Delivery. .................................................................. 42

7.7. Receipt, Accountability and Disposal of Property. .................................................. 43

7.8. Tuition Assistance Program. .................................................................................... 44

7.9. Third-Party Payment Service (e.g., PayPal .............................................................. 44

7.10. Advance Conference Registration Fee. .................................................................... 45

7.11. Improper Purchases. ................................................................................................. 45

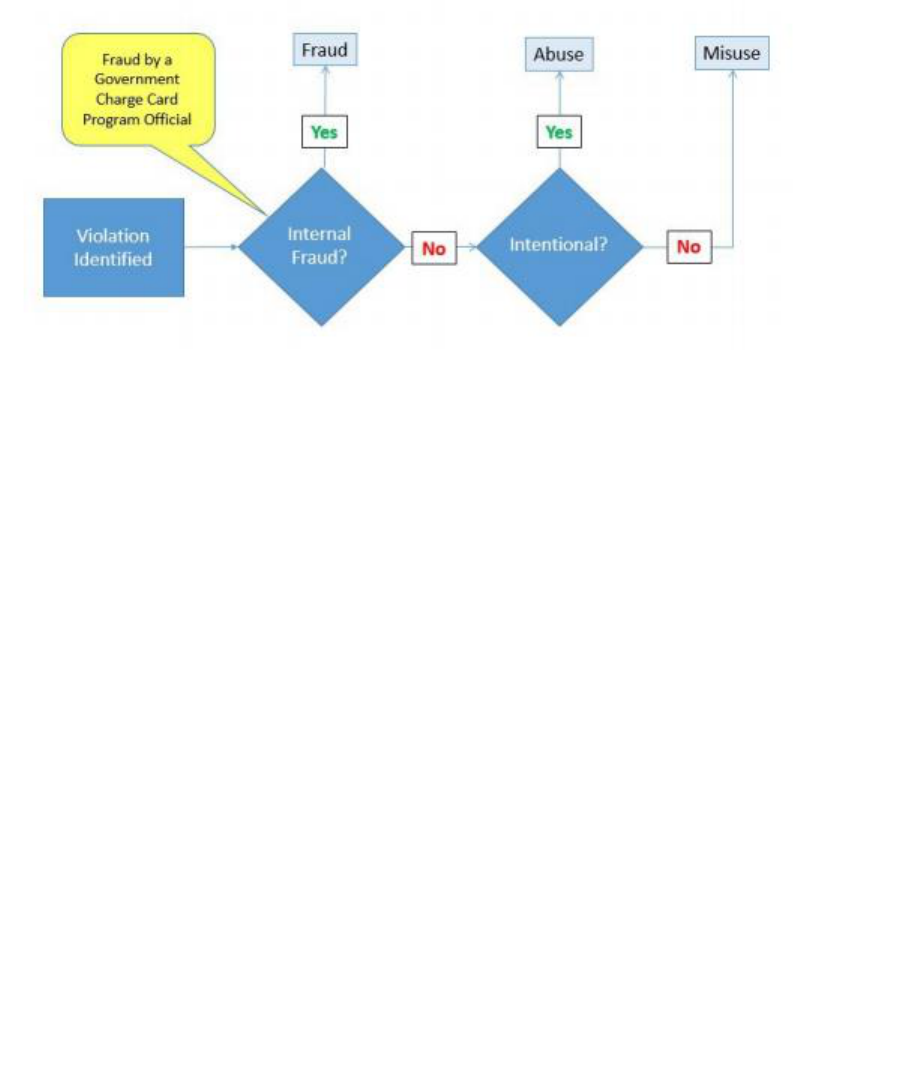

Figure 7.1. Violation Category Decision Framework. ............................................................... 46

7.12. Purchases Requiring Additional Authorization or Documentation ......................... 46

7.13. Disputes, Defective Items and Fraudulent Transactions. ......................................... 51

7.14. Non-Disputable Charges. ......................................................................................... 51

Chapter 8—PROHIBITIONS FOR GPC AND CONVENIENCE CHECKS 53

8.1. Prohibited Purchases. ............................................................................................... 53

8.2. Aircraft fuel and oil. ................................................................................................. 53

8.3. Appliances Acquired for Personal Use in a Work Environment. ............................ 53

8.4. Bail and Bond Payments. ......................................................................................... 53

8.5. Betting, Casino Gaming Chips, and Off-Track Betting. .......................................... 53

8.6. Cash Advances. ........................................................................................................ 53

8.7. Cash Refunds. .......................................................................................................... 54

8.8. Checkout Fees. ......................................................................................................... 54

8.9. Classified Requirements. ......................................................................................... 54

8.10. Construction Services over $2,000 .......................................................................... 54

8.11. Purchases from Military or Civilian Government Employees. ................................ 54

8.12. Court Costs, Alimony, and Child Support. .............................................................. 54

8.13. Dating and Escort Services ...................................................................................... 54

8.14. Donations to or Payment of Expenses for Private Organizations or Membership

Dues in Professional Organizations. ........................................................................ 54

8.15. Entertainment Items. ................................................................................................ 54

8.16. Equal Employment Opportunity (EEO) Settlements ............................................... 55

DAFI64-117 19 MAY 2022 5

8.17. Equipment, Systems, and Services Using Covered Telecommunications

Equipment or Services as a Substantial Component or Critical Technology. ......... 55

8.18. Fines ......................................................................................................................... 55

8.19. Food and Meals. ....................................................................................................... 55

8.20. Foreign Currency ..................................................................................................... 55

8.21. Gift Certificates and Gift Cards. .............................................................................. 55

8.22. Hardware, Software, and Services Developed or Provided by Kaspersky Lab. ...... 55

8.23. Items/Services for the Personal Benefit of Government Employees. ...................... 55

8.24. Long-Term Lease of Land and Buildings. ............................................................... 55

8.25. Personal use. ............................................................................................................ 55

8.26. Preferred Use Memberships. .................................................................................... 55

8.27. Purchases Requiring Advance Payments. ................................................................ 56

8.28. Recurring or Repeat Purchases ................................................................................ 56

8.29. Salaries and Wages. ................................................................................................. 56

8.30. Savings Bonds. ......................................................................................................... 56

8.31. Services Acquisitions Greater than $2,500. ............................................................. 56

8.32. Short Term Lease/Rental of Banquet Halls or Similar Facilities for Non-Mission

Related Events ......................................................................................................... 56

8.33. Split Purchases. ........................................................................................................ 56

8.34. Taxes. ....................................................................................................................... 57

8.35. Telecommunication Systems. .................................................................................. 57

8.36. Travel Advances, Claims, or Expenses. ................................................................... 57

8.37. Vehicle-Related Expenses. ...................................................................................... 57

8.38. Video Surveillance Cameras. ................................................................................... 57

8.39. Weapons, Ammunition, and Explosives. ................................................................. 57

8.40. Use of Merchant Category Code 000 ....................................................................... 57

Chapter 9—CONVENIENCE CHECK ACCOUNTS 58

9.1. Convenience Check Accounts. ................................................................................ 58

9.2. Unauthorized Use. ................................................................................................... 59

9.3. Funding. ................................................................................................................... 60

Chapter 10—GOVERNMENT PURCHASE CARD USE FOR EMERGENCY

ACQUISITIONS 61

10.1. Emergency Acquisition Flexibility (EAF). .............................................................. 61

6 DAFI64-117 19 MAY 2022

10.2. Emergency Thresholds. ........................................................................................... 61

Table 10.1. Table10.1. GPC MPT Values for Contingency Contracting ................................... 61

10.3. Responsibilities ........................................................................................................ 62

10.4. Deviations and Risks. .............................................................................................. 65

10.5. Reconciling Transactions in an Emergency Environment. ...................................... 65

Chapter 11—PURCHASES ABOVE THE MICRO-PURCHASE THRESHOLD 66

11.1. Purchases Above the MPT. ...................................................................................... 66

11.2. Contract Payment Method. ...................................................................................... 66

11.3. Guidance on Program Setup for Contract Ordering Officials. ................................. 66

11.4. Pre-Transaction. ....................................................................................................... 67

11.5. Post-Transaction. ..................................................................................................... 68

11.6. Program setup for GPC as method of Contract Payments. ...................................... 68

Chapter 12—OVERSIGHT 69

12.1. GPC Oversight Requirements. ................................................................................. 69

12.2. Monthly Reviews ..................................................................................................... 69

12.3. Semi-Annual Reviews ............................................................................................. 70

12.4. CPM (Level 2) Program Management Review (PMR) ........................................... 71

12.5. Purchase Card Oversight Module (PCOM). ............................................................ 72

Chapter 13—CORRECTIVE ACTIONS 73

13.1. Corrective Actions of Violations. ............................................................................ 73

13.2. Discovery. ................................................................................................................ 73

13.3. Major Violations. ..................................................................................................... 73

13.4. Disputing and Resolving Fraudulent and Erroneous Transactions. ......................... 74

13.5. Corrective Actions. .................................................................................................. 74

13.6. Pecuniary Liability. .................................................................................................. 75

13.7. Disciplinary Actions. ............................................................................................... 75

13.8. Clearance Revocation. ............................................................................................. 76

13.9. Criminal Prosecution ............................................................................................... 76

Chapter 14—REPORTS 77

14.1. Reports in General ................................................................................................... 77

14.2. ECARS vs FPDS-NG Comparison Report. ............................................................. 77

14.3. The Bank Reports. ................................................................................................... 77

DAFI64-117 19 MAY 2022 7

Attachment 1—GLOSSARY OF REFERENCES AND SUPPORTING INFORMATION 78

Attachment 2—COMMERCIAL PURCHASE CARD (GPC) ROLES AND GPC

CARDHOLDER SPECIAL DESIGNATION AUTHORITY TYPES 83

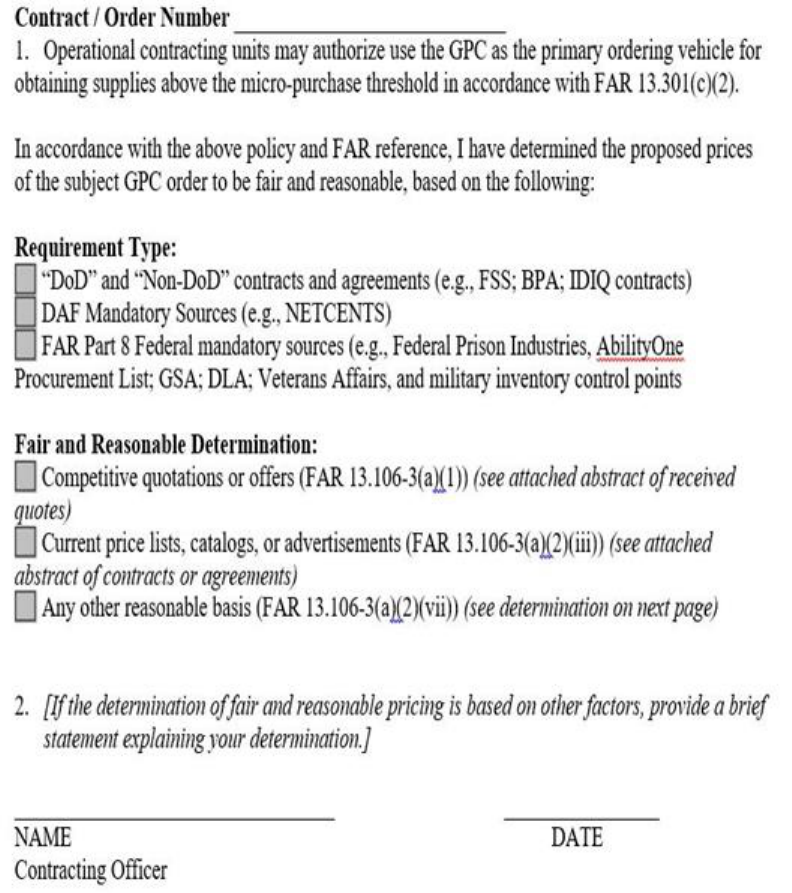

Attachment 3—DETERMINATION OF FAIR AND REASONABLE PRICING 93

Attachment 4—COMMERCIAL PURCHASE CARD (GPC) ROLE SPECIFIC

TRAINING REQUIREMENTS 94

Attachment 5—GOVERNMENT PURCHASE CARD (GPC) MICRO-PURCHASE

THRESHOLD (MPT) 96

8 DAFI64-117 19 MAY 2022

Chapter 1

PROGRAM OVERVIEW

1.1. Overview. The Government Purchase Card (GPC) program provides DAF and supported

organizations a simplified, streamlined method of purchasing and paying for supplies, services,

construction projects, and making contract payments. The program complies with Federal, DoD,

and DAF statutory and regulatory guidance, as well as the terms and conditions specified in the

most current General Services Administration (GSA) SmartPay

®

Master Contract. Contracting

authority flows from the Deputy Assistant Secretary (Contracting), Assistant Secretary

(Acquisition) (SAF/AQC) to the Head of Contracting Activity (HCA). The HCA may re-delegate

contracting authority to local procurement offices. The Chief of Contracting within those

procurement offices may re-delegate their contracting authority to purchase cardholders (CH) and

convenience check account holders through the Delegation of Contracting Authority Letter

produced in the Joint Appointment Module (JAM) within Procurement Integrated Enterprise

Environment (PIEE) https://piee.eb.mil/xhtml/unauth/home/login.xhtml. CHs must

countersign to acknowledge this responsibility. (T-0) Failure to observe the prohibitions and

mandatory provisions in paragraphs 8, 13.1 and 13.6 of this publication by military members is a

violation of Article 92 of the Uniform Code of Military Justice (UCMJ).

1.2. Purchase Card Benefits. The GPC program provides commercial purchase and payment

services that replaces the paper-based, time-consuming purchase order process. The program,

streamlines the acquisition of tactical requirements, and reduces procurement lead time and

procurement office workload. The DAF has received permission from the Office of the Secretary

of Defense (OSD) to utilize the pay and confirm process to maximize potential rebates. This

process means payments must be certified within five (5) calendar days of receipt of supplies or

services. Utilization of pay and confirm provides transaction cost savings, a reduction in interest

payment, and allows for the DAF to receive rebates.

1.3. Purchase Card Uses. As stated in Federal Acquisition Regulation (FAR) 13.301,

Government-wide commercial purchase card, the purchase card is authorized for use for: (1)

micro-purchases (as defined in the (FAR 2.101; (2) placing task or delivery orders (if authorized

in the basic contract, ordering agreement, or blanket purchase agreement); or making payments,

when the contractor agrees to accept payment by the card. When using the GPC as a method of

payment, CHs must follow FAR 32.1108, Payment by government-wide commercial purchase

card. (T-0) Appropriated fund GPCs cannot purchase against non-appropriated funds contracts.

1.4. Information Process. CHs should direct all questions to their approving official (AO) as

structured in the program hierarchy detailed at figure 2.1 under paragraph 2.1. If the AO cannot

resolve the issue, the AO should direct the issue to their agency/organization program coordinator

(A/OPC) (Level 4). If the A/OPC (Level 4) cannot resolve an issue, the A/OPC (Level 4) should

elevate the issue to their oversight agency/organization program coordinator (OA/OPC) (Level 3),

and onto the component program manager (CPM) (Level 2) for guidance as necessary. Key policy,

guidance, and GSA SmartPay

®

contractual information is accessible at Defense Pricing and

Contracting website located at https://www.acq.osd.mil/asda/dpc/ce/pc/docs-guides.html and at

the GSA SmartPay

®

website located at https://smartpay.gsa.gov/.

DAFI64-117 19 MAY 2022 9

1.4.1. The authorities to waive wing/delta/garrison/unit level requirements in this publication

are identified with a Tier (“T-0, T-1, T-2, T-3”) number following the compliance statement.

See DAFI 33-360, Publications and Forms Management, for a description of the authorities

associated with the Tier numbers.

1.4.2. All waivers, exceptions, and deviations shall be in writing and routed to the appropriate

level outlined below. Requests to waive, take exception to, or deviate from the rules,

regulations or processes and procedures will be reviewed on a case-by-case basis. Submit

requests for waivers through the appropriate Tier waiver approval authority.

1.4.3. Copies of all approved waivers must be forwarded to the Department of the Air Force

GPC CPM (Level 2) within 5 business days of approval. (T-0) The CPM (Level 2) will retain

copies of all approved waiver packages. In times of emergencies, approval to waive DAFI

requirements may be obtained through either email or telephone call from the CPM (Level 2)

with a follow up waiver request letter from the requesting commander. The letter must detail

the reasons for the request and what harm would happen if the waiver was not granted. (T-0)

10 DAFI64-117 19 MAY 2022

Chapter 2

ROLES AND RESPONSIBILITIES

2.1. Program Structure. The GPC program is founded on a six-tiered hierarchal reporting chain

of command system identified in figure 2.1 below. The formal names associated with specific

roles within this hierarchy are often used interchangeably with the corresponding level of authority

within the hierarchy. For instance, A/OPC may be referred to as Level 4, and the CPM often called

the Level 2.

Figure 2.1. GPC Hierarchy.

2.2. Responsibilities. All program personnel shall complete all GPC specific training and upload

it to JAM prior to being appointed any responsibilities within the GPC program. (T-0) All

appointments are made in the JAM that is mandated for use by GPC program participants to

initiate, review, approve, store, and terminate GPC appointment and delegation letters (e.g., CH

Delegation of Authority/Appointment Letters). Components are not required to issue or retain

paper copies of appointments issued using JAM. In addition, all GPC appointed personnel shall

maintain currency to continue to hold GPC positions. (T-0) Government contractor employees

shall not be appointed as A/OPC (Level 4), AOs, or CHs; nor perform independent receipt of goods

and services. (T-0) They may, however, be granted READ ONLY access to the card issuing bank’s

Electronic Access System. All program personnel must protect the information derived from use

of the GPC. (T-0)

DAFI64-117 19 MAY 2022 11

2.2.1. The Office of the Secretary of Defense, Defense Pricing and Contracting (OSD/DPC)

(Level 1) (known as the Purchase Card Program Office) interprets and tailors federal statutory

and regulatory laws and guidance for Department of Defense (DoD) usage; develops business

rules common to all DoD corporate card programs (purchase, travel, air, fleet, and fuel), and

codifies them in the DoD Government Charge Card Guide for Establishing and Managing

Purchase, Travel, and Fuel Card programs. Refer to the Purchase Card Program Office website

at

https://www.acq.osd.mil/asda/dpc/ce/pc/docs/guidesdocs/DoD_Govt_Charge_Card_Guide_0

6_03-20.pdf.

2.2.2. The GPC CPM (Level 2) for the Department of the Air Force is appointed by SAF/AQC.

CPM (Level 2) performs oversight of the GPC program for the DAF. (T-0) The CPM (Level

2) duties include:

2.2.2.1. Serve as the liaison between DAF organizations, the Government Purchase Card

Program Office, the card issuing bank, GSA’s Office of Credit Card Management and other

federal agencies. Participate in the mandatory meetings and events including attending and

representing the DAF on panel discussions and training events (e.g., GSA SmartPay

®

Training Forum). Communicate DoD and DAF instruction or guidance updates, data

mining results or audit findings, procedure changes, and other information to the OA/OPC

(Level 3).

2.2.2.2. Maintain and update all GPC guidance as required, i.e., DAFI 64-117, Express

Contract Action Reporting System (ECARS) use guide. (T-0) Review and retain DAFI 64-

117 waivers, exceptions and deviations. Maintain the currency of, and provide the field

access to, all GPC related forms, publications, and guidance (as prescribed in DAFI 33-

360, Publications and Forms Management). (T-0)

2.2.2.3. Review and submit monthly and semi-annual reports as required in accordance

with Department of Defense SP3 Government-wide Commercial Purchase Card Policies,

procedures and Tools – SP3 Transition Memorandum #6 dated April 18, 2019 and

Memorandum #12 dated July 16, 2020. (T-0) Seek out trends and best practices to improve

the program. Implement innovative means of increasing rebates and lowering

administrative costs and merchant prices.

2.2.2.4. Manage enterprise data mining processes in accordance with Department of

Defense SP3 Government-wide Commercial Purchase Card Policies, procedures and Tools

– SP3 Transition Memorandum #6 shall use the Enterprise Data Mining (DM) Tool,

MasterCard’s

®

Insights on Demand (IOD), to document DM Case review results for all

system generated and management added cases and suspend purchasing (e.g., reduce the

managing account spending limit to $1) under account(s) with open DM cases, or Monthly

A/OPC or Semi-Annual Head of Activity Reviews that are not completed within 55 days

of the end of the billing cycle(s) under review. (T-0)

2.2.2.5. Monitor ECARS data. Export files from the ECARS and compare data against the

Federal Procurement Data System-Next Generation (FPDS-NG) data for missing files.

Send missing reports with information to the field for corrective action as needed. Update

contract period of performance as required; provide support for proper and timely reporting

of the ECARS transactional data. (T-0)

12 DAFI64-117 19 MAY 2022

2.2.2.6. Maintain OA/OPC (Level 3) point of contact rosters; and ensure OA/OPC (Level

3) training records and appointments are in JAM. (T-0)

2.2.3. OA/OPC (Level 3). The HCA or delegated contracting authority shall appoint one (1)

primary and one (1) alternate OA/OPC (Level 3) in JAM. Additionally, the Air Force

Installation Contracting Center (AFICC) and supporting directors will provide sufficient

primary and alternate OA/OPC (Level 3) to manage their GPC program. The OA/OPC (Level

3) is responsible for the implementation and administration of the AFICC Operating Location

(OL)/Major Command (MAJCOM)/Field Command (FLDCOM), Direct Reporting Unit GPC

program. (T-0) Headquarters Space Operations Command and Space Systems Command will

continue to receive OA/OPC (Level 3) support from AFICC.

2.2.3.1. The OA/OPC (Level 3) serves as the liaison between SAF/AQC and the A/OPC

(Level 4), the point of contact for all AFICC OL/MAJCOM/FLDCOM/DRU level

inspections, and participates in mandatory meetings and events. They communicate DoD,

DAF and AFICC/MAJCOM/FLDCOM/DRU guidance, findings, procedure changes, and

other information to the A/OPC (Level 4).

2.2.3.2. The OA/OPC (Level 3) reviews and submits monthly and semi-annual reports as

required in accordance with Department of Defense SP3 Government-wide Commercial

Purchase Card Policies, procedures and Tools – SP3 Transition Memorandum #6.

Additionally, the OA/OPC (Level 3) assists the CPM (Level 2) program manager with

implementing innovative means of increasing rebates and lowering administrative costs

and merchant prices as well as seek out trends and best practices to improve the program.

(T-0)

2.2.3.3. Manage enterprise data mining processes in accordance with Department of

Defense SP3 Government-wide Commercial Purchase Card Policies, procedures and Tools

– SP3 Transition Memorandum #6 utilizing the Enterprise Data Mining (DM) Tool,

MasterCard’s

®

Insights on Demand (IOD), to document DM Case review results for all

system generated and management added cases. This includes suspending purchasing (e.g.,

reduce the managing account spending limit to $1) under account(s) with open DM cases,

or Monthly A/OPC or Semi-Annual Head of Activity Reviews that are not completed

within 55 days of the end of the billing cycle(s) under review. (T-0)

2.2.3.4. Manage ECARS data. Update contract period of performance as required. Review

and address, as necessary, information gleaned from the ECARS vs FPDS-NG report

provided by the CPM (Level 2). Assist the field with operational use of the ECARS System

to include proper and timely reporting of the ECARS transactional data. (T-0)

2.2.3.5. The OA/OPC (Level 3) reviews, at least quarterly, the listing of uncashed rebate

checks as applicable.

2.2.3.6. Maintain an A/OPC (Level 4) point of contact roster ensures appointment and

training certificates are updated in JAM.

2.2.4. A/OPC (Level 4). The A/OPC (Level 4) is the specific installation/organization program

coordinator under each AFICC OL, MAJCOM, FLDCOM, or DRU. The contracting

commander, or equivalent, shall appoint a primary and alternate A/OPC (Level 4) in

accordance with Department of Defense SP3 Government-wide Commercial Purchase Card

Policies, procedures and Tools – SP3 Transition Memorandum #6 within JAM. (T-0) The

DAFI64-117 19 MAY 2022 13

authority to appoint primary and alternate A/OPC personnel may only be delegated to the

deputy in the absence of the commander. Primary and Alternate A/OPC (Level 4) shall be an

1102 contracting series civil servant, 6C0X1 enlisted contract specialist, 64PX officer contract

specialist, or foreign national equivalent (for Outside the Continental United States

(OCONUS) installations). (T-0) A/OPC (Level 4) is responsible for program implementation,

administration, training, and monitoring at the installation/organization level. The A/OPC

(Level 4) is also required to process information requests as it relates to the GPC program in

accordance with DoDM 5400.07_AFMAN 33-302, Freedom of Information Act, 27 April

2018. (T-0)

2.2.4.1. The A/OPC (Level 4) serves as the liaison between the OA/OPC (Level 3), and

the installation/organization GPC personnel. They also serve as the liaison between the

financial and contracting communities as it applies to the certification of funds and

payment of bank statements. A/OPC (Level 4) are also the installation or organization point

of contact for bank related matters. They provide business advice to all CHs, check writers,

AOs, small business specialist, the contracting commander, or equivalent, and the

installation or organization commander. Additionally, A/OPC (Level 4) participate in any

mandatory meetings, and communicate DoD, DAF, and MAJCOM/FLDCOM, DRU

guidance, findings, procedure changes, and other information as necessary to installation

or organization personnel and assist the OA/OPC (Level 3) with increasing rebates and

lowing administrative/merchant costs.

2.2.4.2. The A/OPC (Level 4) shall ensure GPC program personnel are properly

appointed, trained, maintain currency in training and capable of performing their respective

duties. A/OPC (Level 4) personnel with authority to delegate procurement authority to CH

or convenience check account holders shall be appointed via a Delegation of Authority

Letter that clearly states their authority to further delegate procurement authority. (T-0)

The A/OPC (Level 4) shall establish and maintain a file for each AO and CH utilizing the

program directed filing system/database and retain in accordance with retention rules. (T-

0) The A/OPC (Level 4) shall temporarily suspend (reduce credit limit to $1) any managing

account or CH account that fails to maintain currency (30 calendar days after billing cycle

end date). If any account is 120 days delinquent, the A/OPC (Level 4) will suspend the

entire organization (all managing accounts (MACs) within the effected organization) and

terminate the delinquent account. The contracting commander, or equivalent, has the

authority to waive the 30 day suspension to avoid mission impacts; however, a Corrective

Action Plan shall be submitted by the AO’s organizational commander to and approved by

the contracting commander or equivalent to preclude recurrence. (T-1) Ensure military and

civilian out-processing checklists include a mandatory A/OPC (Level 4) sign off for AOs

and CHs. (T-0)

2.2.4.3. The A/OPC (Level 4) shall accomplish duties and responsibilities in accordance

with Department of Defense SP3 Government-wide Commercial Purchase Card Policies,

Procedures and Tools – SP3 Transition Memorandum #6. A/OPC (Level 4):

2.2.4.3.1. Must use IOD to document Daily DM Case Reviews (includes AO DM Case

Questionnaires and A/OPC DM Case Questionnaires), Monthly A/OPC Reviews

(includes Monthly A/OPC Check List and Monthly A/OPC Review Report) and Semi-

Annual Head of Activity Reviews (includes Semi-Annual Head of Activity Review

Report). (T-0)

14 DAFI64-117 19 MAY 2022

2.2.4.3.2. Must use IOD to review and approve/disapprove all AO completed DM case

reviews, and document any finding, determination, and corrective action taken by

completing the A/OPC DM Case Questionnaire. Failure to timely complete required

reviews will result in account suspensions. (T-0)

2.2.4.3.3. Are required to initiate and complete reviews and close cases for each

finding and disciplinary category determination they independently identify (i.e., not

flagged by IOD) during their review processes. (T-0)

2.2.4.4. The roles and responsibilities of the A/OPC (Level 4) are to:

2.2.4.4.1. Manage and ensure the integrity of the card program.

2.2.4.4.2. Complete initial and refresher training in accordance with DoD and DAF

requirements. Complete the issuing bank’s training to ensure A/OPC (Level 4) are

familiar with all GPC related terminologies and the issuing bank’s electronic access

system (EAS).

2.2.4.4.3. Work with local Finance Office to minimize the payment of interest and

penalties, and avoid suspension of accounts for past delinquencies.

2.2.4.4.4. Ensure appropriate training (including refresher training) is established,

maintained, and tracked, and ensure that the required training has been completed

before issuing cards.

2.2.4.4.5. Prepare reports on the program.

2.2.4.4.6. Ensure the proper oversight and management controls are in place and

working.

2.2.4.4.7. Oversee or perform account maintenance.

2.2.4.4.8. Provide guidance/procedural advice to CH and charge card officials.

2.2.4.4.9. Serve as the issuing bank’s point of contact.

2.2.4.4.10. Conduct compliance reviews.

2.2.4.4.11. Assist in dispute resolution.

2.2.4.4.12. Process card applications.

2.2.4.4.13. Maintain the required span of control in accordance with DoD and

Component guidance.

2.2.4.4.14. Close accounts using the issuing bank (or, where appropriate, the DoD)

automated tool.

2.2.4.4.15. Ensure financial controls are established in account profiles in coordination

with applicable Financial/Resource Managers.

2.2.4.4.16. Assist CHs and AOs with account management and reconciliation.

2.2.4.4.17. Monitor transactions during the cycle in order to take timely action against

questionable charges, using available automated tools.

2.2.4.4.18. Analyze accounts and specific CH activity.

DAFI64-117 19 MAY 2022 15

2.2.4.4.19. Report program activity to appropriate levels of management.

2.2.4.4.20. Where required, attend training conferences as well as any other relevant

meetings pertaining to the program.

2.2.4.4.21. Perform special processing as required.

2.2.4.4.22. Ensure respective A/OPC (Level 4) contact information is kept up to date.

2.2.4.4.23. Administer and record any waiver requests to MCC blocks. Note: CH

account limitations should reflect the normal usage by that CH rather than defaulting

to the maximum available.

2.2.4.4.24. Ensure necessary appointments and delegations are issued and retained.

2.2.4.5. The A/OPC (Level 4) shall accomplish the following monthly:

2.2.4.5.1. Recommend, to the organization commander, suspension of any accounts

which have not been used within six (6) months, recommend suspension at 300 days

and closure of any accounts which have not been used within 365 days. Exception: any

accounts that have a documented need to remain active, e.g., contingency accounts,

mortuary.

2.2.4.5.2. Coordinate with Financial Service Officers to ensure timely certification and

payment.

2.2.4.5.3. Identify and monitor terminated accounts with outstanding credits until

refunded to the government. (T-0)

2.2.4.5.4. Address program deficiencies and discrepancies identified in the IOD

Finding and Determinations Report. (T-0)

2.2.4.5.5. Ensure the proper disposition of rebate checks in accordance with

paragraph 5.8. (T-0)

2.2.4.6. The A/OPC (Level 4) should brief the local contracting commander, or equivalent,

on a monthly basis but no less than quarterly to ensure the internal controls for the GPC

program continue to be used efficiently, economically, and effectively to help manage and

reduce fraud, misuse, and abuse. The briefing may include:

2.2.4.6.1. A summary of violations to include payment delinquencies that exceed 30

calendar days, unauthorized purchases, split purchases, fraud, misuse, abuse, purchases

exceeding authorized limits, span of control ratios/functions and violations, non-use of

mandatory sources, convenience check violations, and purchases over the MPT that

were not properly competed and what corrective action should be taken;

2.2.4.6.2. FPDS-NG & ECARS comparison report;

2.2.4.6.3. Any tailored items necessary for situational awareness.

2.2.5. AO (Level 5). Each requiring activity commander, or equivalent is responsible for

nominating a primary and alternate AO. (T-1) Appointment of AO personnel shall be

accomplished by the contracting commander, or equivalent (delegable to A/OPC (Level 4)).

(T-0) The following categories of personnel may be appointed AOs: government civilian

employees, members of the armed forces, and foreign nationals at OCONUS locations (both

16 DAFI64-117 19 MAY 2022

direct and indirect hires) subject to operational control and day to day management and

supervision by US civilian and military personnel. The AO administers the program for the

requiring activity and provides assistance and oversight of CH and managing account

activities.

2.2.5.1. AOs are designated under the pay and confirm process. The authority to act as an

AO shall be in accordance with the following references: Department of Defense (DoD)

Government Charge Card Guidebook for Establishing and Managing Purchase, Travel, and

Fuel Card Programs; Office of Management and Budget (OMB) Circular A-123; Federal

Acquisition Regulation (FAR); Defense Federal Acquisition Regulation Supplement

(DFARS); DoD 7000.14-R - Department of Defense Financial Management Regulation

(DoD FMR) Volume 10, Chapter 23: 'Purchase Card Payments'; and Title 31 of the United

States Code. (T-0) AO is responsible for approving the spending of public funds and held

to a high standard of responsibility and accountability. AO roles and responsibilities are as

follows:

2.2.5.1.1. Review and approve all purchases, CH statements, and reconciling where

the CH fails to do so in a timely manner. Report questionable card transactions to the

A/OPC (Level 4) and/or appropriate authorities for investigation.

2.2.5.1.2. Ensure all CH transactions are legal, proper, mission essential, and correct.

2.2.5.1.3. Ensure monthly billing account accuracy. Maintain documentation

supporting certification in accordance with the record retention guidance reconciling

the CH account, and payment of the applicable invoice.

2.2.5.1.4. Complete initial and refresher training in accordance with DoD

requirements.

2.2.5.1.5. Conduct informal compliance reviews.

2.2.5.2. AOs act as a liaison between the requiring activity’s commander and the A/OPC

(Level 4) (e.g., reinstatement requests, corrective action plans). They serve as the point of

contact for GPC compliance in accordance with Department of Defense SP3 Government-

wide Commercial Purchase Card Policies, Procedures and Tools – SP3 Transition

Memorandum #6. AOs should complete reviews throughout the billing cycle (rather than

waiting until the end of the month) to promote timely resolution (e.g., transaction dispute,

CH retraining). AOs should complete reviews within five (5) days of the billing cycle end

date; must complete reviews within 30 calendar days of the billing cycle end date. (T-0)

Note: Any case the A/OPC (Level 4) refers back to the AO for additional review may

require action through day 55.

2.2.5.3. Establish/recommend CH and managing account dollar limits to the A/OPC

(Level 4) based on historical use. The AO shall ensure spending limits are set to the

minimum amount necessary to meet mission requirements and established limits are not

exceeded. (T-0)

2.2.5.4. The AO shall verify appropriate and sufficient funds are available prior to CH

purchases. Approve/disapprove all purchases by the CH to ensure all transactions are for

valid, official government requirements. Rotate sources when possible unless sourcing is

DAFI64-117 19 MAY 2022 17

guided by policy or contract ordering guide/instrument. Ensure CHs are not splitting

requirements to avoid exceeding the micro-purchase threshold (MPT).

2.2.5.5. Maintain a purchase log, to include supporting documentation, to track funds

expenditures via US Bank’s Electronic Access System, and the current Enterprise Data

Mining tool as identified in accordance with Department of Defense SP3 Government-

wide Commercial Purchase Card Policies, Procedures, and Tools – SP3 Transition

Memorandum #6. Register for electronic data notifications within the bank Electronic

Access System for automated e-mail alerts. Electronic data notifications will notify the

A/OPC (Level 4) of time sensitive tasks and assist with monitoring issues within the GPC

program. Ensure convenience check data is maintained; and IRS Form 1099 MISC,

Miscellaneous Income, for the merchant has been completed (to include identification of

the tax ID or social security number of the merchant) and reported. Refer

to:http://comptroller.defense.gov/Portals/45/documents/fmr/current/10/10_23.pdf

2.2.5.6. If the CH is unable, the AO shall reconcile the card statement on behalf of the CH

within three (3) business days after the billing cycle closes. (T-0) The AO shall review and

approve the managing account statement of accounts within five (5) business days after the

billing cycle closes. Managing accounts not reconciled and approved by the AO within 30

days after the end of the billing cycle shall be suspended by the A/OPC (Level 4). (T-0)

Validate proper receipt, acceptance, and inspection of all items for payment certification

(e.g., sign or initial each of the CHs transaction receipts legibly). Flag and track any

transactions for items not yet received; ensure sales taxes are not paid, and document the

file accordingly. Validating CH account documentation upon statement reconciliation is

appropriate for certification and payment. Upon discovery of suspected unauthorized

purchases (e.g., purchases that would indicate non-compliance, fraud, misuse and/or

abuse), immediately notify the requiring activity commander, or equivalent, and the

A/OPC (Level 4). (T-0)

2.2.5.7. Ensure end of fiscal year purchases that do not clear the bank’s Electronic Access

System before 30 September of fiscal year are reported to the Financial Management office

and are clearly identified/logged in IOD.

2.2.5.8. Notify A/OPC (Level 4) of credits applied to terminated accounts (monitor credits

until refunded to the government), personnel changes occur or extended leave of absence

or deployment, and lost or stolen cards. If a CH finds a lost or stolen GPC, the AO will

ensure the card is destroyed.

2.2.5.9. The AO is an accountable official and is subject to personal financial liability

(including reimbursing the government for unauthorized or erroneous purchases through

salary offsets) and/or appropriate adverse personnel action (including removal or other

punishment) if they violate applicable GPC use and control regulations, are negligent,

engage in GPC misuse, abuse, or fraud (10 U.S.C. 2784). For individuals subject to the

UCMJ, GPC misuse is punishable under Article 92, UCMJ, 10 USC §892.

2.2.6. CH (Level 6). The requiring activity commander, or equivalent is responsible for

nominating their organizations’ CH (Level 6), and appointed by the contracting commander,

or equivalent (delegable to A/OPC (Level 4)), via JAM as having procurement authority at a

designated threshold: MPT, above the MPT, or up to the simplified acquisition threshold

18 DAFI64-117 19 MAY 2022

(SAT). (T-0) CHs are legal agents using the charge card to buy supplies and services in support

of official government business. This can be a non-acquisition person or an acquisition person.

2.2.6.1. The CH holds the primary responsibility for the card’s proper use. See

Attachment 2 for JAM GPC Role Descriptions & paragraph 7.12 GPC Cardholder Special

Designation Authority Types. For organizations with an established command support staff

may assign the primary CH within the command support staff. If an organization does not

have an established command support staff, then the primary CH duty will be assigned as

the organization commander, or equivalent, directs. Organizations that have a mission of

size and scope that exceeds a single CH and requires alternate CHs, those duties will be

treated as an additional duty and may require additional CHs outside the command support

staff. The following categories of personnel may be appointed CHs: government civilian

employees, members of the armed forces, and foreign nationals at OCONUS locations

(both direct and indirect hires) subject to operational control and day-to-day management

and supervision by US civilian and military personnel.

2.2.6.2. CH authority is limited to purchases utilizing the GPC up to the threshold

indicated on their delegation of authority in JAM. CHs must countersign their delegation

of authority to acknowledge they have reviewed, understand, and concur with their GPC

program responsibilities. (T-0) CHs do not have the authority to sign any agreements with

terms and conditions. (T-0) The GPC shall only be used by the named individual on the

card to pay for authorized, official US Government purchases. (T-0)

2.2.6.3. It is the CH’s responsibility to safeguard and secure the GPC and account number

at all times. If a CH is requested to participate in any type of illegal or unethical business

arrangement, the CH should immediately report this to the A/OPC (Level 4). A CH who

makes unauthorized purchases, allows others to use their assigned card or card number, or

carelessly uses the GPC has committed a major violation and may be held liable to the

government for the total dollar amount of the unauthorized purchase. The CH may also be

subject to disciplinary action.

2.2.6.4. If the CH will be unable to perform their reconciliation duties, they must notify

the AO and provide information necessary for the AO to act on the CH’s behalf. (T-0) In

addition, the CH must notify AOs and out-process with the A/OPC (Level 4) at least 60

days prior to permanent change of duty station move, separation, retirement, or absence of

position. (T-0)

2.2.6.5. The CH shall:

2.2.6.5.1. Proper and adequate funding is available prior to any purchase by

coordinating with AO. More than one (1) violation of this requirement may result in

permanent termination of appointment. (T-1)

2.2.6.5.2. Screen all requirements for their availability from the mandatory

government sources of supply as prescribed by FAR Part 8, Required Sources of

Supplies and Services (also see AFICC Strategic Sourcing Launch Pad which can be

found at: https://usaf.dps.mil/sites/aficc/afcc/AFICC/KA/AFLaunch/. (T-0)

2.2.6.5.3. Procure only authorized supplies or services and obtain any required specific

approvals outlined in paragraph 7.12 before purchasing.

DAFI64-117 19 MAY 2022 19

2.2.6.5.4. Ensure sources are rotated.

2.2.6.5.5. Log transactions at the time of purchase, or within three (3) business days of

the transaction appearing in Access Online (AXOL).

2.2.6.5.6. Reconcile posted transactions within three (3) business days.

2.2.6.5.7. Review and reconcile the monthly purchase card statement within three (3)

business days of each cycle-end date.

2.2.6.5.8. Ensure that all charges are proper and accurate or have documented actions

taken to correct the inaccurate charge.

2.2.6.5.9. Ensure that the transaction does not include sales tax. The CH should make

every effort to obtain a credit for any tax costs from the merchant. (However, in some

states, ordering agencies may be responsible for paying certain state tax fees.). If a

credit is not obtained, the CH should seek restitution via the guidance provided by the

GSA SmartPay

®

Tax Exemption website located at: https://smartpay.gsa.gov. The CH

should document the file accordingly, however CHs shall not load any documents with

a marking of “FOUO”, Controlled Unclassified Information (CUI) or higher to AXOL.

Supporting documentation with these markings shall be available off-line for purposes

of account inspections and audits.

2.2.6.5.10. Upload the appropriate supporting documentation, (e.g., sales slips,

documentation of receipt and acceptance, purchase log, approved purchase requests,

additional approvals/waivers (if applicable), quotes, documentation required by

Section§ 889 of the 2019 National Defense Authorization Act (NDAA)

representations, etc.) on US Bank’s Electronic Access System for the AO in a timely

manner. If any of the documents are in foreign language, the CH shall add a statement

with the details of the purchases in English. (T-0)

2.2.6.5.11. Notify their AO and the card issuing bank immediately of any lost or stolen

card, or suspected fraudulent activity. If the CH finds the original GPC after reporting

it lost or stolen, the CH shall relinquish the card to the AO for destruction. (T-0)

2.2.6.6. Protect the integrity of the procurement process by ensuring a proper separation

of function. At a minimum, a two-way separation of functions for all purchase card

transactions is defined as one (1) person making the purchase with the purchase card, and

a separate person receiving, inspecting, and accepting the purchase. (T-0)

2.2.6.7. Requirements that exceed the MPT (see Chapter 11) must be purchased against

appropriated funded, pre-priced contractual agreement such as a Federal Supply Schedules,

Indefinite Delivery/Indefinite Quantity, or Blanket Purchase Agreement unless otherwise

stated in this DAFI. CHs must follow the agreements ordering guide procedures regarding

competition or Fair Opportunity. Unless stated otherwise in the ordering guide, CHs must

review prices of at least three (3) contracted sources to select the best value for their

requirement. If fewer than three (3) sources are available, the CH must justify the lack of

competition in writing to their supporting contracting office for a Contracting Officer’s

determination of fair and reasonable pricing prior to purchase and maintain the

determination in the purchase file. A Sample Determination of Fair and Reasonable Pricing

is available in Chapter 11. (T-0)

20 DAFI64-117 19 MAY 2022

2.2.6.8. Maintain a purchase log in the bank’s Electronic Access System that documents

all transactions. (T-0) At a minimum, the purchase log must include the following fields:

a) date the item/service was ordered; b) name of the requestor; c) description of the

item(s)/service(s). (If the purchases are valued less than $75, they may be entered at the

summary level, e.g., office supplies); d) merchant’s name; e) number of items purchased;

f) unit price; g) total dollar value of the transaction; h) name of the recipient of the

item/service; i) date received. (T-0)

2.2.6.9. Verify and document receipt/acceptance of goods or services, and properly mark

those items which are individually valued at $5,000 or more or considered pilferable or

sensitive as prescribed by the rules governing purchases requiring Item Unique

Identification. (T-0)

2.2.6.10. Protect the government’s rights by disputing transactions when receipt and

acceptance of goods or services cannot be verified. The CH has 90 calendar days from the

date the transaction has been processed/posted to the account to dispute it. Ensure fiscal

year end purchases that do not clear in the bank’s Electronic Access System before 30

September of the ending fiscal year are reported to the AO and are tracked.

2.2.6.11. Ensure pay and confirm procedures are followed. The CH shall reconcile each

transaction and approve their statements at the end of each cycle in anticipation the supplies

will be received. If there are billing errors or questionable transactions, the CH must dispute

the transaction; however, reconciliation and statement approval are still required and shall

not be delayed. Resolve any invalid transactions with the merchant. Confirm with the

merchant the items ordered are in transit and track the transactions that have not been

received by the current billing statement. If the billing errors or questionable transactions

are not resolved, or supplies are not received by the next billing statement, the CH will

dispute the item within 90 calendar days of the transaction posting date. (T-0) If there are

damaged items, confirm with the merchant they will replace, modify, or repair any

damaged item within the next billing cycle. If the merchant fails to replace, modify, or

repair the damage by the allotted time, then follow the disputes procedures.

2.2.6.12. Ensure convenience check writer follows procedures in paragraph 9.1 ensuring

data is maintained for DFAS to provide Internal Revenue Service (IRS) Form 1099 MISC,

(Miscellaneous Income) for each merchant (to include identification of the tax ID or social

security number of the merchant) and reported. (T-0)

2.2.6.13. CHs should register for electronic data notifications within the bank’s Electronic

Access System for automated e-mail alerts to act on time-sensitive CH tasks (e.g., bank

payments, unusual purchases reviews, dormant accounts).

2.2.6.14. Authorized CHs shall enter all purchases over the MPT up to $25,000 into the

ECARS for A/OPC (Level 4) approval in accordance with local guidance (e.g., prior to

purchase). (T-0) A manual ECARS is required when the system is down and must be

accomplished in the system when the system returns to operational status but no later than

30 days after the purchase date. (T-1) CHs must have specific delegated authority to make

purchases over the MPT (See Chapter 11).

2.2.6.15. Notify the AO of the following: credits applied to terminated accounts (monitor

credits until refunded to the government); when personnel changes occur or there is an

DAFI64-117 19 MAY 2022 21

extended leave of absence or deployment; when cards are lost or stolen cards (If a CH finds

a lost or stolen GPC, the AO will ensure the card is destroyed).

2.2.7. Installation level program management responsibility rests with the installation

commander, or equivalent; and they shall have overall responsibility for the GPC program for

their installation. They are ultimately responsible for establishing and complying with

mandated internal controls, which ensure the appropriate management, operation, and

oversight of the local GPC program. The commander, or equivalent, is responsible for a

command climate that prevents requiring activities and personnel from exercising undue

influence over the actions of CHs.

2.2.7.1. The contracting commander, or equivalent, shall develop internal management

controls to operate, manage, provide oversight, and maintain the integrity of the local GPC

program. At a minimum, ensure adequate checks and balances are in place to manage local

programs, ensure CHs are not subjected to undue influence over their actions by A/OPC

(Level 4), AOs, or others within the command/organization. (T-0) Additionally,

organizations are responsible for ensuring completion of the monthly A/OPC and Semi-

Annual Head of Activity Review processes and DM case closure in accordance with

Department of Defense SmartPay

®

3 Government-wide Commercial Purchase Card

Oversight and Reporting – SP3 Transition Memorandum #12. This includes enforcement

of mandatory purchasing suspension for accounts with incomplete Monthly A/OPC or

Semi-Annual Head of Activity Reviews or open DM cases for the period under review. On

a case-by-case exception basis, CPM’s (Level 2) are authorized to lift purchasing

suspensions for mission critical purchases with open DM cases or incomplete reviews; this

authority may not be delegated below the CPM (Level 2).

2.2.7.2. The contracting commander, or equivalent, must ensure separation of duties. (T-

0) Ensure the roles and responsibilities of the individuals within the GPC program are not

in conflict. Individuals designated as A/OPC (Level 4) shall not be simultaneously

designated as AOs or CHs and individuals designated as AOs shall not be a CH on the

same managing account. (T-0) No individual shall serve as a CH or AO with the

responsibility of certification on the same funds. (T-0) Certifying Officers are defined as

individuals responsible for certifying payment vouchers are correct and proper for

payment.

2.2.7.3. Span of control shall be managed in accordance with the Government Charge Card

Guide for Establishing and Managing Purchase, Travel, and Fuel Card programs as follows

(T-0) Primary A/OPC (Level 4) shall not be responsible for more than 250 GPC accounts

(250:1 CH and managing accounts combined). Additional A/OPC (Level 4) shall be

appointed whenever the combined number of CH and managing account accounts exceed

the 250:1 ratio. A/OPC (Level 4) can be alternates for each other's 250 accounts, but above

500 accounts, additional A/OPC (Level 4) shall be added to ensure proper oversight of the

GPC program. A/OPC (Level 4) must have the resources to accomplish program oversight.

In addition, the number of CH accounts assigned to a primary AO shall not be more than

seven (7:1). A CH may not be assigned more than three (3) CH accounts. Additional AOs

shall be assigned by the organization whenever the number of CH accounts exceed the 7:1

ratio. The A/OPC (Level 4) should routinely evaluate the effectiveness of each AO’s ability

to review, approve, and reconcile transactions by considering the number of transactions

made by each CH under the AO’s purview. (T-0) The CPM (Level 2) has authority to

22 DAFI64-117 19 MAY 2022

approve deviation from the ratios listed in this paragraph on a case-by-case basis for

specific agency locations provided the organization can establish sufficient local oversight

and compensating controls are in place. (T-1)

2.2.7.4. The contracting commander, or equivalent, in coordination with the small

business specialist, or equivalent, shall ensure all small business regulatory and statutory

requirements are met, and that policies and procedures (i.e., local set-aside programs)

support maximum participation of small business are developed. (T-0)

2.2.7.5. The contracting commander, or equivalent, may tailor the Delegation of

Contracting Authority Letter to appoint CHs as necessary; however, the letter shall reflect

all appropriate limits. (T-0) Do not unnecessarily appoint CHs; appoint only to meet

mission requirements. OCONUS GPC personnel may be granted authority to make single

purchases up to the threshold identified in Attachment 1, Table A1.1, GPC Micro-

Purchases, per transaction in accordance with Defense Federal Acquisition Regulation

Supplement (DFARS) 213.301(2). The restrictions to personnel designated as CHs also

apply to convenience check writers. The contracting commander, or equivalent, should not

issue multiple cards to one (1) CH without documented justification from the CH’s

commander, as multiple lines of accounting can be allocated to one (1) card/account

through Financial Management’s reallocation process. (T-0)

2.2.7.6. The contracting commander, or equivalent, shall provide program management

reviews with the installation commander, or equivalent, on a semi-annual bases. (T-0)

2.2.8. The financial management office will nominate and appoint financial management

personnel on a DD Form 577, Appointment/Termination Record, to serve as certifying officers

under the DAF pay and confirm process. Financial management is responsible for training and

advising CHs and AOs on financial issues and the appropriate use of funds. They provide

certified funding documents for each account and certify bank statements for payment within

five (5) calendar days of receipt. They serve as the liaison between the installation and Defense

Financial and Accounting Service (DFAS) (the paying office). These Certifying Officers have

pecuniary liability for payments they certify.

2.2.8.1. The financial management Level 2 shall maintain and provide a current list of

MAJCOM/FLDCOM level Financial Service Officers to the GPC CPM (Level 2) for

funding/payment issues.

2.2.8.2. The financial management Level 2 shall monitor reports and collaborate with

finance personnel to ensure untimely certification of statements do not cause payment

delinquencies.

2.2.8.3. Financial management shall alert A/OPC (Level 4) within 3 business days of

notification or discovery of any potential or pending issues that can affect timely payment.

2.2.8.4. Financial management will assist the A/OPC (Level 4) in developing/providing

initial CH and AO training. (T-0)

DAFI64-117 19 MAY 2022 23

2.3. The Card Issuing Bank (the bank) . The bank establishes CH and managing accounts for

use with the GPC program. The bank will provide dedicated customer service support, identified

in the current overarching contract and task order, to both domestic and international CHs. The

bank, at a minimum, will issue cards, billing statements, payment services, training in the

utilization of the bank electronic access tools, assist with declined authorization inquires, lost or

stolen cards and transaction disputes. The bank may also coordinate requests for CH account

inquiries, reconciliation assistance services, and provide account information when required.

2.3.1. The bank will mail the GPC to the CH or designated distribution point within 24 hours

of receipt of the electronic request, or notification of a lost or stolen card. For international

card replacement, the bank will send the card within 24 to 48 hours, depending on the

country/region; delivery times will vary. The bank will also manage convenience check

reorders if unavailable through the bank’s Electronic Access System. The A/OPC (Level 4)

must inform the bank if the CH needs an expedited card delivered.

2.3.2. The bank will monitor mutual account performance goals/objectives and provide

standard and ad hoc reports either through queries of its Electronic Access System or actual

report submissions.

24 DAFI64-117 19 MAY 2022

Chapter 3

GOVERNMENT PURCHASE CARD SYSTEMS

3.1. MasterCard

®

Insights on Demand (IOD) by Oversight. IOD is an artificial intelligence

DM platform that automatically analyzes DoD’s GPC data to identify high-risk transactions. IOD

enables the Department to fulfill the 10 USC §2784 (as modified by Public Law (Pub. L.) 112-

194, Government Charge Card Abuse Prevention Act of 2012) requirement to “use effective

systems, techniques, and technologies to prevent or identify improper purchases.” It also facilitates

transaction reviews and enables documentation of any findings identified and corrective actions

taken. (T-0)

3.2. ECARS. The ECARS is a secure web-based application that shall be used to document all

GPC purchases above the MPT and below $25,000. Exception: contract payments. This system

consolidates purchase data by contract number for each location for the Federal Procurement Data

System - Next Generation reporting. If authorized to purchase above the MPT, the CH is

responsible for ensuring all CH ECARS requests are reviewed and approved by the AO prior to

submission to the A/OPC (Level 4). (T-0) The CH will create and submit the ECARS

Approval/Data Form in accordance with local procedures (e.g., prior to purchase), but no later than

the last day of the month in which the purchase was made. The ECARS User’s Guide is available

through the ECARS website Help tab and in the AF Contracting Central/GPC website. (T-0)

3.2.1. FPDS-NG & ECARS Comparison Reports assist in ascertaining if any data has not been

reported correctly (e.g., mismatched records). These are sent the first and third week of the

month from the CPM (Level 2) and can be accessed by GPC personnel through the ECARS

website by clicking on “View;” then “Express Contract Action Reporting System & FPDS

Report” and selecting their organization. A/OPC (Level 4) and OA/OPC (Level 3) program

coordinators will correct mismatched records within five (5) business days of report issuance,

but no later than 30 days after the purchase date. (T-0)

3.2.2. The ECARS Enhancement/Capability Change Requests are accessed via the ECARS

Capability Request Form through the requestor’s GPC hierarchy chain, to the DAF CPM

(Level 2).

3.3. Federal Procurement Data System - Next Generation. FPDS-NG is a web based

government central repository for collecting, developing, and disseminating procurement data to

Congress, the Executive Branch and private sector. The federal government uses the reported data

to measure and assess the impact of federal procurement on the nation’s economy, the extent to

which awards are made to businesses in the various socio-economic categories, the impact of full

and open competition on the acquisition process and other procurement policy purposes. FPDS-

NG contains data that the federal government uses to create recurring and special reports to the

President, Congress, the Government Accountability Office, federal agencies and the general

public (FAR 4.606, Reporting Data). Contracting office personnel shall manually enter the

ECARS data into FPDS-NG on a monthly basis. (T-0) After the creation of the initial FPDS CAR

per contract per FY, CAR updates are required monthly if additional purchases are made from that

contract vehicle. FPDS-NG access, training, and instruction manuals are available on the fpds.gov

website.

DAFI64-117 19 MAY 2022 25

3.4. The Card Issuing Bank’s Electronic Access System is a web-based data management and

reporting tool. GPC personnel have access to account and transactional data, and execute banking

activities related to GPC usage (e.g., initiate disputes, reallocate funds, and approve and reconcile

transactions). The order management log and all data generated or processed in the bank’s

Electronic Access System is maintained by the bank in accordance with FAR 4.805, Storage,

handling, and contract files. The Electronic Access System provides Electronic Data Notifications

(automated e-mail alerts) which remind program personnel to act on time-sensitive CH and

managing account tasks days before the deadlines (e.g., bank payments, unusual purchases

reviews, dormant accounts) Local contracting activities can determine which electronic data

notifications will be optional or mandatory for CHs, AOs, A/OPC (Level 4), and Financial Service

Officer responsible for GPC funds certification and payments.

3.5. Defense Enterprise Accounting and Management System. Defense Enterprise

Accounting and Management System is a major automated information system that uses

commercial off-the-shelf enterprise resource planning software to provide accounting and

management services. Defense Enterprise Accounting and Management System interfaces with

approximately 40 other systems that provide travel, payroll, disbursing, transportation, logistics,

acquisition, and accounting support. Financial management utilizes Defense Enterprise

Accounting and Management System for processing GPC funding and reconciliation to improve

financial management visibility.

3.6. Integrated Accounts Payable System. Integrated Accounts Payable System is a DFAS

automated system. It supports the payment of commercial vendors and provides support for

standard Electronic Data Interchange transactions, thus allowing full support for DoD and

electronic commerce initiatives. Integrated Accounts Payable System is applicable to units still

operating in legacy accounting systems until Defense Enterprise Accounting and Management

System is completely fielded.

26 DAFI64-117 19 MAY 2022

Chapter 4

TRAINING

4.1. Mandatory Training. Mandatory training is divided into initial online training and formal

training. Prior to assuming their duties, program personnel shall complete the GPC training

appropriate to their position. (T-0) GPC personnel must complete the training identified in

Attachment 4, Table 4.1, DAF GPC Role Specific Training Requirements, per DPC Training and

Communication webpage. The training requirements for CHs and AOs trained at a previous duty

station may be abbreviated or waived, in writing, as determined by the A/OPC (Level 4). All

CH/AO initial and refresher training certificates should be stored and maintained electronically in

PIEE JAM. (T-1)

4.1.1. All prospective GPC personnel shall take the online training as prescribed on the DPC

Training and Communication webpage located at

https://www.acq.osd.mil/asda/dpc/ce/pc/training.html. (T-0)

DAFI64-117 19 MAY 2022 27

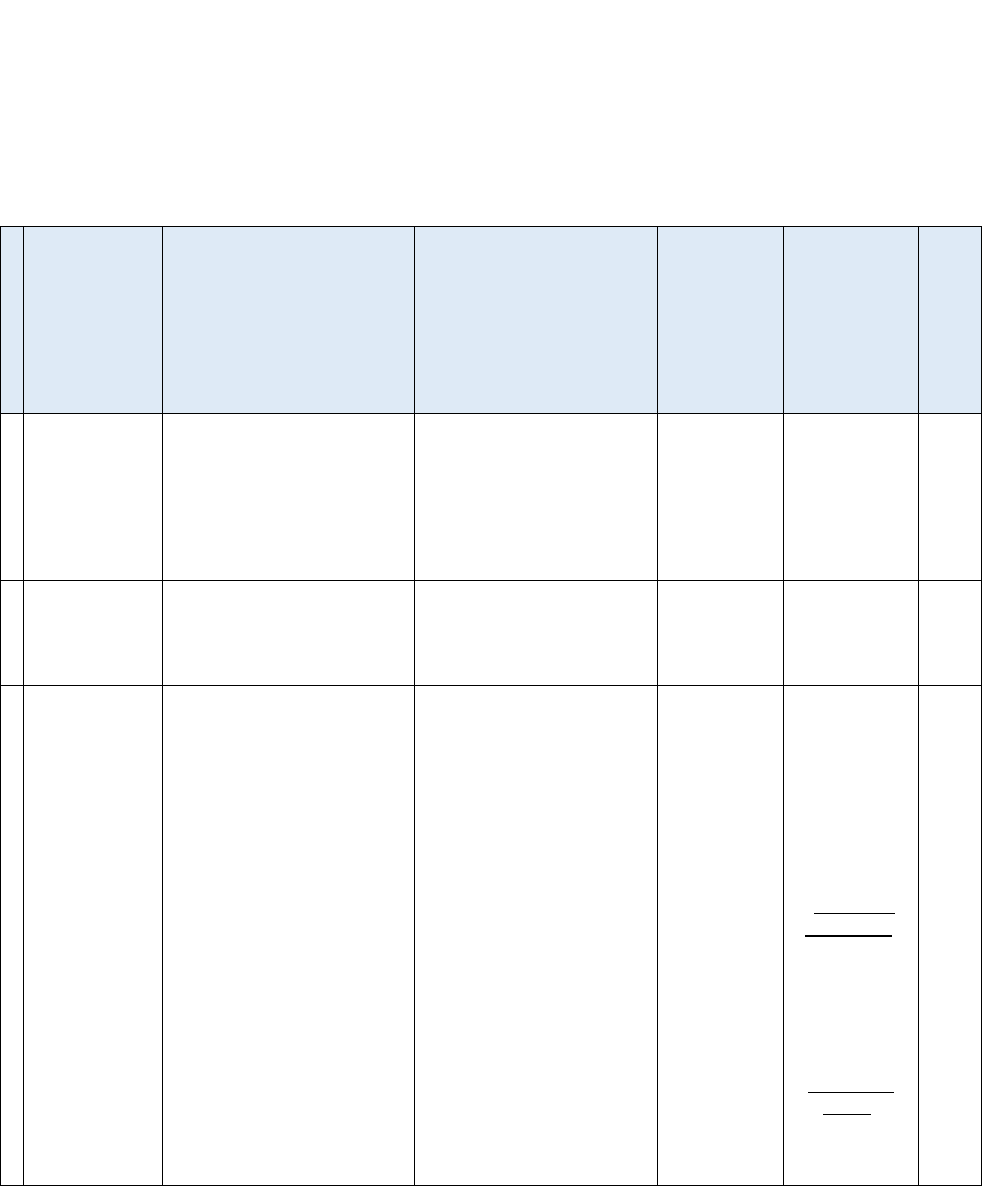

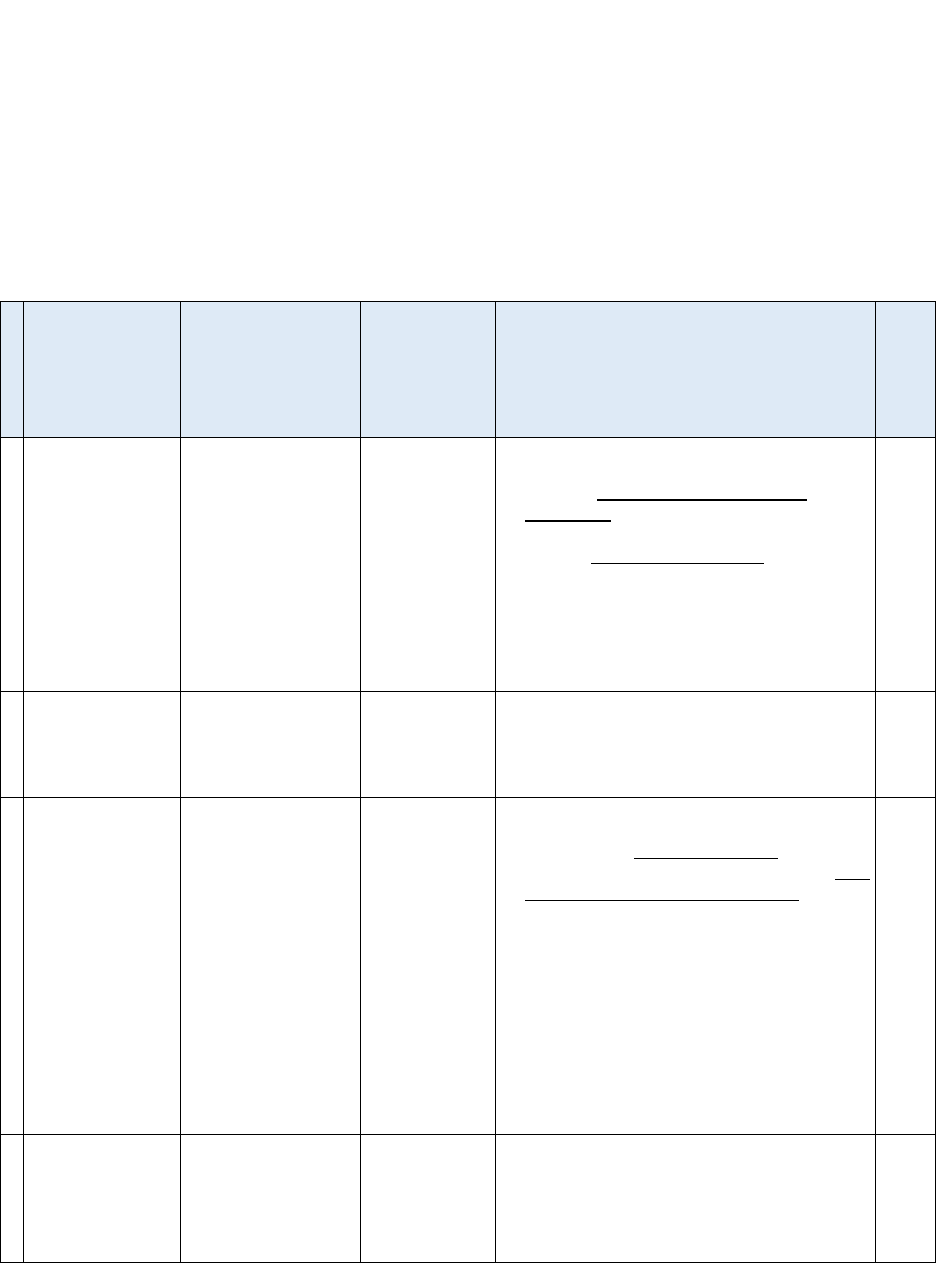

Table 4.1. DAF GPC Role Specific Training Requirements.

Training

Roles

Frequency

1

CLG 0010 – DoD Government-wide

Commercial Purchase Card

Overview (T-0)

- CPM

- OA/OPC

- A/OPC

- AO

- Certifying Officer

- CH

- Convenience Check Writer

Every 2 years

2

CLG 003 – Overview of Acquisition

Ethics (or Agency Provided Annual

Ethics Training). (T-1)

- OA/OPC

- A/OPC

- AO

- CH

- Convenience Check Writer

Annually

3

Micro-Purchases and Section 508

Requirements (T-1)

- A/OPC

- AO

- CH

- Convenience Check Writer

Initial

4

CLM 023 - AbilityOne Contracting

(T-1)

- A/OPC

- AO

- CH

- Convenience Check Writer

Initial

5

CLC 046 - DoD Sustainable

Procurement Program (Green

Procurement) (T-1)

- A/OPC

- AO

- CH

- Convenience Check Writer

Initial

6