2023

Mid-Year Perspective On

Chicago Real Estate Market

2

In 2023, a myriad of market forces are having a compounding effect and recasting the mid-year sentiment

of real estate markets in Chicago, across the U.S. and around the globe. Some of the headwinds include

the pandemic hangover, geopolitical tensions, 10 consecutive interest rate hikes, commercial real estate

(CRE) debt maturities, along with financial instability, inflationary pressures and the threat of a recession.

Among the key findings shaping the 2023 Chicago Mid-Year Sentiment Report by The Real Estate Center

at DePaul University and its partner Urban Land Institute Chicago District Council include:

• The bears are everywhere—Chicago, Lake Forest, Arlington Heights and Naperville—and not just for

a new stadium deal. More than 45.7% of real estate professionals are bearish on market conditions,

a sharp contrast from one year ago when 23.7% were bearish.

• More than 75% believe we are already in a recession or will be by the end of the year.

• The three greatest macro concerns among real estate professionals are rising interest rates, a

recession and additional bank failures.

• When focused on Chicago and the state overall, the greatest concerns are the familiar cluster of the

effectiveness of political leaders, high crime rates and property tax uncertainty.

• Real estate professionals are rooting for Mayor Brandon Johnson to succeed, while acknowledging

that his position as an unknown also creates additional uncertainty.

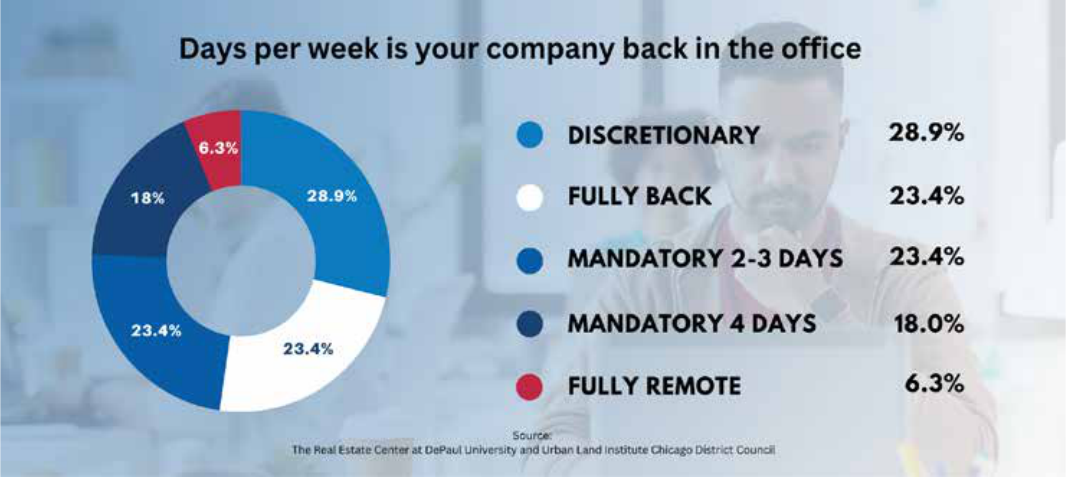

• Getting people back to the oce remains a vital hurdle for building owners, restaurants and the overall

downtown ecosystem. Unfortunately, unless a recession changes the dynamics of the employment

market, most guidelines for oce attendance may be strongly urged but hard to enforce.

• Diversity, Equity & Inclusion remains an important topic of conversation, but moving the needle is

challenging.

In survey responses and one-on-one interviews, most people acknowledge key local and state issues,

including crime rates and a property tax system that create more questions than answers. At the same

time, however, a common and emphatic theme among CRE professionals is that Chicago has a public

relations crisis that fails to combat long-held narratives about the City and ignores the opportunities to

advance storylines that strike greater balance.

Despite the local, regional and national challenges, many commercial real estate professionals are

fiercely loyal to the long-term potential for growth and opportunity in Chicago. Their loyalty is based on

the area’s natural resources, central location, ability to attract entrepreneurial businesses and talent,

a natural migration of graduates from major Midwest universities, and a deep, hometown understanding

of the marketplace and its true potential.

Adding perspective to the dynamics of Chicago’s image, Mary Ludgin, Senior Managing Director, Global

Head Investment Research, Heitman, referenced the Chaucer quote, “familiarity breeds contempt.”

“In Chicago, we know our warts really well. But we don’t necessarily place that in a national context,”

Ludgin said. “Chicago is rebuilding its image and how we manage crime and crowds to make sure that the

city is welcoming and safe for all—and a great place to invest!”

Uncertainty Breeds

Opportunity

DePaul University 6th Annual Mid-Year Sentiment Report

3

In 2023 real estate professionals with a bearish or concerned view of the Chicago marketplace increased

substantially, from 64.9% in 2022 to 82.8% in 2023. The most significant increase came from those

who defined themselves as bearish, not just concerned. The 2023 bears nearly doubled the 2022 bears,

increasing to 45.4% from 23.7%

Only 4.4%, the lowest in the six years the report has been published, are bullish about the market. In

fact, 82.6% of real estate professionals are either bearish or concerned about the second half of the

year. Last year, approximately 65% were less than optimistic about the second half of the year.

Yet, similar to the past, real estate professionals are more optimistic about the year ahead. Thus, the

sentiment changes when looking at 2024. Those who are optimistic or bullish about 2024 total 38.6%.

Ironically, that means that CRE professionals are slightly more optimistic about 2024 than they were for

2023 (35.1%).

One explanation Rick Sinkuler, Douglas and Cynthia Crocker Endowed Senior Managing Director, The

Real Estate Center at DePaul University offered for why professionals are inclined to be more optimistic

about the next year is that people tend to believe time will be on their side and provide some breathing

room to work through the issues on the horizon.

“In the long-term, I am a big believer in the Chicago marketplace,” said Shawn Clark, CEO, CRG. “There

may be some short-term pain, but we will solve our challenges together.”

The bears have taken over Chicago’s real estate markets, and not just in Arlington

Heights, Naperville or wherever the proposed new football stadium ultimately is

developed.

The Bears Are Everywhere

The Real Estate Center at DePaul University & the Urban Land Institute Chicago District Council

In any given point in a real estate cycle there will be projects that are immediate in scope and those that

take years to be fully realized. Developers with long-term projects typically have a perspective that is

different than those whose investment horizons are significantly shorter or have more urgent demands

to place capital.

Mike Ellch, Related Midwest, said developers like his firm are bullish on Chicago in part because they

focus on the presence of underlying, long-term trends and characteristics. As a result, the Chicago

projects Related has underway will have longer horizons, from 5 to 7 years or, in the case of The 78,

perhaps 10 to 15 years.

Ellch finds the work Related is doing in the City exciting because of the broader vision of Related and

other developers in addressing the communities where they are located, including Fulton Market, Lincoln

Yards, the Medical District and Bronzeville, among others.

“The scale is there,” Ellch says, which reinforces why Related is so optimistic about Chicago. “We’re

creating really strong public spaces. Every neighborhood has an opportunity to do something special in

the public realm.”

As most developers and investors with a long-term view believe, Chicago remains unparalleled in the

strength of its resources, talents, architecture and people.

“While coastal growth has historically been greater, Chicago’s potential for robust growth is unassailable

due to its powerful assets. We have a plethora of prestigious universities turning out STEM graduates, a

location in the center of the nation and on the shore of the world’s largest network of freshwater lakes

and world-class cultural assets, housing, mass transit and more,” said Quintin Primo, Capri Investment

Group Founder and Executive Chairman. “Over the course of the next 20 to 30 years, I believe Chicago

could move back to being the second largest city in the country.”

Yet some contend that other cities may be surpassing Chicago because of a mindset and approach to

economic development.

“The development timeline process remains very challenging and unpredictable. That makes it hard to

ascertain when you’ll be in the ground,” said Dean Marks, Managing Principal, Sterling Bay. “One thing

that institutional capital hates is unpredictability. They want to eliminate risk factors.”

Marks believes that big projects have to be a public private partnership so that development can get

a fast start out of the gate. He made the point it’s especially true for long term projects which may

straddle times of economic opportunity and uncertainty, but have the ability to create some of the

hottest markets in the country.

“You can build during a recession, but it’s a lot harder to start a new one,” Marks said. “We’re building

infrastructure—sewer, water and electricity—where there was none, or it was obsolete. That’s hard to

do without full cooperation.”

Developers Taking

the Long View

The Real Estate Center at DePaul University & the Urban Land Institute Chicago District Council

4

While much of Sterling Bay’s project focus is in Fulton Market and Lincoln Yards, Marks says the company

believes a thriving CBD is critical. “A thriving CBD is a huge asset to the City.” The issue, however, is how

to fix antiquated buildings, calling it a real trick box.

Primo’s firm Capri Interests, in partnership with Michael Reschke’s The Prime Group, also believe in the

value of thriving CBDs and have two projects in the pipeline to fulfill that concept. A team led by Primo

is one of a handful who have been selected to help lead in the transformation of LaSalle Street to “a

functioning and viable neighborhood from what has been an architectural museum.”

Like so many urban markets across the country, Chicago’s oce market has been perhaps irrevocably

harmed by Covid, with no more than 40-50% going back to the oce on a regular basis.

“I don’t think we’re ever going back to pre-covid levels of workplace occupancy because of fundamental

lifestyle changes spurred by the convergence of the pandemic and tech innovation,” Primo said.

Nonetheless, countless investors and developers across the country believe that urban markets represent

viable opportunities to bring diversity, inclusion and affordable housing through the redevelopment of

once revered oce markets.

“But once vibrant CBDs are asset-rich, both structurally and culturally. They will be reinvented and

continue to thrive. So, those who work in retail establishments, restaurants and hotels—in fact, most

industries—will likely have the ability to live close to where they work,” Primo said. “And oce sector

occupancy will begin to naturally rise as oce inventory is diminished due to adaptive reuse conversions.

We could easily be in an undersupply condition in 10 or more years.”

Creating Vibrant CBDs

is Essential

5

The confluence of factors has resulted in a significant decline in investment activity as well as values.

“What’s happening with interest rates, inflation and a lack of transaction activity is a cause for some

concern,” Mike Kamienski, Partner, Baker Tilly, said. “We all know that real estate investors like to do

deals so I don’t expect the lack of transactional activity to last too long.”

There is significant capital on the sidelines, more so than we’ve ever seen, waiting to transact. The

question becomes when will the first shoe fall. The answer to that question is challenging to answer

because of the lack of comparable transactions to support a sale price.

THE IMPACT

6

Global, National and Local

Risk Factors

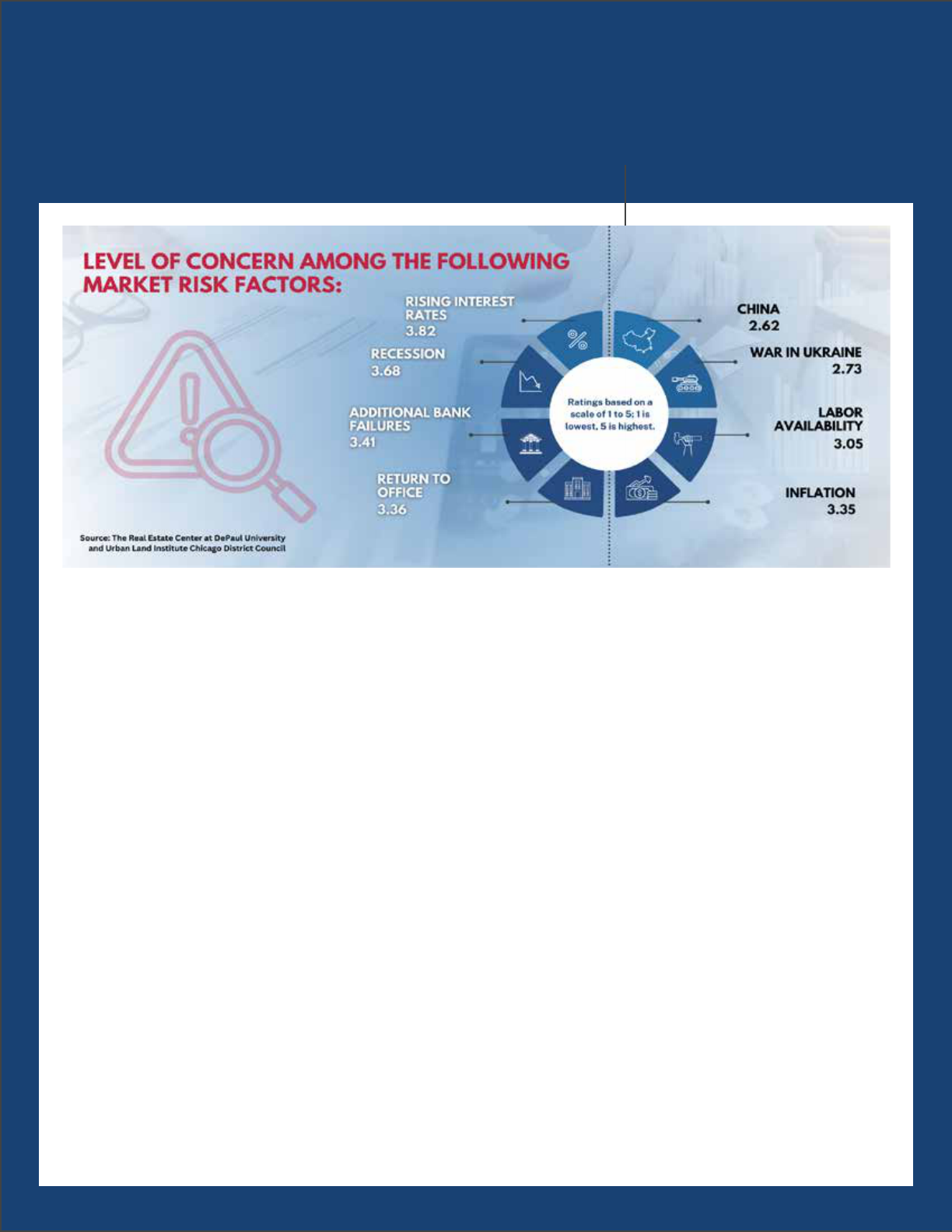

Real estate professionals in Chicago are concerned about a variety of different issues that could pose a

threat to the marketplace. Yet, the general level of concern, according to survey results, has dissipated

year over year. In 2022, the concern expressed for seven of the eight risk factors presented scored a 3.0

or higher; two scored a 4 or higher. In 2023, no scores above 4.0 were recorded, and two scored below

3.0.

Further, of five different risk factors presented in both 2022 and 2023, the level of concern for three of

the risk factors declined. Concerns about labor, the number one area of concern in 2022, inflation and

rising interest rates all fell. Returning to the oce was the only one to show an increase. Concerns of a

recession were unchanged in 2023. This year we’ve added bank failures to the mix.

Yet just because the level of concern was reduced doesn’t mean that real estate professionals aren’t

wary about issues, especially related to the state of the economy.

“We have a lot of plates spinning, including the banking situation, employment issues, inflation,

immigration and a number of others,” said Steven Weinstock, Senior Vice President, Regional Manager,

Marcus & Millichap. “None of them are easy to figure out, even if we all agree there is a problem.”

Source: The Real Estate Center at DePaul University and Urban Land Institute Chicago District Council

“If the Fed stops raising interest rates, which optimistically I believe they will, it will create stability and

people will get more comfortable looking for opportunities and completing deals,” he said.

The belief held by many that interest rates have hit their peak is a welcome first development necessary

before a resurgence in activity would occur. Knowing that rates have peaked will help end the stalemate

in commercial real estate. The other critical need for a resurgence to occur is knowing the trajectory of

net operating income.

“People want to invest while the knife is still falling,” Ludgin said. “They also need to know where the

knife is in its trajectory and prefer it to be closer to the bottom.”

Although Ludgin didn’t offer a prediction when a resurgence will happen, she noted that opportunistic

investment activity by high net worth individuals and family oces, a harbinger of what is ahead, is

picking up. “We’re seeing these investors taking risk … even buying oces … as they attempt to get the

early and best deals,” she said.

Institutional investors, in contrast, are reconciling denominator issues and are looking to avoid immediate

and longer term valuation risks.

Chicago has three areas of strength that would drive investment allocations if an investor had substantial

capital to invest, according to Ludgin. Not surprisingly, industrial real estate tops the list for all the

reasons that have made it a top investment of choice for more than a decade. The next two categories—

medical oce and self-storage—play more to the broad demographics of the Chicago marketplace.

Ludgin also suggests looking out for retail plays. “A site specific retail resurgence is underway. Yields are

high relative to other sectors so your entry point is good.”

She would also look at opportunities in the oce to residential conversion, particularly downtown, and

LaSalle Street Reimagined in part because of the significant growth in the Loop population which has the

ability to stabilize and reduce vacancies in the downtown oce and retail sectors.

THE OPPORTUNITY

7

Confronting City, County &

State Challenges

Since the inception of the Mid-Year Report, one of the great consistencies has been the real estate

industry’s general evaluation of the political systems, at the city, county and state level.

Consistently, the three greatest risks about investing in and/or doing business in Chicago are the

effectiveness of city, state and county leadership and the uncertainty surrounding real estate property

taxes in Chicago and Cook County. In the last several years, increasing crime rates joined the list.

The survey asked real estate professionals to rank from 1 (low) to 5 (high) their level of concern on a

list of factors. In the most recent survey, the effectiveness of government earned a ranking of 4.23,

very narrowly ahead of high crime rates at 4.22. The tax situation followed very closely behind at 4.17.

With ratings that high, it is little consolation that concerns about government effectiveness decreased

slightly from last year’s rating of 4.33.

Survey participants who wrote in comments said, “Chicago has the best of everything,” except the

political landscape,” “Chicago should be experiencing a boom right now but it’s struggling. This is a direct

result of bad city and state leadership,” and “the political climate and crime are both cause for concern.”

In addressing the political posturing that takes place at the local, county and state level, Bill Williams,

CEO, KMW Communities, said, “To get things done and to effect change, you can’t be a progressive, you

have to be a centrist.”

As part of that, Williams advocates creating faith in our institutions and our government and predictability

in our tax situation.

“From a real estate investment perspective, however, real estate tax policies need to be more transparent

and predictable, and social and financial issues must be addressed. Otherwise, the outcome is predictable:

investors will redline this wonderful city,” Primo noted.

Nick Siegel, Partner, Acquisitions at Bridge Industrial, a national real estate operating company and

investment manager, has a different perspective on property taxes, comparatively speaking. On a per

square foot basis, tax bills in states such as California are significantly larger. National users are used

to variations in the property tax line item and, to a certain extent, view it as a cost of doing business in

that state. But the local user, whether in Chicago, Los Angeles, Dallas or New Jersey, typically feels the

bigger brunt of the property taxes.

“Taxes are obviously an issue,” Kamienski said. “Deals are hard to underwrite because of the enormity

and unpredictability of this significant expense. It’s a huge variable that makes it hard to complete deals

in Chicago.”

8

It is too soon into Mayor Brandon Johnson’s administration, and the makeover of the City Council, to rate

effectiveness. However, CRE professionals have definite opinions about what his priorities should be to

positively impact the real estate and business environment.

Lowering crime rates was, without question, the top priority earning a 4.57 rate (out of 5 possible). It

was the only offering rated above 4.0. If people don’t feel comfortable going out past 8 pm that hurts

business; and that hurts real estate.

The next closest priority, streamlining the development approval process, rated more than 100 bps

lower at 3.55.

In another sign of an overarching real estate industry sentiment that Chicago is at a crossroads, the

impressions of what Mayor Johnson can accomplish are wide ranging.

Dean Marks calls early meetings with Johnson and the new administration very collaborative with a clear

intent on listening to issues, challenges and potential solutions. “It’s a welcome path the administration

is following,” he added.

In contrast, a number of survey participants offered comments including, “very concerned about the

new mayor and lack of experience,” “Johnson adds another element of uncertainty after years of Kaegi

doing the same; it causes a wait and see mentality.”

Ludgin, who once worked for Mayor Harold Washington, has high hopes that Johnson can emulate

Washington’s vision and approach and benefit from a City Council that works with him, not against him.”

“Chicago needs a 50-ward strategy that balances the downtown and the neighborhoods, defines how

to effectively police its streets and is in a position to show off its progress and successes,” Ludgin said.

Clark is another industry leader who is optimistic about the administration of the new mayor, observing

that he has been actively engaging smart leaders within the business community to help establish a plan

and build consensus on a host of different issues.

“It’s a complicated job and process,” Clark said, “but in the early days of the administration the new

mayor is working very hard at being inclusive.”

High Hopes for Mayor Johnson’s

Administration

9

10

The lending community is front and center in the minds of commercial real estate professionals, with

rising interest rates and the prospect of more bank failures cited as two of the top three greatest

market risk concerns.

“I personally believe that short- and long-term interest rates will hold near current levels through year

end and potentially taper down in 2024,” said Greg Warsek, Executive Vice President, Group Leader,

Associated Bank. “However, many, including CBRE’s economists, believe that short- and long-term rates

could come down 20-50 basis points by fourth quarter.”

Jerry Lumpkins, Senior Vice President-Midwest Commercial Real Estate Division Head, Valley Bank,

thinks the rate increases have been more than enough, but he does expect one more.

“The massive increases were aggressive,” Lumpkins said. “And we are now feeling the impact.”

In context, the 50 year average for interest rates is 7.75%, so we are well below that average. However,

with interest rates being so low for so long, people have come to believe that a rate at or below 4% is

standard.

“We shocked the system with the intent of curbing inflation and I am not certain that we’ve given it

enough time to take hold,” Warsek added. “I don’t really know if we’ll be able to get it to the Fed’s 2%

target.”

The fallout from the massive interest rate increases has been a stalling out of activity, though financial

institutions continue to actively originate new construction and term loans.

“We’ve seen capital sidelined and the debt markets constrained for several months,” Marks said. “Each

time the Fed raises rates it seems like a blunt force instrument for a more nuanced situation.”

Loans tend to be at lower leverage than one year ago. For example, some report that what may have been

65% LTC last year is likely at 50-55% LTC this year. Spreads on interest rates tend to be higher due to

heightened risk in the market and the more limited availability of lending capacity.

The types of assets getting financed in the current environment will vary from one bank to another,

depending on an institution’s focus and experience. Lumpkins and Warsek both see activity in the

industrial and multifamily sectors. Warsek also sees retail activity.

“Oce has overtaken hotels as a tough sell for lenders,” Warsek noted. “Oce is a four letter word and

that won’t be changing for the foreseeable future.”

One of the storylines most likely to be encountered today is an investor with maturing debt where the

debt service rate is below 4%. That creates the situation where new debt could range from 6.5 to 7%

which requires a lot of net operating income to support.

“If deals can get done, investors are being required to write the bank a check to keep LTVs in balance,”

Lumpkins said. “We are just now coming to terms with and having to address these situations.”

Banking: View From the Top

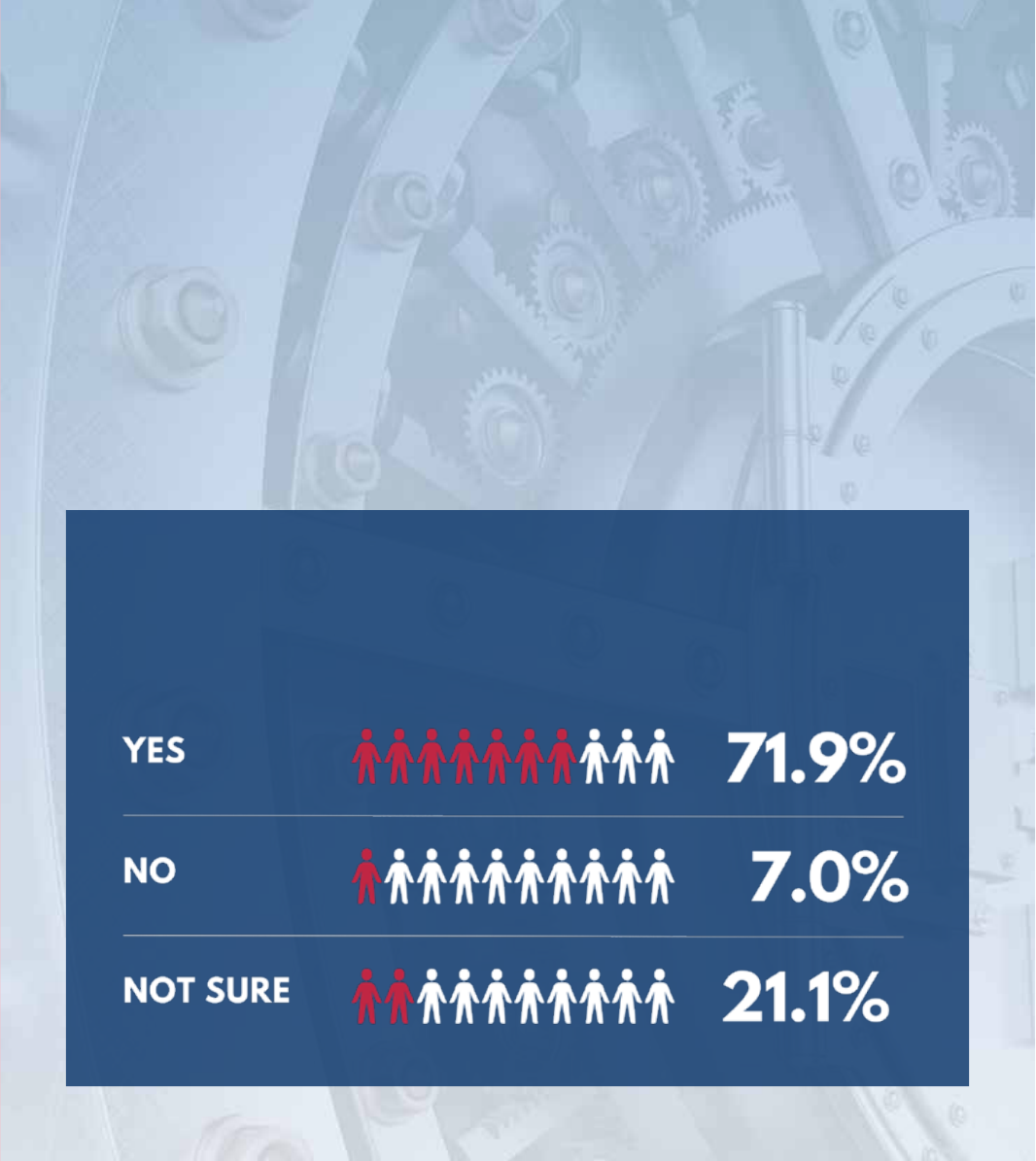

EXPECTATION THAT WE’LL SEE MORE BANK

FAILURES OVER THE NEXT 12 MONTHS

“2025 is when, hopefully,

we’ll see normalcy”

Jerry Lumpkins

Senior Vice President-Midwest Commercial Real Estate

Division Head, Valley Bank

Source: The Real Estate Center at DePaul University and Urban Land Institute Chicago District Council

On the subject of the presence of a recession, Lumpkins said, “We are in the early innings of a recession

and there is a lot of pain yet to be felt, especially when considering debt maturities on oce buildings,”

Lumpkins said. “It will be a very painful process to figure out.”

For all of those factors, Lumpkins labels current conditions “a complicated situation” adding that some

in the banking industry don’t believe rates will move down significantly until late in 2024 or early 2025.

11

2

Source: The Real Estate Center at DePaul University and Urban Land Institute Chicago District Council

12

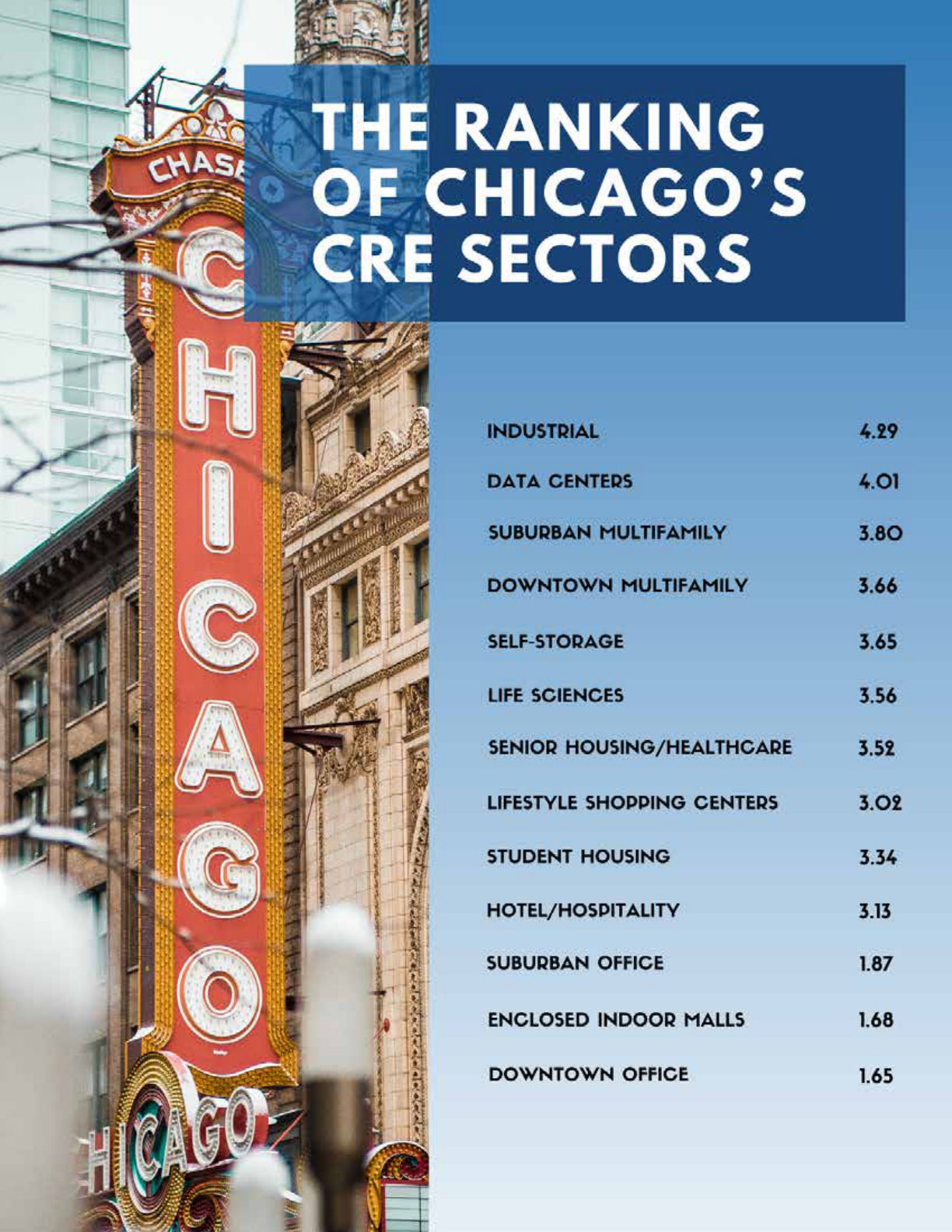

Industrial, data centers, suburban and downtown multifamily and self-storage facilities continue to be

perceived as the strongest CRE sectors. The only year-over-year difference in the ranking of the top five

in 2023 is that downtown apartments traded places with self-storage as the fourth strongest.

Rank notwithstanding, the strength rating of all but four sectors actually declined from 2022 to 2023.

The perceived strength of industrial declined from a 4.46 ranking (out of 5) to 4.29. Not surprisingly, the

greatest declines in perceived strength occurred for suburban and downtown oce properties at 57 and

60 bps, respectively. The ranking of hotel/hospitality properties increased by 56 bps, underscored by

recent select events/weekends when occupancies were above 95%.

Although it wasn’t called out as a specific asset category but included in the broader “healthcare

facilities” class, there is a strong sentiment for Medical Oce and related buildings.

Lumpkins expressed growing interest in financing for medical oce properties because they offer

services that can’t be satisfied with ecommerce. “You can’t get bypass surgery from Amazon.”

Following are overviews of a number of asset classes, including oce, multifamily, industrial and retail.

Strength of the CRE Sectors:

INDUSTRIAL SECTOR CONTINUES TO GROW

The industrial market continues to grow, albeit at a slower pace than it has performed at over the last

10-plus years.

“If you look at the elevated levels of development, leasing and acquisition activity in recent history, a

tempering shouldn’t be a surprise,” said Molly McShane, CEO, The McShane Companies.

While uncertainty in the economy has played a role, development and construction activity has been

more impacted by debt levels and interest rate increases. “You can’t raise rates as they have without

there being a huge impact,” she said.

Nick Siegel, Partner, Acquisitions, Bridge Development described portions of Chicago’s industrial market

as having coastal characteristics, including great locations and access to transportation routes. The

combination of characteristics makes them “extremely relevant, in high demand, and where users and

investors want to be.”

Some of those “Chicago coastal markets” may have further opportunity with the emergence of well-

located in-fill sites that could be converted from oce to industrial campuses. This includes the former

Allstate headquarters, as well as large oce campuses in Rolling Meadows and other suburban markets.

Infill sites typically draw strong demand from developers as well as users; but they are not without

challenges. Entitlements are very dicult, especially when the site’s former use, and neighboring uses,

are not industrial. Communities are becoming increasingly reluctant to approve zoning that would allow

facilities with 24/7 truck loading.

The ability to control land sites of that size and in those locations can be very enticing. Current issues in

the suburban oce market could make these and future opportunities even more appealing.

13

One of the enduring qualities of Chicago’s industrial sector has been its track record of meeting significant

challenges in the market, as was witnessed during the pandemic when the sector gained an even stronger

foothold as one of the most popular asset classes. A byproduct of the pandemic was significantly higher

construction costs and delivery time for materials. That too has mostly abated, with most pricing and

delivery timelines coming back into line or stabilizing, except for labor costs.

Siegel is not nearly as concerned about construction costs as he was two years ago. “The costs are

coming down and flattening. And as development activity slows around the country, construction firms

and subcontractors may strike deals in order to get jobs.”

McShane offered a more cautionary tone and said, “It’s been a lot like playing whack-a-mole. I am not

confident that we’re 100% through yet.”

Siegel’s continued optimism about Chicago’s industrial market is based on macro fundamentals.

“Chicago is still the hub of the Midwest. It’s where people want to be and where companies need to be

to serve the population,” he said.

He further characterized the market as healthy and well-constrained from being oversupplied. Despite

the optimism, Siegel does have one primary concern.

“After interest rate increases and inflation, the one last shoe to drop would be rent growth,” Siegel said.

“Some of the most active investors are value-add buyers that are betting on rent growth. It would be

challenging if the rise in interest rates and other economic factors cause rent growth to go away.”

14

RETAIL: A TALE OF TWO MARKETS

Sentiment for the Chicago retail scene is perhaps best characterized as a tale of two markets: the

downtown CBD market and everywhere else.

Allen Joffe, Principal, First Street Retail Partners, said tourists are back and at pre-pandemic levels,

which has a positive impact for retail and entertainment venues on Michigan Avenue and State Street,

as well as the neighborhoods like the West Loop, Fulton Market, and River North.

“Local retailers aren’t talking about crime; it’s not as much of a concern anymore,” Joffe said. “Minimum

wage and the fair work week provisions are the primary discussion points.”

He characterized the drought in demand for downtown retail space since the start of the pandemic as

being the worst he’s seen in a retail advisory career spanning three decades.

“The presence of retail tenants downtown, in the CBD, used to be generational,” Joffe said. “But that all

changed with the pandemic.”

While there have been reports that “occupancy” or people returning to downtown oces may be

approaching 60%, there is some skepticism about the stat’s accuracy, questioning whether it accurately

captures older building stock. The skeptics suggest the level could be slightly more than 40%.

According to Joffe, restaurants that typically have catered to a downtown lunchtime crowd continue

to struggle. “The bulk of their business is being done Tuesday through Thursday which can result in

significant spoilage from Friday to Monday.”

15

Lower trac volumes in the CBD, increasing labor

costs and higher pro rata property tax bills combined

result in lower profitability for downtown retailers.

“Everything impacts the pro forma, and alters the

risk-reward balance,” Joffe said. The impact is also

being felt by franchisees, some of which may be

seeing their targeted 10% margins sliced by 50% or

more.

As far as CBD retail is concerned, this may be the

new normal.

According to Michael Gold, COO, Pine Tree, “The

disruption we sensed one year ago due to the

likelihood of aggressive interest rate increases has

arrived, which has caused a general reduction or

halting in transaction activity.”

Nonetheless, there are opportunities throughout

Chicago and across the country to acquire property

that is not experiencing distress, and there is plenty

of capital on the sidelines that has an interest in

retail assets. Gold in particular is bullish on acquiring

open air retail centers.

One of the challenges in acquiring open air retail is the

current bid ask spread. “Unless there is a need to sell,

owners aren’t capitulating to the lower bid prices.

We are beginning to see some of that changing.”

Using Pine Tree as a barometer of tenant demand,

Gold said that junior anchor positions, those ranging

from 20-30,000 square feet are faring well. He

reported that the handful of Bed Bath & Beyond

spaces it has had at its centers across the country,

all currently have leases or letters of intent in place

for replacements.

There continues to be a reinvention and reimagining

of retail malls in Chicago and across the country. One

of the most common trends has been incorporating a

multifamily component to enhance the lifestyle vibe

and to build natural synergies with consumers. That

effort is experiencing mixed levels of progress and

success.

SoCHICAGO - JULY MICHIGAN AVENUE SHOPPING

16

OFFICE FLIGHT TO QUALITY

In Chicago’s downtown and suburban oce markets, the flight to quality cannot be overstated according

to Ellen May, Managing Director, Tishman Speyer. She categorized the downtown market in three tiers:

the 20% that are outperforming the market, 25-30% that are functionally obsolete, and the remaining

50-50% that is challenged by age and other factors but form a highly competitive set.

Emerging from Covid, well-located, transit-oriented buildings downtown began to see increasing interest

and build momentum. “We were seeing signs of a recovery in demand; it was occurring at a decent pace,”

May said.

The momentum, however, was short lived given the financial uncertainties that emerged with each

interest rate hike. “Occupier sentiment started to fall and caused a dampening of demand” she said.

Many professionals voiced that it will be interesting to see what lies ahead for Fulton Market, one of

the most popular markets over the last decade. Activity there was strong in 2021 and 2022, but space

absorption and a development slowdown will constrict the market.

“That bodes well for the rest of the market,” May said.

Other concerning factors include the clouds that are forming because of expiring commercial loans.

Segments of the market could be frozen, creating zombie buildings that are paralyzed by lengthy

workouts and/or landlords giving keys back to lenders.

Another challenge facing the downtown market is the inventory of sublease space. Approximately 8.0

million square feet of sublease space is available, but estimates are that only half of that are viable

solutions. “The value buyer has some good opportunities, and that impacts absorption overall,” May said.

“But there isn’t enough demand yet to make a significant difference.”

One of the big differentiators between the downtown and suburban oce markets is transportation to

work. Downtown oces have always had a high percentage of commuters taking public transportation—

until Covid. As demonstrated by the volume of expressway trac, concerns over the safety of public

transportation remain.

17

In contrast, the vast majority of people working in the suburbs drive to the oce. “With these differences,”

Bob Six, Chief Executive Ocer, Zeller, said, “occupancy rates are similar and may actually be higher in

the suburbs.”

One of the common denominators of successful suburban oce buildings is what made downtown work

and so appealing pre-pandemic: the oce building amenity race. Previously, the buildings downtown

that were the most appealing had rooftops, game rooms, conference centers and other common area

tenant amenities. Post Covid, we’ve come full cycle, copying those downtown amenities in the suburbs

and mirroring the comforts of home people had during Covid.

“People want their oces to replicate what they have at home,” Six said. “The focus of creating great

spaces has a new set of standards.”

One outcome, based on suburban buildings’ need to “create community”, has been a pivot from a building

concierge service to a community manager who will create and deliver a comprehensive tenant experience.

“The ability to deliver an experiential oce environment creates a competitive advantage,” he said.

Similar to downtown, suburban landlords are more inclined to give free rent than significant tenant

improvement allowances. “Cash is king for landlords,” Six said. “It’s easier to give free rent than it is to

write a check for improvements.”

According to Six, a reason for optimism in the suburban marketplace is the back-to-work momentum

taking place. People recognize the need for collaboration and socialization. He voiced a concern that is

as applicable to the downtown market as it is for suburban building owners: the state of the capital

markets.

A common situation for oce investors is they have debt obligations coming due, with few extensions

available and requirements for refinancing that would require a significant equity infusion—perhaps as

much as 40-50%.

“In today’s market, who would throw good money after bad?,” Six asked.

He also expressed concern that there are a lot of real estate and financial professionals who are

responsible for making decisions but who haven’t been through an economic downturn. Yet in the end,

his experience tells him that creative minds will come together and deliver innovative means for bringing

in fresh equity.

18

MULTIFAMILY GROWTH STARTING TO COOL

For many real estate markets and sectors, including multifamily, current market conditions are starting

to taper from where they were one year ago. At the same time, conditions and fundamentals have in

many cases exceeded pre-pandemic levels.

According to ALN Apartment Data, Chicago’s multifamily market sector, in a year-over-year comparison

for May, has an occupancy rate that at 93.1% is nominally lower than one year ago. Annualized effective

rent growth is occurring at an average of 6.1%. The good news for the Chicago market is that its

occupancy and rent growth levels are above ALN’s national occupancy and rental growth average of

91.1% and 4.1%, respectively.

Phil Lukowski, Managing Partner, Portfolio Management, Waterton, believes the downtown multifamily

market is in a good place, relatively speaking. “The apartment market today is more normalized.

Occupancy rates and rent growth is solid, the historical seasonality of the market has returned, and

there is a better balance of new construction as a percentage of total inventory when compared to

other markets.”

For multifamily owners and investors like Waterton, the relatively steady and above the national average

performance of Chicago assets is a welcome sign when many of what have been the hottest markets,

like Austin, Phoenix and Nashville have shown signs of a much greater falloff in asking rents.

In fact, plenty of investors are feeling good about Chicago given that predictions for rent growth are

less volatile for the City compared to those other markets.

“The Chicago market was hurt by Covid, especially the CBD,” Lukowski said. “We’ve been pleasantly

surprised at downtown’s recovery and in spite of the slowdown that is occurring nationally, the Chicago

market is still okay.”

Like most markets across the country, Chicago does face a housing supply shortage, but one that is

exacerbated by elevated construction and capital costs. “It makes it tough to pencil out new development,”

Lukowski said. “In addition to higher finance costs, labor and materials aren’t down enough and you

can’t forecast higher rent growth as in previous couple years.”

Despite the general good feeling about the Chicago marketplace, there continues to be a shortage of

affordable housing units, locally and across the country. Lukowski noted that the problem isn’t easily

solved even though there are mandates for including affordable units in Chicago new construction.

19

Lukowski mirrored comments about various concerns for Chicago, highlighting “risks and uncertainty.”

He believes the City can work through the crime issues, issues which similarly are being faced in other

markets nationally. “The stigma is there, but we really aren’t alone.”

As positive as owners like Waterton’s Lukowski feel about Chicago, investment activity has slowed to

a snail’s pace because of the credit markets. In the absence of many sales over the last 12-18 months,

valuations are challenging. Further, sales activity can be impacted by some of the general uncertainty

about real estate property taxes, something Lukowski says may be improving but isn’t yet resolved.

One suburban storyline worth watching to see its evolution is whether suburban oce buildings will

be acquired for multifamily conversion or new development opportunities. Bob Six, CEO, Zeller, sees a

proliferation of mediocre and aging Class B and C assets that could be prime candidates.

“The problem for some of these assets was the 10-year period when interest rates were effectively at

zero percent.” Six said. “It has allowed these B and C buildings to masquerade as a ‘viable’ investment

class, even though a better option would have been to tear the buildings down or repurpose them.”

In terms of converting oce buildings to multifamily properties, Six says that sometimes the greater

question is not whether it can be converted, but whether it should be converted. He estimated that in

order to be a viable project for conversion or new development, buildings would have to be acquired in

the $50 to $70 per-square-foot range.

20

Recession: Yes? No?

Maybe So!

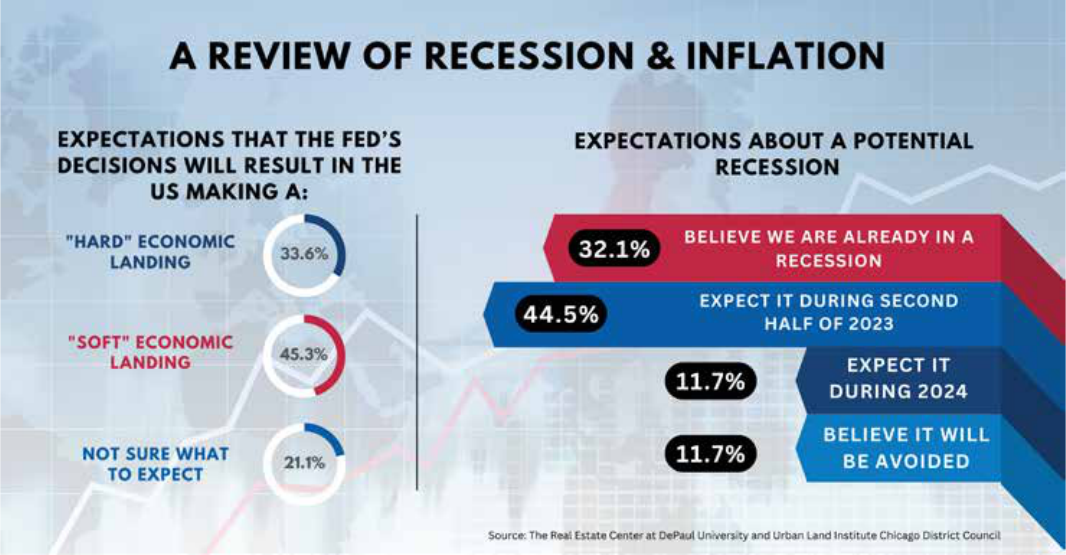

Based on the results of the survey, there is little doubt that a recession is on the horizon, if not already

here. The bigger question is whether we should expect a hard or a soft landing.

More than 75% think a recession will be upon us by year end. One third believe we are already there.

Those not believing we’re in or heading to a recession this year are evenly split between avoiding a

recession altogether and a recession in 2024. Although 45.3% believe the landing will be soft, 33.6%

expect a hard landing. Just over 20% aren’t certain.

“We shocked the system with the intent of curbing inflation, and I am not certain that we’ve given it

enough time to take hold,” Warsek added.

Although inflation has been moving downward, some contend that it is more appropriate to say inflation

is tempering instead of slowing.

Ludgin agreed and said, “We are wrestling with inflation. The Fed made some really remarkable moves

over the past year. I fear the Fed likely overshot and that we are entering into a period of slow growth

or recession.”

Weinstock reflected on witnessing firsthand a number of recessions or economic downturns and how

the real estate industry responded. “We’re like a car that now has better brakes. But the problem is

that sometimes you still have to hit the brakes and you have to know how hard to brake to avoid hitting

the wall.”

“If you hit the brakes too hard, somebody ends up hitting you from behind,” added Sinkuler.

“Hindsight is always 20/20. It’s easy to speculate or suggest that if the Fed had taken a more aggressive

posture sooner to slow inflation everyone would be better off now,” Weinstock said. “It’s been a very

dicult job that is open to a lot of second guessing.”

21

BID ASK SPREAD STARTING TO NARROW

Source: The Real Estate Center at DePaul University and Urban Land Institute Chicago District Council

Real Estate professionals acknowledge a myriad of issues that stand in the way of investment transactions

being completed, including the discrepancy in the bid-ask spread—the price sellers expect, or think they

should receive, versus what buyers are willing to pay.

More than 44% believe that the bid ask spread will narrow, as owners and sellers both become more

realistic and/or are increasingly motivated to complete a transaction. In contrast, more than 31% believe

that the spread will widen, perhaps a reflection of owners who don’t truly need to sell and aren’t willing

to discount pricing.

“Eventually, time will force action. As the cloud of uncertainty starts to lift, buyers and sellers will feel

confident enough to complete transactions,” Sinkuler said.

There is significant capital on the sidelines waiting to transact. The question becomes when will the first

shoe fall. The answer to that question is challenging to answer, according to Kamienski, because of the

lack of economic stability.

He offered that the math doesn’t work very well when multifamily cap rates are still well below interest

rates. Given the state of the bid-ask spread, Kamienski noted that some clients are executing strategies

that further focus on property performance, looking for ways to increase NOI. Then, when the economy

stabilizes their assets will be in a better position for disposition.

Kamienski believes the spread is condensing. “It started out miles apart, is narrowing, but it is still off.”

Source: The Real Estate Center at DePaul University and Urban Land Institute Chicago District Council

22

DIVERSITY, EQUITY, AND

INCLUSION MATTERS

Like most industry sectors in Chicago, CRE continues to address and pay close attention to matters

of Diversity, Equity and Inclusion. In the 2022 Mid-Year Report, it noted that nearly half (48.65%) of

companies had a formal DEI program, with another almost 30% having initiatives in place to improve

their firm’s DEI.

The results of the 2023 survey looked more closely at the execution of a DEI plan. More than 45% reported

firms are making great strides while 21.3% said implementation needs improvement. Yet 54.5% reported

their company’s DEI plan needs improvement, is not working, or is not adequately communicated.

Although the industry is making great strides and having some success, it must work harder at embedding

DEI in everything it does.

“As an industry and as a society, we’re not there yet and it is easy to be impatient with the progress

being made. However, the topic remains front and center,” McShane added. “It’s a concern that isn’t

going away. A full solution will take time but worth the effort.”

Hugh Williams, Co-Founder and Chairman of KWILL Merchant Advisors and a special advisor to Sterling

Bay, agrees that matters of DEI are not going to be changed overnight.

“More people are talking about it which creates positive momentum,” Williams said. “But momentum

does not necessarily equate to progress or change. People are trying to find solutions, but it hasn’t

happened just yet. That said, you have to start where you are and go from there.”

Companies are “establishing a ground game,” hiring interns and others at the early stages of their

professional lives. But other critical elements include hiring or partnering with minority businesses on

projects that are in the neighborhoods and underserved areas, are lagging. Some of that is occurring,

but not at significant levels.

“We need to create capacity and opportunity in the development space for minority owners,” Hugh

Williams said. “One of the best ways to keep momentum going and to actually move the needle is to

get people and projects going. We live in a result-based and project driven society, so to me, it’s about

getting deals on the board.”

One example, however, is a 4-acre site in Englewood that Sterling Bay has under control. The site doesn’t

lend itself to the typical live, work, play projects that Sterling Bay normally develops. As an alternative

strategy, Sterling Bay created a Shark Tank like competition where minority developers in essence

compete for a joint venture partnership. Sterling Bay contributes the land and lends its expertise in

other areas, but the selected developer really controls the project. “We are actively partnering with

developers of color, contributing equity by way of the land, putting our shoulder behind the project, in

hopes of getting a long blighted site back on the tax rolls for the betterment of the community. This is

not a non-profit venture – real project, real dollars, real equity created.”

Hugh Williams noted that, generally speaking, women are making strides at being appointed to positions

of increased responsibility within companies, especially within institutions. “For people of color, the hope

is that the rising tide will lift all boats and we will benefit from the rise of the woman.”

Primo is bullish on investing in Chicago citing one of the great attributes of the city is its full embrace of

diversity, equity and inclusion. He specifically noted the level of black and brown entrepreneurship in the

City, and the diversity on all types of civic, business and charitable boards. “With this level of diversity,

where people from all backgrounds and perspectives work seamlessly together, we will continue to

thrive among other urban centers,” he said.

23

26

Conclusion

The current real estate and economic environments are something we haven’t seen before. The industry

has faced a litany of global headwinds over the last several years – pandemic, geopolitical tensions,

stubborn inflation, rising rates, and financial instability. Yet market fundamentals and underlying

economic conditions, such as job reports, have remained relatively strong.

Dealing with the volatility in the market is not for the faint of heart, especially when the additional

uncertainty of a new mayoral administration, an unpredictable property tax situation, and concerns

about crime and safety are factored into the equation.

Those issues cannot be dismissed, but many in the industry strongly believe that they shouldn’t be

the national or international narratives that shape the impressions or storylines of Chicago. Afterall,

Chicago is ranked 3rd largest in the US and 7th globally in terms of GDP. Further, it has irreplaceable

cultural and natural amenities and continues as a top destination for new college graduates.

“Chicago remains a dynamic city, with access to labor, power, water, and a host of other unique amenities.

That’s never going away,” Sinkuler emphasized. “There’s a sense of long-term optimism that the City

and its leaders will have the courage to make the impactful decisions necessary to accelerate the City’s

standing globally and right here at home.”

The CRE community continues to prove its resiliency, mustering up enough courage to face adversity and

chart a sustainable, innovative path forward.

25

• LaSalle Investment Management

• Marcus & Millichap

• NAIOP Chicago

• Origin Investments

• Prologis

• Real Estate Investment Association

• Rick Sinkuler & Hao Nguyen

• Sterling Bay

• TD Bank NA

• Trinity Hotel Investors, LLC

• US Bank

• Valley National Bank

• Waterton Residential

Acknowledgements

The Real Estate Center at DePaul University and the Urban Land Institute Chicago District Council

would like to thank the following real estate professionals for providing their insights and perspectives

for the Chicago Mid-Year Sentiment Report:

• Shawn Clark, CRG

• Mike Ellch, Related Midwest

• Michael Gold, Pine Tree

• Allen Joffe, First Street

• Mike Kamenski, Baker Tilly

• Mary Ludgin, Heitman

• Gerald Lumpkins, Valley Bank

• Molly McShane, The McShane Companies

• Dean Marks, Sterling Bay

• Ellen May, Tishman Speyer

• Quintin Primo, Capri Interests

• Nick Siegel, Bridge Development

• Rick Sinkuler, The Real Estate Center at DePaul University

• Bob Six, Zeller

• Greg Warsek, Associated Bank

• Steven Weinstock, Marcus & Millichap

• Bill Williams, KMW Communities

• Hugh Williams, KWILL Advisors

The Real Estate Center at DePaul University would like to acknowledge the following Sustaining

Sponsors:

• Associated Bank

• August Hill

• Baker Tilly US

• CBRE

• Charles H. Wurtzebach & Susan M. Marshall

• Chicago Title Insurance Company

• CRG

• DePaul Real Estate Alumni Alliance (DREAA)

• DC Capital Partners

• Duff & Phelps Investment Management

• EY

• Goldie B. Wolfe Miller Women Leaders in Real Estate Initiative

• KPMG LLP

Equally important, it is appropriate to thank Associate Director of The Real Estate Center, Kathleen

O’Hare; ULI Chicago District Council Executive Director, Cindy McSherry; and ULI Chicago District

Council Program Manager, Abbie Olson.

Sentiment Report Content: Michael Millar, Open Slate Communications. Sentiment Report Layout &

Design: Carlson Integrated.

1 East Jackson

Chicago, Illinois 60604

312.362.5906

realestatecenter.depaul.edu

1700 West Irving Park Road, Suite 208

Chicago, Illinois 60613

773.549.4972

chicago.uli.org