Winter 2024

Solar Industry Update

David Feldman

Jarett Zuboy

Krysta Dummit, Lindahl Reed Contractor for SETO

Dana Stright

Matthew Heine

Heather Mirletz

Robert Margolis

January 25, 2024

NREL | 2

Global Solar Deployment1

U.S. PV Deployment

2

PV System Pricing

3

Global Manufacturing

4

Component Pricing

5

U.S. PV Imports

6

7 PV Waste and Toxicity

Agenda

NREL | 3NREL | 3

Global Solar Deployment

• Analysts estimate 350 GW

dc

of PV was installed globally in 2023 (though recent data

have indicated that number could be more like 440 GW

dc

); global installations are

expected to increase to 400 GW

dc

in 2024 and 590 GW

dc

by 2027. 2023 estimates may

increase as it was recently reported that China installed ~260 GW

dc

of PV panels in 2023.

U.S. PV Deployment

• Though California residential installations were up through the first nine months of

2023, likely caused by a spike in interconnection applications in the lead up to April 15

change from CA NEM 2.0 to 3.0, interconnection applications have since plummeted

well below historical levels.

• According to EIA data, the United States installed 15.8 GW

ac

of PV in the first 9 months of

2023—a record—up 31% y/y (SEIA reported 19.3 GW

dc

).

• EIA projects the percentage of U.S. electric capacity additions from solar will grow from

46% in 2022 (18 GW

ac

) to 54% in 2023 (31 GW

ac

), 63% in 2024 (44 GW

ac

), and 71% in

2025 (51 GW

ac

).

• Other analysts’ projections are lower, with a median value of 33 GW

dc

in 2023, growing

to 36 GW

dc

in 2024 and 40 GW

dc

in 2025.

• The United States installed approximately 15.1 GWh (4.8 GW

ac

) of energy storage onto

the electric grid in the first 9 months of 2023, +40% (+32%) y/y, as a result of growth in

all sectors.

PV System and Component Pricing

• U.S. PV system and PPA prices have been flat or increased over the past 2 years.

• Global polysilicon spot prices fell 18% from mid-October ($10.53/kg) to mid-January

($8.70/kg), approaching their lowest levels of the past several years.

• Global module prices reached yet another record low, falling 22% between mid-October

and mid-January to $0.11/W

dc

.

• In Q3 2023, the average U.S. module price ($0.33/W

dc

) was down 11% q/q and down

23% y/y but at a 100% premium over the global spot price for monofacial

monocrystalline silicon modules.

Global Manufacturing

• BNEF reports that at the end of 2023, global PV manufacturing capacity was between

650 and 750 GW―a growth of 2–3x in the past five years, 90% of which occurred in

China. In 2023, global PV production was between 400 and 500 GW.

• Despite global price drops across the PV supply chain, PV manufacturers have generally

remained profitable, thanks to increases in sales volumes (particularly for N-type cells).

U.S. PV Imports

• The United States imported 40.6 GW

dc

of PV modules in Q1–Q3 2023, setting a new

single-quarter record of over 15 GW

dc

of modules imported.

• Most panels imported were exempt from Section 201 duties and were therefore likely

bifacial. A significant number of thin-film modules were also imported.

• 2.4 GW

dc

of cells were imported in Q1–Q3 2023, up 31% y/y.

• The U.S. is not on pace to reach the 5-GW

dc

quota exemption limit for Section 201 tariffs,

although it has exceeded 3 GW

dc

of imports in a single year for the first time ever.

Executive Summary

A list of acronyms and abbreviations is available at the end of the presentation.

NREL | 4

Global Solar Deployment1

U.S. PV Deployment

2

PV System Pricing

3

Global Manufacturing

4

Component Pricing

5

U.S. PV Imports

6

7 PV Waste and Toxicity

Agenda

• Analysts estimate 350 GW

dc

of PV was installed globally in

2023 (though recent data have indicated that number

could be more like 440 GW

dc

); global installations are

expected to increase to 400 GW

dc

in 2024 and 590 GW

dc

by

2027.

– 2023 estimates may increase as it was recently

reported that China installed ~260 GW

dc

of PV panels in

2023.

– JMK Research reported that 10 GW

ac

(12.5 GW

dc

) of PV

was installed in India in 2023―down 28% y/y. Mercom

reported that Indian installations were being delayed

due to transmission connectivity and long-term access.

NREL | 5NREL | 5

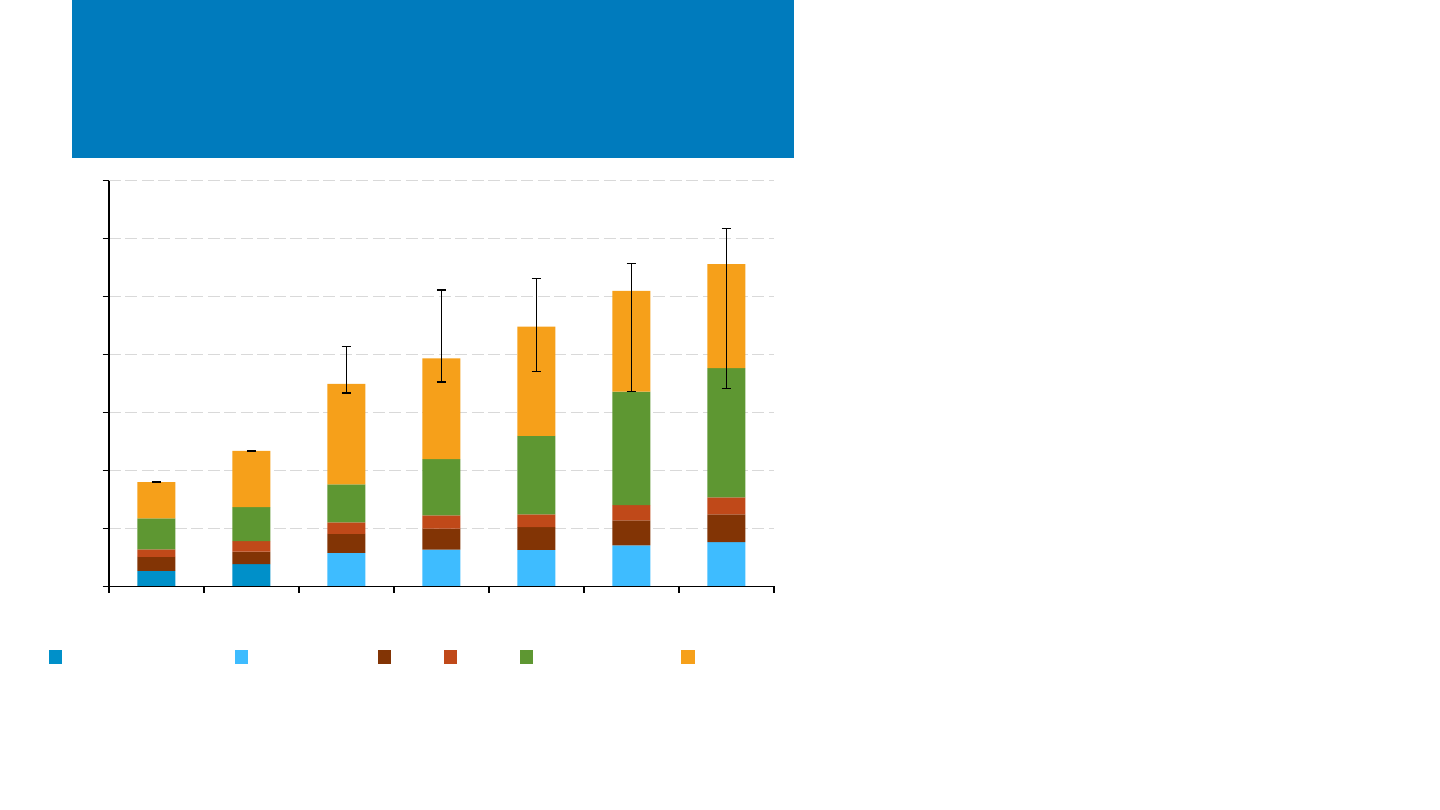

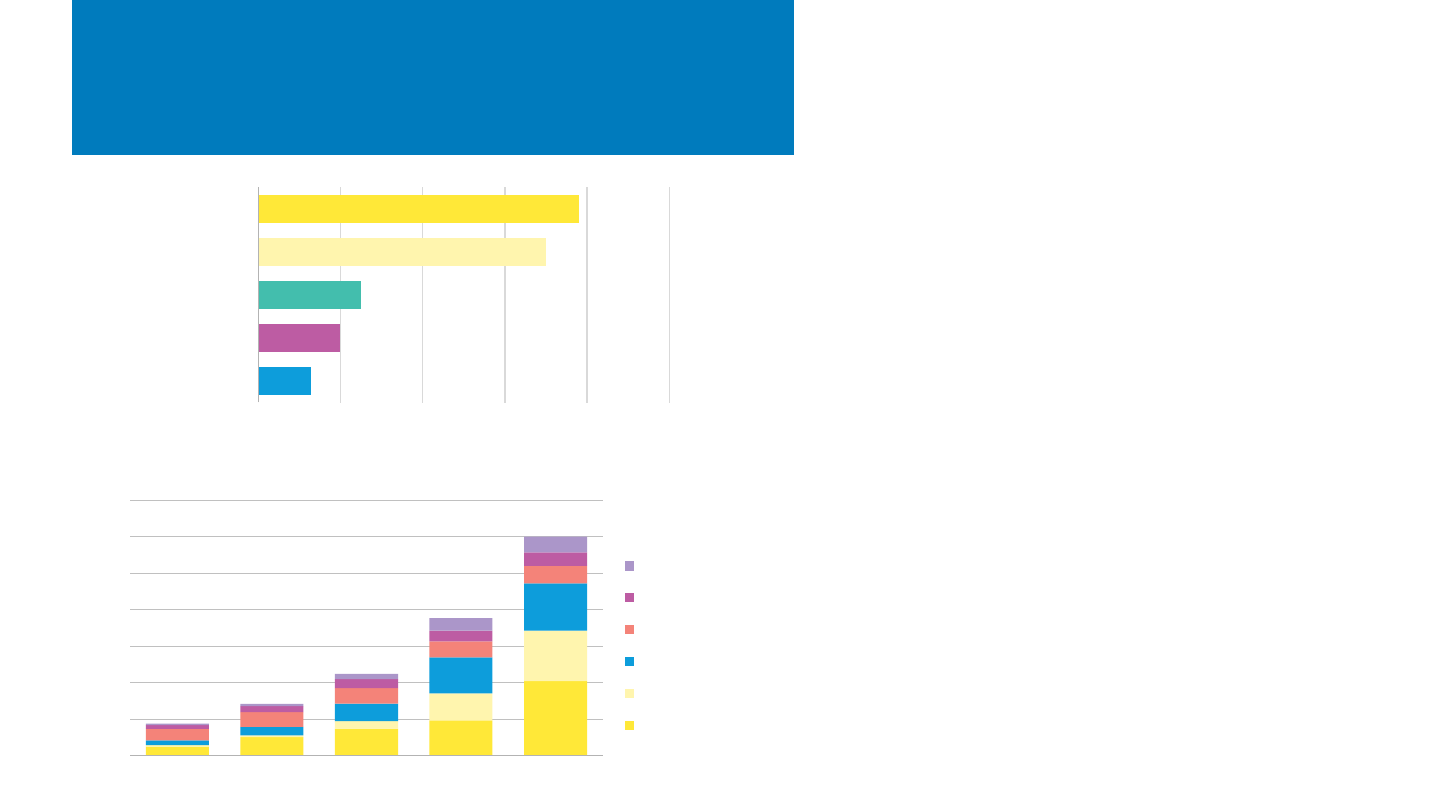

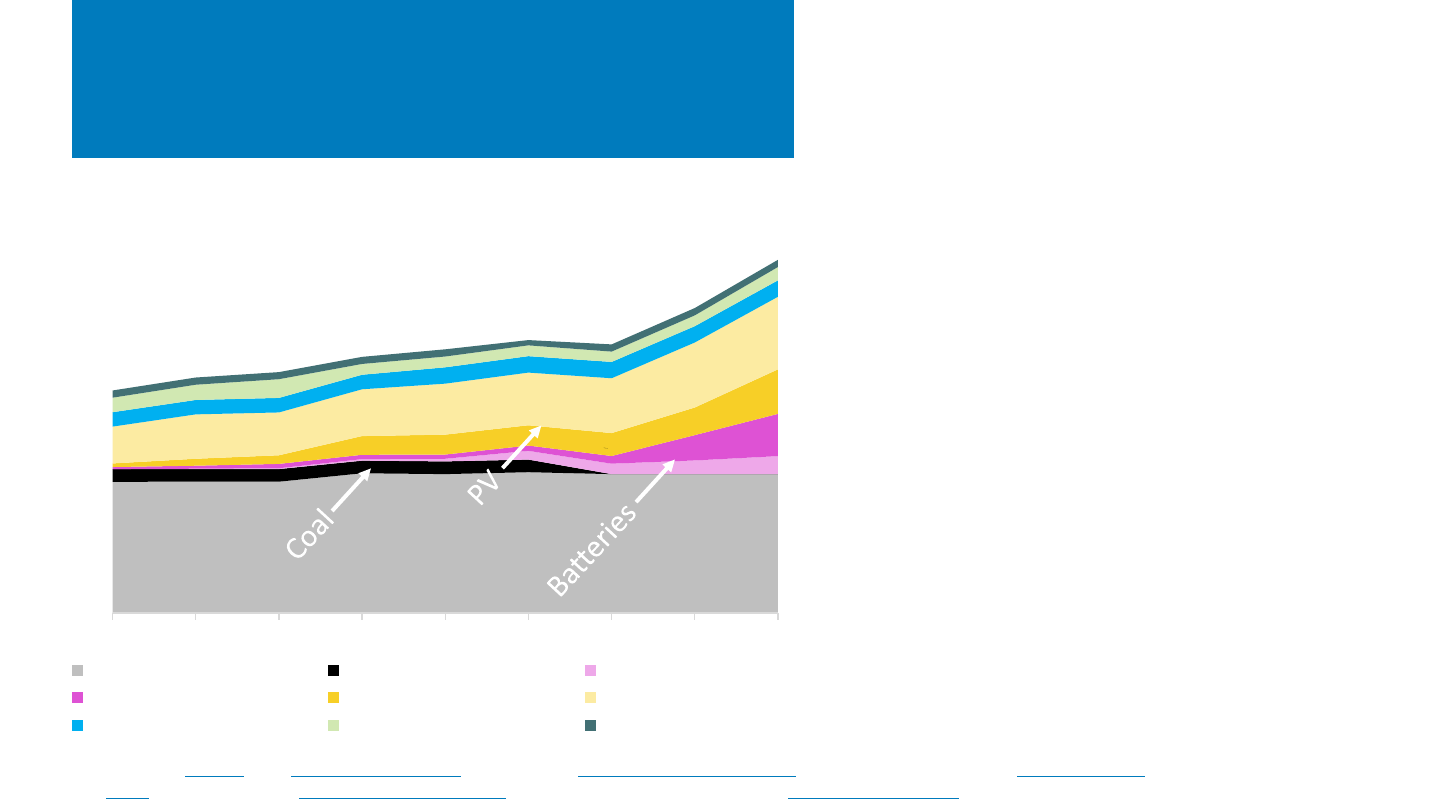

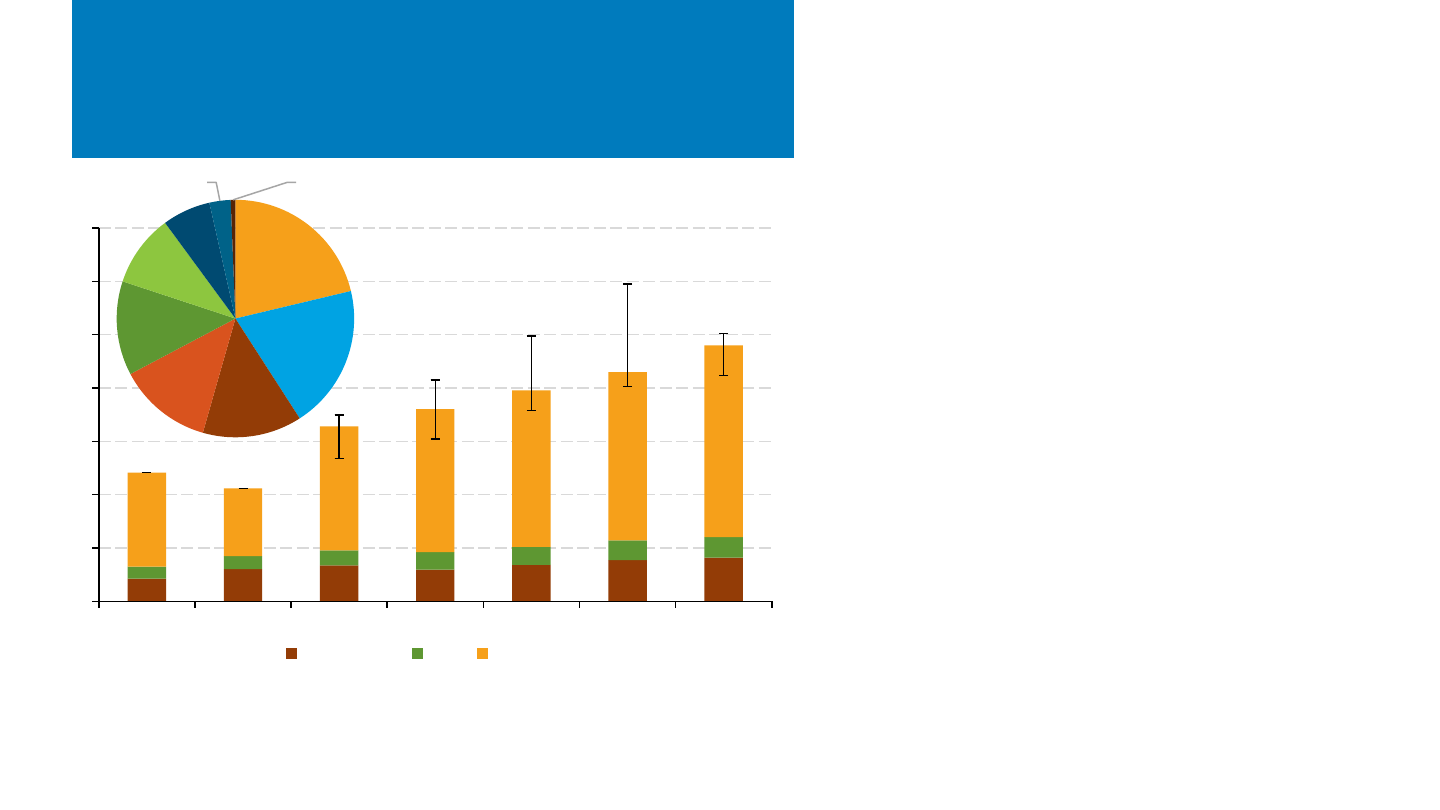

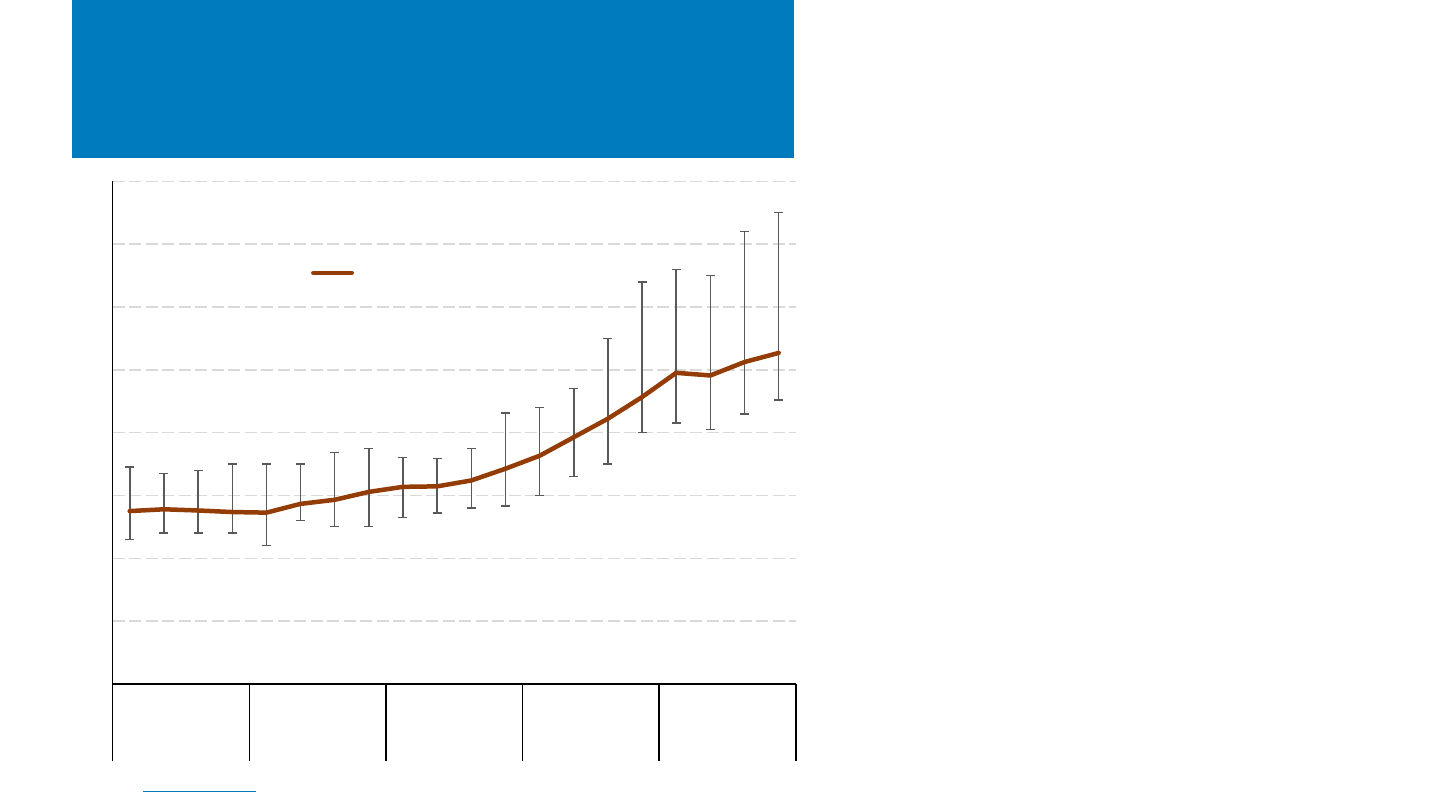

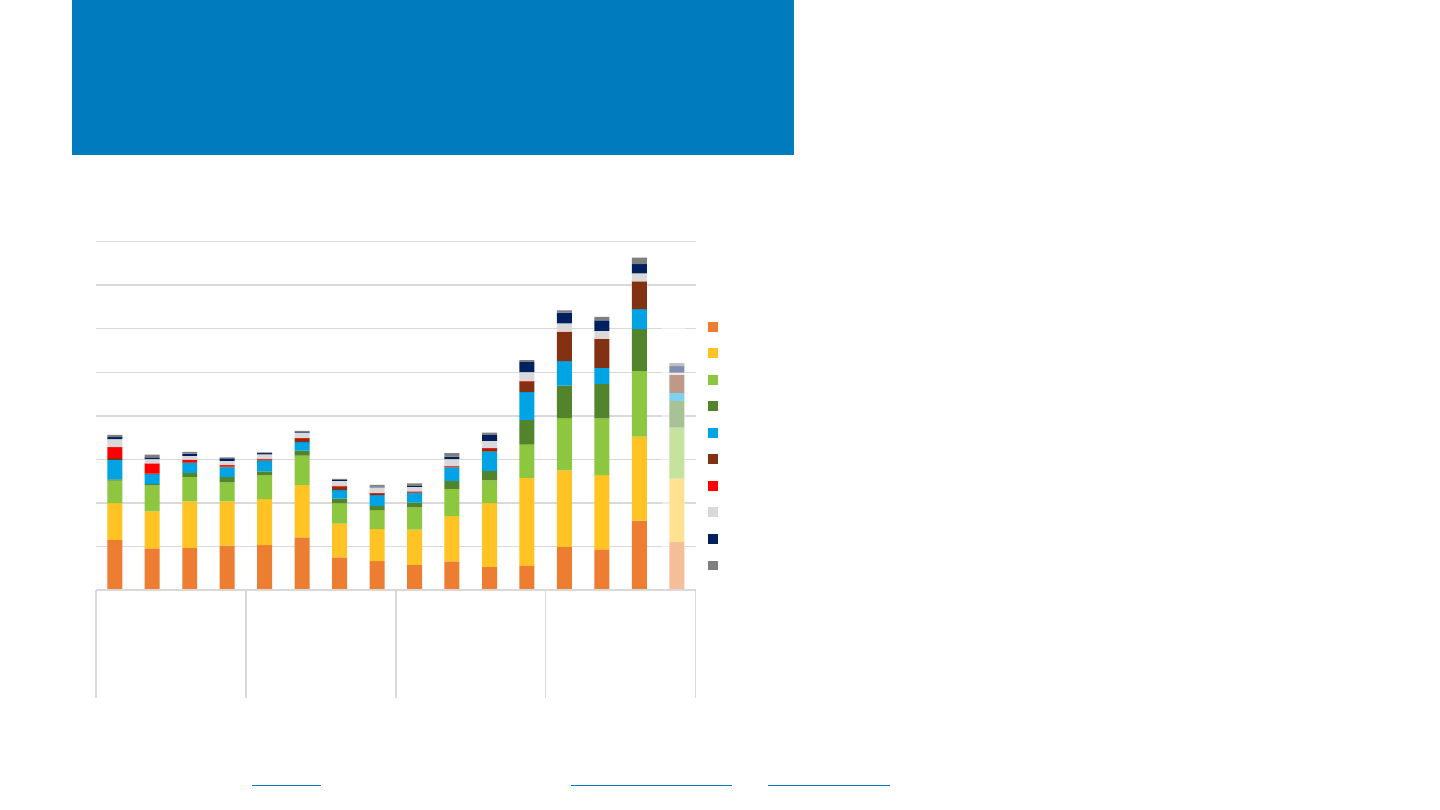

Annual Global PV Deployment

Notes: E = estimate; P = projection. Bar totals represent median global projections across analysts who provide a global projection. Error bars represent high and low global

projections. Regional bar segments represent medians of all available regional projections. Where regional medians do not sum to global medians, the differences are reconciled by

adjusting the Rest of World segments so the correct global median values are retained.

Sources: BNEF, 4Q 2023 Global PV Market Outlook, 11/22/23; EIA, Annual Energy Outlook 2023, 3/23; Goldman Sachs Equity Research, America’s Clean Technology: Solar,

12/17/23; SolarPower Europe, Global Market Outlook For Solar Power 2023–2027, 6/23; Wood Mackenzie, Three Predictions for Global Solar in 2024, 1/24; Wood Mackenzie, Q1

2024 Solar Executive Briefing, 10/23.

• Analysts estimate about 350 GW

dc

of PV were installed

globally in 2023, up 50% from 2022.

– These estimates were made before China announced

2023 PV installs, which could push 2023 global installs to

~440 GW

dc

.

• Analysts project continued increases in annual global PV

installations:

– 390 GW

dc

in 2024 (+12% y/y)

– 450 GW

dc

in 2025 (+14% y/y)

– 510 GW

dc

in 2026 (+14% y/y)

– 560 GW

dc

in 2027 (+9% y/y)

• Among analysts who were covered in the Spring 2023 edition

of the Solar Industry Update, global projections increased in

this edition, e.g., by 2%–31% for 2025 projections.

• The range of projections skews high in the next couple years

but very low toward the end of the projection period.

– One analyst predicts flattening of global deployment

growth, resulting in a projection 220 GW

dc

(40%) below

the median in 2027.

• Over the period shown, China is projected to install the most

PV (39%), followed by Europe (12%), the United States (9%),

and India (6%).

0

100

200

300

400

500

600

700

2021 2022 2023E 2024P 2025P 2026P 2027P

PV Annual Installations (GW

dc

)

European Union Europe (All) U.S. India Rest of World China

NREL | 6NREL | 6

International Q1–Q3 2023

Installations

• In the first 9 months of 2023, PV

installations increased significantly (y/y) in

China (145%), Germany (102%), and the

U.S. (42%):

– China installed ~260 GW

dc

of PV

panels in 2023.

– Germany installed 14.3 GW

dc

in 2023.

– JMK Research reported that 10 GW

ac

(12.5 GW

dc

) of PV was installed in

India in 2023―down 28% y/y.

Mercom reported that Indian

installations were being delayed due

to transmission connectivity and long-

term access.

• At the end of September, these countries

had cumulatively installed 869 GW

dc

of PV.

Sources: Australian Photovoltaic Institute. Mercom (11/27/23; 01/29/24). PV Magazine (11/24/23,

12/22/23); PVTech (10/20/24); Wood Mackenzie/SEIA: U.S. Solar Market Insight: Q4 2023.

Cumulative

capacity

0

5

10

15

20

25

2022 2023 2022 2023 2022 2023 2022 2023

U.S.

161 GW

India

71 GW

Australia

33 GW

Germany

78 GW

Installations (GW

dc

)

Q4

Q1-Q3

0

40

80

120

160

200

2022 2023

China

526 GW

*China reported 87 GW of PV installations in 2022, 129 GW in the first 9 months of 2023, and 216.9 GW in

2023; however, these numbers reflect a combination of utility-scale projects reported in W

ac

and distributed

PV reported in W

dc

. IEA estimated Chinese 2022 installations to be 106 GW. Chinese values here reflect the

same 2022 ILR.

NREL | 7NREL | 7

Concentrating Solar Power

Update

• In Q1 2024, India plans on putting out a tender for renewable energy in which over 50% must come from CSP.

There is renewed interest in CSP in India to provide a longer-duration source of solar energy. Over a decade ago,

India awarded 470 MW of contracts for CSP, but only 200 MW was built

. India is planning to address previous

issues, such as reducing development risk, increased DNI data availability, and loans covering 70% of the costs.

The size of the tender was not provided.

• Recently, there has been a series of CSP spinoff companies that focus on stand-alone thermal energy storage,

powered by electricity from wind and solar to provide more cost-competitive long-term thermal energy storage

for industrial process heat. Recent companies include Malta,

Heatrix, Rondo, and Heatcube. Heatcube has

designed a process with salts that solidify at lower temperatures than traditional CSP, which allows them to use

less expensive steel for their tanks.

• In December, DEWA inaugurated its 700-MW CSP plant (600-MW trough; 100-MW tower). The facility also

includes 250 MW of PV and 5.9 GWh of thermal energy storage capacity.

• In October 2023, GlassPoint announced it will partner with the Ministry of Investment of Saudi Arabia to build a

solar manufacturing plant to mass-produce its solar steam technology. At full capacity, the factory will annually

produce technology to generate 5,000 tons of solar steam.

NREL | 8

Global Solar Deployment1

U.S. PV Deployment

2

PV System Pricing

3

Global Manufacturing

4

Component Pricing

5

U.S. PV Imports

6

7 PV Waste and Toxicity

Agenda

• Though California residential installations were up through

the first 9 months of 2023, likely caused by a spike in

interconnection applications in the lead up to April 15

change from CA NEM 2.0 to 3.0, interconnection

applications have since plummeted well below historical

levels.

• According to EIA data, the United States installed 15.8

GW

ac

of PV in the first 9 months of 2023—a record—up

31% y/y (SEIA reported 19.3 GW

dc

).

• EIA projects the percentage of U.S. electric capacity

additions from solar will grow from 46% in 2022 (18 GW

ac

)

to 54% in 2023 (31 GW

ac

), 63% in 2024 (44 GW

ac

), and 71%

in 2025 (51 GW

ac

).

– Other analysts’ projections are lower, with a median

value of 33 GW

dc

in 2023, growing to 36 GW

dc

in 2024

and 40 GW

dc

in 2025.

• The United States installed approximately 15.1 GWh (4.8

GW

ac

) of energy storage onto the electric grid in the first 9

months of 2023, +40% (+32%) y/y, as a result of growth in

all sectors.

NREL | 9NREL | 9

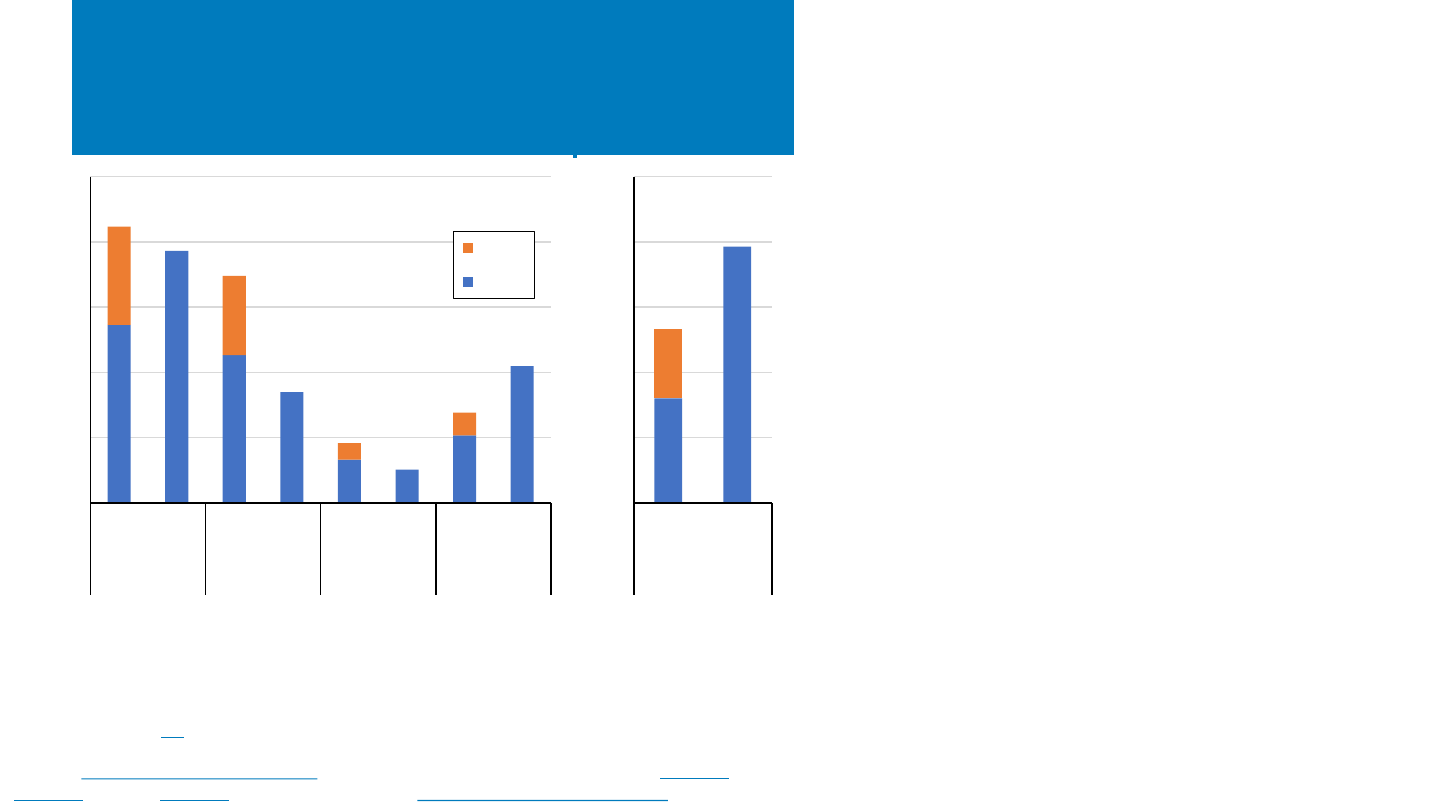

States: Q3–Q4 2023 Updates

Sources: Canary Media (11/20/23); LBNL, U.S. State Renewables Portfolio & Clean Electricity Standards: 2023 Status Update (6/2023); Minnesota Reformer (11/6/23); PV

Magazine (10/24/23, 11/27/23); PV Tech (11/30/23); Solar Power World (10/9/23, 11/28/23); U.S. Government, Fifth National Climate Assessment (2023).

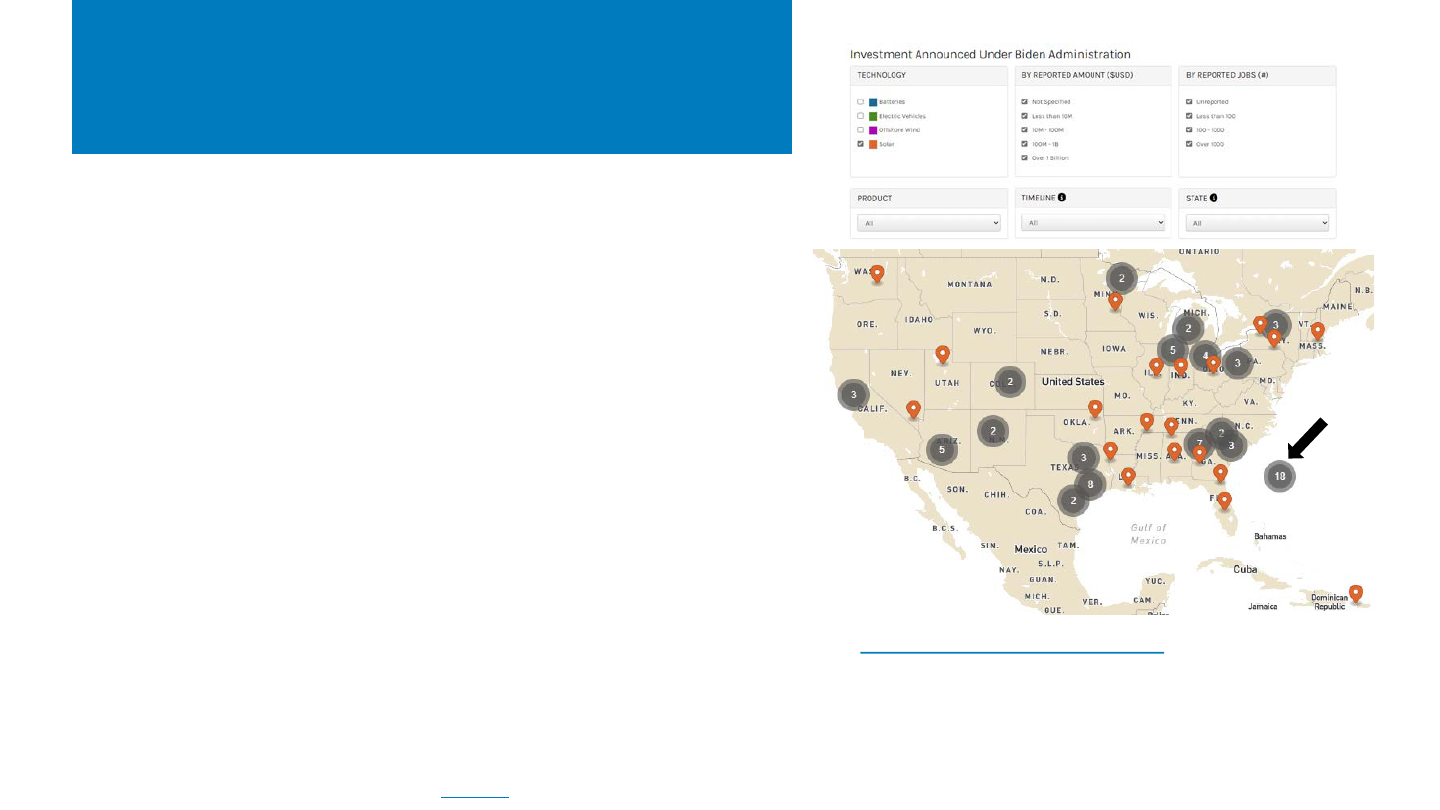

Map shows the number of mitigation actions (reducing greenhouse gas

emissions or removing them from the atmosphere) taken by states, as

reported in the Fifth National Climate Assessment. Cities and tribal

entities have also taken actions. The circles identify the 18 states (plus

Washington, DC) with 100% clean or renewable energy commitments.

Michigan committed to 100% clean electricity

by 2040, 2.5 GW of storage by 2030, higher caps

on distributed PV, and more. The state is also

offering clean energy deployment grants.

Minnesota increased the share of PV

installation incentives going to income-qualified

customers from 30% to 50%.

The Washington, DC metro area targeted

250,000 rooftop PV systems by 2030, equivalent

to PV on 24% of single-family homes.

New York announced investments in 1.5 GW of

PV plus 4.7 GW of other renewables, the

largest-ever state investment in renewable

energy, which will meet 12% of electricity

demand.

California passed laws promoting PV, battery,

and transmission deployment along highways

and accelerating distribution grid

improvements.

100% clean energy std.

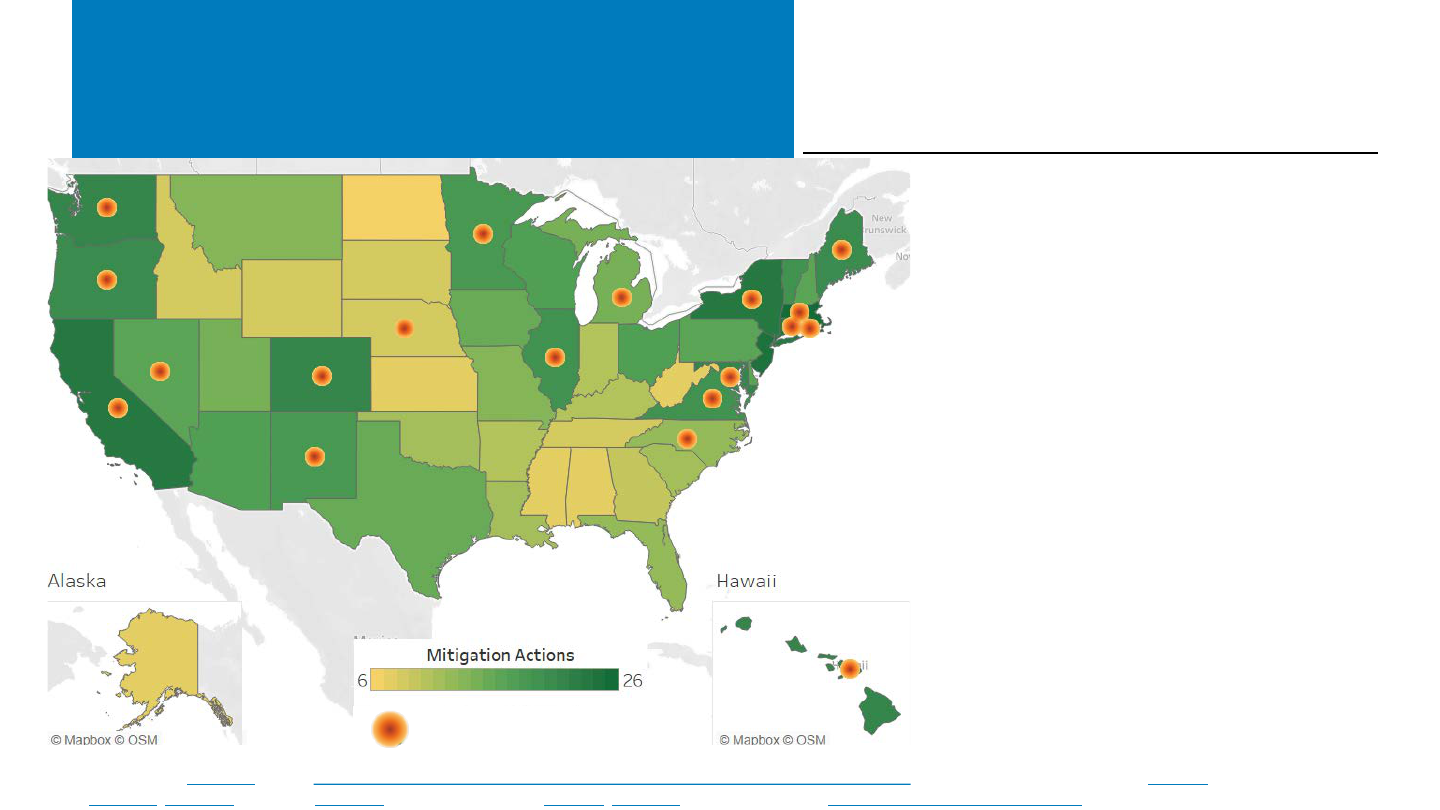

NREL | 10NREL | 10

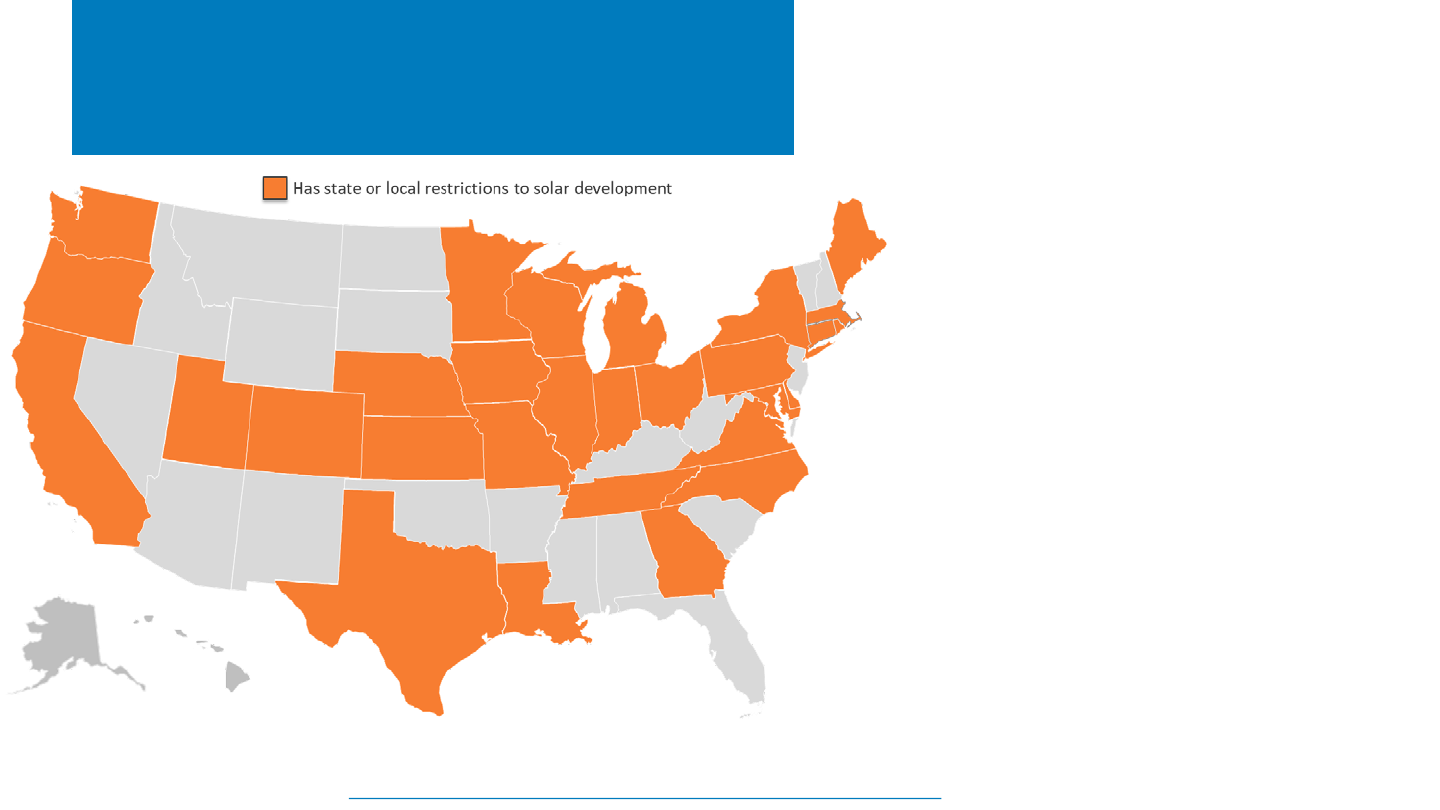

Top State Distributed PV Policy Trends of 2023

• Net billing tariffs

• Incentives for low- to moderate-income customers

• Time-varying PV-compensation rates

• Lack of new utility-proposed/regulator-accepted fees on

PV customers

• Expanded and redesigned state community solar

programs

• Required siting specifications for community solar

projects

• Higher system size and aggregate capacity limits for PV

programs

• Required or allowed application of net excess generation

credits to low-income customer accounts

• Tariffs designed to encourage PV plus storage

• Utility-initiated (not state-initiated) proposals for net-

metering successor tariffs.

States: 2023 Year-in-Review

Source: North Carolina Clean Energy Technology Center, The 50 States of Solar: 2023 Policy Review and Q4 2023 Quarterly Report, January 2024. Map reproduced with permission.

Net Metering and Distributed Generation

Compensation Policies as of December 2023

NREL | 11NREL | 11

Global Residential

PV+Storage (BNEF)

• At the end of 2023, approximately 15 GW/34 GWh of global

residential battery storage capacity had been installed, 88% of

which was located in five countries: Germany, Italy, Japan, the

U.S., and Australia.

• Growth in these markets occurred mostly due to an increase

in storage subsidies coinciding with a decrease in PV export

tariffs (and often high retail rates).

– Germany and Italy have provided incentives between

30% and 50% for the cost of storage while decreasing PV

export rates to the price of wholesale power. The

incentives have scaled back, but self consumption is still a

leading driver ($0.30/kWh vs. $0.05/kWh).

• China has a relatively small residential battery market,

particularly given its high level of product manufacturing. This

is due to low retail rates, low concern for power outages, and

low subsidies.

• Products on the market are now lithium iron phosphate

batteries, which are safer as well as less expensive than the

previously dominant nickel manganese cobalt (which are

denser and therefore better suited for EVs).

• The value chain is evolving to integrate hardware components

and software (for aggregation and energy trading) into a final

product.

0% 20% 40% 60% 80% 100%

US

Australia

European average

Italy

Germany

2023 Residential battery to solar attachment rates, by country (%)

0

2

4

6

8

10

12

14

2019 2020 2021 2022 2023

Residential battery storage annual additions, by country (GWh)

Others

Australia

Japan

US

Italy

Germany

Source: BloombergNEF, “Scaling the Residential Energy Storage Market.”

December 19, 2023.

NREL | 12NREL | 12

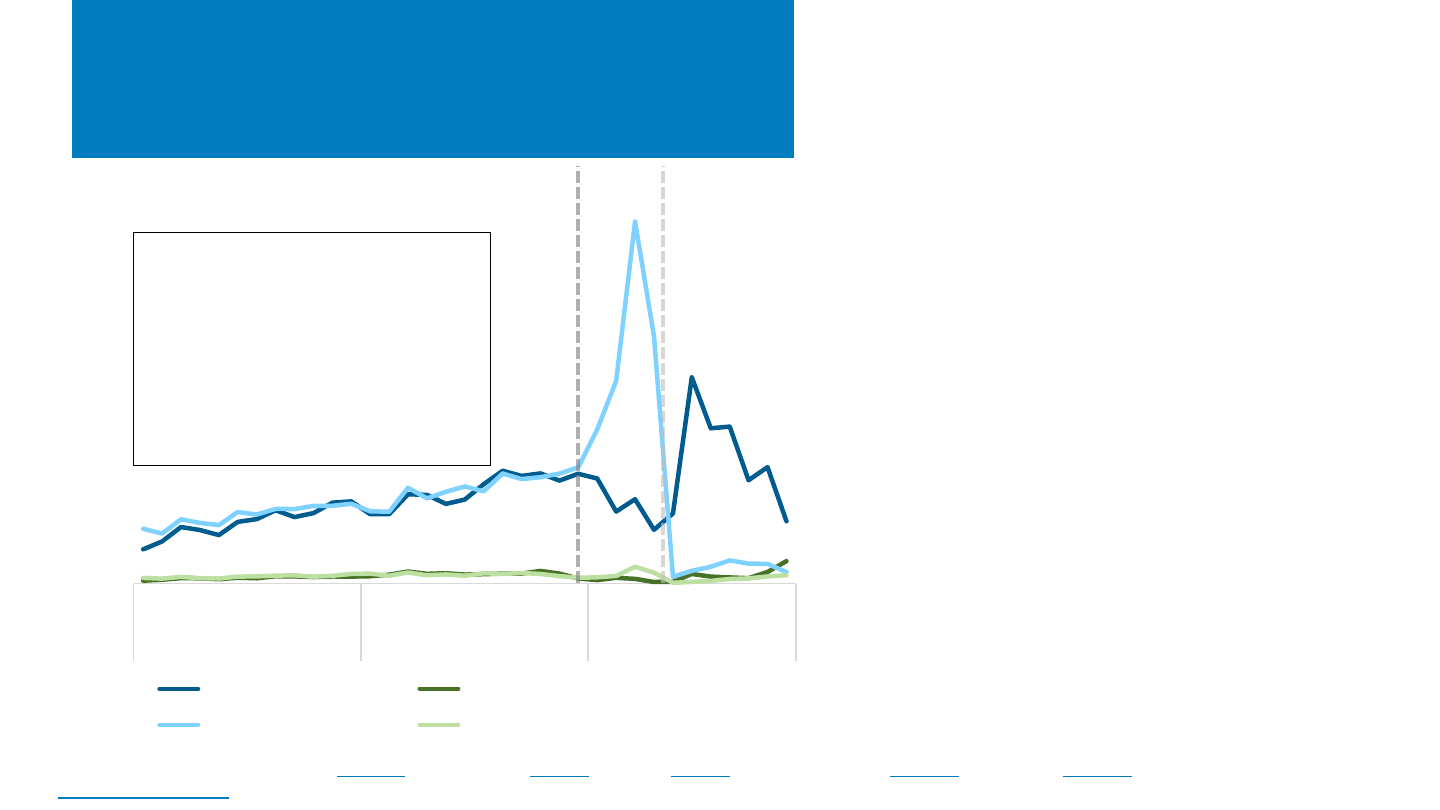

California’s NEM 3.0 Affects

Distributed PV Installations

Sources: California Distributed Generation (11/30/23); Canary Media (12/1/23); PV Tech (12/4/23); Solar Power World (11/30/23); Utility Dive (12/14/23); Wood Mackenzie and

SEIA; US Solar Market Insight, Q4 2023.

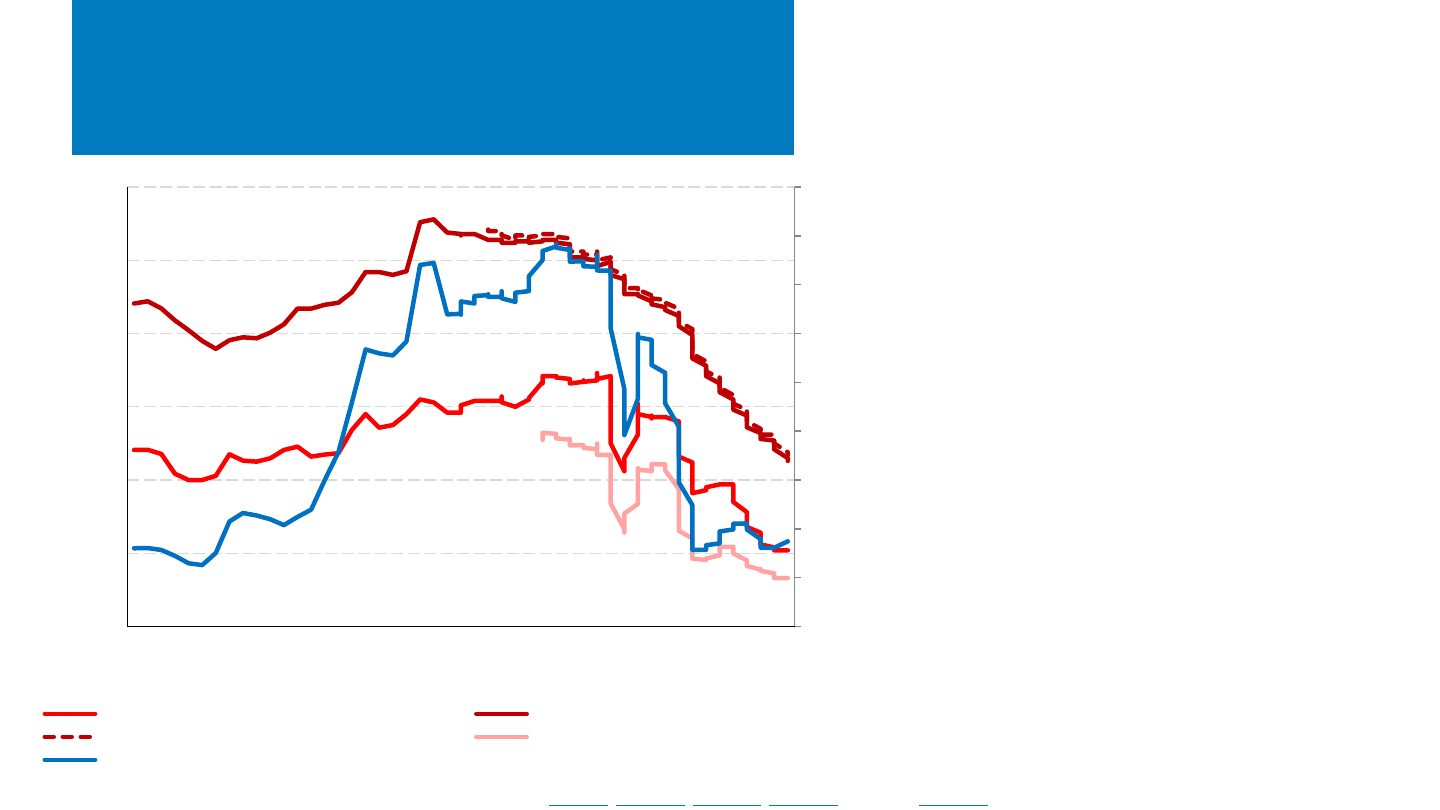

• Implementation of California’s Net Billing Tariff

(i.e., NEM 3.0) rules on April 15, 2023, has already

had a dramatic effect on the residential PV

market:

– Retail export rates under the NEM 2.0 policy

were replaced with avoided-cost rates,

reducing export compensation by ~75%.

– Preliminary data show receipt of residential

interconnection applications spiking in the

lead up to April 15 and then plummeting.

• It is unclear at this point how much of the

drop is attributable to a change in

economics vs. depletion of sales pipelines.

– The NEM 3.0 framework was designed to

encourage PV+storage, which can reduce how

much energy gets exported. To date,

PV+storage applications are still dwarfed by

previous stand-alone PV applications.

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

Jan Mar May Jul Sep Nov Jan Mar May Jul Sep Nov Jan Mar May Jul Sep Nov

2021 2022 2023

No. of Residential Interconnection Applications

Standalone PV (approved) PV + storage (approved)

Standalone PV (received) PV + storage (received)

Interconnection Data: Pacific Gas &

Electric, Southern California Edison

Data are preliminary. Applications

received but not yet approved are

not included. A surge in applications

preceding NEM 3.0 implementation

in April 2023 created an application

approval backlog.

NEM 3.0

effective

NEM 3.0

approved

NREL | 13NREL | 13

California’s NEM 3.0 Affects

Distributed PV Installations (cont.)

• Though it is too early to assess from installation and

application data the true impact of NEM 3.0, a

California Solar & Storage Association (CALSSA) survey

suggests the impacts will significantly harm solar

businesses:

– Respondents reported that 17,000 solar jobs (22%

of all its solar jobs) would be lost by end of 2023.

– 59% of residential PV and storage contractors

responded that they anticipated further layoffs.

• In December 2023, a California appeals court dismissed

a challenge to the NEM 3.0 policy from environmental

groups, who argued that the policy does not consider

the societal benefits of distributed PV as required by

law.

• California accounted for one-third of U.S. residential PV

capacity installed in 2022.

NREL | 14NREL | 14

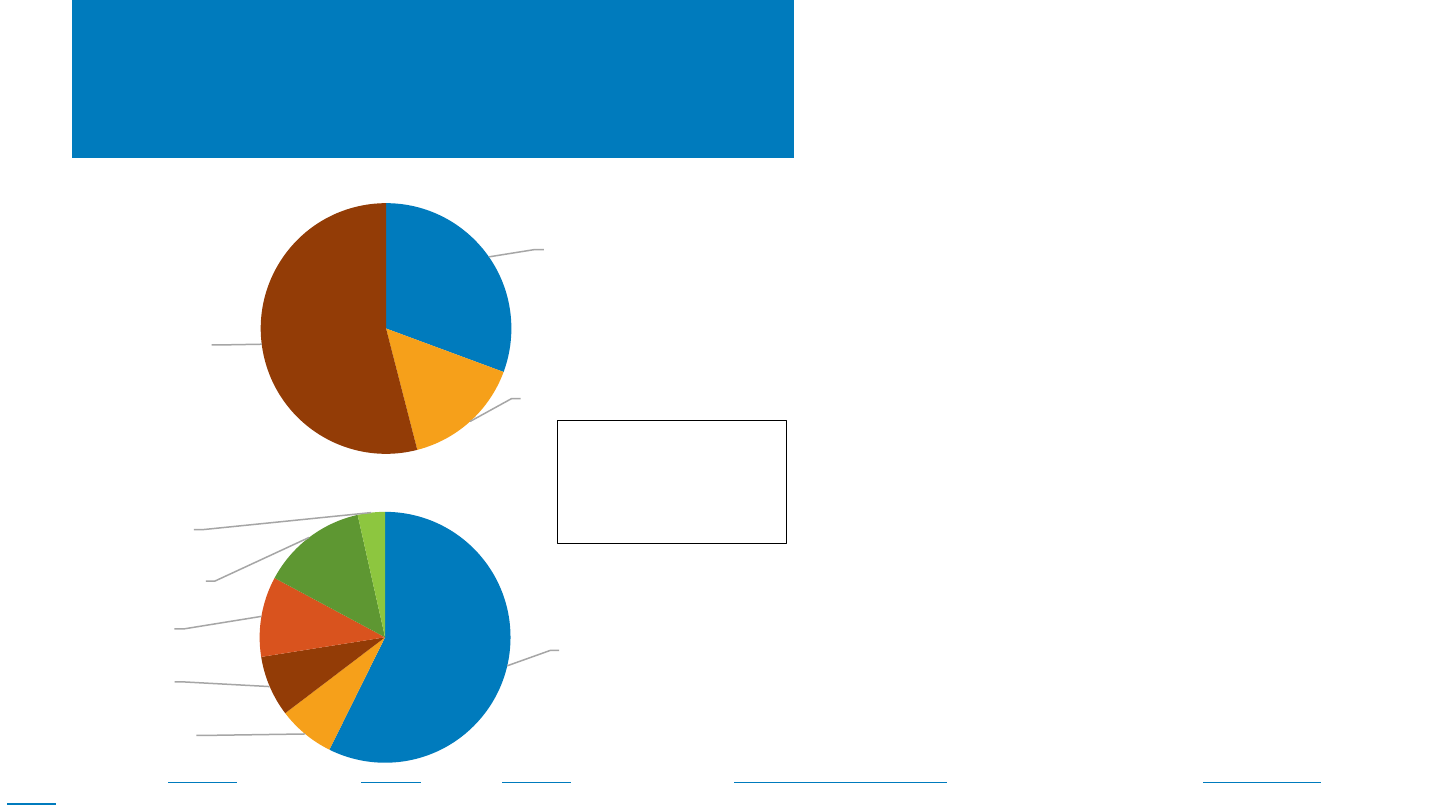

New California Policies Reduce PV

Compensation Further

• In November 2023, the California Public Utilities

Commission (CPUC) reduced PV compensation for

multimeter properties.

– Customers such as schools, farms, and shopping

centers must sell all electricity at reduced rates

while buying all electricity at full retail rates.

– Multifamily housing residents still can self-

consume PV electricity, but multifamily common

areas (lobbies, garages, and so on) cannot.

– Residents enrolled in affordable housing

programs retain existing rates.

– The policy applies immediately to new PV

customers and is phased in over 20 years for

existing customers.

• In a separate decision, CPUC reduced compensation

for single-family homes that host PV-plus-storage

systems under California’s new Net Billing Tariff (i.e.,

NEM 3.0) by limiting which bill charges can be offset

by exporting electricity to the grid during high-value

periods such as early evenings.

– According to one consultant, the policy will

reduce compensation to typical PV-plus-storage

owners by 10%–15% or about $230 per year.

Residential,

13 GW (31%)

Non-residential,

7 GW (15%)*

Utility-scale,

24 GW (54%)

Cumulative California PV by Sector, Through 2023 (GW

dc

)

1-unit detached,

8.4 M (57%)

1-unit attached,

1.1 M (7%)

2 to 4 units,

1.1 M (8%)

5 to 19 units,

1.5 M (10%)

20 or more units,

2.0 M (14%)

Mobile home,

0.5 M (4%)

California Housing Types, 2022

*Non-residential includes

commercial, industrial,

agricultural, school,

government, nonprofit,

community solar.

Sources: Cal Matters (11/16/23

); Canary Media (12/4/23); PV Tech (11/17/23); U.S. Census Bureau, American Community Survey, 2022; Wood Mackenzie and SEIA, US Solar Market

Insight, Q4 2023.

NREL | 15NREL | 15

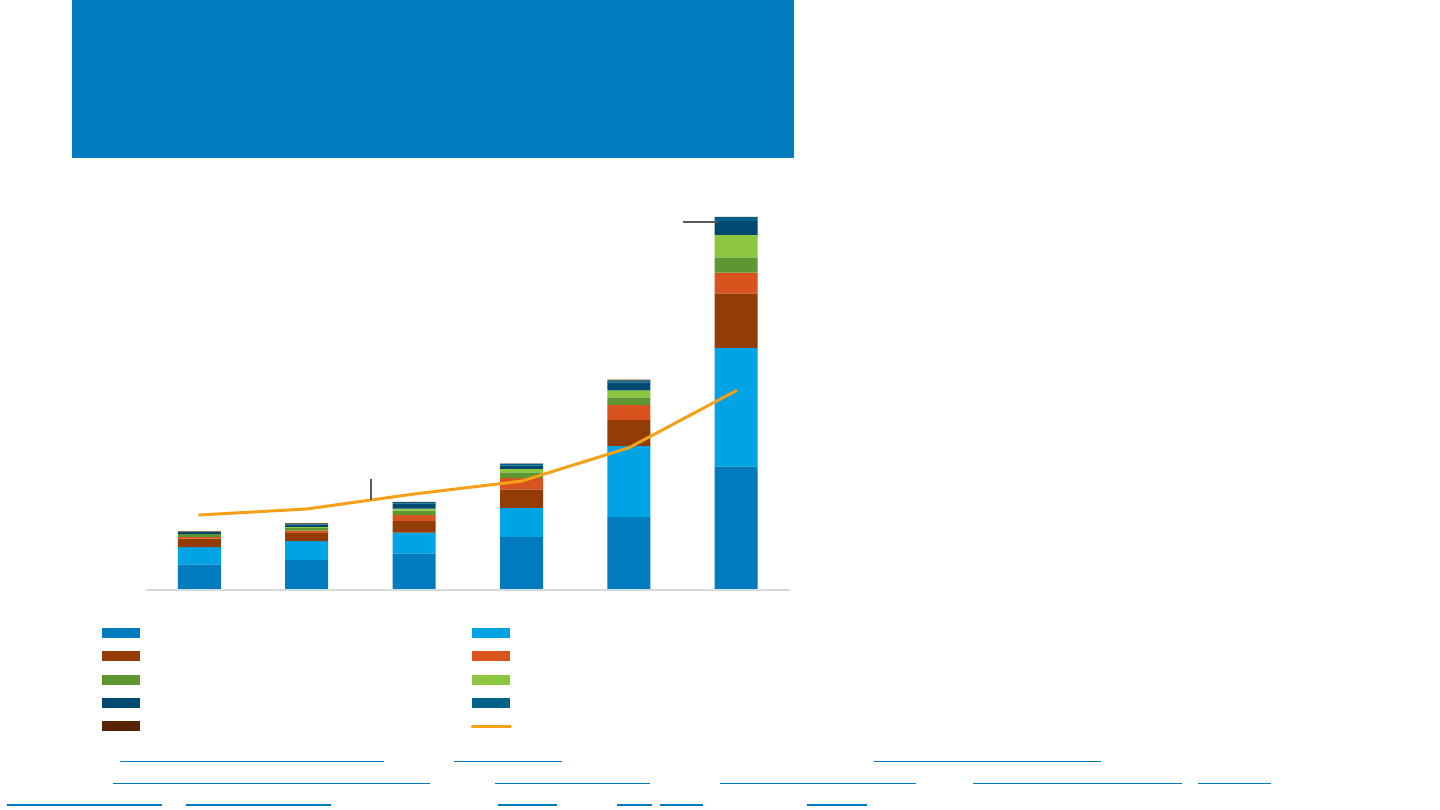

0

1,000

2,000

3,000

4,000

5,000

6,000

2016 2017 2018 2019 2020 2021 2022 2023P 2024P

Capacity (MW

ac

)

Electric Capacity, Hawaii

Petroleum Coal Distributed Battery

Utility Battery Utility PV Distributed PV

Wind Biomass Geo+Hydro+Other

PV and Batteries Help

Replace Coal in Hawaii

Sources: Canary Media (1/10/24); EIA, Electric Power Monthly, Dec 2023; EIA, Hawaii Electricity Profile 2022, Nov 2023; Hawaiian Electric (accessed 1/16/24); Hawaii Public Utilities

Commission (12/23

); Wood Mackenzie, U.S. Energy Storage Monitor, Q4 2023; Wood Mackenzie and SEIA, US Solar Market Insight, Q4 2023.

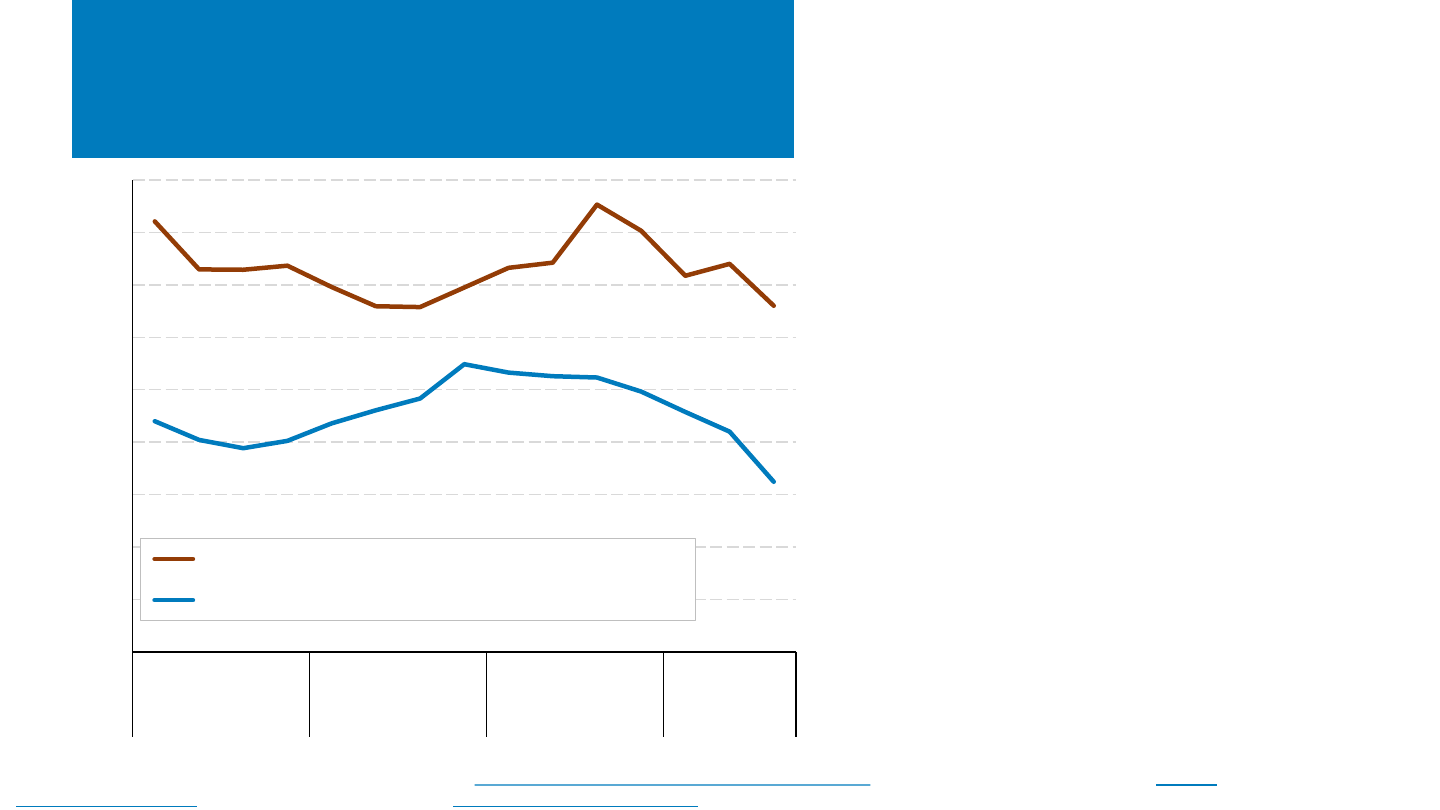

• The 185-MW

ac

Kapolei energy storage plant on

Oahu began operating in December 2023.

– It helps replace capacity lost when Hawaii retired

its 180-MW

ac

coal plant in 2022, constituting 17%

of Oahu’s peak capacity.

– It also provides grid services and black-start

capability.

– It is estimated to reduce curtailment of

renewables by 69% for the first 5 years.

• Statewide, battery capacity is projected to

increase 230% between 2022 and 2024 (to 860

MW

ac

), while PV capacity is projected to increase

50% (to 1,700 MW

ac

).

– Utility-scale installations are growing fastest.

• Hawaii’s electricity market and policies are

promoting this shift.

– Retail electricity rates are the highest in the

United States, triple the national average.

– The state target is 100% clean electricity by 2045.

– Residential PV growth slowed after net metering

ended in 2015.

– Subsequent distributed energy policies have

promoted self-consumption, grid support, and

deployment of energy storage.

NREL | 16NREL | 16

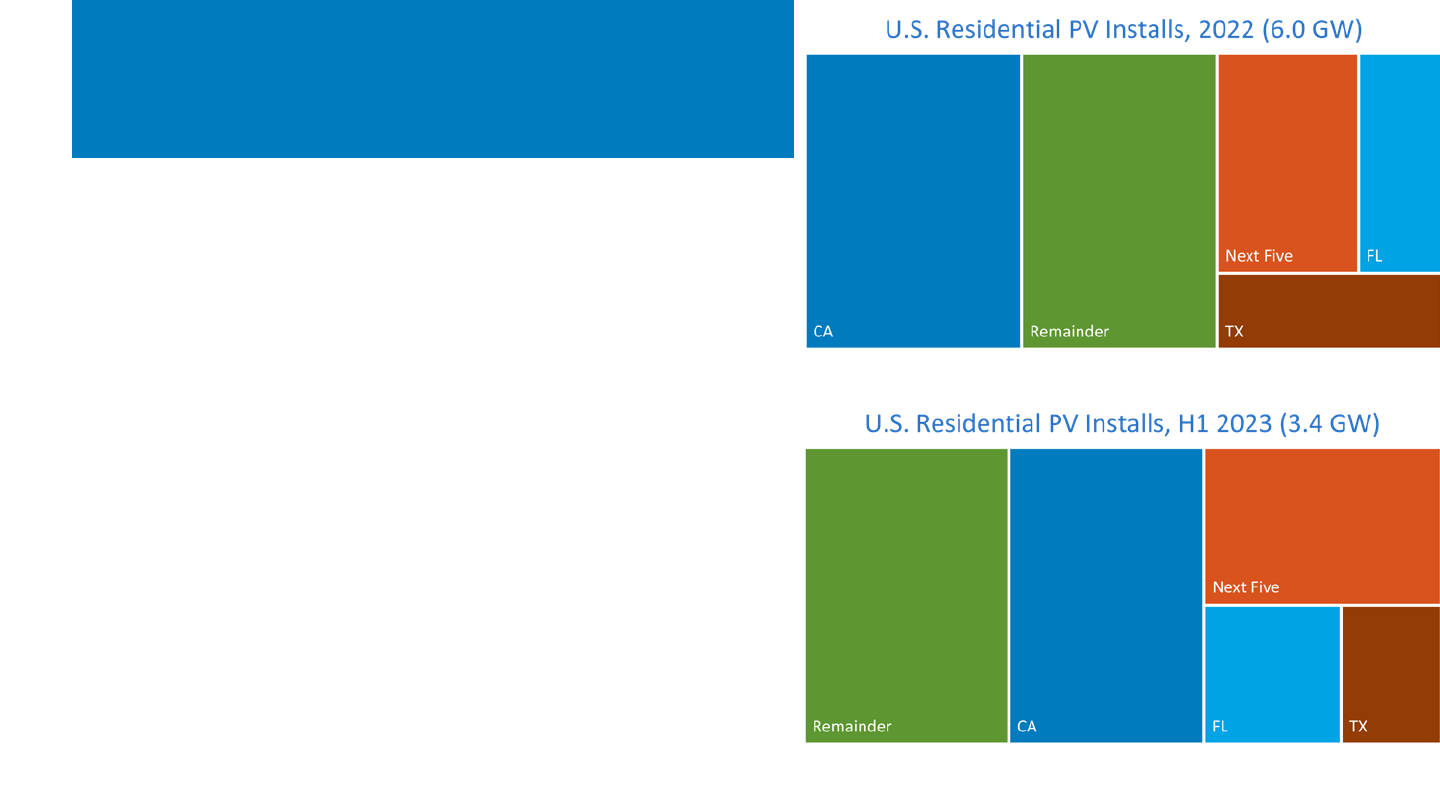

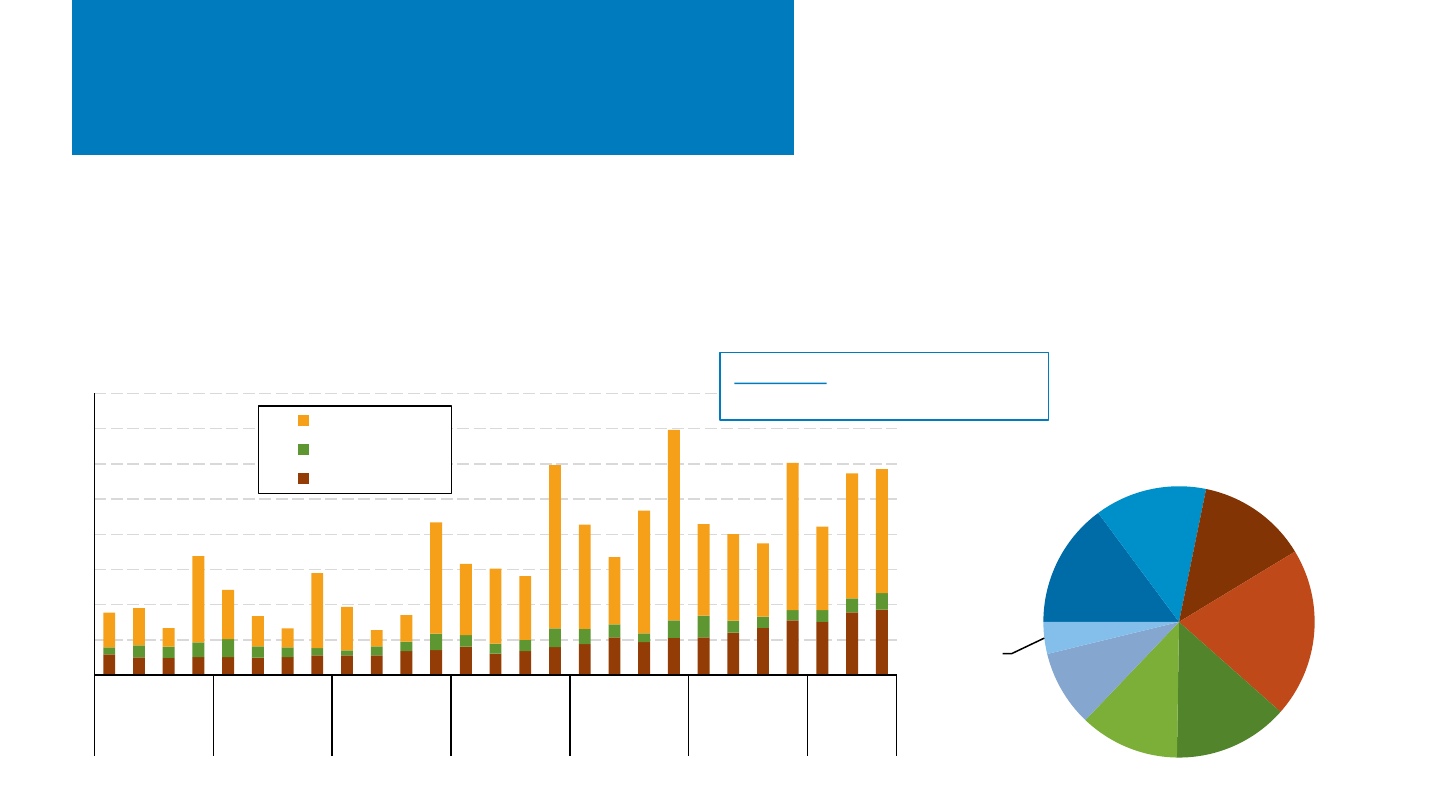

U.S. Installation Breakdown

Quarterly: EIA (GW

ac

)

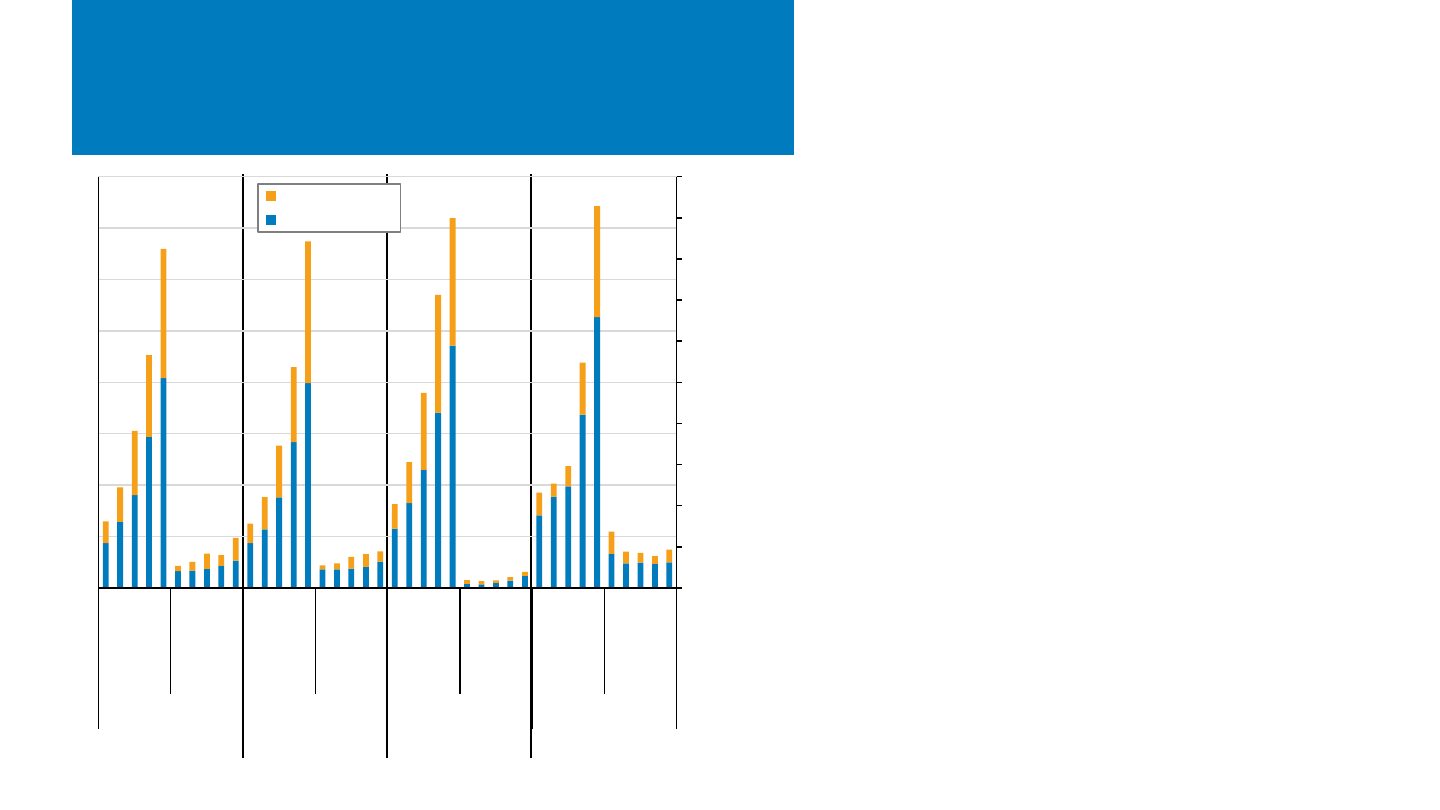

• According to EIA data, the United States installed 15.8 GW

ac

of PV in

the first 9 months of 2023—a record—up 31% y/y (SEIA reported

19.3 GW

dc

).

– Residential (5.1 GW

ac

) remained up significantly YTD, 43% y/y, as

did utility-scale (9.4 GW

ac

—up 32%). Nonresidential was down

6% (1.2 GW

ac

).

• 46% of U.S. PV capacity installed in the first 9

months was in Texas, Florida, and California.

– 28 states installed more than 100 MW

ac

.

– California’s residential market kept

growing, Q/Q, throughout the year, not

yet showing any slowness caused by the

switch to NEM 3.0.

Note: EIA reports values in W

ac

, which is standard for utilities. The solar industry has traditionally reported in W

dc

. See the next slide for values reported in W

dc

.

Sources: EIA, “Electric Power Monthly,” forms EIA-023, EIA-826, and EIA-861 (November 2023, February 2022, February 2019).

13.2

1.5

3.9

0

1

2

3

4

5

6

7

8

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2017 2018 2019 2020 2021 2022 2023

Quarterly PV Installed (GW

ac)

U.S. PV Installations by Market Segment

Utility-scale

C&I

Residential

Texas

15%

Southwest

13%

Florida

13%

California

20%

Midwest

14%

Southeast

12%

Northeast

9%

Other

4%

Q1-Q3 '23 U.S. PV Installations by Region

(15.8 GWac)

Click here to interactively view

these data on Tableau Public.

NREL | 17NREL | 17

U.S. Installation Breakdown

Quarterly: SEIA (GW

dc

)

• Wood Mackenzie/SEIA reports a record first 9 months of PV installations, with 19.3 GW

dc

installed from Q1 to Q3 2023—an increase of

42% y/y.

– The utility-scale sector, up 59% from 2022 y/y, rebounded from supply chain issues, as supplier diversification and the CBP release

of module detentions has brought more modules to waiting project sites.

– The residential sector, up 24% y/y, has been boosted by the backlog of California project sales that qualified for NEM 2.0 getting

installed and interconnected, as well as the Northeast, where sales were boosted by retail rate increases (the Northeast is more

exposes to natural gas price increases). The growth is partially offset by rising interest rates that occurred in 2022, which caused

declines in sales volumes from loan companies in Arizona, Texas, and Florida.

Sources: Wood Mackenzie/SEIA: U.S. Solar Market Insight: Q4 2023.

Unlike the previous slide, these values are

in GW

dc

—not GW

ac

.

California

13%

Texas

11%

Southwest

17%

Florida

19%

Southeast

9%

Northeast

10%

Midwest

12%

Other

8%

Q1-Q3 23 U.S. PV Installations by Region

(19.3 GWdc)

0

2

4

6

8

10

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2019 2020 2021 2022 2023

Quarterly PV Installed (GW

dc

)

U.S. PV Installations by Market Segment

Utility

Nonresidential PV

Residential PV

NREL | 18NREL | 18

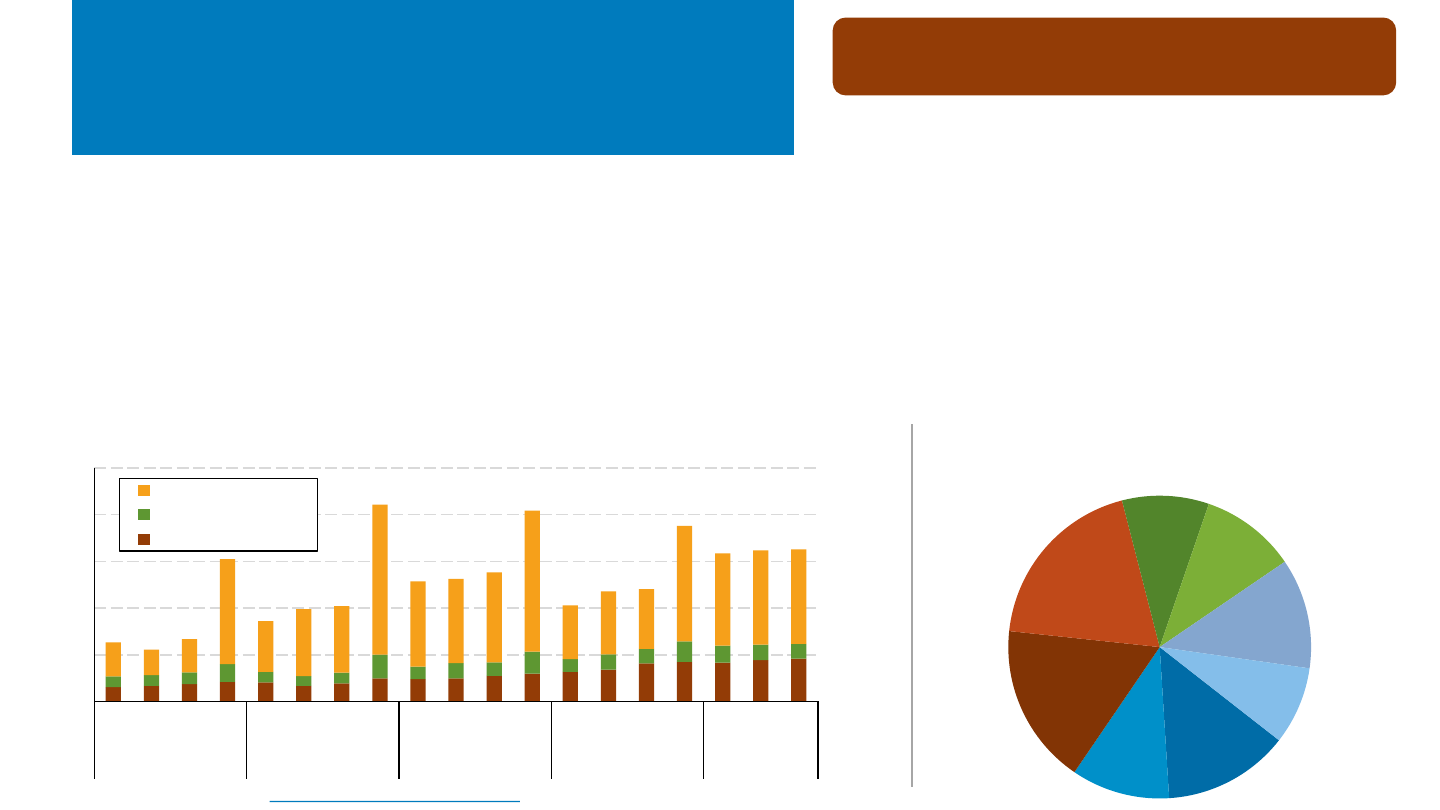

0

10

20

30

40

50

60

70

80

U.S. Generation Capacity Additions (

GW

ac

)

Other

Nuclear

Natural Gas (Other)

Natural Gas CT

Natural Gas CC

Batteries

OSW

LBW

DPV

UPV

71%

U.S. Generation Capacity Additions by

Source: 2010–2023 and

Planned 2023–2025

Sources: EIA Form 860M/Preliminary Monthly Electric Generator Inventory (“Planned” and “Operating”) and EIA Short-Term Energy Outlook Table 7e,

downloaded October 6, 2023; Wood Mackenzie and SEIA US Solar Market Insight Full Report 2Q 2023, Sep 2023.

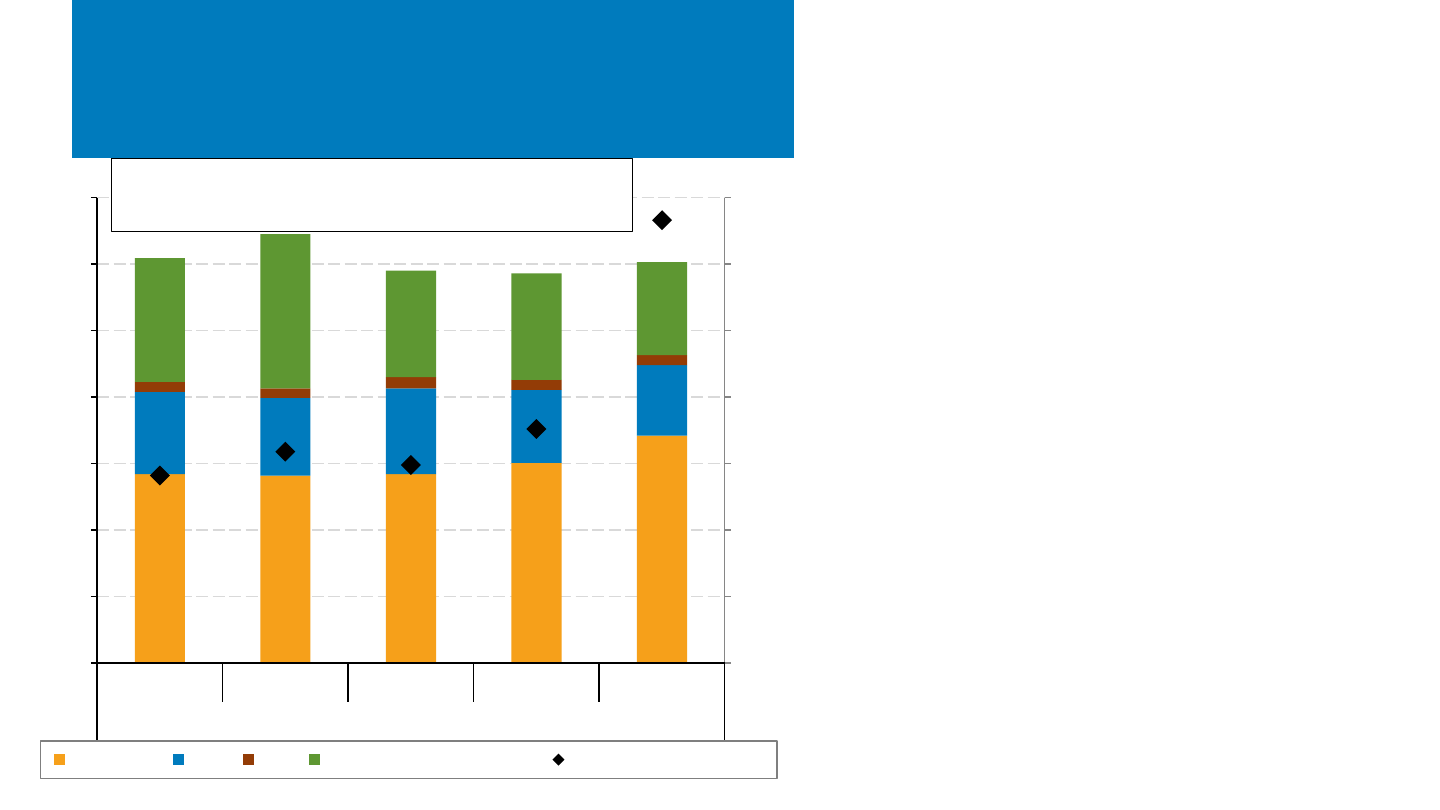

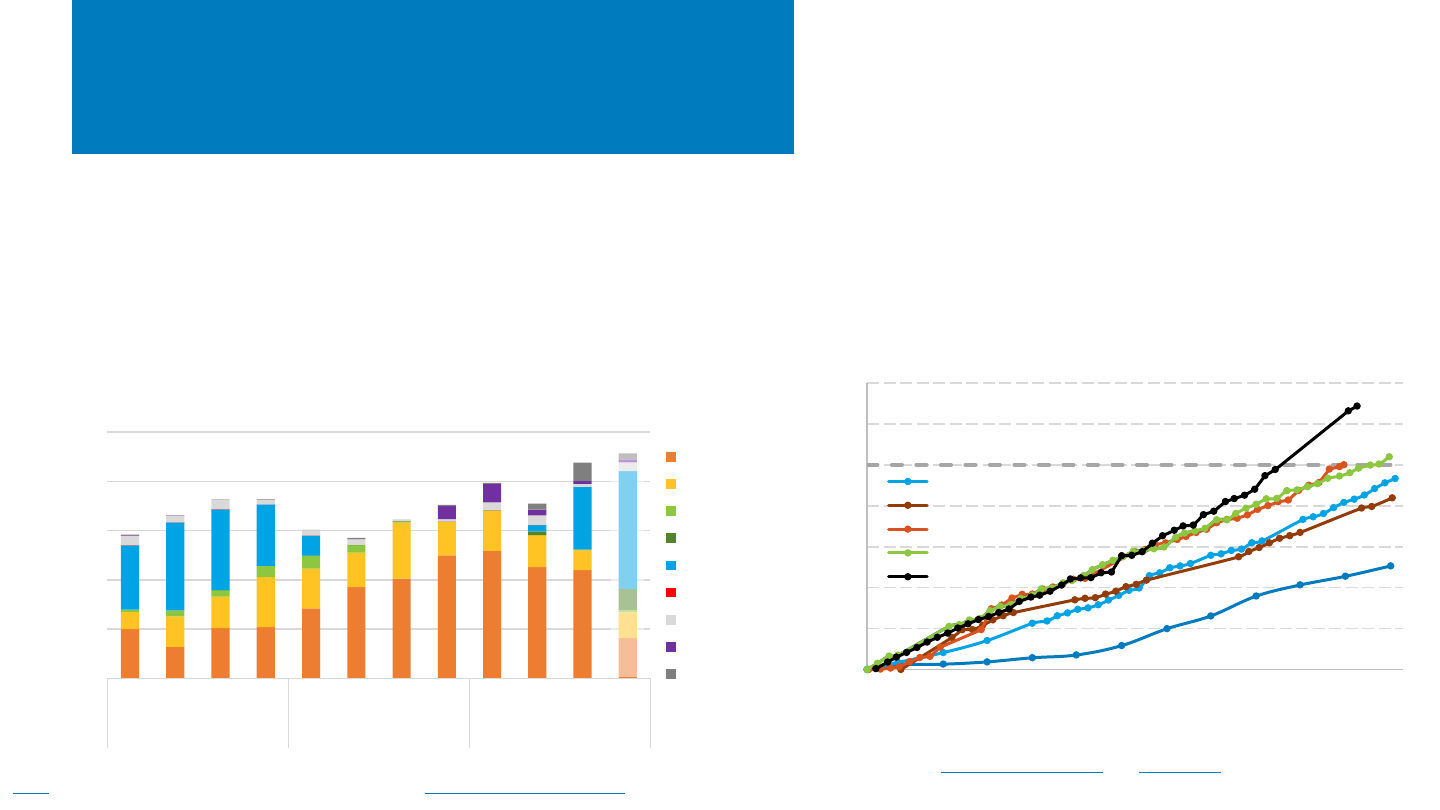

• EIA projects the percentage of U.S. electric

capacity additions from solar will grow from 46%

in 2022 (18 GW

ac

) to 54% in 2023 (31 GW

ac

), 63%

in 2024 (44 GW

ac

), and 71% in 2025 (51 GW

ac

).

– Starting in 2023, batteries are projected to be the

second-leading source of new generation capacity,

followed by land-based and offshore wind (LBW and

OSW).

– Natural gas is projected to account for 16% of new

capacity in 2023 but to drop to 4% and 8% in 2024 and

2025, respectively.

• From 2023 to 2025, EIA projects that PV, storage,

and wind will add 177 GW

ac

of capacity additions.

Began operating

through Oct. 2023

Planned Nov./Dec.

2023 and full

2024/2025

Click here to interactively view

these data on Tableau Public.

NREL | 19NREL | 19

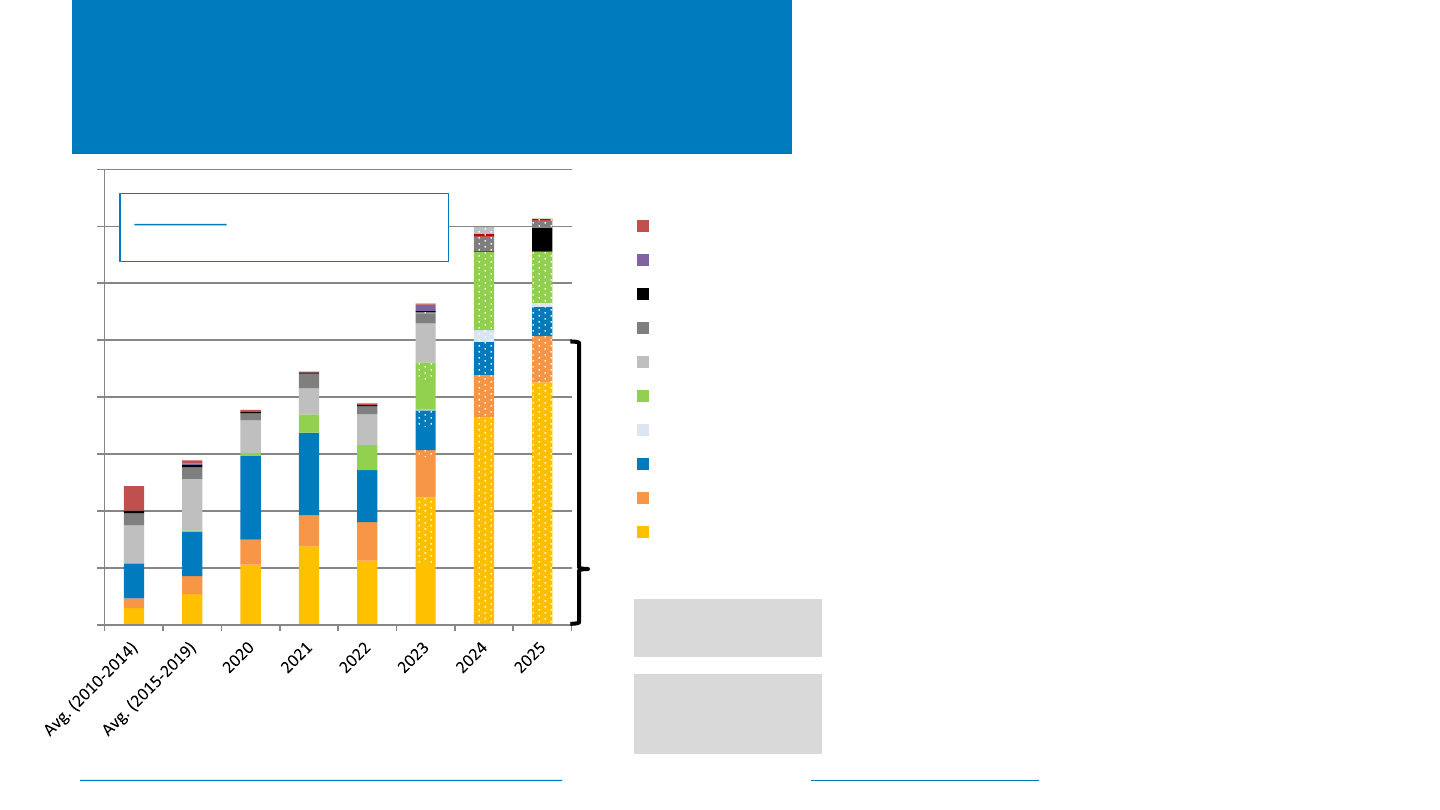

0

10

20

30

40

50

60

70

2021 2022 2023E 2024P 2025P 2026P 2027P

PV Annual Installations (GW

dc

)

Residential C&I Utility-Scale

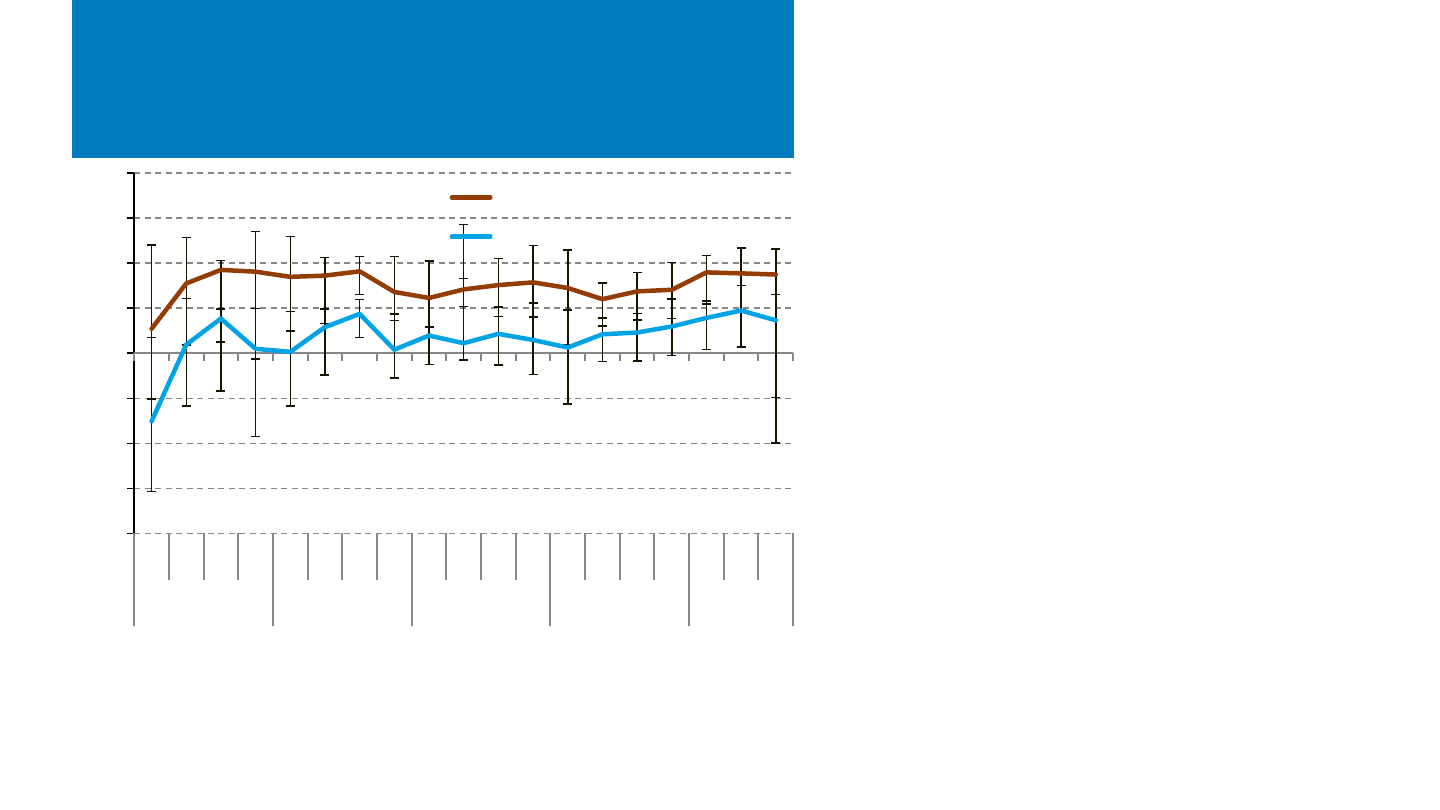

Annual U.S. PV Deployment

Notes: E = estimate; P = projection. Bars represent median U.S. projections. Error bars represent high and low U.S. projections. Where sector medians do not sum to U.S.

medians, the differences are reconciled by multiplying the median percentage contribution from each sector by the total U.S. median values so the correct total U.S. median

values are retained. Pie chart shows projected contributions from each region, 2021–2027.

Sources: BNEF, 4Q 2023 Global PV Market Outlook, 11/22/23; EIA, Annual Energy Outlook 2023, 3/23; Goldman Sachs Equity Research, America’s Clean Technology: Solar,

12/17/23; SolarPower Europe, Global Market Outlook For Solar Power 2023-2027, 6/23; Wood Mackenzie and SEIA, US Solar Market Insight, Q4 2023.

• Annual deployment of PV in the United States was

estimated to have grown by about 55% between

2022 and 2023, to 33 GW

dc

.

• Analysts project continued increases in annual U.S. PV

installations:

– 36 GW

dc

in 2024 (+10% y/y)

– 40 GW

dc

in 2025 (+10% y/y)

– 43 GW

dc

in 2026 (+9% y/y)

– 48 GW

dc

in 2027 (+12% y/y)

• Utility-scale PV drives the 2023–2027 growth, with

the highest compound annual growth rate:

– Utility-scale 12%

– Commercial and industrial (C&I) 8%

– Residential 5%

• The variability in deployment projections suggests

significant upside potential.

• Over the period shown, deployment is geographically

diverse, with Texas, California, and Florida as the top

states and considerable capacity in several regions.

Midwest

21%

Texas

20%

Southeast

13%

Calif.

13%

Southwest

13%

Northeast

10%

Fla.

6%

Northwest

3%

Alaska &

Hawaii

1%

NREL | 20NREL | 20

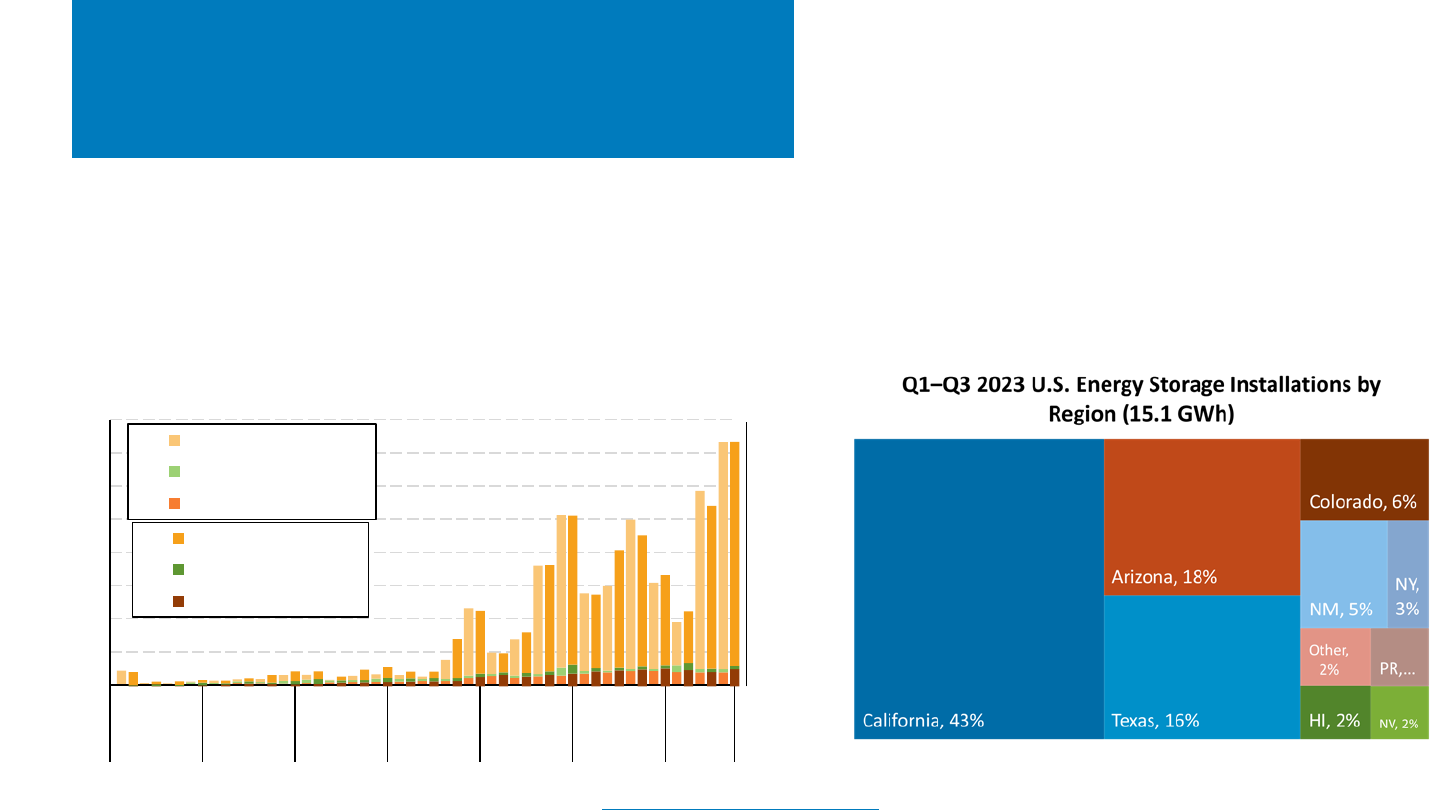

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3

2017 2018 2019 2020 2021 2022 2023

Energy Storage Installed (MWh)

U.S. Energy Storage Installations by Market Segment

Grid-Scale (MWh)

CCI (MWh)

Residential (MWh)

0

150

300

450

600

750

900

1,050

1,200

1,350

1,500

1,650

1,800

1,950

2,100

2,250

2,400

2,550

Energy Storage Installed (MW)

Grid-Scale (MW)

CCI (MW)

Residential (MW)

U.S. Energy Storage Installations by

Market Segment

• In 2023 YTD, two states dominated most energy storage

markets:

– California and Texas represented 62% of grid-scale

installations. Arizona was another 21%.

– California and New York represented 88% of battery

energy storage in the CCI market; Massachusetts was a

large CCI market, but its SMART program is tapering

down.

– California and Puerto Rico represented 62% of residential

energy storage installs YTD. Texas and Hawaii also

contributed a combined 16%.

• The United States installed approximately 15.1 GWh (4.8 GW

ac

) of energy storage

onto the electric grid in the first 9 months of 2023, +40% (+32%) y/y, as a result

of growth in the grid-scale and CCI sectors.

– The residential market was relatively flat in part because of California’s large market

share, which shrank due to a large proportion of PV-only sales to take advantage of

an expiring NEM 2.0.

– SMUD installed 0.5 MW of eventual 200-MW long-duration iron flow battery

storage.

Note: “Grid-scale” refers to all projects deployed on the utility side of the meter, regardless of size or ownership; “CCI” refers to “community-scale, commercial, and industrial.”

Source: Wood Mackenzie Power & Renewables and Energy Storage Association, U.S. Energy Storage Monitor: Q4 2023.

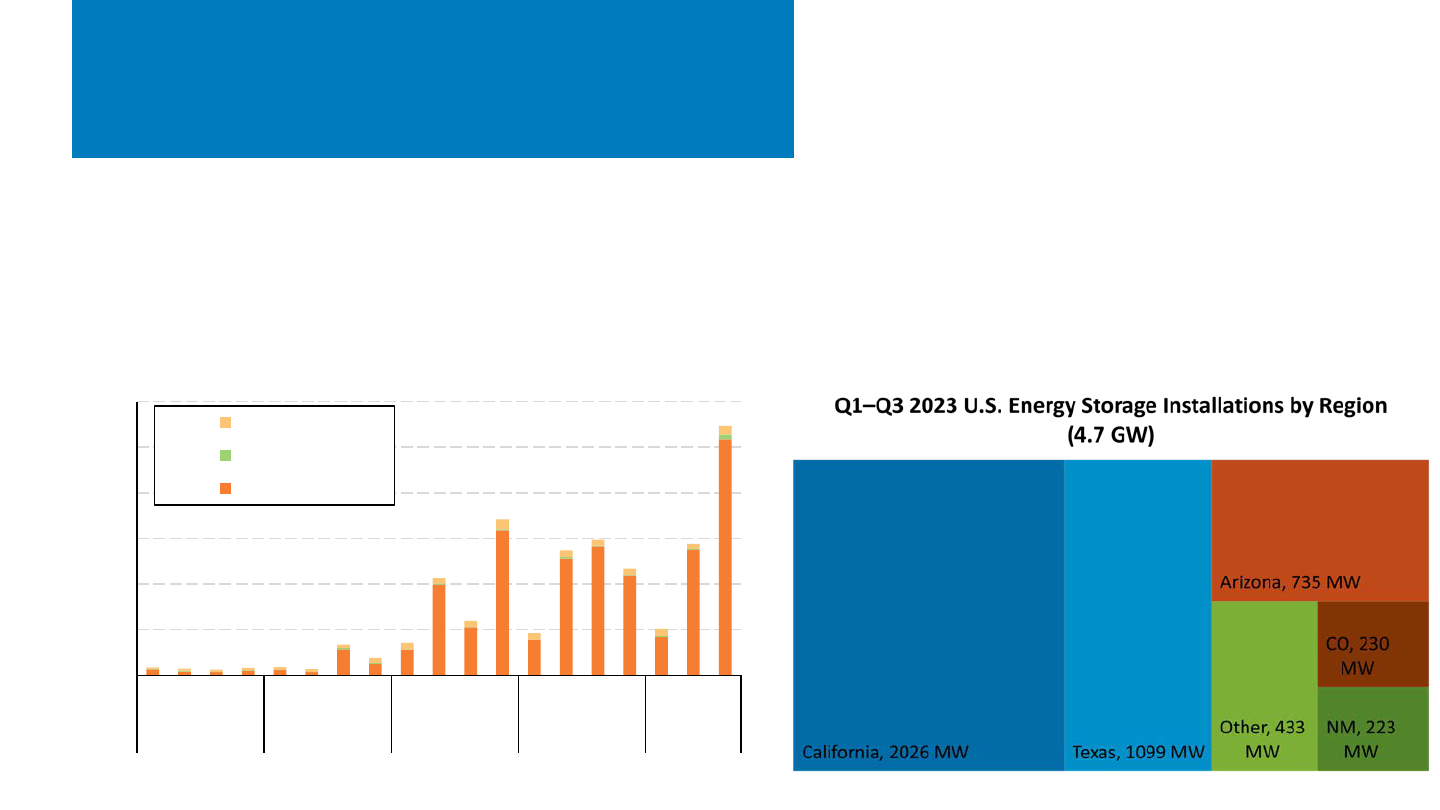

NREL | 21NREL | 21

U.S. Energy Storage Installations

by Market Segment (EIA)

• California represented approximately 43% of

battery storage capacity installed in the first 9

months of 2023, followed by Texas (23%).

– The top five markets represented 91% of installed

energy storage capacity.

• EIA reports that the United States installed approximately

4.7 GW

ac

of energy storage onto the electric grid in the

first 9 months of 2023—up 39% y/y, bringing total U.S.

battery storage capacity to 16.7 GW

ac

(~43 GWh).

Sources: EIA Form 860M, EIA Form 861M.

0

500

1,000

1,500

2,000

2,500

3,000

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2019 2020 2021 2022 2023

Energy Storage Installed (MW)

U.S. Energy Storage Installations by Market Segment

Residential

C&I

Utility-scale

NREL | 22NREL | 22

Solar Consumer Complaints—and

Protections—On the Rise

Sources: BBB, “BBB Complaint and Inquiry Statistics”; CESA, “Program Areas”; Consumer Financial Protection Bureau, “Consumer Complaint Database”; California Public Utilities

Commission, “California Solar Consumer Protection Guide”; IREC, “Consumer Protection”; NREL, “Solar Consumer Protection”; SEIA, Consumer Protection Primer, “Solar 101:

Consumer Protection,” “Solar Business Code”; Solar Power World (8/16/21); Time (9/23, 11/23); Utility Dive (6/22/23); Wood Mackenzie & SEIA, Q3 2023 Solar Market Insight, 9/23.

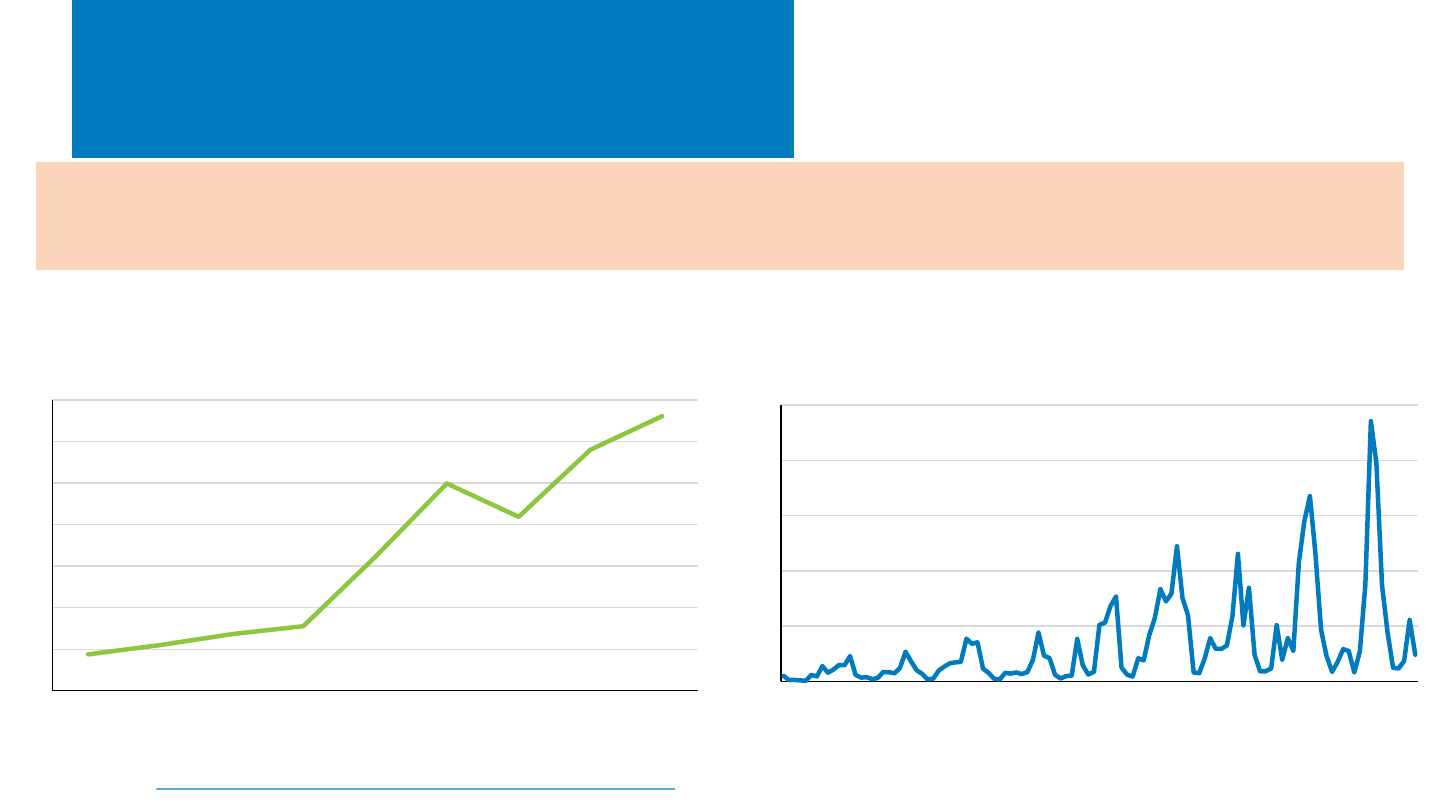

• From 2017 to 2022, annual solar-related

complaints to the U.S. Better Business Bureau

(BBB) grew 3 times faster than U.S. residential PV

capacity:

– Top complaint categories included “Solar Energy

Contractors,” “Solar Energy Equipment Dealers,”

and “Solar Energy Design.”

– Solar-related complaints to the Federal Trade

Commission, Consumer Financial Protection

Bureau, and many state agencies also increased.

• Common complaints include:

– Misrepresenting solar costs and benefits

– Misrepresenting financing terms and government

incentives

– Aggressive sales and marketing tactics

– Unsolicited robocalls.

• Resources, training, regulations, and legal actions

are being instituted to protect consumers and the

solar industry’s image by, for example:

– Clean Energy States Alliance (CESA)

– Interstate Renewable Energy Council (IREC)

– Solar Energy Industries Association (SEIA)

– State solar associations

– Other nonprofit organizations

– State legislators, regulators, attorneys general.

0

2,000

4,000

6,000

8,000

10,000

12,000

2017 2018 2019 2020 2021 2022

Annual BBB complaints (no.),

residential PV installations (

MW

dc

)

Solar Energy Contractors Solar Energy Equipment Dealers

Solar Energy Design Solar Energy Equipment

Solar Energy Products Solar Installation

Solar Energy Product Services Solar Energy Development

Solar Energy Parts Residential PV Installations

Solar BBB complaints (↑540%)

Residential PV capacity (↑170%)

NREL | 23

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

20,000

22,000

24,000

26,000

28,000

12am 3am 6am 9am 12pm 3pm 6pm 9pm

Average Hourly Net Load (March 15–April 15)

2014 2015 2016 2017 2018

2019 2020 2021 2022 2023

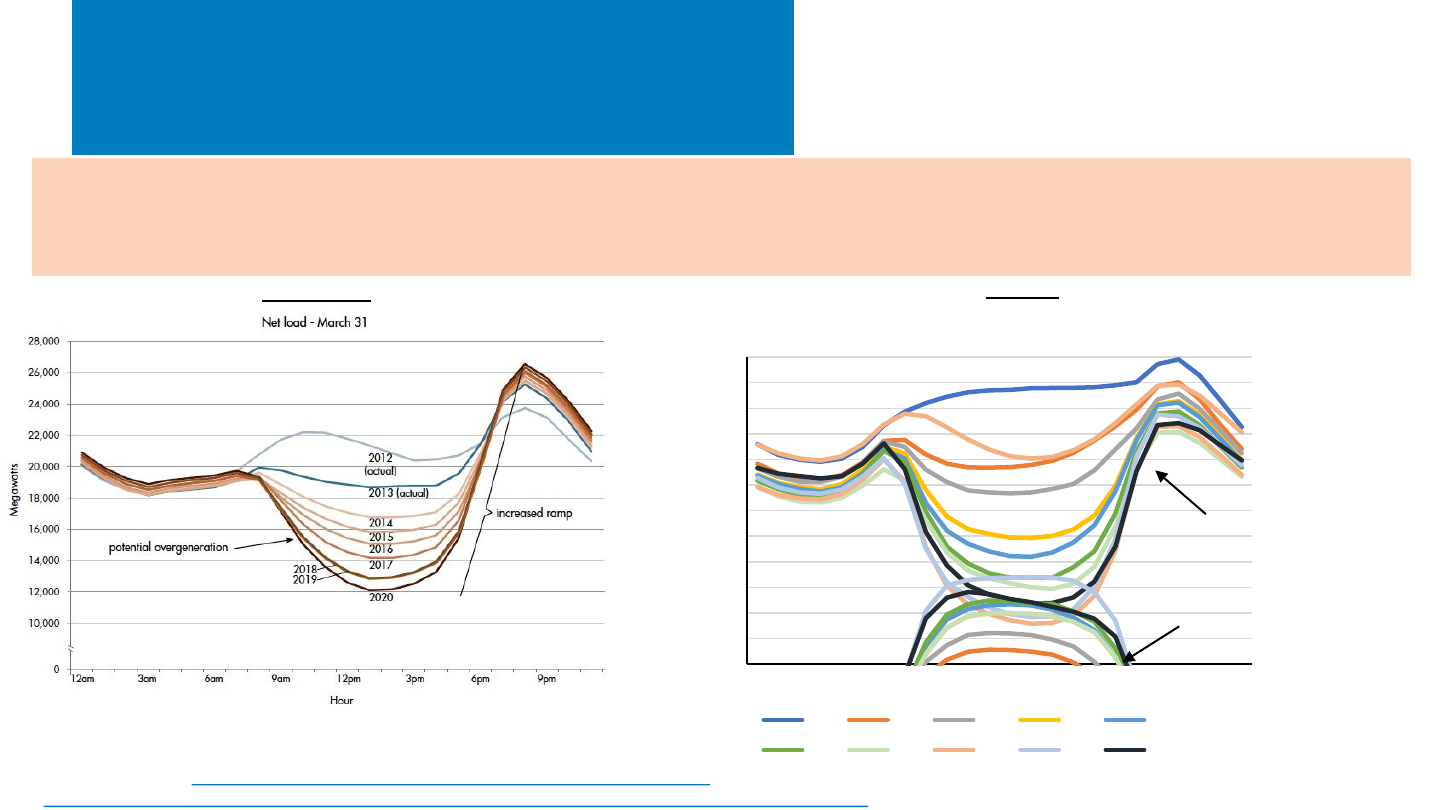

The “Duck Curve” graphic, developed in 2013, predicted that as solar became a larger part of CAISO’s electricity mix, there would

be potential periods of overgeneration and the need for an increased ramp rate―particularly in the springtime when PV is

generating a lot of energy in the middle of the day but demand is low (i.e., not hot enough for AC use). The Duck Curve has

generally come to pass―midday net load has dropped more than predicted, though evening peak has not been as great.

Predicted

Actual

Note: net load = load – solar & wind production. Includes curtailment.

Sources: CAISO: http://www.caiso.com/informed/Pages/ManagingOversupply.aspx; DOE:

https://www.energy.gov/eere/articles/confronting-duck-curve-how-address-over-generation-solar-energy.

Utility solar

generation

Net load

Duck Curve: Predicted vs.

Actual

NREL | 24

Individual days have experienced significantly lower minimum net load and larger evening ramps.

Predicted

Actual

Note: net load = load – solar & wind production.

Sources: CAISO: http://www.caiso.com/informed/Pages/ManagingOversupply.aspx

DOE: https://www.energy.gov/eere/articles/confronting-duck-curve-how-address-over-generation-solar-energy

2015

2016

2017

2018

2019

2020

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

20,000

22,000

24,000

26,000

28,000

12am 3am 6am 9am 12pm 3pm 6pm 9pm

Megawatts

Actual CAISO Net Load (individual days from March 15 - April 15

2015 2016 2017 2018 2019

2020 2021 2022 2023

Duck Curve – Predicted vs.

Actual (specific days of year)

NREL | 25

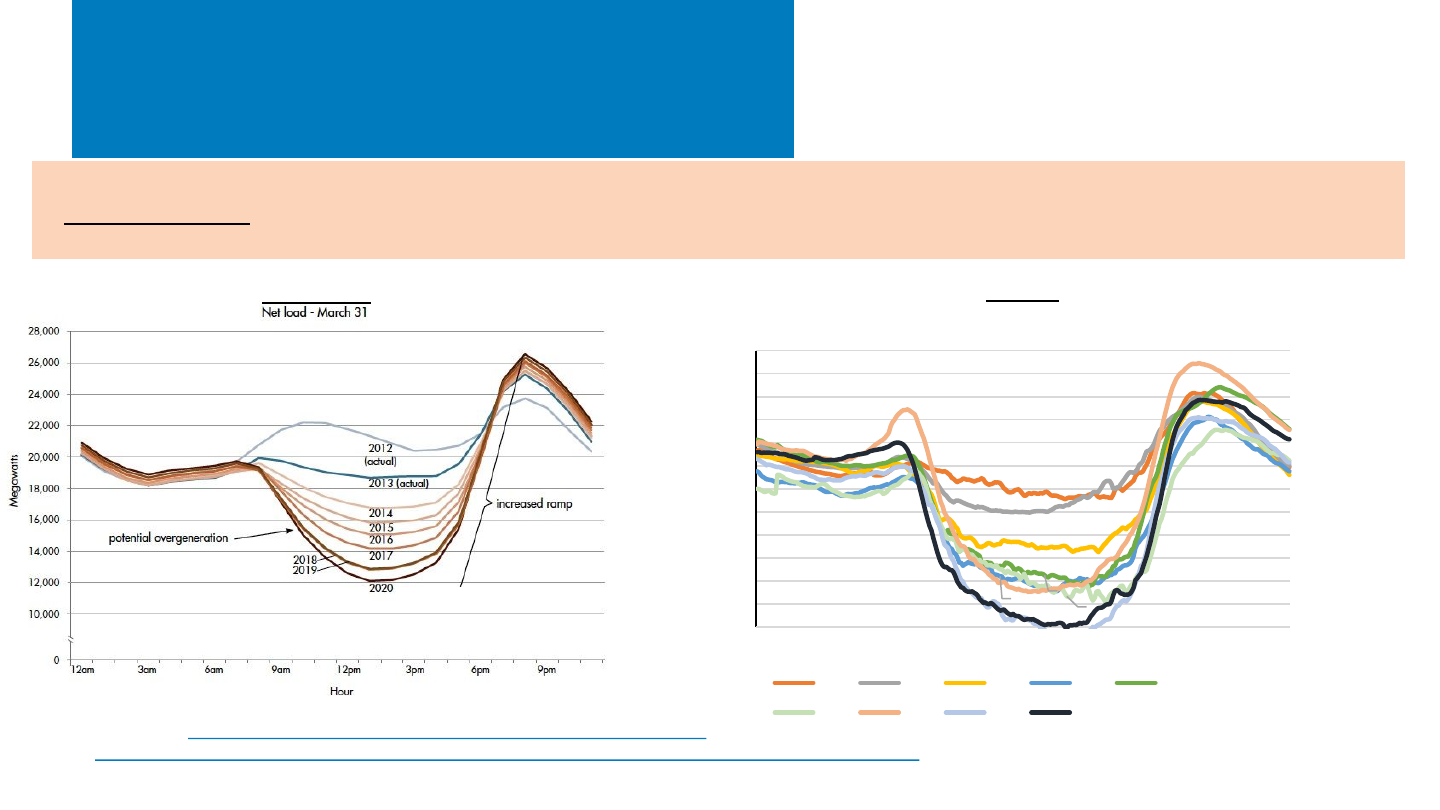

The “Duck Curve” problem is most severe at particular times of the year. In the summer, demand for cooling during the middle of the

day within CAISO mitigates much of the dip in net load. In other parts of the year, solar does not produce as much. Additionally, other

regions do not necessarily have the same solar production and demand profiles to cause such a problem.

Note: net load = load – solar & wind production.

Sources: CAISO: http://www.caiso.com/informed/Pages/ManagingOversupply.aspx; DOE:

https://www.energy.gov/eere/articles/confronting-duck-curve-how-address-over-generation-solar-energy.

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

12am 3am 6am 9am 12pm 3pm 6pm 9pm

Net Load (July–September)

2014 2015 2016 2017 2018

2019 2020 2021 2022 2023

Duck Curve: Seasonality

NREL | 26

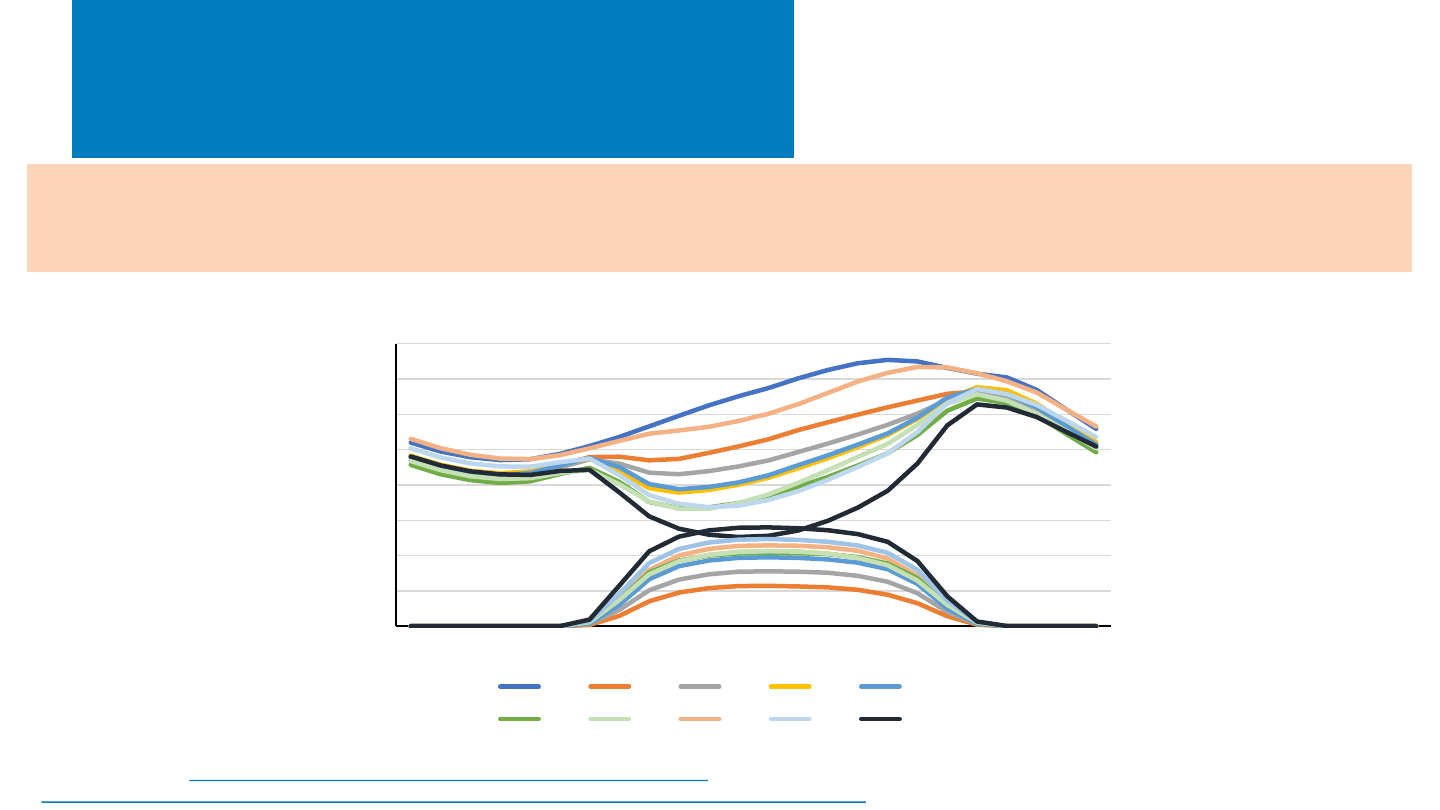

CAISO has mostly dealt with overproduction through curtailment of solar electricity, but over the course of the year, this has not

represented a large amount of energy (though it reached 24% in March 2023). Curtailment has also been driven by other non–Duck

Curve factors, such as local transmission and reliability constraints. Ramping, though also an issue, is something that has been

managed.

Sources: CAISO: http://www.caiso.com/informed/Pages/ManagingOversupply.aspx

0%

1%

2%

3%

4%

5%

6%

7%

2015 2016 2017 2018 2019 2020 2021 2022 2023

CAISO Solar Curtailment (by % of capacity):

Annual

Duck Curve: Curtailment

0%

5%

10%

15%

20%

25%

May-14

Oct-14

Mar-15

Aug-15

Jan-16

Jun-16

Nov-16

Apr-17

Sep-17

Feb-18

Jul-18

Dec-18

May-19

Oct-19

Mar-20

Aug-20

Jan-21

Jun-21

Nov-21

Apr-22

Sep-22

Feb-23

Jul-23

CAISO Solar Curtailment (by % of capacity):

Monthly

NREL | 27

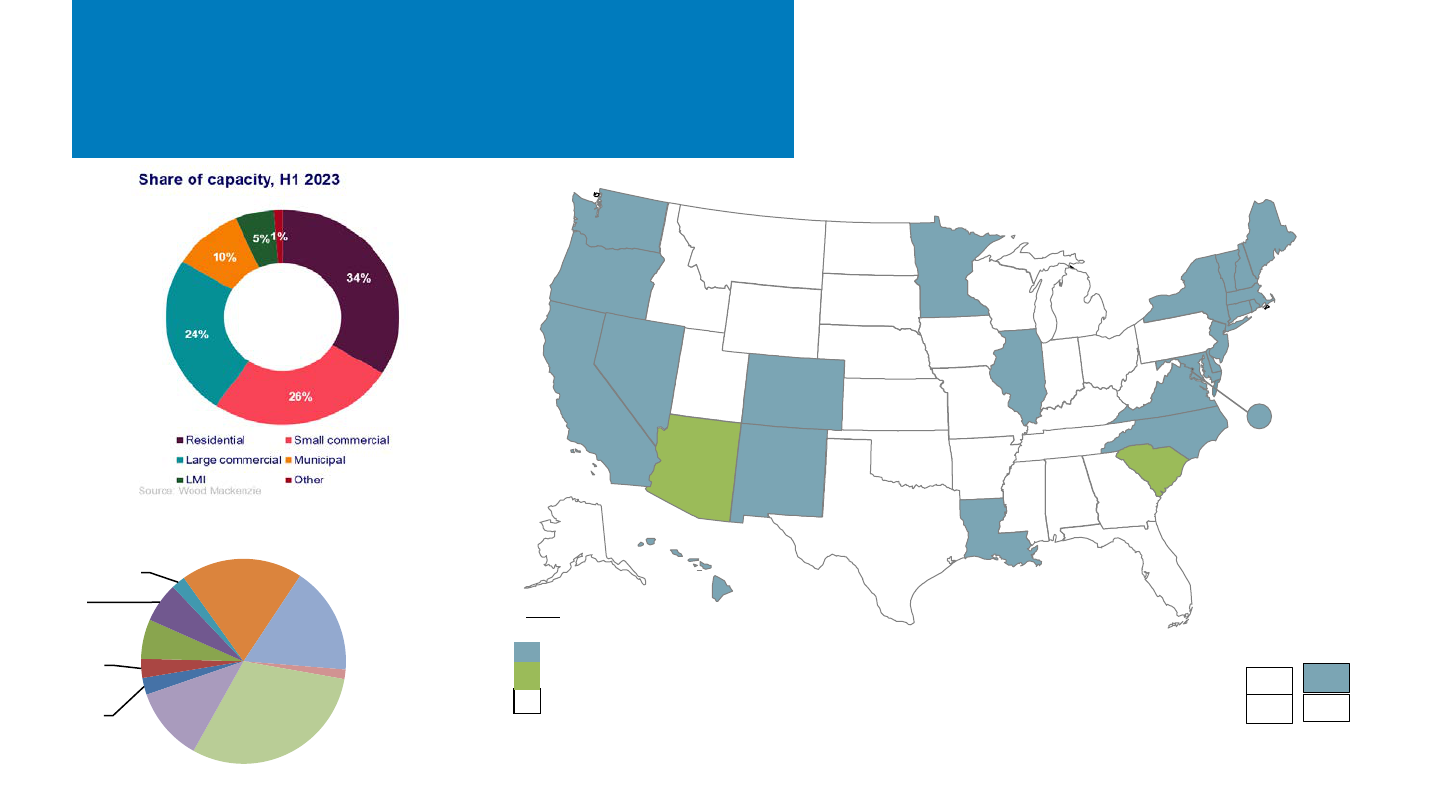

California

3%

Colorado

3%

Illinois

6%

Maine

6%

Maryland

2%

Mass.

19%

Minnesota

17%

New Jersey

2%

New York

30%

Other

12%

Community Solar Capacity, H1 23 (6 GW)

Sources: DSIRE USA; Wood Mackenzie and SEIA.

22 States + DC

and PR currently have

adopted community

solar rules

Community solar policy adopted

No policy, but individual utilities may have programs

www.dsireusa.org/November 2023

*

KEY

U.S. Territories:

DC

GU

AS

PR

VI

Policy adopted providing community solar option

2 states have rules giving

utilities the option to create

community solar programs

*

New Orleans local policy also establishes

a community solar program

Community Solar Programs in

the U.S.

NREL | 28NREL | 28

Cost of Capital, Tax Equity

(Norton Rose Fulbright)

• Tax equity investors invested $20–$21 billion in 2023, with some of that

volume coming from 2022 transactions that were delayed:

• The deals were split relatively evenly between wind and

solar+storage.

• Upwards of 40% of solar deals used the PTC, and some transactions

involved solar using PTC and batteries using ITC.

• There was also another ~$4B in tax credit sales (which includes some non-

generation credits, such as 45X).

• Investors predicted additionality, as opposed to cannibalization of

the tax equity market, caused by tax credit sales.

• Tax credit sales prices started at 90%–93% but have recently been

seen as high as 97%. Price can depend on factors such as insurance

products associated with a deal.

• There are various reasons sponsors would still choose tax equity over

a credit sale: additional markup value; monetizing the accelerated

depreciation expense; timing of when money is received.

• Tax equity flip yields are up 100 to 200 basis points from summer 2022 (up to

an estimated 8%–9% level), as interest rates have increased and there is

more demand for tax equity than supply.

Sources: Norton Rose Fulbright Cost of Capital: 2024 Outlook; Proposed Basel II Rules.

• In July 2023, the federal government issued proposed rules to

large banks, similar to those passed internationally (i.e., “Basel

III”). These rules would require banks with tax equity

investments to quadruple the required cash on their balance

sheet (i.e., capital requirements) for making tax equity

investments compared to what they do now. This would

increase the cost of tax equity and drive some funders out of the

market. The regulations would impact PTC transactions less than

ITC transactions. Banks are hoping the regulators will make

changes for the final rules; however, if there is no resolution,

banks may pause funding midyear. Currently clauses are being

put in transactions that would allow banks to back out if the final

rules are unfavorable. The proposed rules would not take effect

until 2025.

0

5

10

15

20

25

30

2017 2018 2019 2020 2021 2022 2023

U.S. Tax Equity Investments ($B)

Tax credit sales

Tax equity investments

NREL | 29NREL | 29

Cost of Capital, Bank Debt

(Norton Rose Fulbright)

• Bank debt was >$115B in 2023 from 226 deals―similar to 2022, another record year.

Regional banks are beginning to lend again after issues in 2022 (e.g., Silicon Valley Bank).

• Banks are lending plain “vanilla” projects at 7% with a bank margin of 175 points―in June

2022, the same loan would be 3.5%–4.0%.

• A merchant deal would increase the cost by 75–150 basis points.

• The debt service coverage ratio (DSCR) is 1.25 (P50)/1.0 (P99) for solar projects, 1.15 for

storage projects, and 1.3–1.4 (P50)/1.0 (P99) for wind projects.

• For merchant projects, the DSCR increases to 1.75 (P50) for solar, 2.0 for storage,

and 1.8–2.0 (P50)/1.4-1.5 (P99) for wind.

Note: P50 represents an average level of energy production (or 50% likelihood to generate that much or more electricity), and P99 represents a

production level that the project has a 99% chance of exceeding.

Source: Norton Rose Fulbright Cost of Capital: 2024 Outlook.

NREL | 30

Global Solar Deployment1

U.S. PV Deployment

2

PV System Pricing

3

Global Manufacturing

4

Component Pricing

5

U.S. PV Imports

6

7 PV Waste and Toxicity

Agenda

From H2 2022 to H2 2023 (partial), the median reported

distributed PV system price in Arizona, California,

Massachusetts, and New York:

• Decreased 0.2% to $4.25/W

dc

for systems 2.5 to 10 kW

• Decreased 4% to $3.66/W

dc

for systems 10 to 100 kW

• Increased 2% to $2.49/W

dc

for systems 100 to 500 kW

• Increased 7% to $1.92/W

dc

for systems 500 kW to 5

MW.

NREL | 31NREL | 31

$2.84

$2.82

$2.84

$3.01

$3.42

$1.24

$1.17

$1.29

$1.10

$1.06

$0.15

$0.14

$0.17

$0.15

$0.15

1.86

2.32

1.6

1.6

1.4

0%

5%

10%

15%

20%

25%

30%

35%

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

$7.0

Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23

Sunrun

Battery Attachment Rate

Installed Cost ($/W

dc

)

Installation Sales G&A Net Value or Gross Margin Battery Attachment Rate

Large Residential Installer

Cost and Value, Q3 2023

Source: Corporate filings

Large residential installer Sunrun reported a system

value change of -1% y/y and +3% q/q.

Factors reported as supporting higher system value

and/or costs (for Sunrun, SunPower, and Sunnova):

• Increasing inflation and interest rates

• Increasing retail electricity rates

• Increasing battery attachment rates (batteries add

cost but can yield higher margins):

– Sunrun rate rose from 18% to 33% q/q (100%

in HI and PR, 44% in CA, 4% elsewhere)

– Up to 85%+ recent rate in California and 40%+

nationwide

– Sunrun reports “rapidly transitioning to a

storage-first company.”

Factors reported as supporting lower PV system costs

and/or higher margins now and in future:

• Forthcoming Investment Tax Credit adders

• Declining equipment prices

– Module and battery procurement costs down

by >20% compared with recent highs

– Cost reductions expected to have impact over

at least the next several quarters

• Process cost cutting via artificial intelligence

Mostly systems leases—bars represent subscriber value including the net

present value of contracted cash flows, tax credits, and other benefits,

including an assumed contract extension

NREL | 32NREL | 32

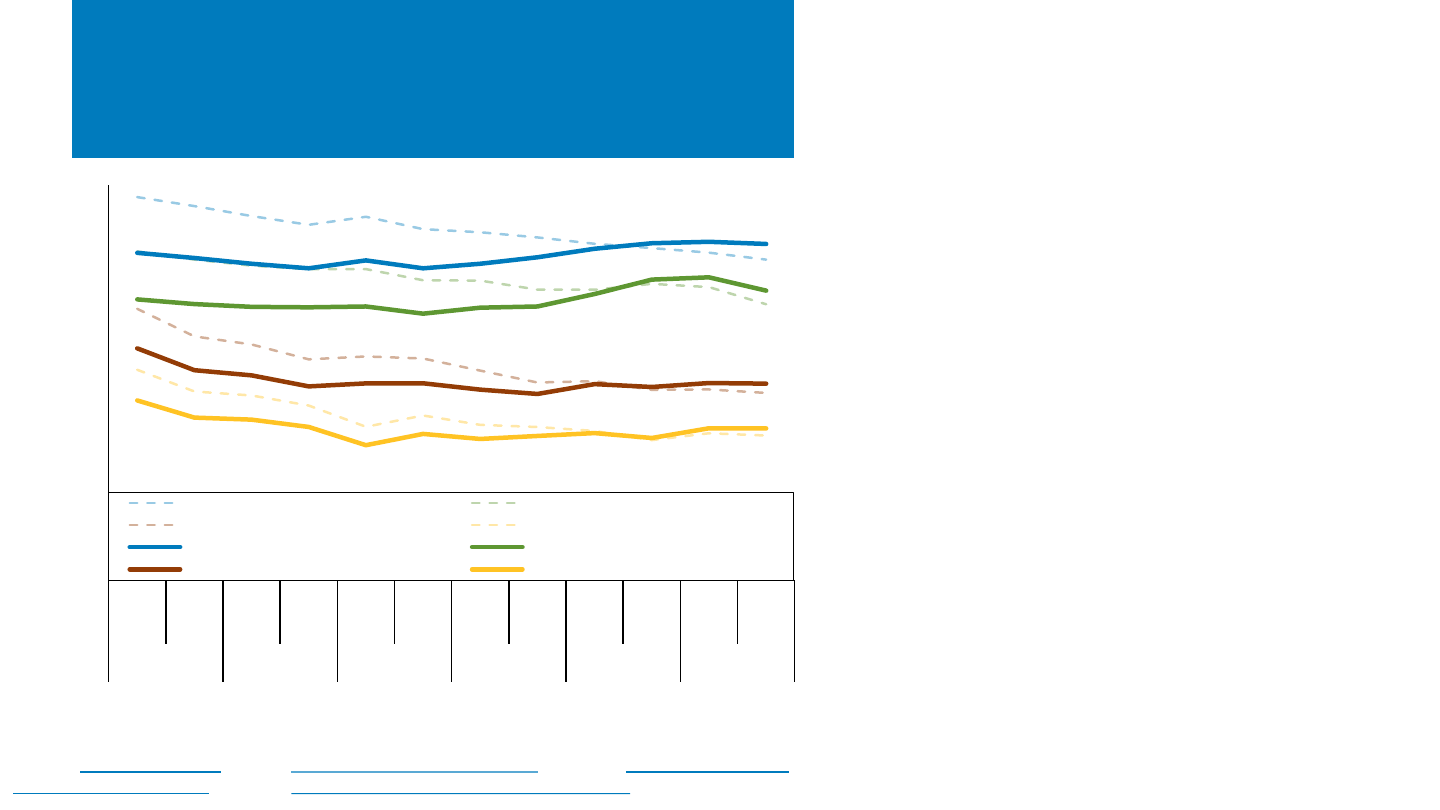

Distributed PV System Pricing From

Select States

From H2 2022 to H2 2023 (partial), the median

reported distributed PV system price—in nominal

U.S. dollars (USD)—across Arizona, California,

Massachusetts, and New York:

• Decreased 0.2% to $4.25/W

dc

for systems 2.5 to 10 kW

• Decreased 4% to $3.66/W

dc

for systems 10 to 100 kW

• Increased 2% to $2.49/W

dc

for systems 100 to 500 kW

• Increased 7% to $1.92/W

dc

for systems 500 kW to 5

MW.

From H2 2022 to H2 2023 (partial), the median

reported distributed PV system price—in 2022

(inflation-adjusted) dollars—across these states:

• Decreased 3% for systems 2.5 to 10 kW

• Decreased 7% for systems 10 to 100 kW

• Decreased 2% for systems 100 to 500 kW

• Increased 3% for systems 500 kW to 5 MW.

Adjusting for inflation reveals the continuing real

distributed PV price reductions over the past several

years of economic volatility.

2023 MW data YTD: Arizona (290), California (1,566), Massachusetts (77), New York (596).

Note: System prices above $10/W and below $0.75/W were removed from the data set. There were not enough

reported prices for systems above 5 MW in the data set to show a trend over time.

Sources: Arizona Goes Solar (1/2/24); California Distributed Generation (11/30/23); Massachusetts Lists of

Qualified Generation Units (12/6/23); Solar Electric Programs Reported by NYSERDA (1/4/24).

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

H1 H2 H1 H2 H1 H2 H1 H2 H1 H2 H1 H2

(part)

2018 2019 2020 2021 2022 2023

System Price ($/W

dc

)

2.5–10 kW (2022 USD) 10–100 kW (2022 USD)

100–500 kW (2022 USD) 500 kW – 5 MW (2022 USD)

2.5–10 kW (nominal USD) 10–100 kW (nominal USD)

100–500 kW (nominal USD) 500 kW – 5 MW (nominal USD)

NREL | 33NREL | 33

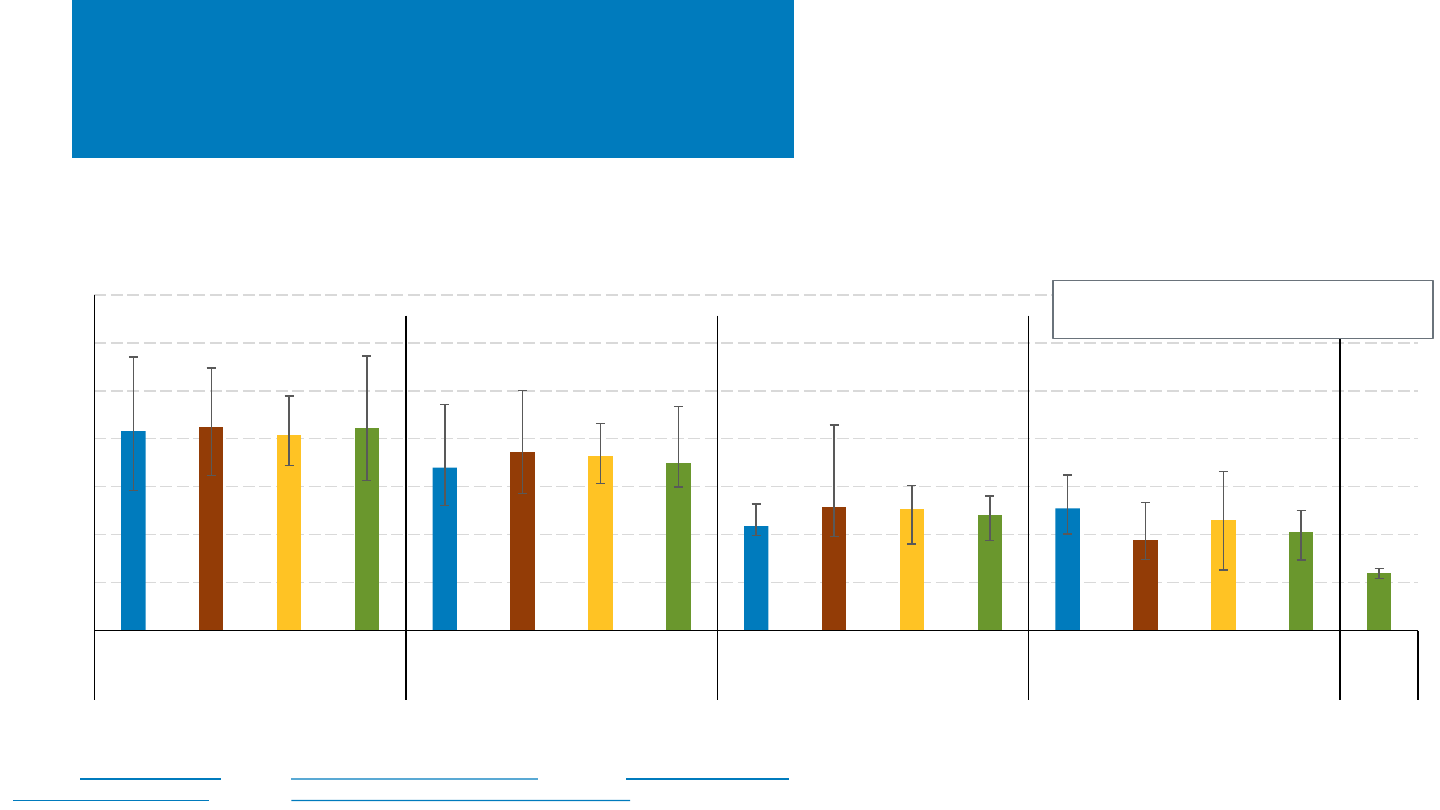

$0

$1

$2

$3

$4

$5

$6

$7

AZ CA MA NY AZ CA MA NY AZ CA MA NY AZ CA MA NY NY

2.5 kW–10 kW 10 kW–100 kW 100 kW–500 kW 500 kW–5 MW 5 MW+

System Price ($/W

dc

)

Distributed System Pricing From

Select States, H2 2023 (partial)

• For systems of 2.5–10 kW, nominal price changes varied

between H2 2022 and H2 2023 (partial):

– -5% in Arizona, no change in California, +4% in

Massachusetts, -1% in New York.

• In addition to price differences based on system size, there is variation

between states and within individual markets.

• Dollar-per-watt prices generally decrease as system size increases.

Bars represent the median, with error bars

representing 80

th

and 20

th

percentiles.

2023 MW data YTD: Arizona (290), California (1,566), Massachusetts (77), New York (596).

Note: System prices above $10/W and below $0.75/W were removed from the data set.

Sources: Arizona Goes Solar

(1/2/24); California Distributed Generation (11/30/23); Massachusetts Lists of

Qualified Generation Units

(12/6/23); Solar Electric Programs Reported by NYSERDA (1/4/24).

NREL | 34NREL | 34

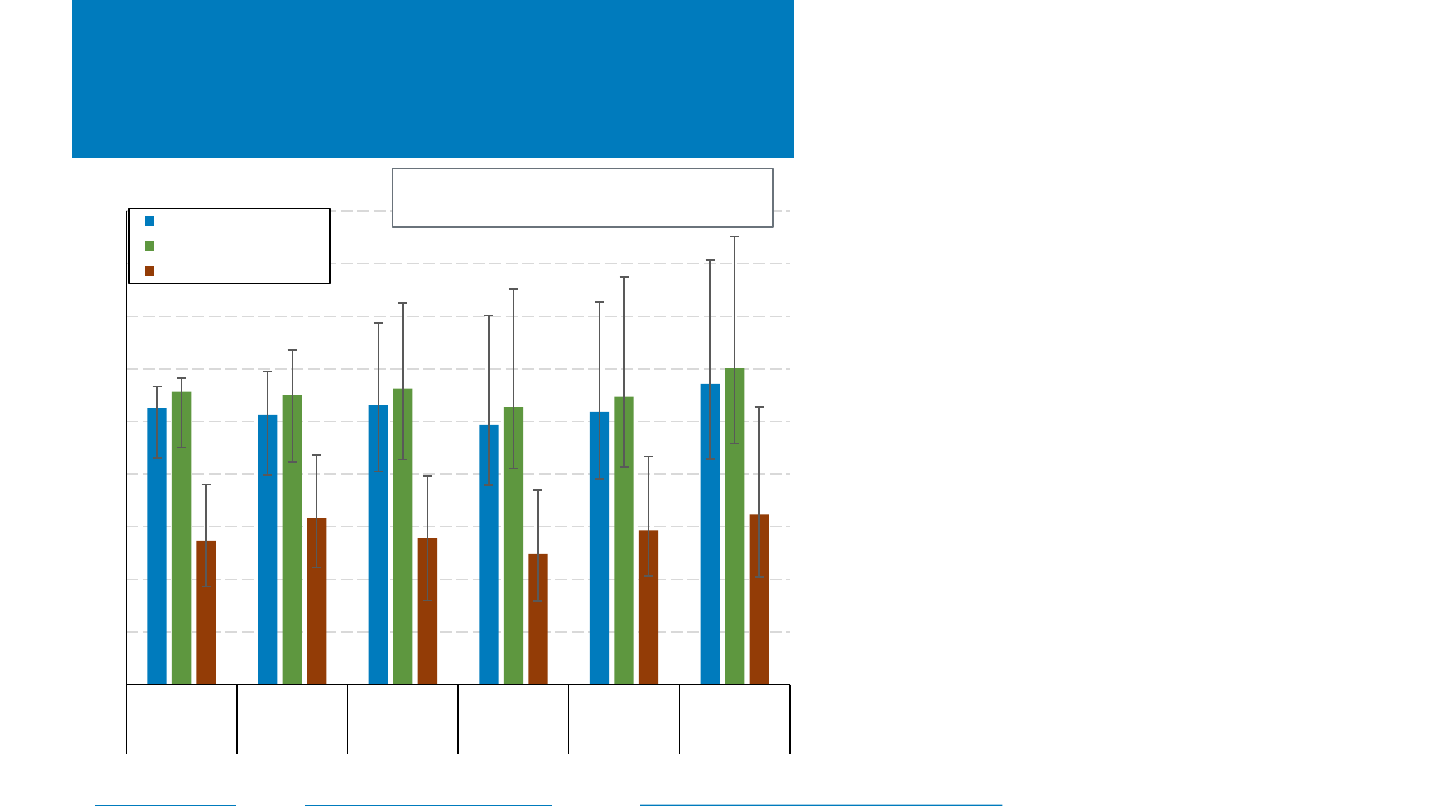

Residential U.S. PV+Storage Pricing

2023 YTD residential PV+storage sample, after data cleaning (MW

dc

): Arizona (16), California (106), Massachusetts (7).

Sources: Arizona Goes Solar (1/2/24); California Distributed Generation (11/30/23); Massachusetts Lists of Qualified Generation Units (12/6/23).

• In 2023 YTD, residential PV+storage systems

in Arizona, California, and Massachusetts

had a median system price of $3,235/kWh,

or $6,015/kW

ac

($5,719/kW

dc

)—an increase

of about 10% compared with full 2022

median values:

– Most of these systems offer 2–3 hours of

storage.

– Units represent total system price divided by

the capacity of the battery (kWh) or the

capacity of the PV system (kW).

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

2018 2019 2020 2021 2022 2023

n= 3,380 n= 4,248 n= 7,837 n= 13,299 n= 20,440 n= 13,873

System Price

PV+Storage ($/kWdc)

PV+Storage ($/kWac)

PV+Storage ($/kWh)

Bars represent the median, with error bars

representing the 80

th

and 20

th

percentiles.

NREL | 35NREL | 35

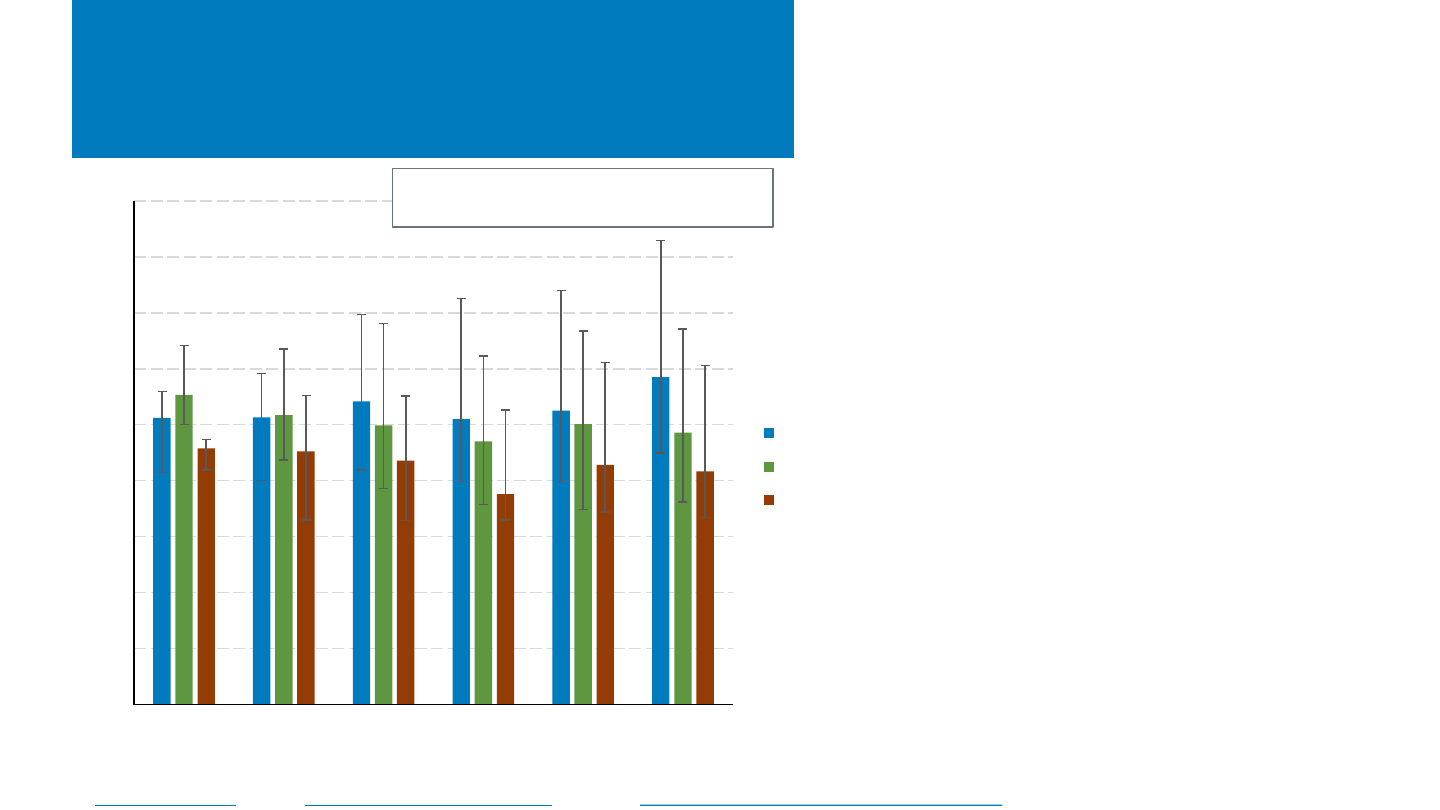

Residential U.S. PV+Storage Pricing

• During 2023 YTD, residential PV+storage

system prices in Arizona, California, and

Massachusetts varied between states and

internally.

– Prices may vary due to differences in storage

power and capacity, permitting and

interconnection differences, local competitive

factors, and installer experience.

• Compared with full median 2022 values,

prices (in dollars per kW

dc

of PV capacity)

increased in 2023 YTD in California (11%)

while decreasing in Massachusetts (3%) and

Arizona (3%).

2023 YTD residential PV+storage sample, after data cleaning (MW

dc

): Arizona (16), California (106), Massachusetts (7).

Sources: Arizona Goes Solar (1/2/24); California Distributed Generation (11/30/23); Massachusetts Lists of Qualified Generation Units (12/6/23).

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

2018 2019 2020 2021 2022 2023

System Price ($/kW

dc

)

CA

AZ

MA

Bars represent the median, with error bars

representing the 80

th

and 20

th

percentiles.

NREL | 36NREL | 36

U.S. Solar PPA Pricing

(LevelTen)

Source: LevelTen, PPA Price Index.

• LevelTen reports that following a modest dip

in prices in Q2, U.S. utility-scale PV PPA prices

increased for the second straight quarter,

increasing 3% q/q and 15% y/y in Q4 2023.

• Market-level trends diverged with some

experiencing price declines and others seeing

price increases:

– ERCOT pricing was relatively low due in

part to low interconnection costs and low

REC pricing. Conversely, PJM pricing was

relatively high due to higher

interconnection and REC pricing.

• PPA prices were pushed down by a more

efficient solar supply chain and lower module

prices; however, high interest rates negated

any benefits of lower equipment pricing.

$0

$10

$20

$30

$40

$50

$60

$70

$80

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

2019 2020 2021 2022 2023

25th Percentile PPA Offer Price ($/MWh)

National average across

markets

NREL | 37NREL | 37

SREC Pricing

Source: SRECTrade, https://www.srectrade.com/, accessed 01/31/31.

• Solar renewable energy certificate (SREC) pricing has been relatively flat in 2023, particularly for legacy

programs such as New Jersey and Massachusetts, which are not accepting new projects.

• However, potential programmatic or supply/demand changes can still impact markets. A bill currently

being debated in Pennsylvania’s state House would increase its RPS from 8% to 30% and the solar

carveout from 0.5% to 4.0% by 2030.

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

Jan-19

Apr-19

Jul-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Jan-23

Apr-23

Jul-23

Oct-23

Jan-24

Price Per SREC (Simple Average)

Lower-Priced Markets

PA MD OH In-state

$0

$100

$200

$300

$400

$500

Jan-19

Apr-19

Jul-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Jan-23

Apr-23

Jul-23

Oct-23

Jan-24

Price Per SREC (Simple Average)

Higher-Priced Markets

NJ DC MA (SREC II)

NREL | 38

Global Solar Deployment1

U.S. PV Deployment

2

PV System Pricing

3

Global Manufacturing

4

Component Pricing

5

U.S. PV Imports

6

7 PV Waste and Toxicity

Agenda

• BNEF reports that at the end of 2023, global PV

manufacturing capacity was between 650 and 750

GW―a growth of 2–3x in the past 5 years, 90% of which

occurred in China. In 2023, global PV production was

between 400 and 500 GW.

• Despite global price drops across the PV supply chain, PV

manufacturers have generally remained profitable,

thanks to increases in sales volumes (particularly for N-

type cells).

NREL | 39NREL | 39

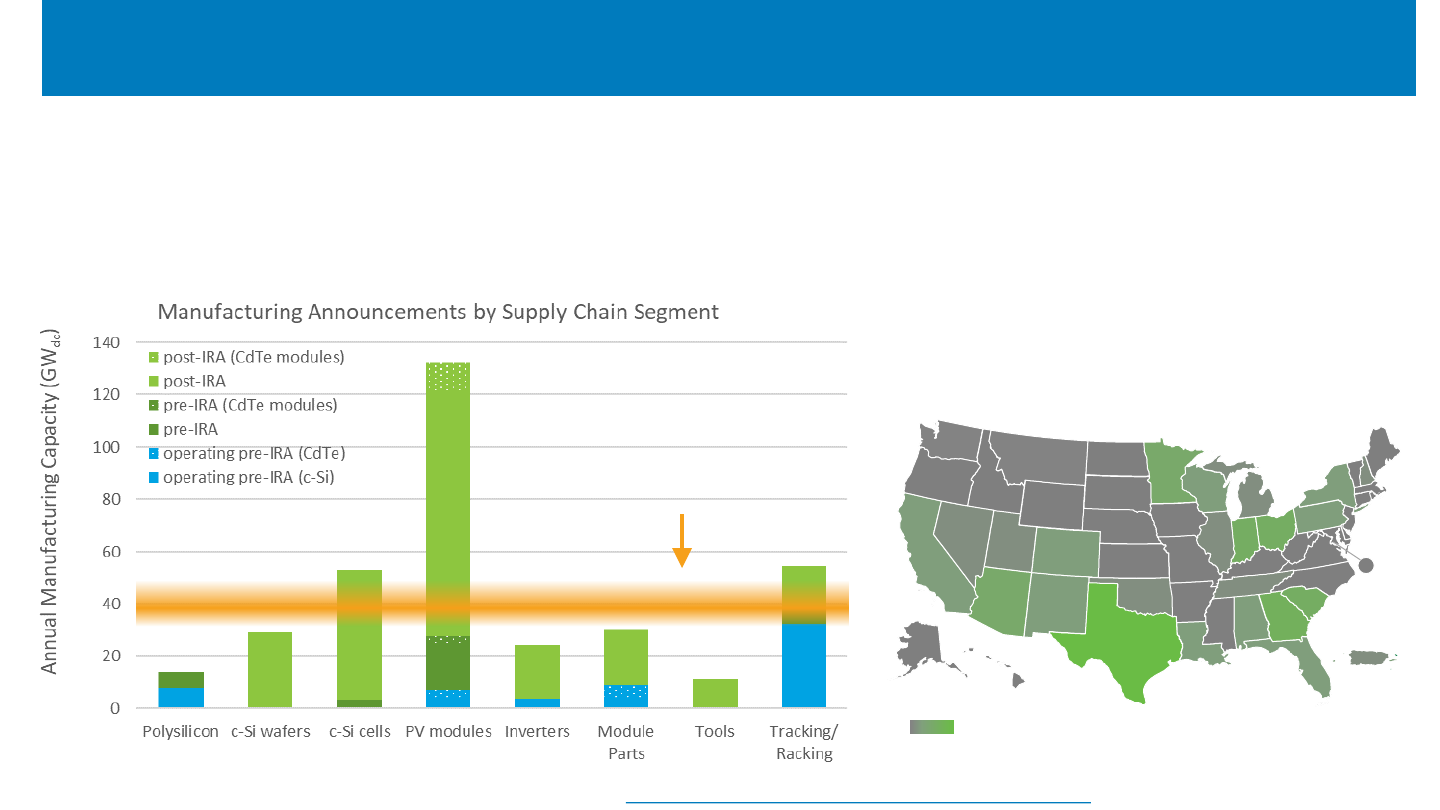

PV Manufacturers’ Margins

• Despite global price drops across the PV supply

chain, PV manufacturers have generally

remained profitable, thanks to increases in

sales volumes (particularly for N-type cells):

– Lower pricing upstream also means lower

costs downstream.

– At the end of Q3 2023, over half of

Canadian Solar capacity and Jinko Solar

production (57%) used N-type cell

architecture.

– Jinko reported mass-produced TopCon cell

efficiencies reaching 25.6%.

Lines represent the median, with error bars representing 80

th

and 20

th

percentiles for the following companies in Q3 2023: Canadian Solar, First Solar, JA Solar, Jinko Solar,

LONGi, Maxeon, Motech Industries, REC Silicon, Renesola, Risen, Shanghai Aiko, Shanghai Aerospace, Tongwei, Trina Solar, and United Renewable Energy.

Note: Gross margin = revenue minus cost of goods sold (i.e., the money a company retains after incurring the direct costs associated with producing the goods or services it

sells); operating margin = gross margin minus overhead and operating expenses (i.e., the money a company retains before taxes and financing expenses).

Sources: Company figures based on public filings and finance.yahoo.com.

-40%

-30%

-20%

-10%

0%

10%

20%

30%

40%

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2019 2020 2021 2022 2023

Margins

gross margin

operating median

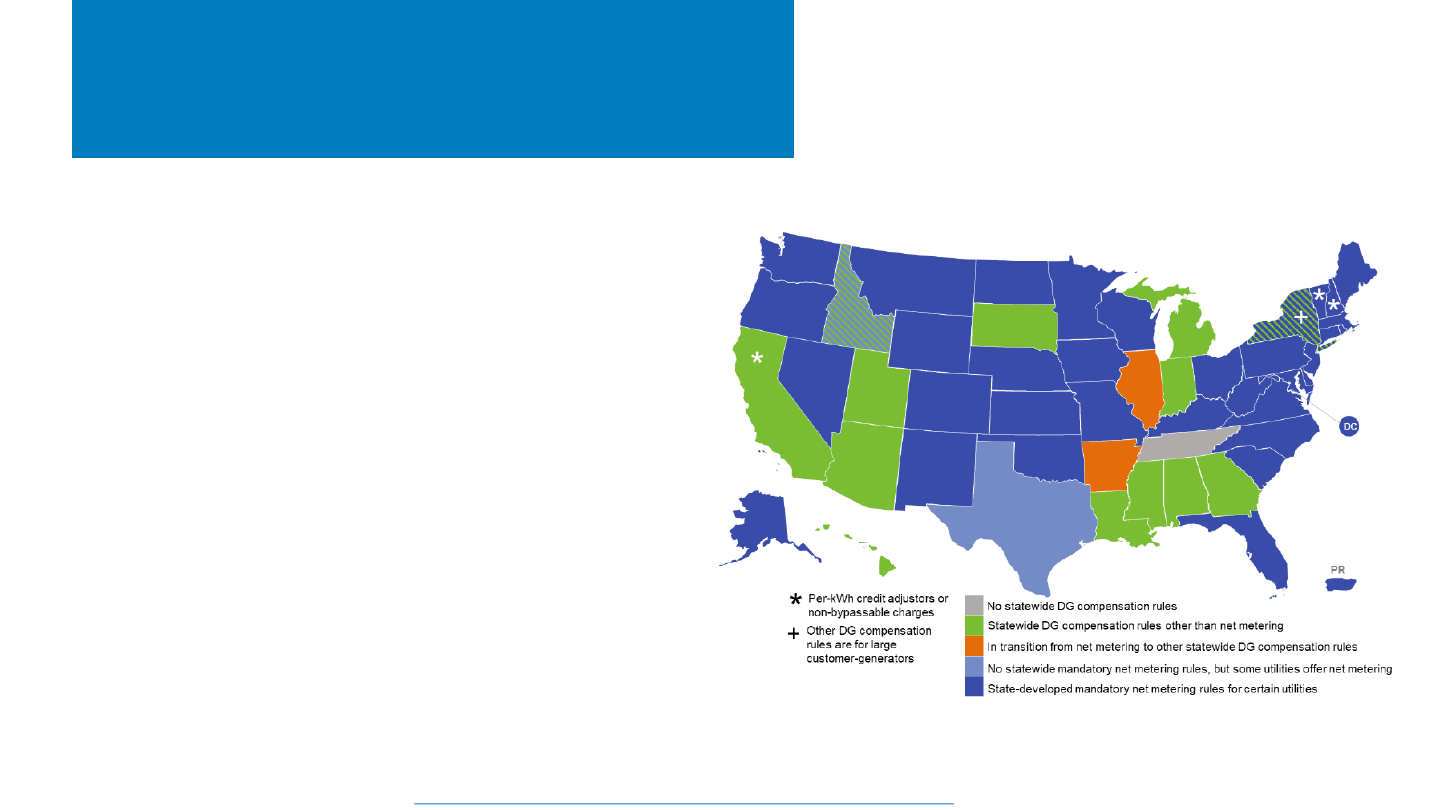

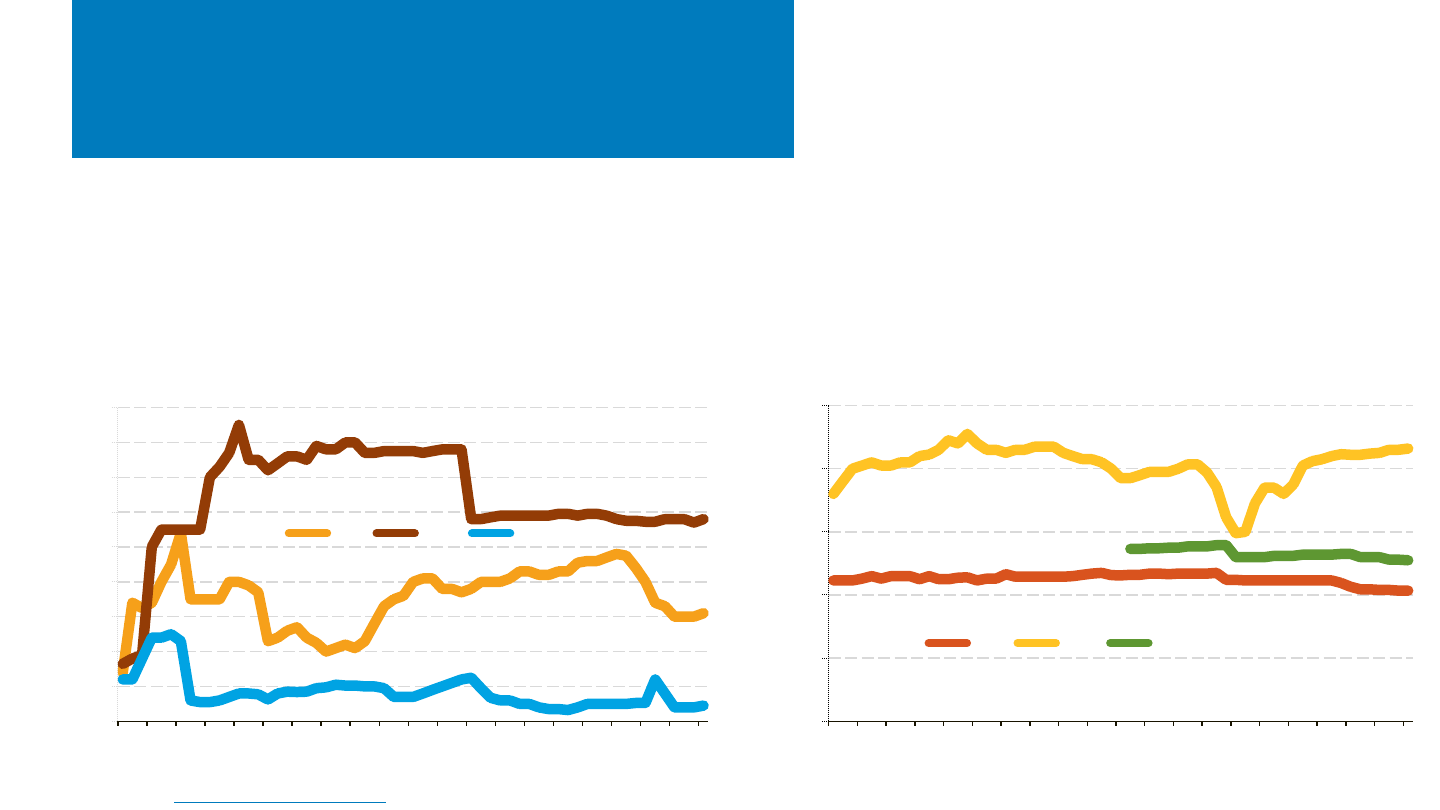

• Since the passage of the IRA, >250 GW of manufacturing capacity has been announced across the solar supply chain, representing

more than 27,000 potential jobs and more than $14 billion in announced investments across 80 new facilities or expansions.*

Sources: Internal DOE tracking of public announcements and BNEF Global PV Market Outlooks and Wood Mackenzie and SEIA Solar Market Insights Q2 2022 and Q2 2023.

*Not all announcements include facility locations, job, or investment numbers. See Building America's Clean Energy Future | Department of Energy.

IRA Impacts on U.S. Solar PV Manufacturing Capacity

These announcements post-IRA represent

potential investment in 23 states and Puerto Rico.

# of facilities* announced post-IRA

0 13

2

1

2

1

2

1

3

1

13

3

2

2

2

1

4

1

4

2

6

5

2

2

1

DC

1

Projected 2025

U.S. PV Deployment

– 105 GW of solar module capacity (including 11 GW of CdTe)

– 49 GW of c-Si cell capacity

– 29 GW of c-Si wafer capacity

– 69 GW of BOS (including glass, encapsulant, backsheet,

junction boxes, inverters, trackers, and tracker components)*

– Another 35 GW of solar manufacturing capacity had been

announced since the start of the Biden administration prior to

the passage of the IRA.

Recent Manufacturing News

• Notable announcements over the last several months include:

– Array Technologies announced solar tracker plans for Albuquerque,

New Mexico

– Canadian Solar announced plans for 5 GW of cells in Jeffersonville,

Indiana

– Heliene announced plans to expand in Mountain Iron, Minnesota

– NSG Glass North America announced plans to make glass for First

Solar in Rossford, Ohio

– Priefert Steel (Nevados) announced solar tracker plans for Mount

Pleasant, Texas

– SMA Solar announced plans to make 3.5 GW of inverters in the U.S.

– Soltec announced plans to make trackers within the U.S.

– Waaree Energies announced a location for its module

manufacturing in Brookshire, Texas, and announced plans to make

c-Si cells within the U.S. by 2025.

• In less positive manufacturing news, Enphase Energy also announced that it

plans to close its recently-opened Wisconsin facility in 2024.

https://www.energy.gov/invest, updated 1/11/24

Facilities

announced

without

locations

Source: Internal DOE tracking of announcements, PV Tech.

NREL | 42NREL | 42

Growth in Global PV

Manufacturing Capacity

• PVTech and Goldman Sachs report that at the end of

2023, approximate global PV manufacturing

capacity was between 650 and 750 GW. In 2023,

global PV production was between 400 and 500 GW.

• In the past 5 years, PV manufacturing capacity has

grown 2–3x, with more than 90% of the growth

occurring in China:

– 20% (wafer) to 40% (polysilicon) of new

manufacturing capacity came online in 2023.

• The ratio of production as a percent of

manufacturing capacity fell slightly in 2023;

however, some of that might be explained by the

large amount of manufacturing capacity ramping up.

• Historically, the previous years’ manufacturing

capacity has been a good indicator of the next year’s

production, across manufacturing steps. However,r

analysts project that it may take a few years for the

industry to produce at the 2023 level of global

manufacturing capacity.

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

0

100

200

300

400

500

600

700

800

2019

2021

2023

2020

2022

2019

2021

2023

2020

2022

2019

2021

2023

2020

2022

2019

2021

2023

2020

2022

China Outside

China

China Outside

China

China Outside

China

China Outside

China

Modules Cells Wafers Polysilicon

MT (000s)

Gigawatts

Excess Capacity

Production

Note: Data represent median values from multiple sources.

Sources: Goldman Sachs (12/17/23), PVTech Research, “PV Manufacturing & Technology Quarterly Report - Release 31 - November 2023.”

NREL | 43NREL | 43

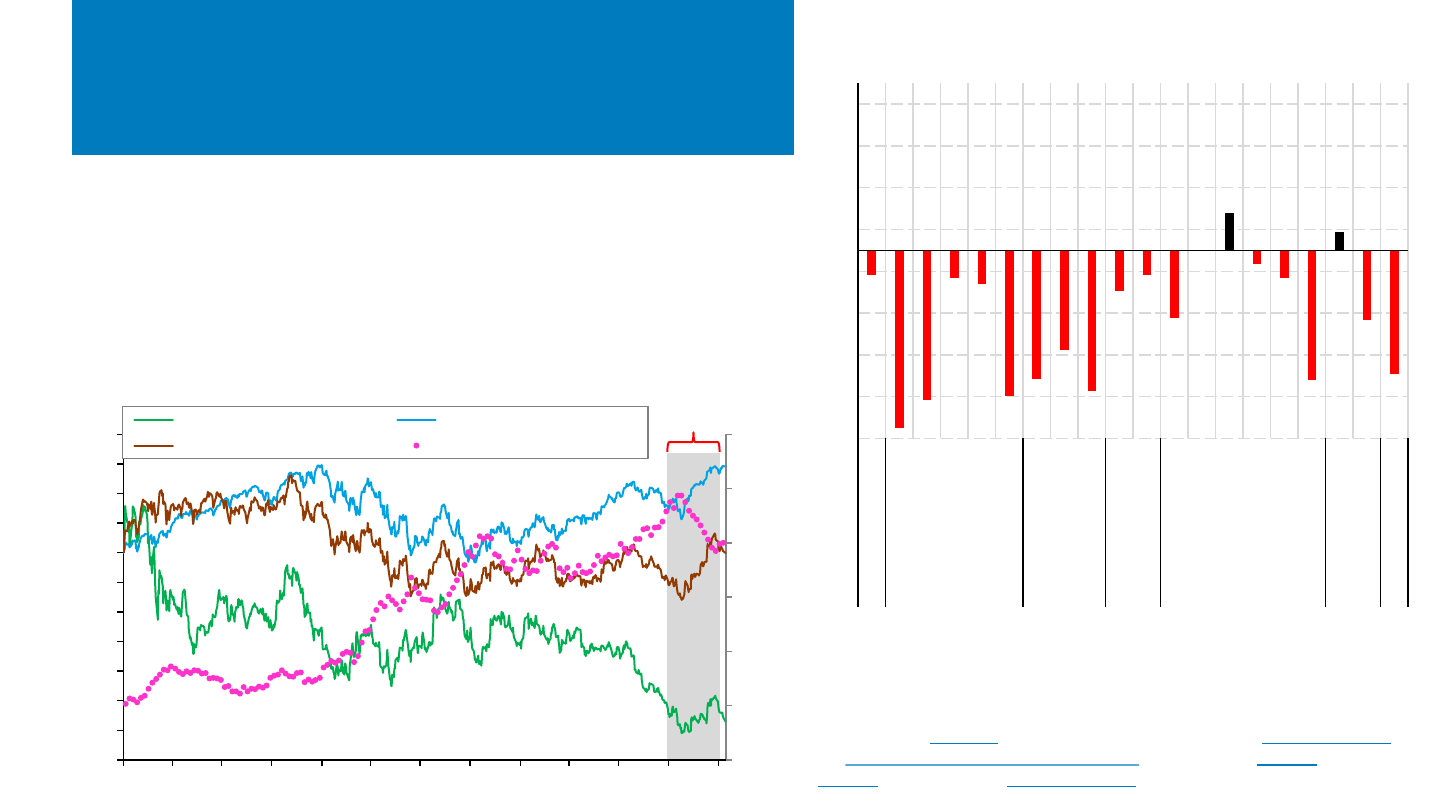

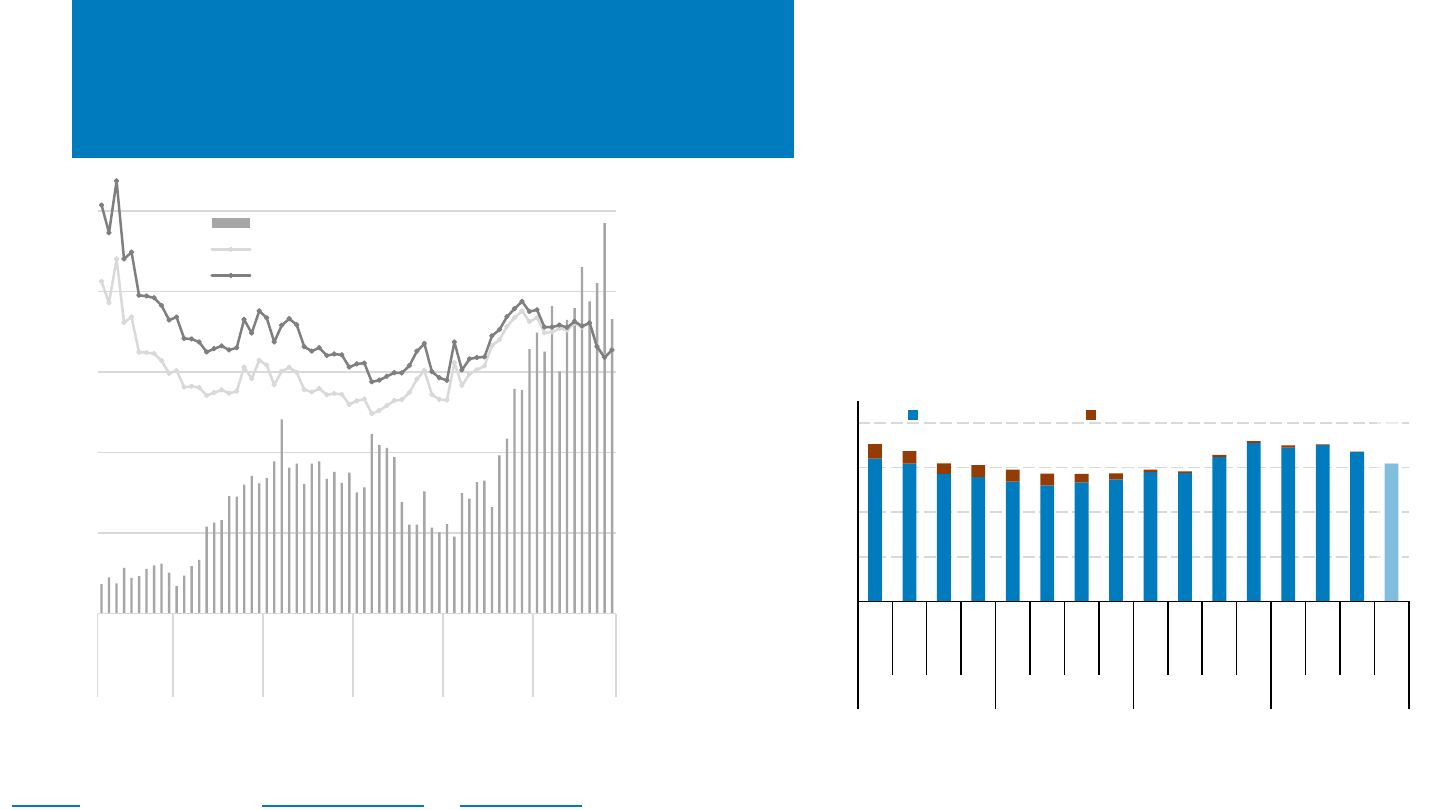

Stock Market Activity

Note: The TAN index is weighted toward particular countries and sectors. As of

1/16/24, 55% of its funds were in U.S. companies and 17% were in Chinese

companies. Its top 10 holdings, representing 62% of its value, were First Solar,

Enphase, SolarEdge, Sunrun, GCL, Hannon Armstrong, Xinyi, Shoals, Array

Technologies, and Encavis.

Sources: CNBC (11/15/23); Federal Reserve Bank of St. Louis (accessed 1/16/24);

IEA, Projected Costs of Generating Electricity, 2020; Invesco (1/16/24); Nasdaq

(1/13/24); Yahoo Finance (accessed 1/16/24).

Q4 2023

-90%

-70%

-50%

-30%

-10%

10%

30%

50%

70%

Atlantica Yield

Sunworks

SunPower

Sunnova

Sunrun

Azure Power

Ginlong

Enphase Energy

SolarEdge

Soltec Power

Array Tech.

Solargiga Energy

Tainergy Tech

First Solar

Jinko Solar

Canadian Solar

Shunfeng

Wacker Chemie

Daqo

Meyer Burger

Yieldcos Installers Inverters Trackers PV Manufacturers Poly Equip.

Individual Stock Performance (Q1–Q4 2023)

The Invesco Solar ETF rose 8% in Q4 2023 (-26% for the year) vs. an 11%–

15% increase across the broader market (+16% to +25% for the year). Rising

interest rates weighed on solar stocks for much of the year, reducing

profitability. A 5-percentage point increase in interest rates can increase

solar energy costs by one-third. Additional headwinds included California’s

NEM 3.0 policy, high labor costs, and large installer inventories of PV

equipment. Potential tailwinds going forward include falling interest rates,

strong demand for solar energy worldwide, and rapidly rising utility rates.

0

1

2

3

4

5

6

-70%

-60%

-50%

-40%

-30%

-20%

-10%

0%

10%

20%

30%

40%

Jan-21Apr-21 Jul-21 Oct-21Jan-22Apr-22 Jul-22 Oct-22Jan-23Apr-23 Jul-23 Oct-23Jan-24

10-Year Treasury Yield (%)

% Change (Index: 01/04/21

Adjusted Close)

Invesco Solar ETF (TAN) S&P 500 Index

iShares Russell 2000 ETF 10-Year Treasury Yield

NREL | 44

Global Solar Deployment1

U.S. PV Deployment

2

PV System Pricing

3

Global Manufacturing

4

Component Pricing

5

U.S. PV Imports

6

7 PV Waste and Toxicity

Agenda

• Global polysilicon spot prices fell 18% from mid-October

($10.53/kg) to mid-January ($8.70/kg), approaching their

lowest levels of the past several years.

• Global module prices reached yet another record low,

falling 22% between mid-October and mid-January to

$0.11/W

dc

.

• In Q3 2023, the average U.S. module price ($0.33/W

dc

)

was down 11% q/q and down 23% y/y but at a 100%

premium over the global spot price for monofacial

monocrystalline silicon modules.

NREL | 45NREL | 45

$0

$5

$10

$15

$20

$25

$30

$35

$40

$45

$0.00

$0.05

$0.10

$0.15

$0.20

$0.25

$0.30

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Jan-23

Apr-23

Jul-23

Oct-23

Jan-24

Average Polysilicon Spot Price ($/kg)

Average Wafer, Cell, and Module Spot Price ($/

W

dc

)

Cells, mono ($/Wdc) Monofacial modules, mono ($/Wdc)

Bifacial modules, 210 mm, mono ($/Wdc) Wafers, mono M10 ($/Wdc)

Polysilicon ($/kg)

PV Value Chain Global Spot Pricing

Sources: BloombergNEF, Solar Spot Price Index (1/17/24); PV Magazine (9/25/23, 11/23/23, 11/28/23, 12/19/23); PV Tech (10/20/23).

Global polysilicon spot prices fell 18% from

mid-October ($10.53/kg) to mid-January

($8.70/kg), approaching their lowest levels of

the past several years:

• Additional polysilicon capacity scheduled to

come online in 2024 far exceeds the increase in

expected polysilicon demand, further increasing

global polysilicon overcapacity.

During the same period, global prices

decreased for wafers (27%) and cells (33%).

Global module prices reached yet another

record low, falling 22% between mid-October

and mid-January to $0.11/W

dc

:

• Decreasing supply chain costs, increasing module

manufacturing capacity, and large module

inventories in Europe as well as intense

competition among manufacturers depressed

demand and prices.

Monofacial modules

Cells

Wafers

Bifacial modules

Polysilicon (right axis)

NREL | 46NREL | 46

Module Prices:

Global vs. United States

Sources: BloombergNEF, Solar Spot Price Index (1/17/24); EIA, Monthly Solar Photovoltaic Module Shipments Report (1/19/24); Wood Mackenzie and SEIA, US Solar

Market Insight: Q3 2023 (9/23); Wood Mackenzie and SEIA, US Solar Market Insight: Q4 2023 (12/23).

In Q3 2023, the average U.S. module price

($0.33/W

dc

) was down 11% q/q and down 23%

y/y but at a 100% premium over the global spot

price for monofacial monocrystalline silicon

modules.

The directional trend in U.S. module prices

realigned with the trend in global module prices,

although the difference between the two prices

remained about the same ($0.16–$0.17/W

dc

).

• The U.S. premium has been maintained by

tariffs on Chinese modules as well as friction

on Southeast Asian module imports due to

the antidumping and countervailing duties

(AD/CVD) investigation as well as module

detainment under the Uyghur Forced Labor

Prevention Act (UFLPA).

• Decreasing UFLPA detainment periods have

contributed to recent declines in U.S. module

prices.

$0.00

$0.05

$0.10

$0.15

$0.20

$0.25

$0.30

$0.35

$0.40

$0.45

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2020 2021 2022 2023

PV Module Price ($/W

dc

)

U.S. average module value

Global spot price, monofacial monocrystalline modules

NREL | 47NREL | 47

$0.00

$0.10

$0.20

$0.30

$0.40

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Oct-Nov

2020 2021 2022 2023

Nominal U.S. Module Price

Imported value/Watt "Effective" 201 Tariff Rate

Calculated U.S. Module Pricing

• As module imports rose at the end of 2022, prices rose

with them, but in Q3 2023, prices began to fall―although

they are still well within historical norms (in both real and

nominal price).

– Based on the reported value and capacity of imported PV

modules, the average price of a PV module in the United

States fell less than a cent q/q in Q3 2023 to $0.34/W and

is on track to fall back to $0.31/W in Q4, while the

effective Section 201 tariff has fallen below $0.01/W.

– Price fluctuations continue to vary by country, with

module prices from South Korea experiencing the most

significant changes and those from Malaysia remaining

the steadiest.

Note: Manual corrections were made to three values due to suspected data entry errors for HTS code 8541430010: Cambodia (February 2022), Malaysia (June 2020), and Vietnam (July 2019);

nominal price = the price paid at the time of transaction (i.e., not adjusted for inflation); real price = the price adjusted for inflation.

Sources: Imports by HTS code: 8541460015(2018-2021)/8541430010(2022-); Customs Value and Second Quantity (watts) from the U.S. International Trade Commission

DataWeb; the U.S. Census Bureau USA Trade Online tool and corrections page. Manual corrections were made to imports from India due to suspected data entry errors.

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

0.0

1.0

2.0

3.0

4.0

5.0

MAR

JUN

SEP

DEC

MAR

JUN

SEP

DEC

MAR

JUN

SEP

DEC

MAR

JUN

SEP

DEC

MAR

JUN

SEP

DEC

MAR

JUN

SEP

2018 2019 2020 2021 2022 2023

c-

Si Module Price (Nov 2023 US$/

W

dc

)

Imported c-Si Modules (GW

dc

)

Total c-Si import volume (GW)

Total c-Si imports nominal price ($/W)

Total c-Si imports real price ($/W)

NREL | 48NREL | 48

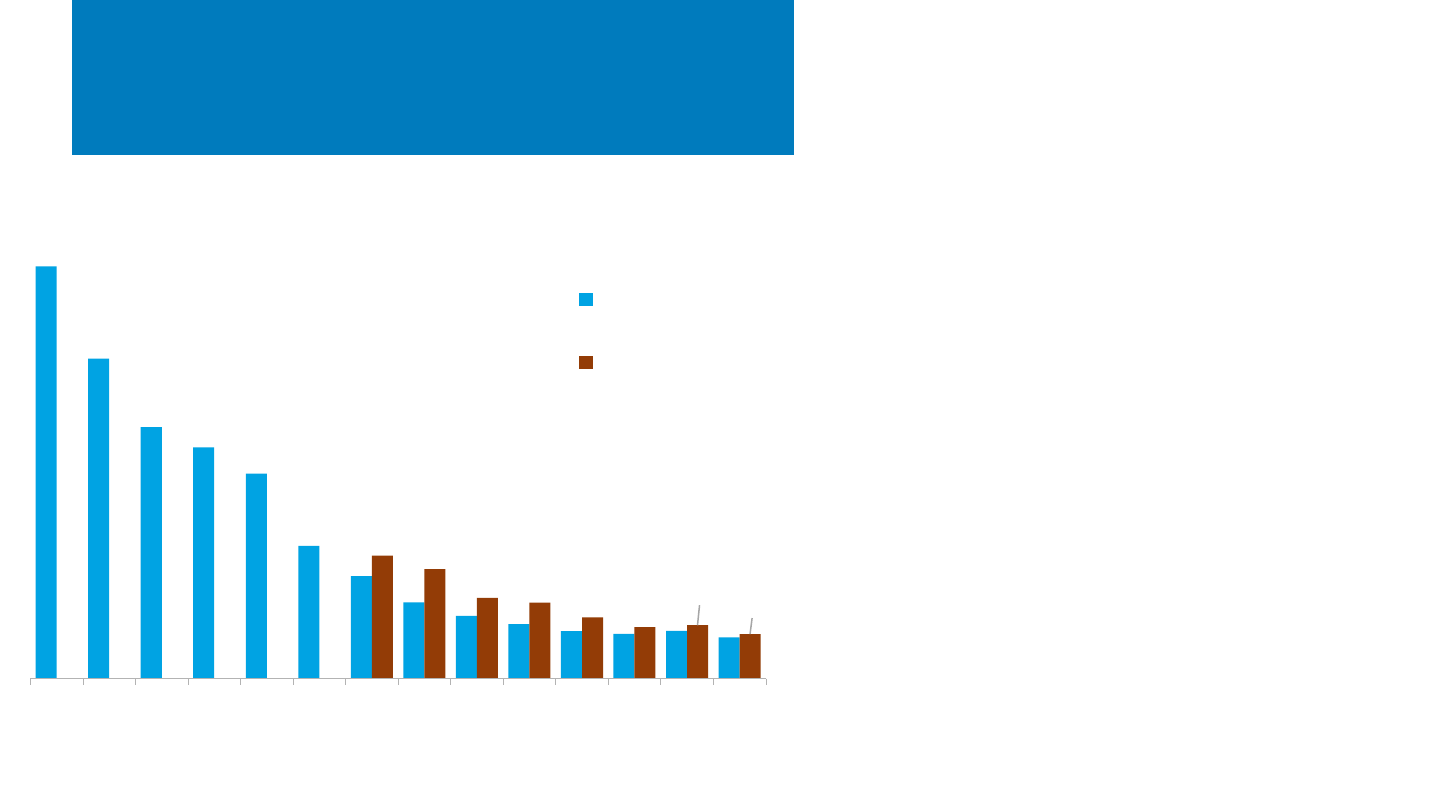

Average Lithium-Ion Battery

Pack Price, 2010–2023

• After a small increase in 2022, battery pack prices

continued their historical downward trend in

2023, falling 90% from 2010 to 2023, and 14%

between 2022 and 2023.

– From 2016 to 2023, average battery pack

prices within the stationary storage sector

decreased 64% and 17% from 2022 to 2023.

– BNEF reported the lowest price to date:

$82/kWh in China.

• BloombergNEF cited falling raw material and

component prices due to large increases in

manufacturing capacity throughout the supply

chain. Additionally, despite a growth in demand,

it may have been lower than expected.

• BloombergNEF reported that large stationary

storage providers are entering multiyear cell

supply agreements while allowing flexibility to

take advantage of low Chinese prices.

Source: BloombergNEF, “2023 Lithium-Ion Battery Price Survey.”

1,391

1,079

848

780

692

448

345

258

2…

183

160

150

161

139

415

369

272

256

207

173

180

150

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Battery pack price (real 2023 $/kWh)

All Sectors

Stationary

Storage

NREL | 49

Global Solar Deployment1

U.S. PV Deployment

2

PV System Pricing

3

Global Manufacturing

4

Component Pricing

5

U.S. PV Imports

6

7 PV Waste and Toxicity

Agenda

• The United States imported 40.6 GW

dc

of PV modules in Q1–Q3

2023, setting a new single-quarter record of over 15 GW

dc

of

modules imported.

– Most panels imported were exempt from Section 201 duties

and were therefore likely bifacial. A significant number of thin-

film modules were also imported.

• 2.4 GW

dc

of cells were imported in Q1–Q3 2023, up 31% y/y.

– The U.S. is not on pace to reach the 5-GW

dc

quota exemption

limit for Section 201 tariffs, although it has exceeded 3 GW

dc

of

imports in a single year for the first time.

NREL | 50NREL | 50

0.0

2.0

4.0

6.0

8.0

10.0

12.0

14.0

16.0

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Oct-Nov

2020 2021 2022 2023

Modules Imported (GW

dc

)

U.S. Module (c-Si + CdTe) Imports by Region

Malaysia

Vietnam

Thailand

Cambodia

South Korea

India

China

Rest of Asia

N. America

ROW

Module Imports and

Calculated Prices by Region

Sources: Imports by HTS code: 8541460015(2018-2021)/8541430010(2022-) and 8541460035(2018-2021)/8541430080(2022-), Second Quantity (watts) from the U.S.

International Trade Commission DataWeb as well as the U.S. Census Bureau USA Trade Online tool and corrections page as of 1/10/24. Manual corrections were made to

imports from India due to suspected data entry errors.

• In Q3 2023, U.S. module imports achieved new record-

high levels at 15.3 GW

dc

(+111%, or 8 GW

dc

y/y), totaling

40.6 GW

dc

in Q1–Q3 2023.

– Import levels decreased after the withhold release order

(WRO) on PV cells and modules was announced in late

Q2 2021. Additionally, many manufacturers in Southeast

Asia had reduced production levels earlier in the year

with the announcement of a U.S. anti-circumvention

investigation and when the 2-year waiver was

announced in June; however, the supply chain appears

to have recovered from those disturbances.

– The Q3 q/q increase (+22%, +2.72 GW

dc

) was mainly the

result of increased imports from Malaysia (+71% q/q,

+1.3 GW

dc

) as well as more modest increases from the

other southeast Asian countries of import.

• Though Q4 is not yet complete, it looks to be another

strong quarter for module imports.

– This has been mainly the result of imports from Vietnam,

Malaysia, and Thailand all exceeding 2 GW

dc

in just 2

months, with Vietnam at nearly 3 GW (2.3 GW

dc

c-Si and

0.7 GW

dc

).

NREL | 51NREL | 51

0.0

0.2

0.4

0.6

0.8

1.0

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4*

2021 2022 2023

Imported c-Si Cells (GW

dc

)

U.S. Cell Imports by Region

Malaysia

Vietnam

Thailand

Cambodia

South Korea

China

Taiwan

Indonesia

ROW

(previous) 2.5 GWdc PV Cell Import Quota Exemption

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

7-Feb

9-Mar

8-Apr

9-May

8-Jun

9-Jul

8-Aug

8-Sep

8-Oct

8-Nov

8-Dec

7-Jan

7-Feb

PV Cells Imported Into U.S. (

GW

dc

)

U.S. Cell Imports by Tariff Year

2019

2020

2021

2022

2023

c-Si Cell Import Data

Sources: Imports by HTS code: 8541460025(2018-2021)/8541420010(2022-), Second Quantity (watts) from U.S. Census Bureau USA Trade Online tool and corrections

page

as of 1/10/24; U.S. Customs and Border Protection Commodity Status Reports Feb 2019–Jan 2024.

• According to U.S. Census data, 875 MW

dc

of cells were imported in Q3

2023 (2.4 GW in Q1–Q3 2023, +31% y/y), setting a record for imports in a

single quarter. However, that record has already been broken by the first 2

months of imports in Q4.

– This was mainly the result of increased imports from South Korea in Q3 (+228

MW

dc

q/q) and again the first 2 months of Q4 (+225 MW

dc

q/q), although there

was also a noticeable increase in imports from Cambodia (+84 MW

dc

) in Q4,

after having been responsible for less 4 MW total imports prior to Q2 2023.

• According to CBP Commodity Status Reports, starting in

mid-September of 2023, there was a noticeable uptick in

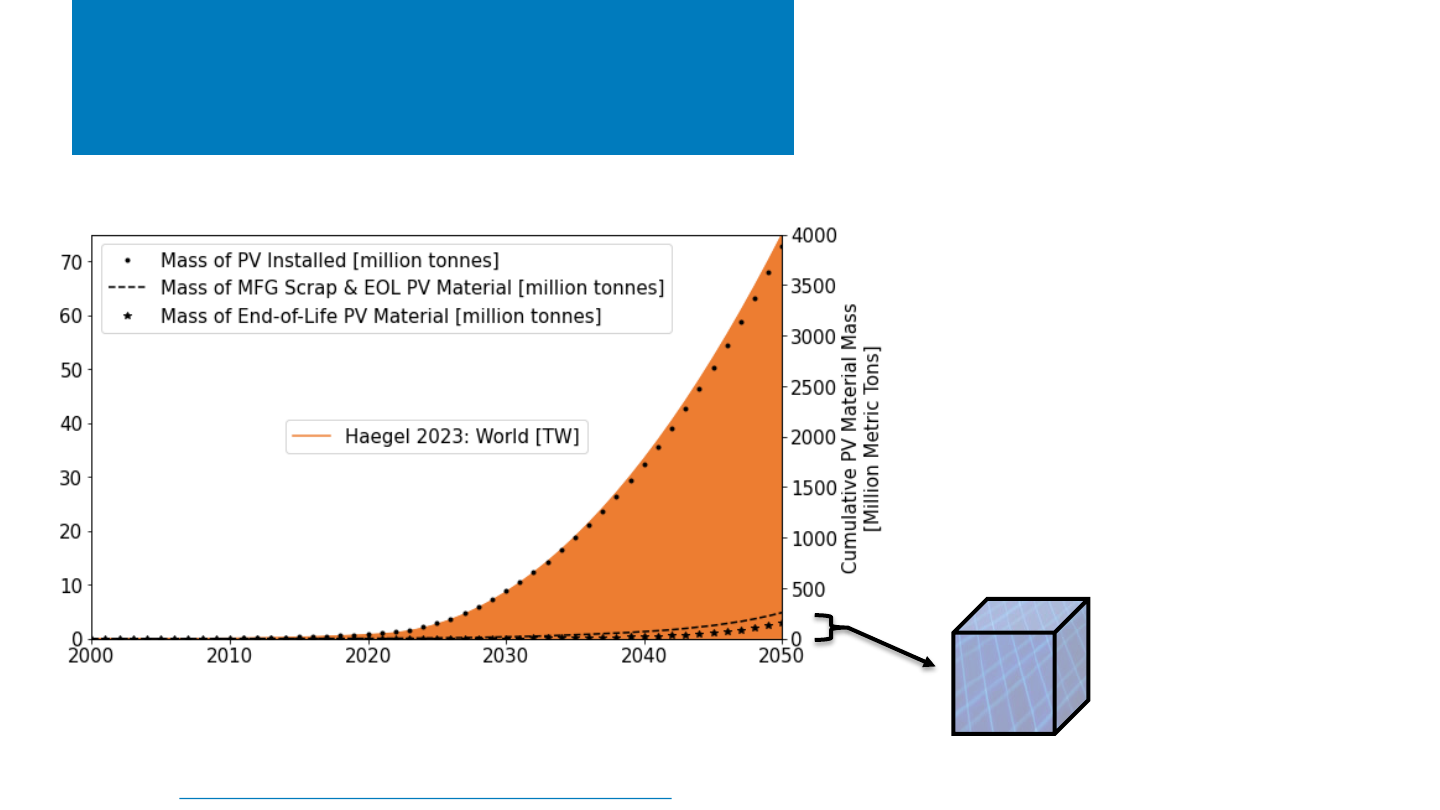

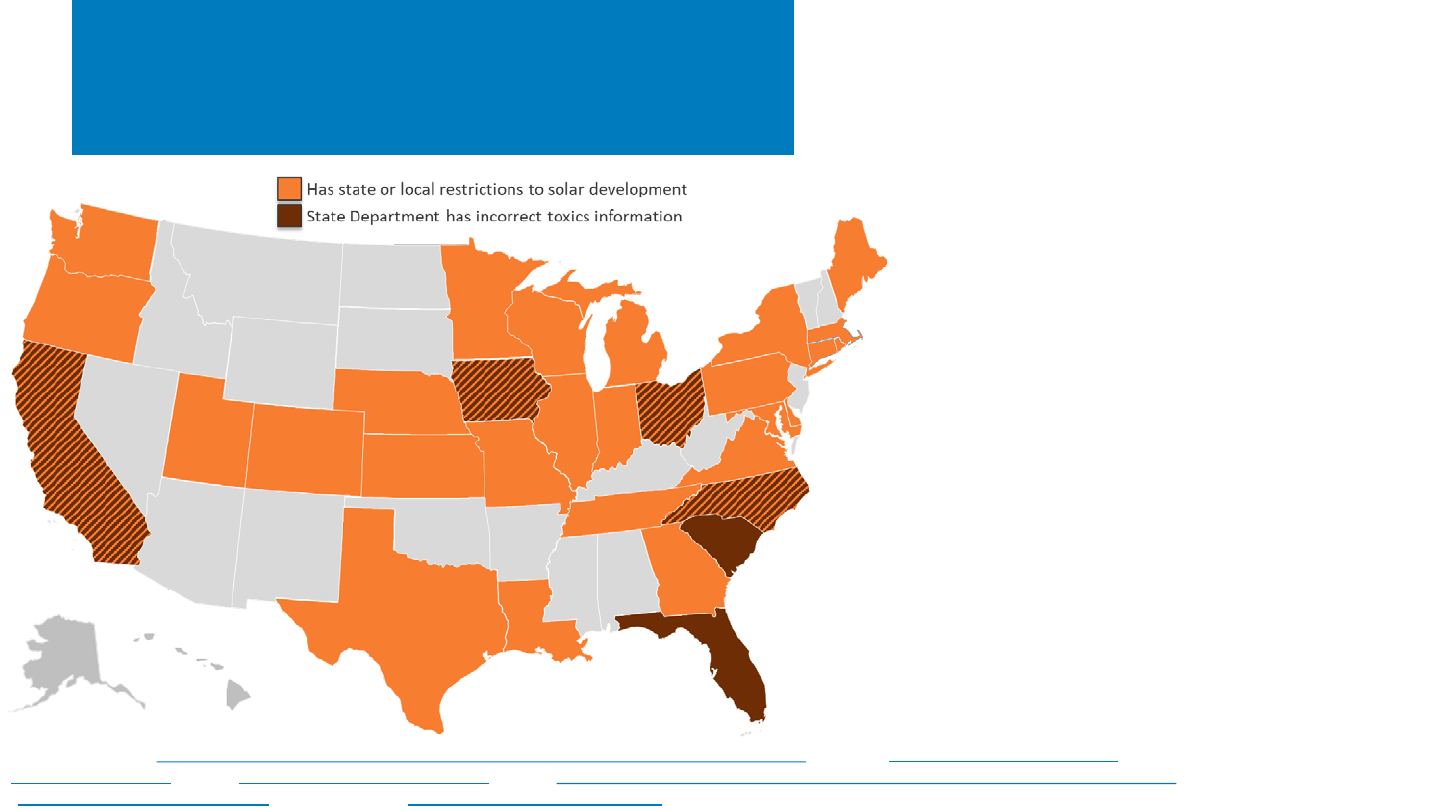

the import of cells relative to prior years. In mid-