Solar Photovoltaics

Supply Chain Deep Dive Assessment

U.S. Department of Energy Response to Executive

Order 14017, “America’s Supply Chains”

February 24, 2022

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

ii

About the Supply Chain Review for the

Energy Sector Industrial Base

This is one of a series of reports and deep dive assessments produced in response to Executive Order 14017

“America’s Supply Chains,” which directs the Secretary of Energy to submit a report on supply chains for the

energy sector industrial base. The Executive Order is helping the federal government to build more secure and

diverse U.S. supply chains, including energy supply chains.

To combat the climate crisis and avoid the most severe impacts of climate change, the U.S. is committed to

achieving a 50 to 52 percent reduction from 2005 levels in economy-wide net greenhouse gas pollution by

2030, creating a carbon pollution-free power sector by 2035, and achieving net zero emissions economy-wide

by no later than 2050. The U.S. Department of Energy (DOE) recognizes that a secure, resilient supply chain

will be critical in harnessing emissions outcomes and capturing the economic opportunity inherent in the

energy sector transition. Potential vulnerabilities and risks to the energy sector industrial base must be

addressed throughout every stage of this transition.

The DOE energy supply chain strategy report summarizes the key elements of the energy supply chain a s well

as the strategies the U.S. government is starting to employ to address them. Additionally, it describes

recommendations for Congressional action. DOE has identified technologies and crosscutting topics for

analysis in the one-year time frame set by the Executive Order. Along with a policy strategy report, DOE is

relea sing 11 deep dive assessment documents, including this one, covering the following technology sectors:

• carbon capture materials,

• electric grid including transformers and high voltage direct current (HVDC),

• energy storage,

• fuel cells a nd electrolyzers,

• hydropower including pumped storage hydropower (PSH),

• neodymium magnets,

• nuclear energy,

• platinum group metals and other catalysts,

• semiconductors,

• solar photovoltaics (PV), and

• wind

DOE is a lso relea sing two deep dive assessments on the following crosscutting topics:

• commercialization and competitiveness, and

• cybersecurity and digital components.

More information can be found at

www.energy.gov/policy/supplychains.

I n addition to the solar energy-related policy strategies laid out in DOE's companion

en ergy supply chain policy strategy report, this deep dive assessment includes its

own section focused on policy strategies and recommendations.

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

iii

Executive Summary

The Important Role of Solar Power

Over the past decade, solar power has gone from an emerging, niche technology to a mature energy industry.

By 2035, sola r power could supply 40% or more of U.S. electricity demand, dramatically accelerating the

decarbonization of buildings, transportation, and industry; and, if current technology trends continue, it could

do so without increasing the price of electricity.

∗

The rapid expansion of solar energy has the potential to yield broad benefits in the form of economic activity

and workforce development. The solar industry already employs roughly 230,000 people in the United States,

at an average wage that is higher than the national average for most comparable positions. By decarbonizing

the electricity sector by 2035, the U.S. solar industry could employ 500,000–1,500,000 people by 2030.

The Solar Photovoltaics Supply Chain

The components that are assembled to install a photovoltaic power system are produced by a global supply

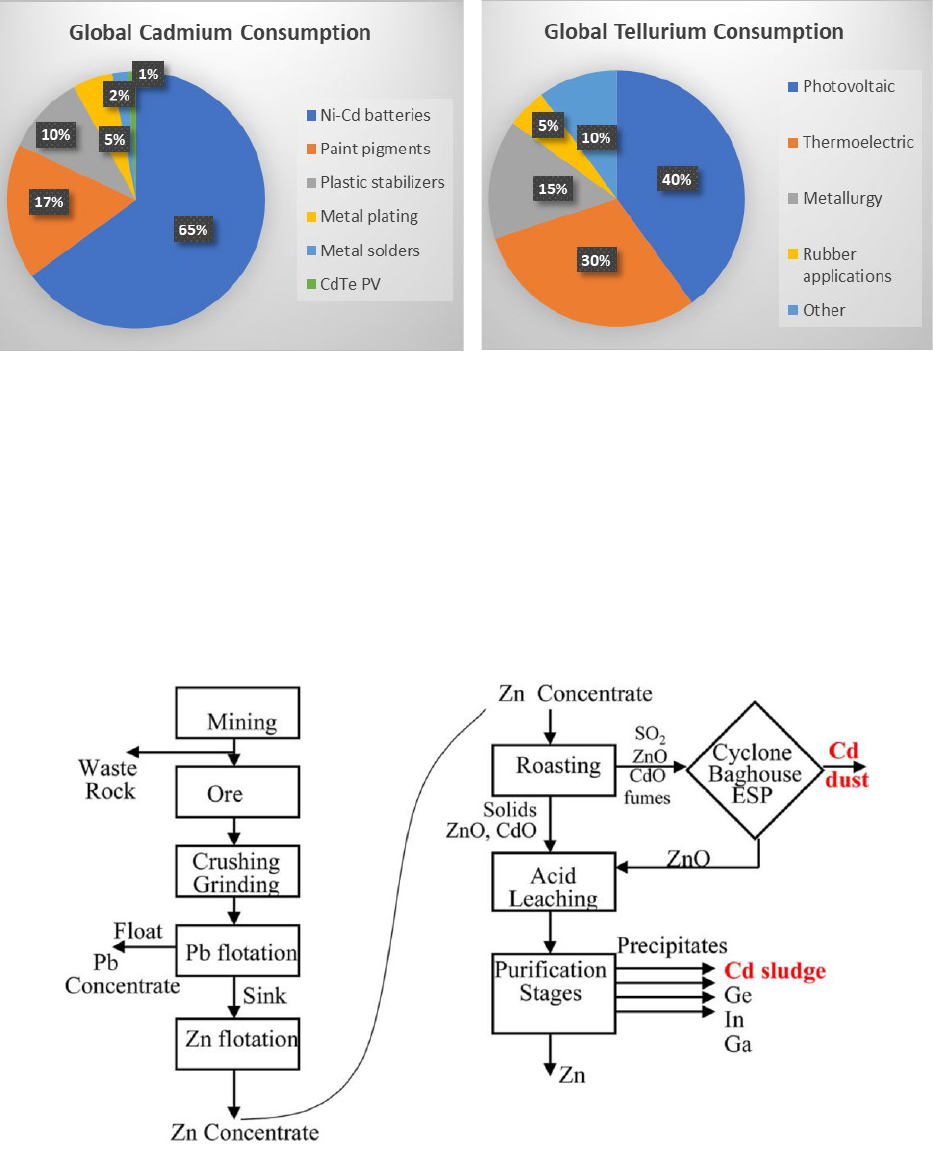

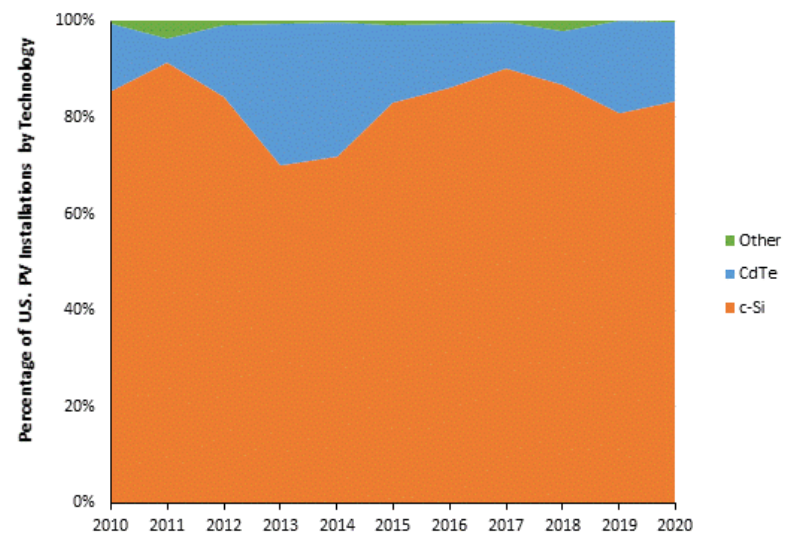

chain. Photovoltaic (PV) modules (also called panels) are made of cells that use a variety of technologies.

There are two leading types of solar modules used in the United States, with crysta lline silicon (c-Si) modules

representing 84% of the market and ca dmium telluride (CdTe) modules representing 16% of the market.

Modules of either type require mounting structures to provide mechanical support (racking), which may be

configured to follow the sun (tracking). The output of any PV module is direct current (dc), which is a lm ost

always converted to alternating current (ac) by an inverter.

The supply chain for c-Si modules starts with the refining of high-purity polycrystalline silicon (polysilicon).

The primary input material for polysilicon is metallurgical-gra de silicon (MGS). MGS (a lso ca lled silicon

metal) is a commodity material produced from high-grade quartz. About 12% of the world’s MGS is refined to

make high-purity polysilicon for the solar supply chain. Polysilicon is melted to grow monocrystalline silicon

ingots, which are sliced into thin silicon wafers. Silicon wafers are processed to make the solar cells that are

interconnected and sandwiched between glass and plastic sheets to make c-Si modules.

About 97% of the world’s production of silicon wafers occurs in China. Those wafers are shipped from China

and made into solar cells. About 75% of the silicon solar cells incorporated into modules installed in the

United States are made by Chinese subsidiaries located in just three Southeast Asian countries: Vietnam,

Malaysia, and Thailand. As of this writing, the United States has no active c-Si ingot, wafer, or cell production.

∗

Solar Futures Study, U.S. Department of Energy, September 2021.

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

iv

The United States does have production capacity for thin-film CdTe modules, which do not rely on obtaining

ma teria ls from Chinese companies. The U.S. PV installations using CdTe modules (16% of the total) were all

supplied by a single U.S. company that produced roughly one-third of those modules in the United States.

The concentration of the c-Si supply chain in companies with close ties to China, a country with documented

human rights violations and an unpredictable trade relationship with the United States, poses a significant risk

of disruption to the c-Si supply chain. Given the rate at which the U.S. economy will need to deca rbonize, it is

unlikely that any alternate PV technology, including CdTe, could displace c-Si before 2035.

Strategies, Actions, and Recommendations

Significant financial support and incentives from the U.S. government as well as strategic actions focused on

workforce, manufacturing, human rights, and trade will facilitate a global solar industry aligned with U.S.

interests and the reestablishment of robust U.S. domestic solar manufacturing leadership –thus leading to

tremendous benefits for the climate as well as for U.S. workers, employers, and the economy. Three strategies,

actions, and recommendations are critical to U.S. success in building a robust solar supply chain:

Enact legislation to provide tax incentives to support domestic manufacturing, including

incentives for building new facilities and for the ongoing operation of those facilities.

Tax incentives are needed to provide a clear demand signal and help U.S. manufacturers build and maintain a

competitive edge in clean energy technologies such as solar photovoltaics. To reestablish domestic solar

manufacturing in the United States, companies that produce and sell solar components will require financial

support to offset the 30 to 40% higher cost of domestic solar production. Expansion of ingot and wafer

production should receive the highest incentive because nearly all the world’s capacity currently exists inside

China, and expansion in these sectors would have the compounding effect of creating demand for existing U.S.

polysilicon producers to run at full capacity. These tax credits should be enacted for at least a decade to

provide the long-term signal for companies to establish new production facilities. Renewal for some time

thereafter, perhaps at a reduced level, could be required to maintain domestic competitiveness.

Enact legislation to encourage domestic solar adoption and deployment

Extend and revise credits for clean energy deployment, such as the Production Tax Credit (PTC) and

Investment Tax Credit (ITC) to provide stronger incentives for clean energy projects that support domestic

manufacturing and increase family-sustaining jobs. To provide demand certainty in support of domestic

manufacturing investments, these tax credits should be in place for at least 10 years and should not phase out

until significant progress has been made toward domestic competitiveness and decarbonization goals.

Enhance coordination of trade policy across the U.S. government to create fair conditions for

the U.S. solar industry and its workers

U.S. solar manufacturers have too often faced unfair – a nd illega l - competition from firms that benefit from

foreign, non-market practices such as dumping. The United States has responded with trade remedies designed

to protect domestic manufacturing. Transparent, effective coordination and implementation of these policies is

critical to supporting domestic manufacturing as well as clean energy deployment. The U.S. government will

continue to conduct expert analysis and engage with relevant stakeholders to refine implementation of trade

policies to optimize their effectiveness in leveling the playing field across the supply chain, while removing

barriers to solar deployment.

Supplement these strategies and recommendations with supportive policy actions.

See Section 3.4 for detailed strategies starting to be implemented by the U.S. government and

recommendations for Congressional action related to the solar energy supply chain.

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

v

Find the policy strategies to address the vulnerabilities and

opportunities covered in this deep dive assessment, as well as

assessments on other energy topics, in the Department of Energy 1-

year supply chain report: “America’s Strategy to Secure the Supply

Chain for a Robust Clean Energy Transition.”

For more information, visit www.energy.gov/policy/supplychains

.

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

vi

Table of Contents

1 Solar Photovoltaics............................................................................................................... 1

1.1 The Solar Photovoltaic System .........................................................................................1

1.2 U.S. Solar Photovoltaics Strategy......................................................................................2

1.3 The Global Role of Solar Photovoltaics .............................................................................7

2 Supply Chain Mapping ....................................................................................................... 13

2.1 Input Materials............................................................................................................. 13

2.2 Polysilicon Refining ..................................................................................................... 23

2.3 Ingots/Wafers .............................................................................................................. 29

2.4 Solar Cell Fabrication ................................................................................................... 35

2.5 Module Assembly ........................................................................................................ 43

2.6 Mounting Structures ..................................................................................................... 50

2.7 PV Inverters ................................................................................................................ 56

2.8 Cadmium Telluride Technology ..................................................................................... 63

3 Policy Considerations ......................................................................................................... 72

3.1 Opportunities and Challenges ......................................................................................... 72

3.2 Current Policies in the United States................................................................................ 75

3.3 Current Policies in Other Countries ................................................................................. 79

3.4 Policy Actions ............................................................................................................. 81

Appendix................................................................................................................................ 84

Stakeholder Outreach

List of Acronyms

Lists of Tables and Figures

References

Acknowledgements

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

1

1 Solar Photovoltaics

1.1 The Solar Photovoltaic System

To create a grid-connected photovoltaic (PV) system, multiple PV modules (panels) are electrically

interconnected and mounted to a support structure. The module (panel) is the core component of a photovoltaic

(PV) system. The vast majority of global PV module shipments (96% in 2020) use crystalline silicon (c-Si)

technology, made from melting chunks of polysilicon into ingots (i.e., blocks of polysilicon), slicing those

ingots into thin wafers, converting the wafers into PV cells (which convert light into energy), and then

assembling a series of cells into a PV module. The remaining PV module shipments mostly use cadmium

telluride (CdTe) technology, which is typically manufactured by directly depositing the CdTe cell onto the

glass of the PV module. A higher percentage of CdTe is installed in the United States (16% compared to 4%

globa lly), with c-Si representing the remaining 84% (Feldman and Margolis 2021).

Additional components are added to manage the flow of electricity. Inverters, which convert direct current (dc)

electricity from the modules into alternating current (ac) for connection to the grid, are the most important and

expensive balance-of-system component. Other components include wiring, meters, junction boxes, ac and dc

disconnects, combiner boxes, transformers, electrical panels, and mounting structures.

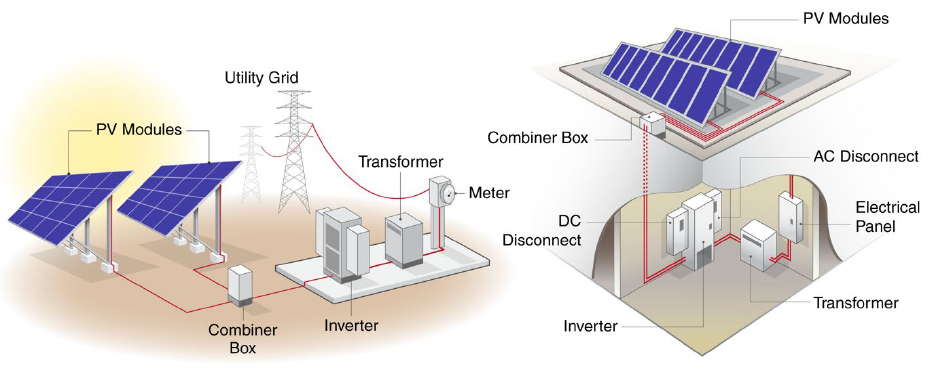

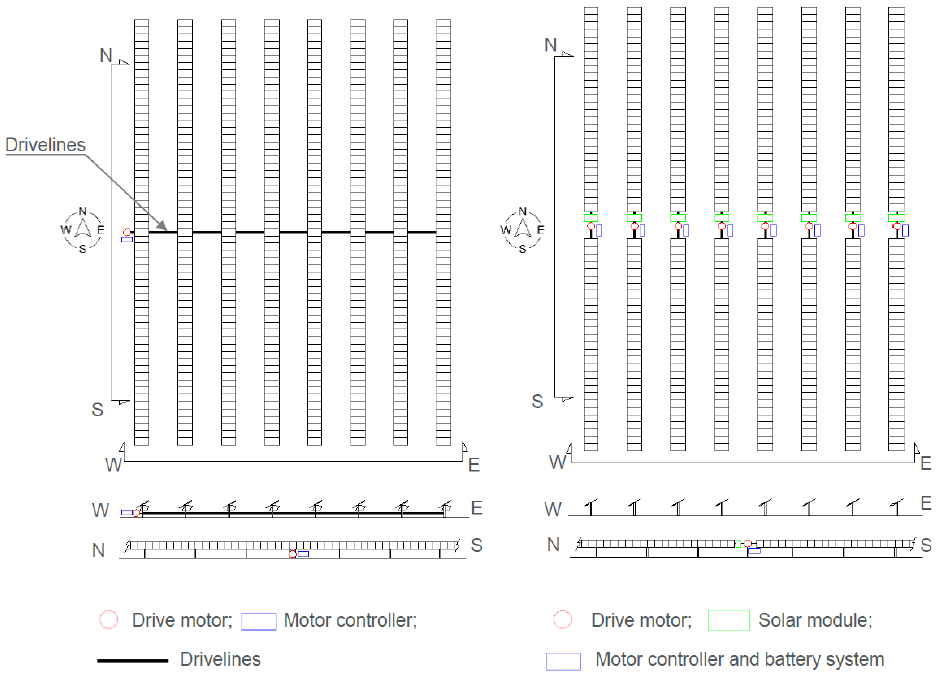

System components and designs vary by installation type (Figure 1). For example, the mounting structures

used for residential rooftop PV systems can differ substantially from those used for commercial rooftop

systems, and the mounting structures used for both categories of rooftop systems are much different than those

used for ground-mounted systems. Increasingly, batteries are being combined with PV systems, which requires

additional or substitute components such as battery-based inverters and charge controllers.

Beyond hardware components, various activities are required to create PV systems, such as customer

acquisition, land acquisition, system installation by trained installers, permitting, and grid interconnection.

These activities result in “soft” costs, which make up more than half of total system costs for residential and

com m ercia l PV insta lla tions.

Figure 1. Illustrations of a utility-scale PV system (left) and a commercial rooftop system (right).

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

2

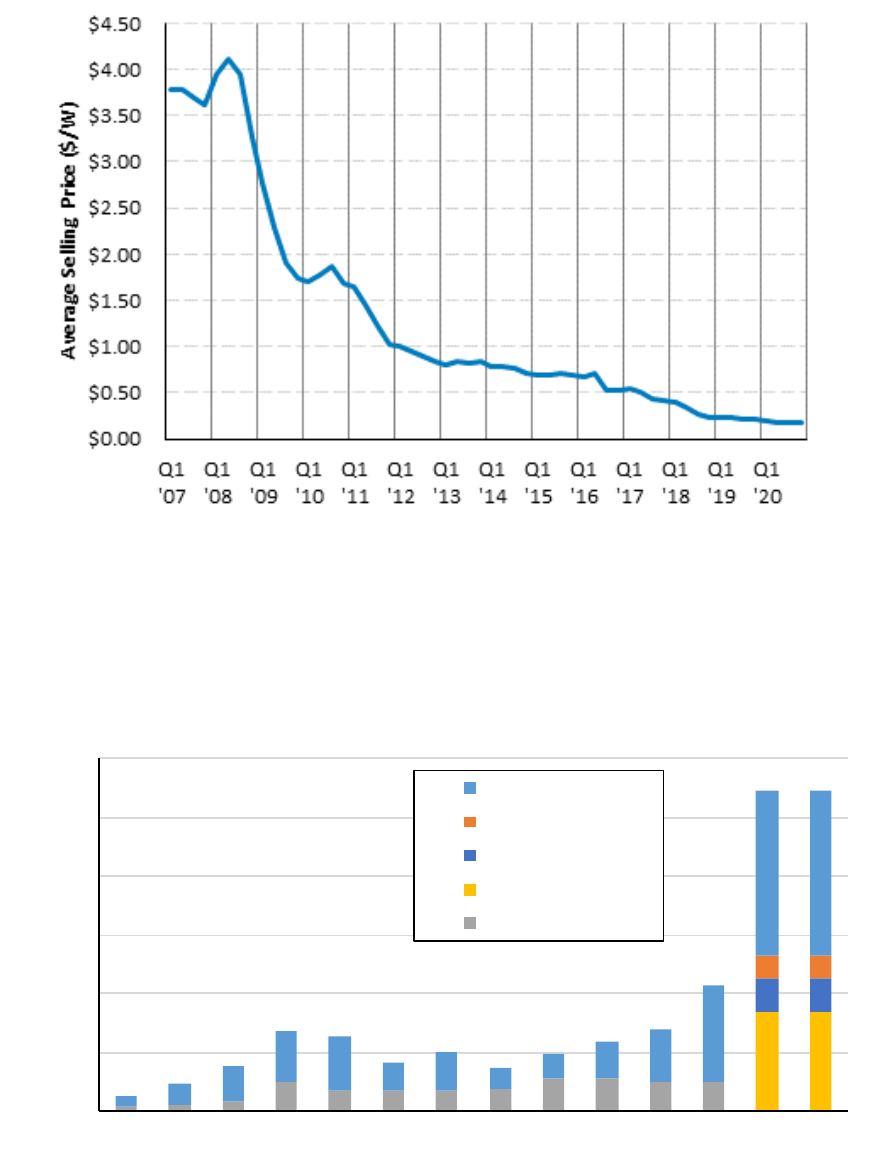

1.2 U.S. Solar Photovoltaics Strategy

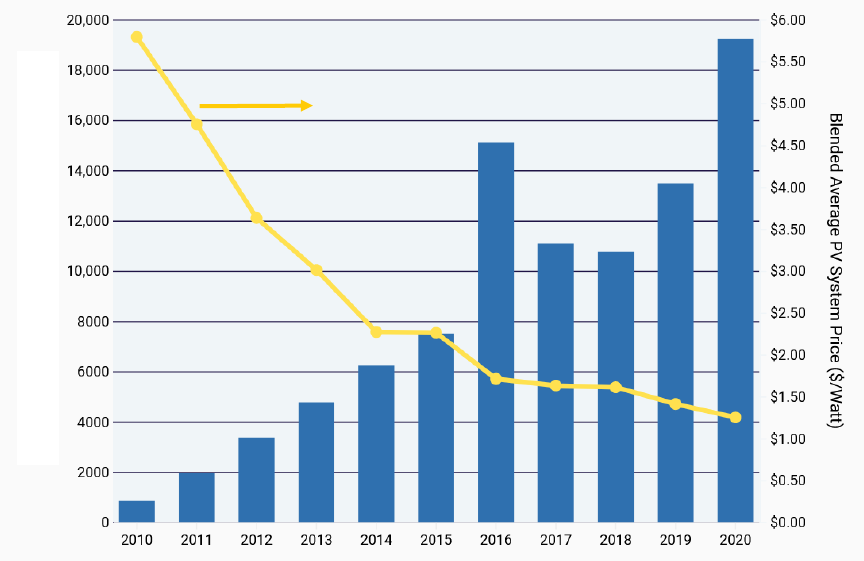

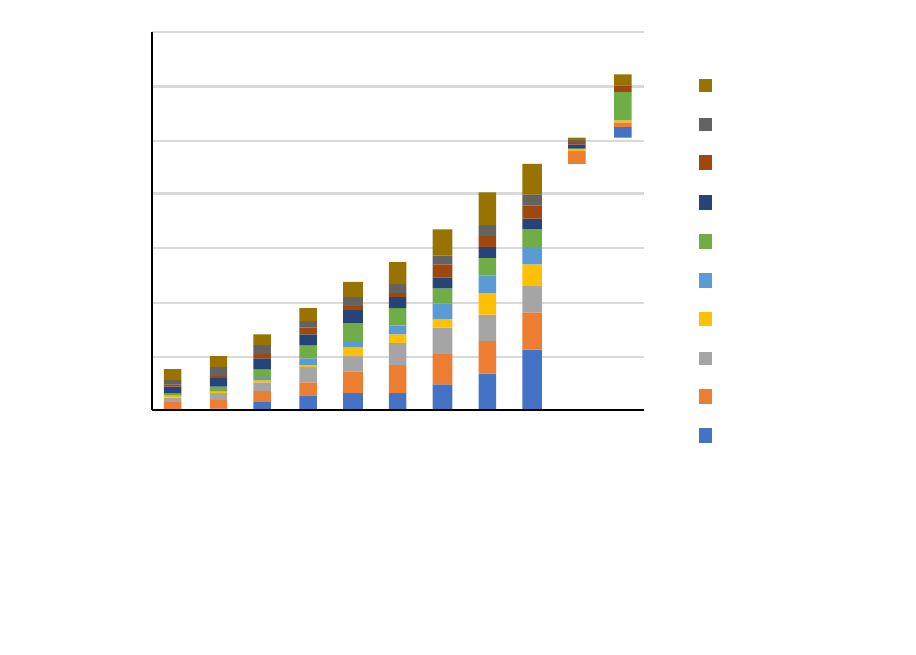

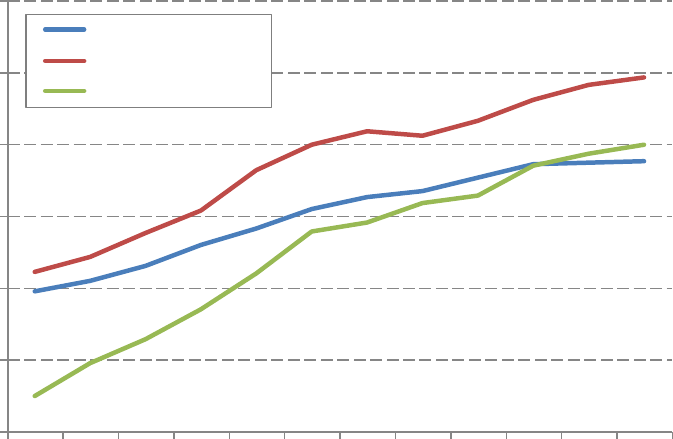

Solar photovoltaics is an important technology in U.S. efforts to reduce greenhouse gas emissions and

minimize climate change impacts. Decades of innovation and cost reductions have made PV one of the lowest-

cost forms of electricity generation, and PV deployment has grown in concert with falling prices (Figure 2).

Figure 2. U.S. PV price reductions and annual deployment growth.

Source: (“Solar Industry Research Data” n.d.)

In 2010, solar power represented approximately 5% of new U.S. electric generation capacity additions; by

2020, it had grown to 40% and EIA expects it to further grow above 50% in 2022 (EIA 2021a; 2021b; 2022).

Sola r power is a critical, affordable, and reliable energy option for America, supplying more than 8% of energy

generation in six U.S. states (with California leading the way at almost 23%) (Feldman and Margolis 2021;

IEA 2021).

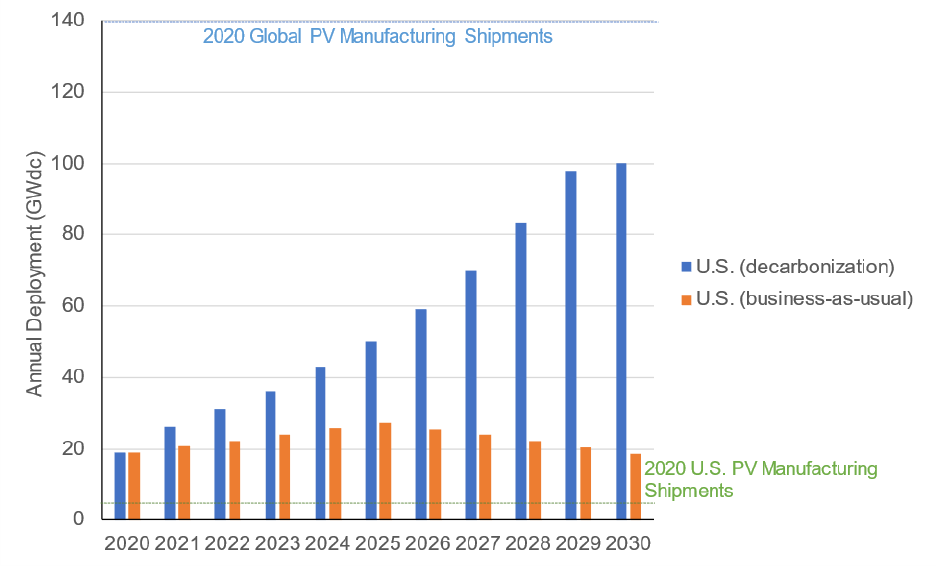

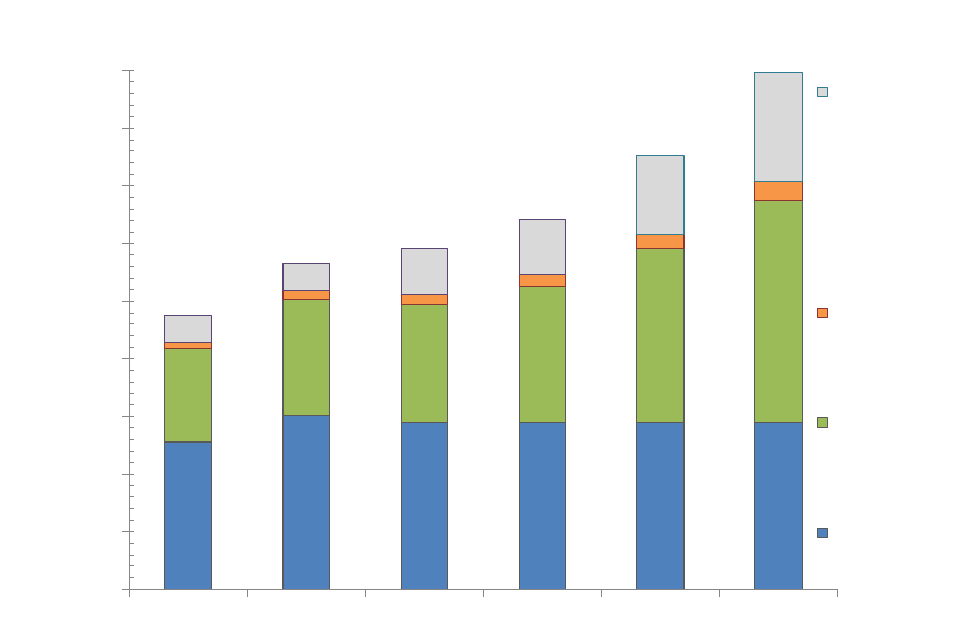

Despite this growth, decarbonizing the electricity sector in the United States would require significa nt

acceleration of annual PV deployment. Compared with 19 giga wa tts (GW

dc

) of PV deployed in the United

States in 2020, annual PV deployment would need to double in the early 2020s and to quintuple by the end of

the decade in the most aggressive grid decarbonization scenario, as demonstrated in Figure 3 (Ma rgolis et a l.

2021). This would greatly dwarf current U.S. PV manufacturing and represent a significant portion of current

global PV manufacturing shipments. That said, global shipments are projected to grow to close to 200 GW

dc

per year by 2030, in a business-as-usual case, and could grow above 500 GW

dc

by 2030 under a globa l

decarbonization scenario (BloombergNEF 2021; IEA 2020).

Annual Installed New Capacity (MW

dc

)

Use right axis

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

3

Source: (Adapted from Ma rgolis et a l. 2021)

Further substantial technological and cost improvements are expected over the coming years which should

facilitate the growth of the PV sector. In addition, the modularity of PV enables deployment at a wide range of

scales—from a few kW

dc

on residential rooftops to one or more GW

dc

in utility-scale solar parks—and creates

unique roles for PV in the buildings, industrial, and transportation sectors. In such a decarbonized scenario

with continued PV cost reductions, solar power could supply 40% or more of U.S. electricity demand,

dramatically accelerating the decarbonization of buildings, transportation, and industry; and doing so without

increasing the price of electricity.

The solar-driven clean energy transition could yield broad economic benefits in the form of jobs and workforce

development. The solar industry already employs around 230,000 people in the United States, at an average

wa ge that is higher than the national average for most comparable positions. With such a dramatic increase in

domestic demand, there is potential for significant expansion in U.S. PV manufacturing. At the growth rate

necessary to achieve power-sector decarbonization by 2035, the U.S. solar industry could employ 500,000–

1,500,000 people by 2030.

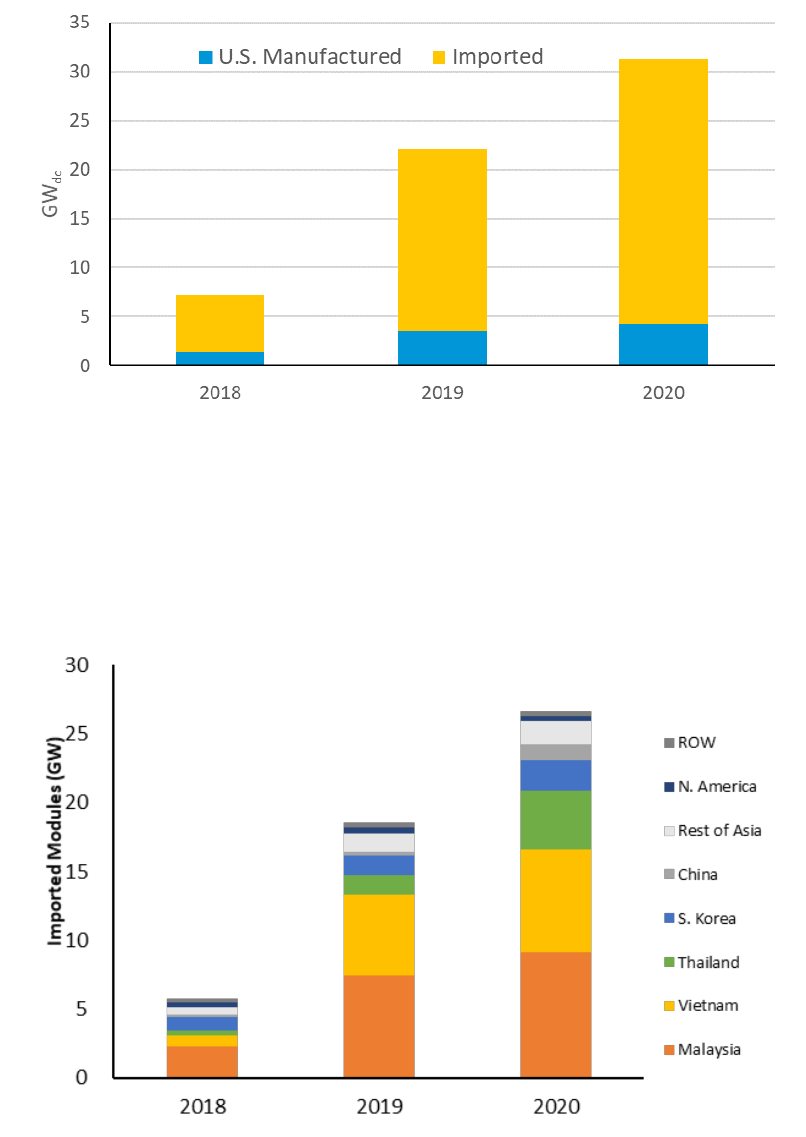

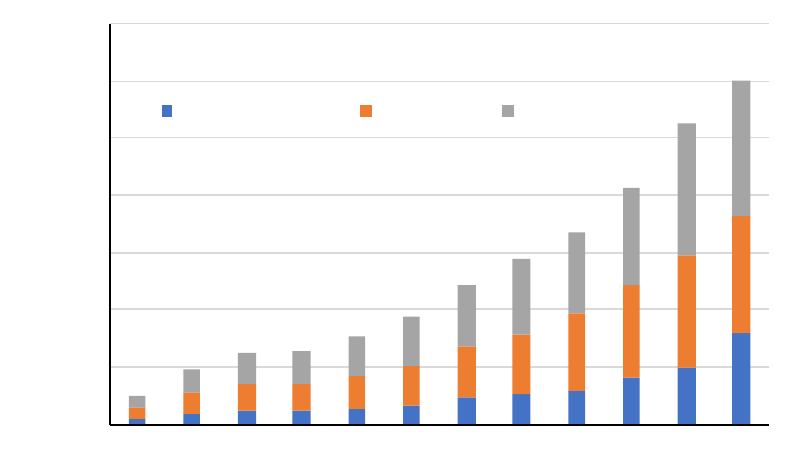

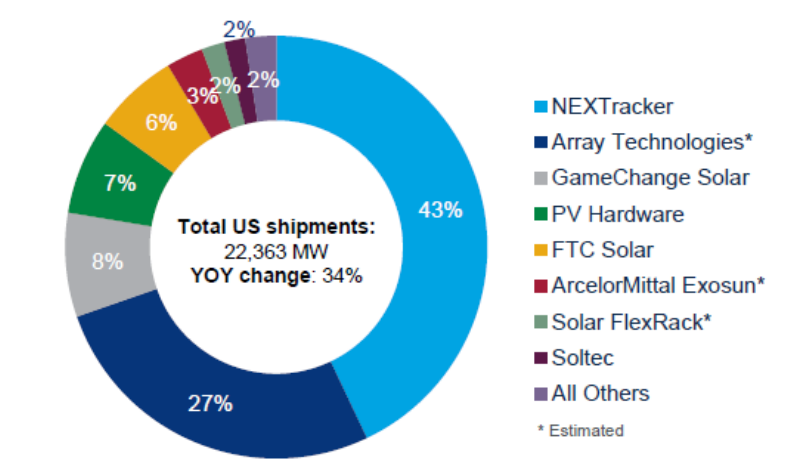

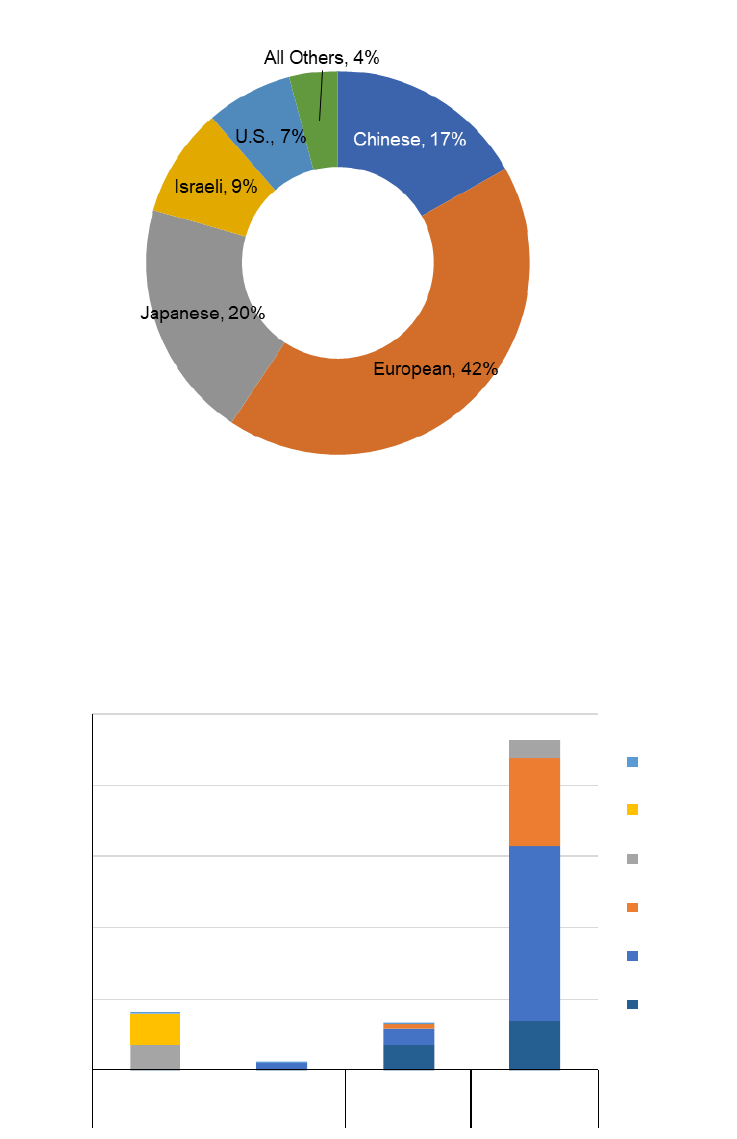

Recently, the vast majority of PV modules installed in the United States were imported (Figure 4), with U.S.

manufacturing of c-Si and CdTe modules together supplying just 14% of U.S. PV insta lla tions in 2020.

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

4

Figure 4. U.S. PV module production and imports.

Figure 5 and Figure 7)

More than 75% of the modules imported in 2020 (counting both c-Si and CdTe) came from just three

Southeast Asian countries: Malaysia, Vietnam, and Thailand (Figure 5). These Southeast Asian manufacturers

rely heavily on an upstream Chinese supply chain.

Figure 5. U.S. PV module imports by region.

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

5

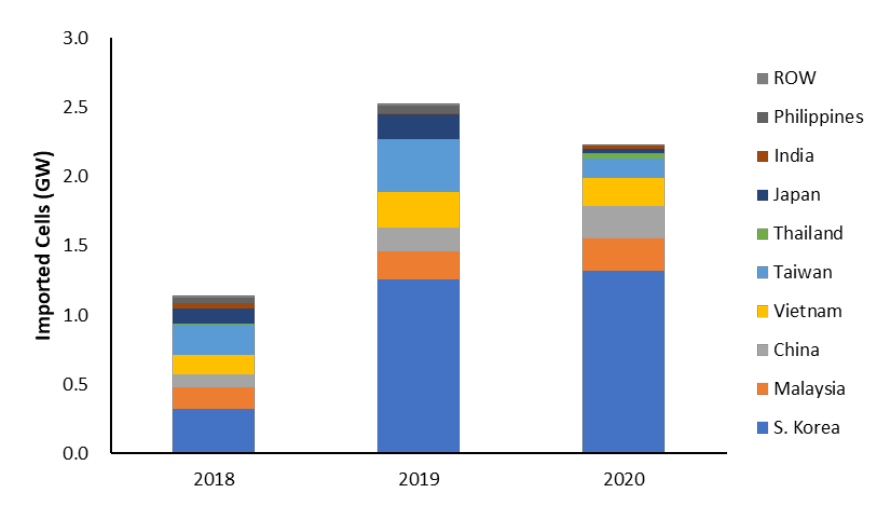

In addition, all of the silicon sola r cells that are assembled into modules in the United States are imported

(Figure 6). The United States has no operating capacity for making silicon solar cells. Considering both

imported c-Si modules and domestic c-Si module assembly, about 75% of the silicon solar cells installed in the

United States in 2020 came from Southeast Asia (Vietnam, Malaysia, and Thailand), with the majority of the

remainder coming from South Korea.

Figure 6. U.S. silicon cell imports by region.

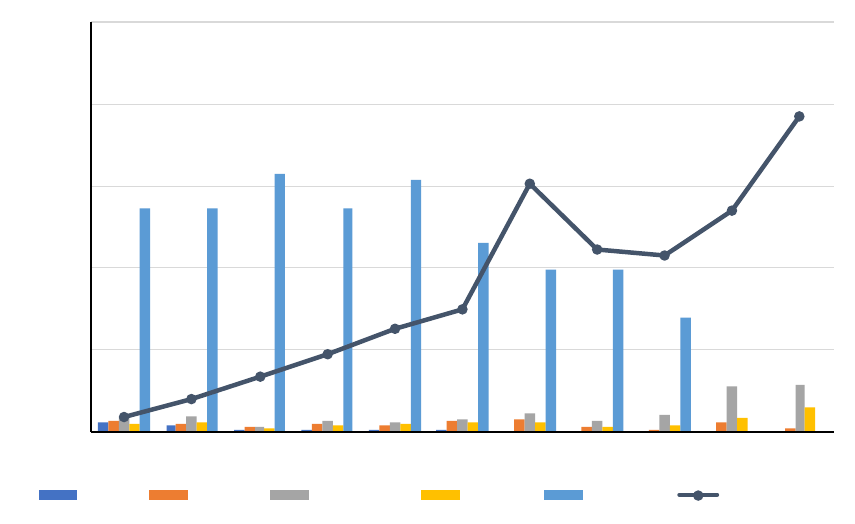

Historically, the U.S. PV market was not as heavily dependent on imports, however from 2010 to 2020, U.S.

manufacturers faced multiple challenges related to low-cost imports or imposed tariffs. Capacity for module

assembly stagnated for most of the past decade due to market availability of low-cost imported PV modules;

first, largely from China, and then mostly Southeast Asia. Wafer production in the United States ended

altogether in 2015 due to lower-cost imports. Production of cells varied year to year, but cell producers

suffered a series of bankruptcies in 2018, again due to the availability of low-cost imports.

In 2019, cell production started to rebound in part because of the new tariffs; however, the tariffs were not

sufficient to enable the existing cell manufacturers to continue and, in Q4 2020, cell production stopped,

having produced 198 MW

dc

for the year. As of this writing, the United States has no active ingot, wafer, or c-

Si cell manufacturing capacity. The considerable polysilicon production capacity, which could be a part of the

U.S. PV supply chain, is also mostly idle because China, which hosts the vast majority of all wafer

manufacturing, placed tariffs on U.S.-produced polysilicon in 2014, forcing them to scale-back production to

supply only the semiconductor (integrated-circuit) industry. Over this same period, as U.S. PV manufacturing

was shrinking, the U.S. PV installation rate grew from 0.8 GW

dc

to 19 GW

dc

(Figure 7).

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

6

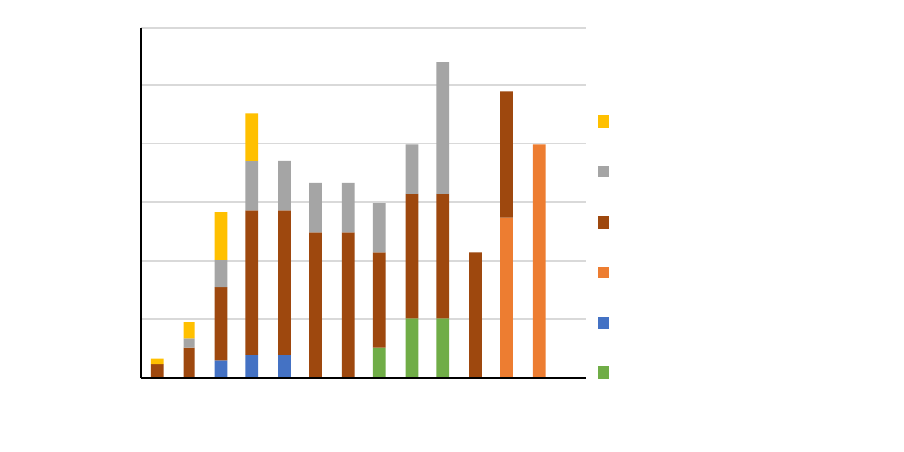

Figure 7. U.S. production of PV components and U.S. PV installations over time.

Using im ported cells, U.S. c-Si module assembly did began scaling up significantly in 2018 and 2019, due in

pa rt to U.S.-placed tariffs on imported modules. In 2020, the United States assembled a record 4.3 GW

dc

of PV

modules, up 24% over 2019, mostly because of a doubling of production capacity by thin-film ma nufacturer

First Solar. If U.S. PV demand growth continues, there may be an opportunity for further domestic

manufacturing expansion, particularly given the disruptive nature that global politics can have on the PV

supply chain. The impact of restrictions imposed in 2021 on importing solar products potentially traceable

back to a company in China linked to human rights abuses illustrates the importance of having multiple

sources of supply. Developing the U.S. PV supply chain could also mitigate challenges related to production

disruptions, competing demand from other industries or countries, and global politics (Margolis et al. 2021).

Beyond domestic supply chain growth, to fully realize the benefit of solar power to society, its costs and

benefits must be distributed equitably, the entire supply chain must be operated in a safe and socially

responsible manner, the input materials must be produced without forced labor, and recycling at end-of-life

must become standard practice.

Like all energy technologies, solar power generates negative externalities throughout its life cycle, though they

are trivial compared to the externalities of fossil fuel technologies that solar technology displa ces. The negative

externa lities of sola r power can be mitigated through measures to promote a circular economy in solar

manufacturing, installation, and disposal. For example, periodic repairs can extend solar system lifetimes

beyond the conventional useful life of 20–30 years and degraded solar panels can be transferred and reused in

applications compatible with lower system output. By extending useful lifetime, repair and reuse can delay the

need for new resource extraction and manufacturing and delay end-of-life disposa l. Further, certa in sola r

system components and materials can be recycled, avoiding raw material extraction and disposal (Ma rgolis et

al. 2021).

0

5

10

15

20

25

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

(GW)

Wafe rs c-Si Cells c-Si Modules Thin- Polysilicon

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

7

Solar energy also presents an opportunity to remedy historic injustices in the energy sector. Low- and medium-

income communities and communities of color have been disproportionately harmed by the fossil-fuel-based

energy system, with exposure to poor air quality and other harmful pollution disproportionately higher in

communities of color. Further, low- and medium-income communities and communities of color have

historically had to dedicate a greater share of household income toward energy expenses than white and

higher-income households. Solar deployment—at the scale necessary to decarbonize the U.S. electricity

sector—presents an opportunity to maintain the benefits of the modern energy system while distributing

mitigated costs and larger rewards more equitably. The growth in the use of solar technologies presents many

potential benefits including climate change mitigation, improved air quality, job creation, and local wea lth

building. New approaches to energy policy and development may be needed to ensure that the benefits of the

zero-carbon system are equitably distributed (Margolis et al. 2021).

1.3 The Global Role of Solar Photovoltaics

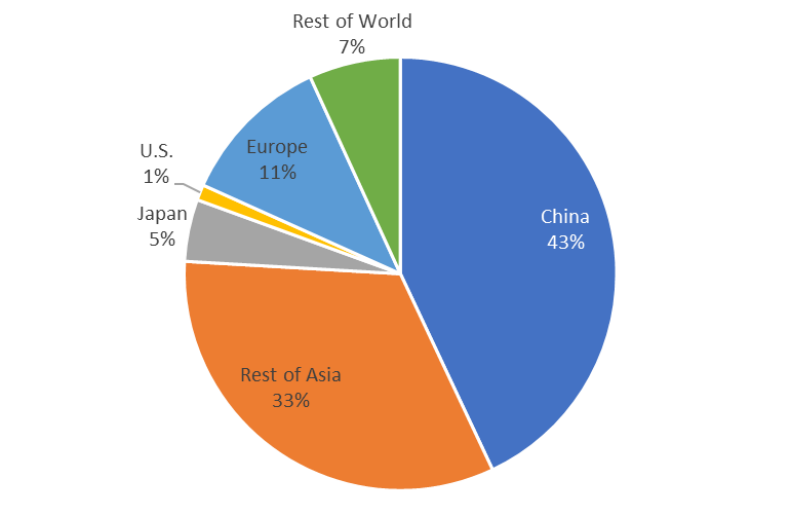

A significant portion of PV-component supply, varying by the stage of the supply chain, comes from China.

While a considerable (but minority) portion of cells, modules, and polysilicon can be sourced outside of China,

the global PV supply chain is almost entirely dependent on ingot and wafers from China. Additionally, many

of the other pieces of the module supply chain, such as the manufacturing of production-facility equipment and

balance-of-module components (e.g., glass, aluminum frames), are predominantly located in China. China also

manufactures a significant share of balance-of-PV-system components, including inverters (which convert the

dc output from PV modules to ac power used by the electrical grid) as well as aluminum and steel used for

mounting PV modules.

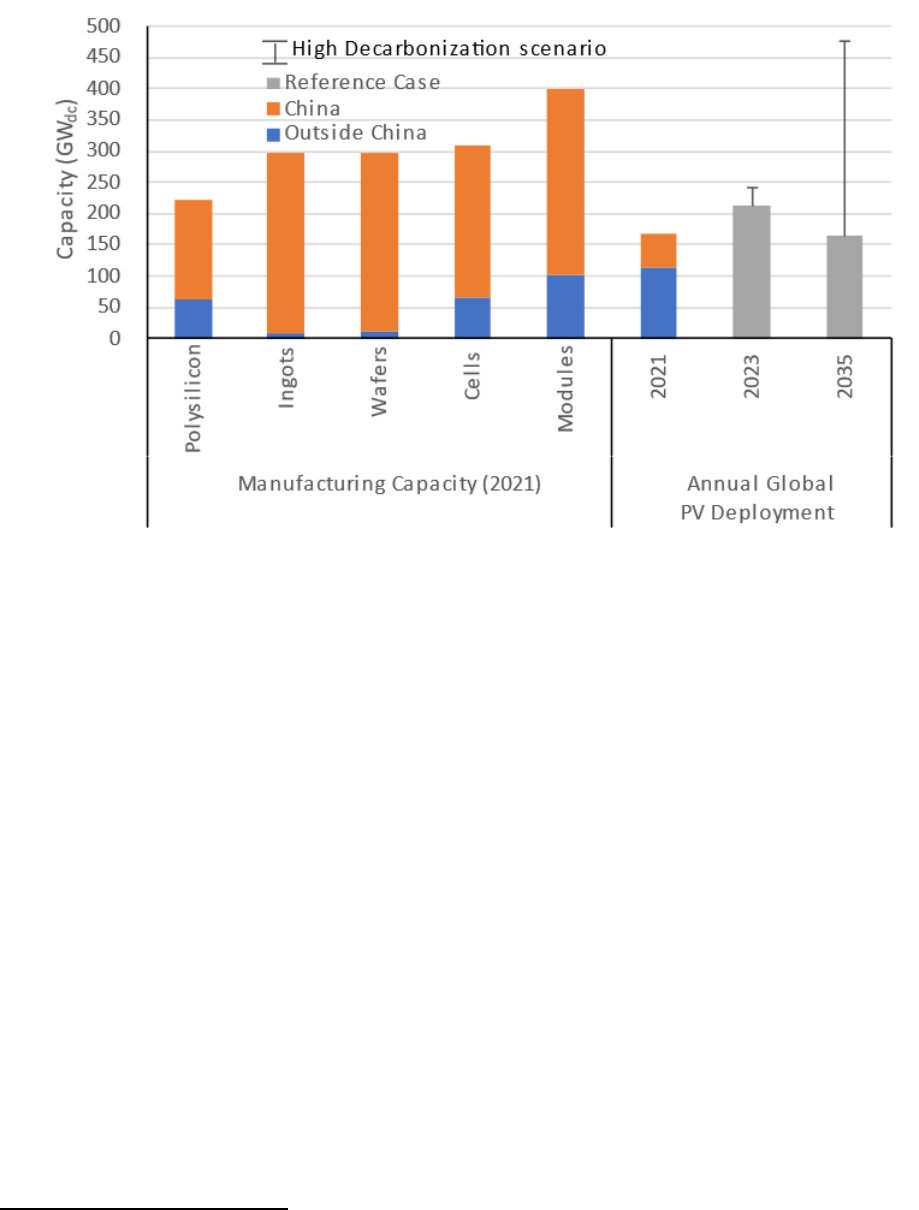

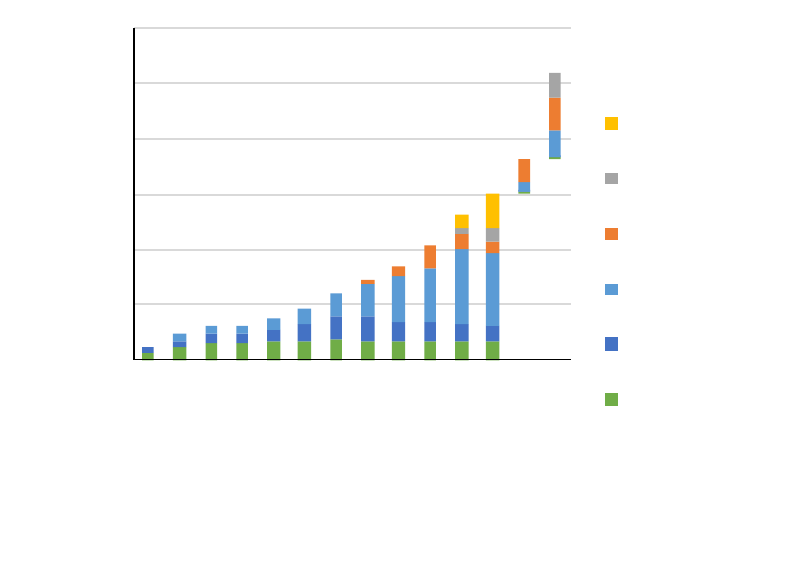

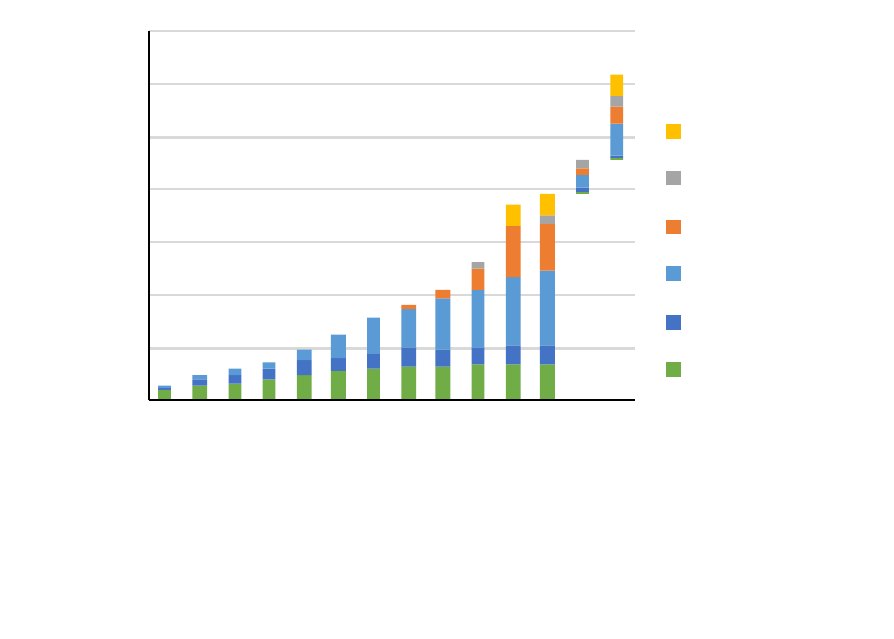

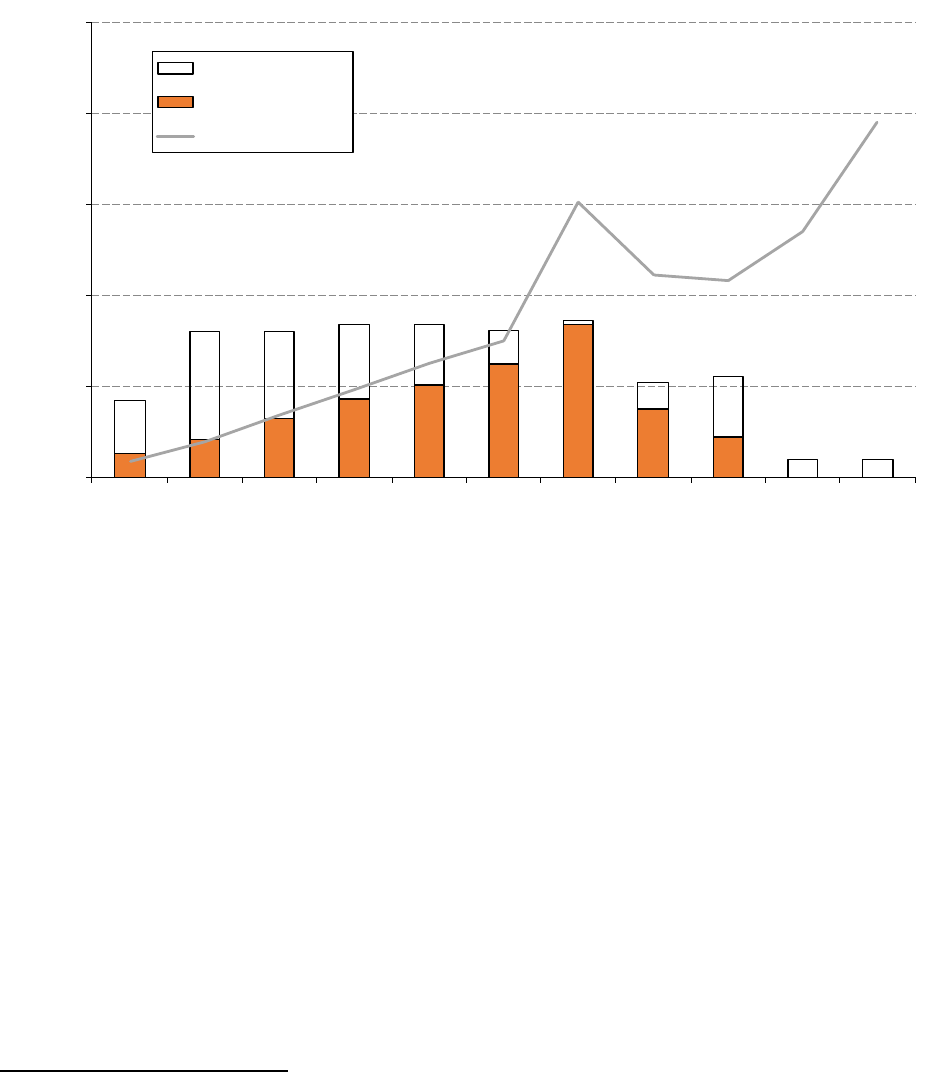

Current PV module manufacturing capacity is well above current deployment levels. By 2035, a high-

decarbonization scenario would require significant expansion of several parts of the supply chain (Figure 8).

Regardless of capacity increases, existing manufacturing capacity will likely be replaced or refurbished by

lines that will produce more efficient and/or cheaper panels.

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

8

Figure 8. PV manufacturing capacity and deployment, inside and outside China.

1

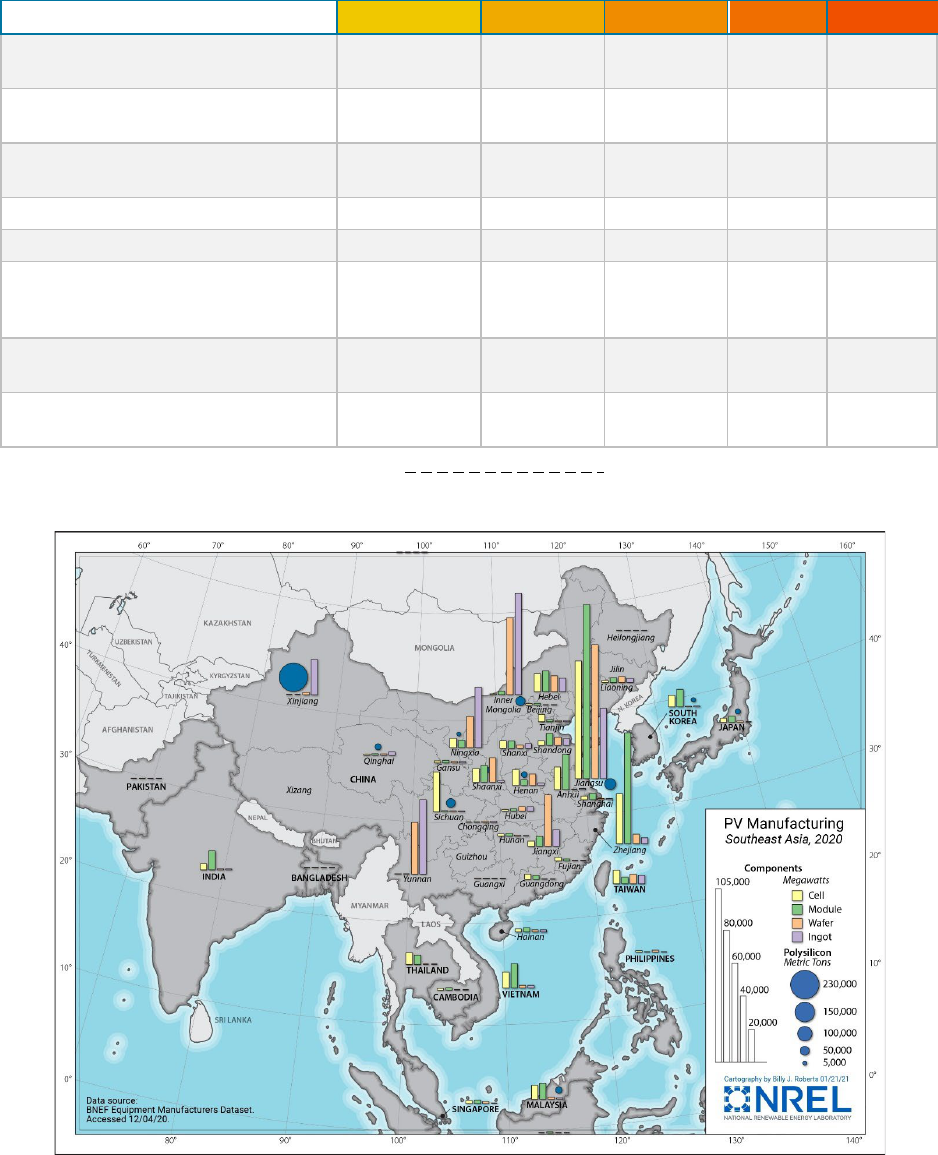

Within China, PV production is clustered in a handful of provinces, representing 80%-93% of total Chinese

manufacturing and 64%-81% of total global manufacturing (Ta ble 1, Figure 9). Some provinces span multiple

PV manufacturing steps, but many tend to focus on one manufacturing step.

Labor, electricity price, and proximity to shipping correlate with provincial strength and manufacturing needs.

Western Chinese provinces, with cheap labor and electricity, have high levels of manufacturing for steps that

use significant amounts of electricity (polysilicon, ingots) or labor (ingots, wafers). Eastern provinces, with

easier access to global shipping and proximity to Chinese populations, are more likely to have PV

manufacturing steps later in the process, in preparation for the exports or domestic end-use development

(wafers, cells, modules). Some provinces have significant market share across components, due to the benefits

of integrating manufacturing steps, and economies of scale a ssocia ted with la rger-sca le fa cilities a nd supply

chains.

Forced labor in the mining and processing of raw materials in China’s Xinjiang province adds a new

dimension of uncertainty to the solar supply chain’s reliance on Chinese production. Metallurgical-gra de

silicon (MGS) and the coal used to produce electricity have been highlighted by the U.S. government as direct

beneficiaries of government-sponsored forced-labor programs in that region.

1

Assumes 3 grams of polysilicon per watt.

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

9

Table 1. Chinese PV manufacturing by component and province.

Province Rank in China

Polysilicon

Ingots

Wafers

Cells

Modules

1

Xinjiang

Inner

Mongolia

Jiangsu

Jiangsu

Jiangsu

2

Inner

Mongolia

Yunnan

Yunnan

Zhejiang

Zhejiang

3

Jiangsu

Ningxia

Inner

Mongolia

Sichuan

Anhui

4

Sichuan

Jiangsu

Jiangxi

Shaanxi

Hebei

5 Qinghai Sichuan Ningxia Henan Jiangxi

Chinese Frac t i o n of Global

Manufacturing Capacity by

Component

72% 98% 97% 81% 77%

To p -5 Provinces Fraction of

Chinese Manufacturing Capacity

93%

83%

81%

80%

84%

To p -5 Provinces Fraction of Global

Manufacturing Capacity

67%

81%

78%

65%

64%

Source: (BloombergNEF 2021)

Figure 9. PV manufacturing in Southeast Asia, 2020.

Source: (BloombergNEF 2021f)

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

10

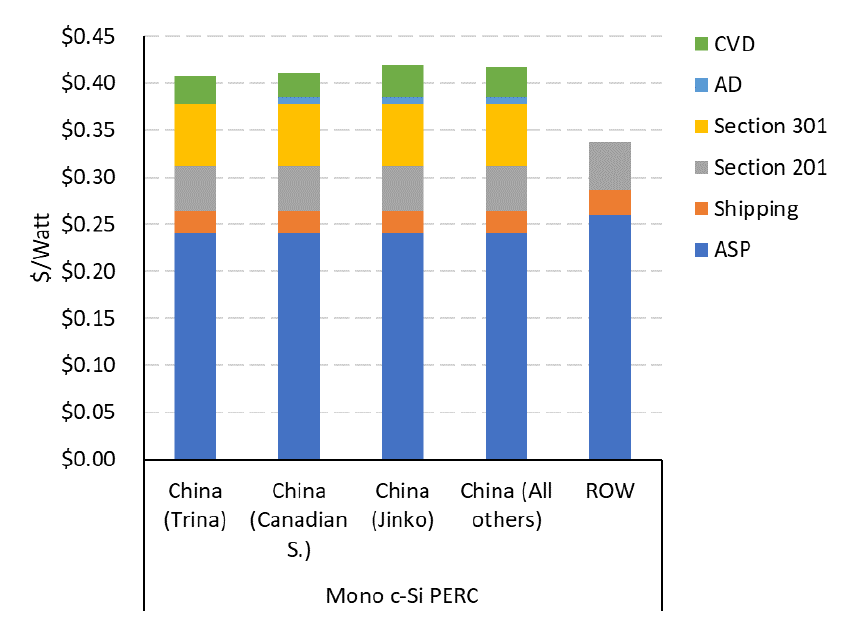

Due to China’s low labor costs, concentrated supply chain, a nd non-market practices, it has been difficult for

the United States to compete against China across c-Si PV components. The capital cost of production

fa cilities is a minor a dditiona l factor in China’s favor, with capital expenditure representing 8% of the

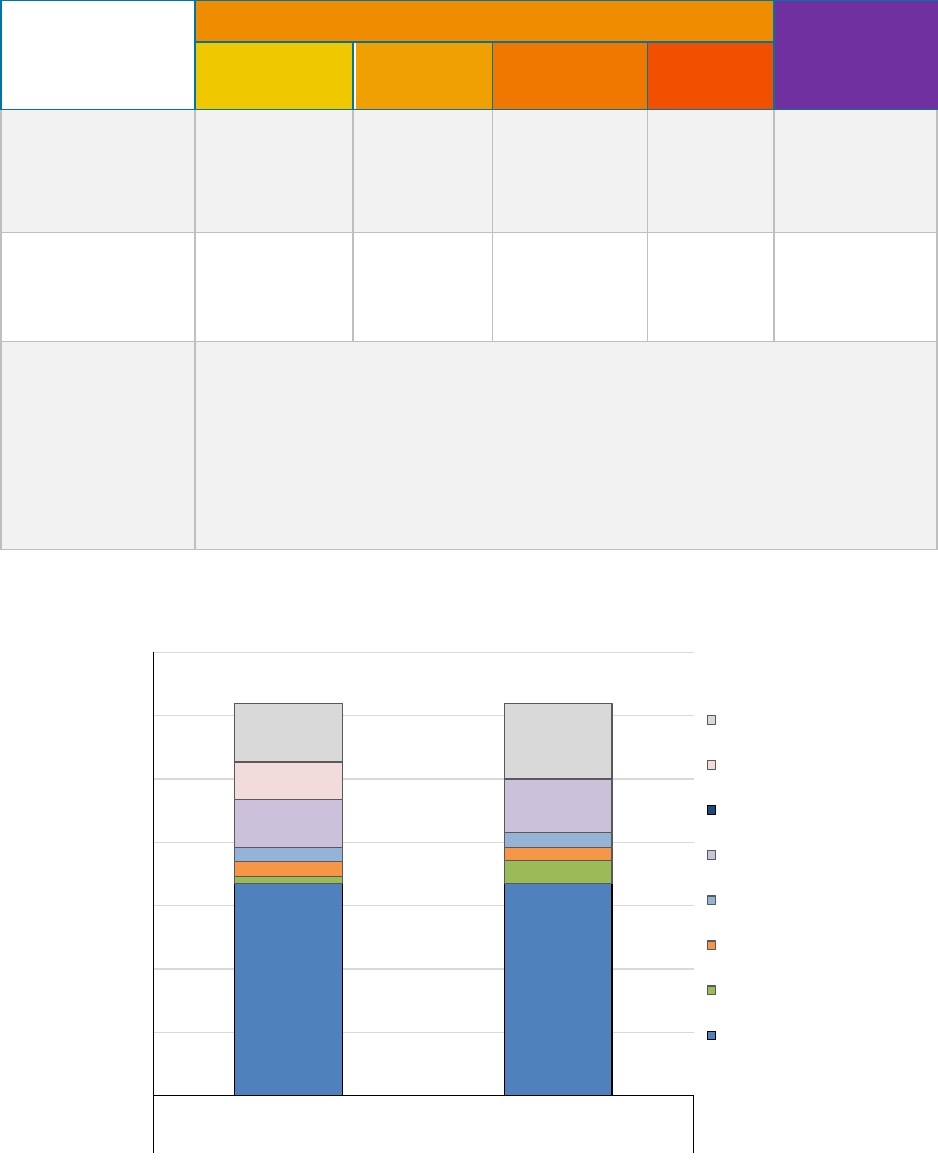

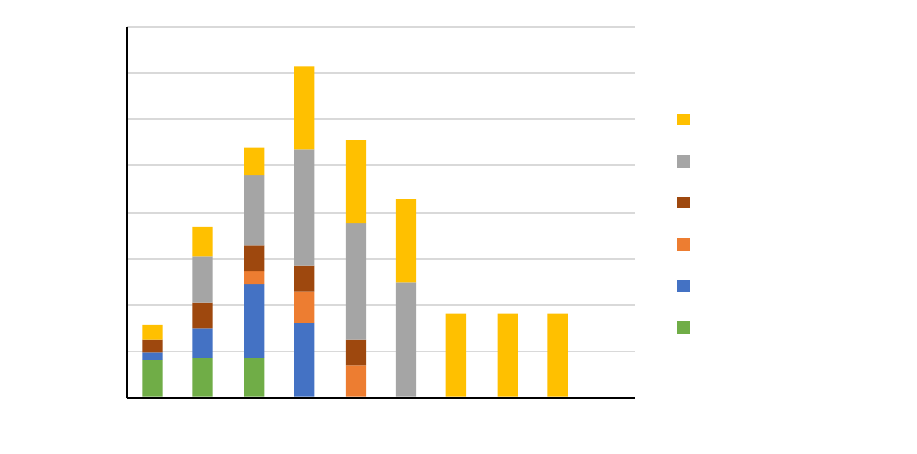

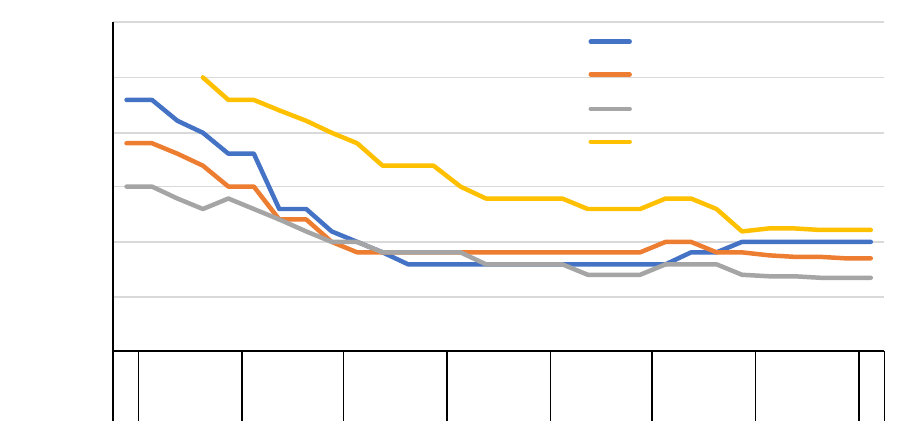

production cost in China versus 10% in the United States. Figure 10 compares Chinese and U.S. production

costs across the c-Si PV supply chain.

Figure 10. Production costs for c-Si PV manufacturing in the United States and China.

Source: NREL

Labor expenses are the principal source of difference between calculated PV manufacturing costs in the United

States and China, particularly for labor intensive manufacturing steps (see Ta ble 2). Labor costs represent 22%

of total U.S. manufacturing costs versus 8% in China, 33% of U.S. cell manufacturing costs versus 8% in

China, and 36% of U.S. wafer manufacturing costs versus 23% in China.

There are pathways to reduce the cost delta by introducing more automation in the United States. These

include more-automated approaches being developed by ingot and wafer factories, as well as more-automated

approaches being used to manufacture state-of-the-art cell and module technologies. Automation should be

considered as part of a holistic workforce approach that accounts for job quality and the ability of incumbent

workers to maintain their livelihood, in addition to a company’s long-term growth plan. Such a strategy has

proven to be successful for the production of CdTe panels in the United States. As demonstrated in Figure 11,

the cost to produce a CdTe in the United States is approximately the same as that of Southeast Asia, when

accounting for shipping.

$0.00

$0.05

$0.10

$0.15

$0.20

$0.25

$0.30

$0.35

$0.40

China U.S. China U.S. China U.S. China U.S. China U.S.

Polysilicon

Wafer

Ce l l

Module To ta l

($/Wdc)

Shipping

Maintenance

Labor

Materials

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

11

Table 2. Labor cost drivers across the c-Si and CdTe supply chain.

Labor Cost

Drivers

c-Si Supply Chain

CdTe Module

Production

Polysilicon

Ingot and

Wafer

Cell

Conversion

Module

Assembly

Labor Intensity

(Direct full-time

employees (FTE) per

MW

dc

of production)

0.035—0.070

(40—85 MT per

year per FTE for

Siemens to FBR.

@ 2.8 g/W)

0.40—0.80

(Labor intensity

in U.S or

Europe to

China)

0.15—0.45

(Advanced

technology to

PERC)

0.50—0.70

(Advanced

technology to

PERC)

0.40—0.60

Direct

Manufacturing

Jobs at 1 GW

dc

Scale

35—70 400—800 150—450 500—700 400—600

Assumed Hourly

Labor Rates for

Cost Models

($2020 USD)

$4.1—5.0 per hour for direct operators in China

$6.2—7.5 per hour for first-line supervisors in China

Housing, cafeteria, and insurance expenses included.

$14.3—22.0 per hour for direct operators in electronics assembly in the United

States

$23.3—38.8 per hour for first-line supervisors in the United States

Additional 35% benefits expense assumed for workers in the United States

Source: NREL update of (Smith et al. 2021)

Figure 11. Production costs for CdTe PV manufacturing in the United States and Southeast Asia.

Source: NREL update of (Smith et al. 2021)

$0.00

$0.05

$0.10

$0.15

$0.20

$0.25

$0.30

$0.35

Southea s t Asia U.S.

CdTe

($/Wdc)

Shipping

Maintenance

Labor

Materials

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

12

Because of the current gaps in the domestic PV supply chain, virtually all c-Si manufacturing inputs are

imported (i.e., “Import Costs” in Figure 10), from the aluminum frame and glass to the PV cells. These import

costs add 11% to the total U.S. PV manufacturing costs. A build-up in domestic PV supply chain would

significantly reduce these costs. The time to build new fa cilities, minim um sca le of fa cilities, a nd ca pita l

expenditures, vary by manufacturing step (Ta ble 3), with certain steps less expensive and faster (module

assembly) to scale than others (ingot and wafer).

Table 3. Fixed cost drivers across the c-Si and CdTe supply chain.

Fixed Cost

Drivers

c-Si Supply Chain

CdTe Module

Production

Polysilicon

Ingot and

Wafer

Cell

Conversion

Module

Assembly

Initial Capital

Expenditure

($USD per Watt of

annual capacity)

for equipment:

for balance-of-plant

or factory

$0.11-0.14/W

($40—50/kg,

2.8 g/W)

$0.06—0.08/W

$0.04—0.06/W

$0.08-0.10/W

($0.54/wafer, 6.0

W for M6)

$0.06—0.07/W

$0.02—0.03/W

$0.05-0.13/W

(PERC to

Advanced

technology)

$0.03—0.10/W

$0.02—0.03/W

$0.05-0.08/W

(Standard to

Busbarless)

$0.03—0.05/W

$0.02—0.03/W

$0.28-0.36/W

(430-W series)

$0.25—0.30W

$0.03—0.06/W

1 GW

dc

Investment

for equipment:

for balance-of-plant

or factory

$110—140M

$65—80 M

$45—60 M

$80—100M

$60—70 M

$20—30 M

$50—130M

$30—100M

$20—30M

$50—80M

$30—50M

$20—30M

$280—360M

$250—300M

$30—60M

Time to Build

(Engineering to

production)

3—4 years

(All-new, not

retrofit)

1—3 years

1—3 years

1—3 years

1—3 years

Source: NREL update of (Smith et al. 2021)

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

13

2 Supply Chain Mapping

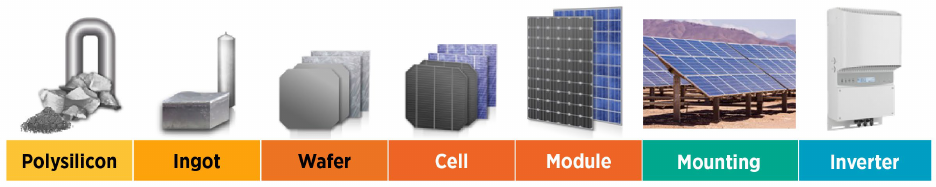

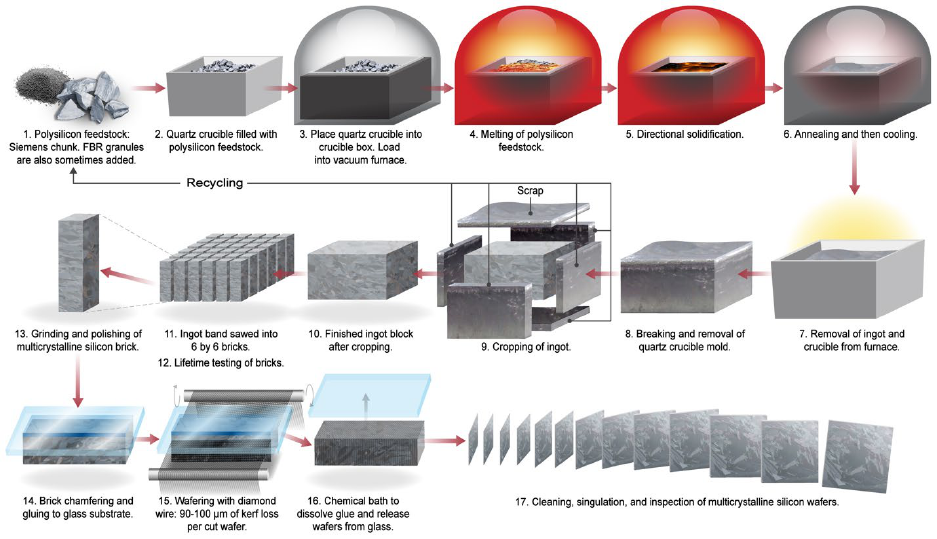

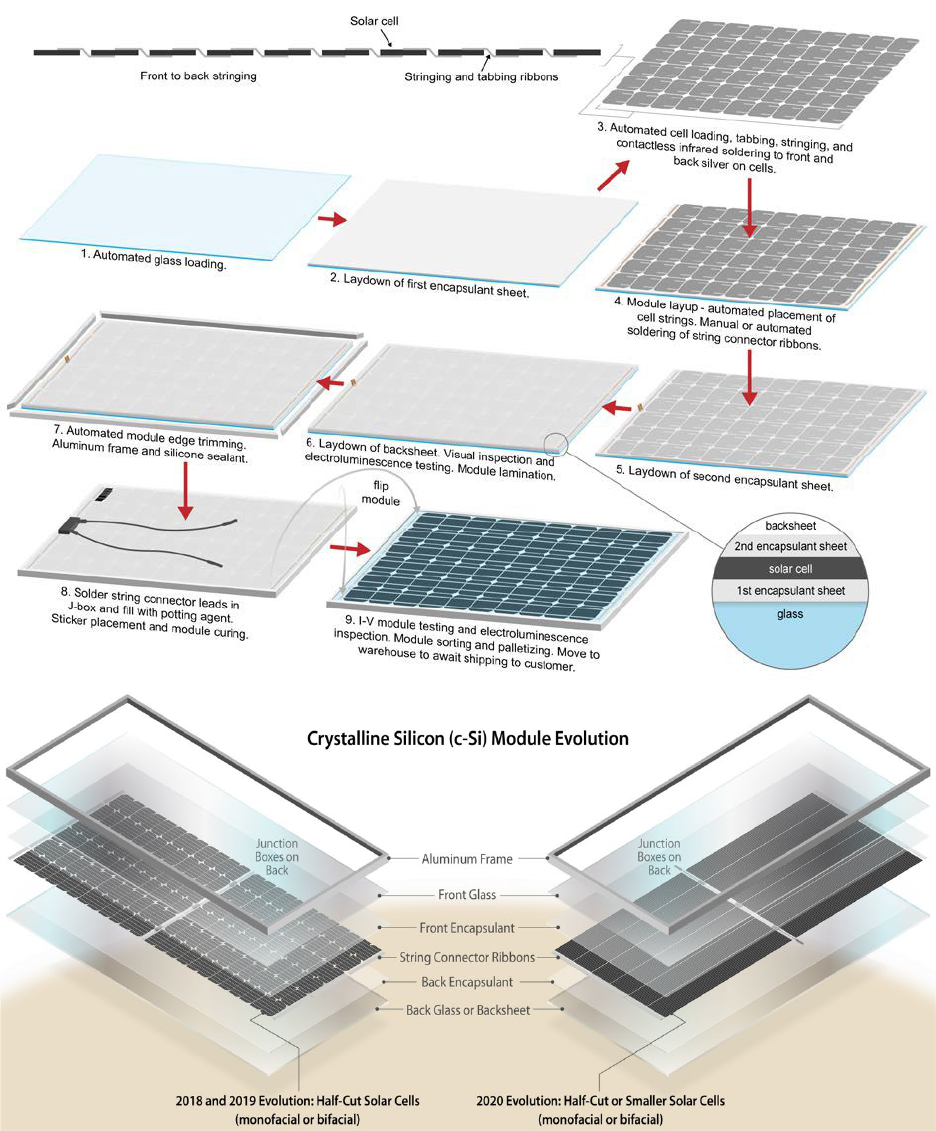

Figure 12 illustra tes the steps in the c-Si supply chain, from polysilicon to modules, which are physically

attached to mounting structures and electrically attached to inverters. This chapter provides supply chain

details for each step, followed by a section addressing ca dm ium telluride thin-film technology.

Figure 12. Principal sectors of the c-Si supply chain.

Source: NREL

2.1 Input Materials

2.1.1 Metallurgical-Grade Silicon

2.1.1.1 Technology Overview

The silicon incorporated into c-Si modules initia lly comes f rom silicon dioxide (or silica ), the second most

abundant mineral in the Earth’s crust (Honsberg and Bowden 2019). Silica occurs naturally in the form of

quartz, but there are limitations on the type of quartz (and quartz mines) that can be used, due to the need for

high levels of purity. While some elements, such as aluminum and calcium, are easy to extract from silica,

other elements—such as iron, phosphorus, titanium, and boron—have deleterious effects on solar cell

performance and are very difficult to remove; therefore, manufacturers of m eta llurgica l-gra de silicon (MGS)

must be selective with the quartz they use. Sand, for example, is made of quartz but tends to have too many

impurities. There are typically two ways quartz is mined for silica:

1) Riverbeds often have quartz from broken mountain ranges. Quartz can be collected from such sites, but

there can be environmental considerations for active waterbeds due to the connection with water supply. This

type of mining is common in the United States, as are other dry excavation and mining approaches.

2) Quartz veins are often found and mined below ground. This can be a dangerous process as fine quartz dust

particles from mining can be lethal if inhaled. This type of quartz mining requires great care and typically also

leaves a big scar where the land was blasted.

While quartz is the main input to MGS refining, it is relatively inexpensive and represents less than 10% of the

cost. For this reason, companies do not typically explore for high-quality quartz mines, but rather find them

when looking for something more valuable, such as gold (gold is often associated with quartz). Therefore, the

amount of world reserves for quartz is unknown; however, there does not appear to be any shortage globally.

While quartz can be transported, sourcing quartz close to where it is needed minimizes shipping costs. China,

the leader in MGS production, does not have abundant resources of quartz. Conversely, Spain and Brazil have

the lowest-cost quartz. India has good quartz but high energy costs, making MGS production uneconomical.

In addition to quartz, low-ash coal and woodchips are necessary for producing MGS, and these are somewhat

specia lized ma teria ls. Low-ash coal can be found in the United States for domestic MGS production, but a

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

14

significant portion of international MGS production relies on low-ash coal from the Cerrejón mine in

Colombia. There are also key washing operations in the Netherlands, Spain, and Portugal. Charcoal may be a

substitute for Colom bia n coa l.

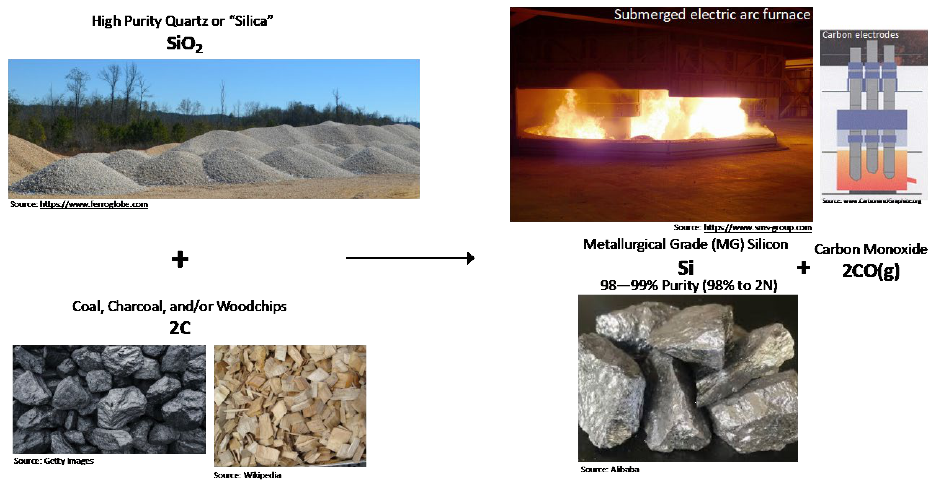

Figure 13 shows the principal input materials and process for MGS production. Quartz, or silicon dioxide, is

made into MGS by removing the oxygen using carbon (i.e., coal and woodchips), which produces the

byproduct carbon monoxide, which can later be processed into carbon dioxide. This process is very energy

intensive and requires the use of an electric arc furnace; 10–15 MWh of power are required for each ton of

MGS produced.

Many producers of MGS can also make ferrosilicon by adding in iron during the process. As most silicon

production is actually ferrosilicon production, capacity could be switched over, and even brownfield existing

sites could currently pick up any solar demand. Unless there are restrictions against particular production

locations (e.g., Xinjiang or China more broadly), MGS is not believed to be a bottleneck material.

Figure 13. Principal input materials and process for MGS production.

Source: NREL

MGS is used to make polysilicon for solar wafers and semiconductors, silicones, and aluminum alloys (Figure

14). While the process is in principle flexible, polysilicon producers oftentimes impose expectations of MGS

chemistry (impurity tracing) and size. To guarantee supply and purity levels, MGS manufacturers often

backwardly integrate, owning a significant portion of the mines in which they source quartz. Additionally,

because of the energy-intensive nature of the process, MGS processing typically occurs in locations with

abundant and cheap sources of electricity including the United States, Malaysia, Norway, and the Xinjiang

region of China. In 2021, the U.S. government determined that Hoshine Silicon’s MGS operation in Xinjiang

was benefiting from forced labor and imposed a Withhold Release Order (WRO) to prevent products

incorporating Hoshine’s MGS from being imported into the United States (see Section 3.2.3).

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

15

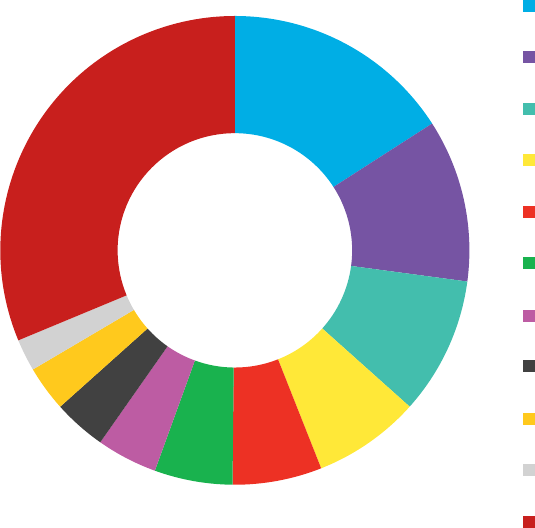

Figure 14. Global demand for MGS by application.

Sources: USGS, Sandia, CRU Group, BloombergNEF, ITRPV, NREL

The competing uses for MGS are silicones and aluminum alloys. Growth in demand for aluminum alloys is

difficult to determine currently. On the one hand, demand should increase due to population growth; however,

there could also be less demand for aluminum as recycling becomes more efficient globally.

Silicon demand from the sola r industry is a function of deployment targets and silicon utilization. Based upon

technology advancements outlined within the International Technology Roadmap for Photovoltaic (ITRPV),

the net MGS utilization is expected to drop from 3.4 g/W in 2020 to 2.1 g/W by 2030 (J Trube 2021).

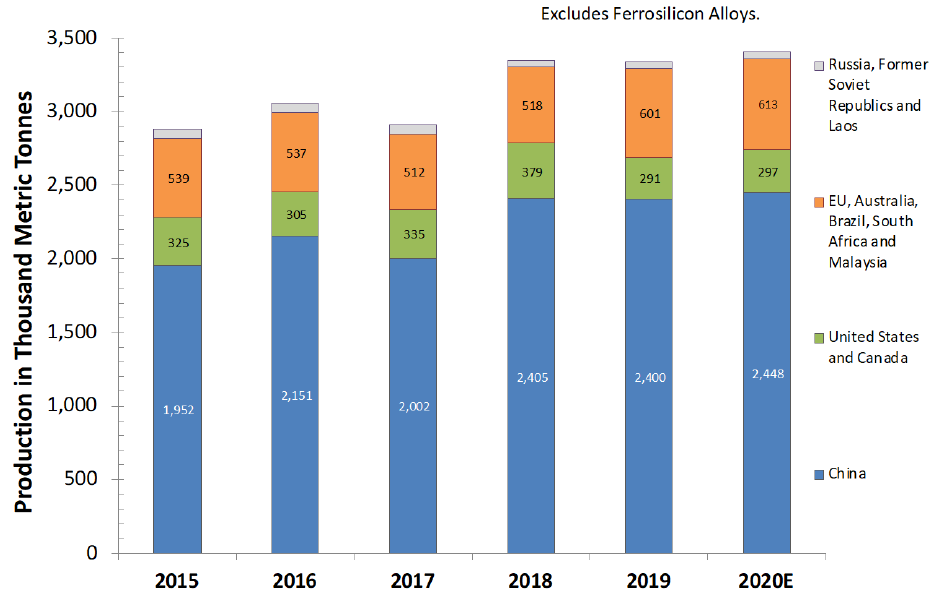

2.1.1.2 Industry Overview

There are currently about 15 countries with MGS capacity (Figure 15) (BGS 2021; USGS 2021b). These

include: China, Norway, Iceland, Brazil, the United States, France, Canada, Australia, Malaysia, Russia,

Kazakhstan, Bosnia and Herzegovina, Laos, and Thailand (U.S. International Trade Commission 2018). South

Africa had production facilities, but those recently closed. Production in Malaysia began in 2019 due to access

to a new hydropower hub. Location is limited to places with cheap and abundant electricity, access to quartz

(domestically or near a port), and access to buyers without prohibitive trade restrictions.

1,277

1,507

1,453 1,453 1,453 1,453

816

1,009

1,017

1,178

1,503

1,918

48

78

87

101

129

164

232

235

402

473

672

945

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

2013 2015 2017 2020E 2025E 2030E

Demand (kilitonnes)

Polysilicon for

Solar (High

Projected

Scenarios)

Polysilicon for

Solar (Historical)

Polysilicon for

(5% CAGR)

Silicones and

Silanes

(5% CAGR)

(0% CAGR)

Demand (kilotonnes/year)

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

16

Figure 15. Principal locations of MGS production.

Sources: USGS, British Geologica l Survey

China currently has around 70% of global MGS production capacity and hundreds of companies of varying

size (USGS 2021b; BGS 2021). As of 2017, the top 10 Chinese producers owned approximately 35% of

domestic capacity and the top five approximately 25% (Normann 2018). Non-Chinese silicon manufacturers

are consolidated, with the top 10 manufacturers holding 96% of non-Chinese manufacturing capacity (Figure

16).

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

17

Figure 16. China and non-China MGS manufacturing capacity, 2017.

Source: (Normann 2018)

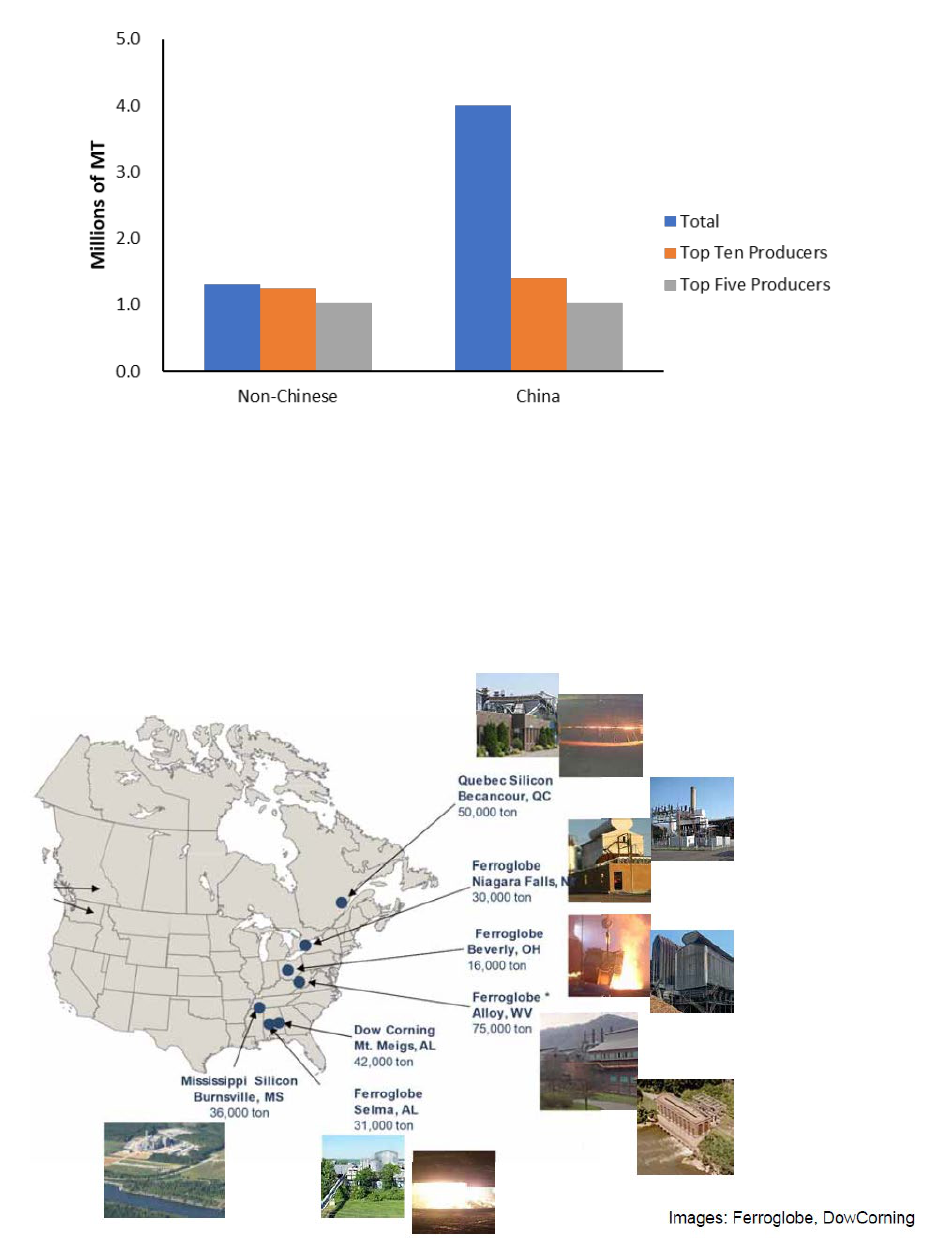

There are currently four companies with seven plants producing MGS in North America, as shown in Figure

17, but the Dow Corning plant has been shut down for some time. Many of the plants improve their

competitiveness and keep their greenhouse gas emissions low by sourcing inexpensive hydropower electricity

(even in coal-rich West Virginia ).

Figure 17. North American MGS plants.

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

18

Source: (Chalamala 2018)

2.1.2 Glass

2.1.2.1 Technology Overview

The fla t gla ss used for PV module assembly typically has low iron content for optimal transmissivity of

sunlight and is both tempered and anti-reflective coated. Silica sand is typically reported to be the primary

input material for solar-gra de gla ss (Heidari and Anctil 2021).

• The front glass typically used on crystalline silicon PV modules (also known as “coverglass”) is

typically 3.2-m m rolled gla ss, which is slightly dimpled on one side to improve encapsulant adhesion.

This glass is produced between two rollers, one of which is patterned.

• The front glass on thin-film PV m odules is typica lly 3.2-mm float glass produced on a float line, due to

the need for a highly flat surface to act as a superstrate or substrate.

Rea r gla ss for thin film or bifa cia l c-Si modules is typically 2.0-mm soda lime glass, since it does not need

high optical transmittance and is less expensive.

2.1.2.2 Industry Overview

Float lines are most common in China and the United States as shown in Figure 18, but little detail is known

about the distribution of rolled glass production, aside from the fact that most PV coverglass is produced in

China. The United States currently does not have significant excess capacity to produce rolled glass, though

float glass lines may be able to be built in a relatively short time, as demonstrated by First Solar’s exclusive

gla ss line in Ohio.

Figure 18. Flat glass production by country and number of float lines, 2017.

Source: (B. Smith and Margolis 2019)

Float glass is generally reported to be more expensive than rolled glass, and larger facilities are necessary to

achieve the necessary economies of scale. A single float line would produce approximately 2 GW

dc

of

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

19

covergla ss per yea r and would require a capital investment of approximately $150 million. To produce the

low-iron pattern glass that is typically used as coverglass for c-Si PV, the float line would have to be slowed

down considerably, which worsens the economic performance of the float line. Because rolled gla ss has a

higher proportion of labor costs as compared to float gla ss, it is much cheaper when produced in areas with

low-wage labor, such as China.

2.1.3 Encapsulant

2.1.3.1 Technology Overview

In a PV module, front and back layers of encapsulant film form a protective barrier around the PV cells,

essentially laminating the cells. The predominant resins used to make encapsulant are ethylene vinyl acetate

(EVA), which is primarily used for monofacial PV modules, and polyolefin elastomers (POE), which is

primarily used for bifacial or thin-film modules. EVA is synthesized by polymerizing vinyl acetate monomers

and ethylene (B. Smith and Margolis 2019). Natural gas is the primary feedstock to produce both ethylene a nd

POE.

Typically, EVA or POE is produced by a petrochemical company in resin form and sold to a film extruder

which extrudes the resin into the film needed in the module assembly process. These two steps are typically

not vertically integrated, though some vertically integrated firms exist, such as Hanwha and Mitsui.

2.1.3.2 Industry Overview

Generally, resin is produced globally, but extrusion capabilities are concentrated in China (Figure 19). Some

Southeast Asian countries have encapsulant production established by Chinese corporations to support the

module industry in those countries. Similarly, encapsulant extrusion exists in India, but is often owned by

Chinese companies. Hangzhou First (or “First Applied Material”) is the largest global encapsulant producer,

though it also supplies backsheets. HIUV, Sveck, and Cybrid are also major encapsulant producers in China,

while Borea lis is a smaller producer in Austria.

The United States has significant capability to produce encapsulant resin, but extrusion capabilities are less

common. DOW Chemical is focused on POE resin for PV applications, though it produces EVA resin as well.

Na tural gas is the feedstock for both POE and ethylene, so low U.S. gas prices can be an advantage for U.S.

production.

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

20

Figure 19. Largest EVA-producing countries, 2017.

Source: (B. Smith and Margolis 2019)

2.1.4 Backsheets

2.1.4.1 Technology Overview

Backsheets are used in monofacial c-Si modules as the final back layer of the module, but some clear

backsheets are now starting to be used as the backing for bifacial c-Si m odules a s well. Backsheets are

intended to electrically insulate the module and protect it from moisture and wind da m age.

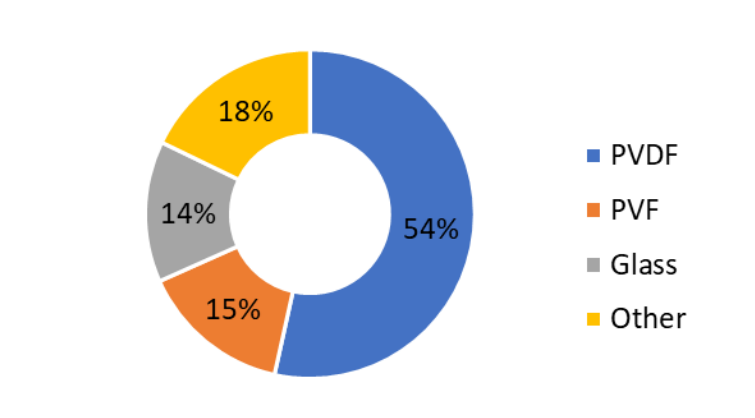

The materials used in backsheets vary significantly across the market (Figure 20). Almost all backsheets use

polyester (PET), typically in some combination with polyvinyl fluoride (PVF), polyvinylidene fluoride

(PVDF), polyethylene, or less commonly polyolefin or polypropylene (Chunduri and Schmela 2020).

Like encapsulants, backsheet materials are typically first produced as bulk resins and are then extruded into

films. Backsheets are typically made of three films laminated together: the inner layer (touching the

encapsulated cells), the core (middle) layer, and the outer layer which is exposed to air. The core layer is

typically PET, while the outer layer is frequently PVF or PVDF. Firms often operate as independent laminators

by purchasing films and laminating desired stacks together into backsheets.

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

21

Figure 20. Market share of backsheet materials, 2019.

Source: (Chunduri and Schmela 2020)

2.1.4.2 Industry Overview

PVDF-based backsheets are reported to dominate the backsheet market; Fumotech, ZTT, and Arkema are

major suppliers of PVDF resin. Some examples of vertical integration include ZTT in China, which produces

PVDF resin and consumes about 50% of its own resin to produce completed backsheets (Chunduri and

Schmela 2020).

Conversely, Cybrid was first known as a major backsheet supplier and now operates a PVDF

resin production facility. DuPont reports that all its PVF (Tedlar) production occurs in the United States, and

approximately 50% goes to PV backsheet applications. It supplies the extruded film to backsheet laminators.

Jinko and LONGi, two of the largest PV module producers, use PVF-based backsheets for most of their

products.

There are a few major PET suppliers, mostly located in China, though the DuPont-Asia PET supplier is loca ted

in Japan. DTF is a major supplier of the PET core layer for backsheets.

Very few backsheet laminators exist in the United States, but examples include Dunmore, Tomark Worthen,

and FLEXcon. Most laminators are located in China, with some appearing in India more recently.

2.1.5 Aluminum Frames

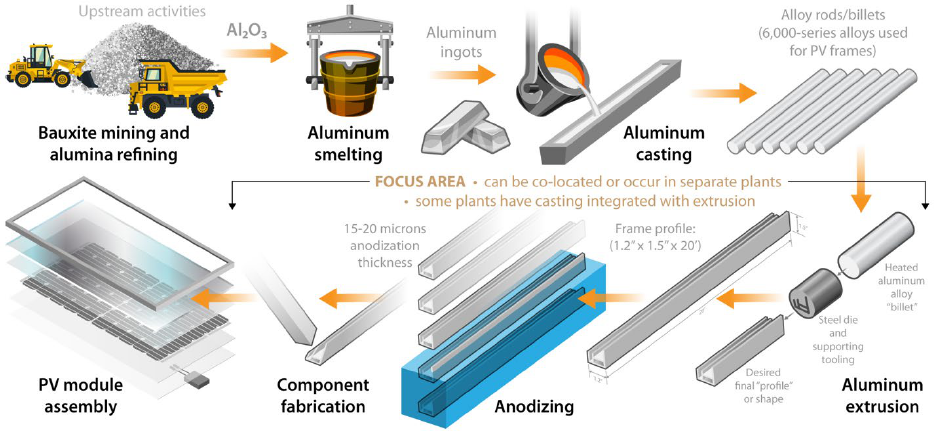

2.1.5.1 Technology Overview

The aluminum used in PV module frames or PV system racking can either be sourced from primary extraction

(mining) or secondary extraction (recycled content). Module frames and aluminum racking (typically used for

residential systems) have similar production processes, which rely on extrusion and anodization or other

coatings (Figure 21).

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

22

Figure 21. Production process for aluminum module frames, assuming primary aluminum extraction.

Source: NREL

The raw input aluminum must be alloyed appropriately for its intended application. Alloying occurs during the

casting stage when smelted ingots are cast into billets. The most popular extrusion alloy class, which is

typically used in solar applications, is the 6000 series (Werner 2013). This alloy class is created by varying a

combination of magnesium and silicon, depending on the strength required by the end use of the extruded

aluminum profile. Once the desired alloy has been produced, it is extruded into the desired shape, then coated

and cut (fabricated) as needed.

The general structure of the aluminum extrusion industry encompasses production of the desired alloy,

extrusion into the desired shape, then coating or anodization, and finally fabricating or cutting as needed.

Extrusion, coating/anodization, and fabrication processes are often co-located but may occur in separate

facilities operated by different firms.

2.1.5.2 Industry Overview

Some countries subsidize aluminum, which would result in PV frames and racking at lower cost. Both

extrusion and anodizing use large amounts of water, for cooling as well as cleaning and rinsing. Stricter

regulations regarding water treatment will add to the cost of producing PV frames and racking. The United

States has significant capacity to produce aluminum for frames.

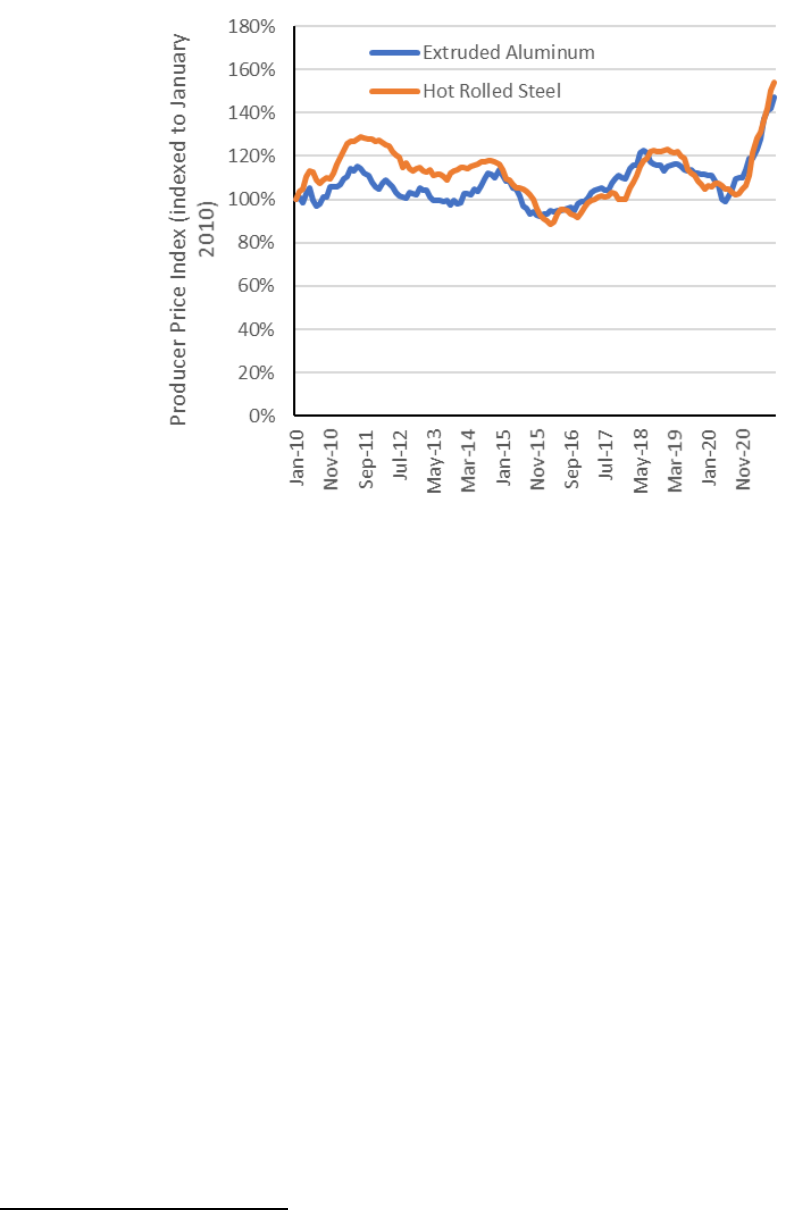

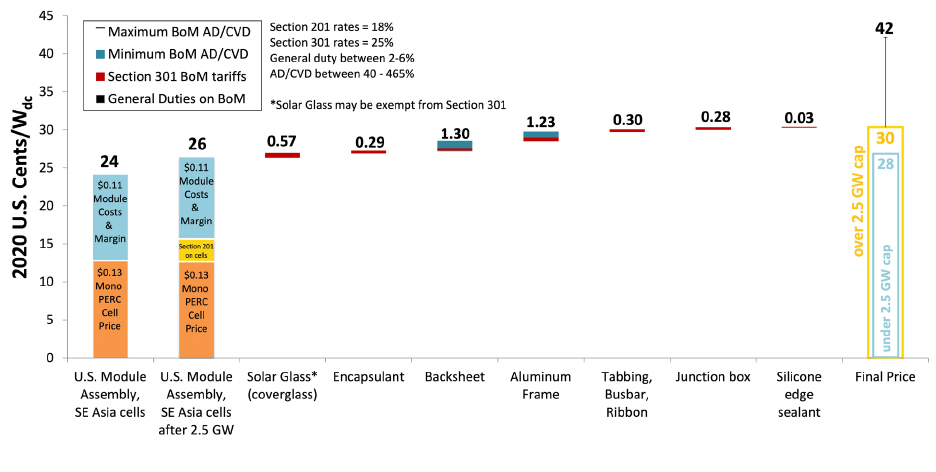

The prices of steel and aluminum in the United States rose in 2018 following the implementation of two tariffs

(see Section 3.2.2). A Section 301 tariff on Chinese solar products imported into the United States wa s placed

in spring and summer of 2018; and a Section 232 tariff on steel and aluminum imported to the United States

from various countries was imposed starting in the spring of 2018 (Figure 22). China produces more than half

the world’s aluminum and steel (U.S. Congressional Research Service 2021). The price increases subsided in

2019 with the exclusion of some countries from the Section 232 tariffs (U.S. Congressional Research Service

2021), but since the start of the coronavirus pandemic, supply-chain logistics combined with the tariffs, and

other import quotas, have caused domestic shortages in the United States and significant price increases.

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

23

Figure 22. Producer price index for extruded aluminum and hot rolled steel.

2

Source: (FRED n.d.)

2.2 Polysilicon Refining

2.2.1 Technology Overview

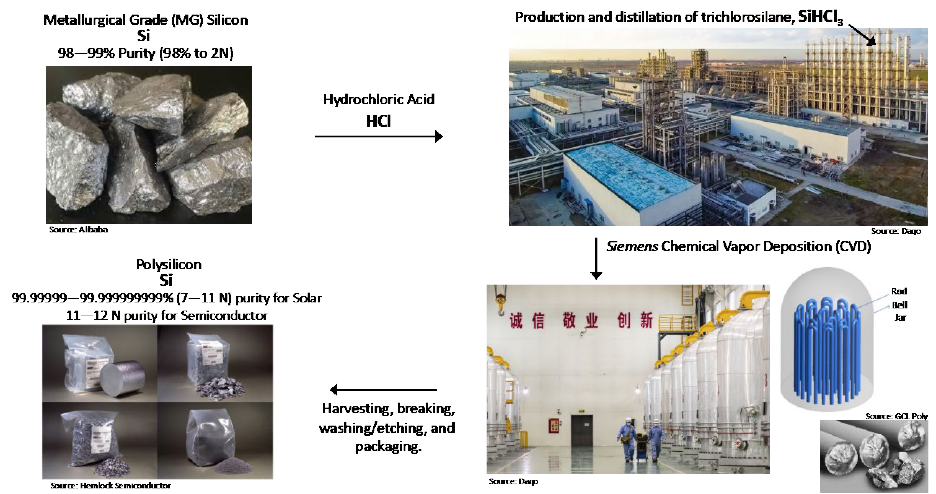

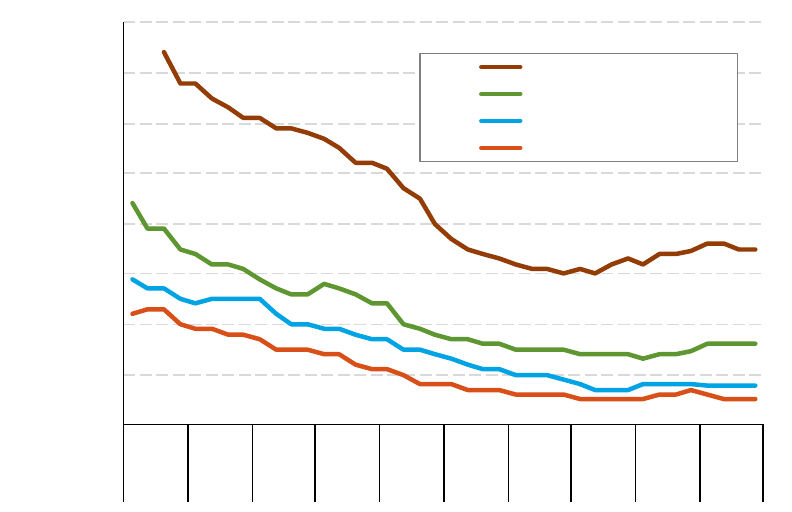

Polysilicon is the high-purity product obtained by refining MGS. PV is the primary consumer of polysilicon

(greater than 80% of demand), and the other principal end use is for consumer electronics and semiconductors

(Figure 23). Whereas MGS is 99% pure (“2 nines” or 2N) silicon, polysilicon for PV typically has a purity of

8N–11N. Numerous variations in polysilicon production techniques exist, but the two general approaches with

the largest market shares are the Siemens chemical vapor deposition method (greater than 90% market share)

and the fluidized bed reactor (FBR) method (3%–5% market share). Figure 23 shows the steps to produce

polysilicon from MGS, based on the Siemens process.

The Siemens process generally entails passing a gaseous trichlorosilane (TCS) or silane precursor over heated

silicon filaments housed within bell-shaped reaction vessels, which deposits pure silicon onto the filaments.

Recovered compounds are recirculated and can be used to synthesize new precursors. The end results of this

process are U-shaped silicon rods, which are later broken into chunks and sealed in plastic bags with an inert

gas such as argon.

2

Steel includes: “Hot Rolled Steel Bars, Plates, and Structural Shapes.” Aluminum includes: “Extruded Aluminum Rod, Bar, and Other Extruded Shapes.”

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

24

Figure 23. Steps to produce polysilicon from MGS, Siemens chemical vapor deposition method.

Source: NREL

In the FBR process, a bed of silicon beads floats on the fluidizing gases silane and hydrogen, which flow

upward through an inverted cone-shaped reaction vessel. Through controlling the temperature differential

between the fluidized silicon beads and the reactor walls, silicon layers are deposited onto the beads. As beads

become heavy, they fall to the bottom of the cone for collection, ultimately yielding granular polysilicon. This

granulated form can facilitate subsequent steps in the c-Si PV manufacturing process. Compared with

polysilicon chunks from the Siemens process, the granules fill ingot crucibles more quickly and efficiently,

and they are better suited to continuous-Czochralski (Cz) ingot pulling, which can contribute toward PV

efficiency and cost advantages. The decision between polysilicon chunk vs. FBR beads must consider impurity

differences between the suppliers and the processing capabilities of the ingot production equipment.

2.2.2 Industry Overview

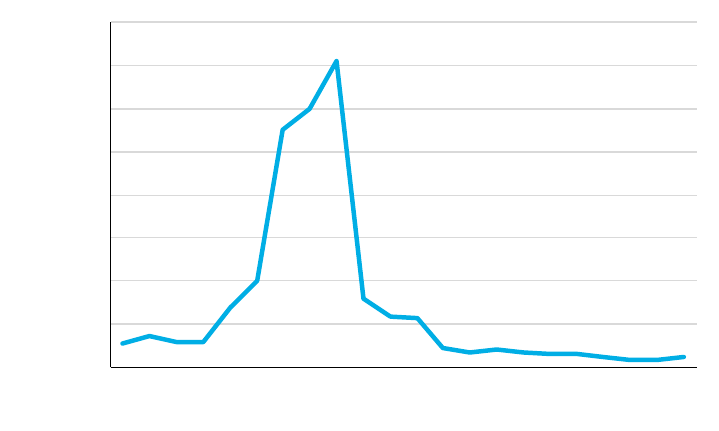

Before 2005, the solar industry sourced most of its polysilicon supply via scrap from the semiconductor

industry. As demand for PV grew rapidly, in large part due to the German feed-in tariff beginning in 2004,

there was a shortage of polysilicon, which significantly increased its price (Figure 24).

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

25

Figure 24. Polysilicon prices.

Source: (BloombergNEF 2021b)

Polysilicon production requires large capital investments to build a plant, large corporate investment to learn

and refine the production process, highly skilled labor to operate the plant, and low electricity costs due to the

large amount of energy needed to produce polysilicon. These requirements limit the geographical locations

suitable for polysilicon production.

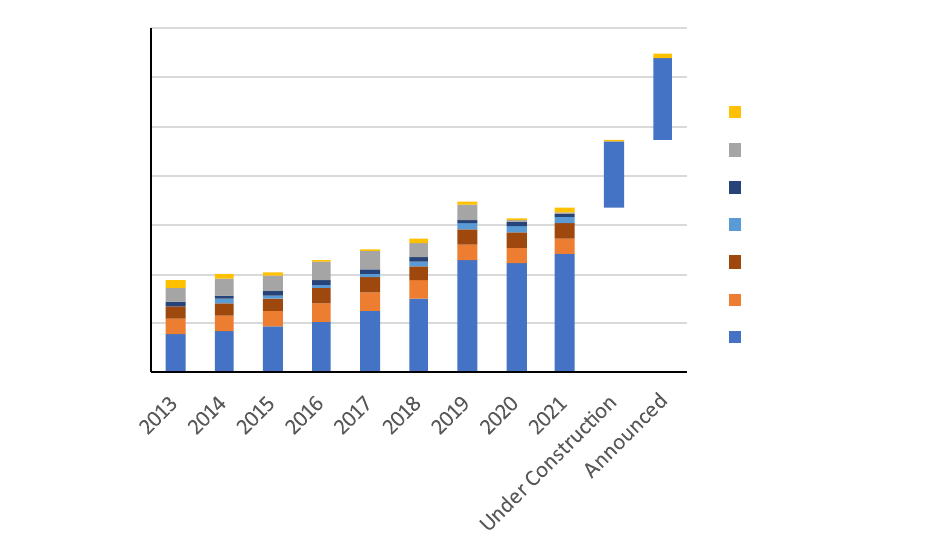

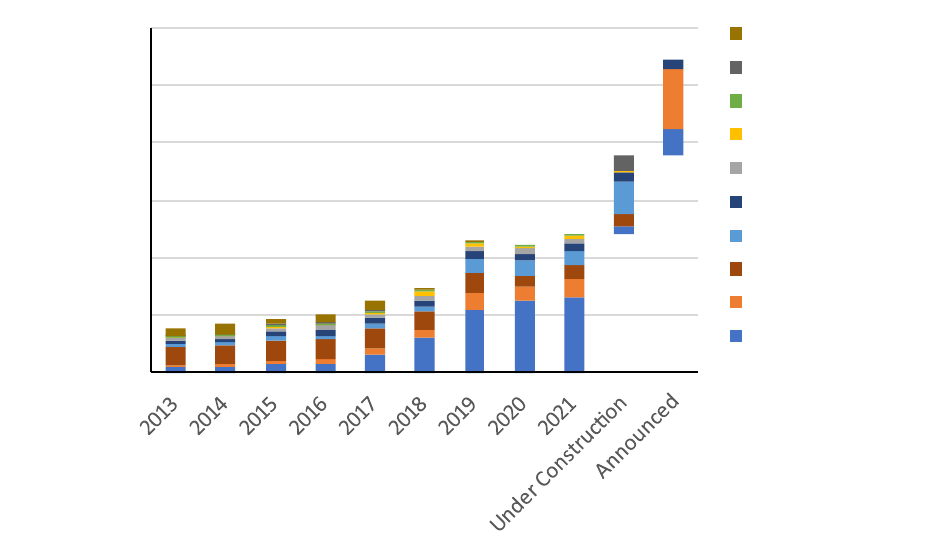

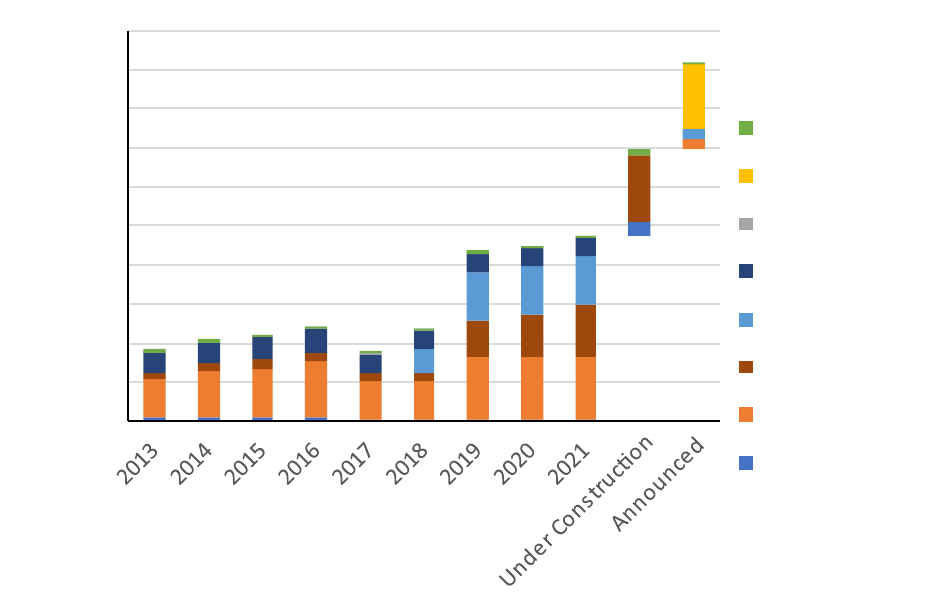

Virtually all polysilicon production capacity is located in 10 countries, with China having 72% of total global

capacity (Figure 25) (BloombergNEF 2021f). With greater than 96% of ingot capacity, virtually all buyers of

sola r-grade silicon are located in China.

Polysilicon prices increased threefold from $6.27/kg in June 2020 to $28.46/kg in June 2021 (BloombergNEF

2021a). The price increase has been attributed to a supply/demand imbalance caused by significant capacity

expansion in wafer and cell manufacturing. Now that polysilicon is the limiting factor, downstream entities

(wafer and cell producers) have been stockpiling polysilicon supplies in anticipation of growing demand,

especia lly a ra m p-up in utility-scale deployment in China. Although new polysilicon capacity came online in

early 2021, shortages are expected to persist in the short term until polysilicon capacity expansions come

online in 2022–2023. Based upon projects that have been announced or are under construction, polysilicon

manufacturing is expected to double in capacity, with most of the new plants located in China.

Many of the new plants built in the past two years have manufacturing capacities of 30,000-70,000 metric

tonnes (MT) of polysilicon per year, and there have been announcements for plans to build plants with

capacities greater than 100,000 MT (BloombergNEF 2021f).

$0

$50

$100

$150

$200

$250

$300

$350

$400

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

Polysilicon Spot Prices ($/kg)

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

26

Figure 25. Global polysilicon annual manufacturing capacity.

Source: (BloombergNEF 2021f)

Before 2017, most of the polysilicon manufacturing was located in Jiangsu, the leading province for other solar

manufacturing steps. Since then, Chinese companies have strived to continue lowering the price of polysilicon

by locating manufacturing in regions with cheaper land, electricity, and labor. There has been considerable

build-out of polysilicon in the western provinces of Inner Mongolia, Sichuan, Quinghai, and in particular,

Xinjiang. Xinjiang currently hosts 54% of Chinese polysilicon manufacturing and 39% of global

manufacturing (Figure 26). Based upon projects that have been announced or are under construction,

polysilicon manufacturing is expected to increase considerably in Inner Mongolia, Sichuan, and to a lesser

extent Xinjiang.

0

200

400

600

800

1,000

1,200

1,400

Manufacturing Capacity (kilotonnes)

Other

Korea (Republic)

Japan

Malaysia

United States

China

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

27

Figure 26. Polysilicon annual manufacturing capacity by Chinese province.

Source: (BloombergNEF 2021f)

Outside of China, Germany and the United States have the largest polysilicon manufacturing capacity (Figure

25). Plants outside China are typically smaller in size, with the largest plants having capacities between

20,000-40,000 MT (BloombergNEF 2021f). The principal advantage of U.S. and German polysilicon firms has

been their ability to deliver semiconductor-quality (11N and greater) material.

South Korea also benefited from the proximity to China and historically had significant polysilicon

manufacturing capacity. As polysilicon prices declined from 2010 to 2020, most polysilicon production in

South Korea waned due to low margins within the industry, and the inability to get the same low electricity

tariffs as those found in Western China (Bernreuter n.d.). Malaysia, on the other hand, grew its manufacturing

capacity with the help of low electricity prices from abundant natural gas and new hydroelectric facilities. The

South Korean company OCI, which was in the process of ramping down its South Korean operations, has been

a critical technology partner for establishing polysilicon production in Malaysia. A small amount of

manufacturing capacity has been announced in Saudi Arabia and Iceland.

Ten manufacturers produced 96% of global solar polysilicon in 2020 (Figure 27). Until 2005, the vast majority

of polysilicon was produced by seven German, U.S., and Japanese firms with operations in those three

countries. Italy also produced polysilicon for the semiconductor industry. After 2005, with the rapid growth in

demand for polysilicon from the solar industry, other companies began to gain significant market share. OCI, a

South Korean chemical company, began developing its own polysilicon production process in 2000

(Bernreuter n.d.). OCI, as well as some Chinese companies, grew with the help of the polysilicon shortage

from 2006-2008 as well as proximity to the growing demand for polysilicon wafer producers in China.

0

200

400

600

800

1,000

1,200

Manufacturing Capacity (kilotonnes)

Other

Yunnan

Henan

Qinghai

Sichuan

Jiangsu

Inner Mongolia

Xinjiang

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

28

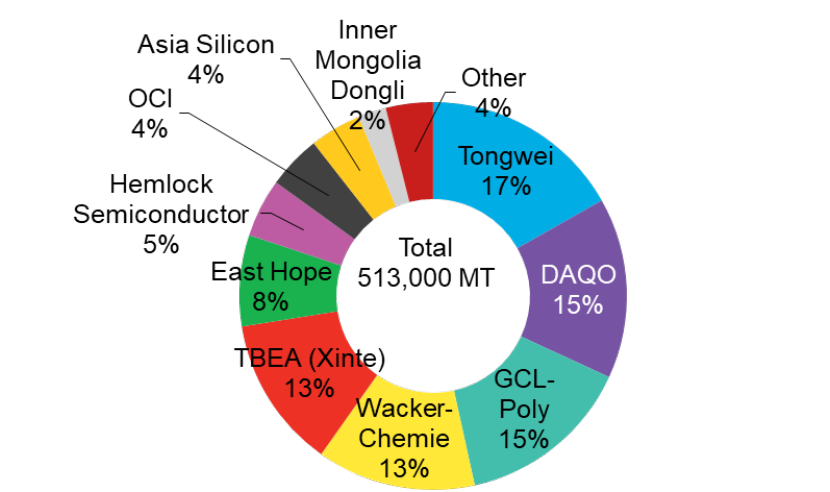

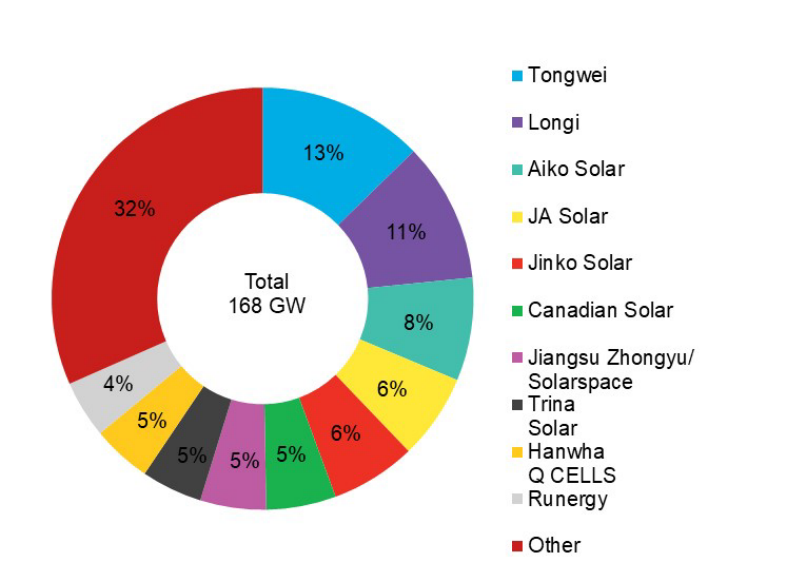

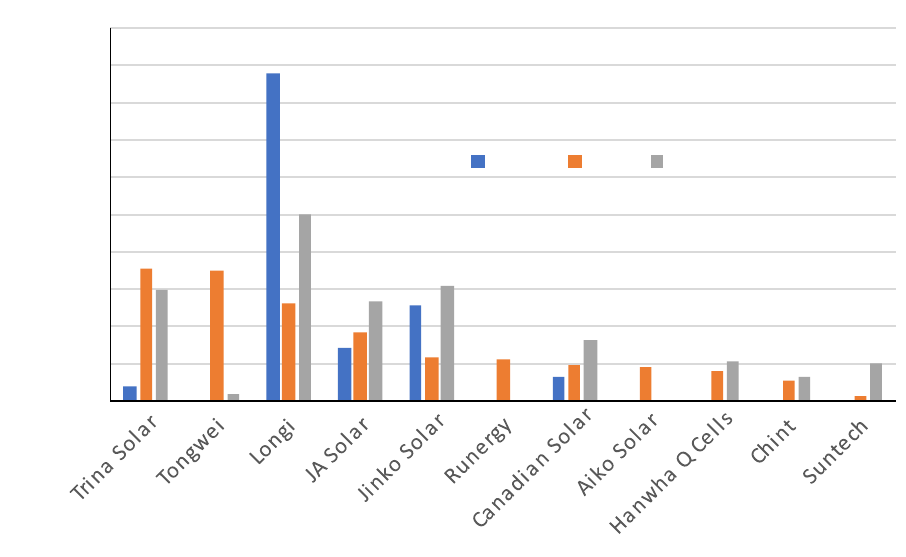

In 2020, the top 10 manufacturers consisted of seven Chinese companies, one German company (Wacker –

which has plants in Germany and the United States), one U.S. and Japanese company (Dow and Shin-Etsu

Handotai collectively owning Hemlock – which is headquartered and has plants in the United States), and one

South Korean company (OCI – which has a solar-grade plant in Malaysia and an electronic-gra de polysilicon

plant in South Korea ).

Tongwei, Daqo, and Xinte, three of the five leading producers of polysilicon, benefit from long-term contracts

with the largest wafer manufacturer in the world, LONGi, which produced 34% of global wafers in 2020

(BloombergNEF 2021e). Tongwei also benefits from being a leading supplier of cells and modules. GCL, the

third largest producer of polysilicon, also benefits from being the third largest producer of PV wafers.

Wacker has been helped by a German trade agreement with China, which made imports from the German

plants exempt from punitive import duties that are applied to U.S. and South Korean producers (see Section

3.3). Dow and Shin-Etsu Handotai (owners of Hemlock) are vertically integrated upstream, producing MGS.

Figure 27. Polysilicon production, by manufacturer, 2020.

Source: (BloombergNEF 2021e)

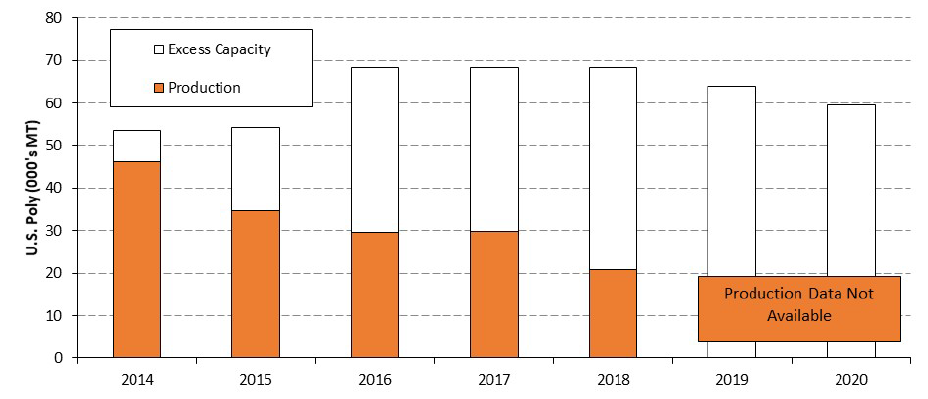

Four polysilicon companies operate in the United States: Hemlock, with 35,000 MT of annual production

capacity in Michigan; Wacker, with 20,000 MT in Tennessee; REC Silicon, with 4,000 MT in Montana, and a

16,000 MT plant in Washington, which shuttered in 2018; and Mitsubishi, with 1,500 MT in Alabama

(BloombergNEF 2021f). Hemlock, Wacker, and REC were awarded manufacturing tax credits under Section

48C and subsequently expanded capacity (obamawhitehouse.archives.gov, n.d.). U.S. plants are operating

significantly under capacity since Chinese duties (see Section 3.3) were placed on U.S. polysilicon in 2014

(Figure 28). Some production is being sold to the semiconductor industry.

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

29

Figure 28. U.S. polysilicon production and excess manufacturing capacity.

Source: (Wood Mackenzie & SEIA 2021)

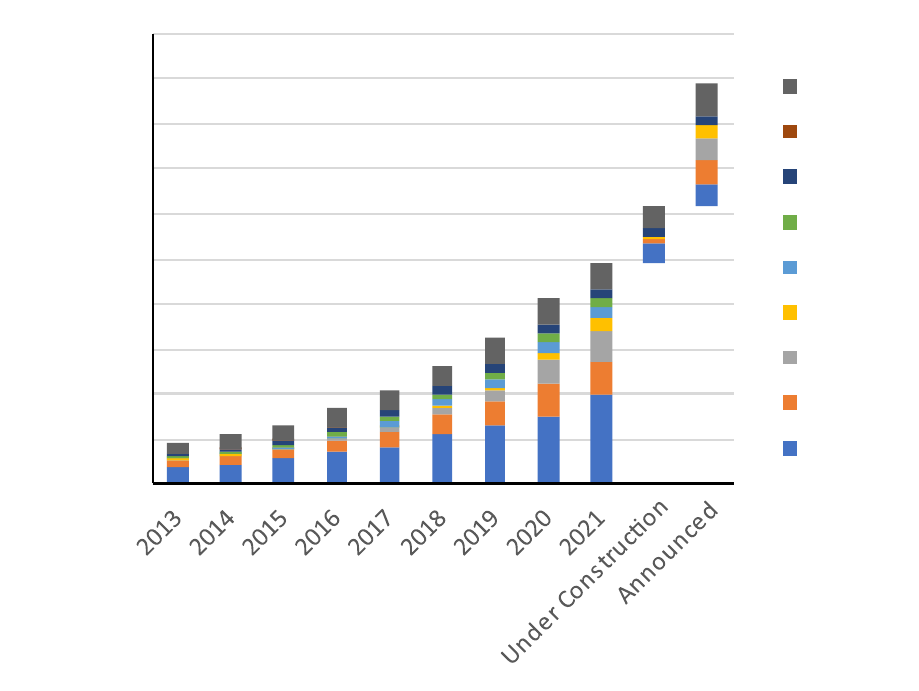

2.3 Ingots/Wafers

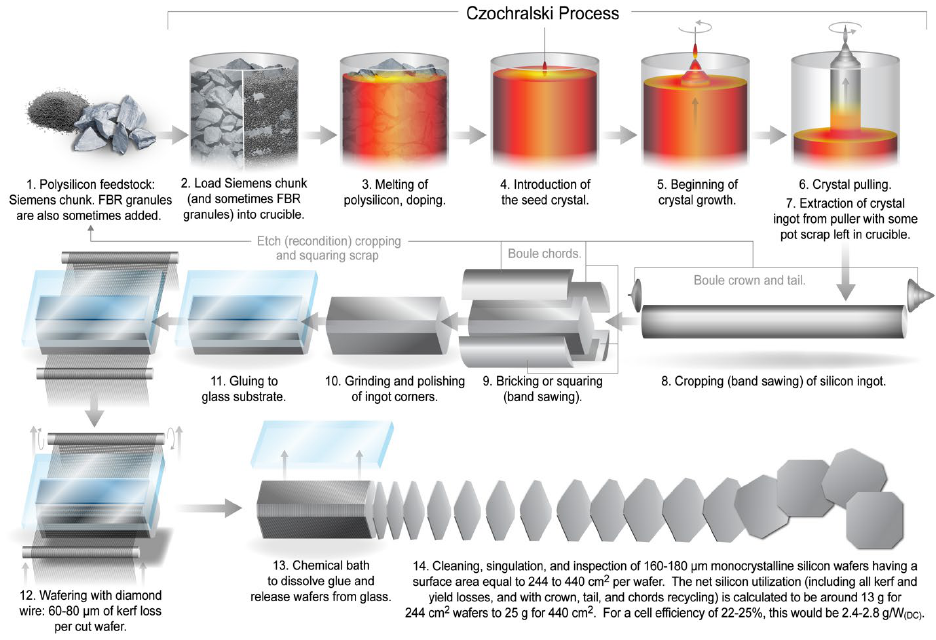

2.3.1 Technology Overview

The two primary methods for manufacturing PV wafers from polysilicon feedstock are the continuous-

Czochralski (Cz) process for monocrystalline wafers (Figure 29) and the directional solidification (DS) process

for m ulticrysta lline wa fers (Figure 30). Both approaches involve melting the polysilicon at 1410°C in a

crucible designed to minimize contamination, then solidifying the melt to grow a rectangular-block ingot

comprised of centimeter-sized crysta ls (DS) or a single-crysta l cylindrica l ingot (Cz).

A typical cylindrical monocrystalline ingot in 2010 was around 140 kg in size and led to cropped (squared)

ingots that were 1.5–2.0 m long, with a flat-edge width of 156 mm and a cross-sectional area standardized to

237 cm

2

. After accounting for wafer thickness, kerf (silicon sawdust generated when slicing the ingot into

wafers) and yield losses, and cell efficiencies around 16.5%, the net silicon utilization was around 7–8 g/W at

that time. By 2020, industry-typical ingot mass had increased to 400–450 kg, and ingots larger than 800 kg had

been demonstrated at pilot scale. Two separate movements for wafer size standardization also began in 2020,

to either the M10 size (182 x 182 pseudo-square with a diagonal of 260 mm) or the G12 size (210 x 210 full

square with a diagonal of 297 mm). These larger sizes are following the development of 300 mm Cz ingots for

the semiconductor industry. Solar and semiconductor ingot capabilities now range from 200 mm diameter

ingots around 5.5 m in length (400–450 kg) to 300 mm diameter ingots greater than 5 m in length at pilot scale

(800 kg). About 4 days are required to produce a Cz ingot at the typical growth rate of 1 mm per minute.

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

30

Figure 29. Process flow for making monocrystalline-silicon wafers via Cz crystal growth.

Source: NREL

The DS process produces shorter but much wider rectangular-block ingots. After the polysilicon is melted, the

bottom surface of the crucible is cooled at a certain rate to create a temperature gradient that induces the DS

process. As in the Cz process, sections of DS ingots produced during cropping and squaring can be remelted

for later ingot generations, except for the contaminant-heavy topmost section. The square ingots are easily

sawn into square wafers that enable cells to occupy essentially the entire PV module area. About 3 days are

required to produce a typical multicrystalline silicon ingot including melting, DS, and cool down.

Whether formed by DS or Cz, the resulting ingot must be sliced into thin wafers, typically 180 micrometers

thick. Diamond-coated wires are typically used that wrap around the ingot many times and cut all of the wafers

in parallel, simultaneously. About one-third of the ingot is wasted as sawdust in the sawing process.

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

31

Figure 30. Process flow for making multicrystalline-silicon wafers via directional solidification (DS).

Source: NREL

2.3.2 Industry Overview

Beginning with polysilicon melting, producing ingots requires a lot of energy. The ingot production process

alone requires greater than 70% of the total energy to produce a wafer. Therefore, it is advantageous to site

ingot production near large, inexpensive sources of energy, and global ingot capacity reflects these trends.

Because wafers are cheap to transport, it is not necessary to locate these facilities near cell manufacturing

plants (though this often occurs). Ingot growth and wafer sawing benefit heavily from economies of scale.

Therefore, it is advantageous to site an ingot/wafer plant in a location with cheap electricity, low la bor ra tes,

large industrial scale, and access to abundant sources of polysilicon.

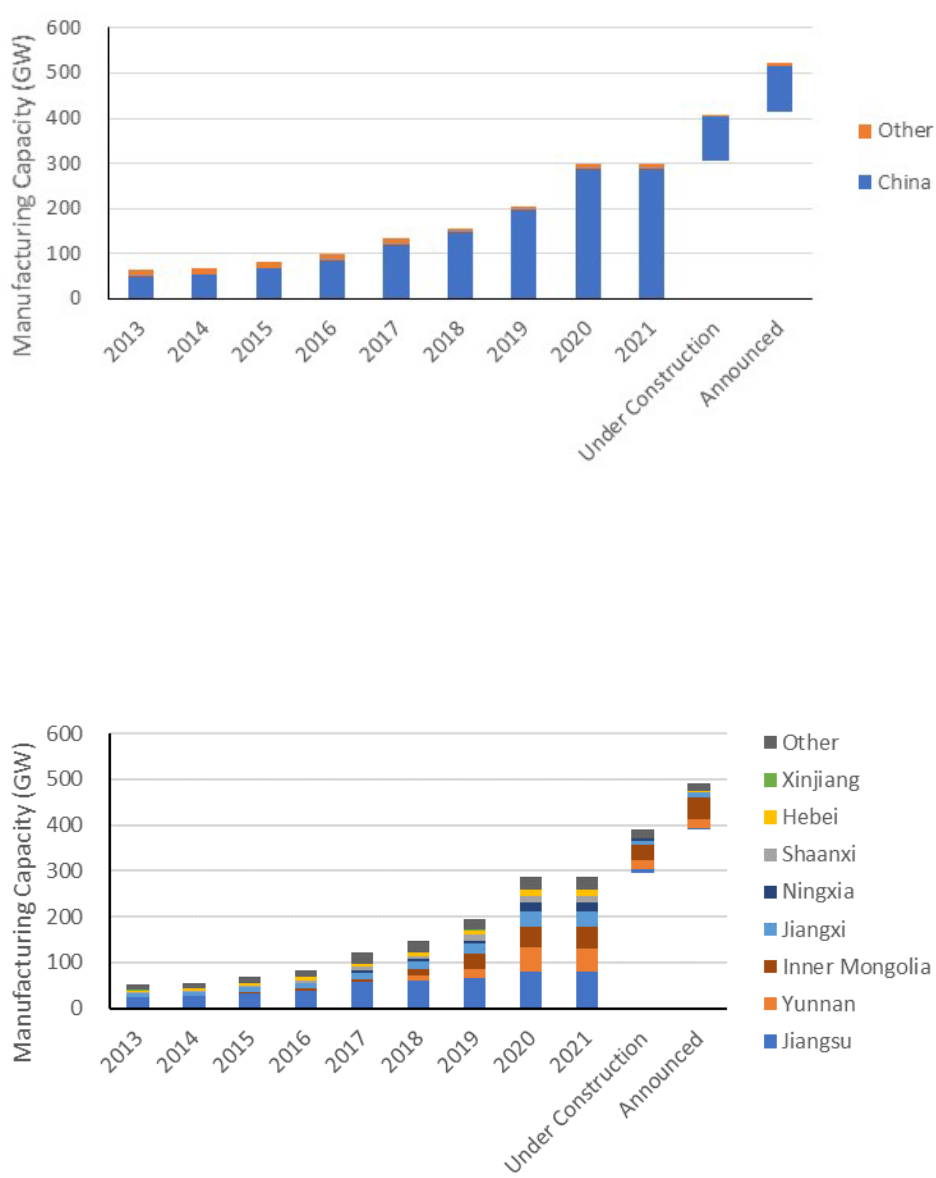

Virtually all ingot and wafer manufacturing is located in China (Figure 31) and half of global capacity located

in just eight plants (BloombergNEF 2021f). Many of the new plants built in the past two years have

manufacturing capacities of 20-50 GW

dc

per yea r. This concentration of ingot and wafer capacity was a direct

result of intensive Chinese government support for expansion of this sector over the period 2000 – 2010,

during which an estimated $50 billion was invested in Chinese solar production facilities.

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

32

Figure 31. Wafer manufacturing capacity in China vs. other locations.

Source: (BloombergNEF 2021f)

There is no dominant province or region within China for ingot and wafer manufacturing. Seven Chinese

provinces have over 10 GW

dc

of wafer manufacturing capacity (Figure 32). Some are in the western provinces,

but Jiangsu, with 28% of Chinese wafer capacity, is just north of Shanghai. It is also a domestic hub of cell and

module manufacturing.

Figure 32. Wafer manufacturing capacity by Chinese province.

Source: (BloombergNEF 2021f)

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

33

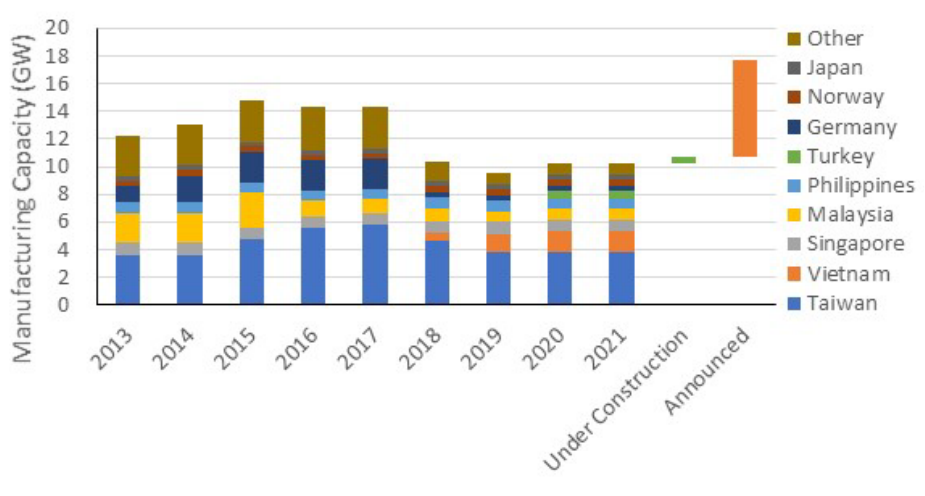

Outside of China, there is only 10 GW

dc

of wafer manufacturing capacity, mostly in East Asia (Figure 33). The

Chinese company Jinko Solar recently announced it would build a 7 GW

dc

ingot and wafer facility in Vietnam

to service its cell and module factory in Malaysia and its module assembly in the United States. The company

stated that it had made plans to build the factory in 2020, before the current U.S. trade restrictions on material

from Hoshine Silicon (Bellini 2021a).

Figure 33. Wafer manufacturing capacity outside of China.

Source: (BloombergNEF 2021f)

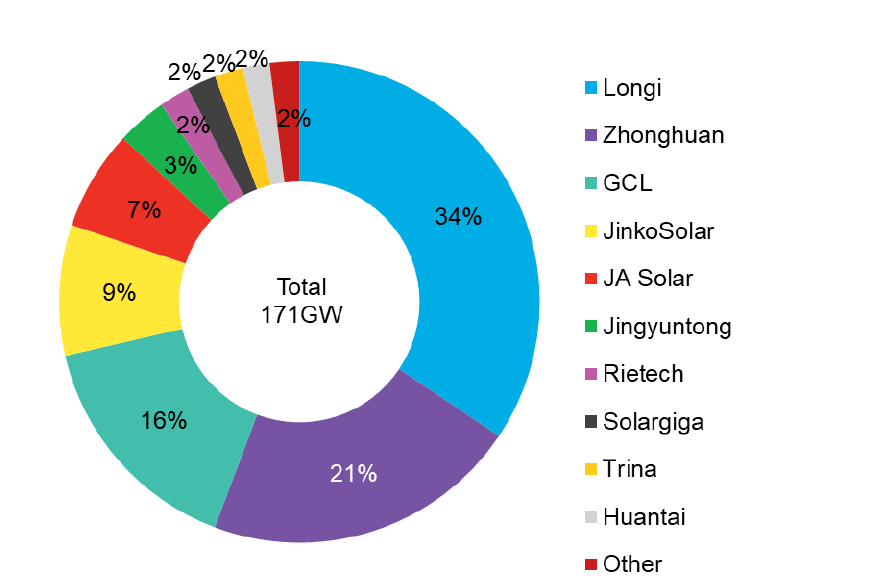

Ten Chinese manufacturers produced 98% of global solar wafers in 2020, with three companies (LONGi,

Zhonghuan, and GCL) producing 71% (BloombergNEF 2021e). From 2016 to 2020, these three companies

grew their collective manufacturing capacity from 29 GW

dc

(29% of global capacity) to 173 GW

dc

(58% of

global capacity) (Figure 34). The large growth from these companies followed the rapid growth in market

share of monocrystalline PV modules.

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

34

Figure 34. Wafer manufacturing capacity by company, 2020.

Source: (BloombergNEF 2021e)

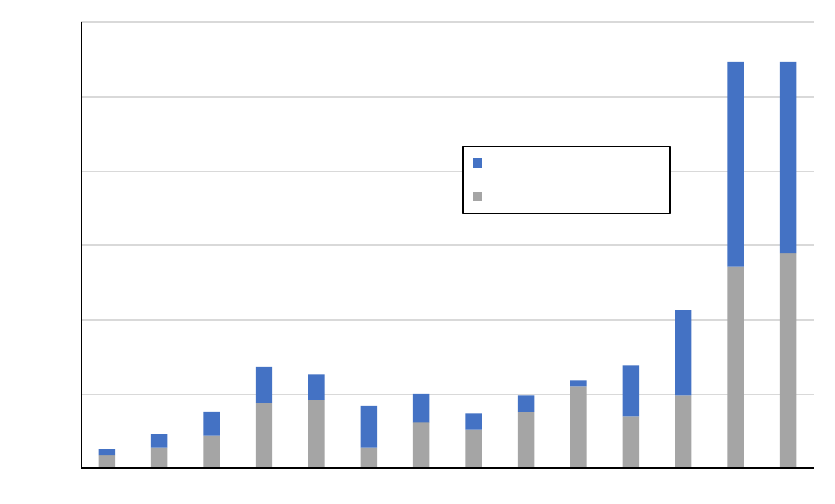

By 2010, the United States had built its wafer manufacturing capacity to over 700 MW

dc

, able to supply over

80% of domestic installations that year (Figure 35). The fa cilities were typica lly pa rt of a fully integra ted

manufacturing process, from wafers to modules (though at one point MEMC, which bought SunEdison, was

only making wafers, with synergies to its polysilicon production). But these facilities could not compete on

cost with Chinese wafers, which benefitted from 50 times greater scale. By 2016, all U.S. wafer production

had stopped, and many of these companies had gone out of business.

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

35

Figure 35. U.S. wafer manufacturing capacity.

Sources: (Wood Mackenzie Power & Renewables 2018; Wood Mackenzie & SEIA 2021)

The company 1366 Technologies received a $150 million loan guarantee from the U.S. Department of Energy

in 2011 to build a novel wafer manufacturing facility that would avoid the step of slicing ingots to make

wafers by casting wafers directly (U.S. Department of Energy n.d.). The “direct wafer” process was designed

to require less silicon use, save time and money, and better compete with Chinese wafer manufacturers through

automation over cheaper labor. 1366, however, never constructed a commercial sca le wa fer fa cility in the

United States, instead forming a partnership with South Korean company Hanwha Q Cells to establish pilot

production in Malaysia (Bellini 2019). In 2021, 1366 merged with Hunt Perovskite Technologies to form

CubicPV, with the aim of developing a novel perovskite-silicon tandem-cell technology.

2.4 Solar Cell Fabrication

2.4.1 Technology Overview

Wafers are converted into cells through a series of wet chemical treatments, high-temperature gaseous

diffusions, coating depositions, and metallization steps. The steps and the tools used vary based on cell

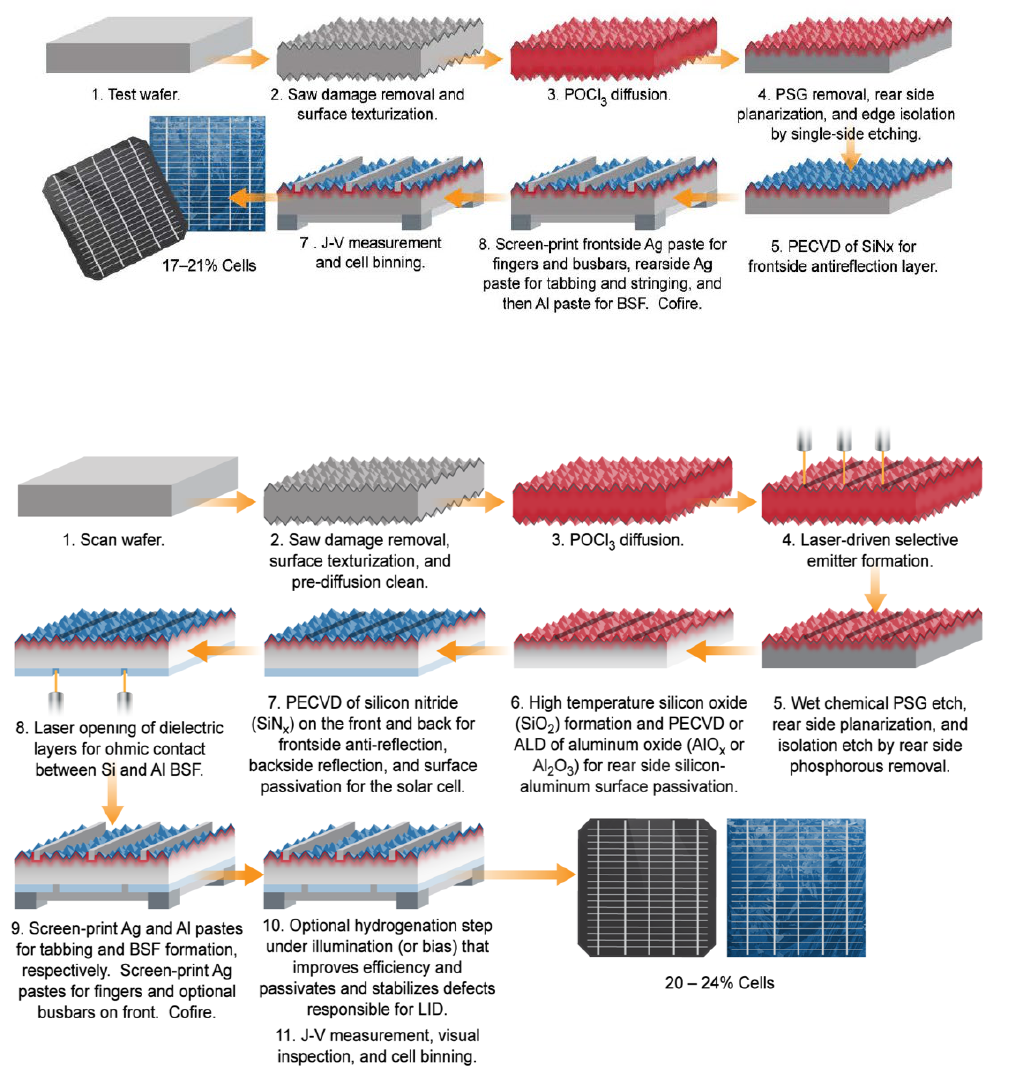

architecture. Figure 36 shows the process for the full-area aluminum back surface field (Al-BSF) cell structure

that was the dominant cell structure prior to 2018. Figure 37 shows the process for the passivated emitter and

rea r cell (PERC) structure, which—because of cell efficiency advantages over the standard Al-BSF

architecture—now dominates the market. The PERC process is like the Al-BSF process, with a few more

steps. Additional architectures designed to provide efficiency advantages over standard cells are also emerging.

Regardless of the architecture, inspections at the start of the manufacturing line and electrical testing at the end

of the line are used to identify cells that must be discarded. The tools and expertise needed to manufacture

standard and PERC cells at high volume with guaranteed efficiencies are widely available.

0

100

200

300

400

500

600

700

800

2007

2008 2009 2010 2011

2012 2013 2014 2015 2016

Manufacturing Capacity (MW)

SolarWorld USA

Sola r Power Indus tries

Sa nyo/Panasonic

BP Solar

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

36

Figure 36. Process flow for manufacturing standard full-area Al-BSF cells.

Source: NREL

Figure 37. Process flow for manufacturing standard full-area PERC cells.

Source: NREL

Silver is an important component in c-Si sola r cells, a s it is used in the form of screen-printable paste to make

electrical contact to the silicon material. In 2019, silver accounted for about 10% of cell cost (Bellini 2021b).

Silver can be mined as a principal product, extracted as a byproduct or coproduct at other metal extraction

operations, or recovered from secondary sources (USGS 2021a). For PV applications, silver is refined to high

SOLAR PHOTOVOLTAIC S SUPPLY CHAI N DEEP DIVE ASSESSMENT

37

purity levels, processed into a fine powder, and immersed in solvent to create a paste for screen-printing

applications (Yüce et al. 2019).

In 2019, the PV sector accounted for approximately 10% of global silver demand (Bellini 2021b). However,

the amount of silver used per cell has declined over time even as cells have become larger in area, dropping

from 521 milligrams per cell in 2009 to 111 milligrams per cell in 2019 (Marsh 2021). This trend is expected

to continue (Keen 2020).

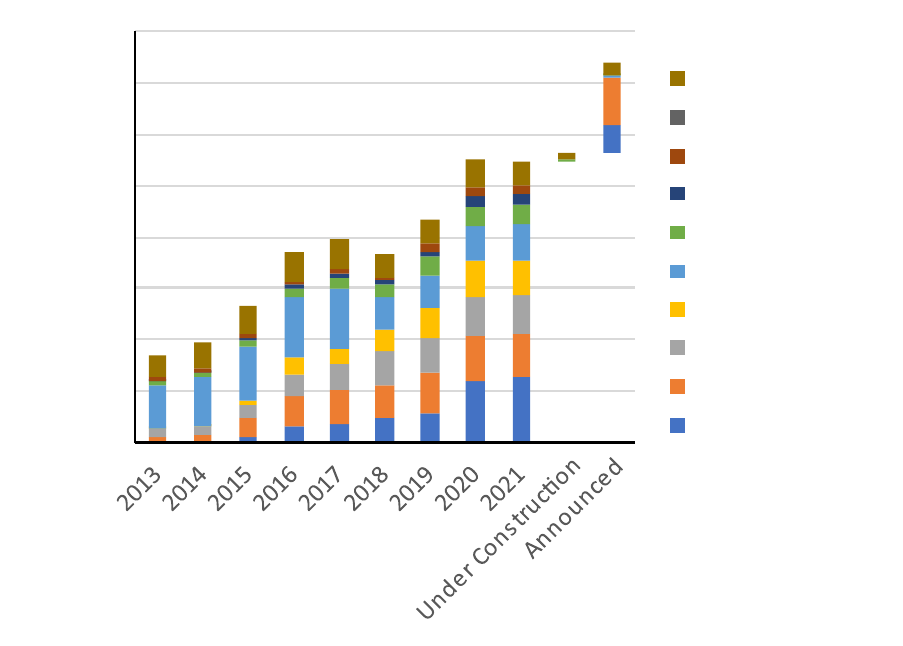

2.4.2 Industry Overview

Sola r cell f a brication has become a very automated process and thus typically benefits from locations with a

sufficient labor pool of manufacturing engineers and machine laborers; government support of manufacturing

through cheap land, electricity, and tax breaks to incentivize companies with sufficient access to capital to

procure the equipment and land; and access to a supply chain of affordable machines.

While not always the case, cell manufacturing is often collocated with wafer and module manufacturing due to

synergies in the manufacturing process, procurement of equipment and land, taking advantage of captive

demand, and economies of scale. As of July 2021, approximately 27% of cell manufacturing capacity was

collocated with wafer capacity, and 61% was collocated with module capacity (Figure 38). Still, over 100

GW

dc

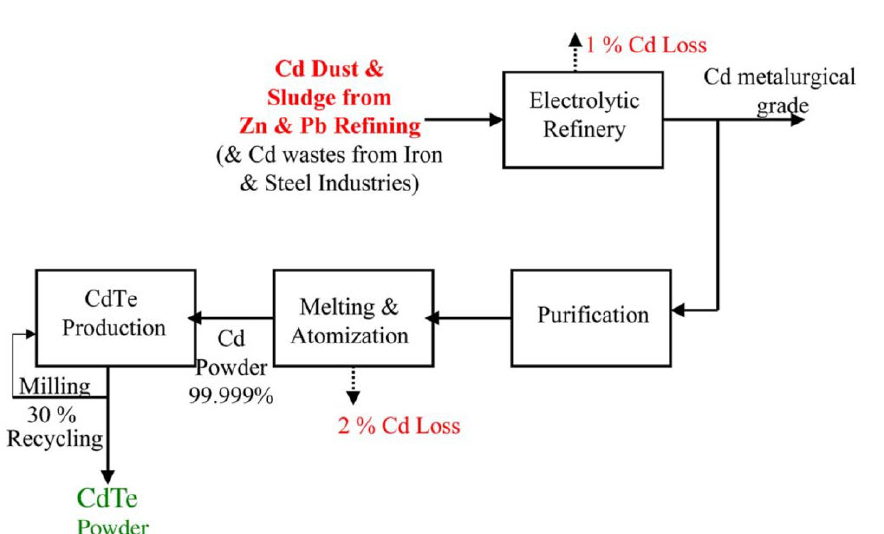

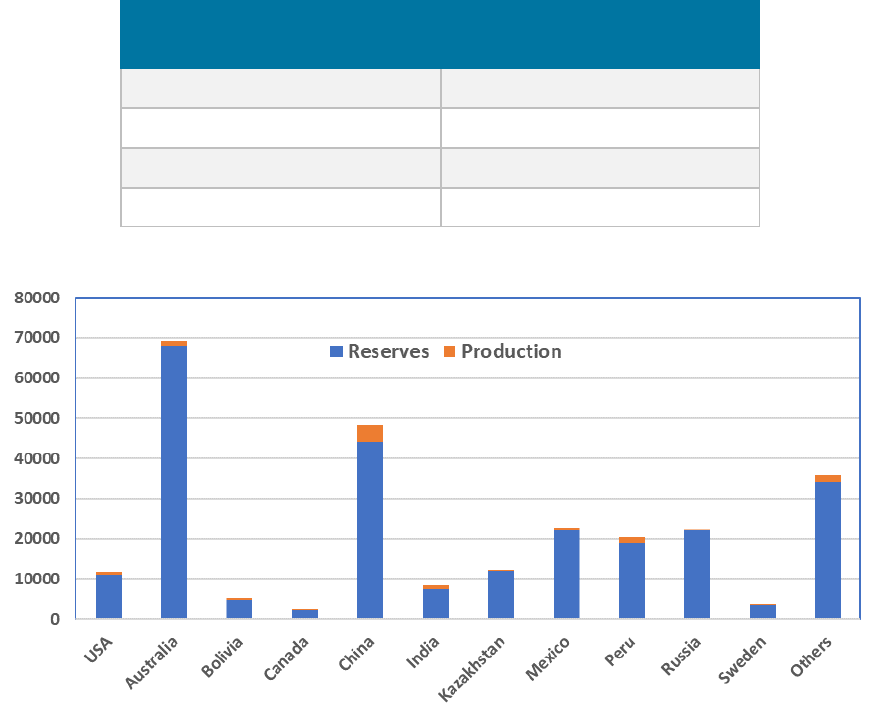

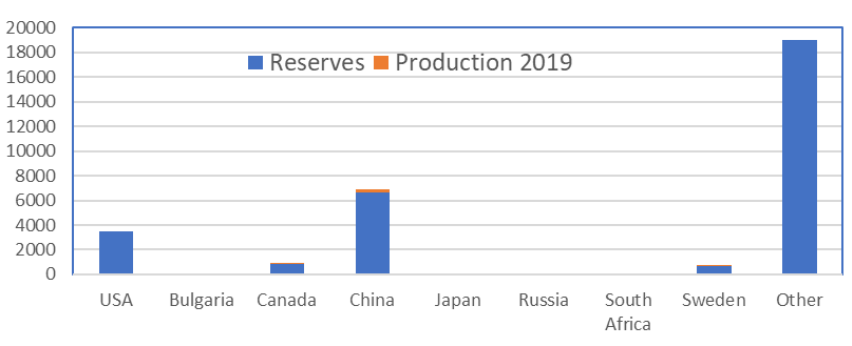

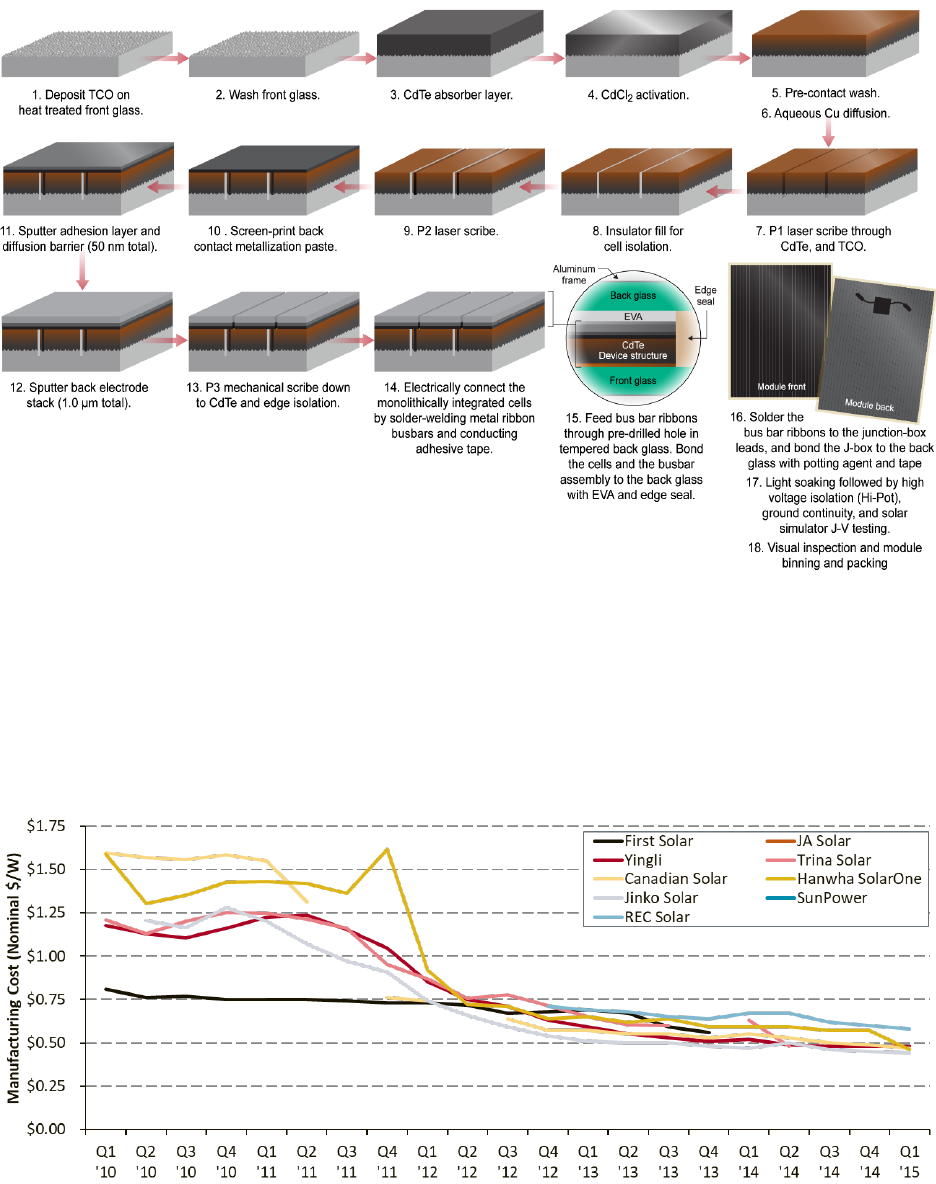

of cell manufacturing is sited alone.