Spring 2023

Solar Industry Update

David Feldman, NREL

Krysta Dummit, BGS Contractor for SETO

Jarett Zuboy, NREL

Robert Margolis, NREL

April 27, 2023

Photo by Werner Slocum, NREL 74637

NREL | 2

Global Solar Deployment1

U.S. PV Deployment

2

PV System Pricing

3

Global Manufacturing

4

Component Pricing

5

Market Activity

6

7 U.S. PV Imports

Agenda

NREL | 3NREL | 3

Global Solar Deployment

• IEA reported that in 2022, 231 GWdc of PV was installed globally, bringing cumulative

PV installs to 1.2 TWdc.

– China’s annual PV installations grew 57% y/y in 2022, representing 42% of total

global demand, with the majority coming from distributed PV.

– The U.S. was the second-largest market in terms of cumulative and annual

installations.

• Analyst project 2023 annual installations to grow to more than 300 GW and by 2025

more than 400 GW.

U.S. PV Deployment

• In 2022, PV represented approximately 46% of new U.S. electric generation capacity,

compared to 4% in 2010.

• Solar still represented only 9.0% of net summer capacity and 4.7% of annual generation

in 2022.

• However, 16 states generated more than 5% of their electricity from solar, with

California leading the way at 27.3%.

• The United States installed 17.0 GWac (20.2 GWdc) of PV in 2022, ending the year with

110.1 GWac (140.6 GWdc) of cumulative PV installations.

• The United States installed approximately 14.1 GWh, 4.8 GWac of energy storage onto

the electric grid in 2022, up 34% y/y.

PV System and Component Pricing

• The median system price for a select group of utility-scale PV projects in 2022 was

$1.49/Wac—up 13% y/y.

• The median reported price by EnergySage for residential PV systems increased 6.3%

y/y to $2.85/Wdc – the third straight period of increase, after never having done so

before.

• After plunging to a 1.5-year low of $20/kg in mid-January, global polysilicon spot prices

rebounded to $30/kg in mid-February and then dropped to $24/kg by mid-April.

• Global module prices have declined steadily since fall 2022 despite strong demand,

reaching lows in April 2023 that have not been seen for 2 years.

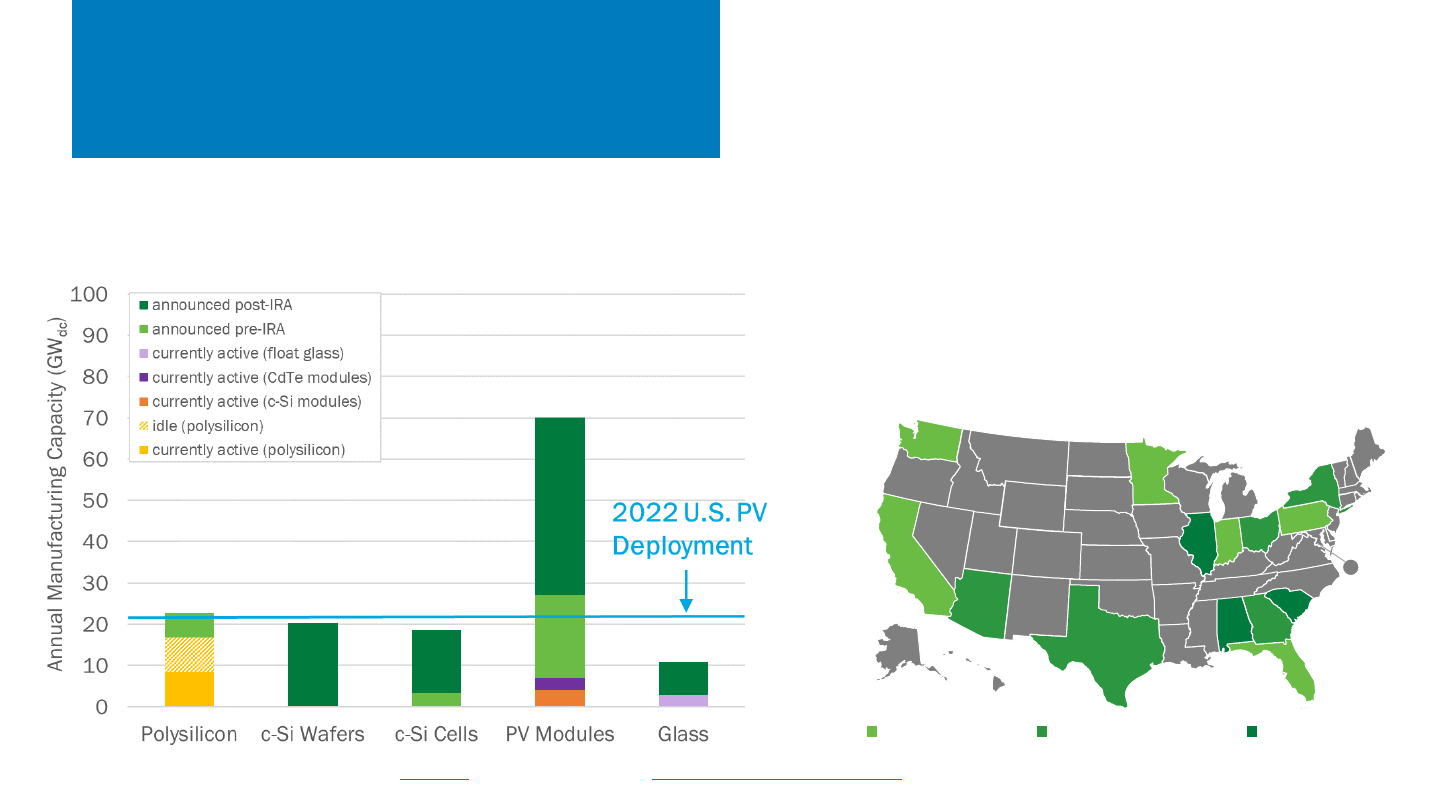

Global Manufacturing

• In 2022, global PV shipments were approximately 283 GW—an increase of 46% from

2021.

• In 2022, 96% of PV shipments were mono c-Si technology, compared to 35% in 2015.

• N-type mono c-Si grew to 51% - up from 20% in 2021 (and 5% in 2019).

• In 2022, the United States produced a around 5 GW of PV modules.

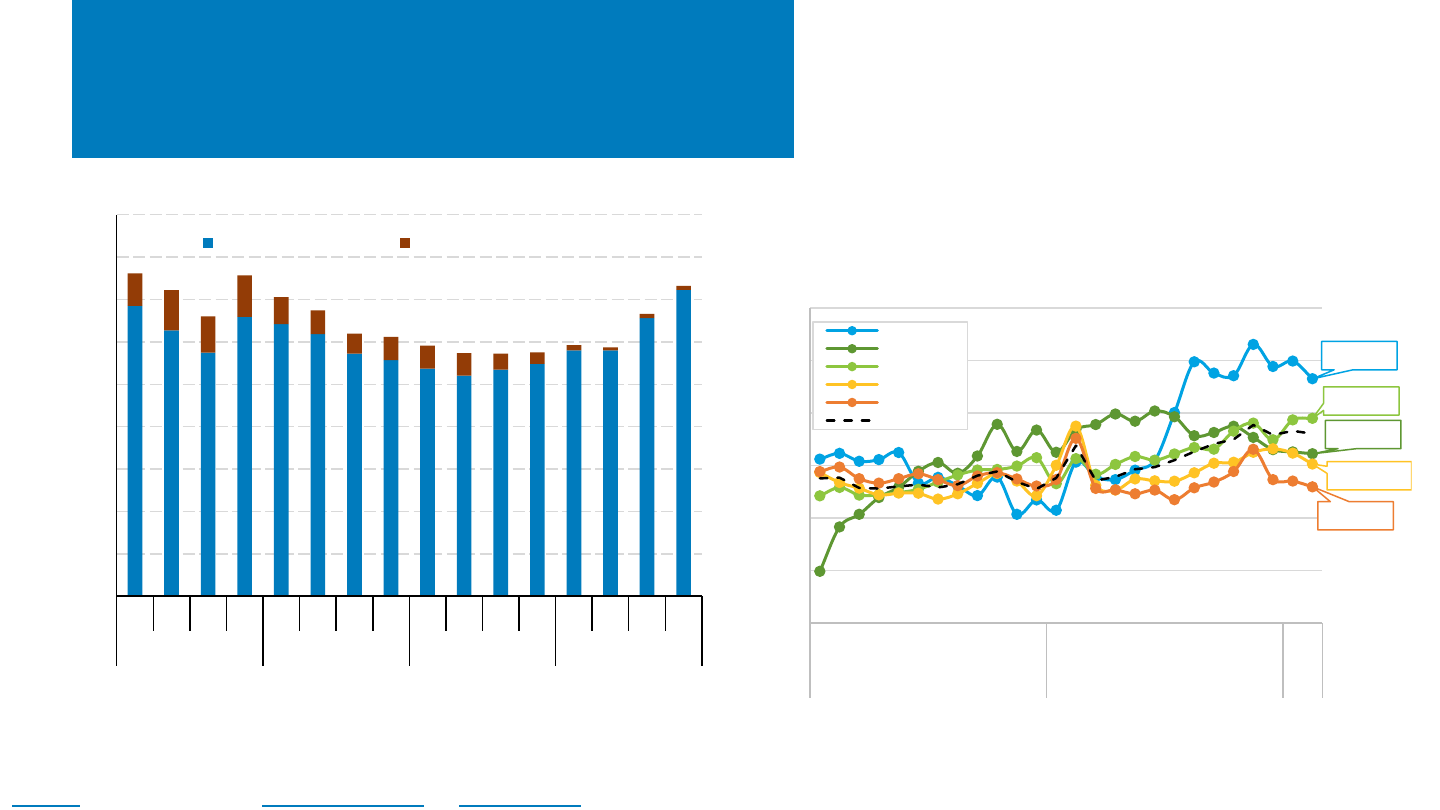

U.S. PV Imports

• According to U.S. Census data, 28.7 GWdc of modules and 2.5 GWdc of cells were

imported in 2022, an increase of 21% y/y (+5 GW) and 7% y/y (178 MW), respectively.

• Collectively, Malaysia, Vietnam, Thailand, and Cambodia represented 73% of c-Si

module imports (75% including c-Si cells).

• According to U.S. Census data, 2.5 GWdc of cells were imported in 2022. Quarterly cell

imports grew for the second quarter in a row in Q4 2022 (+60 MWdc, +9% q/q).

• In 2022, only 10% (2.7 GWdc) of modules reported a tariff, compared to 56% (13.2

GWdc) in 2021.

Executive Summary

A list of acronyms and abbreviations is available at the end of the presentation.

NREL | 4

Agenda

Global Solar Deployment1

U.S. PV Deployment

2

PV System Pricing

3

Global Manufacturing

4

Component Pricing

5

Market Activity

6

7 U.S. PV Imports

• IEA reported that in 2022, 240 GWdc of PV was installed

globally, bringing cumulative PV installs to 1.2 TWdc.

– China’s annual PV installations grew 93% y/y in 2022,

representing 44% of total global demand, with the

majority coming from distributed PV.

– The U.S. was the second-largest market in terms of

cumulative and annual installations.

• Analysts project 2023 annual installations to grow to more

than 300 GW and by 2025 more than 400 GW.

• At the end of 2022, global CSP capacity reached

approximately 6.4 GW, with 1.3 GW under construction.

NREL | 5NREL | 5

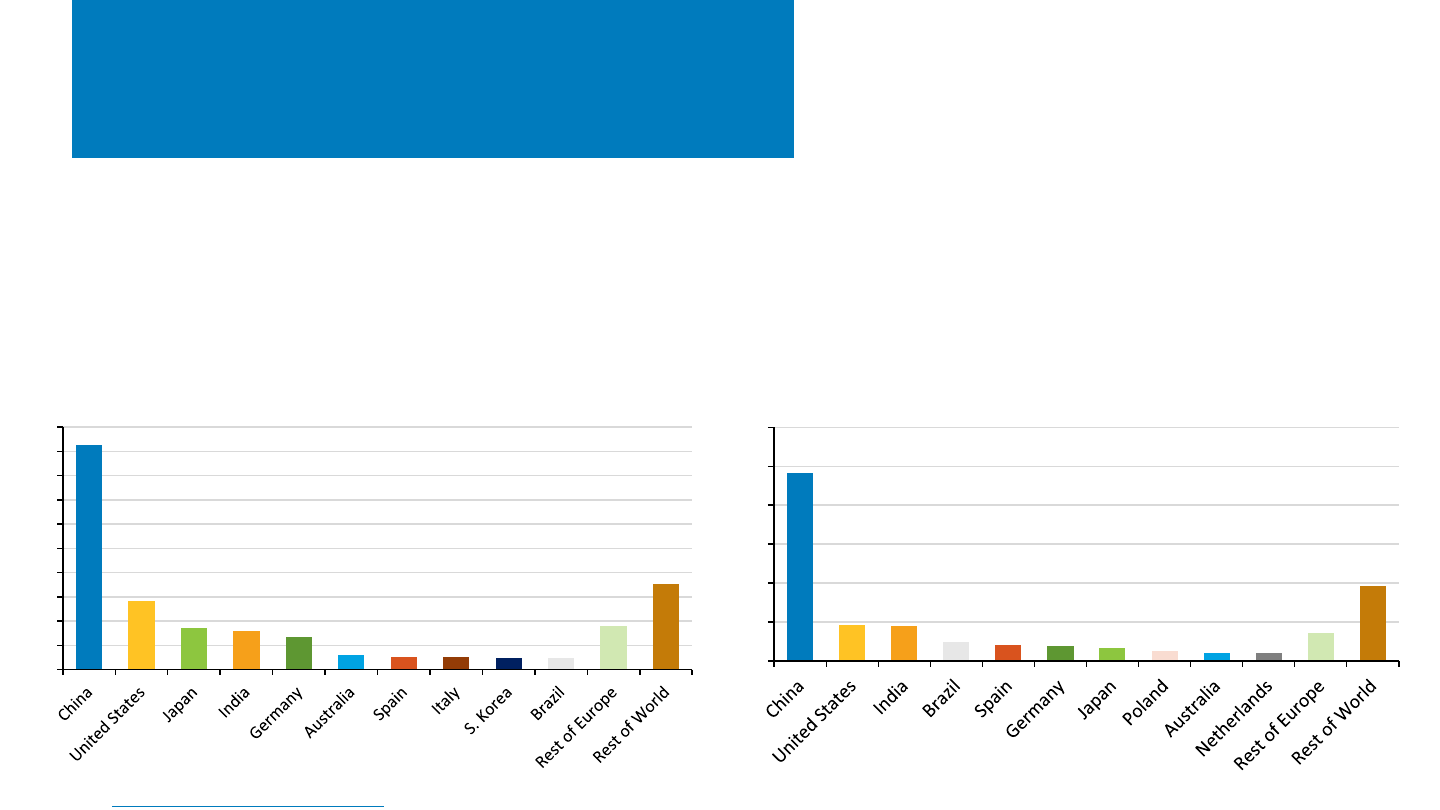

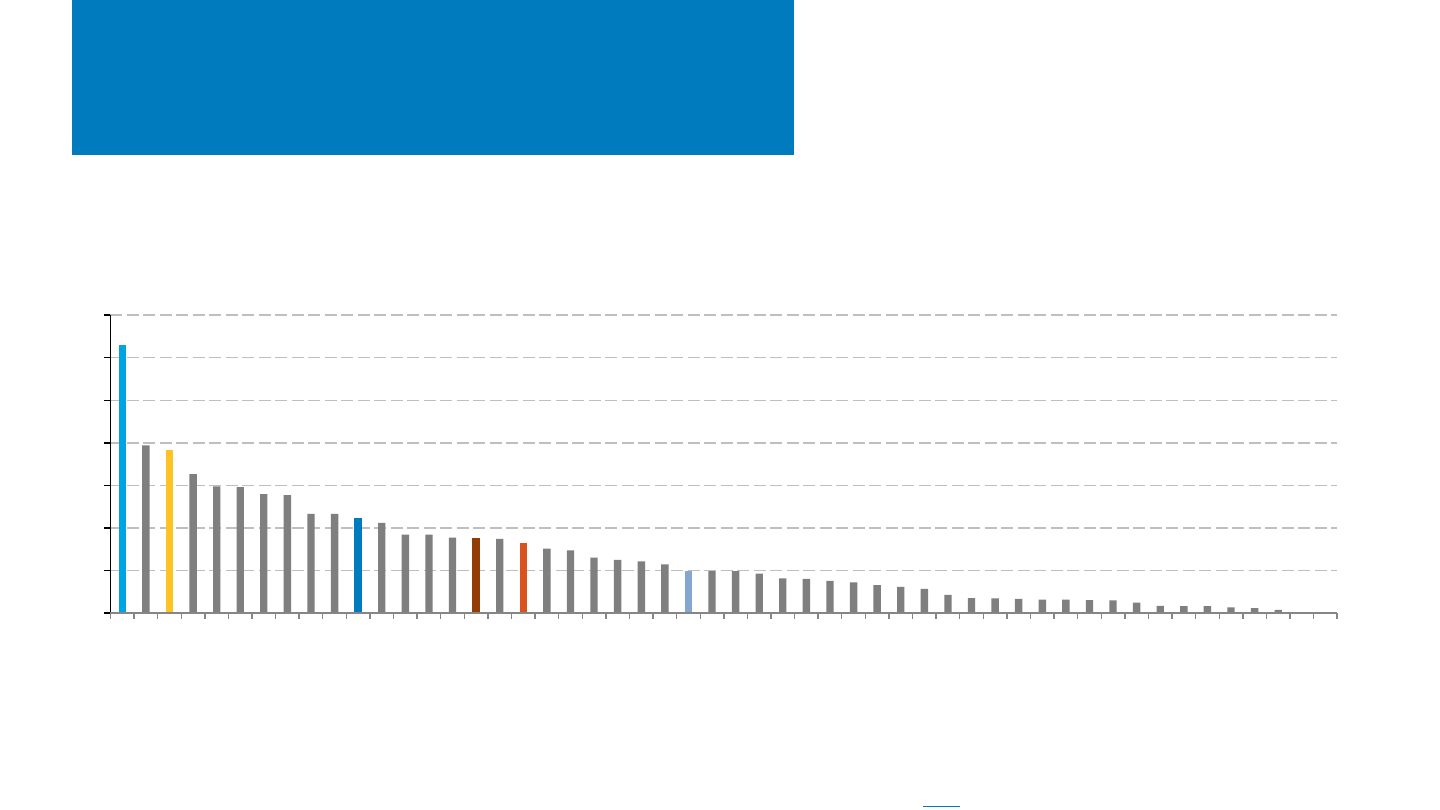

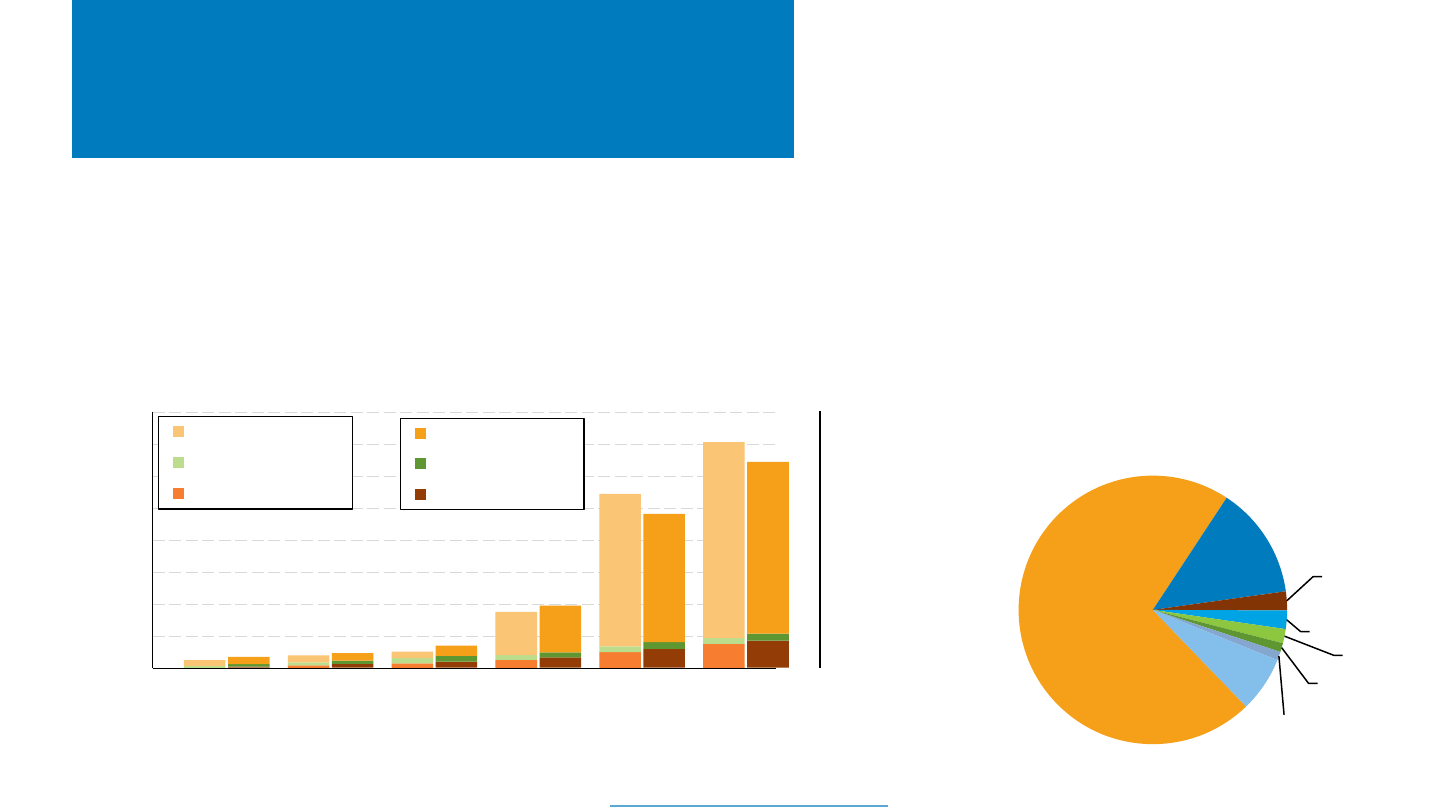

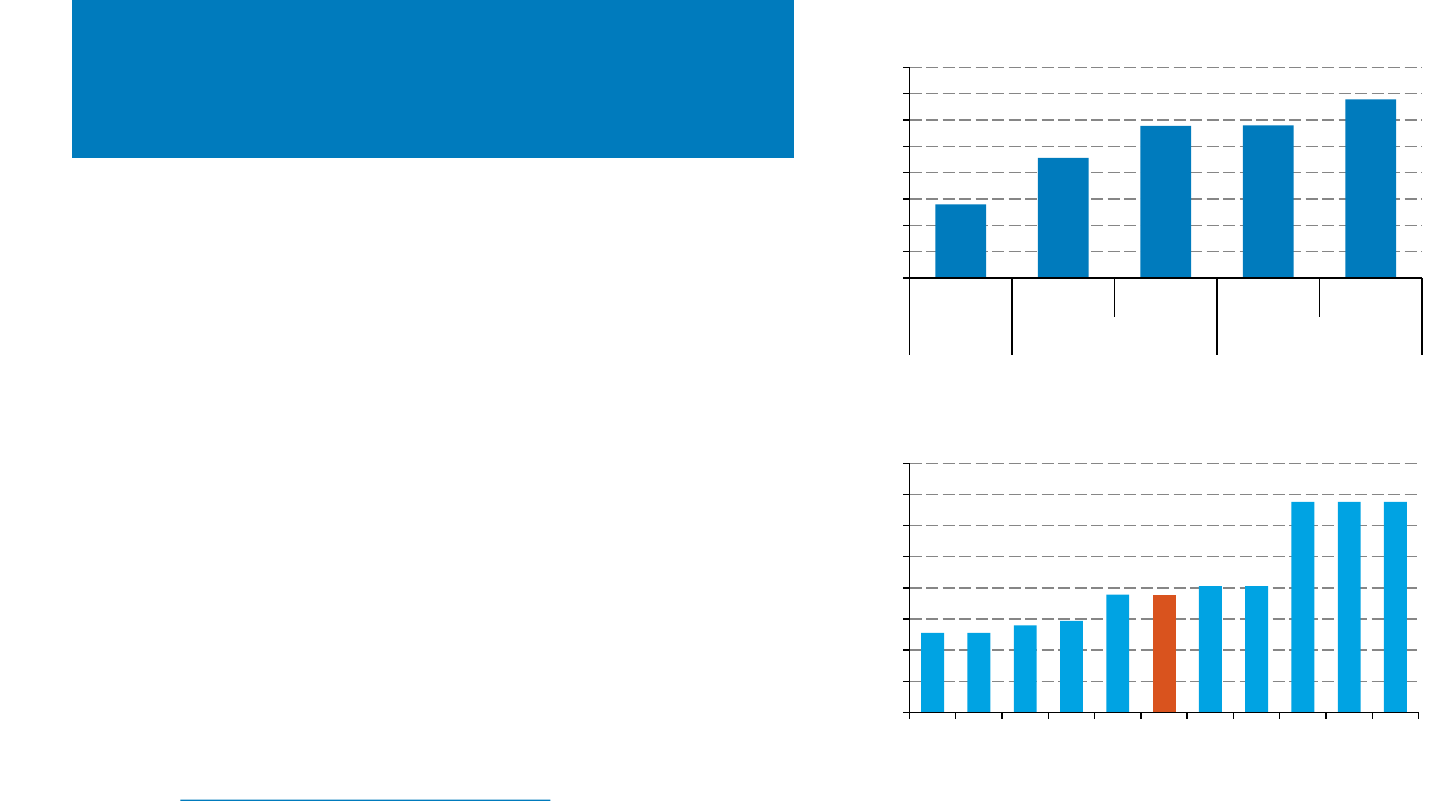

Top PV Markets

• The leading 10 markets in terms of cumulative capacity remained

relatively unchanged between 2021 and 2022.

– Brazil jumped ahead of Vietnam for the 10

th

spot in 2022.

• China’s annual PV installations grew 57% y/y in 2022,

representing 42% of total global demand.

• In 2022, despite a market contraction, the United States

was the second-largest PV country market in terms of

both cumulative and annual installations.

– The EU, however, was the second-largest market,

with 209 GWdc of cumulative installations (17% of

global installations and 3 countries in the top 10)

and 38.7 GWdc annual installations (17% of global

installations and 4 countries in the top 10) in 2022.

462

142

85

79

67

30

27

25

25

24

91

177

0

50

100

150

200

250

300

350

400

450

500

Cumulative PV Deployment - 2022 (1,233 GWdc)

96.6

18.6

18.1

9.9

8.1

7.5

6.5

4.9

3.9 3.9

14.3

38.3

0

20

40

60

80

100

120

Annual PV Deployment - 2022 (231 GWdc)

Note: Chinese numbers were adjusted, assuming Chinese DPV reported in Watts-DC (with an ILR of 1.1) and UPV reported in Watts-AC (with an ILR of 1.3).

Sources: IEA, Snapshot of Global PV Markets: 2023; Trends in Photovoltaic Applications 2022.

NREL | 6NREL | 6

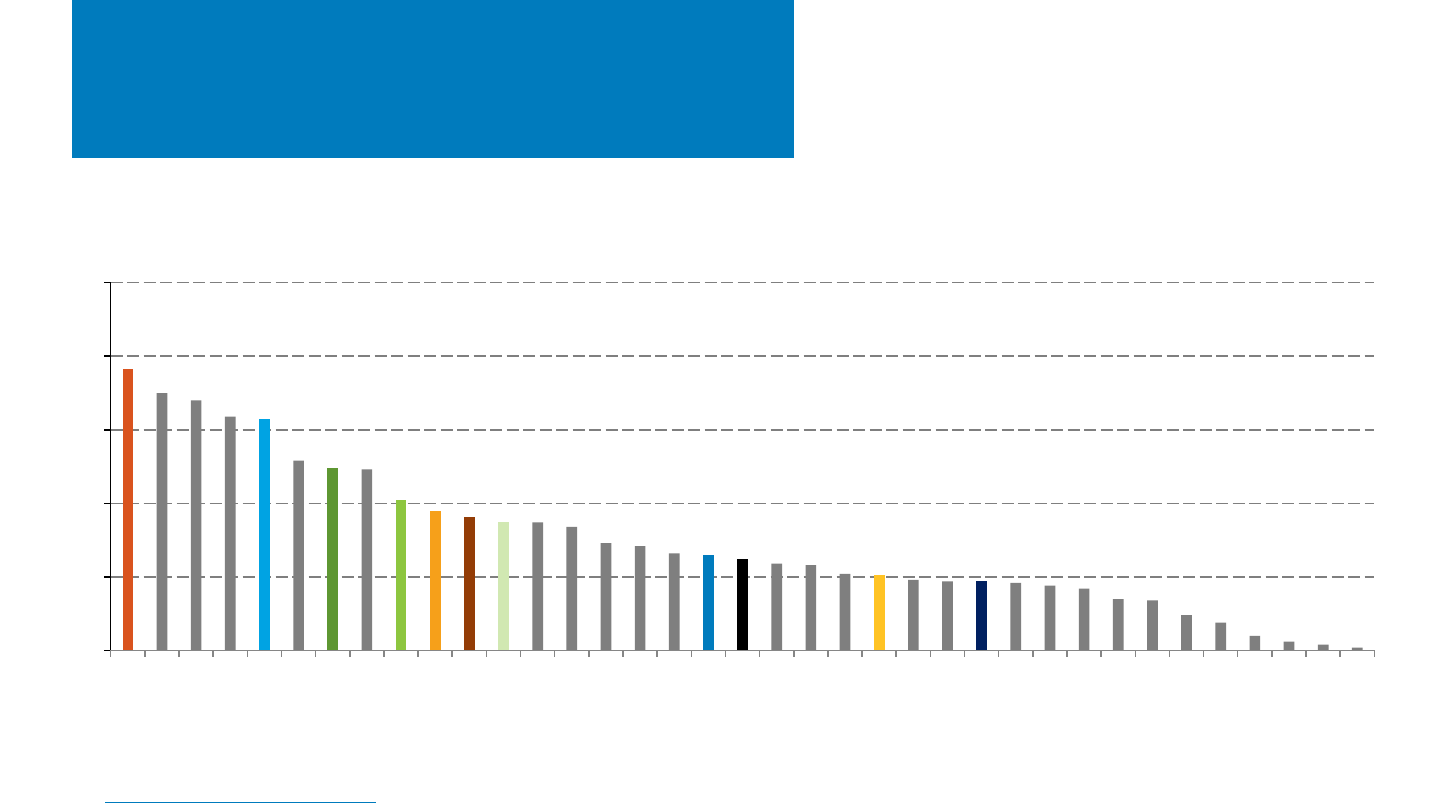

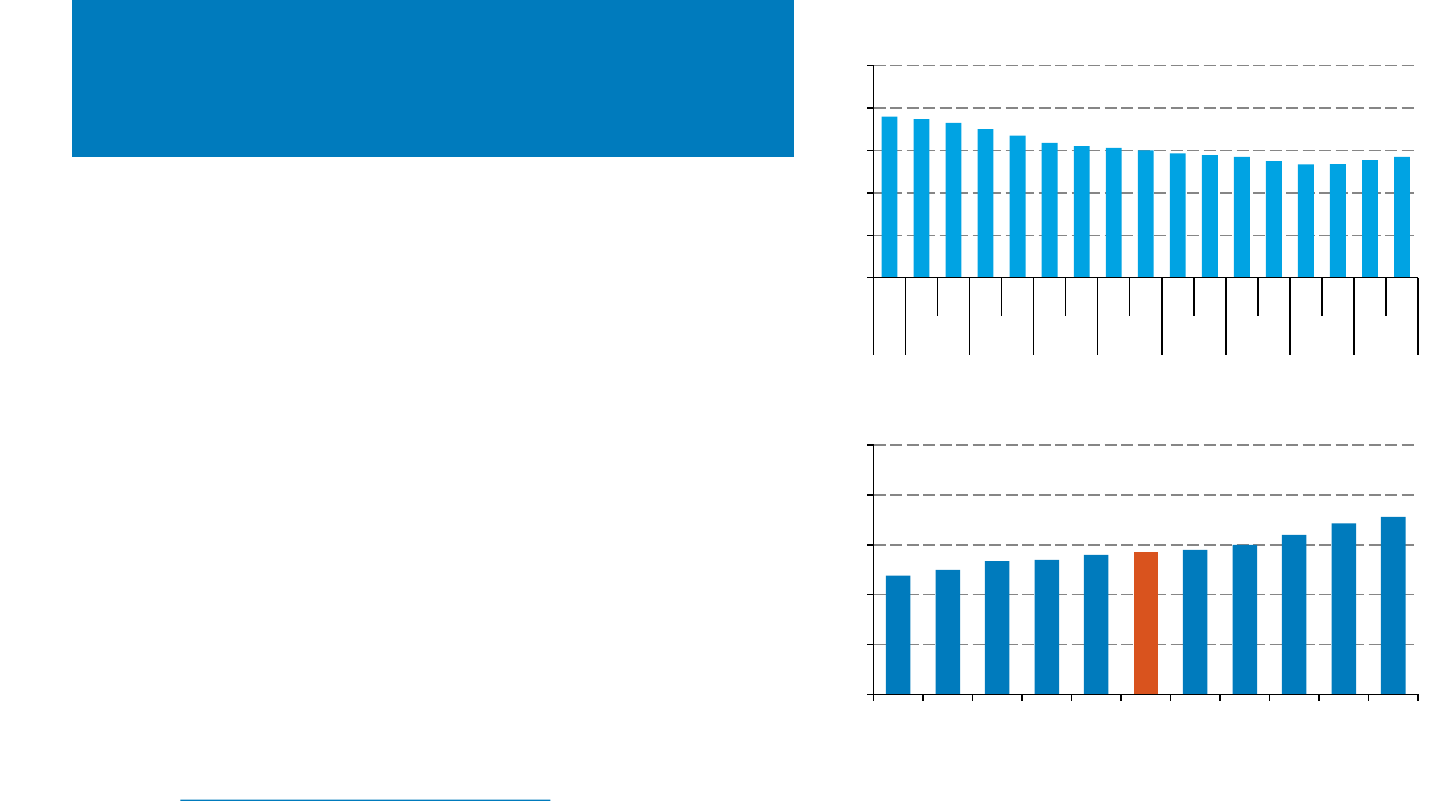

Global PV Penetration

• The United States, despite being a leading PV market, is

below the global average and other leading markets in

terms of PV generation as a percentage of total country

electricity generation, with 5%.

– If California were a country, its PV contribution

(28%) would be the highest.

• IEA estimates that in 2022, 6% of global electricity generation came

from PV.

Source: IEA, Snapshot of Global PV Markets: 2023.

0%

5%

10%

15%

20%

25%

Spain

Greece

Chile

Netherl…

Australia

Honduras

Germany

Israel

Japan

India

Italy

EU

Belgium

Portugal

Denmark

Switzerl…

Turkey

China

World

Austria

Bulgaria

Mexico

USA

Morocco

UK

S. Korea

France

Romania

S. Africa

Czech…

Thailand

Slovakia

Sweden

Canada

Malaysia

Finland

Norway

Percent of Annual Electricity Generation

NREL | 7NREL | 7

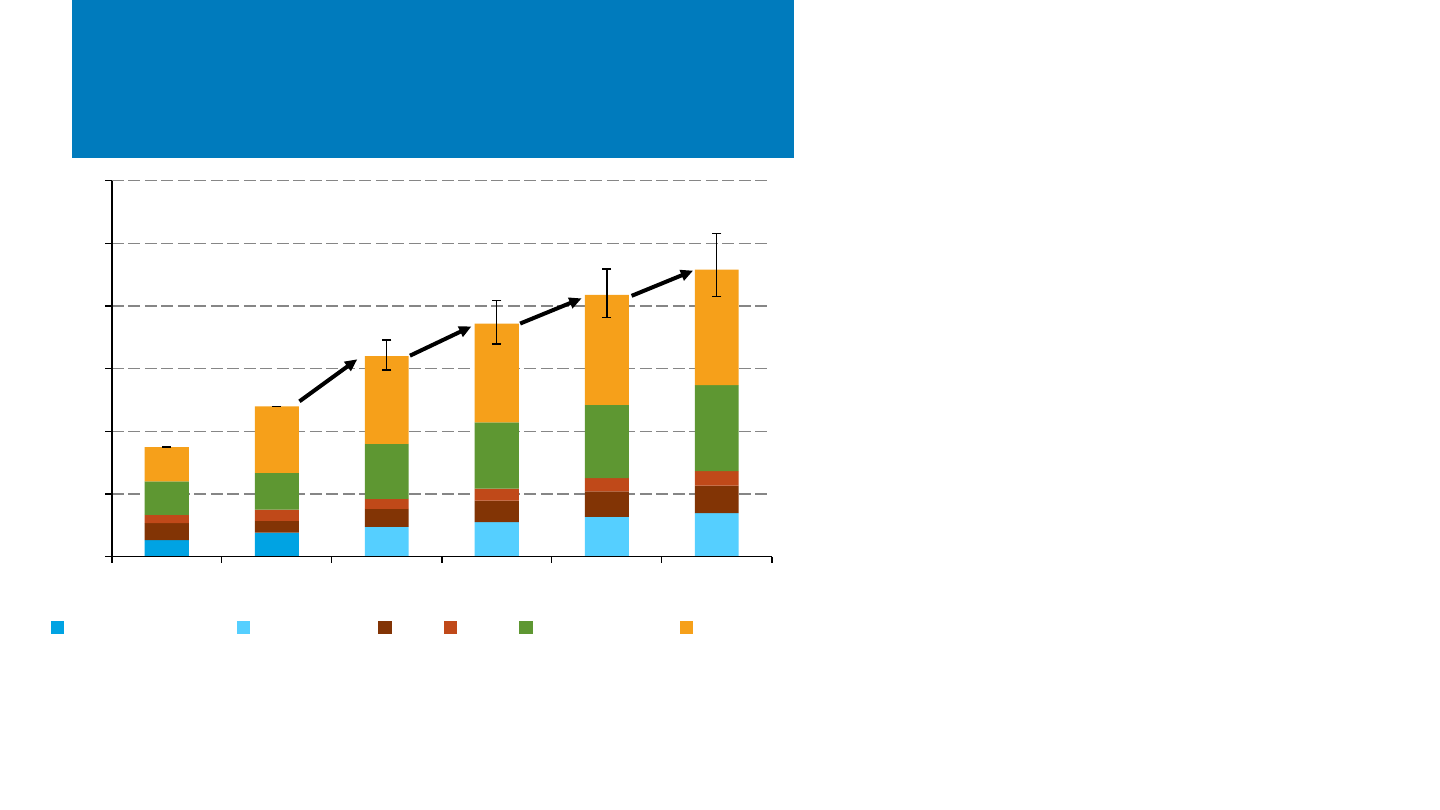

0

100

200

300

400

500

600

2021 2022 2023P 2024P 2025P 2026P

PV Annual Installations (GWdc)

European Union Europe (All) U.S. India Rest of World China

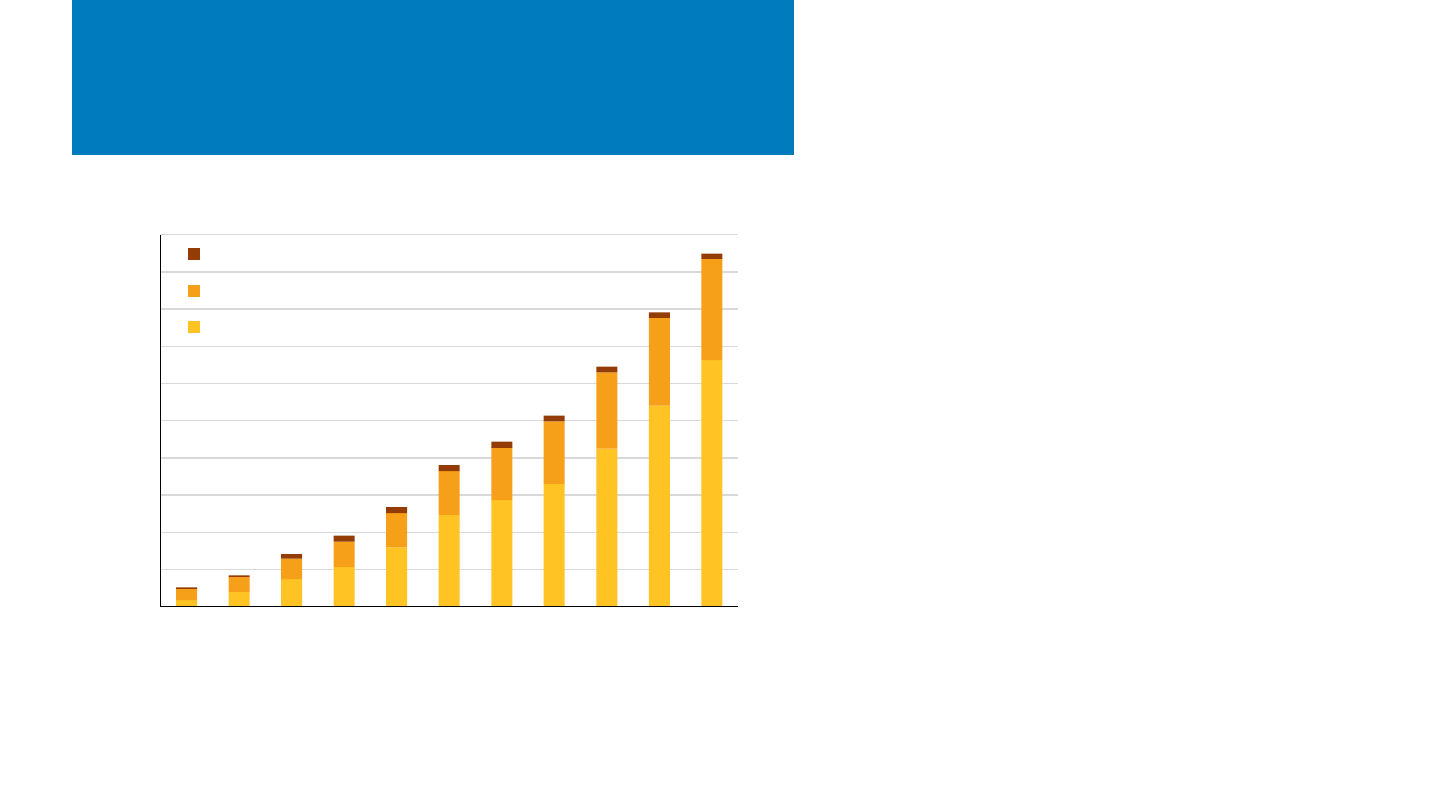

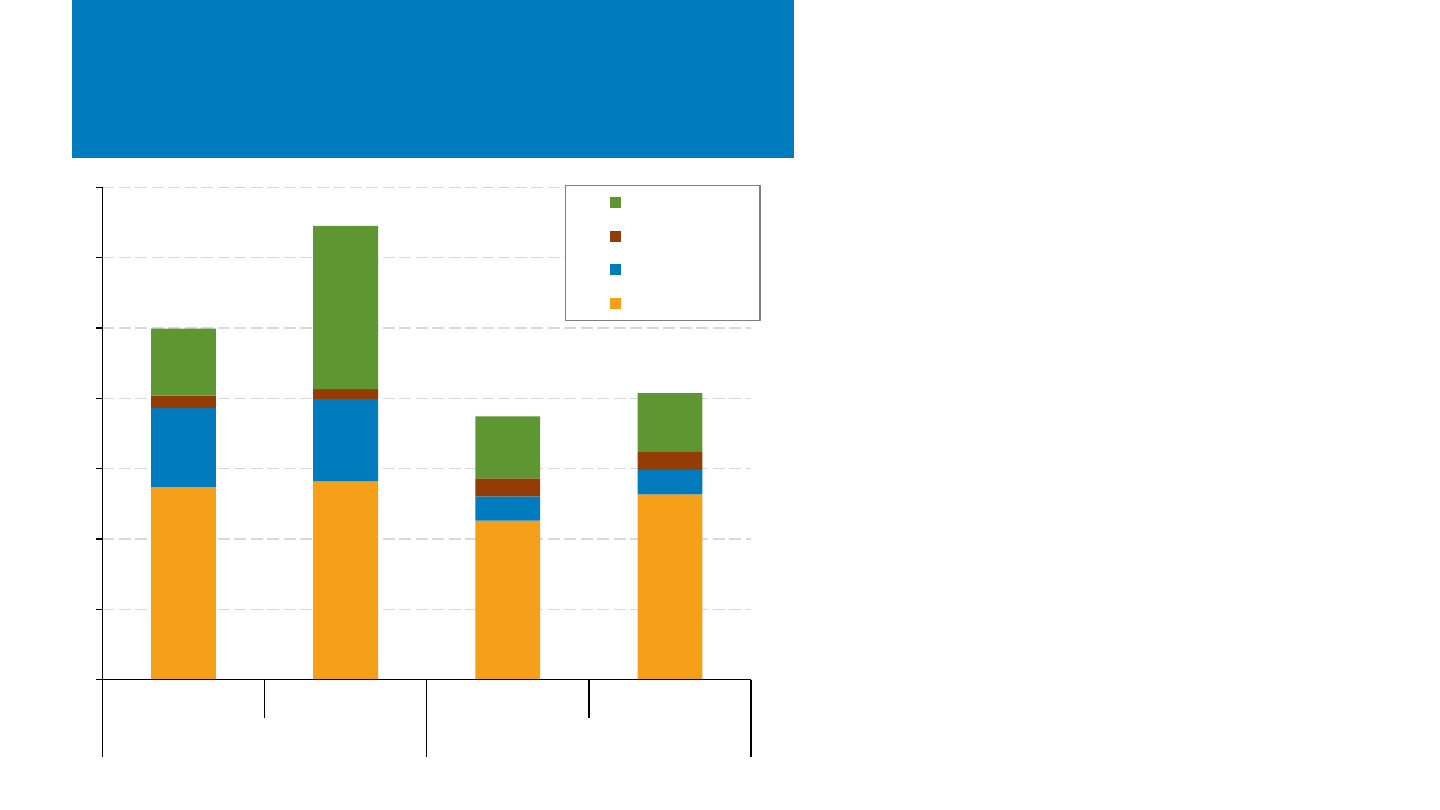

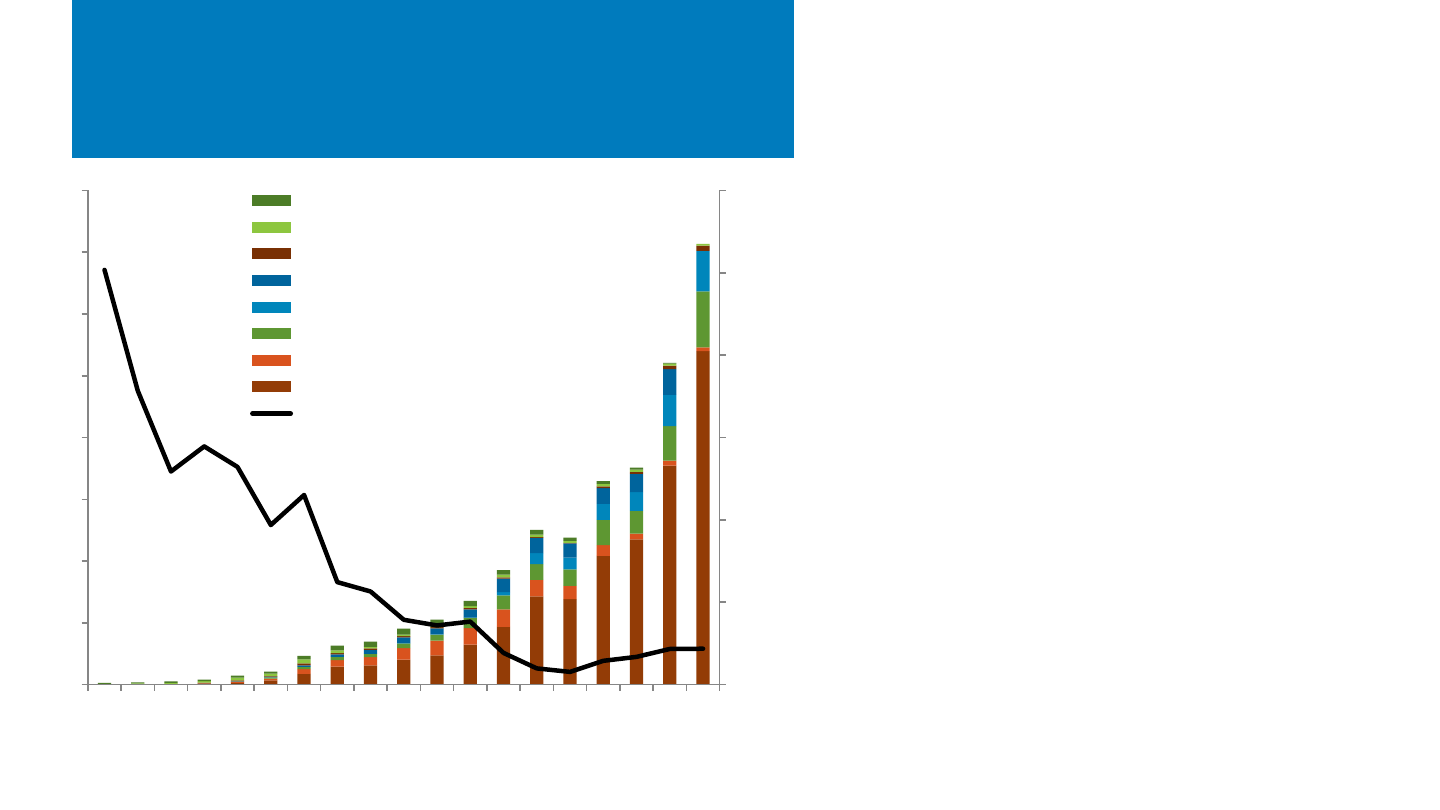

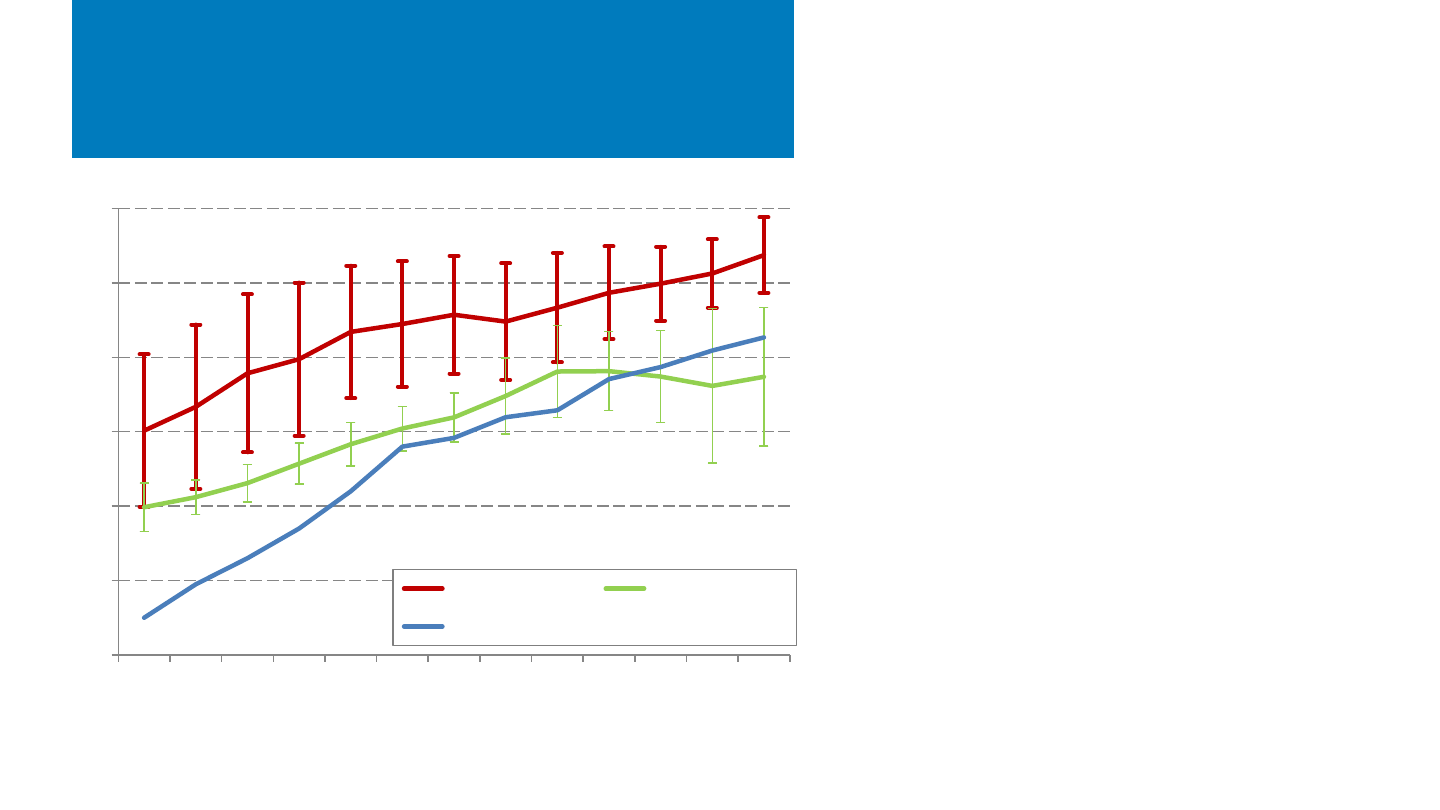

Annual Global PV Demand

Notes: E = estimate, P = projection. Colored bars represent median projections for region/country-level

estimates. Error bars represent high and low global projections. Not all sources have data for all categories.

Sources: BNEF, 1Q 2023 Global PV Market Outlook, 2/28/23; Goldman Sachs Equity Research, America’s

Clean Technology: Solar, 2023 Outlook, 12/18/22; IEA, Snapshot of Global PV Markets: 2022, 4/22; IEA,

Snapshot of Global PV Markets: 2023, 4/23; U.S. Energy Information Administration, Annual Energy

Outlook 2023, 3/16/23; U.S. Energy Information Administration, Monthly Energy Review, 12/22; Wood

Mackenzie and SEIA, US Solar Market Insight, 2022 Year in Review, 3/23.

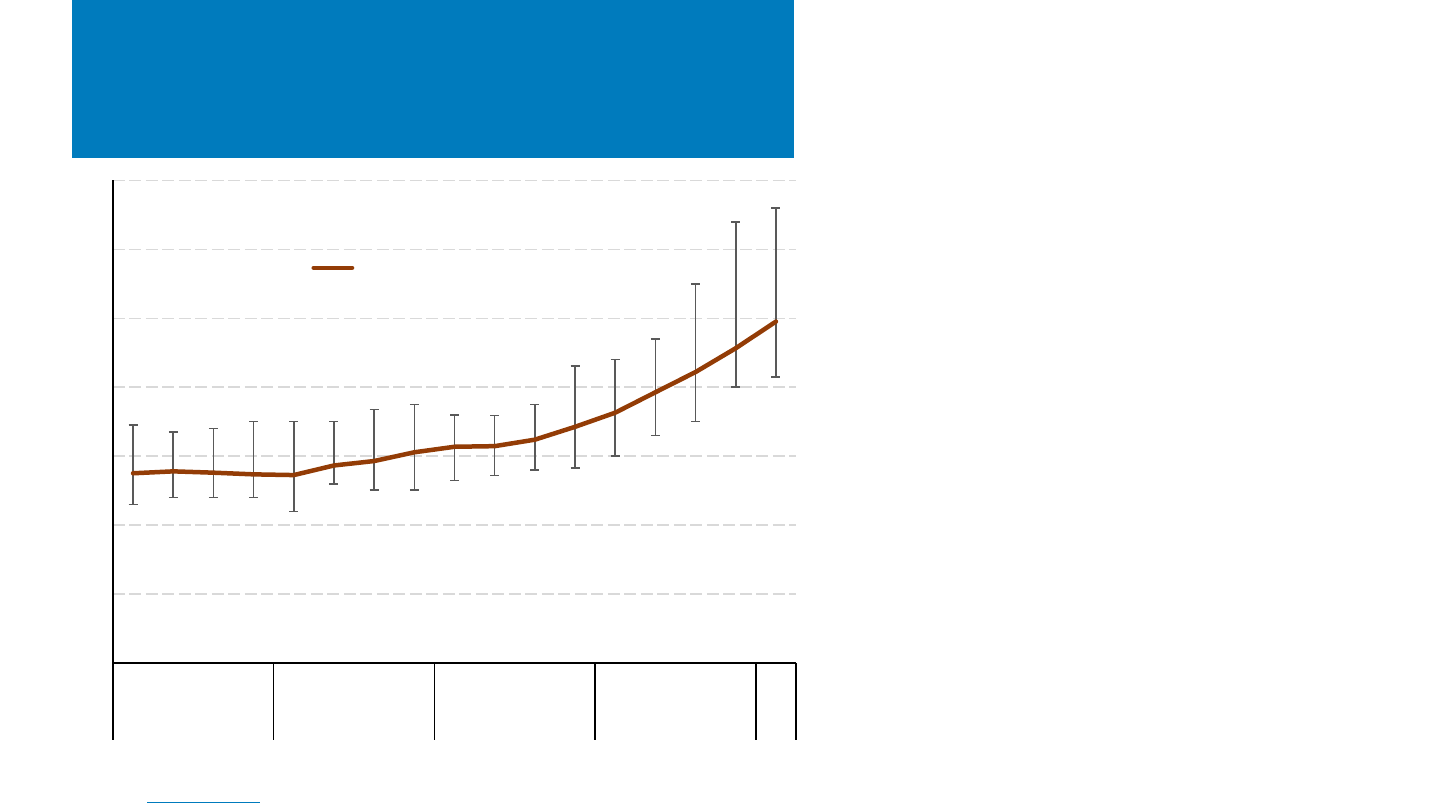

• About 240 GWdc of PV were installed globally in 2022.

• Analysts project continued increases in annual global PV

installations.

– 320 GWdc in 2023

– 372 GWdc in 2024

– 418 GWdc in 2025

– 458 GWdc in 2026.

• Analysts who provided global projections 1 year ago

increased those projections this year (e.g., by 34%–38%

for 2025 projections).

• China, Europe, the United States, and India account for

about 70% of global PV installations over the period

shown.

+33%

+16%

+12%

+10%

NREL | 8NREL | 8

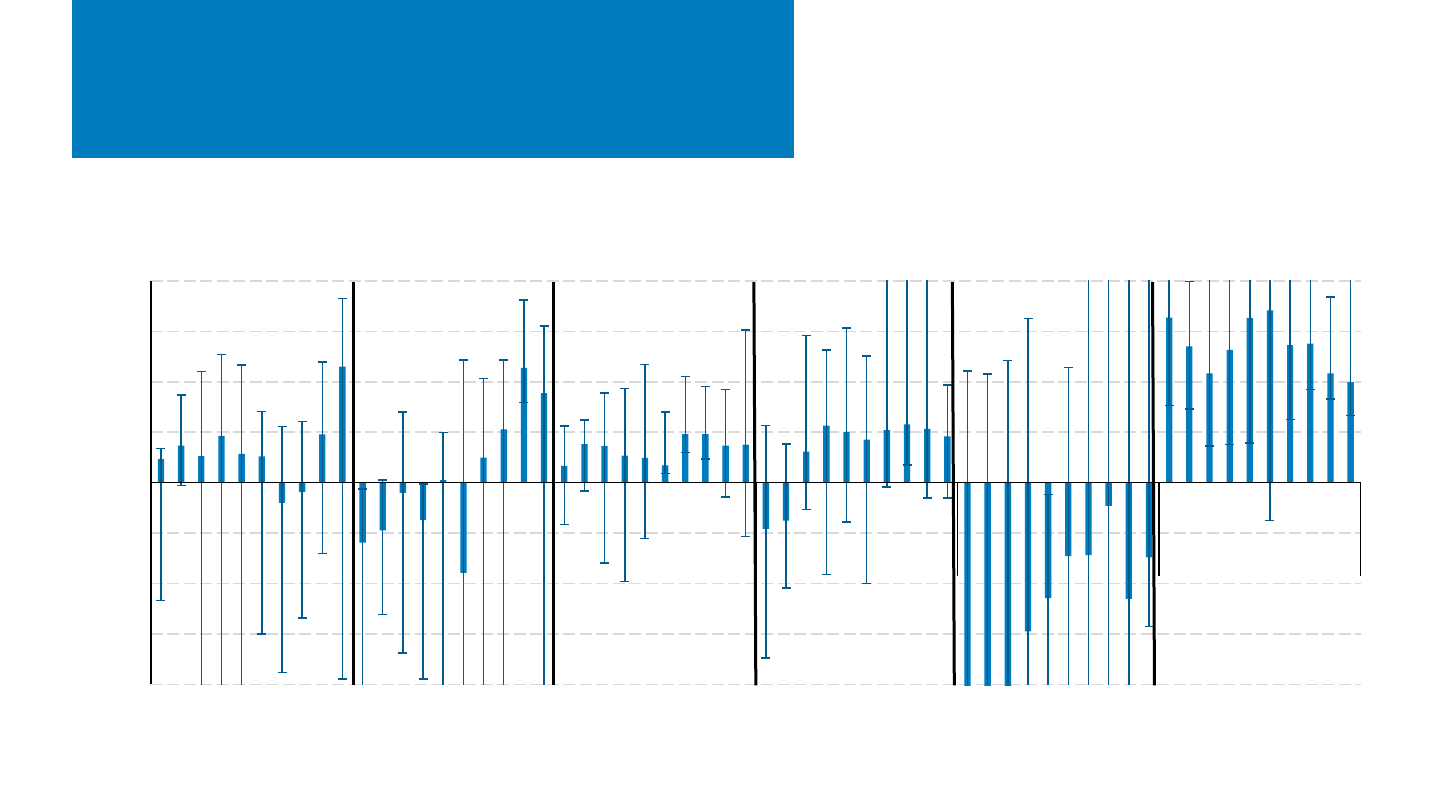

Change in Recent Global PV

Demand Projections

0

100

200

300

400

500

2020 2021 2022 2023 2024 2025 2026

PV Annual Installations (GWdc)

1

2

3 4

Reported Drivers of Growth in Installed PV Projections

1. Projections in Mid to Late 2021: COVID-19 coming

under control, improving supply chains, reduced

geopolitical trade risks.

2. Projections in Early 2022: invasion of Ukraine by

Russia, increasing desire for energy security, increasing

conventional energy prices, improving supply chains,

higher national PV targets.

3. Projections in Mid to Late 2022: increasing

conventional energy prices, increasing polysilicon supply,

declining module prices, adjusting for underestimation of

global market in official installation statistics.

4. Projections in Late 2022 to Early 2023: oversupply

throughout supply chain, declining module prices, large

module inventories, IRA and other U.S. policies, energy

cost inflation in Europe, supply chain normalization in

China, potentially explosive growth constrained only by

local conditions (permitting, interconnection, labor,

financing, etc.).

1

2

3

4

+81 GW

+34 GW

+42 GW

261 GW

in 2025

Sources: BNEF, Global PV Market Outlook, 11/25/21, 3/1/22, 8/26/22, 2/28/23; Goldman Sachs, Americas Clean Technology: Solar 2021 Outlook, 01/09/22; Goldman Sachs,

Americas Clean Technology: Solar, Assessing the Impact of Volatile Macro - Oil, Commodities & EU in Focus, Raise Demand View Thru 2025, 3/29/22; Goldman Sachs, America’s

Clean Technology: Solar, 2023 Outlook, 12/18/22; NREL, Solar Industry Update, 1/11/22, 4/26/22, 10/27/22, 4/27/23; Solar Power Europe, Global Market Outlook For Solar Power

2021-2025, 7/20/21; SolarPower Europe, Global Market Outlook For Solar Power: 2022-2026, 5/22.

NREL | 9NREL | 9

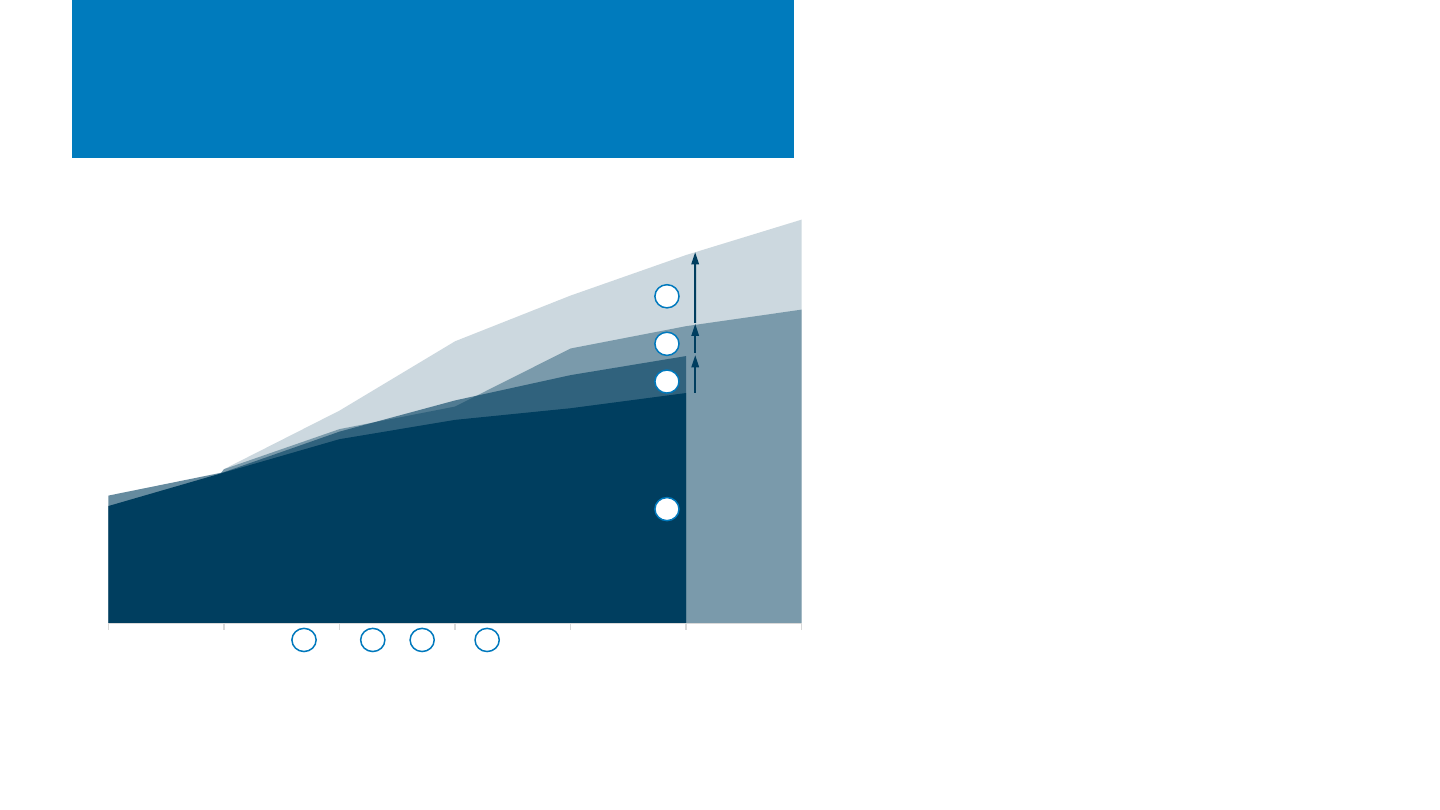

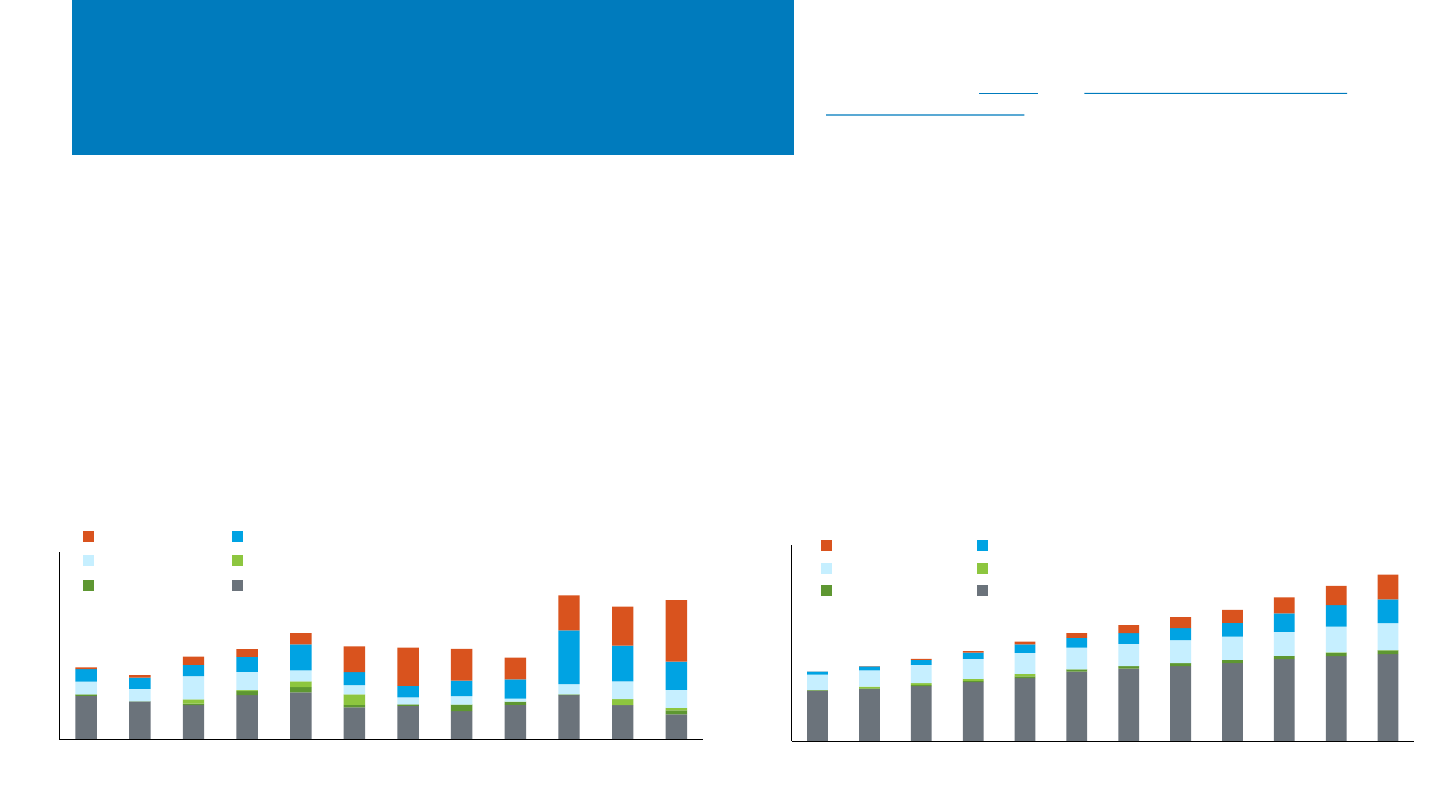

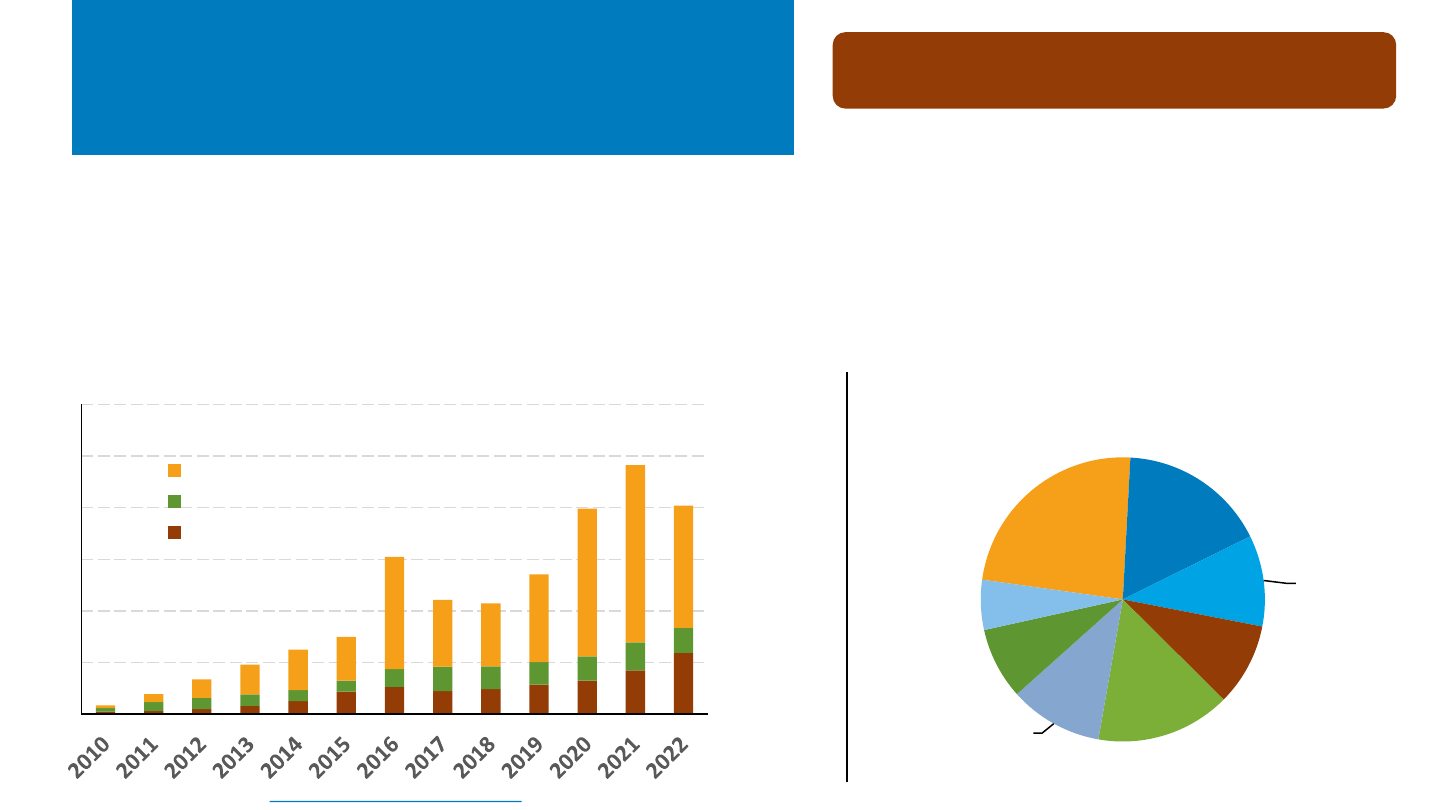

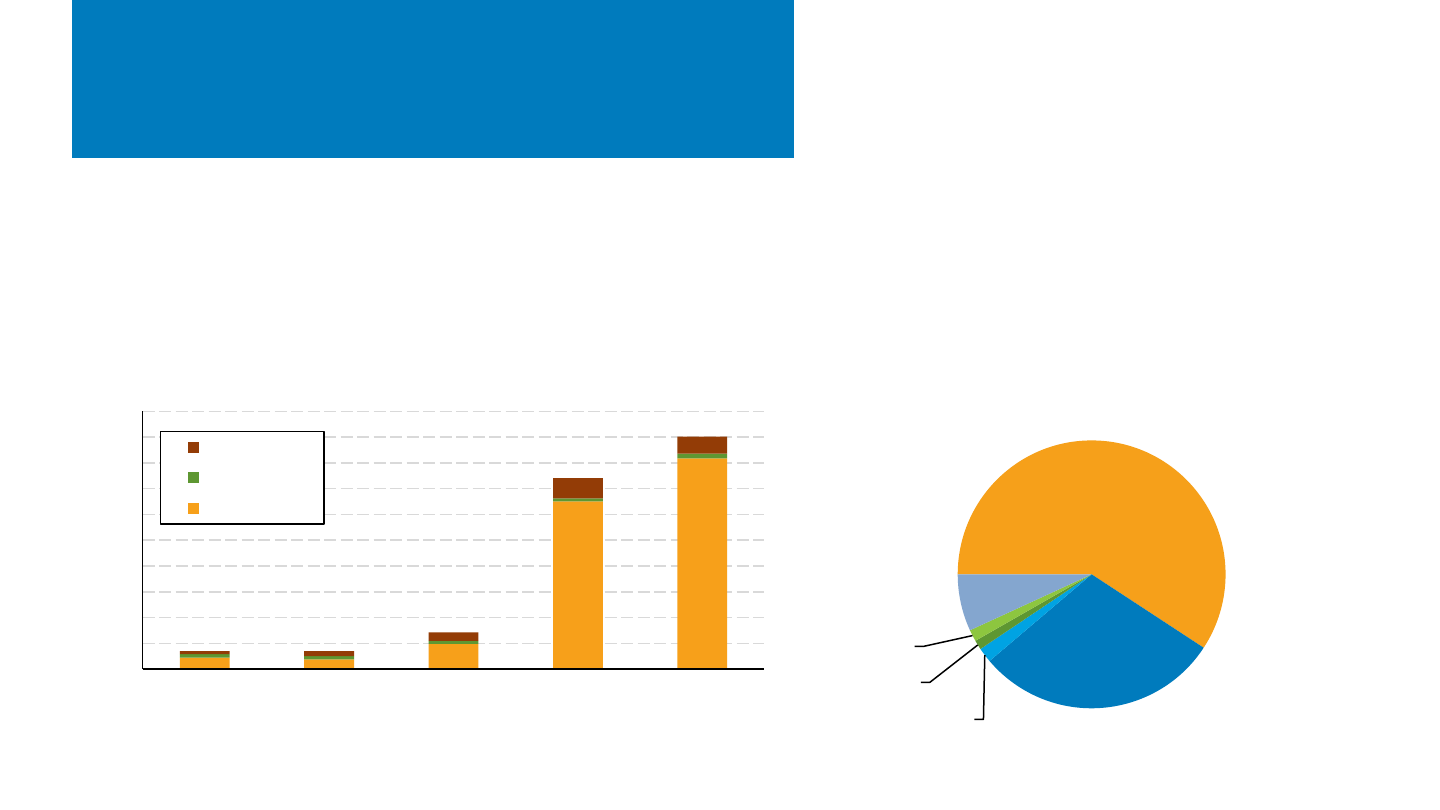

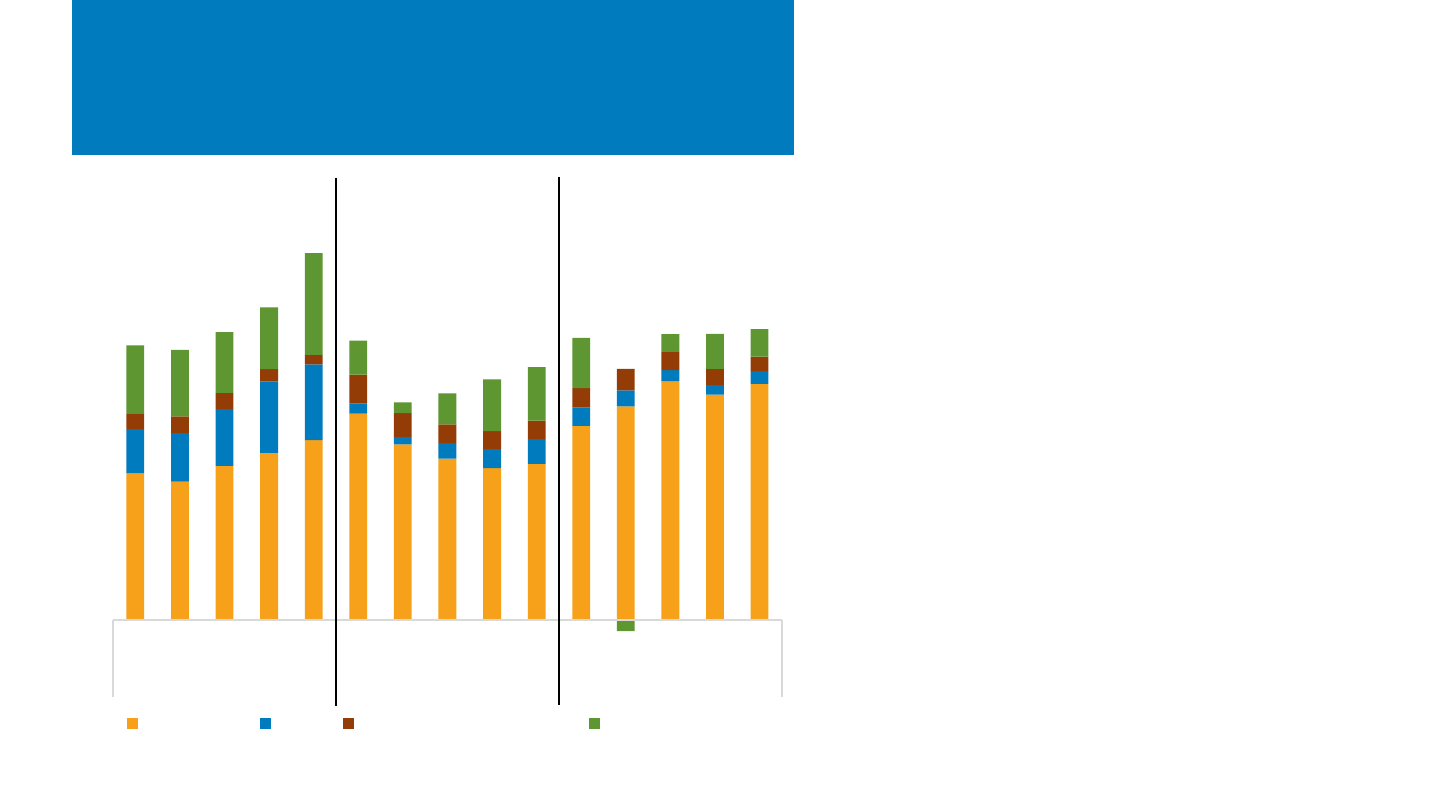

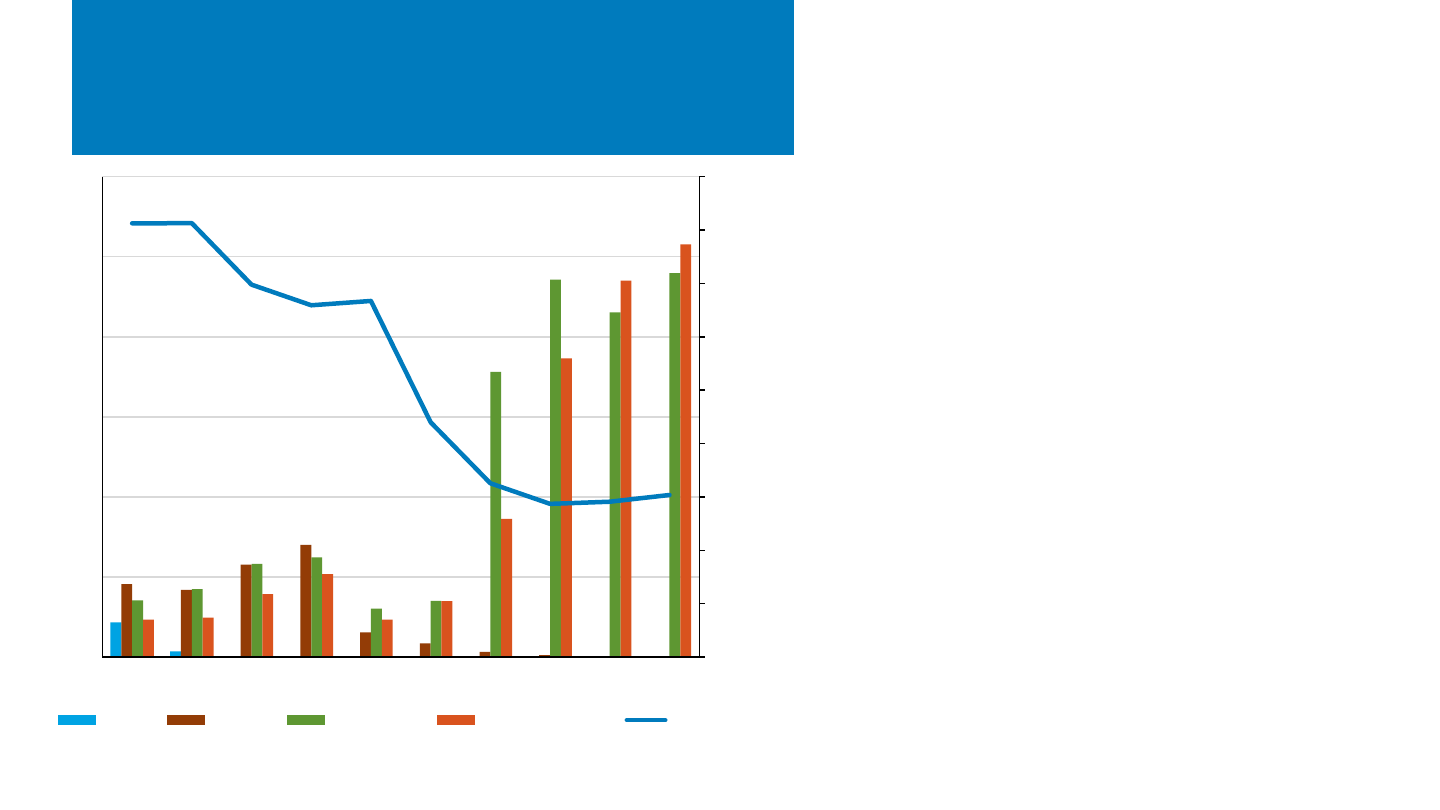

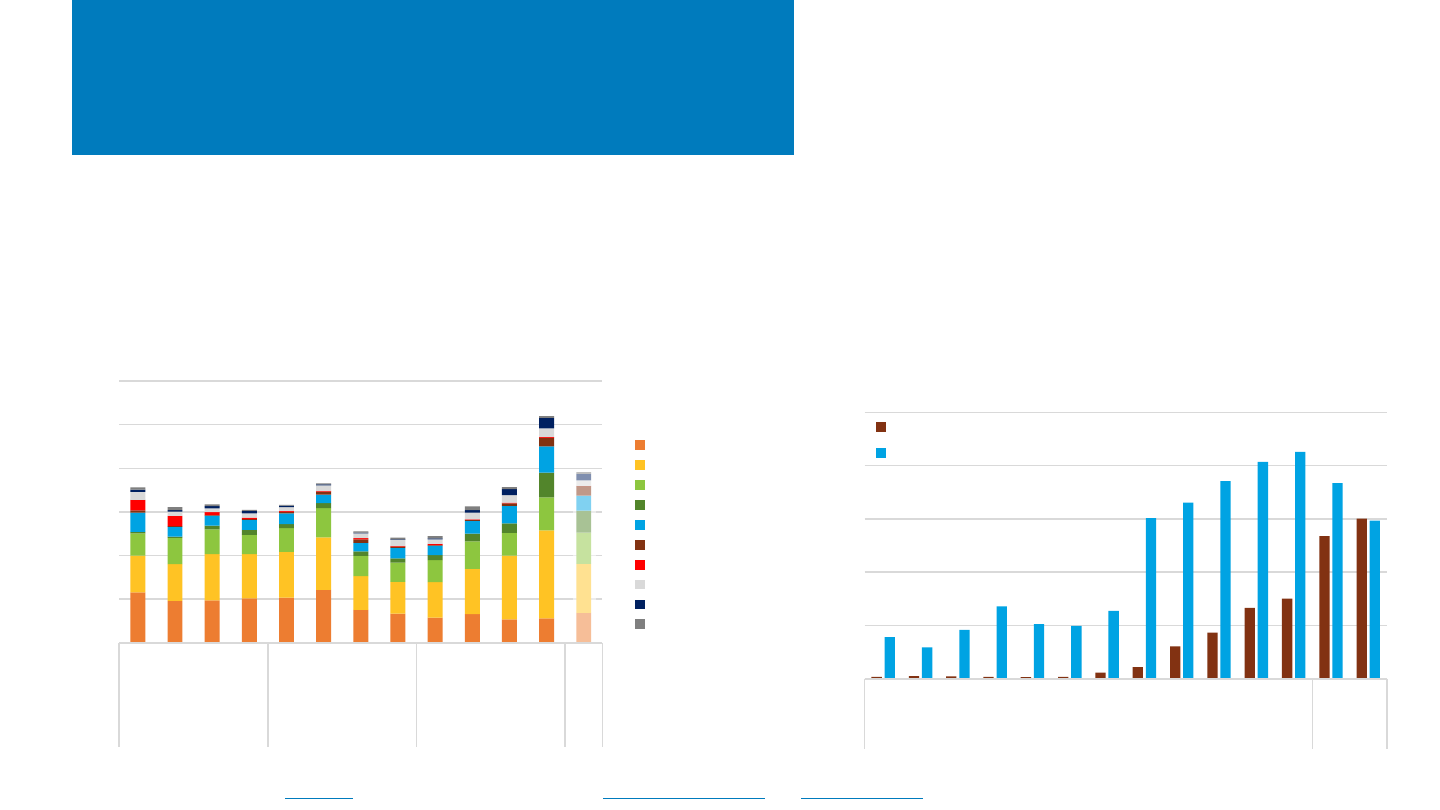

Chinese Generation Capacity

Additions by Source

Note: Based on new information, annual and cumulative solar values now assume

that China’s National Energy Administration (NEA) reports distributed PV in direct

current terms and utility-scale PV in alternating current terms.

Sources: China NEA (1/18/23); IEA, National Survey Report of PV Power

Applications in China, 2021

.

• In 2022, solar contributed 44% to new generation capacity in China (97 GWdc/82

GWac) and 15% of cumulative capacity (462 GWdc/378 GWac).

– The record for annual solar installed was broken for the second year in a row.

– In 2022, 61% of new PV was distributed, 39% was utility scale.

– Wind and solar accounted for 64% of capacity installed in 2022, and together

they have constituted the most capacity installed for 7 years running.

– Annual coal and gas additions fell for the second year in a row, reaching the

lowest level in more than a decade.

• Renewable sources continue to capture a larger

share of China’s growing electric capacity.

– In 2011, renewables made up 26% of 1.1 TW of

total capacity.

– In 2022, renewables made up 45% of 2.5 TW of

total capacity.

15

34

51

42

29

47

52

82

96

84

111

121

142

125

125

123

111

191

178

186

0

50

100

150

200

250

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Annual Capacity Additions (GWac)

Solar ac Wind

Hydro Other

Nuclear Coal and Gas

41

75

126

168

197

244

296

378

1,063

1,147

1,258

1,379

1,521

1,652

1,777

1,900

2,011

2,200

2,373

2,545

0

500

1,000

1,500

2,000

2,500

3,000

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Cumulative Capacity (GWac)

Solar ac Wind

Hydro Other

Nuclear Coal and Gas

NREL | 10NREL | 10

Chinese Market Update

Sources: BloombergNEF, China Will Produce 430 GW of Modules in 2023

Industry Says, 3/8/23; BloombergNEF, China’s Rooftops Are Becoming the Key to

the World’s Solar Boom, 3/31/23; China NEA (1/18/23); PV Tech (3/28/23,

3/30/23).

• Although China has continued to deploy PV rapidly, headwinds include high supply chain prices, constraints on land development,

and lack of transmission from remote PV projects to densely populated areas.

• One solution is more rooftop PV—for the second year, China installed more distributed PV than utility-scale PV in 2022.

– Distributed PV now constitutes about 40% of total PV capacity.

– The 50 GWac of distributed PV installed in 2022 eclipsed the total renewable energy installed by any other country; about 1 of

every 4 modules installed globally in 2022 was on a Chinese rooftop.

– Distributed PV surged in 2021 and 2022 owing to subsidies, lower sensitivity to module price, high electricity rates charged to

businesses along with power outages and pressure to decarbonize, and a bulk-buying program for local governments.

– Challenges going forward include strains from excess PV generation on distribution grids—which is stimulating time-of-use

rate structures—expiration of national subsidies in 2021, and higher costs due to requiring storage paired with PV in most

provinces.

• Another solution is funneling utility-scale PV onto low-value lands—the Chinese government is promoting deployment in desert

areas and oil and coal fields while discouraging deployment on farmlands and areas with ecological or cultural value.

NREL | 11NREL | 11

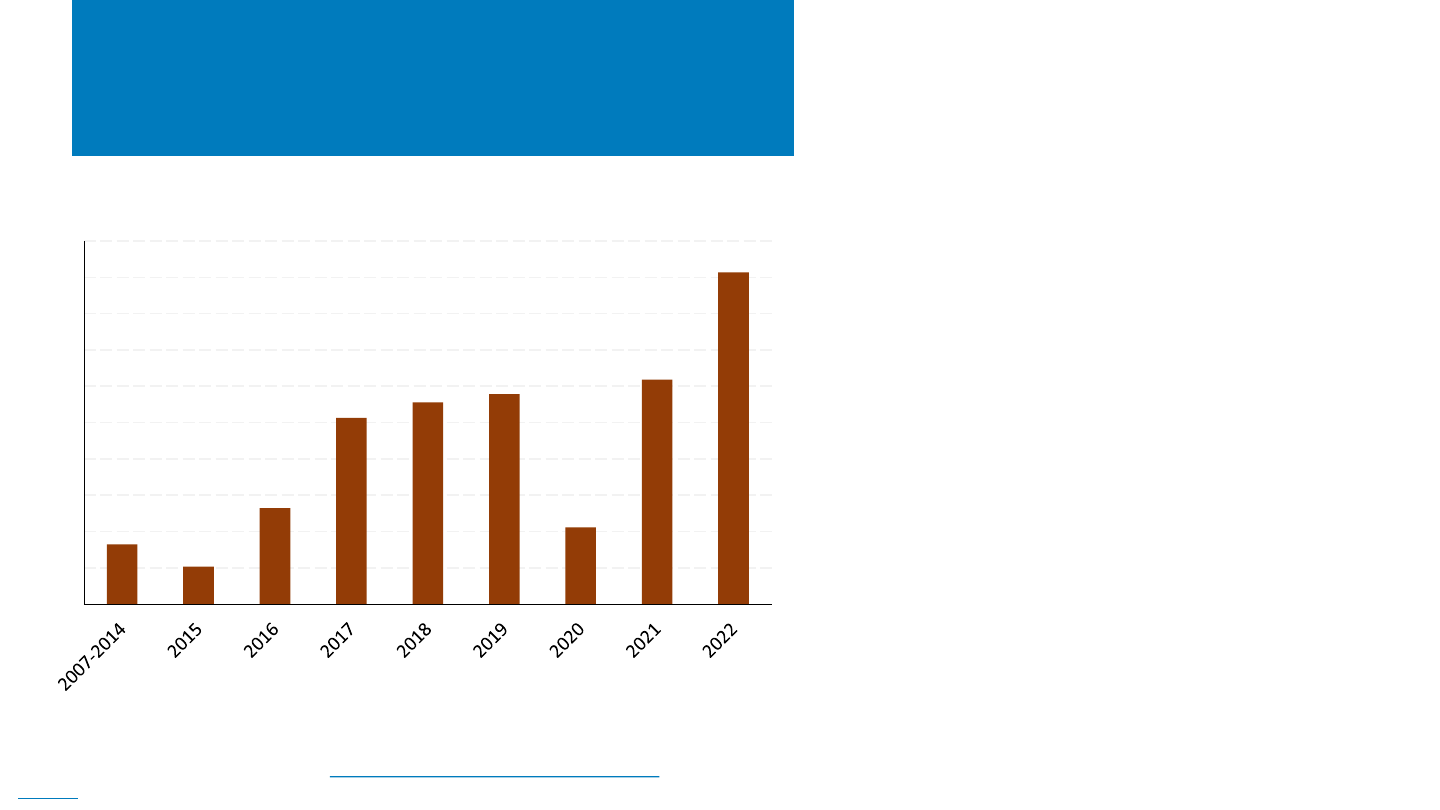

Indian Market Update

Sources: BNEF, 1Q 2023 Global PV Market Outlook, 2/28/23; BNEF, 1H 2023 India Renewables Market

Outlook, 2/28/23; Mercom India Research, Q4 & Annual 2022 India Solar Market Update, 2/20/23; Mercom

(2/28/23).

• India’s annual PV additions achieved a record in

2022 at 13 GWac (18 GWdc), up 27% from 2021.

– Large-scale projects increased 33% from 2021 and

made up 87% of new 2022 PV capacity.

– Rooftop projects decreased 4% from 2021 and made up

13% of new 2022 PV capacity.

– PV made up a record 82% of total capacity additions

and totaled 63 GWac at year end.

• Large project costs increased 7.3% in 2022.

– Costs increased for 10 consecutive quarters mainly

owing to higher module prices and supply constraints.

– PV auction tariffs rose for the first time in 2022,

primarily because of the higher equipment costs and

higher financing costs.

• At year end, 58 GWac of large projects were in the

pipeline, with another 51 GWac pending auction.

0

2

4

6

8

10

12

14

16

18

20

India's Annual PV Capacity Additions (GWdc)

NREL | 12NREL | 12

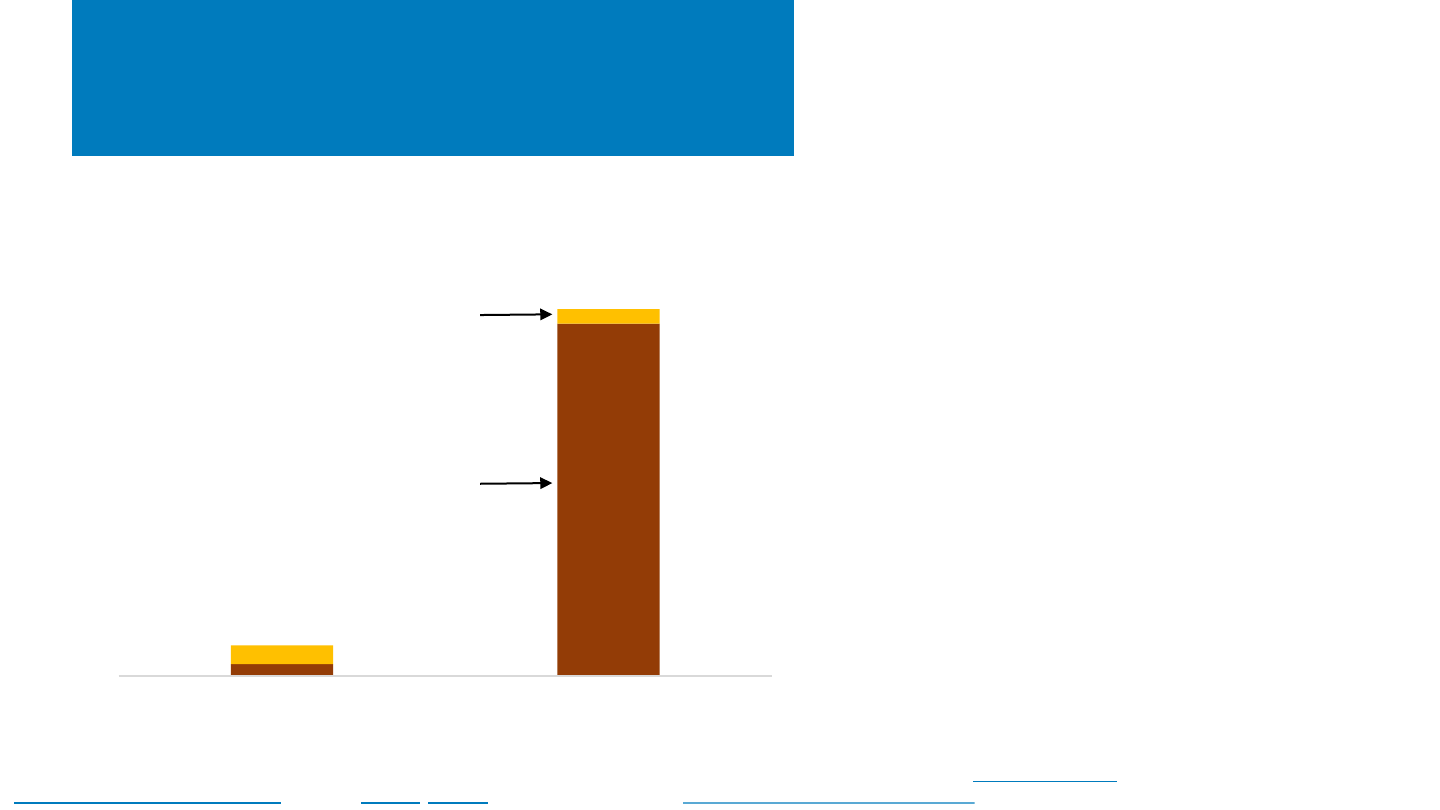

Indian Market Update

Sources: BNEF, 1H 2023 India Renewables Market Outlook, 2/28/23; BNEF, 1Q 2023 Global PV Market Outlook, 2/28/23; Goldman Sachs Equity Research,

America’s Clean Technology: Solar, 2023 Outlook, 12/18/22; JMK Research and Institute for Energy Economics & Financial Analysis, India’s Photovoltaic

Manufacturing Capacity Set to Surge, Mercom (3/10/23, 3/14/23); Mercom India Research, State of Solar PV Manufacturing in India, 3/23.

• Indian module exports jumped more than tenfold

between the first and second halves of 2022, with

all the increase going to the United States.

– India’s module manufacturing capacity reached 40

GWdc in 2022, but only 10 GWdc was for modules of

500 Wdc or higher.

– One projection shows India’s module manufacturing

capacity reaching 110 GWdc by 2026, which is 90 GWdc

more than projected domestic installations in that year.

– The U.S. module market yields higher profit margins

than the Indian market.

– Mid-year U.S. policies (UFLPA, AD/CVD investigation)

contributed to demand for Indian modules.

– Indian module exports to the U.S. totaled about 1.5–2.0

GWdc in 2022.

• Indian manufacturing is promoted through import

barriers and incentives, but some Indian

manufacturers are expanding without incentives.

• Indian manufacturers are reportedly considering

U.S. module plants to benefit from IRA incentives.

0

100

200

300

400

500

600

January-June 2022 July-December 2022

Million U.S. dollars

Value of Indian Module Exports: H1 2022 vs. H2 2022

Exported

to the U.S

Exported

elsewhere

NREL | 13NREL | 13

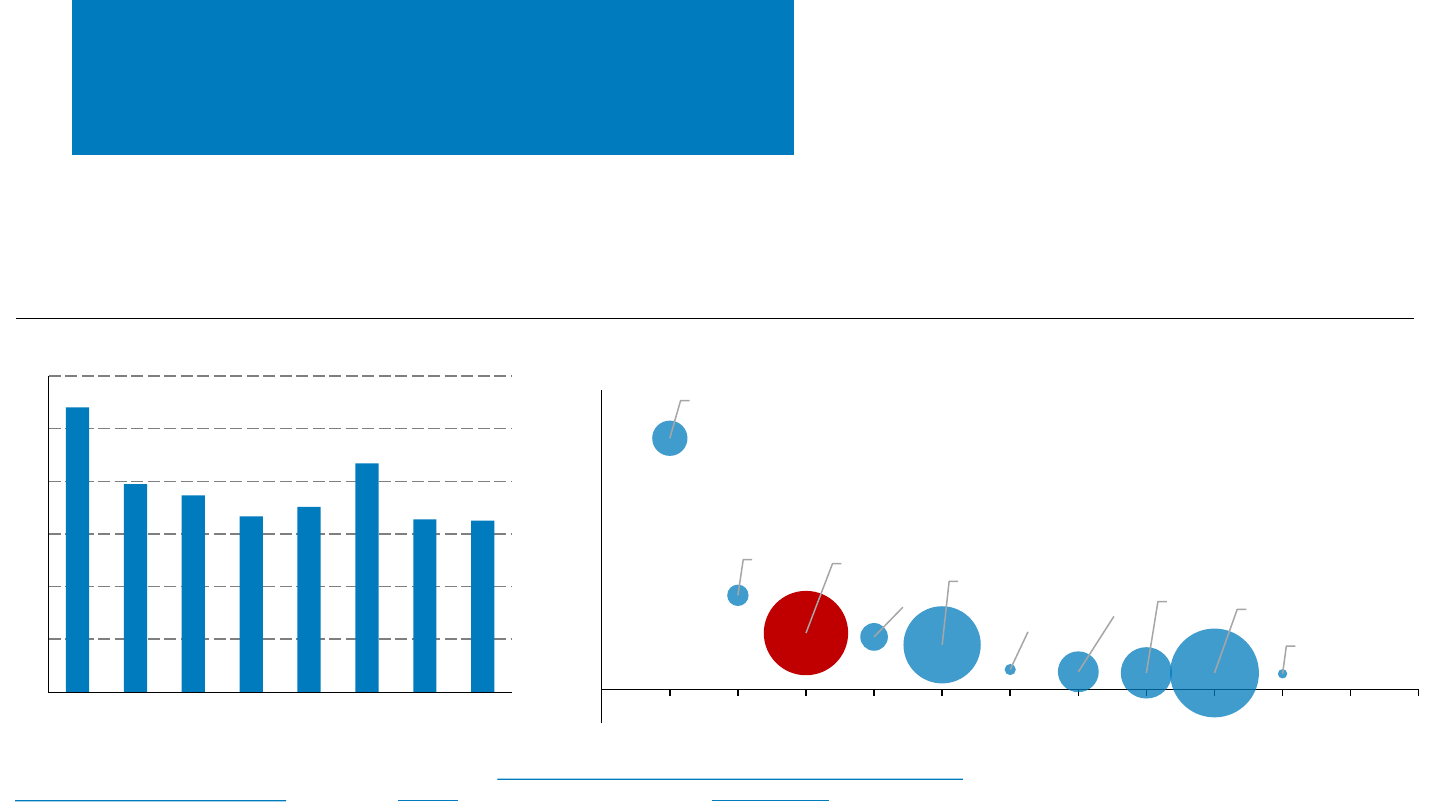

Japanese Market Update

• Japan installed 6.5 GWdc of PV in 2022, about the same as in

2021 as part of a mostly declining trend since the high in 2015.

• Cumulative capacity at the end of 2022 was about 85 GWdc.

• Scarce land and decreasing feed-in tariff rates

continue to constrain PV deployment, while goals

require at least doubling PV capacity by 2030.

• Japan is experimenting with requiring PV on new

buildings and with deploying agrivoltaics.

• Government subsidies stimulated an increase in

corporate PPAs in 2021 (91 MWdc) and 2022 (228

MWdc), most of which were PV PPAs.

China, 39

USA, 14

Japan, 225

India, 24

Germany, 188

Australia, 4

Spain, 53

Italy, 83

S Korea, 249

Brazil, 3

-50

0

50

100

150

200

250

300

350

400

450

0 1 2 3 4 5 6 7 8 9 10 11 12

Cumulative PV capacity (GWdc)

Top 10 countries for PV installed in 2022

Japan’s High PV Density

Cumulative PV capacity per sq km of total (land + water) country area, 2022

Sources: BloombergNEF, 1Q 2023 Global PV Market Outlook; IEA, National Survey Report of PV Power Applications in Japan, 2021; IEA,

Snapshot of Global PV Markets: 2023; PV Magazine (3/21/23); U.S. Central Intelligence Agency, World Factbook.

0

2

4

6

8

10

12

2015 2016 2017 2018 2019 2020 2021 2022

Japan's PV Capacity Additions (GWdc)

NREL | 14NREL | 14

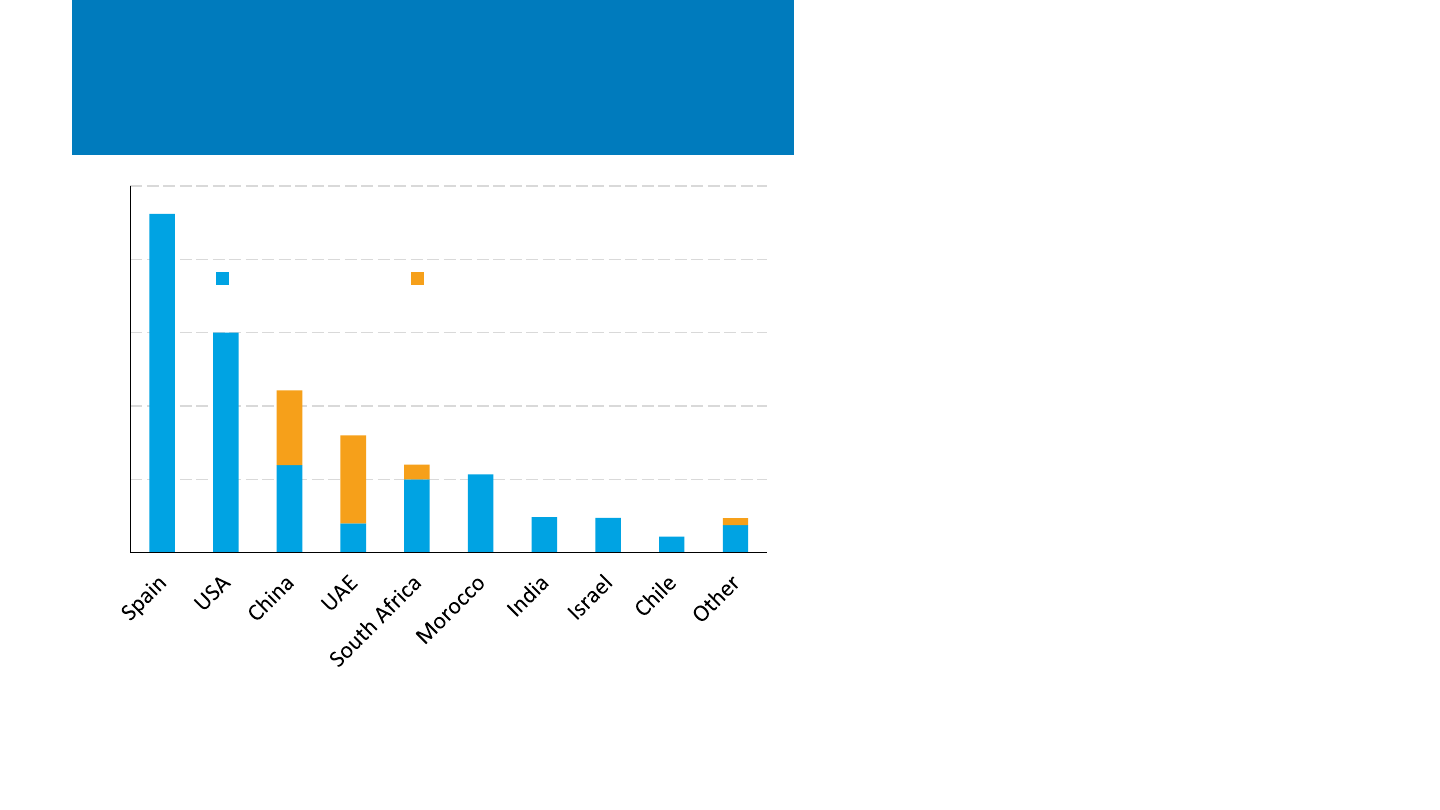

Global CSP Capacity

• At the end of 2022, global CSP capacity reached

approximately 6.4 GW, with 1.3 GW under

construction.

– While no CSP projects were installed in 2022, the Noor

facility in UAE added 100 MW of CSP in February 2023.

– All Chinese CSP projects under construction are co-

located with PV.

• There are an additional 3 GW of CSP projects

under development in China, not included in

these numbers.

Sources: Richard Thonig, Alina Gilmanova & Johan Lilliestam. (2023). CSP.guru 2023-01-01 [Data

set]. Zenodo.https://doi.org/10.5281/zenodo.1318151.

0.0

0.5

1.0

1.5

2.0

2.5

CSP Capacity (GWac)

Operational Under Construction

NREL | 15NREL | 15

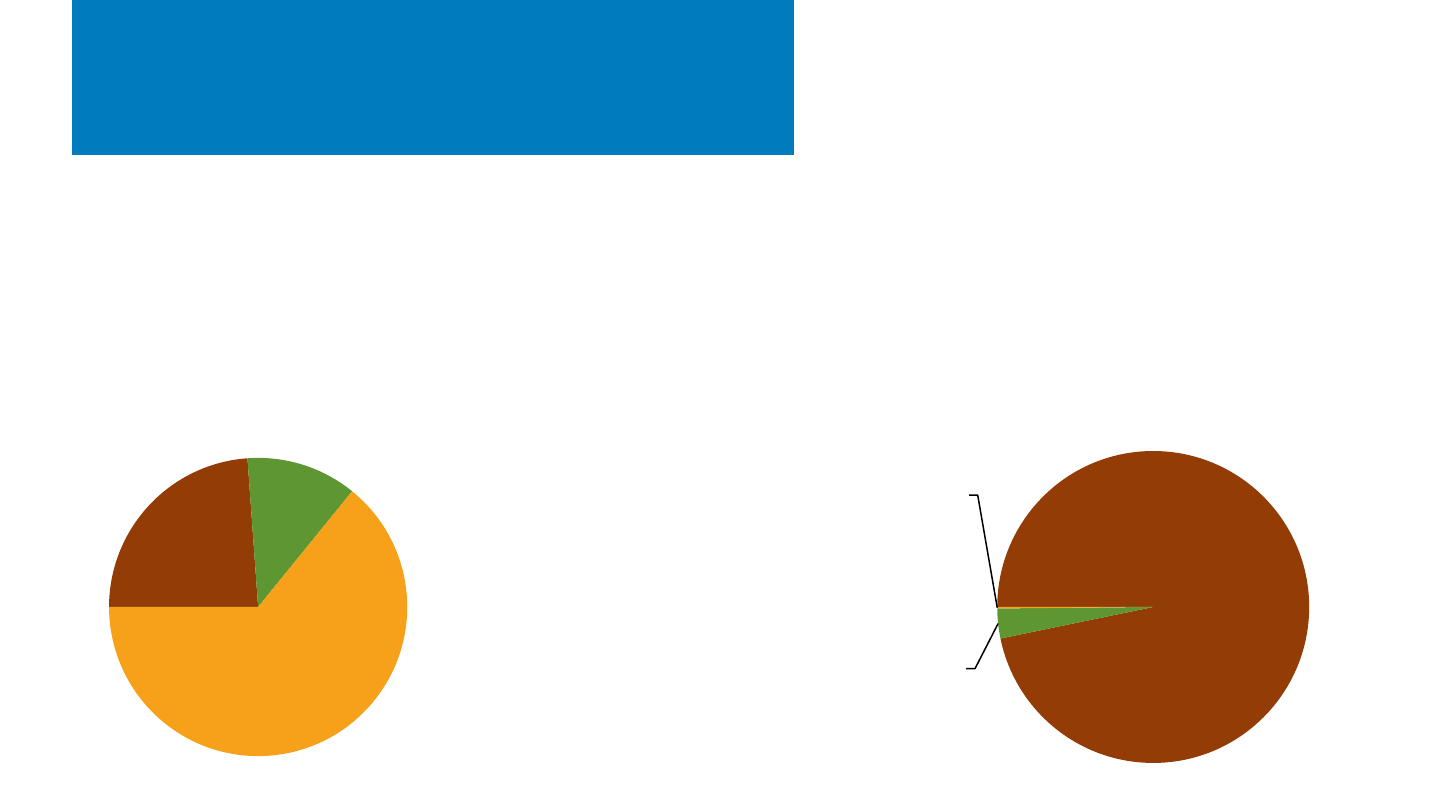

Global CSP Capacity

• 73% of current CSP capacity uses parabolic

trough technology, compared to 51% of those

under construction.

Sources: Richard Thonig, Alina Gilmanova & Johan Lilliestam. (2023). CSP.guru 2023-01-01 [Data

set]. Zenodo.https://doi.org/10.5281/zenodo.1318151.

• Over half of CSP projects in operation have storage, with

36% of the capacity having 6 hours or more of storage.

• Projects under construction, on average, have storage,

and longer hours of storage, than those currently in

operation.

0

1

2

3

4

5

6

7

Operational Under Construction

CSP Capacity (GWac)

Technology

Fresnel

Tower

Trough

0

1

2

3

4

5

6

7

Operational Under Construction

CSP Capacity (GWac)

Hours of Storage

10+ hrs.

6-10 hrs.

2-6 hrs.

<2 hrs.

No Storage

NREL | 16NREL | 16

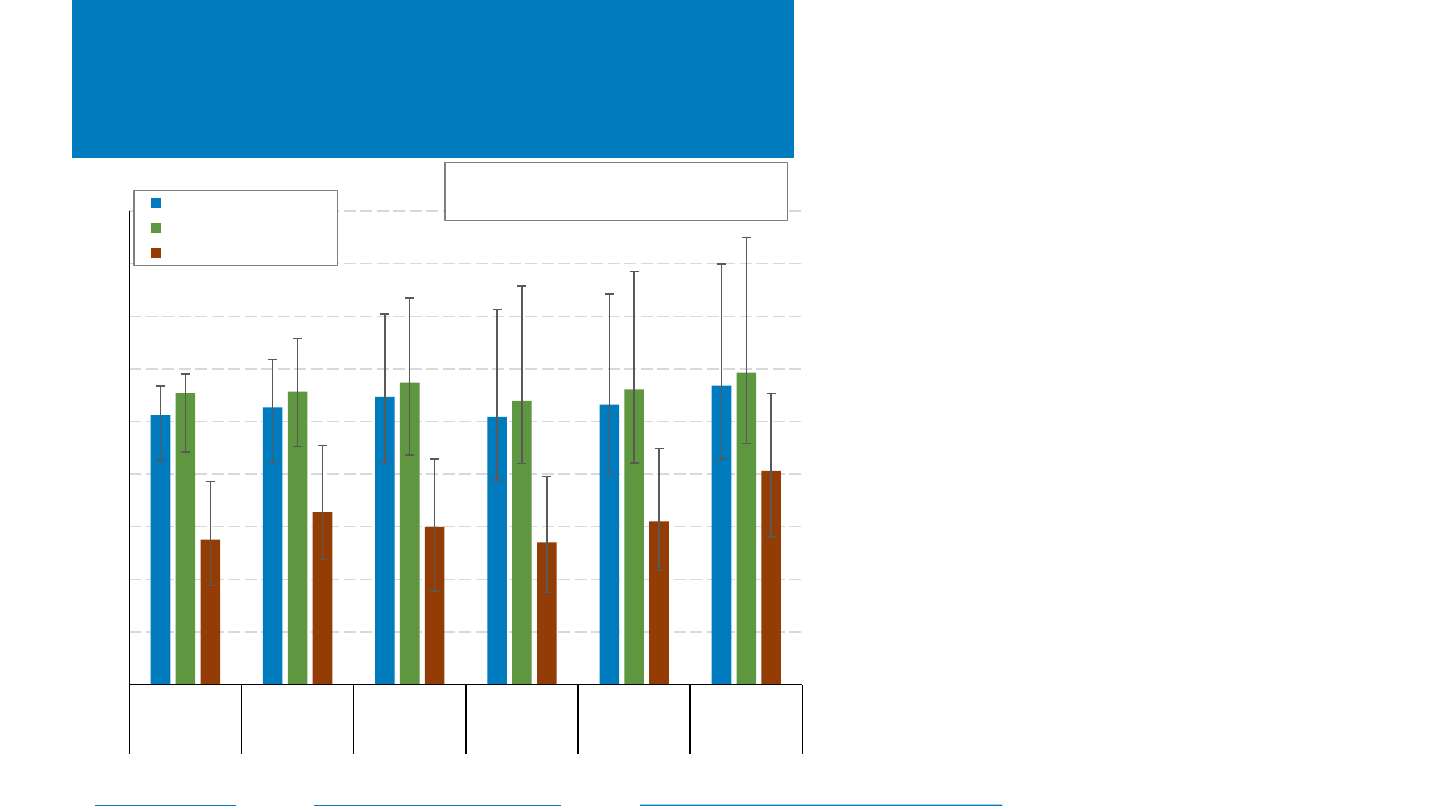

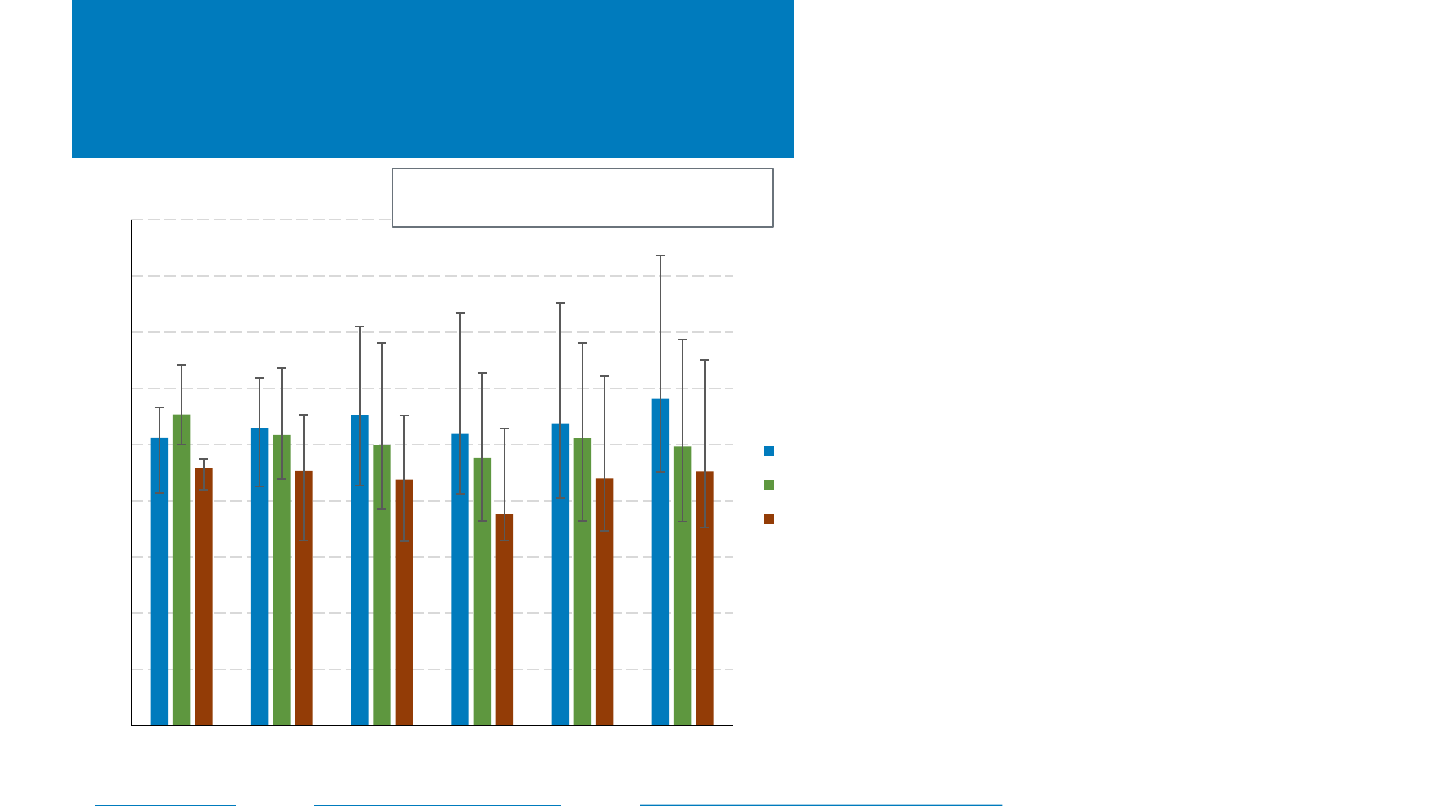

U.S. CSP Project Generation

Performance, 2014–2022

Source: EIA, Form 923.

• While it took a few years to optimize the

operation of the five U.S. CSP plants brought

online from 2013–2015, four of them now

generally perform better than when they

began operation.

– Annual weather variation also caused some

of the differences in annual production.

– Tonopah continues to have, however

produced power for seven months of the

year in 2022 – the most since 2018. In

September and October it reported an

average capacity factor of 29%.

• Absolute capacity factor is not necessarily the

best metric for performance as plants can be

designed and operated differently.

0%

5%

10%

15%

20%

25%

30%

35%

Capacity Factor

SEGS III-IX

(Trough)

Nevada Solar One

(Trough)

Genesis (Trough)

Solana (Trough+6

hours storage)

Mojave (Trough)

Tonopah

(Tower+10 hours

storage)

Ivanpah (Tower)

NREL | 17

Agenda

Global Solar Deployment1

U.S. PV Deployment

2

PV System Pricing

3

Global Manufacturing

4

Component Pricing

5

Market Activity

6

7 U.S. PV Imports

• In 2022, PV represented approximately 46% of new U.S.

electric generation capacity, compared to 4% in 2010.

– Nearly 30 GWac of new installed capacity was either from

renewable energy or battery technologies in 2022, a decline of 7

GWac compared to 2021.

• Solar still represented only 9.0% of net summer capacity

and 4.7% of annual generation in 2022.

– However, 16 states generated more than 5% of their

electricity from solar, with California leading the way at

27.3%.

• The United States installed 17.0 GWac (20.2 GWdc) of PV in

2022, ending the year with 110.1 GWac (140.6 GWdc) of

cumulative PV installations.

• The United States installed approximately 14.1 GWh, 4.8

GWac of energy storage onto the electric grid in 2022, up

34% y/y.

NREL | 18NREL | 18

Recent Solar News (Congressional)

Repeal of the AD/CVD waiver/“bridge”

– On April 1, 2022, at the request of Auxin Solar, Commerce initiated country-wide circumvention inquiries on whether imports of c-Si PV cells and modules

from Cambodia, Malaysia, Thailand, or Vietnam using parts and components from China are circumventing AD and CVD orders.

– On June 6, 2022, President Biden declared an emergency and authorized the temporary extension of time and duty (and deposit)-free importation of solar

cells and modules from Southeast Asia for up to 24 months, over concerns the lack of panel supply would cause electric grid reliability issues.

– In December 2022, the U.S. Department of Commerce issued a preliminary decision to impose anti-circumvention duties on some solar panels and cells

produced in Vietnam, Malaysia, Thailand, and Cambodia. A final determination was set to be due May 1, 2023, but has been extended to August 17

th

, 2023.

– In January 2023, a bipartisan group of lawmakers objected to the two-year waiver under the Congressional Review Act (CRA), which allows Congress to

repeal executive decisions if a simple majority is reached and passed within 60 days.

– On April 18, 2023, a group of over 400 U.S. solar companies led by the Solar Energy Industries Association (SEIA) petitioned Congress to uphold the waiver.

SEIA stated that if the CRA legislation passes, it will eliminate 30,000 U.S. solar jobs, including 4,000 in the manufacturing sector, cost U.S. solar companies

over $1B in retroactive duties, and lead to the cancellation of 4 GW in planned projects.

– On April 28, 2023, the House passed the CRA (221-202) and the Senate passed it on May 3

rd

(56-41). On April 24, the WH promised to veto the legislation.

House debt ceiling bill:

– Repeals the ITC/PTC extension (including the domestic content, energy community, and low-income bonuses, as well as the labor requirements), and the

25D extension (including revoking the battery storage tax credit)

– Repeals the 48C increase (including the energy community and labor requirements) and repeals the MPTC

– Repeals the elective payment and transferability options

– Ultimately repeals or revisits 24 different tax incentives from IRA.

Sources: past 2022 Quarterly Solar Industry Updates, PV Tech in January and in April (18 and 19), WH press release, H.R. ___ - Limit, Save, Grow Act of 2023

NREL | 19NREL | 19

Recent Solar News

• On April 4, 2023, the White House released a Guidebook intended to help Tribal and indigenous communities navigate IRA opportunities. The Guidebook

provides descriptions and eligibility information for Tribes to benefit from IRA grant, loan, and clean energy incentives. It also provides a brief summary of

each program, key dates to watch out for, and important links for further information.

• On April 19, 2023, the EPA released its framework for the Greenhouse Gas Reduction Fund (GGRF), a $27B fund for clean energy projects targeting low-

income and disadvantaged communities.

– The framework outlines three grant competitions: the National Clean Investment Fund ($14B), the Clean Communities Investment Accelerator ($6B), and

the Solar for All competition ($7B), which will provide 60 grants to States, Tribal governments, municipalities, and nonprofits.

– The EPA invites feedback by May 12

th

on this framework, and also plans to hold six public listening sessions.

• Sunnova VPP loan guarantee

– The U.S. Department of Energy Loan Program Office (LPO) announced a conditional commitment of up to $3B in a partial loan guarantee (i.e., a 90%

guarantee of up to $3.3B) to Sunnova to support its Project Hestia. Certain conditions must still be satisfied before the DOE loan guarantee is issued,

including finalization of definitive financing documents.

– Sunnova’s Project Hestia offers disadvantage individuals and communities better access to loans for solar installations, battery systems, or other Sunnova

Adaptive Home™ technologies. To be eligible, the energy system must be outfitted with Sunnova’s VPP-enabling software, which is designed to improve

customer insights regarding their power usage and to facilitate demand response behavior.

– The project is expected to provide loans for ~75,000-115,000 homeowners throughout the United States, with Sunnova targeting 20% of their loans to

homeowners in Puerto Rico and at least 20% to customers with FICO credit scores of 680 or less. The ~568 MW, 25-year project is also estimated to

created 3,400 job.

– Sunnova has agreed to: provide monthly servicing reports supplemented by hardware and software deployment information to DOE, measure the

reduction in greenhouse gases associated with Project Hestia, and deliver collateral pools that realize agreed criteria related to FICO distributions and

certain concentrations of customers located in disadvantaged communities.

Sources: iratracker.org, WH press release, EPA press release, Solar Power World, LPO press release, Sunnova press release

NREL | 20NREL | 20

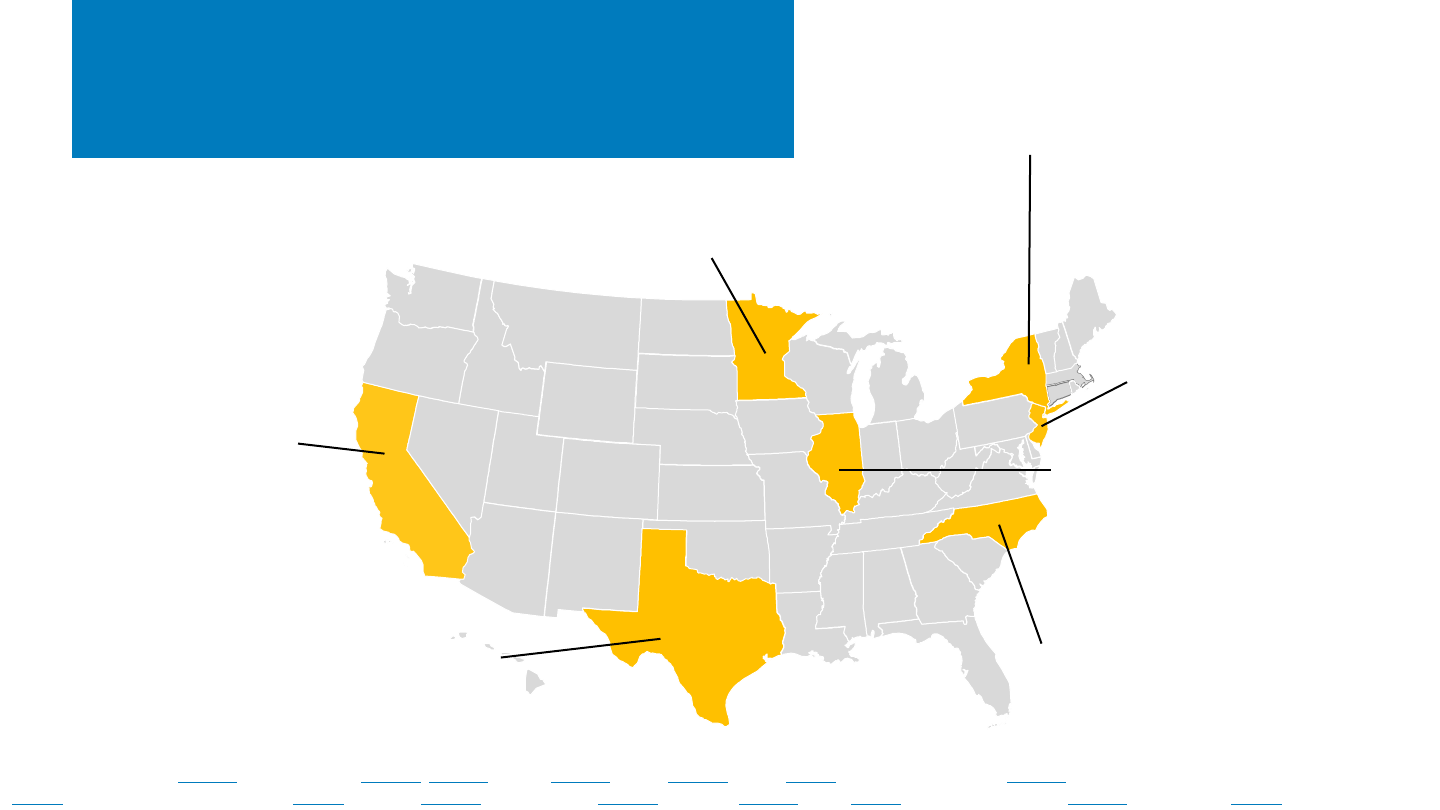

States: Q1 2023 Updates

Source: Canary Media (1/27/23), Canary Media (2/24/23, 3/27/23), CPUC (2/23/23), Grist (9/15/21), Grist (3/2/23), Inside Climate News (2/27/23), New Jersey Legislature

(8/8/22), Office of Governor Tim Walz (2/7/23), Politico (1/30/23), PV Magazine (2/15/23), PV Tech (2/20/23), RMI (3/6/23), State of New Jersey (2/15/23), Utility Dive (2/7/23)

A Minnesota law requires electric utilities to reach 100% carbon-free power

by 2040. North Dakota, an exporter of coal-generated power, is considering

suing Minnesota under the Constitution’s Dormant Commerce Clause.

Three executive orders

accelerate New Jersey’s

100% zero-carbon electricity

target by 15 years, to 2035.

Legislation is required to

implement the orders. A bill

revising the state’s

renewable portfolio standard

was introduced in 2022.

A controversial Illinois law prevents

local governments from limiting or

banning solar and wind in support of

the state’s 2021 law targeting

carbon-free power by 2045.

California and New York have taken

similar actions.

A New York State Public Service Commission

authorization provides $4.4 billion to fund 62

local transmission upgrades, which will enable 3.5

GW of renewable energy capacity. The upgrades

are expected in the 2024–2030 timeframe.

A California Public Utilities

Commission (CPUC) order

requires 4 GW of zero-

carbon capacity by 2027, to

support grid reliability and

decarbonization, in addition

to 11.5 GW ordered in 2021.

CPUC also approved an

integrated resource plan

targeting 86 GW of new

resources—mostly solar and

batteries—by 2035.

Texas’ Aggregated Distributed Energy Resources

Pilot Program is enabling controllable energy

equipment (such as PV + storage) on homes and

businesses to act as virtual power plants.

A utilities commission ruling in North

Carolina adds rooftop PV minimum

bills, introduces time-of-use rates, and

incentivizes PV-plus-storage systems.

NREL | 21NREL | 21

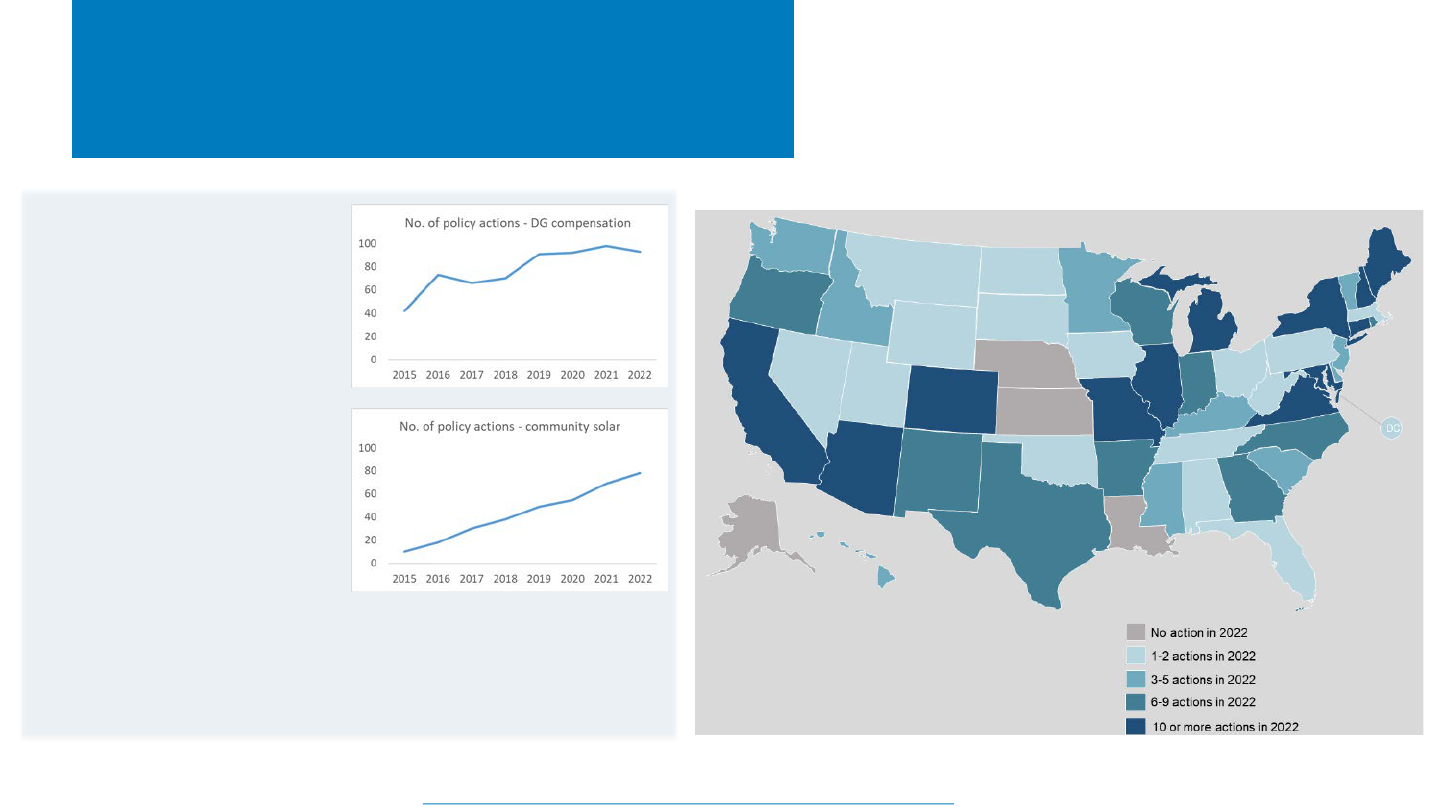

States: 2022 Year-in-Review

Source: North Carolina Clean Energy Technology Center, The 50 States of Solar: 2022 Policy Review and Q4 2022 Quarterly Report, January 2023. Map reproduced with permission.

Top Solar Policy Trends of 2022

• Less use of traditional net

metering

• More use of net billing and

time-varying compensation

• More consideration of grid-

access fees and minimum bills

(with mixed results)

• Incorporation of PV provisions

specific to low- and medium-

income households

• Consideration of community

solar programs

• Promotion of PV + battery

systems

• Linking of labor requirements with PV programs

• Increased complexity of PV programs

• Use of iterative approaches to PV program design.

Number of solar policy and rate design actions in 2022

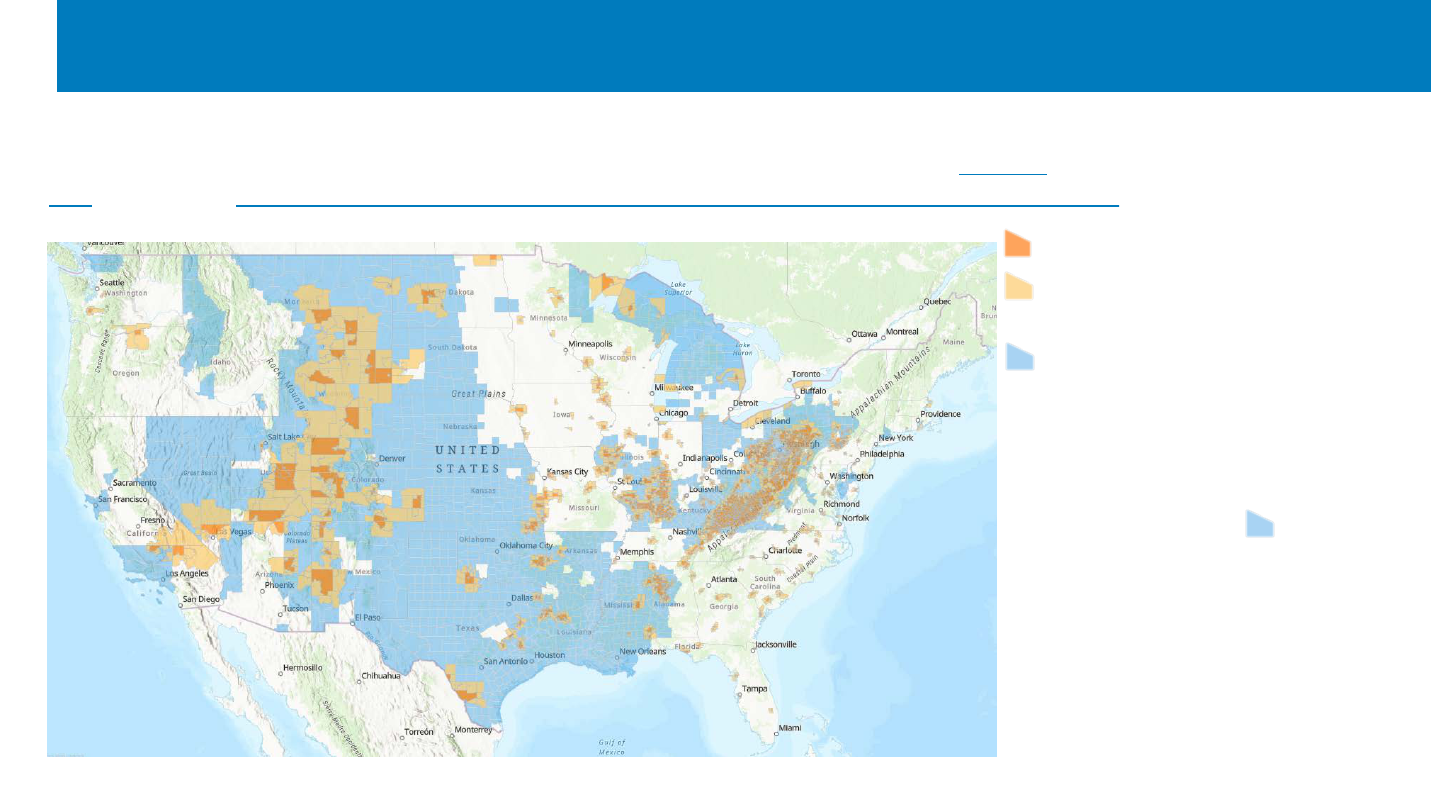

Energy Communities Bonus Credit Program: a 10% increase to the Investment or Production Tax Credits (ITC/PTC) to brownfields, fossil

fuel communities with high unemployment, and coal closure communities. Treasury released guidance on April 4

th

, including releasing a

map hosted by the Interagency Working Group on Coal & Power Plant Communities & Economic Revitalization, DOE and IRS.

- Coal Closure Community

- Adjacent to a Coal Closure

Community

- Metropolitan or Non-Metropolitan

Statistics Areas that meet the Fossil

Fuel Employment Threshold

*Unemployment rates from 2022 are

not yet available, so the areas are

not yet confirmed as energy

communities.*

Not depicted:

- Brownfields

- Fossil fuel communities as

determined based on tax revenue.

New Guidance on the Energy Communities Bonus

New Guidance on the Energy

Communities Bonus

• Brownfield Category: Treasury clarified that any federal, state, territory, or federally recognized Indian tribal

assessment process is sufficient to qualify, or the completion of an ASTM E1903 Phase II Environmental Site

Assessment (Phase I for < 5 MW

ac

sites) to confirm the presence of hazards and/or pollutants.

• Statistical Area Category (a.k.a. Fossil Fuel Communities w/High Unemployment): Treasury clarified how

metropolitan and non-metropolitan statistical areas were defined, how fossil fuel employment was defined, and

how unemployment rates are calculated (and how those rates will be updated annually each May).

– Treasury has invited public comments by May 4

th

addressing possible data sources, revenue categories, and procedures for determining

eligibility based on Fossil Fuel Tax Revenue (instead of Fossil Fuel Employment).

• Coal Closure Category: Treasury clarified that census tracts are defined via the 2020 census, how a coal mine is

deemed abandoned, how a coal-fired electric generating unit is deemed retired, and that “directly adjoining” is

defined as a single point of contact.

• Timing:

– For the PTC: the facility can located within an energy community for any part of the taxable year.

– For the ITC: the facility must be within an energy community when it is placed in service.

– Grandfather clause: If a facility begins construction within an energy community, the location can continue to be considered an energy

community for the duration (for ITC or PTC).

• Location: ≥50% of a facility’s nameplate capacity (dc for solar, MWh for storage, ac otherwise) must be within the

boundaries of an energy community. Offshore projects can attribute their capacity to their land-based

transmission/distribution equipment that is closest to the point of interconnection.

Canada via Budget 2023

• Clean Electricity Investment Tax Credit: 15% refundable tax credit for eligible investments in non-emitting electricity generation

(wind, solar, hydro, nuclear, abated natural gas), storage, and transmission equipment, lasts from 2024-2034, and includes labor

incentives.

• Investment Tax Credit for Clean Technology Manufacturing: 30% refundable tax credit on the cost of investments in new machinery

and equipment used to manufacture or process clean technologies, or extract/process/recycle critical minerals.

• "Canada must either meet this historic moment - this remarkable opportunity before us - or we will be left behind.“

• These two tax credits are estimated to cost $25.7B + $11.1B = $36.8B CAD.

Australia via the National Reconstruction Fund

• $15B AUD fund to invest in 7 “priority areas” for the Australian economy:

- Renewables and low-emission technologies were one category, as was mining and raw material processing.

- $3B AUD was allocated for investing in: green metals; clean energy component manufacturing; hydrogen electrolyzers and fuel

switching; and agricultural methane reduction and waste reduction.

- $1B AUD was allocated for investment in advanced manufacturing.

• One of “the largest peacetime investments in Australian manufacturing capability.”

Source: Chapter 3: A Made-In-Canada Plan: Affordable Energy, Good Jobs, and a Growing Clean Economy | Budget 2023, National Reconstruction Fund | Policies | Australian Labor Party (alp.org.au),

Australia’s Response To Inflation Reduction Act | TaiyangNews

International Versions of IRA

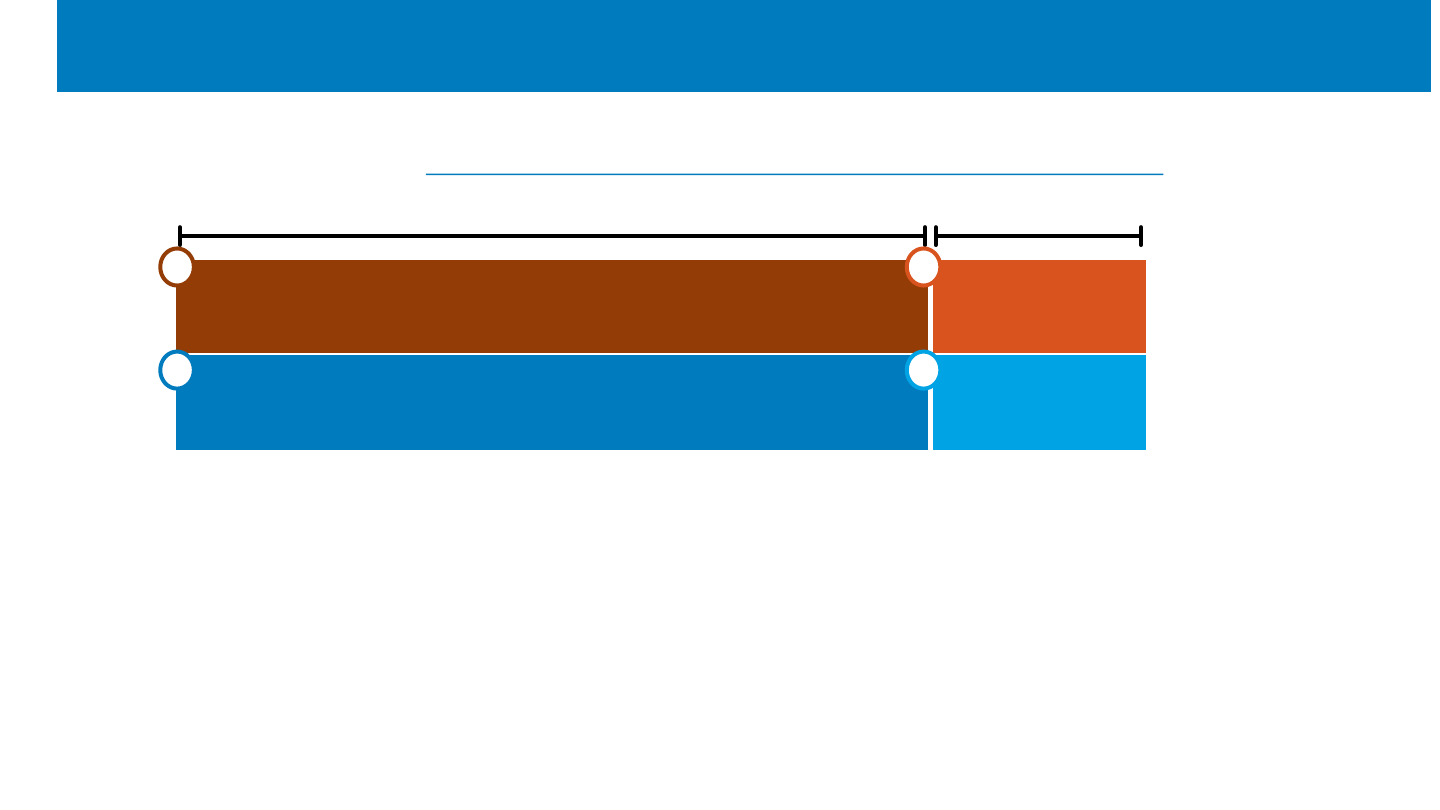

Low-Income Communities Bonus Credit Program (48(e)), awards an upfront 10% or 20% bonus tax credit for a maximum of 1.8 GW

dc

per

year of solar projects ≤ 5 MW

ac

in size. Treasury announced in February how the credits would be allocated in 2023:

700 MW 200 MW

10% credit low-income community as defined by the New Markets Tax Credit Indian Land

20% credit qualified low-income economic benefit project

qualified low-

income residential

building

Applications in Q3 2023

Applications after

Q3 2023

Treasury and the IRS can reallocate excess capacity to any oversubscribed categories, with any unallocated capacity rolling over. Only the

owner of the project can apply; projects cannot apply to more than one category; and projects placed in service prior to receiving an

awarded an allocation are not eligible.

Treasury is still developing additional selection criteria, which may include 1) ownership by community-based organizations and mission-

driven entities; 2) encourages new market participants; 3) provide substantial benefits to low-income communities and individuals

marginalized from economic opportunities; and 4) have a high degree of commercial readiness.

Most of the guidance only applies to 2023 allocations and further guidance is still required in many key areas (to be provided later).

New Guidance on the Low-Income Communities Bonus

1

3

2

4

On February 13, as mandated by law, the IRS issued guidance on the two Treasury tax credit programs with an allocation process.

• Advanced Energy Project Credit (48C ITC), administered by DOE’s MESC, awards an upfront 30% tax credit (if labor requirements are met)

for capital investments made to purchase and commission an industrial or manufacturing facility.

– 48C was originally established under the 2009 ARRA with $2.3B in funding and with a scope only covering green manufacturing.

– IRA reestablished the program, expanding eligibility to include industrial facilities, and authorizing $10B in allocated tax credits, with

$4B of the allocations going to projects in “energy communities” and that have not been allocated a credit before.

• Notable 48C guidance issues on February 13

th

– Selection will follow the standard DOE two-step FOA process of concept papers which received encourage/discourage letters, followed

by review of a full application. The program will begin accepting concept papers on May 31, 2023, for a first round of $4 billion in

credits, with approximately $1.6 billion reserved for projects in energy communities. Concept papers will be due no later than July 31,

2023.

– The IRS will provide additional guidance May 31, 2023 on the technical review criteria that will be used to evaluate proposals. The IRS

anticipates the criteria will include net impact on greenhouse gas reduction; community benefits of the project (community and labor

engagement, as well as high quality, accessible jobs, and workforce pathways); the extent to which the proposed project addresses

specific gaps, vulnerabilities, or risks to domestic clean energy production (including the risk associated with foreign involvement); and

others.

– Appendix A of the Notice provides further guidance by giving examples of property, product, and technology that are eligible and

ineligible. Solar property is defined quite broadly.

New Guidance Issued on 48C

NREL | 27NREL | 27

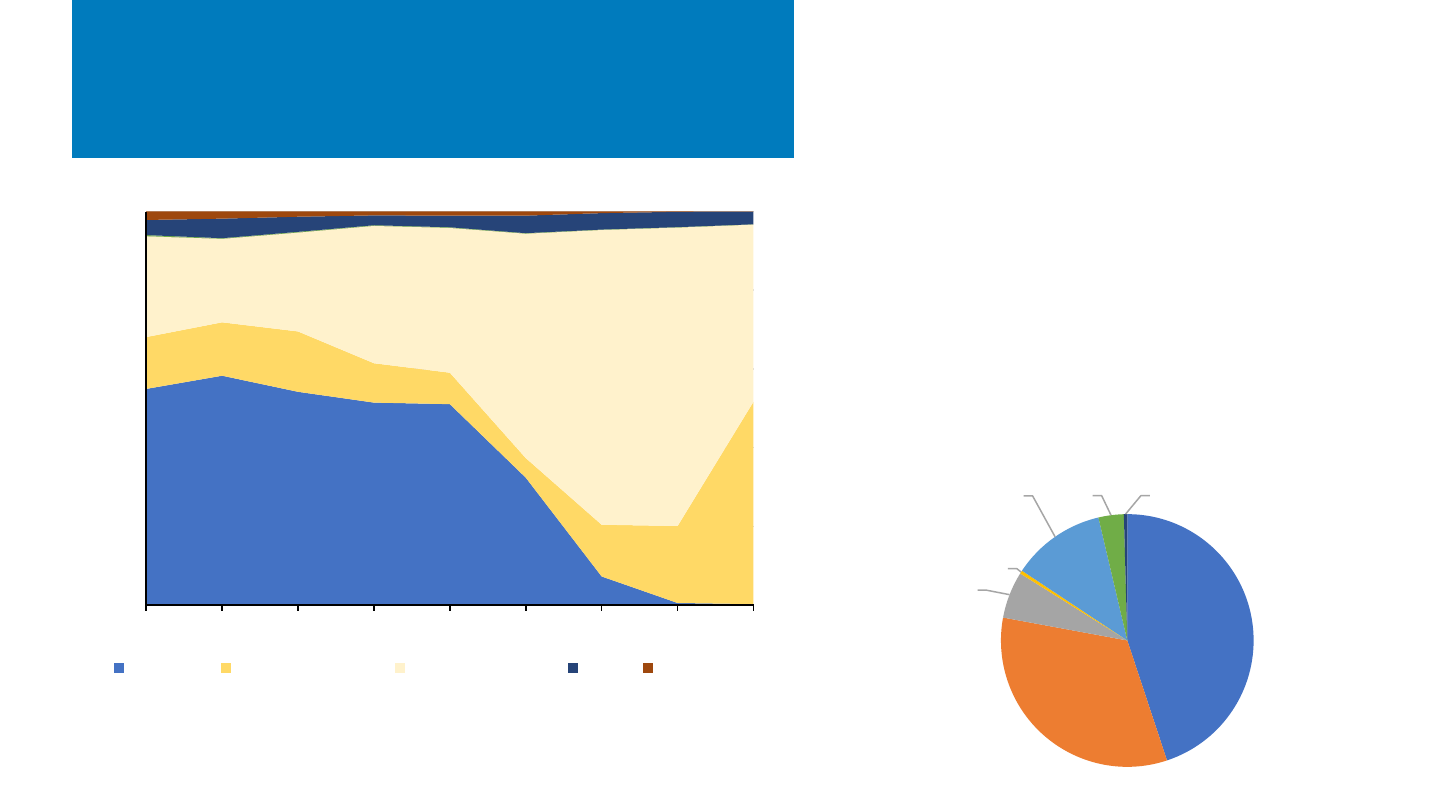

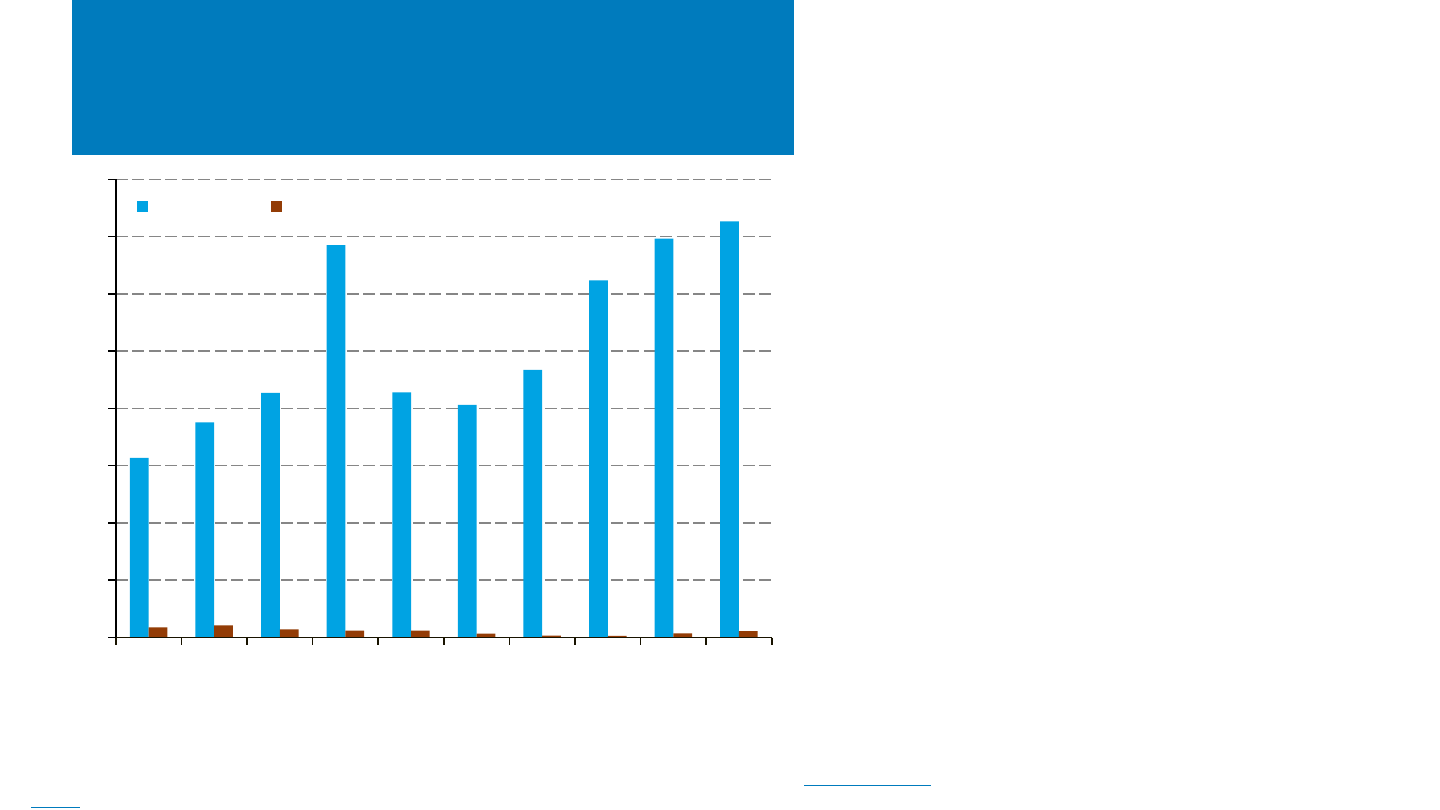

U.S. Generation, 2012–2022

Sources: U.S. Energy Information Administration (EIA), “Electricity Data Browser.” Accessed April 10, 2023; and a Today In Energy article (March 27, 2023).

• The United States generated 4,300 terawatt-hours (or

4.3 petawatt-hours) of electric power last year.

• Energy generation from renewables continued its

steady upward trend, as a result of increases in both

wind and solar generation.

– Solar and wind generation combined accounted for

15% of electric generation in 2022, up from 13% in

2021.

• The percentage of electricity generated by fossil fuels

in the United States dropped from 69% in 2012 to 60%

in 2022, while the percentage of electricity generated

by renewable generation increased from 12% to 23%

over the same period.

• In 2022, renewable energy facilities continued to

produce more electricity than both nuclear and coal

sources.

– EIA attributed the decrease in coal-fired generation to

several plants retiring and the remaining plants being

less used. The decrease in nuclear generation was

similarly the result of the Palisades nuclear power

plant retiring.

12%

23%

9%

10%

4%

5%

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2012 2014 2016 2018 2020 2022

Annual Generation (TWh)

Coal

Natural gas

Nuclear

Renewables

Hydro

Wind

Geothermal

Other

Solar

NREL | 28NREL | 28

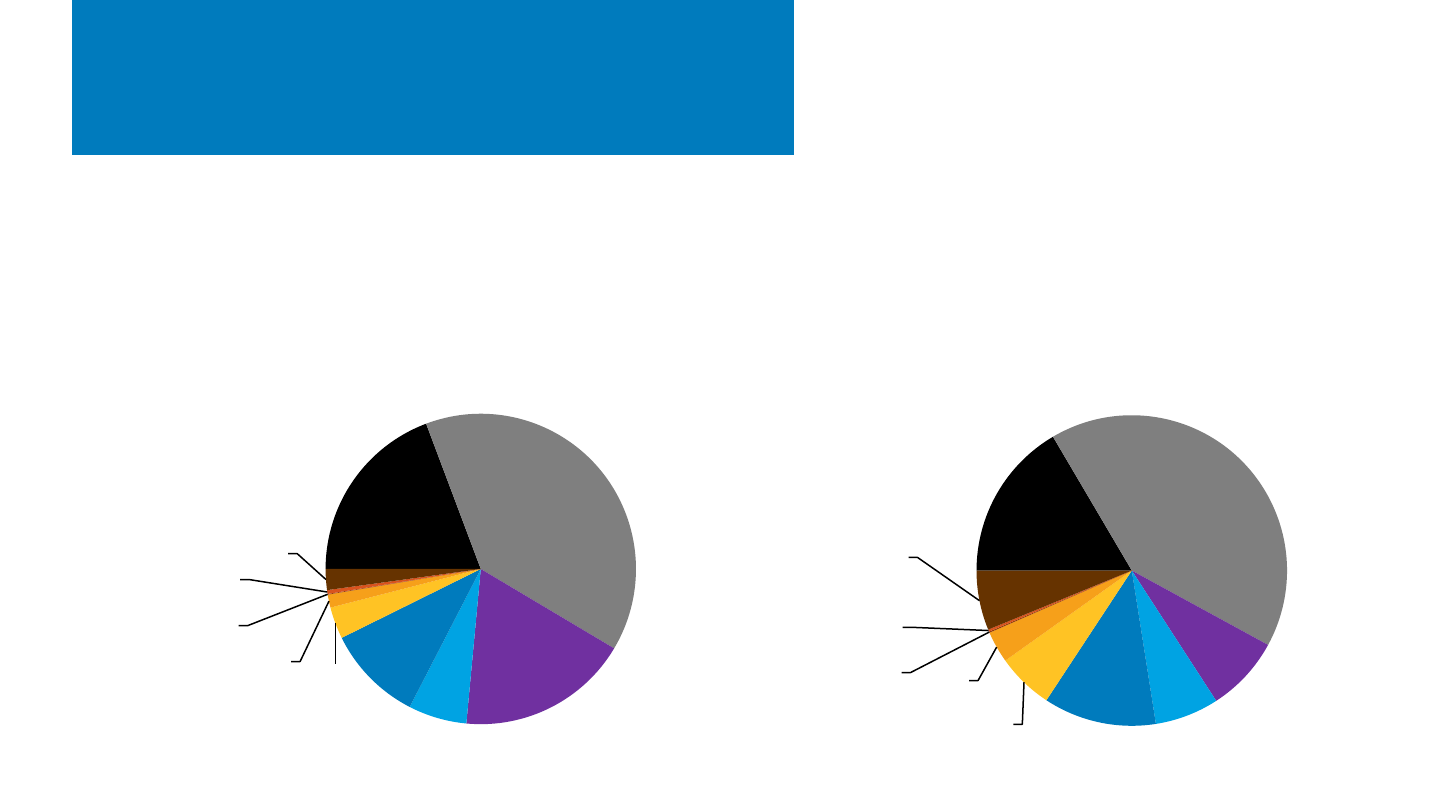

2022 U.S. Generation and Capacity

Sources: EIA, “Electric Power Monthly” Tables 6.1, 6.1A, February 2023, “Electricity Data Browser,” April 10, 2023.

• Renewables are becoming an increasingly large part of the U.S.

electric generation mix, representing 28% of capacity and 23% of

generation in 2022.

– Adding nuclear, non-carbon sources represented 36% of

capacity and 41% of generation.

• Solar still represents a small but growing

percentage of the U.S. electric generation mix.

– In 2021, solar represented 9.0% of net

summer capacity and 4.7% of annual

generation.

• Capacity is not proportional to generation, as

certain technologies (e.g., natural gas) have lower

capacity factors than others (e.g., nuclear).

Coal

19%

Natural gas

39%

Nuclear

18%

Hydro

6%

Wind

10%

UPV

3.3%

DPV

1.4%

CSP

0.1%

Geothermal

0.4%

Other

2.2%

2022 U.S. Generation (Total 4,302 TWh)

Coal

17%

Natural gas

41%

Nuclear

8%

Hydro

7%

Wind

12%

UPV

5.9%

DPV

3.3%

CSP

0.1%

Geothermal

0.2%

Other

6%

2022 U.S. Generation Capacity (Total 1.2 TW)

NREL | 29NREL | 29

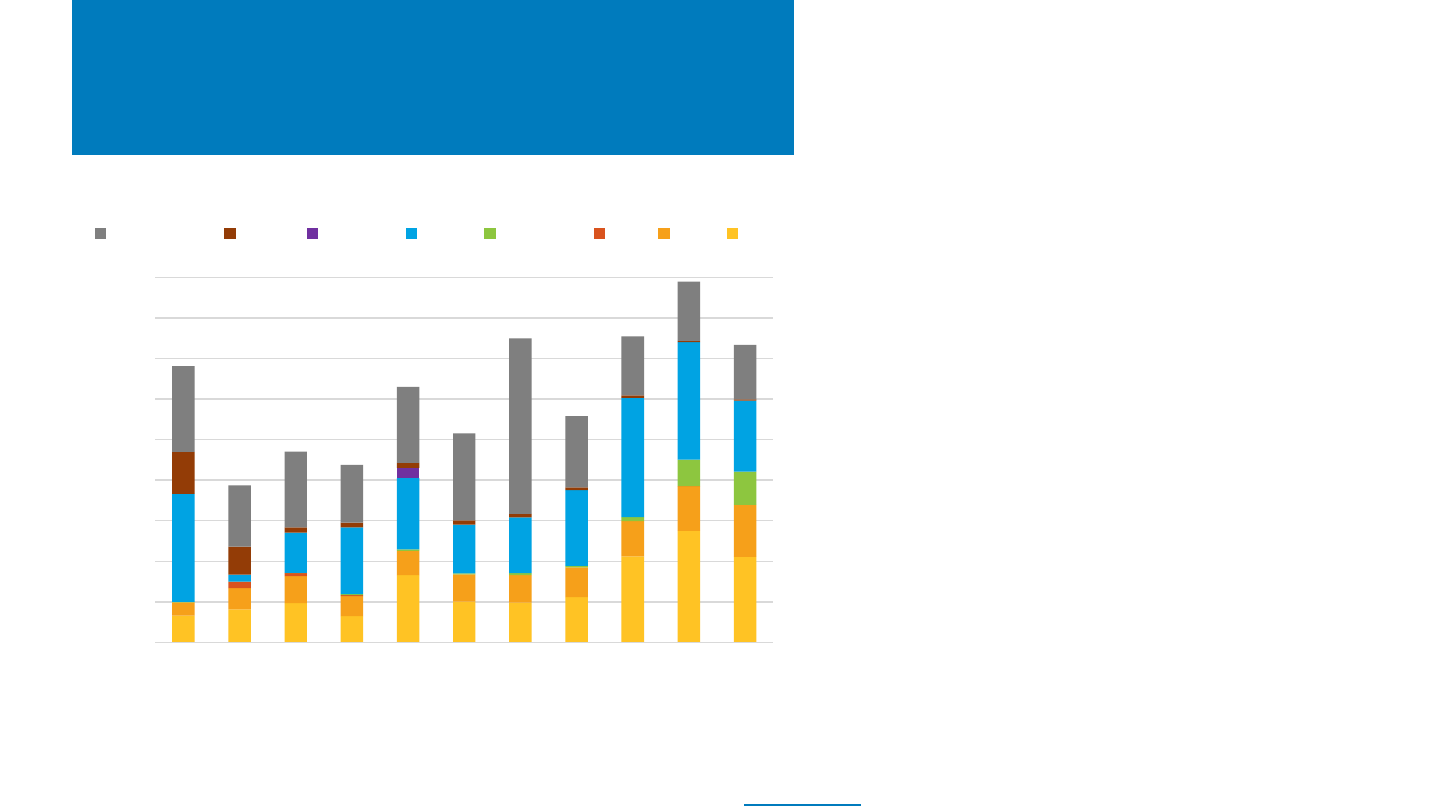

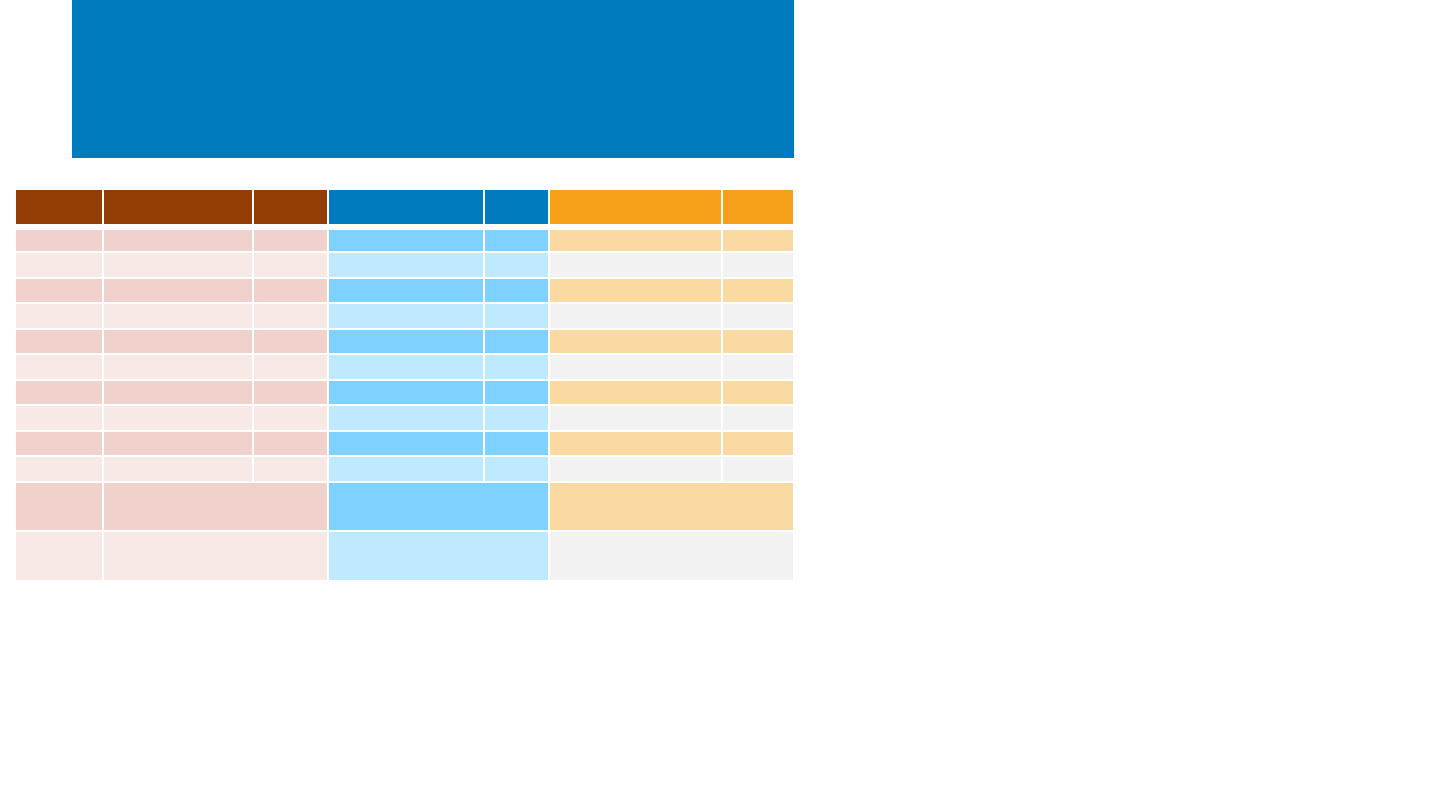

New U.S. Capacity Additions,

2012–2022

Note: “Other” includes coal, geothermal, landfill gas, biomass and petroleum.

Sources: EIA, “Electric Power Monthly” Tables 6.1, 6.2B, 1.1, 1.1A; Forms 860M & 861M. April 2023. Today in Energy.

• In 2022, PV represented approximately 46% of

new U.S. electric generation capacity (29% UPV,

17% DPV), compared to 15% in 2012.

– Wind represented 24% of added capacity

and batteries an additional 11%, for a total

of 81% of capacity additions from those

three technologies.

• Nearly 30 GW

ac

of new installed capacity was

either from renewable energy or battery

technologies in 2022, a decline of 7 GW

ac

compared to 2021.

– Both solar and wind installations declined

in 2022, although solar installations still

nearly doubled that of wind.

– Only battery installations grew from 3.3 to

4.1 GW

ac

in 2022.

0

5

10

15

20

25

30

35

40

45

2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

U.S. Electric Capacity Additions (GW

dc

)

Natural gas Other Nuclear Wind Batteries CSP DPV UPV

NREL | 30NREL | 30

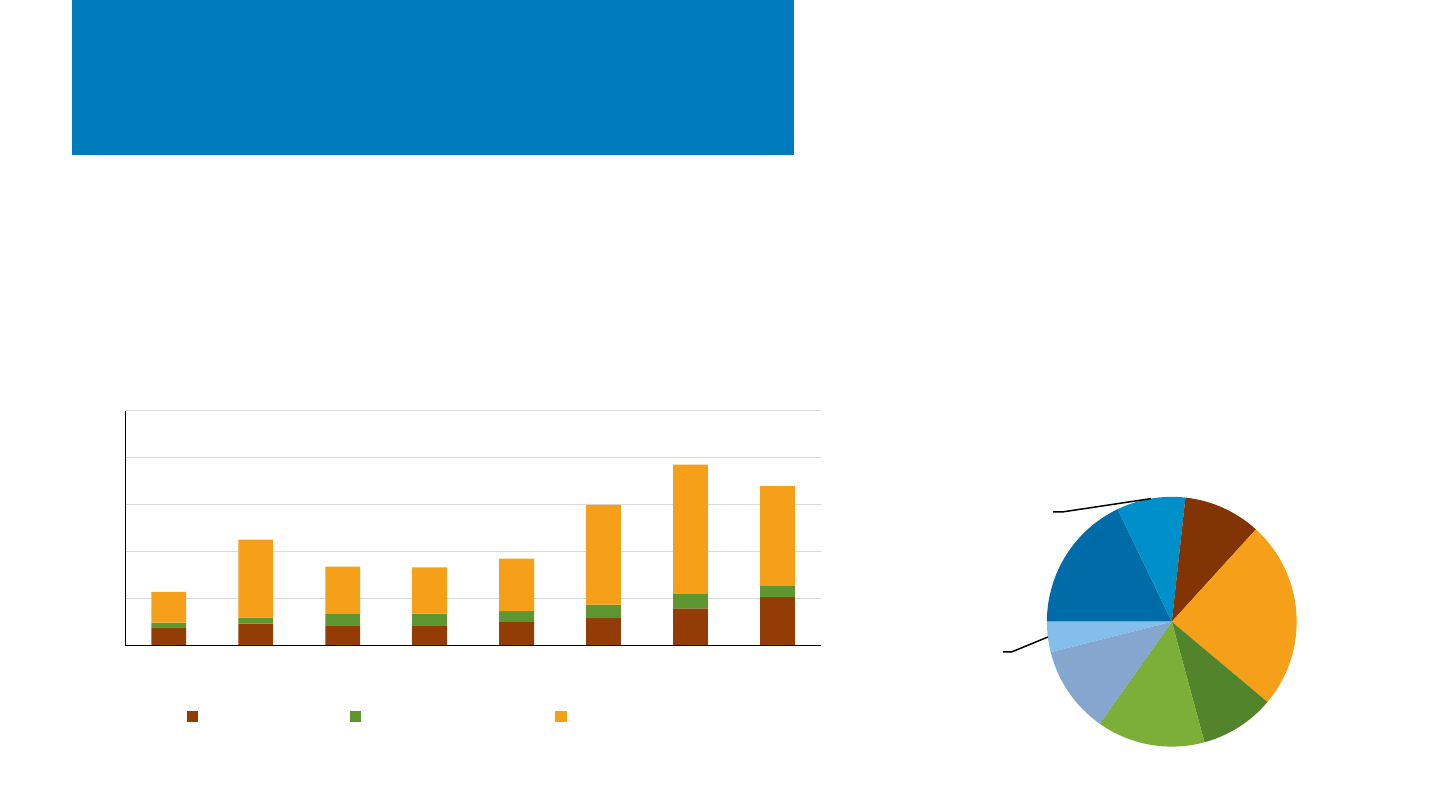

0

10

20

30

40

50

60

70

80

U.S. Generation Capacity Additions (GWac)

Other

Nuclear

Natural Gas (Other)

Natural Gas CT

Natural Gas CC

Batteries

Wind

DPV

UPV

68%

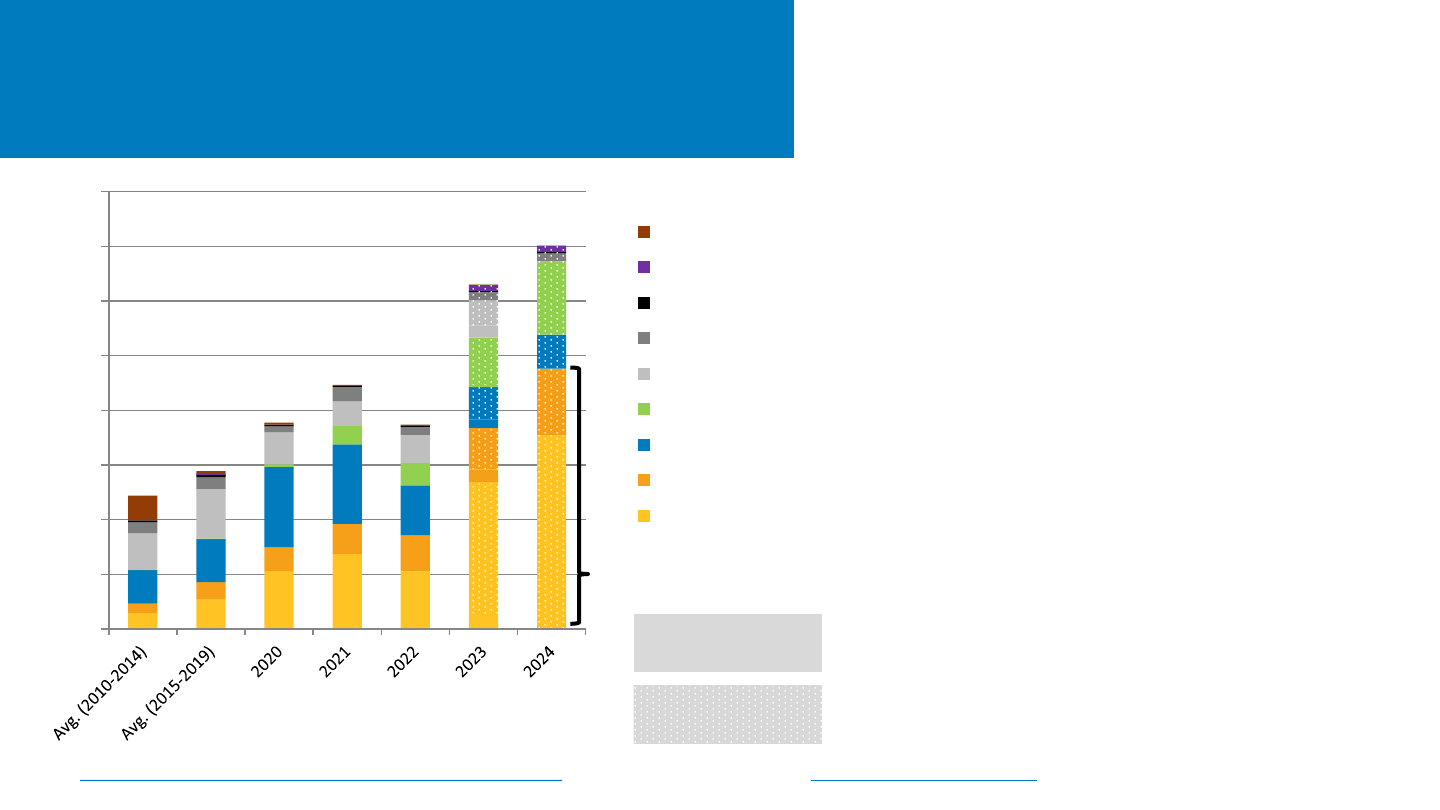

U.S. Generation Capacity Additions by Source:

2010–2022 and Planned 2023–2024

Sources: EIA Form 860M/Preliminary Monthly Electric Generator Inventory (“Planned” and “Operating”) and EIA Short-term Energy Outlook Table 7e,

downloaded April 25, 2023; Wood Mackenzie and SEIA US Solar Market Insight Full Report 2022 Year in Review, Mar 2023.

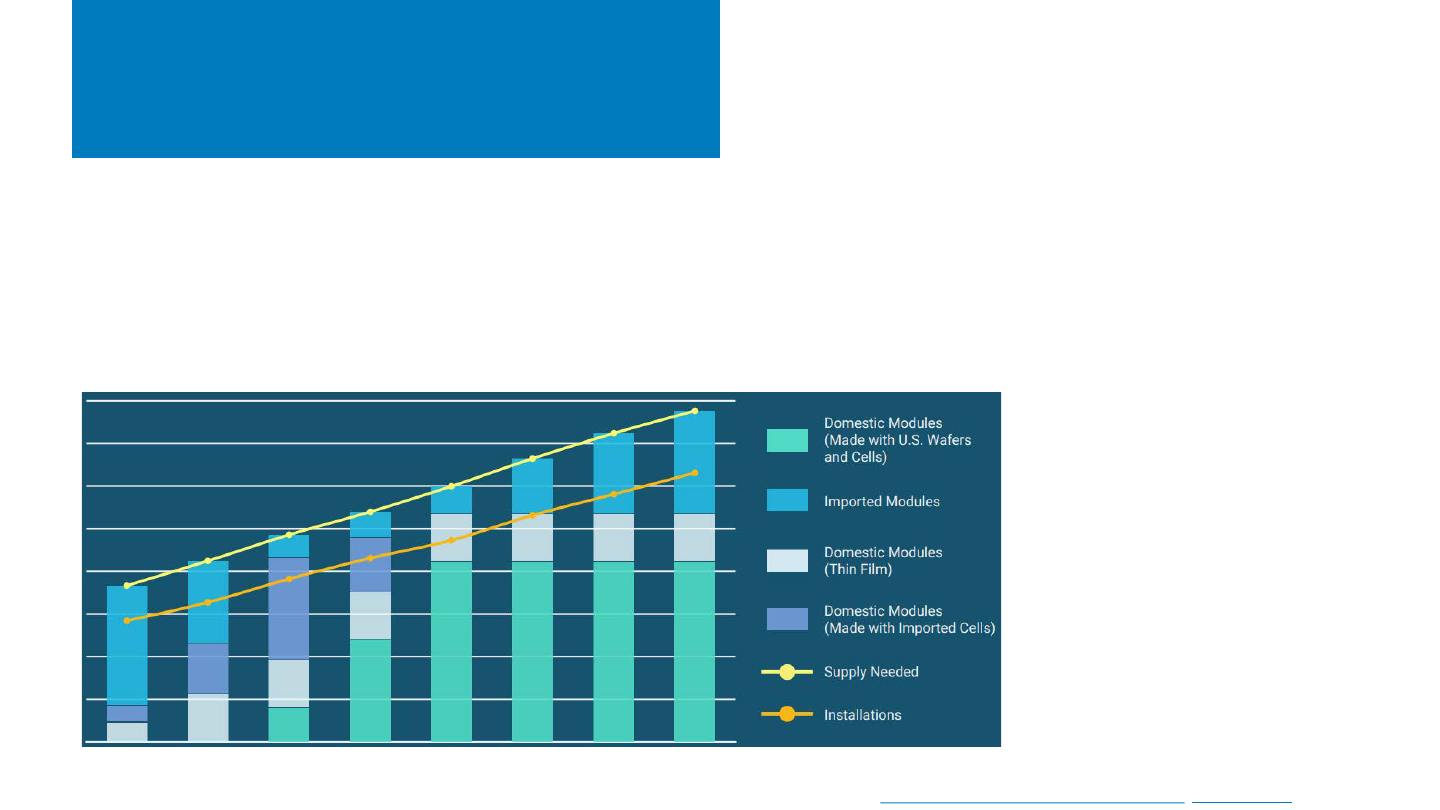

• EIA projects the percentage of U.S. electric capacity

additions from solar will grow from 46% in 2022

(17 GWac) to 58% in 2023 (37 GW

ac

), and 68% (47

GWac) in 2024.

– Wind accounts for 12% and batteries 14%, and nuclear

2% of estimated capacity in 2023; in 2024 those

percentages are 9%, 19%, and 2%, respectively.

– Natural gas accounts for the remaining 13% in 2023.

• Over the next two years, EIA projects there will be

nearly 100 GWac of capacity additions from wind

and solar alone.

• Wood Mackenzie/SEIA projects 26-30 GW

dc

of solar

installations in 2023 and 30-36 GW

dc

in 2024,

depending both on favorable supply chain

conditions (both domestic and international) as

well as the ability to optimize the Inflation

Reduction Act bonus credits.

– Over the next five years, Wood Mackenzie/SEIA

projects about 20 GWdc upside or downside relative to

their base case as a result of these factors.

Began operating

through March 2022

Planned April 2023

and full 2024

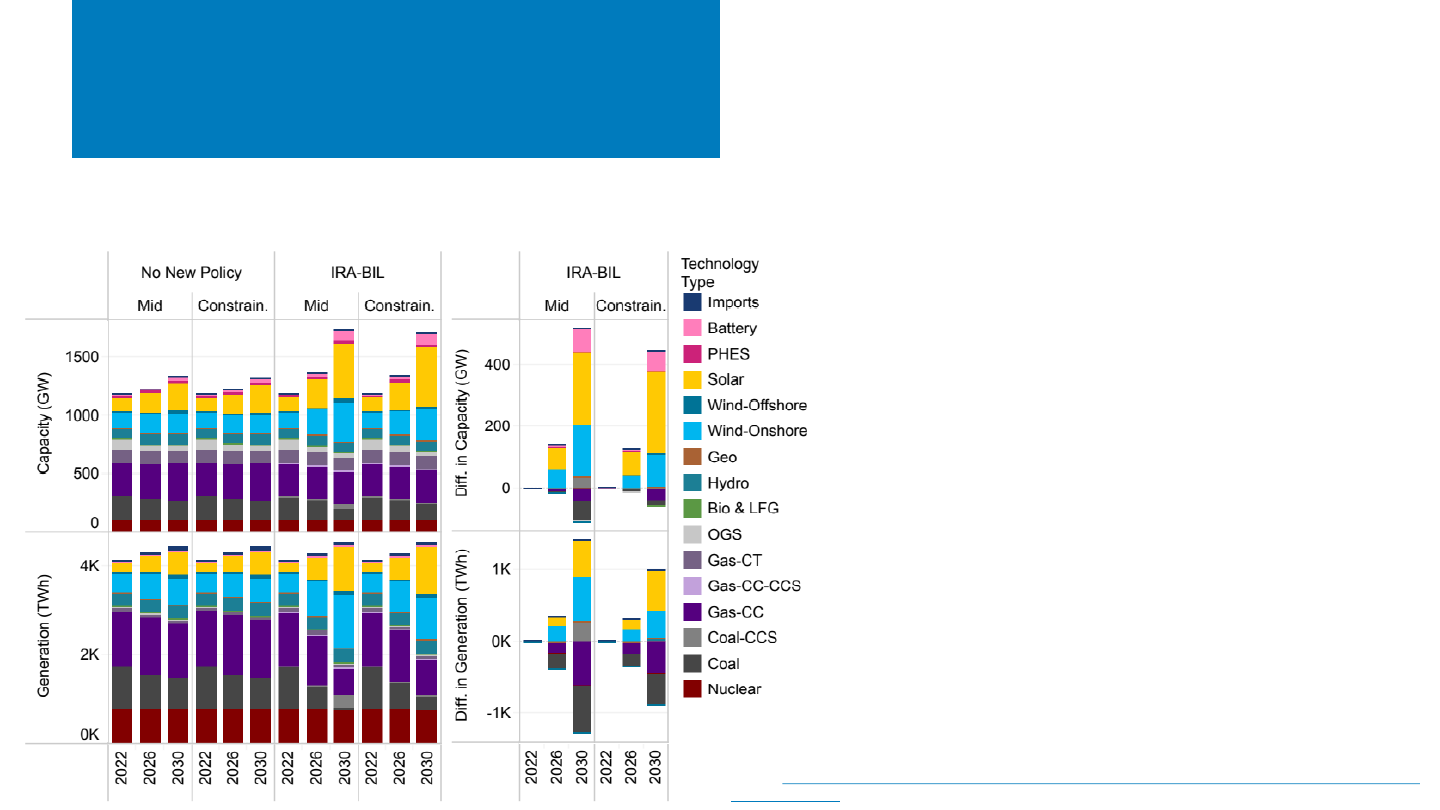

NREL Report on Projected

BIL + IRA Impacts

Using ReEDS (the Regional Energy Deployment System), a team at NREL looked at the impact of IRA + BIL on the contiguous U.S.

power sector from 2023 to 2030. They found:

• Clean electricity could grow from 41% of total

generation in 2022, to 71-90% by 2030.

– Without IRA+BIL, clean electricity would only

account for 46-52% of the grid.

– This is mainly the result of increased production

from wind and solar, supplemented by battery

storage and long-distance transmission.

• Annual power sector CO

2

emissions could decline

by 72-91% below 2005 levels by 2030.

– Estimated avoided climate damages range from $160B

to $230B.

• IRA+BIL are estimated to lead to a net decrease in

power system costs of $8B-$25B annually by 2030

or $50B-115B from 2023 to 2030.

• Annual average deployment rates for wind and

solar combined range from 44 GW/yr–93 GW/yr.

Source: Evaluating Impacts of the Inflation Reduction Act and Bipartisan Infrastructure Law on the U.S. Power

System (nrel.gov)

NREL | 32NREL | 32

U.S. Installation Breakdown

Annual: EIA (GWac)

• The United States installed 17.0 GWac of PV in 2022—down 12%

y/y.

– Residential (5.2 GWac), was up 30%, however C&I (1.3

GWac), and utility-scale PV (10.6 GWac) were down 19% and

23%, respectively, in 2022.

• Approximately 52% of U.S. PV capacity installed in

2022 was in Texas, Florida, and California.

• Despite a concentration of PV installations in the

top three markets, diversification of growth

continues across the United States.

– 20 states had more than 1 GWac of cumulative PV

installations at the end of 2022 (Oregon achieved

this distinction for the first time in 2022), and 29

states installed more than 100 MWac in 2022.

13.2

1.5

3.9

Texas

18%

Southwest

9%

Florida

10%

California

24%

Midwest

10%

Southeast

14%

Northeast

11%

Other

4%

2022 U.S. PV Installations by Region

(17.0 GWac)

5.7

11.3

8.4

8.3

9.3

15.0

19.3

17.0

0

5

10

15

20

25

2015 2016 2017 2018 2019 2020 2021 2022

PV Installed (GWac)

U.S. PV Installations by Market Segment

Residential PV Non-Residential PV Utility PV

Note: EIA reports values in Wac which is standard for utilities. The solar industry has traditionally reported in Wdc.

Sources: EIA, “Electric Power Monthly,” forms EIA-023, EIA-826, and EIA-861 (March 2023, April 2022, February 2021, February 2019).

NREL | 33NREL | 33

0

5

10

15

20

25

30

Annual PV Installed (GWdc)

U.S. PV Installations by Market Segment

Utility

Nonresidential PV

Residential PV

U.S. Installation Breakdown

Annual: SEIA (GWdc)

• SEIA reports that the United States installed 20.2 GWdc of PV in 2022

(140.6 cumulative)—an annual decrease of 16% y/y.

– 11.8 GWdc UPV (-31% y/y), 2.4 GWdc Non-residential (-10% y/y), and

5.9 GWdc Residential (40% y/y).

• Q4 2022 installations totaled 6.6 GWdc.

• In 2022, 50% of installed capacity occurred in California,

Texas, and Florida, however 28 states installed more

than 100 MW.

Sources: Wood Mackenzie/SEIA: U.S. Solar Market Insight: 2022 YIR.

Unlike the previous slide, these values are in GWdc—not GWac.

California

24%

Texas

17%

Southwest

10%

Florida

9%

Southeast

15%

Northeast

11%

Midwest

8%

Other

6%

2022 U.S. PV Installations by Region

(20.2 GWdc)

NREL | 34NREL | 34

27.3%

23.3%

19.3%

18.5%

17.0%

11.5%

11.0%

9.9%

8.9%

7.0%

6.8%

6.3%

6.1%

5.7%

5.6%

5.4%

4.7%

0%

5%

10%

15%

20%

25%

30%

CA NV MA VT HI UT RI AZ NC ME NJ CO NM GA VA FL U.S.

Solar Generation as a Percentage of Total

Net Generation

CSP

Residential

C&I

UPV

Solar Generation as a Percentage

of Total Generation, 2022

• During 2022, 16 states generated more than 5%

of their electricity from solar, with California

leading the way at 27.3%.

– Five states (California, Nevada, Massachusetts,

Vermont, and Hawaii) generated more than 15% of

their electricity using solar.

– These five states have consistently led in solar

generation for several years, although Nevada

overtook Massachusetts and Vermont overtook

Hawaii relative to 2021.

– Colorado, Maine, Georgia, Virginia, and Florida all

recently surpassed 5% solar generation.

Interestingly, despite having significant levels of

deployment, Texas, at 4.8%, has yet to hit this

threshold.

• Nationally, 4.7% of electricity was generated

from solar—up from 3.9% during calendar year

2021.

• The roles of utility and distributed solar varies

by state. Southern and Western states rely more

on utility-scale solar, while northern states and

Hawaii rely more on distributed solar.

Note: EIA monthly data for 2022 are not final. Additionally, smaller utilities report information to EIA on a yearly basis, and

therefore a certain amount of solar data has not yet been reported. “Net Generation” includes distributed PV generation. Net

generation does not take into account imports and exports to and from each state, and therefore the percentage of solar

consumed in each state may vary from its percentage of net generation.

Source: U.S. Energy Information Administration (EIA), “Electricity Data Browser.” Accessed March 31, 2023.

▲ ▼ ▲ ▼

NREL | 35NREL | 35

Solar Generation as a Percentage

of Total Generation, 2012–2022

• In 2012, solar produced approximately

0.3% of total U.S. electric generation.

• By 2022, solar grew to 4.7% of electric

generation.

– 3.3% from utility-scale PV (UPV), a nearly

40-fold increase

– 1.4% from distributed PV (DPV), a 9-fold

increase

– 0.1% from concentrating solar power

(CSP), a 3-fold increase.

Note: EIA monthly data for 2022 are not final. Additionally, smaller utilities report information to EIA on a yearly basis, and

therefore, a certain amount of solar data has not yet been reported.

Source: U.S. Energy Information Administration, “Electricity Data Browser.” Accessed April 10, 2023.

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

4.0%

4.5%

5.0%

2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Percent of U.S. Electric Generation

CSP

DPV

UPV

NREL | 36NREL | 36

5

10

15

20

25

Dec-13

Jun-14

Dec-14

Jun-15

Dec-15

Jun-16

Dec-16

Jun-17

Dec-17

Jun-18

Dec-18

Jun-19

Dec-19

Jun-20

Dec-20

Jun-21

Dec-21

Jun-22

Dec-22

U.S. Solar Electric Generation (TWh)

CSP Residential PV C&I PV UPV Total PV

Monthly U.S. Solar Generation,

2014–2022

• Total peak monthly U.S. solar generation increased

by a factor of 7.2 from 2014 to 2022.

– U.S. electric generation in December 2022 (during the

low seasonal period of electric generation) was above

the peak solar production in 2018 (orange dotted line).

– In April 2022, solar produced 5.8% of all U.S. electricity

production, and produced over 5% of all U.S.

electricity production in April, May, June, September,

and October of 2022.

• Utility-scale solar electricity production (including

PV and CSP technologies) dropped by 56% from its

summer peak (June 2022) to its winter low

(December 2022), and DPV systems dropped 47%.

– The drop in production would likely be greater without

continued builds of solar installations throughout the

year.

Note: EIA monthly data for 2022 are not final. Additionally, smaller utilities report information to

EIA on a yearly basis, and therefore, a certain amount of solar data have not yet been reported.

“Net Generation” includes DPV generation.

Sources: EIA, “Monthly Energy Review,” (April 2023).

NREL | 37NREL | 37

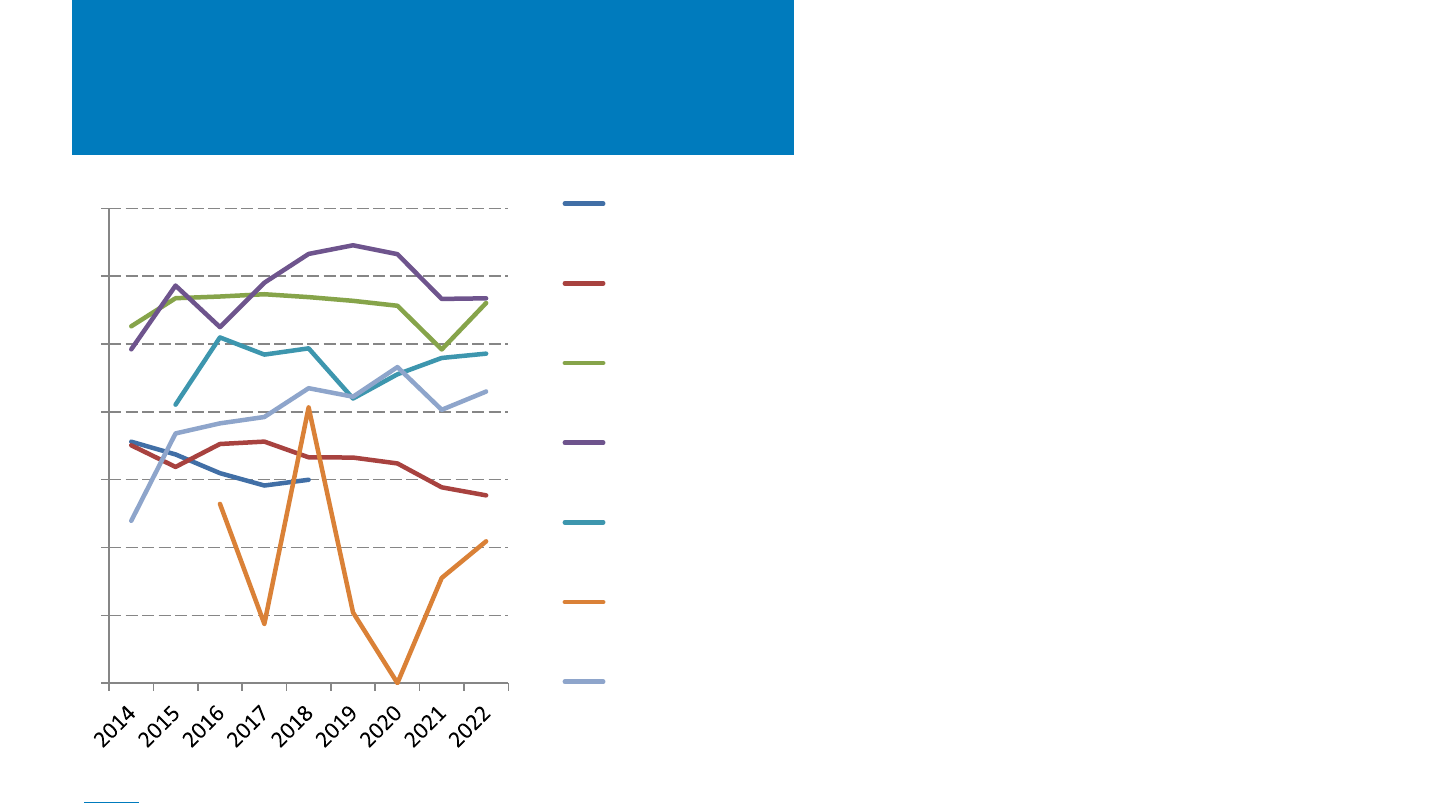

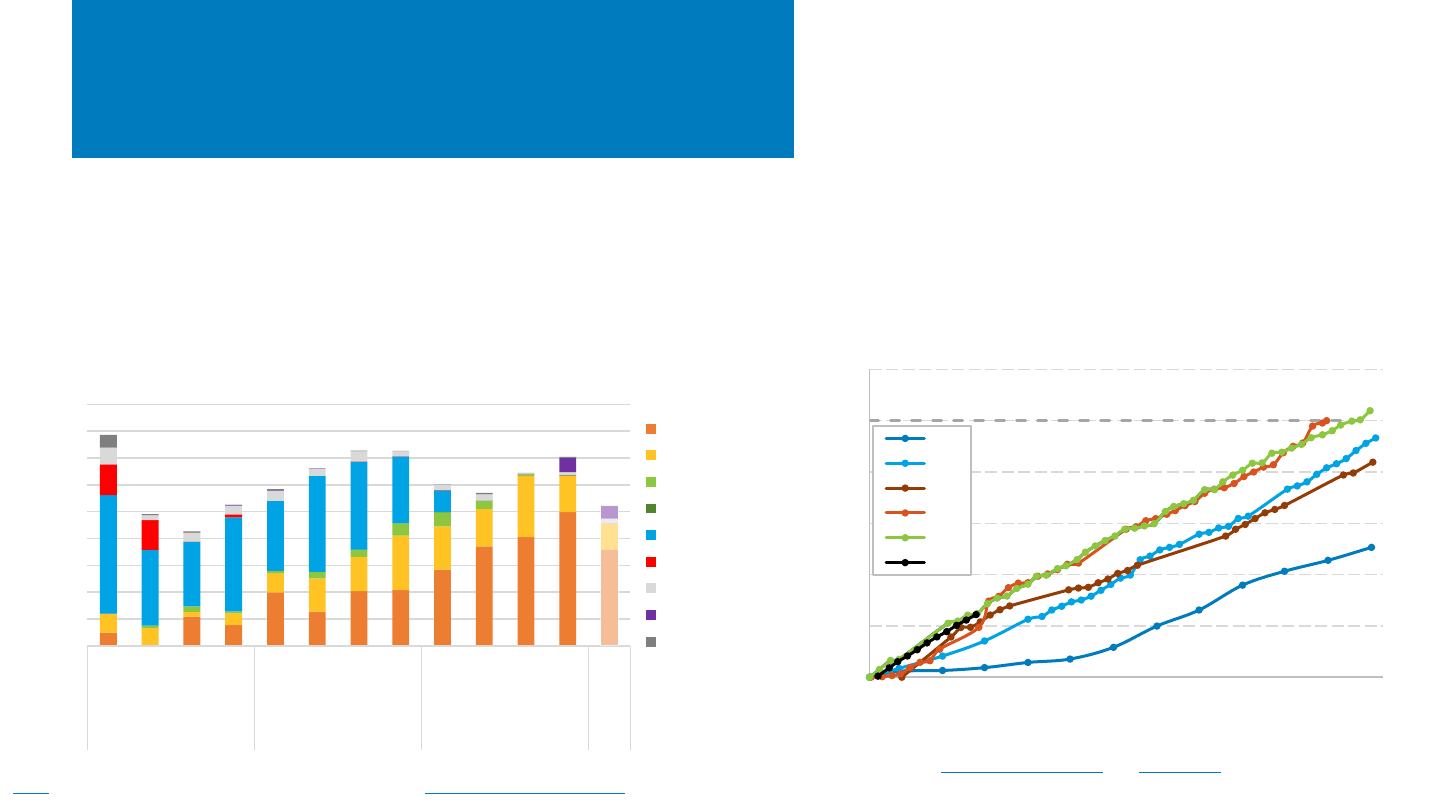

Solar Generation as a Percentage

of Total Generation, 2014–2022

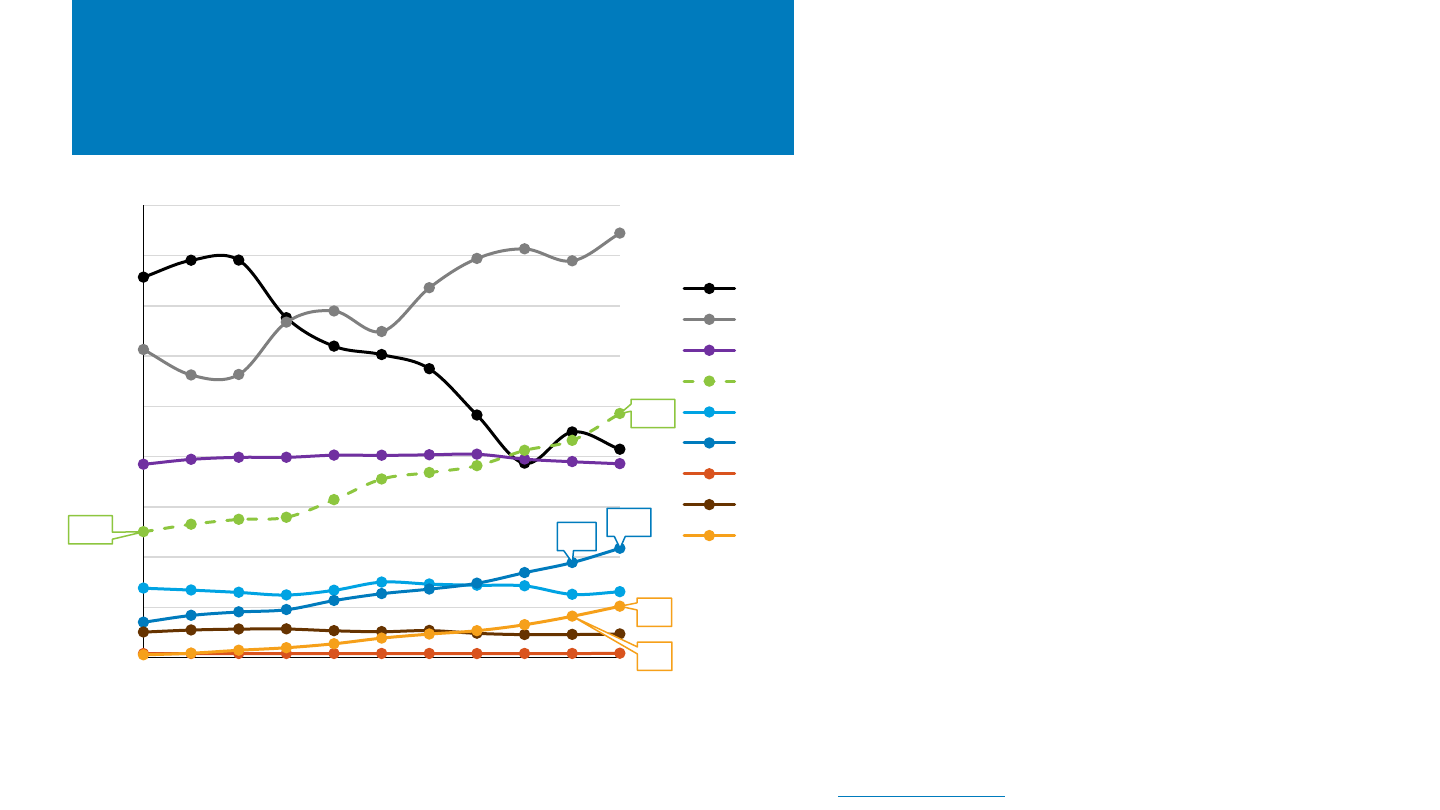

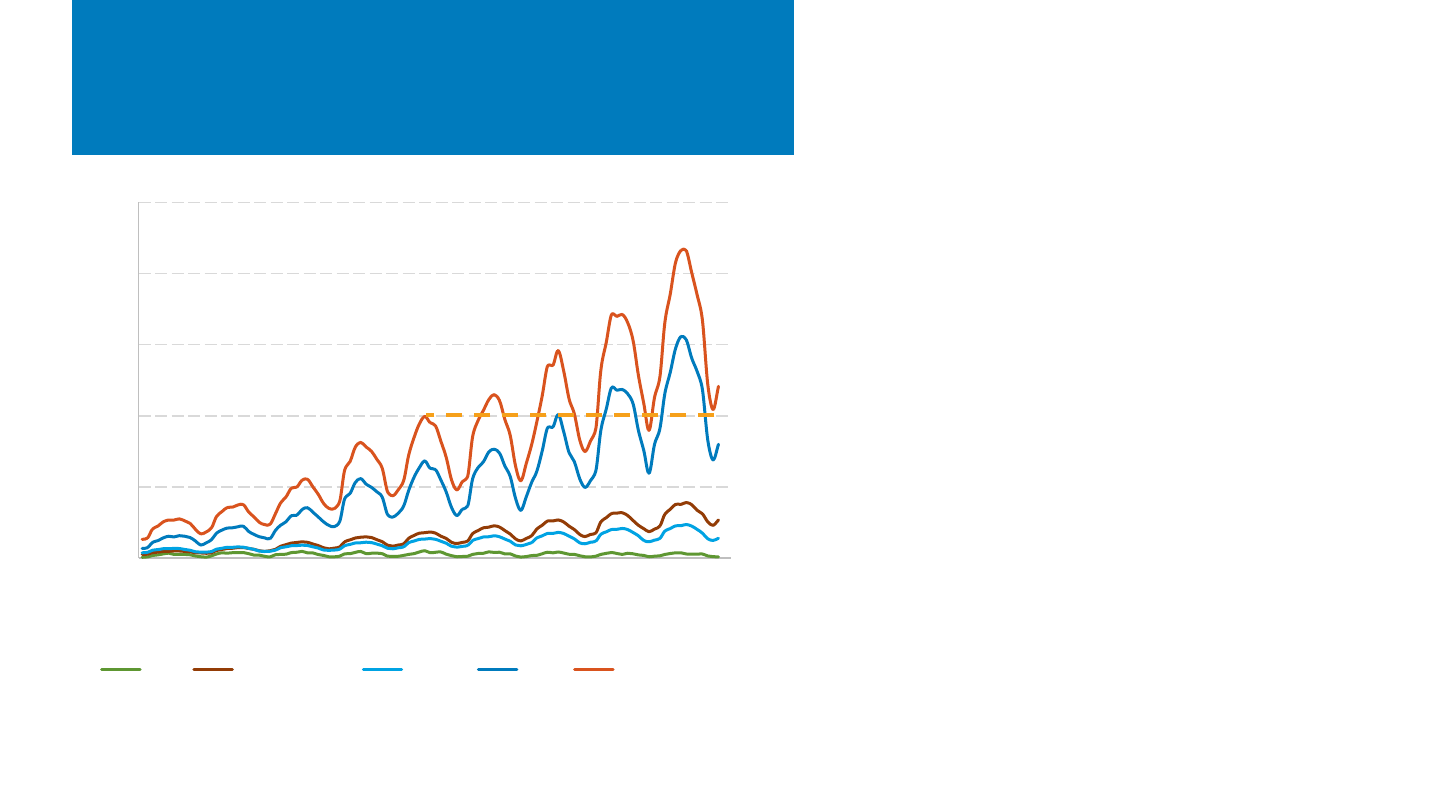

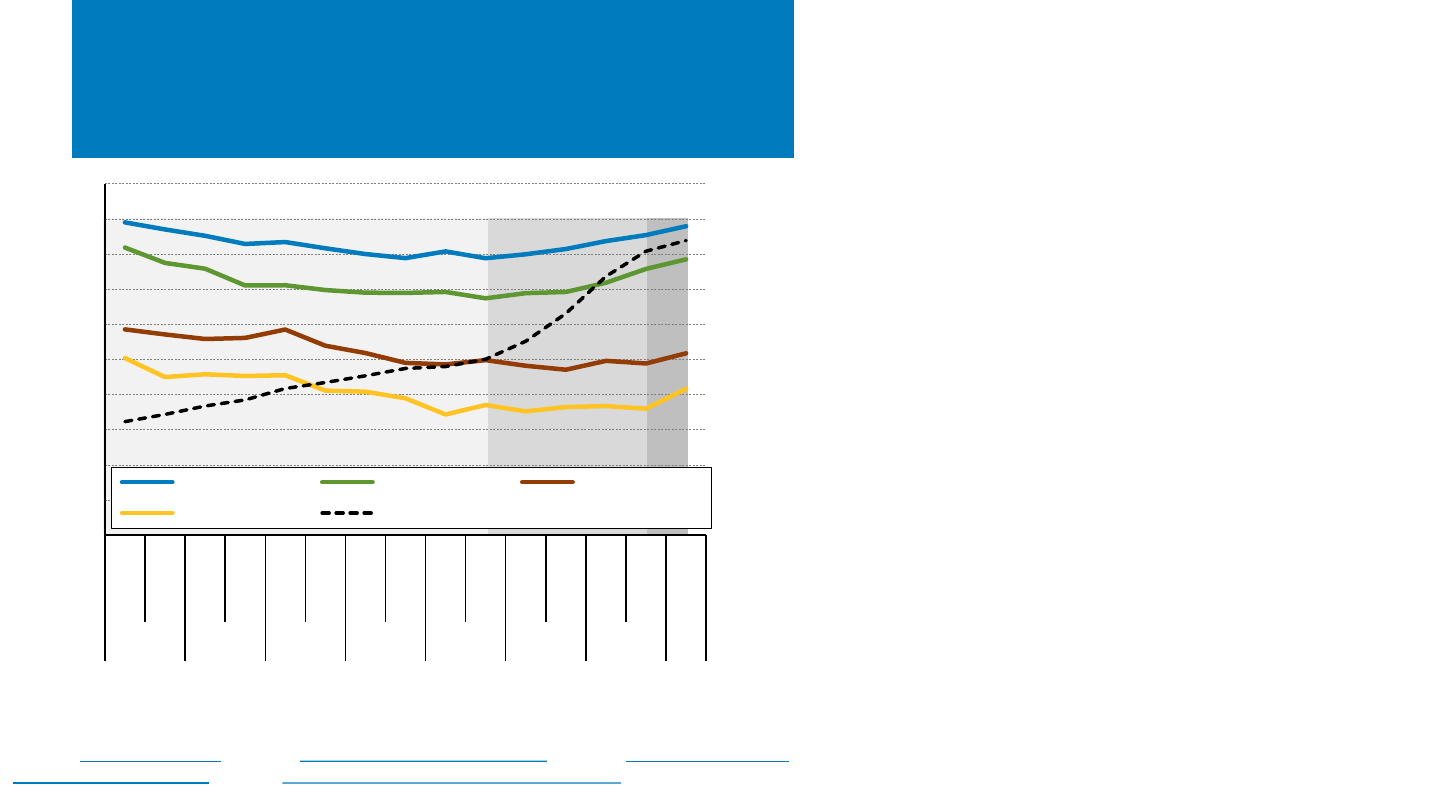

• From 2014 to 2022, leading solar deployment

states greatly increased solar electricity

penetration.

– Rhode Island and Maine (light green) in

particular have seen substantial growth since

2019.

• In the past 5 years, five states (solid lines) shifted

over 9% of their electricity generation to solar

sources.

– Some of the increase in Massachusetts's percentage is

due to significant reduction in total electricity

production within the state.

• The United States, as a whole, has a much lower

level, but it has still increased generation by

573% since 2014.

Note: EIA monthly data for 2022 are not final. Additionally, smaller utilities report information to EIA on a yearly

basis, and therefore a certain amount of solar data has not yet been reported. “Net Generation” includes DPV

generation. Net generation does not include imports and exports to and from each state, and therefore the

percentage of solar consumed in each state may vary from its percentage of net generation.

Source: U.S. Energy Information Administration (EIA), “Electricity Data Browser.” Accessed April 4, 2023.

0%

5%

10%

15%

20%

25%

30%

2014 2015 2016 2017 2018 2019 2020 2021 2022

Solar Generation as a Percentage of Total

Net Generation

CA

NV

MA

VT

HI

UT

RI

AZ

NC

ME

NJ

CO

U.S.

NREL | 38NREL | 38

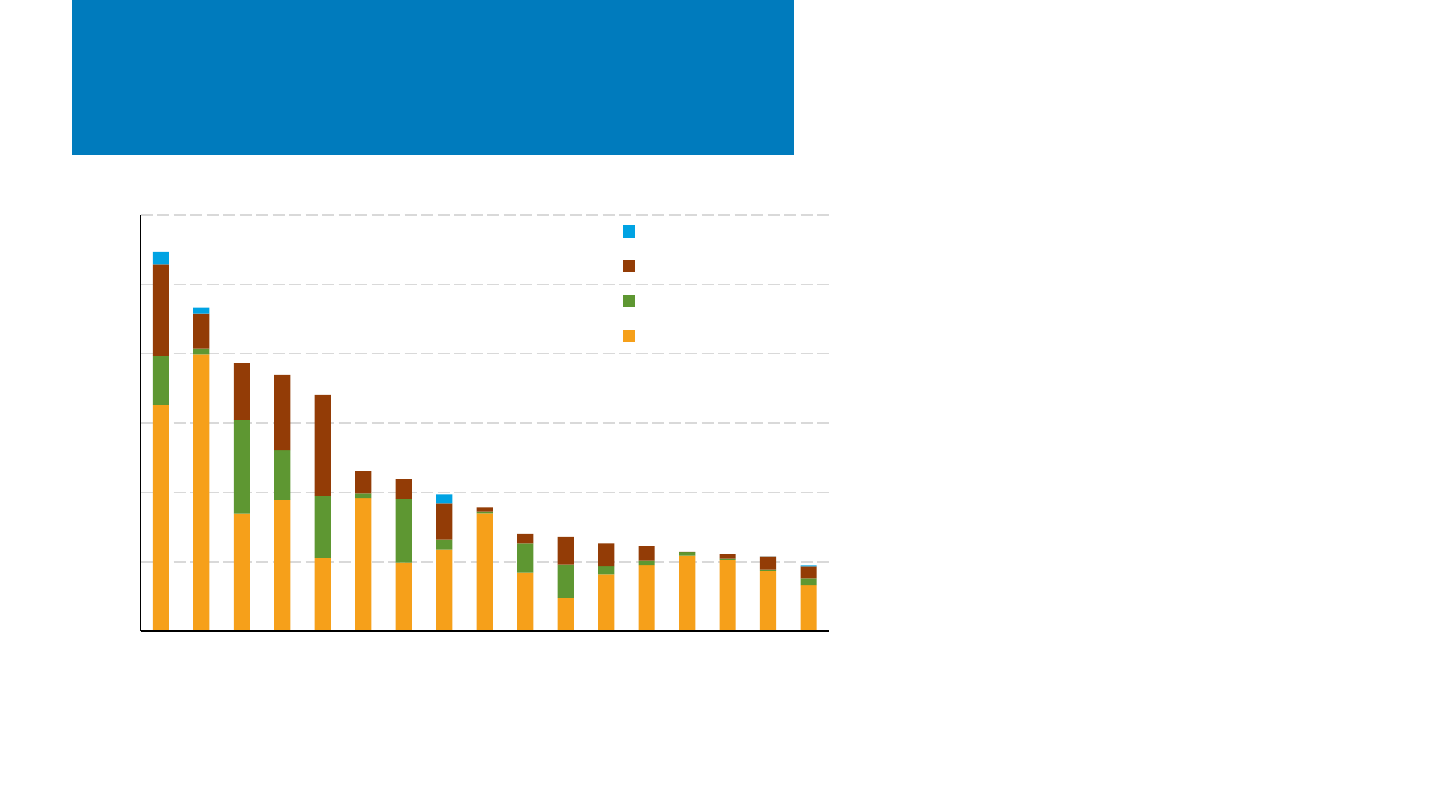

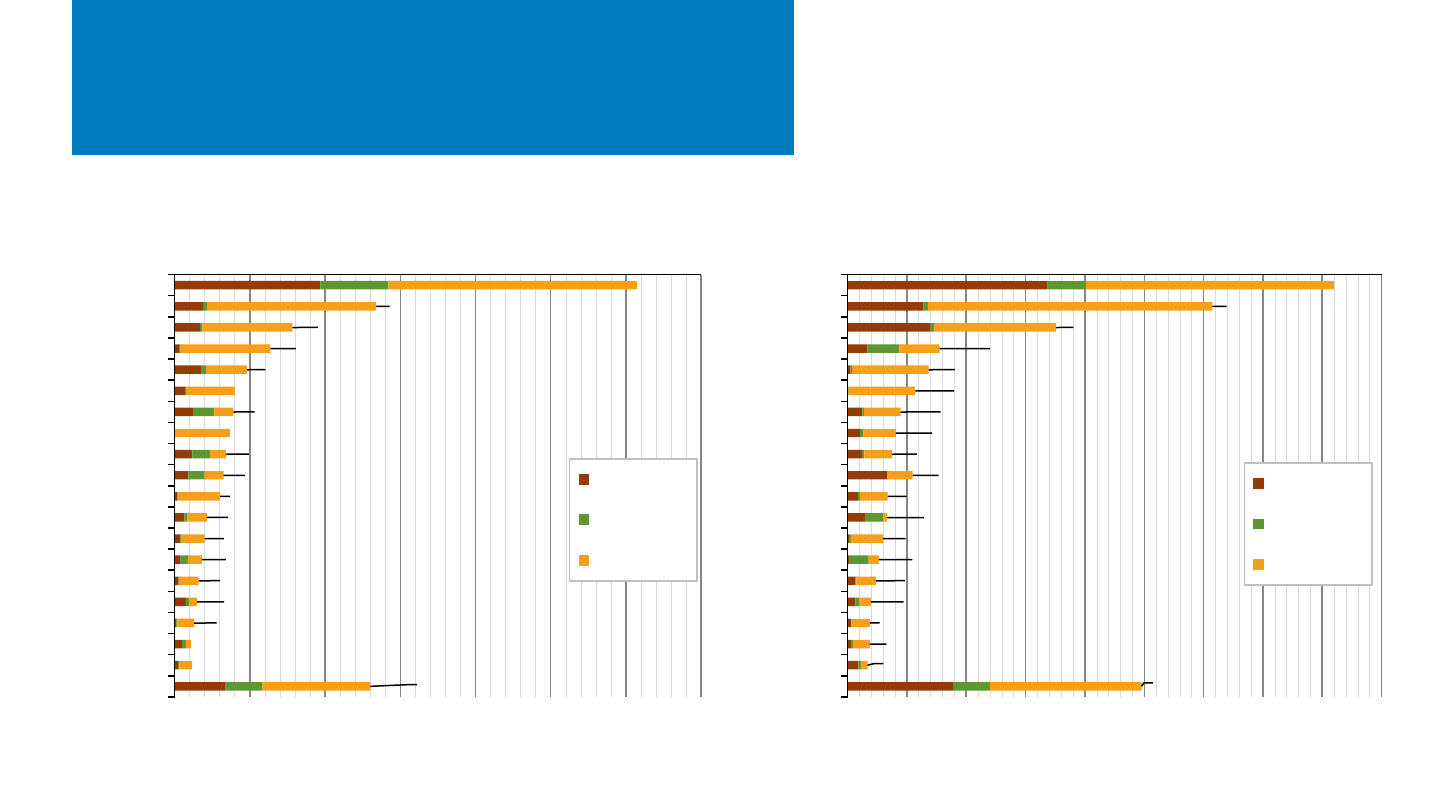

4,098

3,074

1,756

776

683

570

447

408

376

363

337

332

300

264

239

197

188

187

169

2,477

0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500

California

Texas

Florida

New York

Virginia

Georgia

Nevada

Illinois

Colorado

Arizona

North Carolina

New Jersey

Wisconsin

Maine

Washington

Maryland

Michigan

Iowa

Massachusetts

Other

PV Capacity Installed in 2022 (MWac)

Residential

C&I

Utility-scale

30,738

13,404

7,838

6,371

4,806

4,008

3,906

3,676

3,413

3,257

3,032

2,154

2,001

1,815

1,602

1,496

1,309

1,107

1,173

13,009

0 5,000 10,000 15,000 20,000 25,000 30,000 35,000

California

Texas

Florida

North Carolina

Arizona

Nevada

New York

Georgia

New Jersey

Massachusetts

Virginia

Colorado

Utah

Illinois

South Carolina

Maryland

Minnesota

Hawaii

New Mexico

Other

Cumulative PV Capacity Installed as of Dec 2022 (MWac)

Residential

C&I

Utility-scale

U.S. Installation Breakdown

by State

Note: EIA monthly data for 2022 are not final. Additionally, smaller utilities report information to EIA on a yearly basis, and therefore, a certain amount of solar data have not

yet been reported. “Net Generation” includes DPV generation. Arizona’s C&I installations in 2022 were net negative.

Sources: EIA, “Electric Power Monthly,” forms EIA-023, EIA-826, and EIA-861 (February 2023, February 2022).

At the end of 2022, there were 110.1 GWac of solar PV systems in the United States, of which 70.6 GWac were utility-scale

PV, 26.3 GWac were residential PV, and 13.2 GWac were C&I PV.

NREL | 39NREL | 39

Cumulative U.S. PV Capacity Per

Capita (2022)

Note: EIA monthly data for 2022 are not final. Additionally, smaller utilities report information to EIA on a yearly basis, and therefore, a certain amount of solar data have not

yet been reported. “Net Generation” includes DPV generation. Virginia’s C&I installations in 2021 were net negative.

Sources: EIA, “Electric Power Monthly,” forms EIA-023, EIA-826, and EIA-861 (February 2023); United States Census Bureau (2023).

• Some large states that ranked high in total cumulative capacity at the end of 2022, such as Texas (#2), Florida (#3) and New

York (#7), are noticeably lower in rankings on a watts per capita basis. Texas drops to #11, Florida to #16, and New York to #25.

– Conversely, Nevada and Hawaii, which ranked 6

th

and 19

th

in cumulative PV capacity, jump to 1

st

and 3

rd

in terms of PV

watts per capita.

0

200

400

600

800

1,000

1,200

1,400

Nevada

California

Hawaii

Arizona

North Carolina

Utah

Rhode Island

New Mexico

Massachusetts

Vermont

Texas

Maine

Colorado

New Jersey

Georgia

Florida

Virginia

U.S.

South Carolina

Connecticut

Oregon

Idaho

Maryland

Minnesota

New York

DC

Delaware

Wyoming

Arkansas

Wisconsin

Iowa

Illinois

NH

Indiana

Mississippi

Alabama

Missouri

Michigan

Washington

Ohio

Louisiana

Pennsylvania

Tennessee

Montana

Kentucky

Nebraska

Kansas

Oklahoma

Alaska

West Virginia

South Dakota

North Dakota

Cumulative PV Capacity Per Capita

(Wac/person)

NREL | 40NREL | 40

U.S. Installation Breakdown

Annual: EIA (GWac)

• At the end of 2022, there were 110.1 GWac of cumulative PV

installations.

• EIA reports that at the end of 2022, 64% of U.S. installed PV capacity

was from utility-scale PV systems.

• Despite representing only 24% of installed U.S. PV

capacity at the end of 2022, 97% of PV systems—over

3.6 million systems—were residential applications.

Note: EIA reports values in Wac which is standard for utilities. The solar industry has traditionally reported in Wdc. See the next slide for values reported in Wdc.

Sources: EIA, “Electric Power Monthly,” forms EIA-023, EIA-826, EIA-860, and EIA-861 (April 2023).

Residential

26.3

C&I

13.2

Utility-scale

70.6

Cumulative U.S. PV Installations as of

December 2022 (110.2 GWac)

Residential

3,647,828

C&I

116,546

Utility-scale

5,707

Cumulative U.S. PV Installations as of

December 2022 (3.8 million systems)

NREL | 41NREL | 41

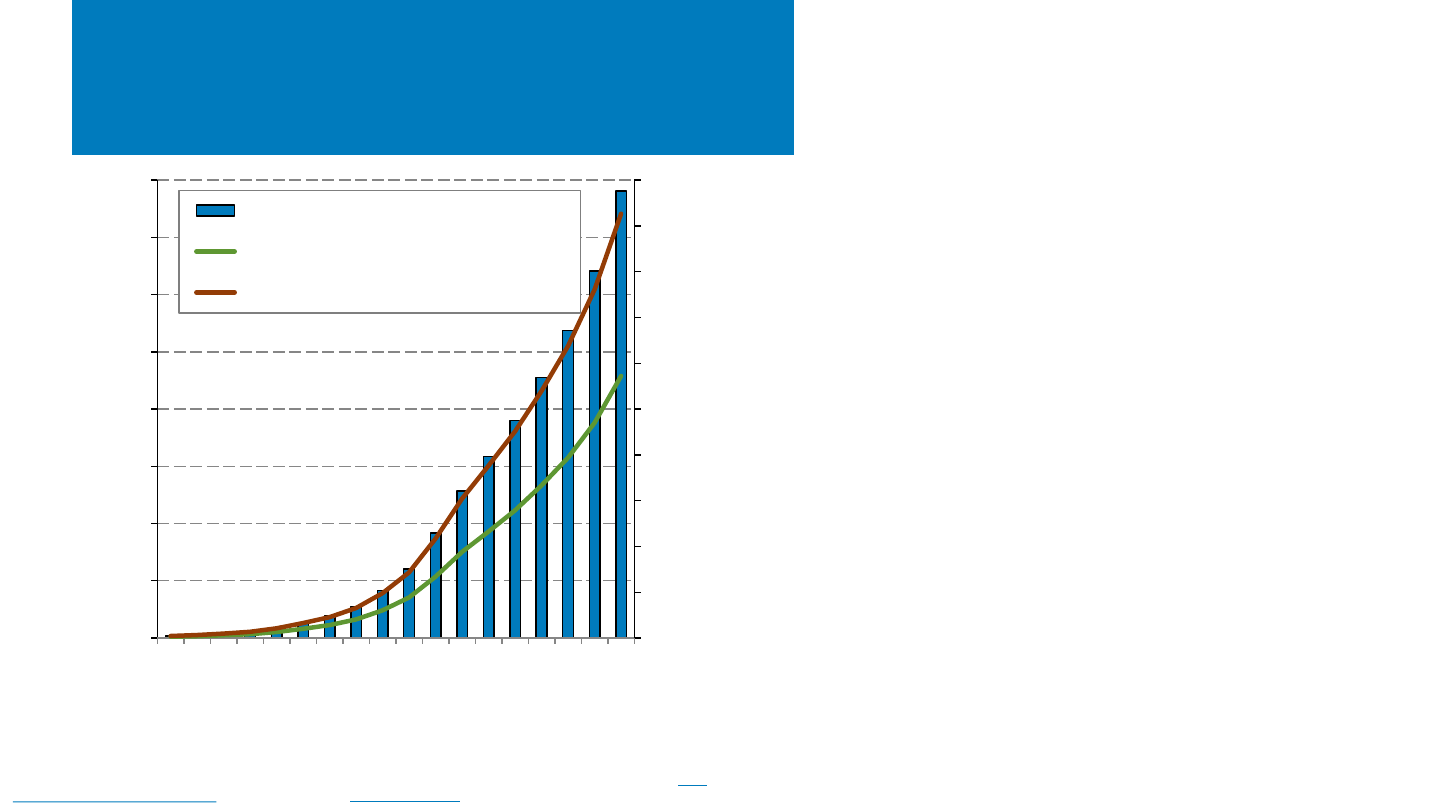

U.S. Residential PV Penetration

• Since 2005 when Congress passed the

investment tax credit, the number of annually

installed residential PV systems has grown by

approximately 37% per year, or over 200X.

• At the end of 2022, there were approximately

3.9 million residential PV systems in the United

States.

– Still, only 2.7% of households own or lease a

PV system (or 4.4% of households living in

single-family detached structures).

– However, solar penetration varies by

location. Hawaii, California, and Arizona

have residential systems on an estimated

33%, 20%, and 12% of households living in

single-family detached structures.

Sources: Res. PV Installations: 2000-2009, IREC 2010 Solar Market Trends Report; 2010-2022, SEIA/Wood Mackenzie Solar

Market Insight 2022 Year-in-Review; U.S. Households from U.S. Census Bureau.

0

400,000

800,000

1,200,000

1,600,000

2,000,000

2,400,000

2,800,000

3,200,000

3,600,000

4,000,000

0.0%

0.6%

1.2%

1.8%

2.4%

3.0%

3.6%

4.2%

4.8%

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

Cum. # of Res. PV Systems

% of households with PV

Residential PV systems (right axis)

U.S. households (left axis)

Single-family detached houses (left axis)

NREL | 42NREL | 42

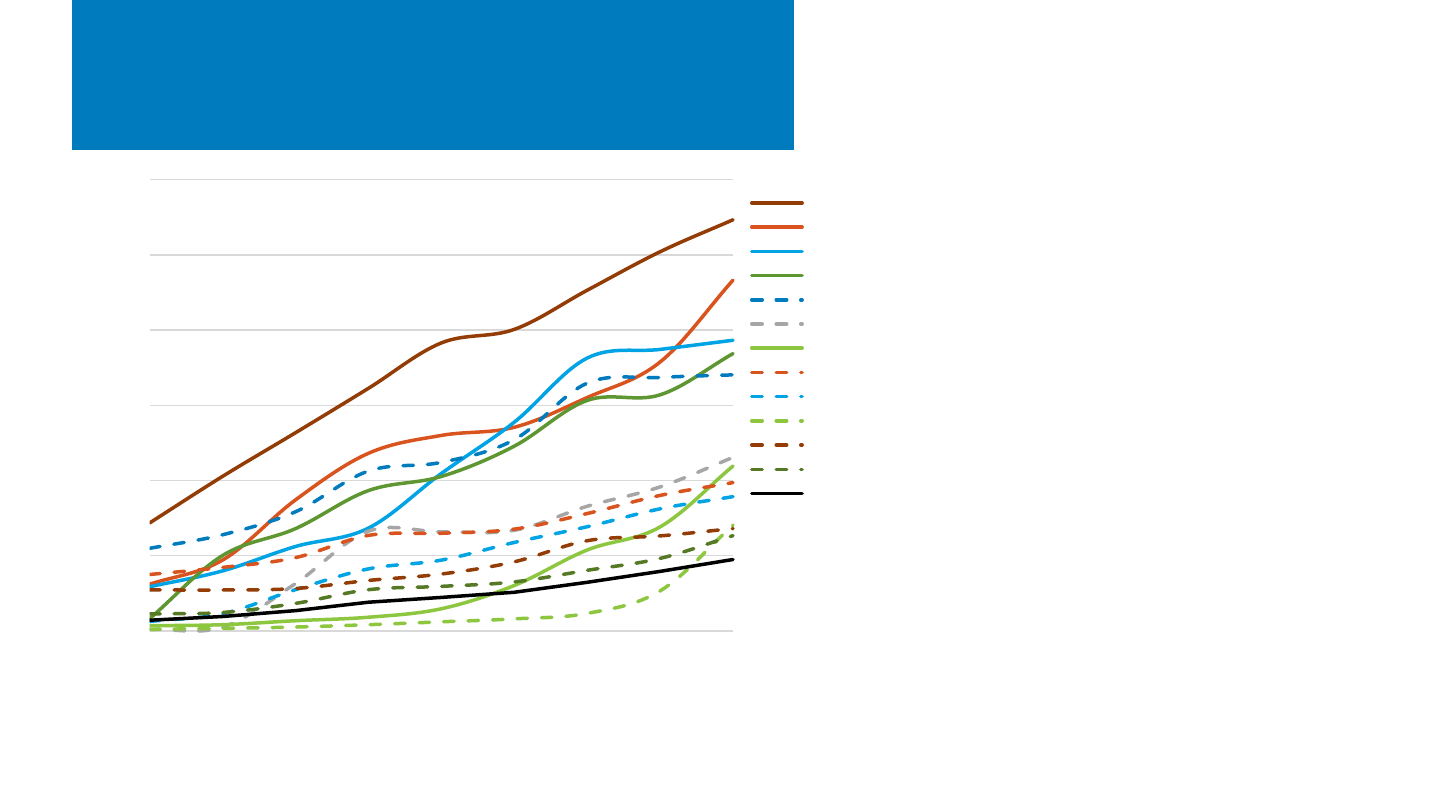

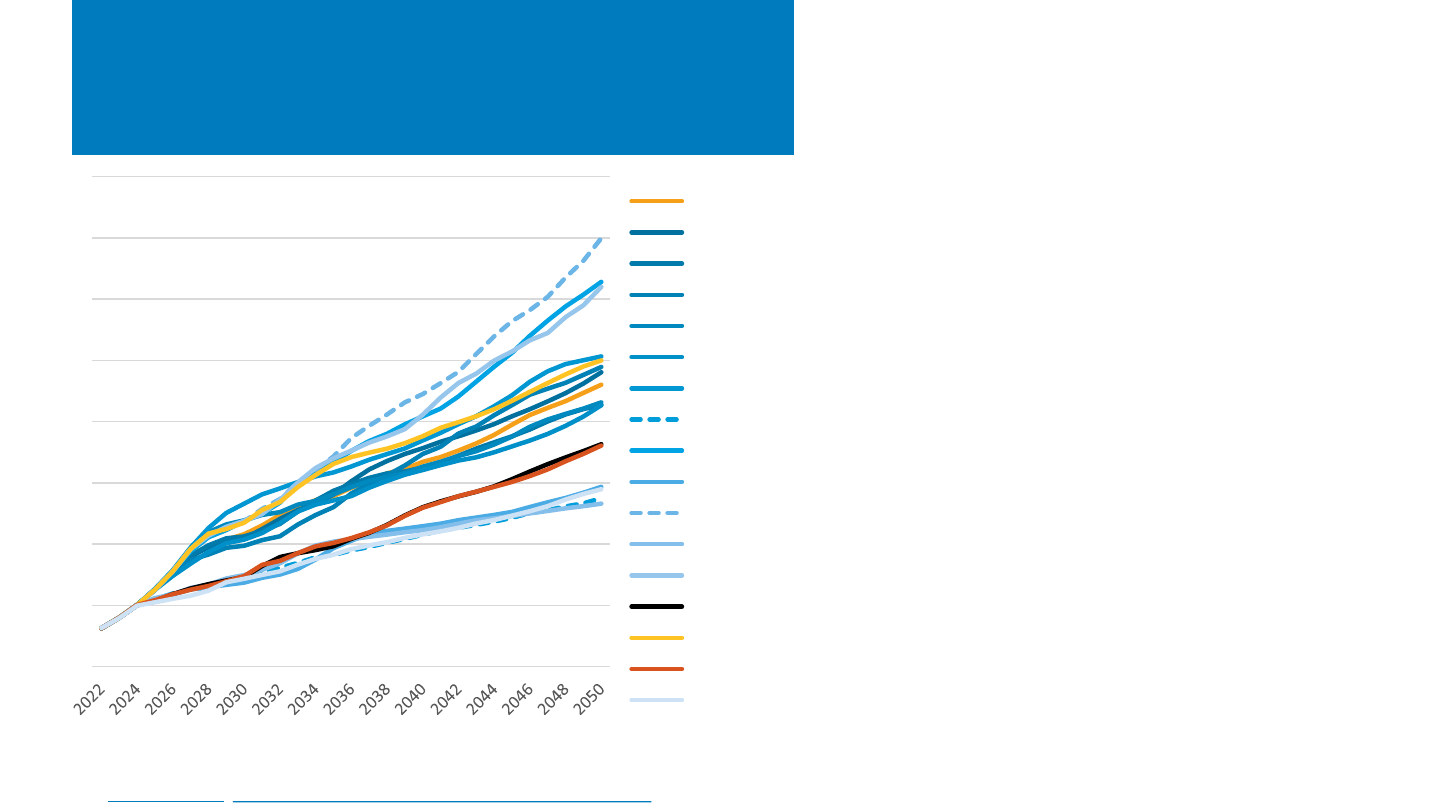

AEO2023 Projections

Note: “Other” includes coal, geothermal, landfill gas, biomass and petroleum.

Sources: EIA Today in Energy, Issues in Focus: Inflation Reduction Act Cases in AEO2023

EIA projects that total U.S. solar capacity

(including both UPV and DPV) could range from

0.5 TWac to 1.4 TWac by 2050, across the 16

scenarios investigated.

EIA estimates that IRA could result in as much as

270 GWac more capacity by 2050 than there

would be without the law.

• The High Uptake case, which assumes that

qualified projects receive the maximum

bonus tax credits, projects 660 GWac of solar

capacity by 2035, and 1 TWac by 2050.

• In the Reference case, the electric power

sector solar is assumed to take the

production tax credit and meet the labor

requirements, growing to 560 GWac of solar

capacity by 2035, and 920 GWac by 2050.

• Low Uptake case, which assumes most

qualified projects only receive the base tax

credit, projects only 400 GWac of solar

capacity in 2035, and 720 GWac by 2050.

– The SunShot Vision Study (released in

2012, projected 715 GWac of solar by

2050).

• No IRA case excludes energy-related IRA

provisions and trends nearly identically to

the Low Uptake case.

0

0.2

0.4

0.6

0.8

1

1.2

1.4

1.6

Solar Net Summer Capacity (TWac)

Reference case

High Economic Growth

Low Economic Growth

High Oil Price

Low Oil Price

High Oil and Gas Supply

Low Oil and Gas Supply

High Zero-Carbon Technology Cost

Low Zero-Carbon Technology Cost

High Macro and High Zero-Carbon Technology Cost

High Macro and Low Zero-Carbon Technology Cost

Low Macro and High Zero-Carbon Technology Cost

Low Macro and Low Zero-Carbon Technology Cost

No Inflation Reduction Act

High Uptake of Inflation Reduction Act

Low Uptake of Inflation Reduction Act

AEO2022 Reference case

NREL | 43NREL | 43

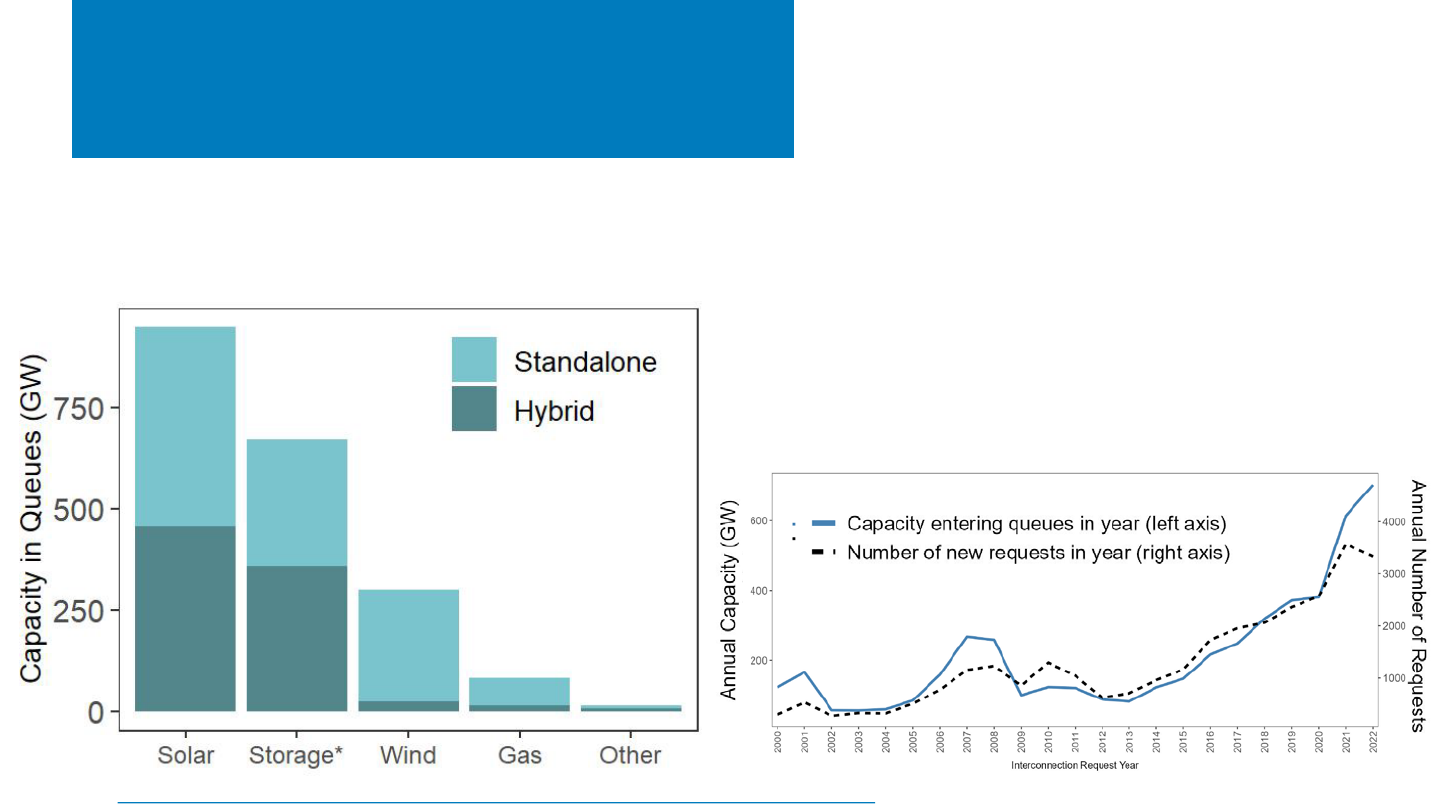

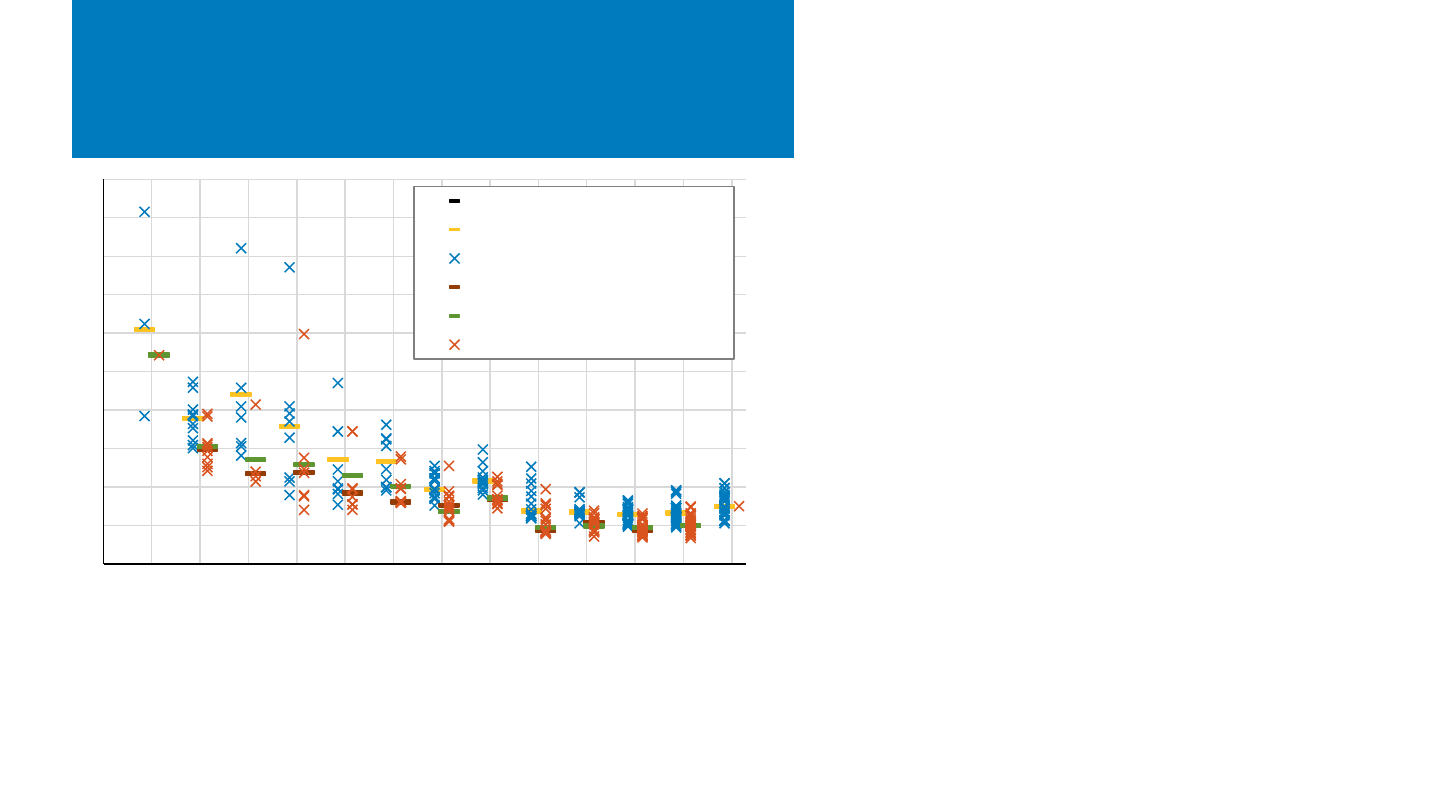

U.S. Transmission

Interconnection Queues

• Substantial solar and storage capacity have been proposed in most

regions of the United States.

– Over 10,000 projects representing 1.35 TWac of generator

capacity (1.26 TW of which is zero-carbon and 0.95 TW is solar)

and 0.7 TWac of storage are seeking interconnection.

• Annual interconnection requests have increased dramatically—in

terms of both number and capacity—since 2013; over 700 GWac was

added in 2022 alone. Hybrids represent a significant portion of solar

capacity.

• Only 14% of proposed solar projects entering queues from 2000 to

2017 have reached commercial operations (compared to 21% for all

technologies).

• The average time spent in queues has increased over time. The typical

projects built in 2022 took 5 years from interconnection request to

commercial operation. This compares to 3 years in 2015 and less than

2 years in 2008.

Source: LBNL, Queued Up: Characteristics of Power Plants Seeking Transmission Interconnection as of the End of 2022.

Proposed Interconnections by Technology

Interconnection Requests by Year

NREL | 44NREL | 44

Residential Building-Integrated PV

Rebound in California

• In 2022, 8.9 MWdc of residential building-integrated

photovoltaics (BIPV) was installed in the territories

of California’s investor-owned utilities.

– After stagnating for more than a decade, residential BIPV

averaged 140% growth in annual installations from 2020

through 2022.

– During this period, 72% of the BIPV systems were

coupled with energy storage.

– Tesla installed 98% of BIPV capacity in 2021 and 94% in

2022.

– GAF Energy—a spinoff of the major roofing

manufacturer—began offering solar shingles in 2022 and

captured 3% of the year’s BIPV market share.

• Despite the recent growth, BIPV made up only

0.5%–0.7% of total residential PV installed in the

California IOU territories in 2021 and 2022.

• About 3,000 Tesla BIPV “Solar Roofs” (~30 MWdc)

have been installed nationwide since launching in

2016, constituting around 0.2% of the national

residential PV market in 2021 and 2022.

Note: BIPV, as defined by the California Energy Commission’s PV Module List, includes modules that are not rack mounted. The residential data

described on this slide include standalone PV and PV-plus-storage systems installed in the territories of Pacific Gas & Electric (PG&E), Southern

California Edison (SCE), and San Diego Gas & Electric (SDG&E).

Sources: Canary Media (3/30/23); CA NEM database (1/31/23); Fast Company (05/03/22); Forbes (04/19/21); Wood Mackenzie (3/30/23).

0%

1%

2%

3%

4%

0

1

2

3

4

5

6

7

8

9

10

Percent of resi. installs in PG&E, SCE, SDG&E (line)

Resi. installs in PG&E, SCE, SDG&E (bars, MWdc)

Standalone BIPV

BIPV+storage

BIPV market share

NREL | 45NREL | 45

Bifacial Increase in California

Distributed PV Installations

• In 2022, 81 MWdc of bifacial modules was installed

in the California IOU territories—56% more than in

2021.

– 24 MWdc (1.3%) of residential capacity was

bifacial.

– 58 MWdc (15.9%) of nonresidential capacity

was bifacial.

• Ground-mount and flat-roof nonresidential PV

installations can provide bifacial energy gain, but

typical sloped residential rooftop installations do

not provide bifacial gain.

• Installers may use bifacial modules to avoid tariff-

related module costs: bifacial modules were

exempted from Section 201 tariffs starting in June

2019.

• California’s distributed generation data do not

include utility-scale PV projects, which are the

primary application for bifacial modules.

Note: Bifacial modules are defined as having the term “bifacial” in the description field in the California Energy Commission’s PV Module List.

Source: CA NEM database (1/31/23); Solar Power World (11/16/21); DOE, Solar Futures Study

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

0

10

20

30

40

50

60

70

2014 2015 2016 2017 2018 2019 2020 2021 2022

Percent of Market

Installations (MWdc)

Bifacial residential

Bifacial non-residential

Bifacial market share residential

Bifacial market share non-residential

NREL | 46NREL | 46

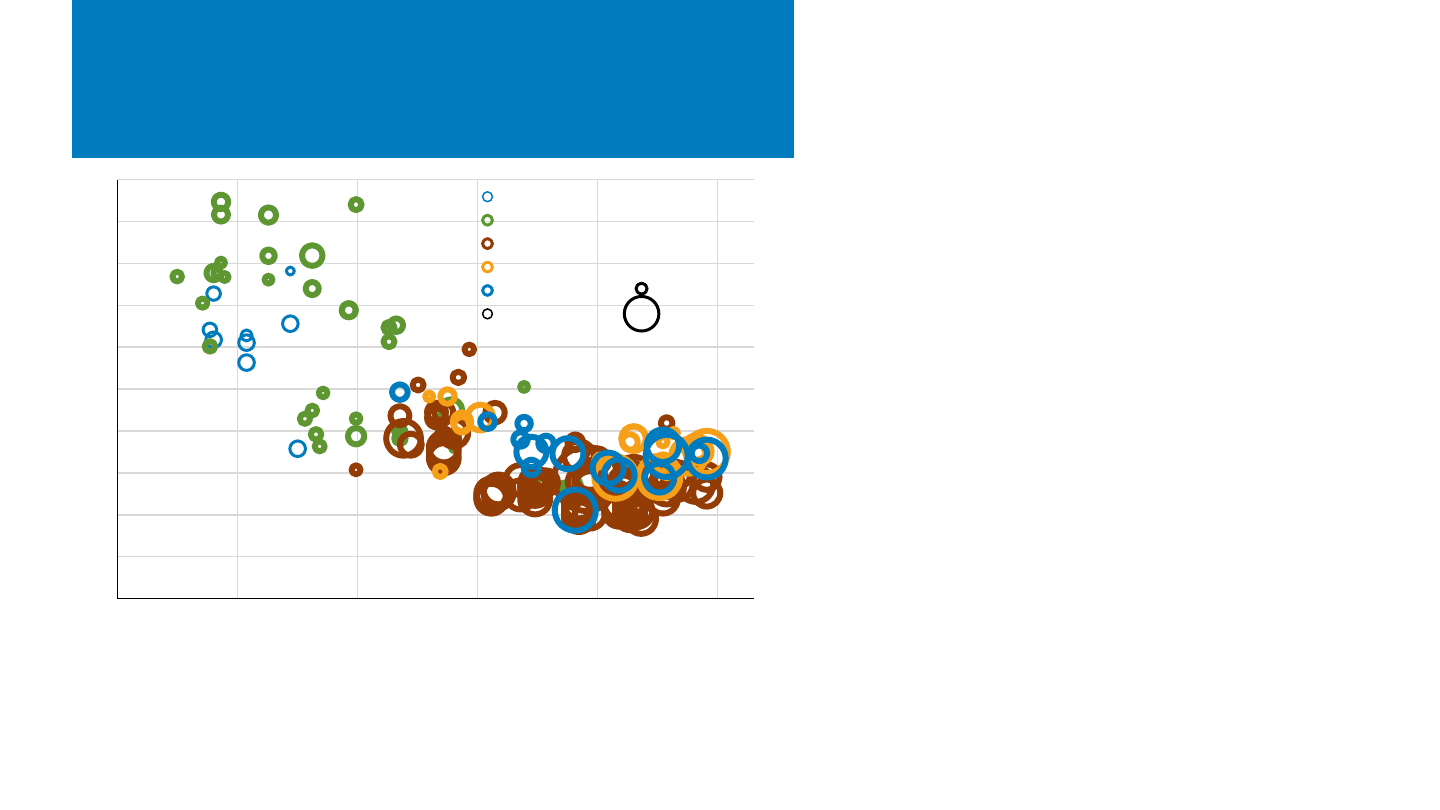

Bifacial Prevalence in New York’s

Community Solar

• New York’s dataset reported a larger share of

bifacial modules in 2022 than California’s NEM

database.

– 4 MWdc (3.8%) of NY residential was bifacial.

– 347 MWdc (54.8%) of NY nonresidential was

bifacial.

• Differences between state datasets include project

sizes and prevalence of community solar.

– For all nonresidential capacity in 2022, the

median was 39 kWdc in CA vs. 162 kWdc in NY,

and the mean was 132 in CA vs. 1,431 in NY.

– Community solar accounted for 87% of NY non-

residential capacity in 2022 vs. 1% in CA.

– 60% of NY community solar capacity (median

project 420 kWdc) was bifacial in 2022 vs. 20%

of other non-residential capacity (median

project 39 kWdc).

– The bifacial share varied by system size in CA,

but less dramatically than in NY; for example,

the share for systems ≥ 400 kWdc was 17% vs.

6% for systems < 40 kWdc.

Note: Bifacial modules are defined as having the term “bifacial” in the description field in the California Energy Commission’s PV Module List. New

York data are for projects supported by the New York State Energy Research and Development Authority (NYSERDA).

Source: CA NEM database (1/31/23); Solar Electric Programs Reported by NYSERDA (3/3/23); Wood Mackenzie & SEIA, US Solar Market Insight: 2022

Year in Review (3/23).

0%

10%

20%

30%

40%

50%

60%

70%

0

100

200

300

400

500

600

700

2014 2015 2016 2017 2018 2019 2020 2021 2022

Bifacial Share

Installations (MWdc)

Total non-community solar (nonresidential)

Total community solar (nonresidential)

Bifacial share of community solar

Bifacial share of non-community solar

NREL | 47NREL | 47

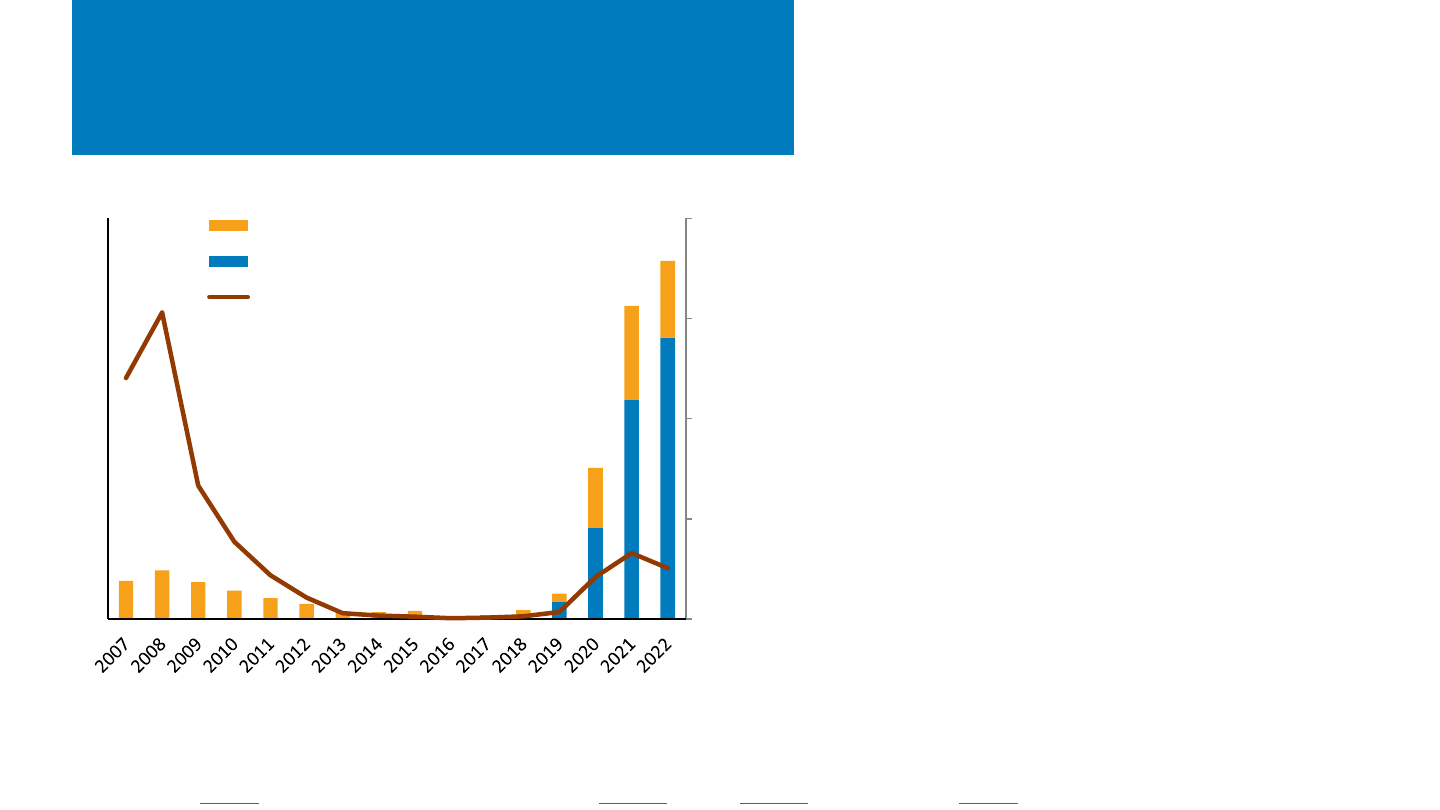

U.S. Energy Storage Installations

by Market Segment (Energy Storage

Association)

California and Texas represented 85% of installed capacity in

2022, though the islands of Puerto Rico and Hawaii came in 3

rd

and 5

th

, respectively, installing around 300 MW of storage each.

– 12 states installed more than 40 MWh of storage in 2022.

The United States installed approximately 14.1 GWh (4.8 GW

ac

) of energy storage

onto the electric grid in 2022, +34% (+30%) y/y as a result of high levels of

residential deployment and grid-scale deployment.

– Grid-scale and residential storage installations were up 29% (34%) and 50% (44%) in

2022 y/y respectively.

– The increase came despite a 40% (34%) reduction deployment in Q4 2022, y/y.

California

71%

Texas

14%

PR 2%

NV 2%

HI 2%

MA 1%

NY 1%

Other

7%

2022 U.S. Energy Storage Installations by Region

(14.1 GWh)

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

2017 2018 2019 2020 2021 2022

Energy Storage Installed (MWh)

U.S. Energy Storage Installations by Market Segment

Grid-Scale (MWh)

CCI (MWh)

Residential (MWh)

0

1,000

2,000

3,000

4,000

5,000

6,000

Energy Storage Installed (MW)

Grid-Scale (MW)

CCI (MW)

Residential (MW)

Note: Front-of-the-meter refers to all projects deployed on the utility side of the meter, regardless of size or ownership. CCI

refers to Community-scale, commercial and industrial.

Source: Wood Mackenzie Power & Renewables and Energy Storage Association, U.S. Energy Storage Monitor: Q4 2022.

NREL | 48NREL | 48

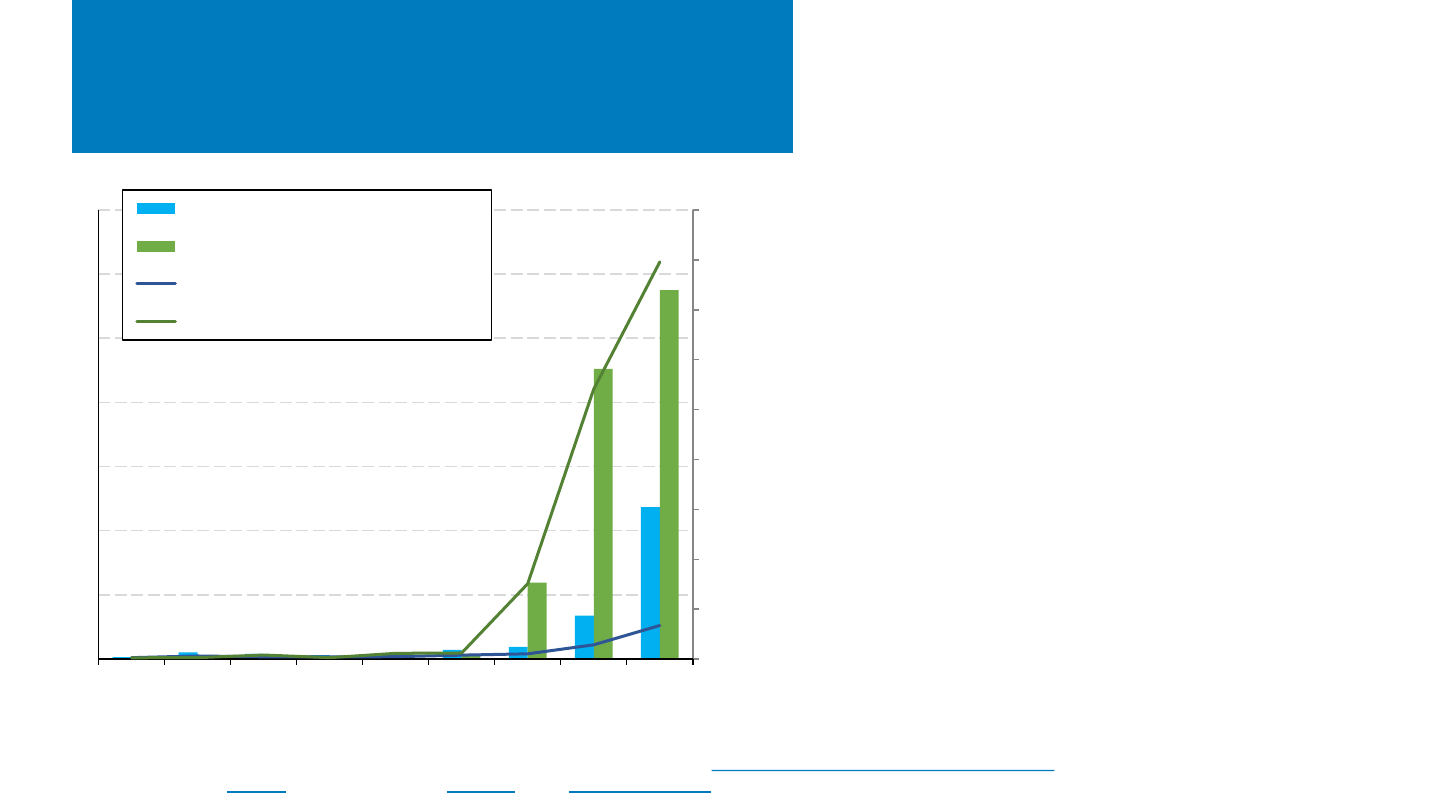

U.S. Energy Storage Installations

by Market Segment (EIA)

California represented 59% of installed battery storage capacity,

followed by Texas (30%).

– The top five markets represented 93% of installed energy storage

capacity.

The United States installed approximately 4.5 GW

ac

of energy storage onto the

electric grid in 2022— up 22% y/y as a result of high levels of utility-scale and C&I

deployment.

– EIA reported a 16% reduction in residential storage installations.

Note: EIA reports no storage from Puerto Rico.

Sources: EIA Form 860M.

348

347

713

3,702

4,510

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

5,000

2018 2019 2020 2021 2022

Energy Storage Installed (MW)

U.S. Energy Storage Installations by Market Segment

Residential

C&I

Utility-scale

California,

2671

Texas, 1333

Nevada, 81

Massachusetts,

52

Hawaii, 64

Other, 309

2022 U.S. Energy Storage Installations by Region (4.5

GW)

NREL | 49

Agenda

Global Solar Deployment1

U.S. PV Deployment

2

PV System Pricing

3

Global Manufacturing

4

Component Pricing

5

Market Activity

6

7 U.S. PV Imports

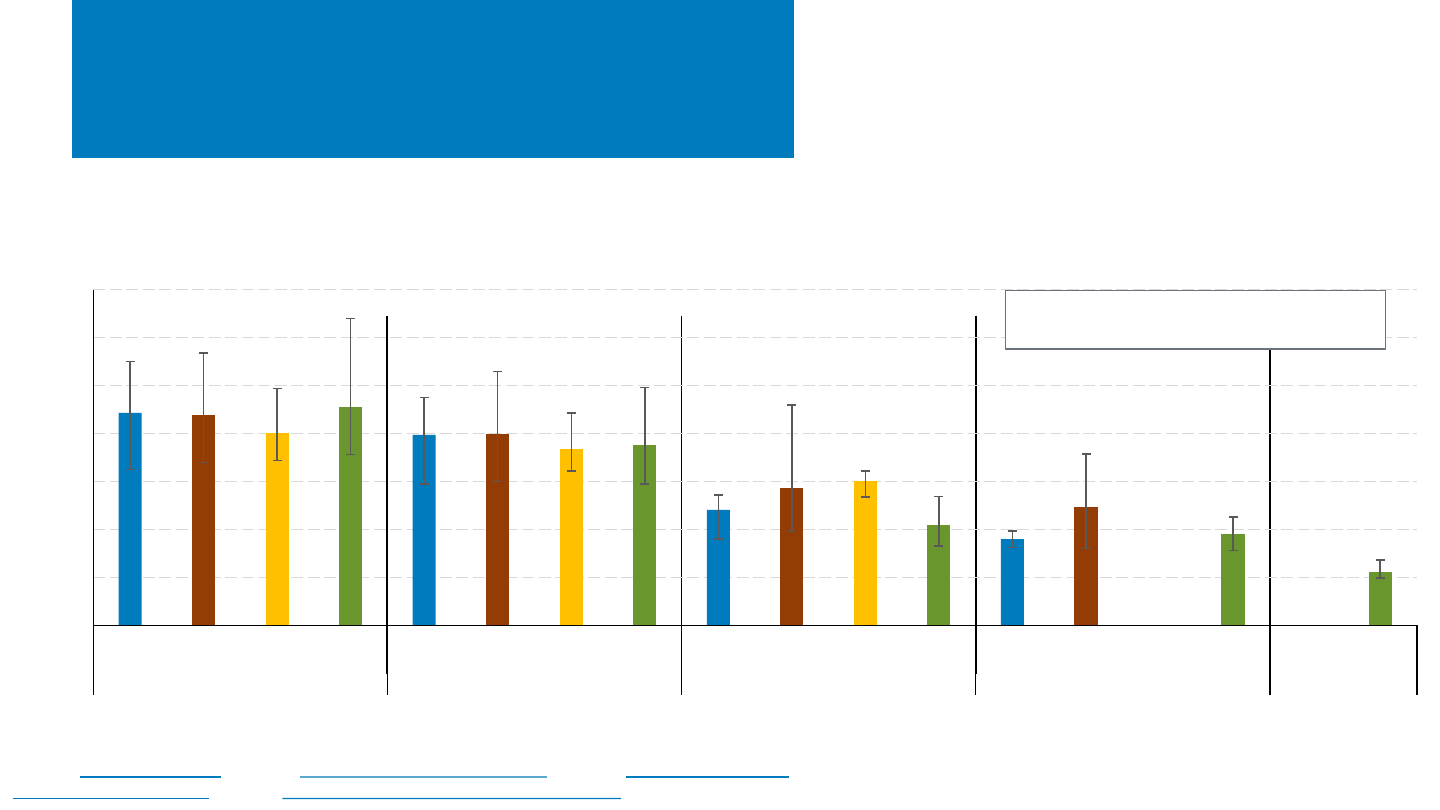

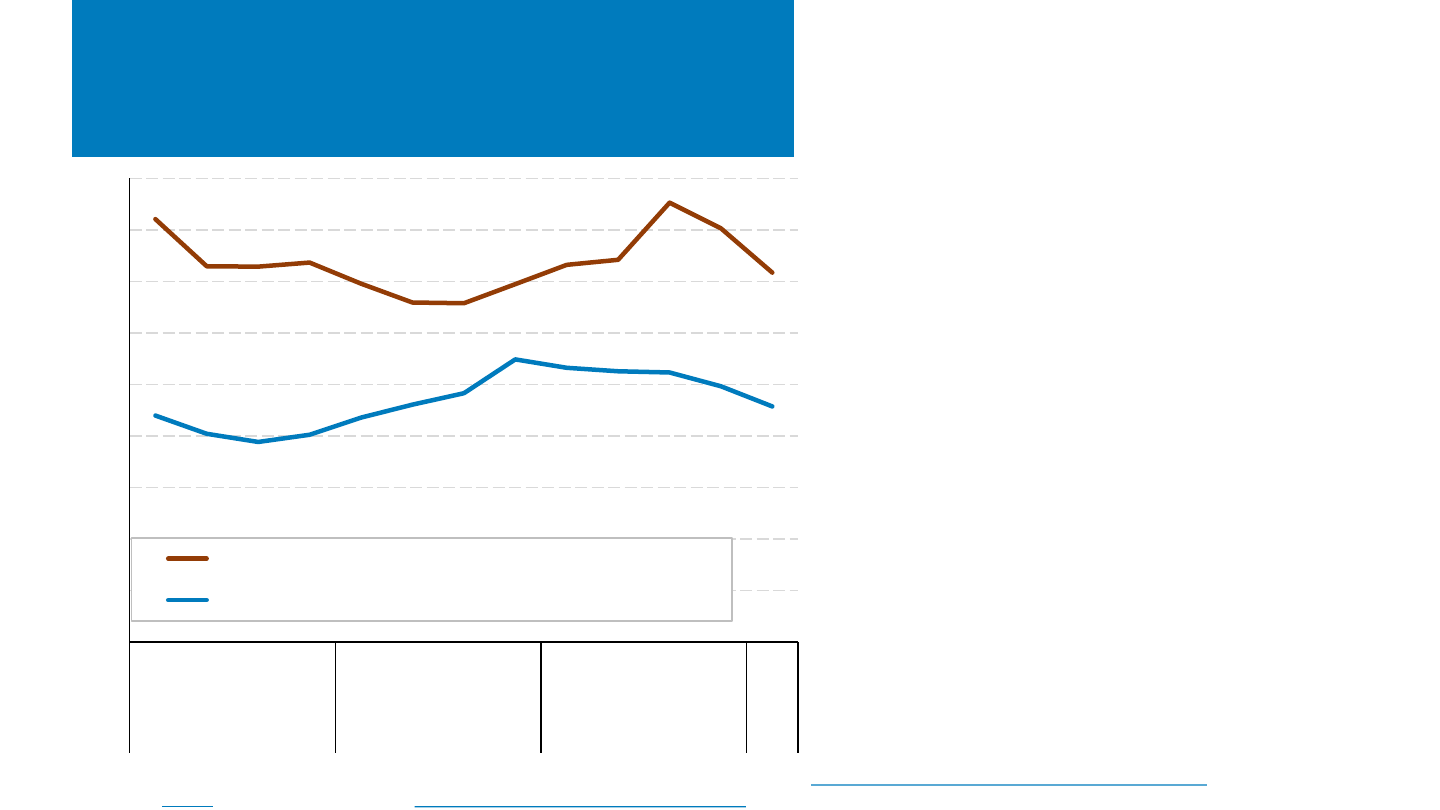

• In a select data set of utility-scale PV systems owned by 25

regulated utilities for 202 projects totaling 9.6 GWac installed

from 2010 to 2022, the median system price in 2022 was

$1.49/Wac—up 13% y/y.

• The median reported price by EnergySage for residential PV

systems increased 6.3% y/y to $2.85/Wdc – the third straight

period of increase, after never having done so before.

• From H1 2022 to early 2023, the median reported distributed

PV system price across Arizona, California, Massachusetts,

and New York:

– Increased 5% to $4.40/Wdc for systems 2.5 to 10 kW

– Increased 9% to $3.92/Wdc for systems 10 to 100 kW

– Increased 4% to $2.59/Wdc for systems 100 to 500 kW

– Increased 13% to $2.08/Wdc for systems 500 kW to 5 MW.

NREL | 50NREL | 50

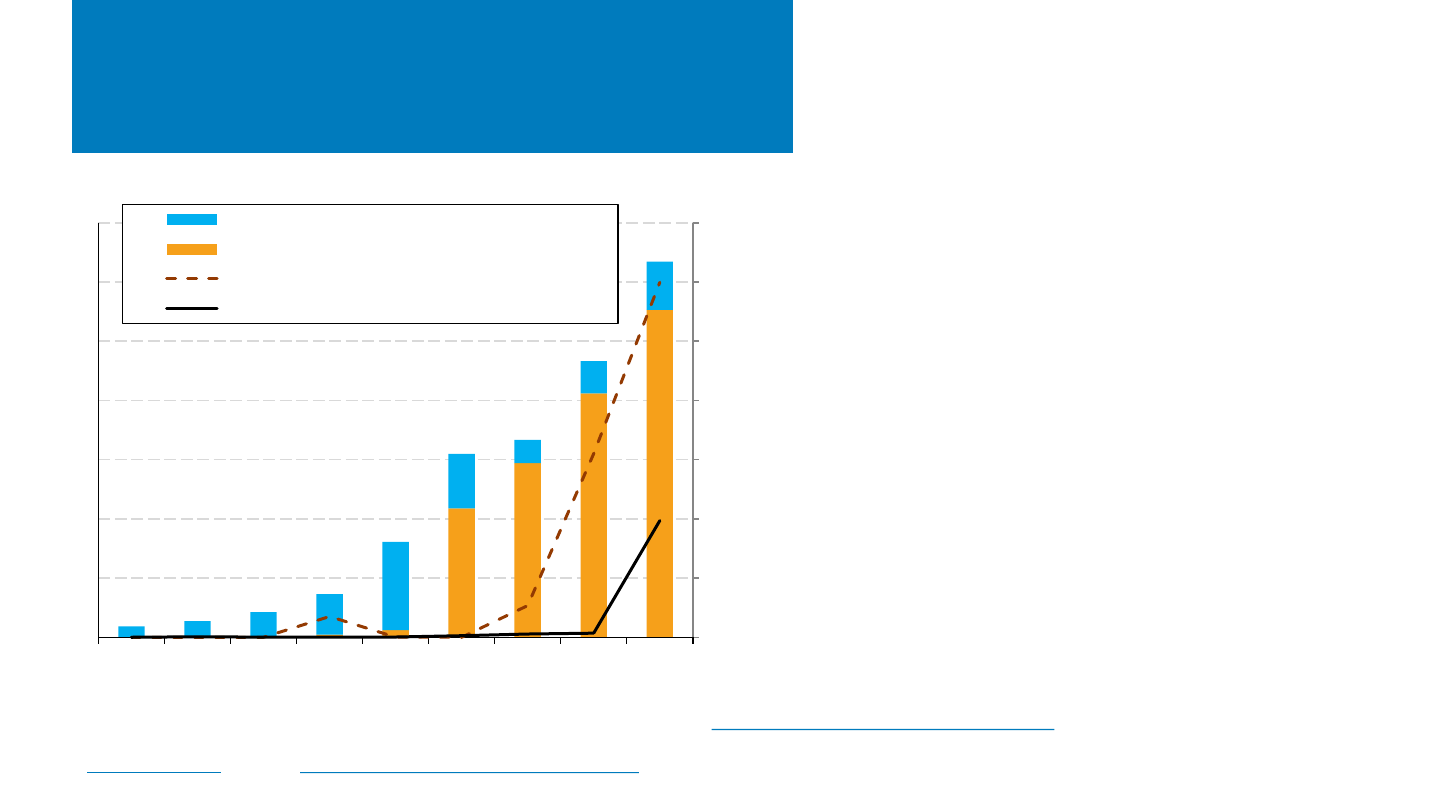

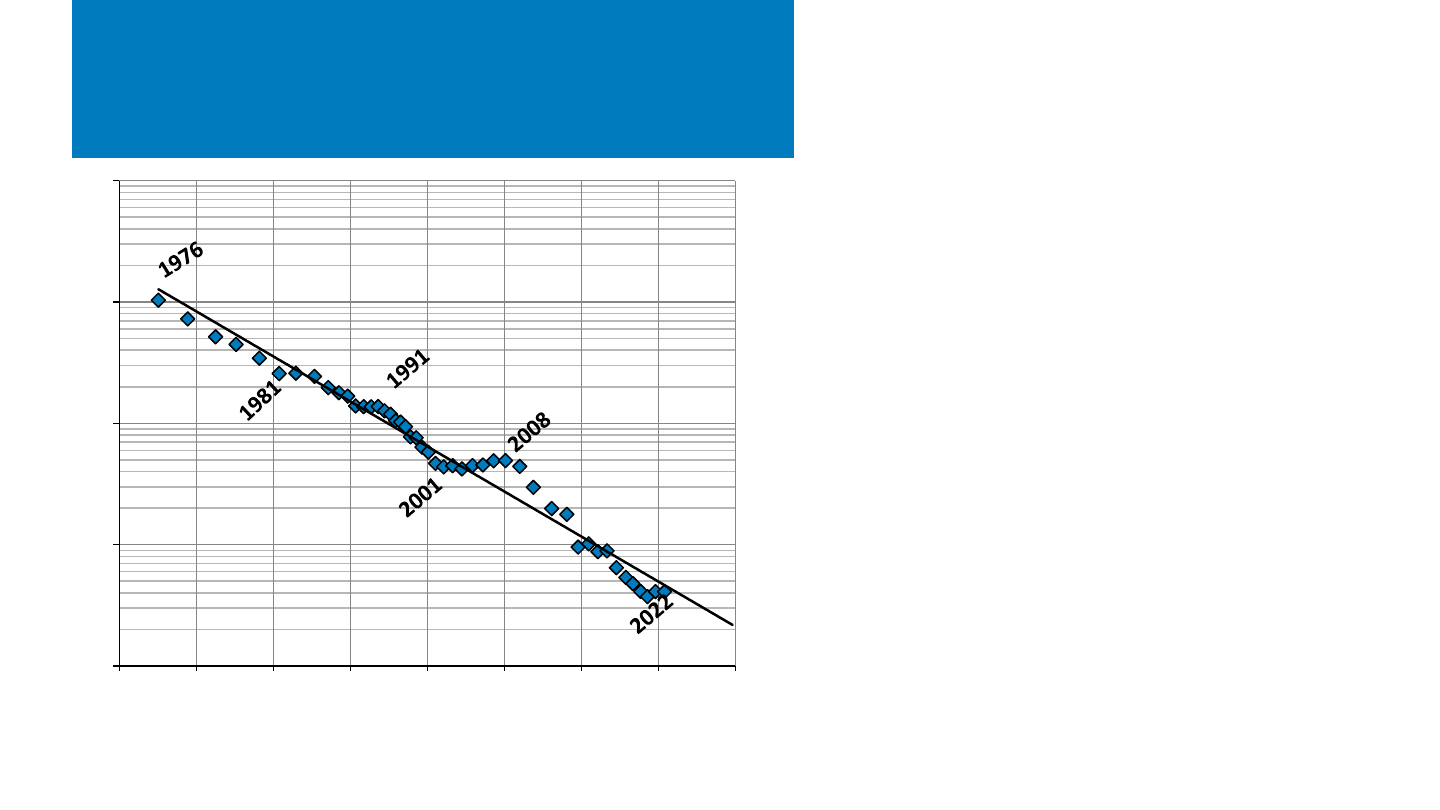

Utility-Owned PV Pricing (>5 MW)

Sources: FERC Form 1 filings from the from the following utilities: Alabama Power, Allete, Arizona Public Service, Avangrid, Dominion, DTE, Duke

Energy, El Paso Electric, Entergy, Florida Power and Light, Georgia Power, Indiana Michigan Power, Kentucky Utilities, MidAmerican, Nevada

Power, Pacific Gas and Electric, Public Service of New Mexico, Southern California Edison, Tampa Electric, Tucson Electric, United Illuminating,

Union Electric, UNS Electric, Virginia Electric, and Wisconsin Public Service.

In a select data set of utility-scale PV systems owned

by 25 regulated utilities for 202 projects totaling 9.6

GWac installed from 2010 to 2022, the median

system price in 2022 was $1.49/Wac—up 13% y/y.

– The lowest and highest reported prices in 2022 were

$1.06/Wac and $2.10/Wac, respectively.

– Still, from 2010 through 2022, system prices fell 11%

per year.

$0

$1

$2

$3

$4

$5

$6

$7

$8

$9

$10

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Installed Cost ($/ac)

Project Completion Year

Median (AC)

Capacity-weighted Average (AC)

Individual Projects (AC)

Median (DC)

Capacity-weighted Average (DC)

Individual Projects (DC)

NREL | 51NREL | 51

$0.0

$0.5

$1.0

$1.5

$2.0

$2.5

$3.0

$3.5

$4.0

$4.5

$5.0

Jul-09 Apr-12 Dec-14 Sep-17 Jun-20 Mar-23

Installed Cost ($/Wac)

Project Completion Year

California

Southwest

Southeast

Midwest

Mid-Atlantic

Sizing

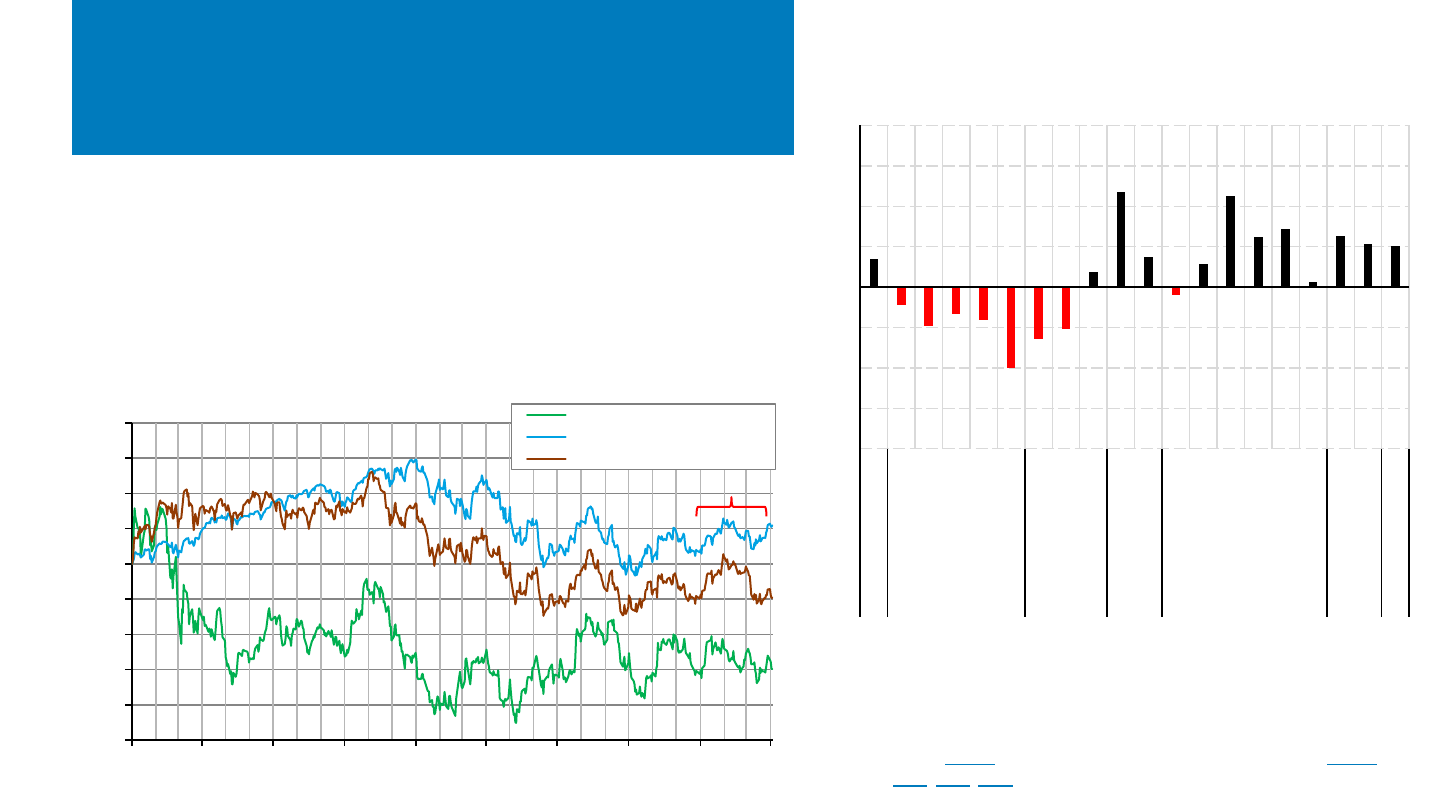

Utility-Owned PV Pricing (>5 MW)

Sources: FERC Form 1 filings from the from the following utilities: Alabama Power, Allete, Arizona Public Service,

Avangrid, DTE, Duke Energy, El Paso Electric, Florida Power and Light, Georgia Power, Indiana Michigan Power,

Kentucky Utilities, Nevada Power, Pacific Gas and Electric, Public Service of New Mexico, Southern California

Edison, Tampa Electric, Tucson Electric, United Illuminating, UNS Electric, and Virginia Electric.

• While geographic considerations (as well as

size) impact cost per watt, system prices have

been relatively in-line across several different

regions but generally lower in the Southeast

.

– The data sample had a capacity-weighted

average price of $1.48/Wac in 2022.

– The capacity-weighted average price in the

Southeast was $1.28/Wac compared to

$1.74/Wac in the Midwest and Mid-Atlantic.

– Utility-owned projects still represent a

minority of all PV systems installed in the

United States, and prices may differ from IPP-

owned projects.

10 MW

100 MW

NREL | 52NREL | 52

U.S. Solar PPA Pricing (LevelTen)

Source: LevelTen, PPA Price Index.