Fall 2023

Solar Industry Update

David Feldman

Krysta Dummit, BGS Contractor for SETO

Jarett Zuboy

Brittany Smith

Dana Stright

Matthew Heine

Robert Margolis

October 26, 2023

NREL | 2

Global Solar Deployment1

U.S. PV Deployment

2

PV System Pricing

3

Global Manufacturing

4

Component Pricing

5

U.S. PV Imports

6

7 PV Domestic Content

Agenda

NREL | 3NREL | 3

Global Solar Deployment

• H1 2023 PV installations increased significantly (y/y) in China (153%) and Germany

(102%), and to a lesser extent the United States (34%). Australian and Indian first PV

installations in H1 2023 shrank modestly, y/y.

U.S. PV Deployment

• EIA projects the percentage of U.S. electric capacity additions from solar will grow from

45% in 2022 (17 GW

ac

) to 56% in 2023 (31 GW

ac

) and 62% (41 GW

ac

) in 2024.

• The United States installed 11.2 GW

ac

(11.8 GW

dc

) of PV in H1 2023—its largest H1

ever—up 44% y/y.

• The United States installed approximately 7.7 GWh (2.5 GW

ac

) of energy storage onto

the electric grid in H1 2023, +32% (+8%) y/y, as a result of growth in all sectors.

PV System and Component Pricing

• U.S. PV system and PPA prices have been flat or increased over the past 2 years.

• Global polysilicon spot prices rose 35% from late June ($7.84/kg, below the weighted

average production cost of $8.2/kg) to early October ($10.55/kg).

• Global module prices reached yet another record low, falling 21% between late June and

early October to $0.14/W

dc

.

• In Q3 2023 (first 2 months), the average U.S. module price ($0.33/W

dc

) was down 11%

q/q and down 23% y/y, but at a 98% premium over the global spot price for monofacial

monocrystalline silicon modules.

Global Manufacturing

• According to Infolink (formerly PV Infolink), the top 10 module manufacturers were

responsible for 160 GW (+57% y/y) in H1 2023 and the top 5 cell manufacturers together

shipped 84 GW of cells (+49% y/y).

• Since the passage of the IRA, more than 240 GW of manufacturing capacity has been

announced across the solar supply chain, representing more than 22,000 potential jobs

and more than $12 billion in announced investments across 72 new facilities or

expansions.

• In H1 2023, the U.S. shipped 3.1 GW of PV modules – an increase of 0.8 GW from H1

2022.

U.S. PV Imports

• The United States imported 25.1 GW

dc

of PV modules in H1 2023, well over double

imports from H1 2022.

• Most panels imported were exempt from Section 201 duties and were therefore likely

bifacial. A significant number of thin-film modules were also imported.

• 1.5 GW

dc

of cells were imported in H1 2023, up 28% y/y.

• The U.S. is not on pace to reach the 5-GW quota exemption limit for Section 201 tariffs.

Executive Summary

A list of acronyms and abbreviations is available at the end of the presentation.

NREL | 4

Global Solar Deployment1

U.S. PV Deployment

2

PV System Pricing

3

Global Manufacturing

4

Component Pricing

5

U.S. PV Imports

6

7 PV Domestic Content

Agenda

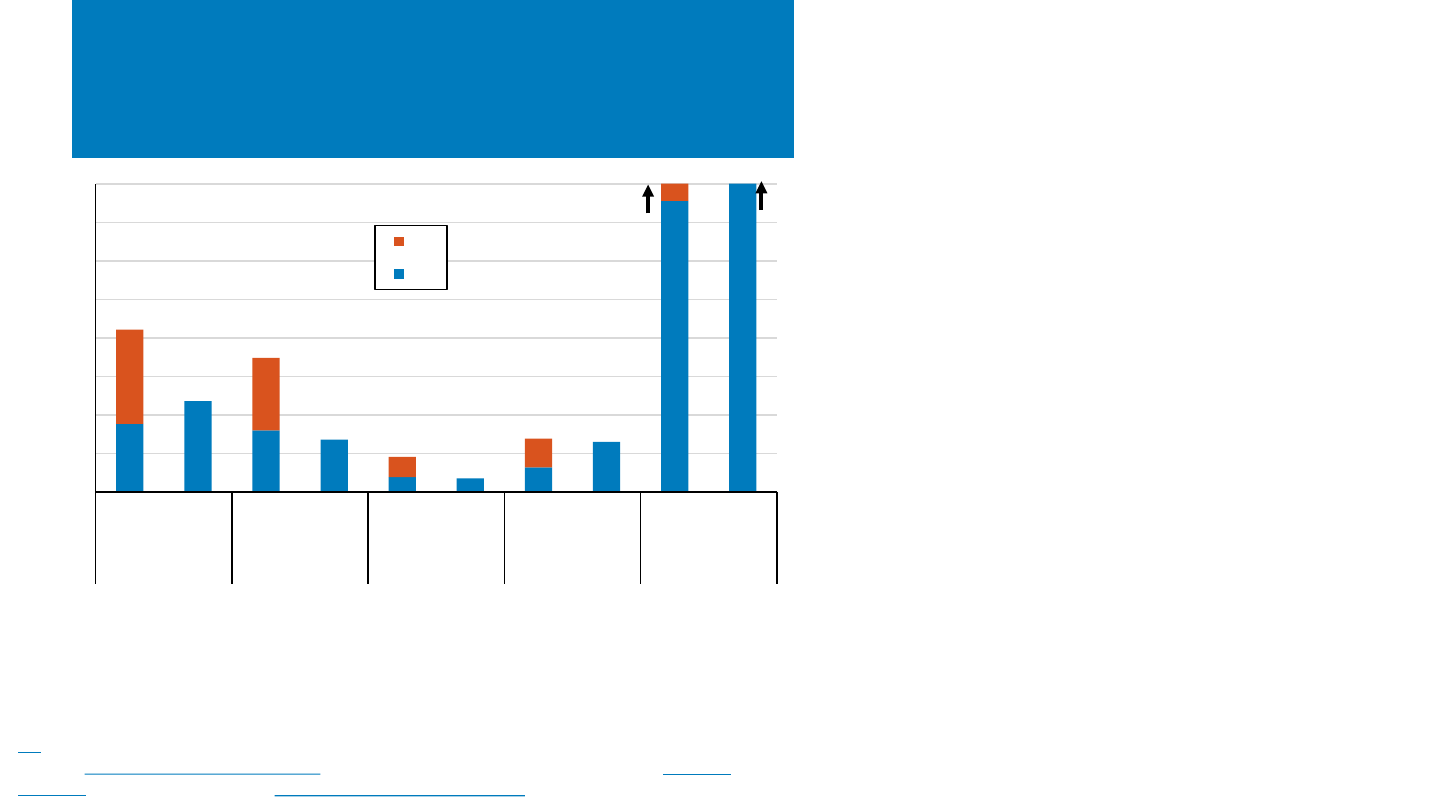

• H1 2023 PV installations increased significantly (y/y) in

China (153%) and Germany (102%), and to a lesser extent

the United States (34%). Australian and Indian first PV

installations in H1 2023 shrank modestly, y/y.

• BloombergNEF estimates 2023 installations in China to be

around 200 GW, far exceeding last year’s record of 106

GW.

NREL | 5NREL | 5

0

5

10

15

20

25

30

35

40

2022 2023 2022 2023 2022 2023 2022 2023 2022 2023

U.S.

153 GW

India

70 GW

Australia

32 GW

Germany

74 GW

China

510 GW

Installations (GW

dc

)

H2

H1

International H1 2023

Installations

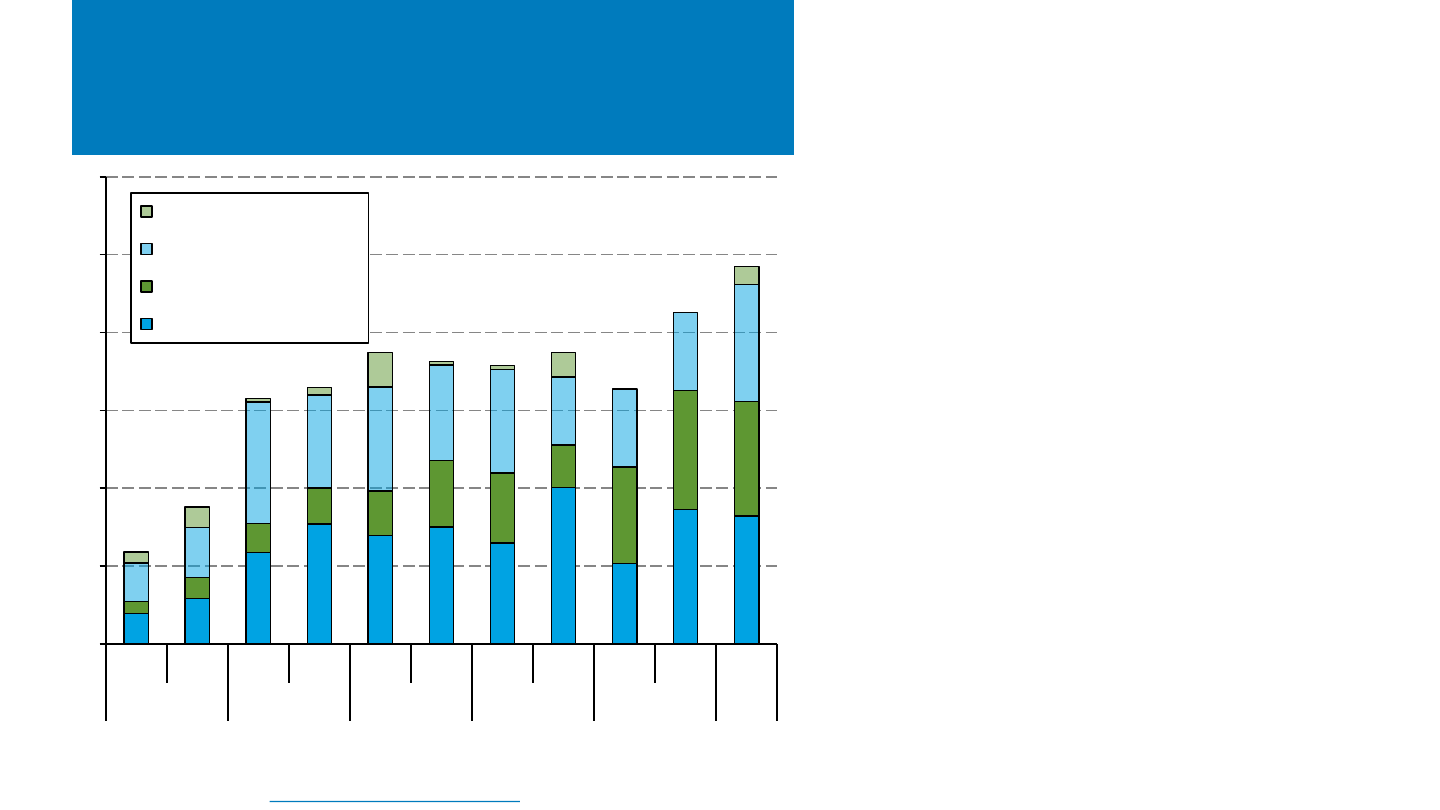

• H1 2023 PV installations increased

significantly (y/y) in China (153%) and

Germany (102%), and to a lesser extent the

United States (34%). Australian and Indian

PV installations shrank modestly in H1 2023,

y/y.

– BloombergNEF estimates Chinese 2023

PV installations to be around 200 GW,

far exceeding last year’s record of 106

GW.*

– JMK Research expects India to install 14–

15 GW in 2023 (compared to 17–18 GW

in 2022), and estimates the country had

a solar pipeline of 47 GW at the end of

June.

• At the end of June, these countries had

cumulatively installed 839 GW

dc

of PV.

106 GW

*China reported 87 GW of PV installations in 2022 and 78 GW in the first half of 2023; however, these

numbers reflect a combination of utility-scale projects reported in W

ac

and distributed PV reported in W

dc

.

IEA estimated Chinese 2022 installations to be 106 GW. Chinese values here reflect the same 2022 ILR.

Sources: Australian Photovoltaic Institute. Mercom (07/31/23, 08/28/23). PV Magazine (06/13/23;

08/28/23); Wood Mackenzie/SEIA: U.S. Solar Market Insight: Q2 2023.

Cumulative Capacity

95 GW

NREL | 6NREL | 6

Concentrating Solar Power

Update

• Chinese CSP company Cosin Solar currently has 100 MW of projects operational and another 900 MW under

construction, making it the first company to supply 1 GW of tower projects

.

• HeliosCSP interviewed an engineer who has been working on the 110-MW U.S. Crescent Dunes project—the first

large-scale, high-storage CSP plant, which began operation in 2015.

– Crescent Dunes is essentially recommissioning itself now, slowly bring the plant back online from several

repairs. ACS, a multinational EPC firm, indirectly purchased the plant from the original owner,

SolarReserve.

– It is currently selling power to NV Energy, which was originally under a PPA with the contract until the

project defaulted in 2019. They are selling electricity exclusively at night or when their storage tanks are

full.

– Reason for operational challenges: (1) The hot tanks were poorly designed the first time (for cost-cutting

reasons) and poorly welded when they were replaced. (The welders were not used to working with those

type of alloys, causing the tank to crack.) They’ve been installed now a third time. (2) One of the two

superheaters sat with water in it and rusted; it has yet to come online.

– These expenses are much less than the estimated $250M it would take to satisfy BLM requirements for

removing the plant (SolarReserve initially estimated it would cost $7M).

NREL | 7

Global Solar Deployment1

U.S. PV Deployment

2

PV System Pricing

3

Global Manufacturing

4

Component Pricing

5

U.S. PV Imports

6

7 PV Domestic Content

Agenda

• EIA projects the percentage of U.S. electric capacity

additions from solar will grow from 45% in 2022 (17 GW

ac

)

to 56% in 2023 (31 GW

ac

) and 62% (41 GW

ac

) in 2024.

• According to EIA data, the United States installed 11.2

GW

ac

of PV in H1 2023—its largest H1 ever—up 44% y/y

(SEIA reported 11.8 GW

dc

).

• The United States installed approximately 7.7 GWh (2.5

GW

ac

) of energy storage onto the electric grid in H1 2023,

+32% (+8%) y/y, as a result of growth in all sectors.

NREL | 8NREL | 8

States: Q2 2023 Updates

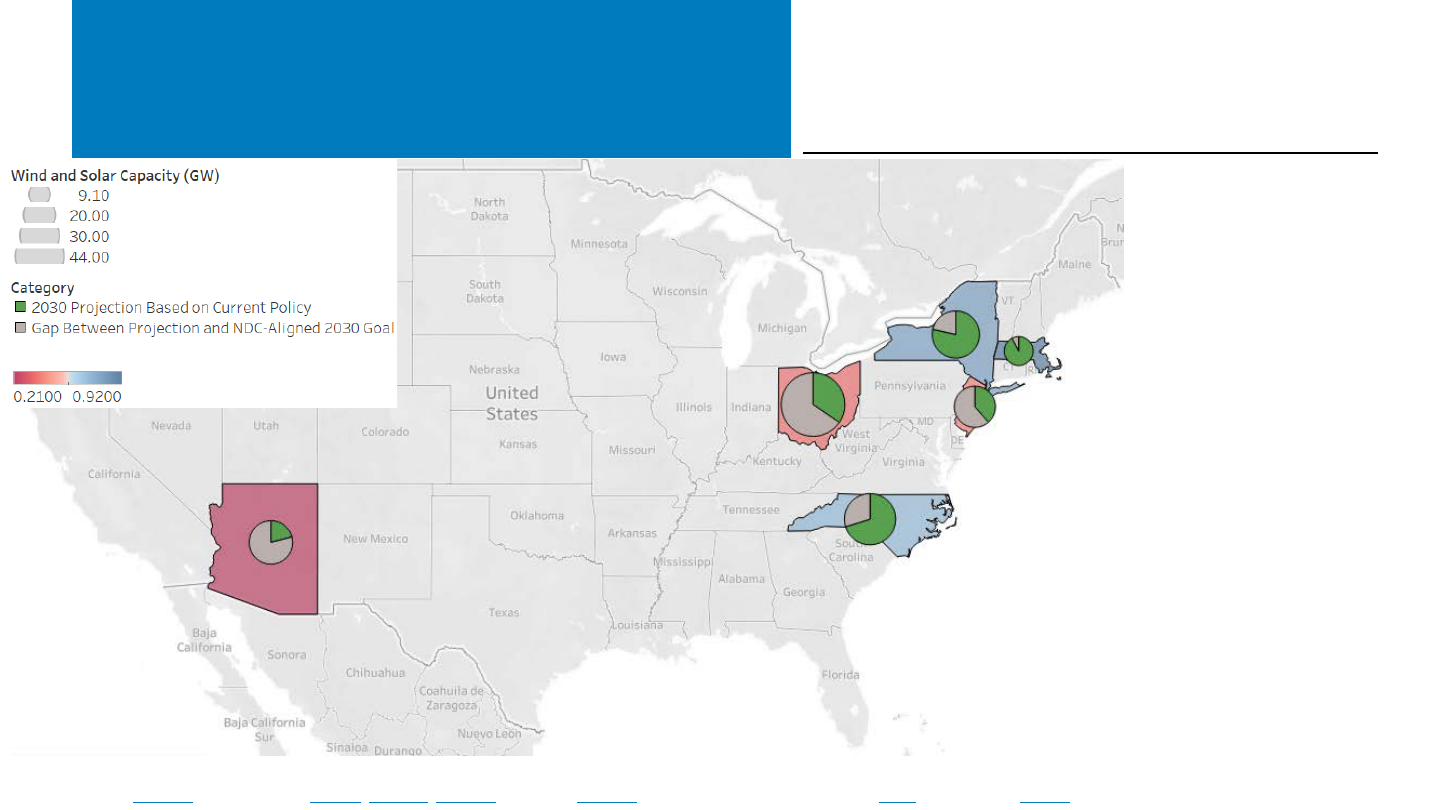

Sources: NJBPU (8/16/23); PV Magazine (8/7/23, 8/24/23, 8/28/23); PV Tech (8/18/23); RMI, State Climate Scorecards (2023); Utility Dive (8/8/23)

Map shows progress toward installed wind + PV capacity by 2030

compatible with the U.S. Nationally Determined Contribution (NDC) under

the Paris Agreement, as modeled by RMI. For example, if current policies

are successful, MA will achieve 92% of an NDC-compatible 9-GW wind + PV

target by 2030, while AZ will achieve only 21% of a 21-GW target. The gaps

are mostly PV in AZ and NJ and a mix of PV and wind in NY, MA, NC, OH.

Ohio required PV

installations >50 MW to

meet rules related to noise,

setbacks, and drilling safety.

New York increased low- and

moderate-income (LMI)

access to community solar

via pre-development grants

and technical assistance.

Projected share of NDC goal achieved in 2030

New Jersey made its pilot community solar program

permanent, with requirements including 51% LMI

subscribers and 15% minimum bill savings.

Arizona

reduced the

value of rooftop

PV energy

exports by 10%.

North Carolina will add 6 GW of PV and 2.7 GW of

energy storage by 2031 under Duke Energy’s updated

Carbon Plan and Integrated Resource Plan.

Boston, Massachusetts banned fossil fuel use

in new municipal building construction and

renovations. The city will require all buildings

to be wired for all-electric use starting 2024.

NREL | 9NREL | 9

Background

• Bottlenecks in interconnection queues are holding up

1,700 GW of clean power in the United States (mostly

solar and batteries).

• Interconnection approval times can take 3 years or more,

on average.

• The cost of interconnection upgrades is increasing.

– In 2017, more than one-third of systems in the

Midwest incurred no upgrade costs, and by 2021 it

had dropped to 11%.

• Solar projects in the U.S. pay on average $0.09/W,

according to BloombergNEF analysis, or about 8%–10% of

their total costs.

Source: BloombergNEF, “US Takes a Step to Clear Grid Backlog But a Leap Is Needed.”

0.00

0.05

0.10

0.15

0.20

0.25

2016 2017 2018 2019 2020 2021

$/W(AC)

Solar Wind

FERC Issues Order 2023

Average grid connection cost in PJM, MISO, and NYISO

NREL | 10NREL | 10

The new order includes several changes:

• Implements a first-ready, first-served cluster study process, in which project requests enter a “cluster window”

and all receive the same priority, allowing for a group interconnection study rather than sequentially.

– Cluster study costs imposed on a pro rata and per capita basis, and upgrade costs allocated to cluster on a

“proportional impact method.”

– BNEF stated that most grid operators already (or will soon) conduct joint grid connection studies, and it

will not necessarily reduce the combined cost of grid interconnection.

• Implements enhanced financial commitments and withdrawal penalties to discourage withdrawals and

requires demonstration of site control at the time of submission (or a deposit of $500k–$2M).

• Aims to increase the speed of the interconnection queue by removing the “reasonable efforts” standard

governing transmission provider’s duty for timely completion of studies and places firm study deadlines and

penalties for missing study deadlines ($1k per business day of delays to cluster studies / $2.5k for facilities

studies).

• Allows interconnection process to have one interconnection point (and study) for co-located facilities.

Source: JDSupra (08/11/23); The National Law Review (08/18/23)

FERC Issues Order 2023

NREL | 11NREL | 11

Impact

• Once implemented, FERC rules will improve and harmonize existing grid interconnection best practices but do not

represent disruptive, structural changes that may be necessary to install the levels of solar and wind necessary to

decarbonize the grid by 2035. Such measures may include:

– Reforms to the cost allocation of grid upgrades (e.g., in Texas, upgrades are borne by the consumer, not the project).

– Allowing interconnections ahead of all grid upgrades.

– A more proactive approach for grid planning that identifies areas with high wind and solar potential and preemptively

builds out system capacity in those regions.

• Many of the upgrades occur now as developers seek

interconnection.

– Permitting reform to significantly build out transmission assets.

BNEF states that current process has deterred lots of projects

that would help.

• After the order was issued, BNEF did not change its outlook on

U.S. solar and wind deployment, as it already assumed some level

of interconnection process improvements.

Source: BloombergNEF, “US Takes a Step to Clear Grid Backlog But a Leap Is Needed.”

0

20

40

60

80

100

120

140

160

2015 2020 2025 2030

$ billion

Historical

With IRA

Net Zero Scenario

Comparison of U.S. annual grid investment scenarios

FERC Issues Order 2023

NREL | 12NREL | 12

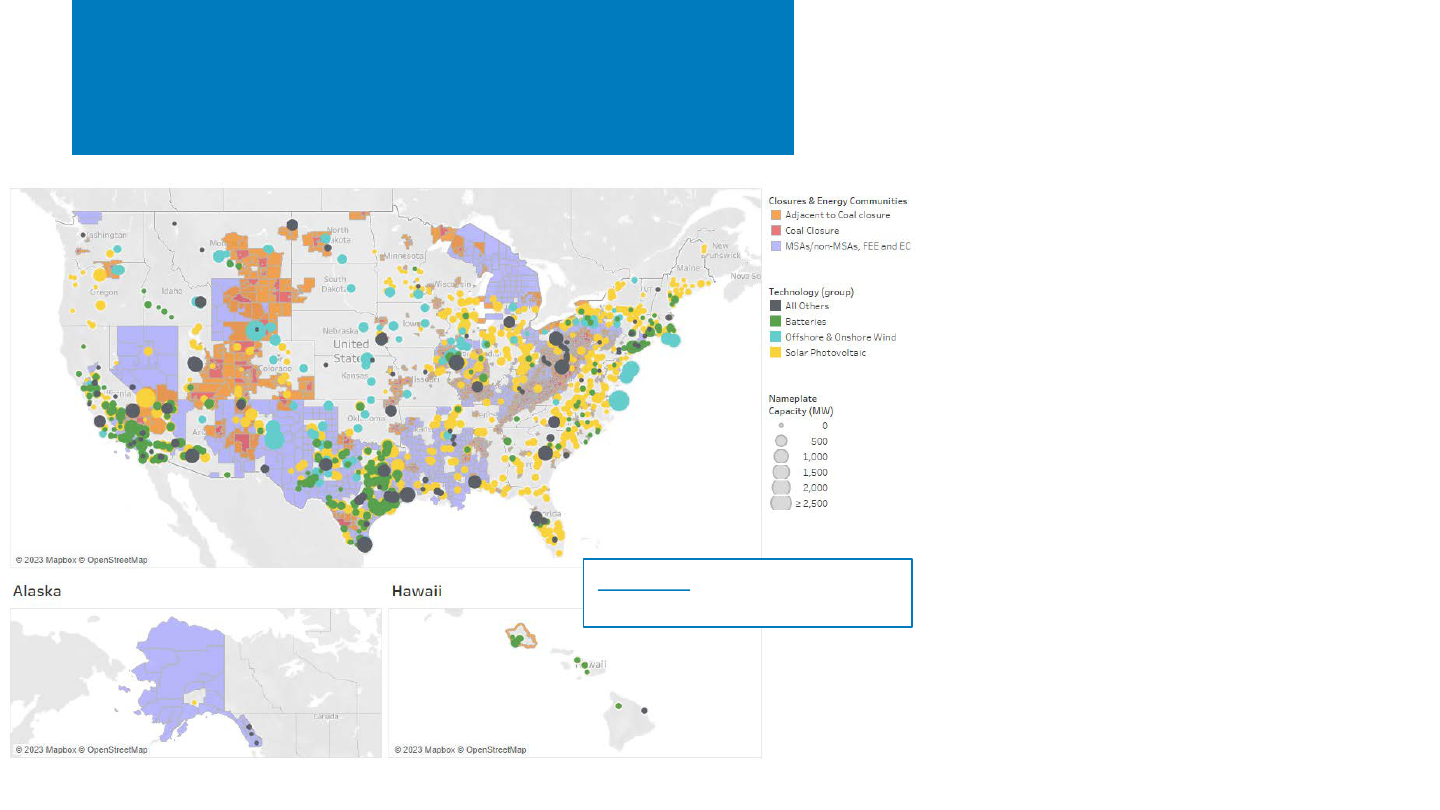

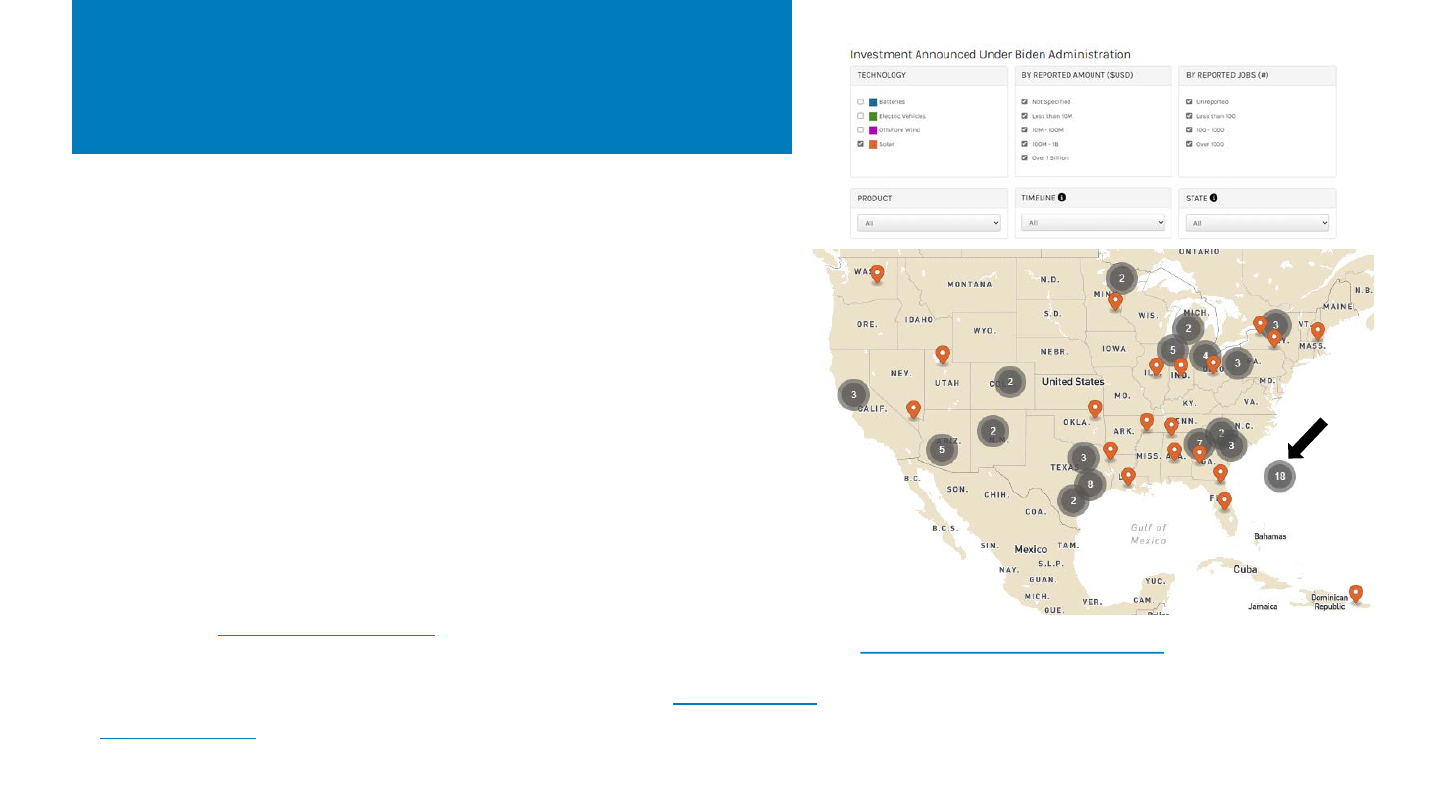

Planned U.S. Electric Generation Plants in

Relation to Energy Communities

• Since the passage of the Inflation Reduction

Act, which provides an additional 10% tax

credit for renewable energy projects located

in an “Energy Community”, a significant

amount of new planned renewable energy

projects have been announced.

• In September 2022, one month after the

passage of the Inflation Reduction Act, the

EIA tracked approximately 123 GW of planned

utility-scale PV, land-based wind, and battery

projects (of which 78 GW had not yet started

construction).

– Since then, 60 GW of new projects have

been added to the dataset, 38 GW of

which has not yet started construction.

Note: Brownfields, which are also eligible for the energy community bonus credit, do not have the same census tract delineations and so

are not included in this analysis.

Sources: U.S. Energy Information Administration (EIA), EIA Form 860 (November 2022, November 2023).

Planned U.S. Generation Capacity in Relation to Energy Communities, September 2023

Click here to interactively view

this data on Tableau Public.

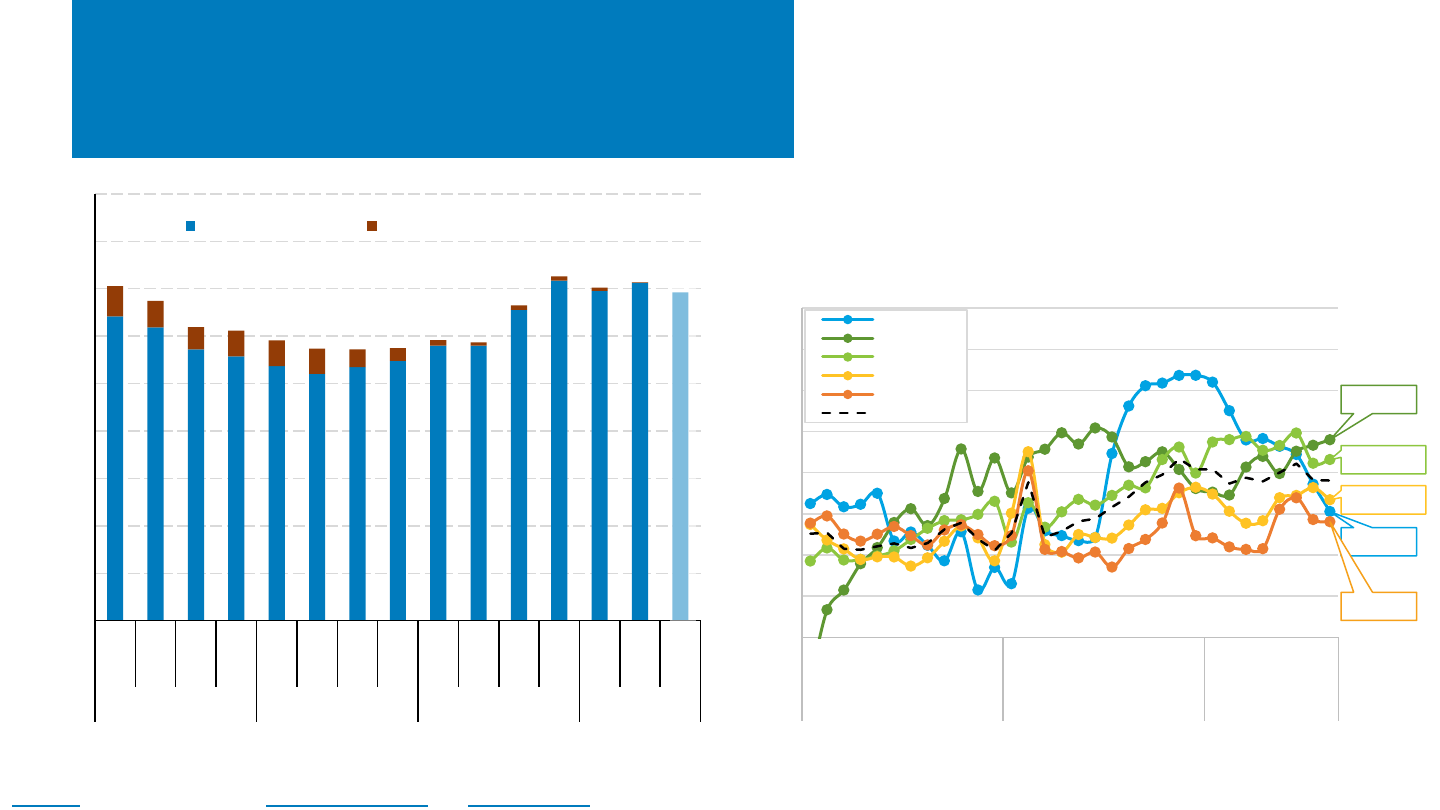

NREL | 13NREL | 13

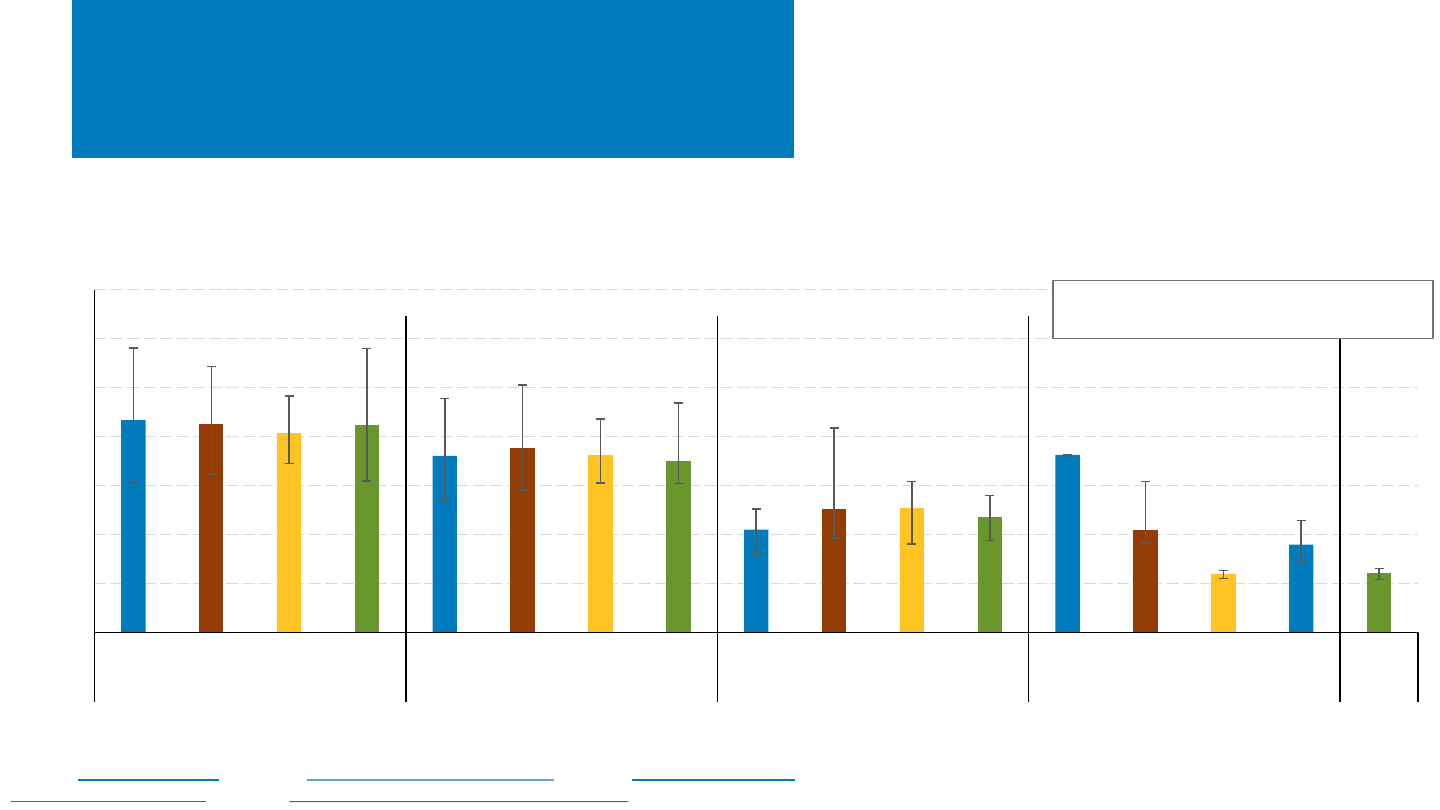

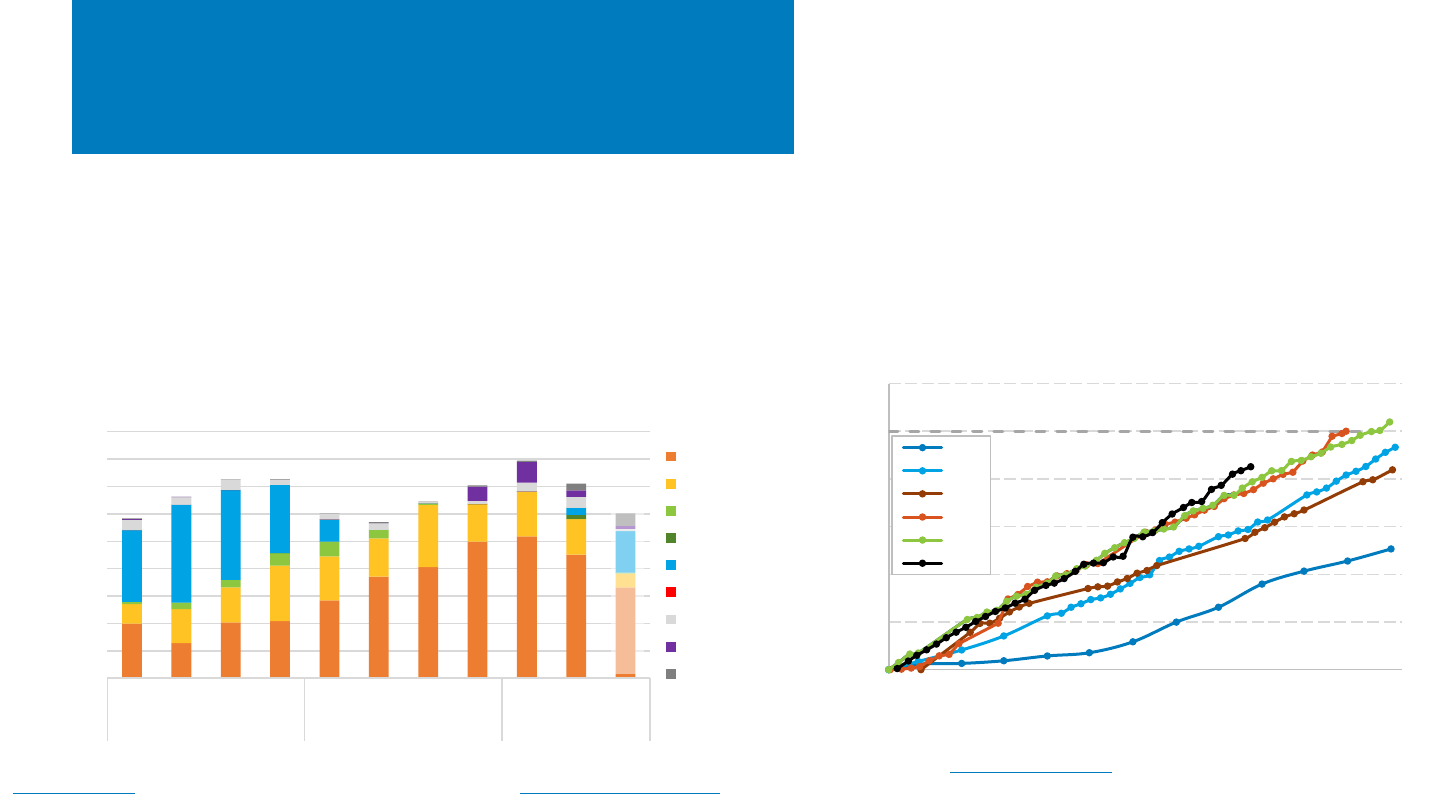

0%

10%

20%

30%

40%

50%

60%

70%

0

20

40

60

80

100

120

Planned (Sep.

2022)

Planned (Sep.

2023)

Planned (Sep.

2022)

Planned (Sep.

2023)

Planned (Sep.

2022)

Planned (Sep.

2023)

Solar Photovoltaic Batteries Land-based Wind

Capacity (GW)

Out of Energy Community

In Energy Community

% Capacity in Energy Community

% Capacity in Energy Community (new projects)

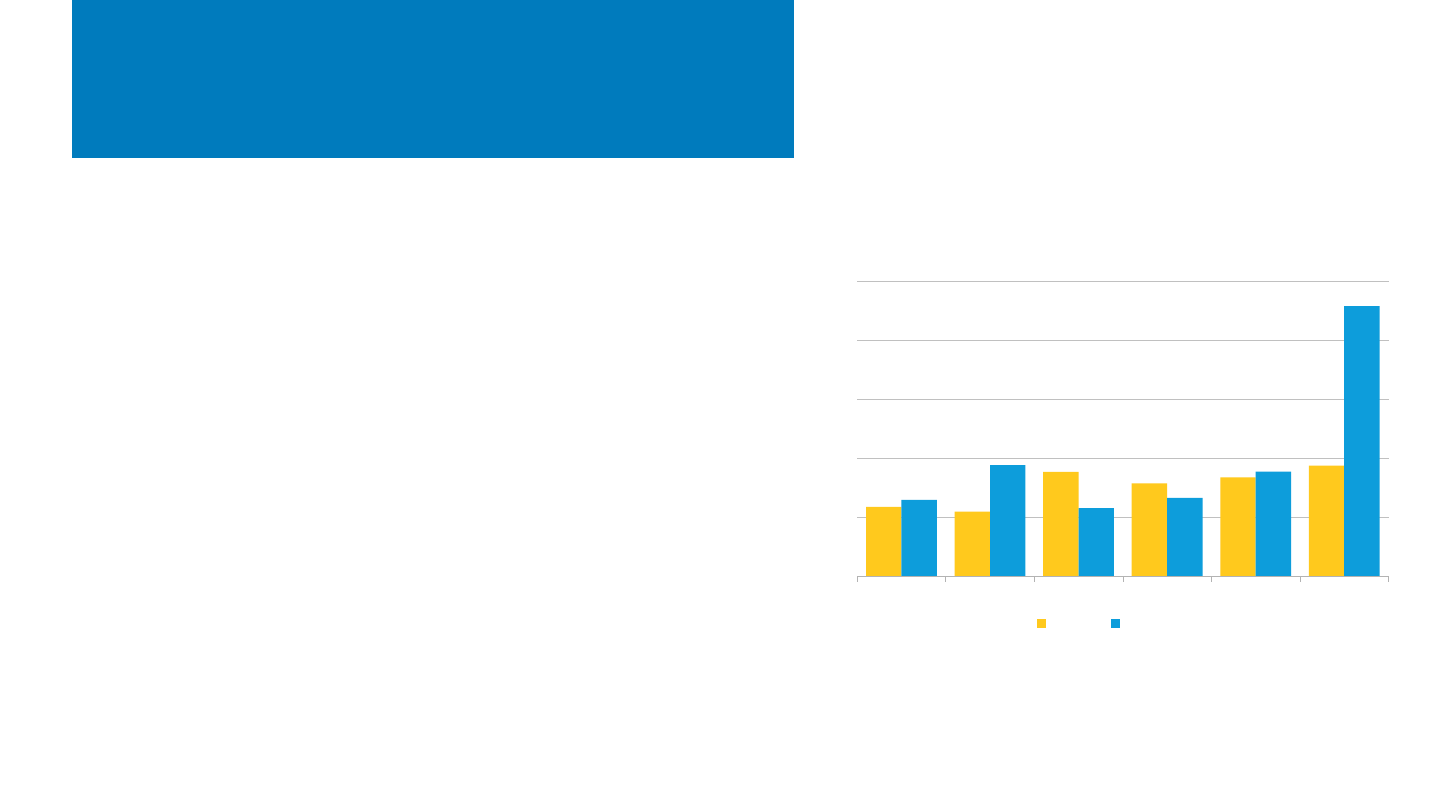

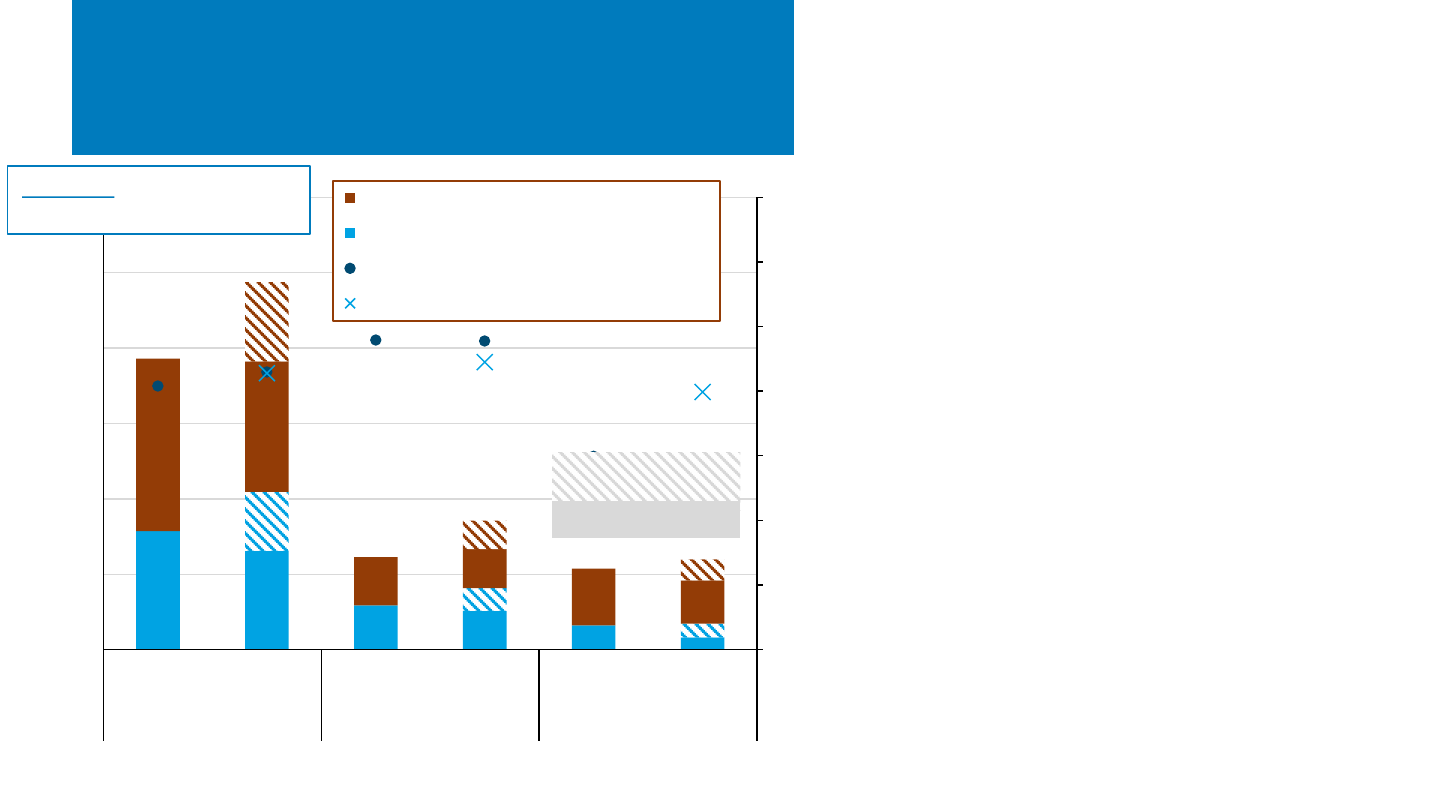

Percent of Planned Solar, Wind, and

Battery Markets Located in Energy

Communities

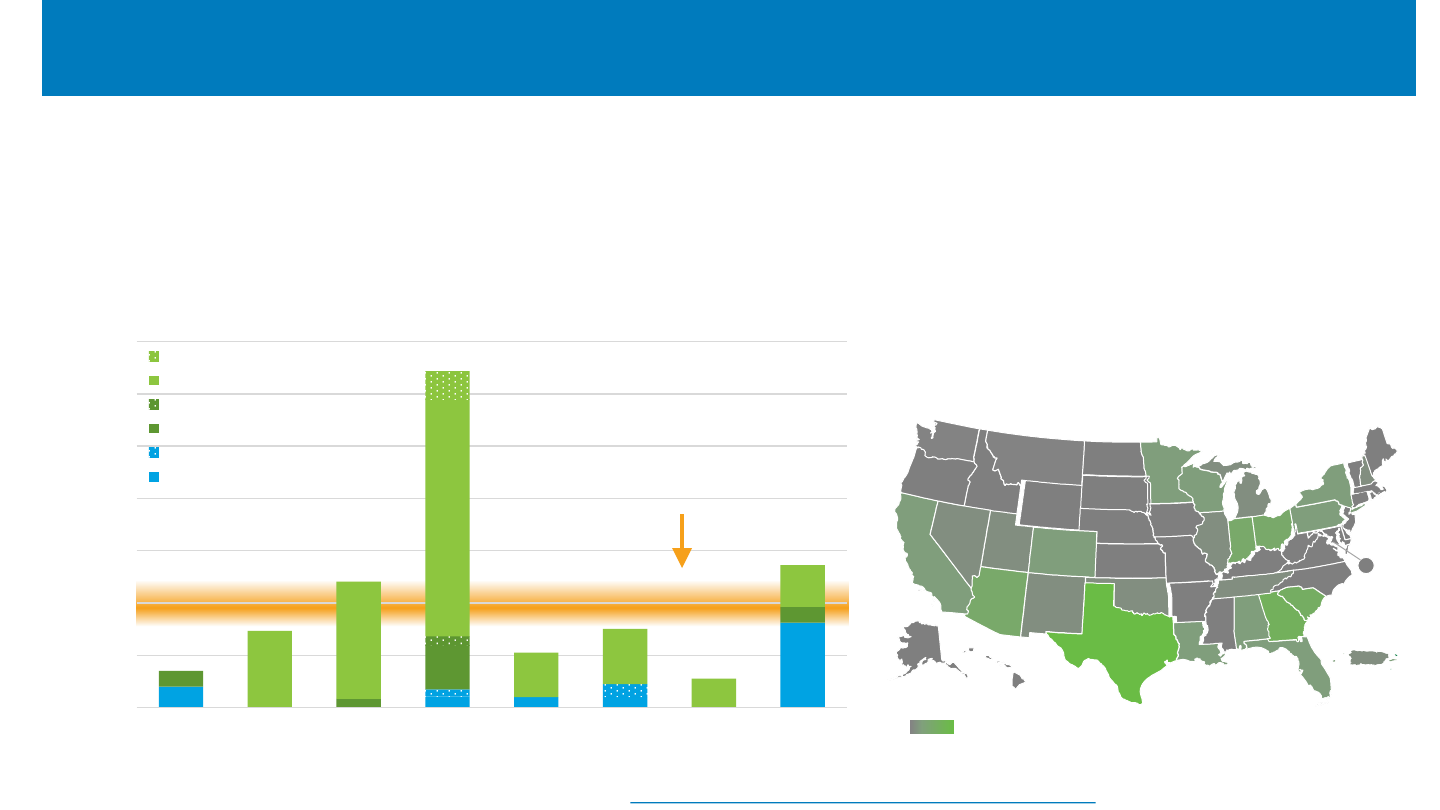

• NREL analysis found that new projects added to the planned

project dataset do not have a significantly higher percentage of

capacity located in energy communities as projects which were

in the dataset as of September 2022.

– This analysis also includes projects in construction, however

the results are very similar when only looking at new

projects which have not begun construction yet.

– The percentage of planned land-based wind capacity

located in energy communities increased the most (from

30% to 40%), however the number of projects located in

energy communities increased less dramatically (from 26%

to 30%) and was impacted by a few large projects.

– The percent of planned solar PV capacity in energy

communities is relatively consistent (if not lower) than the

percent of installed capacity in those areas from 2021

through July 2023 (see LBNL data on slide 20).

• It typically takes years to develop large electric generating assets

in the United States, therefore data may not show a significant

change in deployment in these communities for some time.

– Additionally, a relatively large percentage of projects were

already being developed in these areas.

– EIA data is also not necessarily added uniformly in terms of

project development and therefore is a better indicator of

long-term trends.

Note: based on EIA data, there were no new planned offshore wind projects announced between September 2022 and September 2023.

Additionally, the latitude and longitude of these projects reported in EIA Form 860 likely does not reflect the location in which these

projects will determine their eligibility (i.e., the point of interconnection).

Sources: U.S. Energy Information Administration (EIA), EIA Form 860 (November 2022, November 2023).

Added Planned

Projects

Planned Projects

Click here to interactively view

this data on Tableau Public.

NREL | 14NREL | 14

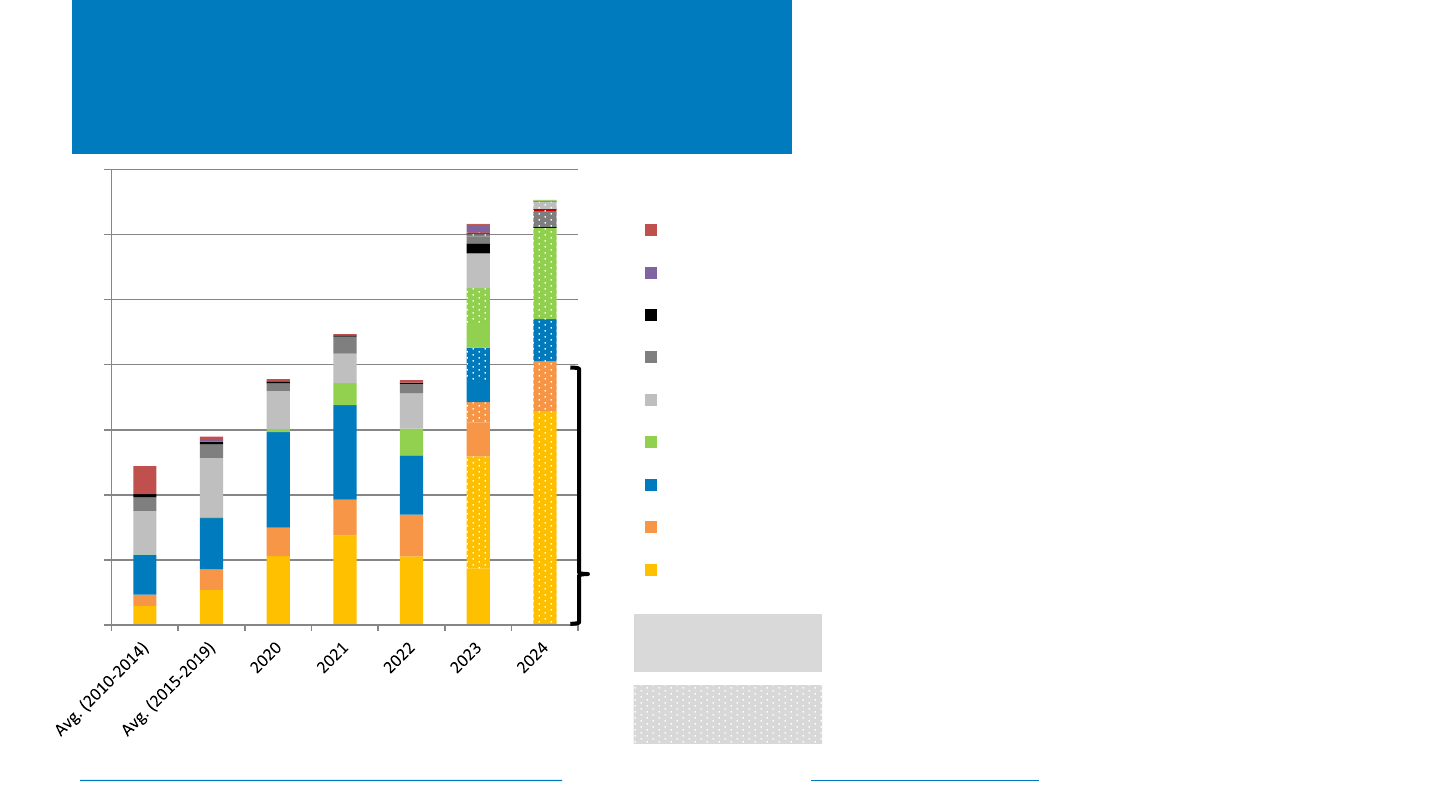

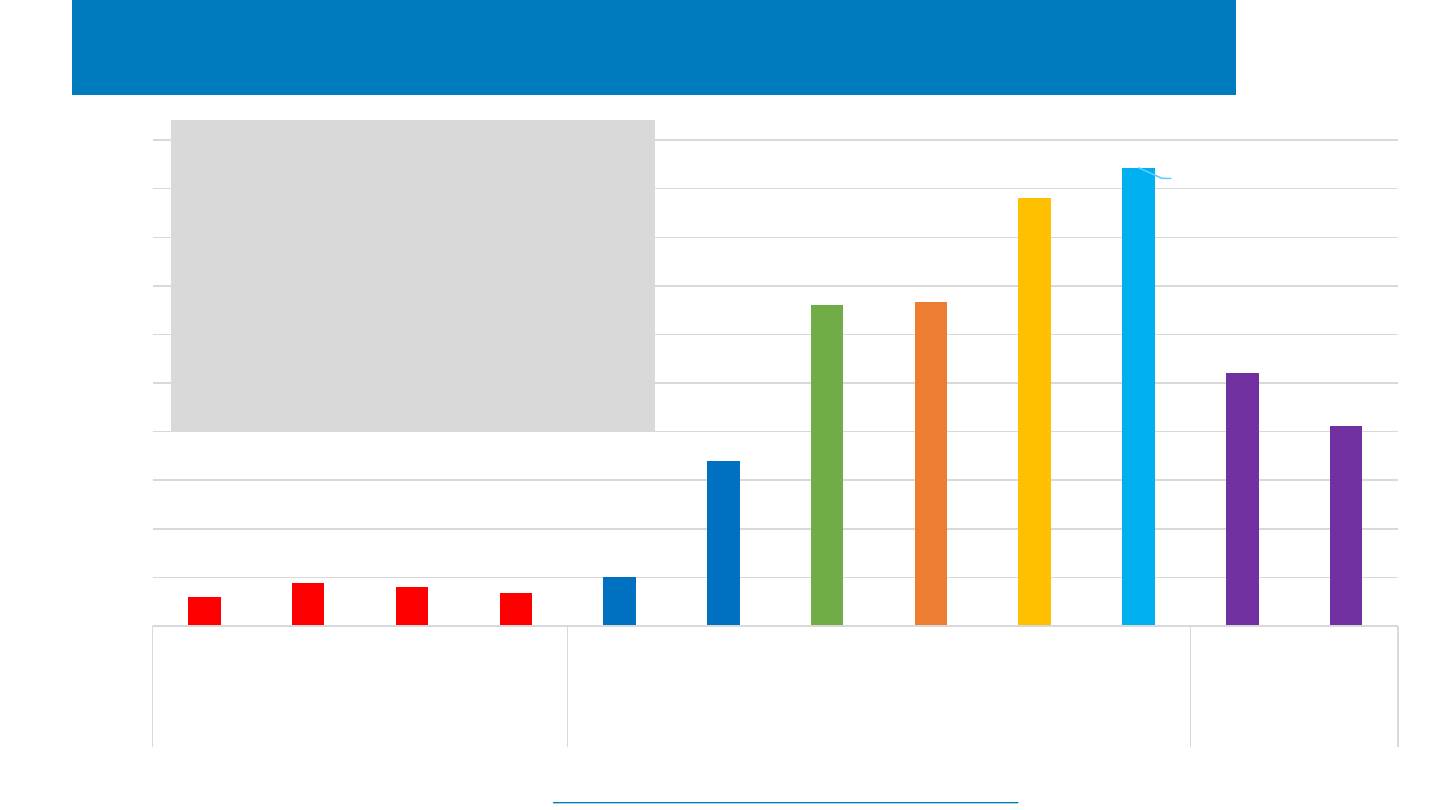

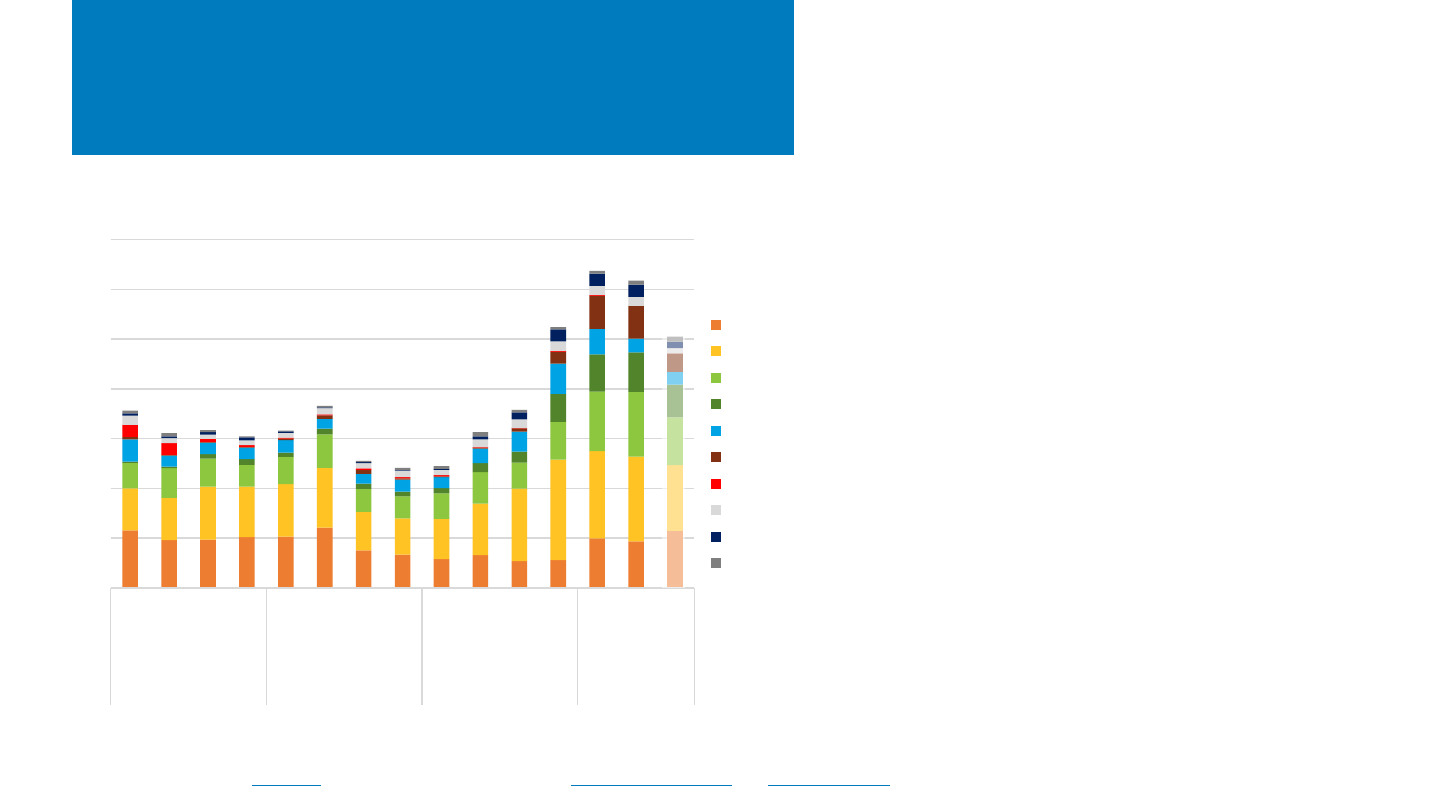

0

10

20

30

40

50

60

70

U.S. Generation Capacity Additions (GW

ac

)

Other

Nuclear

Natural Gas (Other)

Natural Gas CT

Natural Gas CC

Batteries

Wind

DPV

UPV

62%

U.S. Generation Capacity Additions by

Source: 2010–2022 and

Planned 2023–2024

Sources: EIA Form 860M/Preliminary Monthly Electric Generator Inventory (“Planned” and “Operating”) and EIA Short-Term Energy Outlook Table 7e,

downloaded October 6, 2023; Wood Mackenzie and SEIA US Solar Market Insight Full Report 2Q 2023, Sep 2023.

• EIA projects the percentage of U.S. electric

capacity additions from solar will grow from 45%

in 2022 (17 GW

ac

) to 56% in 2023 (31 GW

ac

), and

62% (41 GW

ac

) in 2024.

– Wind accounts for 14%, batteries 15%, and nuclear 2%

of projected capacity in 2023; in 2024 those

percentages are 9%, 19%, and 2%, respectively.

– Natural gas accounts for the remaining 14% in 2023.

• Over the next 2 years, EIA projects there will be

nearly 90 GW

ac

of capacity additions from wind

and solar alone.

• Wood Mackenzie/SEIA projects 32 GW

dc

of solar

installations in 2023 and 35 GW

dc

in 2024,

depending both on favorable supply chain

conditions (domestic and international) and on

the ability to optimize the Inflation Reduction Act

bonus credits.

– Over the next 5 years, Wood Mackenzie/SEIA projects

about 20 GW

dc

upside or downside relative to their

base case as a result of these factors.

Began operating

through July 2023

Planned August 2023

and full 2024

NREL | 15NREL | 15

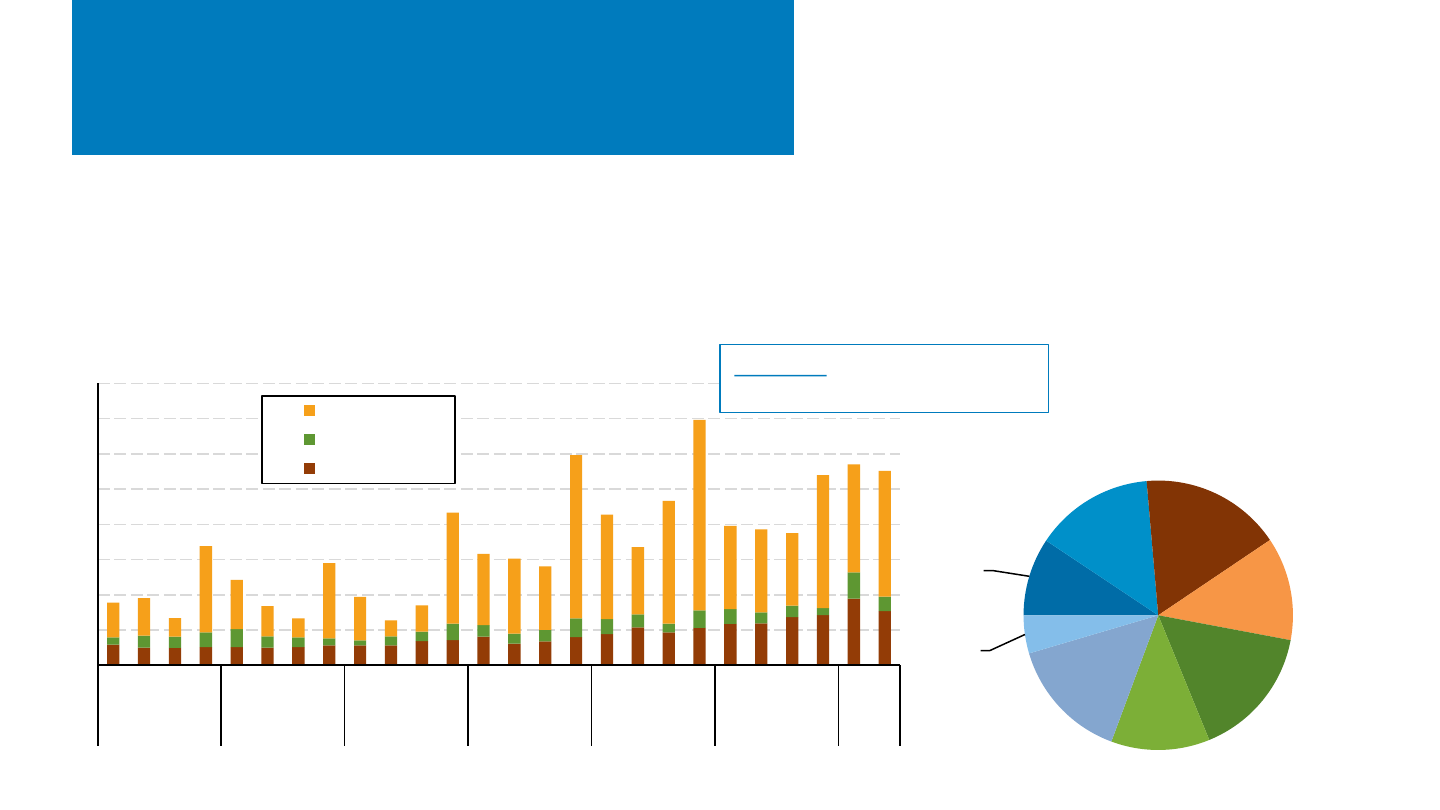

U.S. Installation Breakdown

Quarterly: EIA (GW

ac

)

• According to EIA data, the United States installed 11.2 GW

ac

of PV in

H1 2023—its largest H1 ever—up 44% y/y (SEIA reported 11.8 GW

dc

).

– Residential (3.4 GW

ac

) remained up significantly in H1 2023, 45%

y/y, as was nonresidential (1.2 Gw

ac

—up 60%) and utility-scale

(6.6 GW

ac

—up 40%).

• 39% of U.S. PV capacity installed in H1 2023

was in Texas, Florida, and California.

– 23 states installed more than 100 MW

ac

in H1 2023.

Note: EIA reports values in W

ac

, which is standard for utilities. The solar industry has traditionally reported in W

dc

. See the next slide for values reported in W

dc

.

Sources: EIA, “Electric Power Monthly,” forms EIA-023, EIA-826, and EIA-861 (July 2023, February 2022, February 2019).

13.2

1.5

3.9

0

1

2

3

4

5

6

7

8

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

2017 2018 2019 2020 2021 2022 2023

Quarterly PV Installed (GWac)

U.S. PV Installations by Market Segment

Utility-scale

C&I

Residential

Texas

9%

Southwest

14%

Florida

17%

California

12%

Midwest

16%

Southeast

12%

Northeast

15%

Other

5%

H1 2023 U.S. PV Installations by Region

(11.2 GW

ac

)

Click here to interactively view

this data on Tableau Public.

NREL | 16NREL | 16

U.S. Installation Breakdown

Quarterly: SEIA (GW

dc

)

• Wood Mackenzie/SEIA reports a record first half of PV installations, with 11.8

GW

dc

installed in H1 2023—an increase of 34% y/y.

– Big growth occurred year over year in the residential and utility-scale

space, with Q2 residential installations hitting another record level of

deployment. SEIA reports that the growth comes despite uncertainties

that remain in receiving IRA benefits, higher interest rates, and challenges

with UFLPA compliance.

– Nonresidential installations were mostly flat, with SEIA citing continued

impacts of interconnection delays, supply chain constraints, and

uncertainty over IRA implementation.

• Installations typically fall after Q4 and this

Q1 was particularly large due to delays in

projects originally intended for a Q4

installation.

• Florida, California, and Texas continue to

lead installations, accounting for 46% of H1

2023 installations.

– However, 27 states installed more than

100 MW in the first half of the year.

Sources: Wood Mackenzie/SEIA: U.S. Solar Market Insight: Q3 2023.

Unlike the previous slide, these values are

in GW

dc

—not GW

ac

.

California

14%

Texas

11%

Southwest

15%

Florida

21%

Southeast

11%

Northeast

10%

Midwest

10%

Other

8%

H1 2023 U.S. PV Installations by Region

(11.8 GW

dc

)

0

2

4

6

8

10

Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2

2017 2018 2019 2020 2021 2022 2023

Quarterly PV Installed (

GW

dc

)

U.S. PV Installations by Market Segment

Utility

Nonresidential PV

Residential PV

NREL | 17NREL | 17

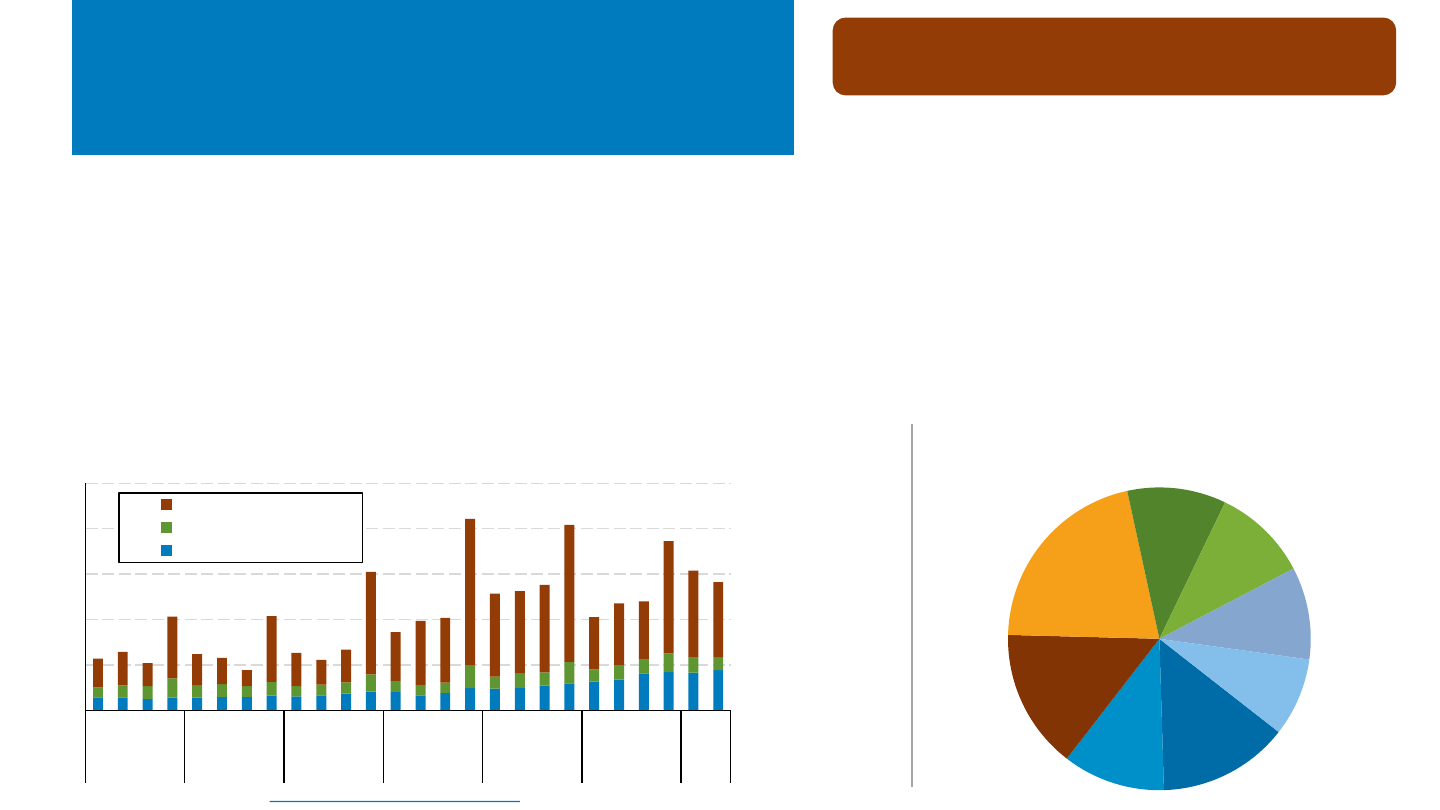

Solar Generation as a Percentage

of Total Generation, Q4 2022–Q3 2023

During the 1-year time span from Q4 2022 to Q3

2023, 20 states generated more than 5% of their

electricity from solar, with California leading the

way at 27.5%.

• Five states (California, Nevada, Massachusetts,

Hawaii, and Vermont) generated more than 15% of

their electricity using solar.

• Three other states generated more than 10% of their

electricity using solar: Utah, Rhode Island, Arizona.

• In calendar year 2022, solar generation was 4.1% in

Delaware, 4.3% Idaho, and 4.8% in Texas—all these

states broke the 5% barrier recently.

Nationally, 5.3% of electricity was generated from

solar—up from 4.8% during 2022.

The roles of utility and distributed solar vary by

state. Southern and Western states rely more on

utility-scale solar, while northern states and Hawaii

rely more on distributed solar.

Note: EIA monthly data for 2023 are not final. Additionally, smaller utilities report information to EIA on a yearly basis, and therefore a

certain amount of solar data has not yet been reported. “Net Generation” includes distributed PV generation. Net generation does not

take into account imports and exports to and from each state, and therefore the percentage of solar consumed in each state may vary

from its percentage of net generation.

*EIA does not estimate distributed PV production in Puerto Rico; utility-scale values derived from EIA Form 923 and distributed PV values

represent estimates based on capacity installations from EIA Form 861 and system production from PVWatts.

Source: U.S. Energy Information Administration (EIA), “Electricity Data Browser.” Accessed October 2023.

*

Click here to interactively

view this data on Tableau

Public.

NREL | 18NREL | 18

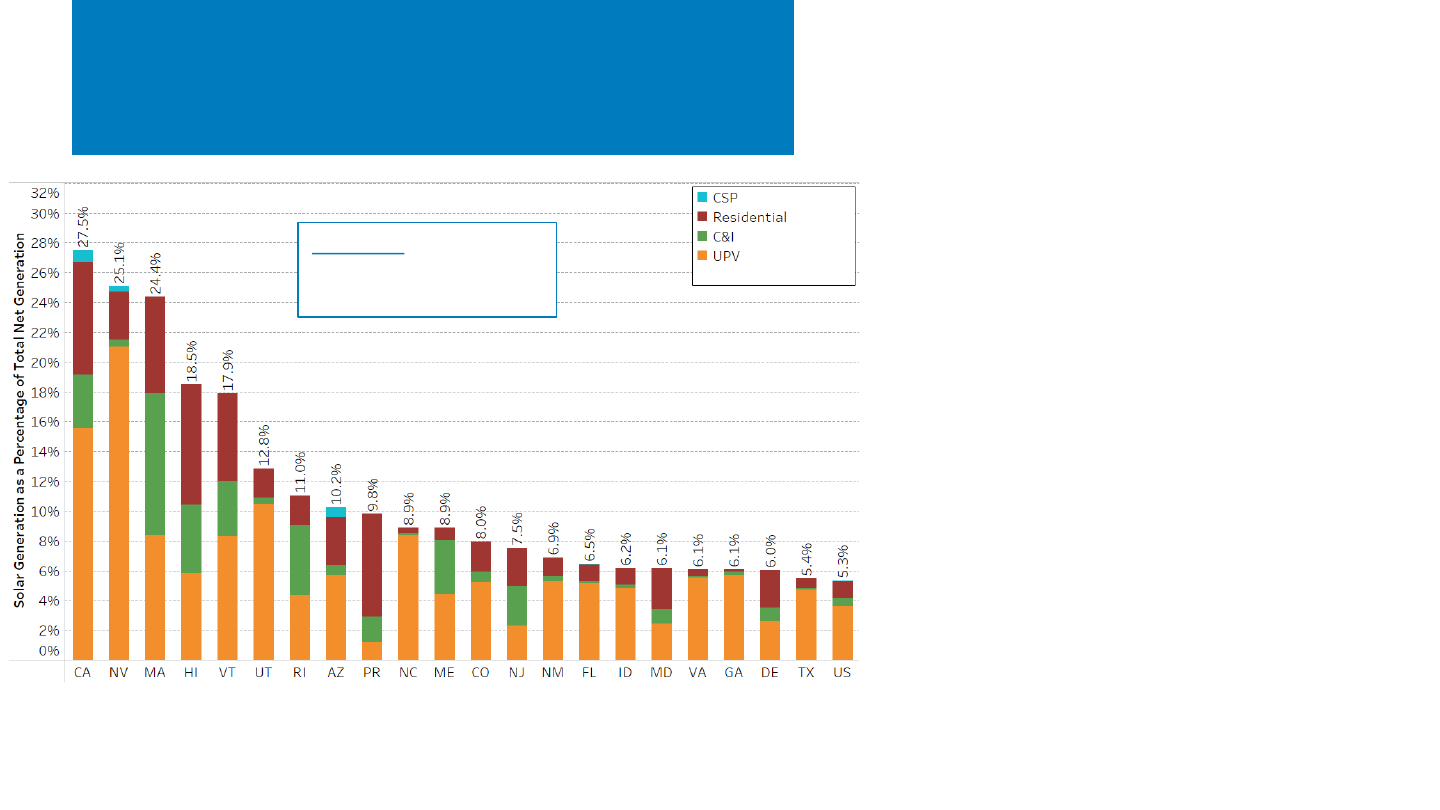

U.S. Energy Storage Installations by

Market Segment

• Wood Mackenzie reports that battery costs are declining from

their late 2022 peak; however, labor and balance of plant

costs are increasing.

– Lithium spot prices decreased, but transformer and inverter

costs continue to rise.

• California continues to lead in the residential and utility-scale

space, but other markets are developing as well, with 8 other

states/territories installing more than 100 MWh in H1 2023.

Colorado was the third-leading state thanks to two utility-scale

projects installed in H1 2023.

• The United States installed approximately 7.7 GWh (2.5 GW

ac

) of energy

storage onto the electric grid in H1 2023, +32% (+8%) y/y, as a result of

growth in all sectors.

– Q2 2023 installations were the highest on record, despite contractions in

the residential and CCI markets.

– In Q2 2023, California had its lowest residential storage installs since 2020.

Note: “Grid-scale” refers to all projects deployed on the utility side of the meter, regardless of size or ownership; “CCI” refers to “community-scale, commercial, and industrial.”

Source: Wood Mackenzie Power & Renewables and Energy Storage Association, U.S. Energy Storage Monitor: Q2 2023.

0

1,000

2,000

3,000

4,000

5,000

6,000

Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2

2017 2018 2019 2020 2021 2022 2023

Energy Storage Installed (MWh)

U.S. Energy Storage Installations by Market Segment

Grid-Scale (MWh)

CCI (MWh)

Residential (MWh)

0

150

300

450

600

750

900

1,050

1,200

1,350

1,500

1,650

1,800

Energy Storage Installed (MW)

Grid-Scale (MW)

CCI (MW)

Residential (MW)

NREL | 19NREL | 19

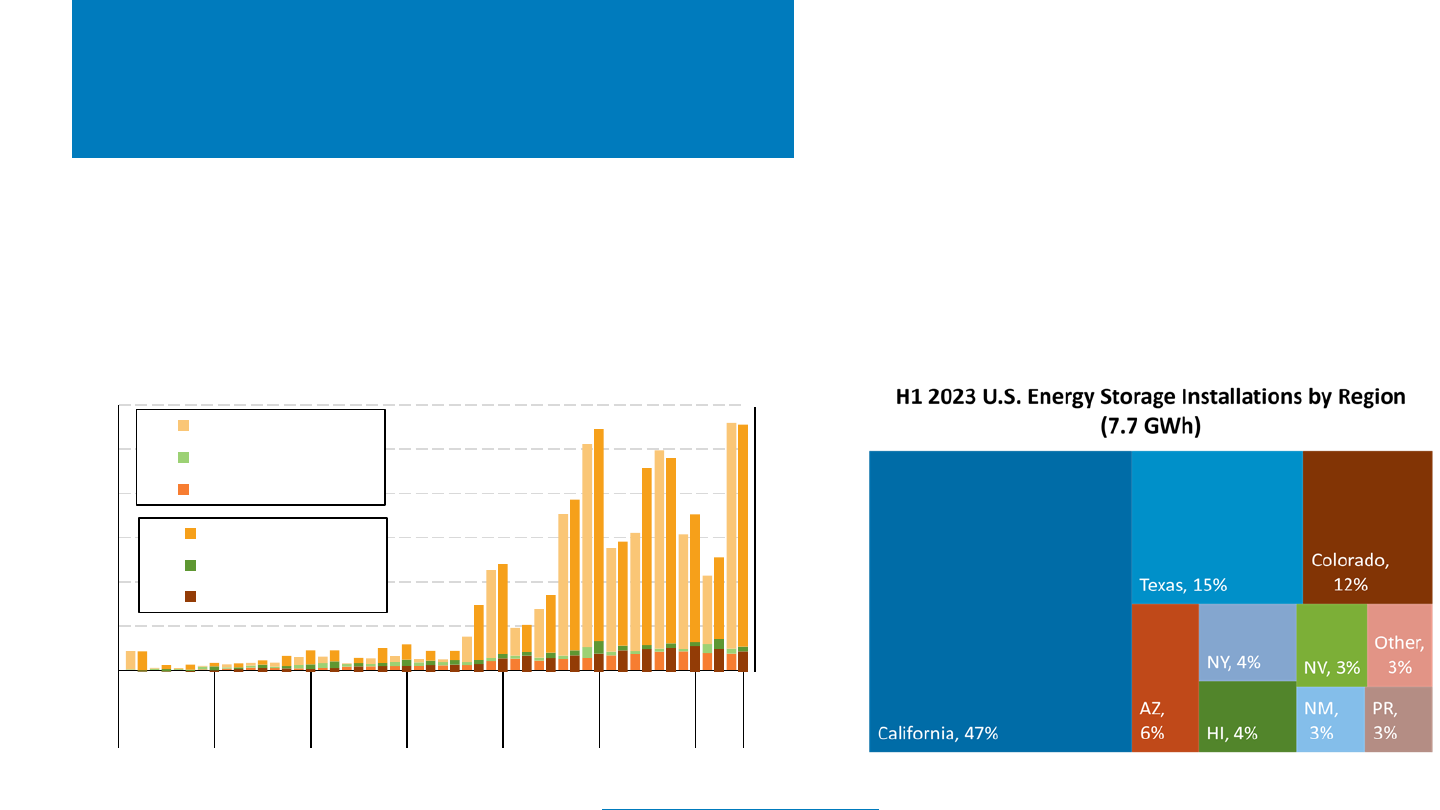

U.S. Energy Storage Installations

by Market Segment (EIA)

• California represented approximately 35% of

battery storage capacity installed in H1 2023,

followed by Texas (27%).

– The top five markets represented 88% of installed

energy storage capacity.

• EIA reports that the United States installed approximately

2.0 GW

ac

of energy storage onto the electric grid in the

first half of 2023—up 5% y/y as a result of high levels of

utility-scale and residential deployment.

Sources: EIA Form 860M, EIA Form 861M.

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

2018 2019 2020 2021 2022 2023

Energy Storage Installed (MW)

U.S. Energy Storage Installations by Market Segment

Residential

C&I

Utility-scale

NREL | 20NREL | 20

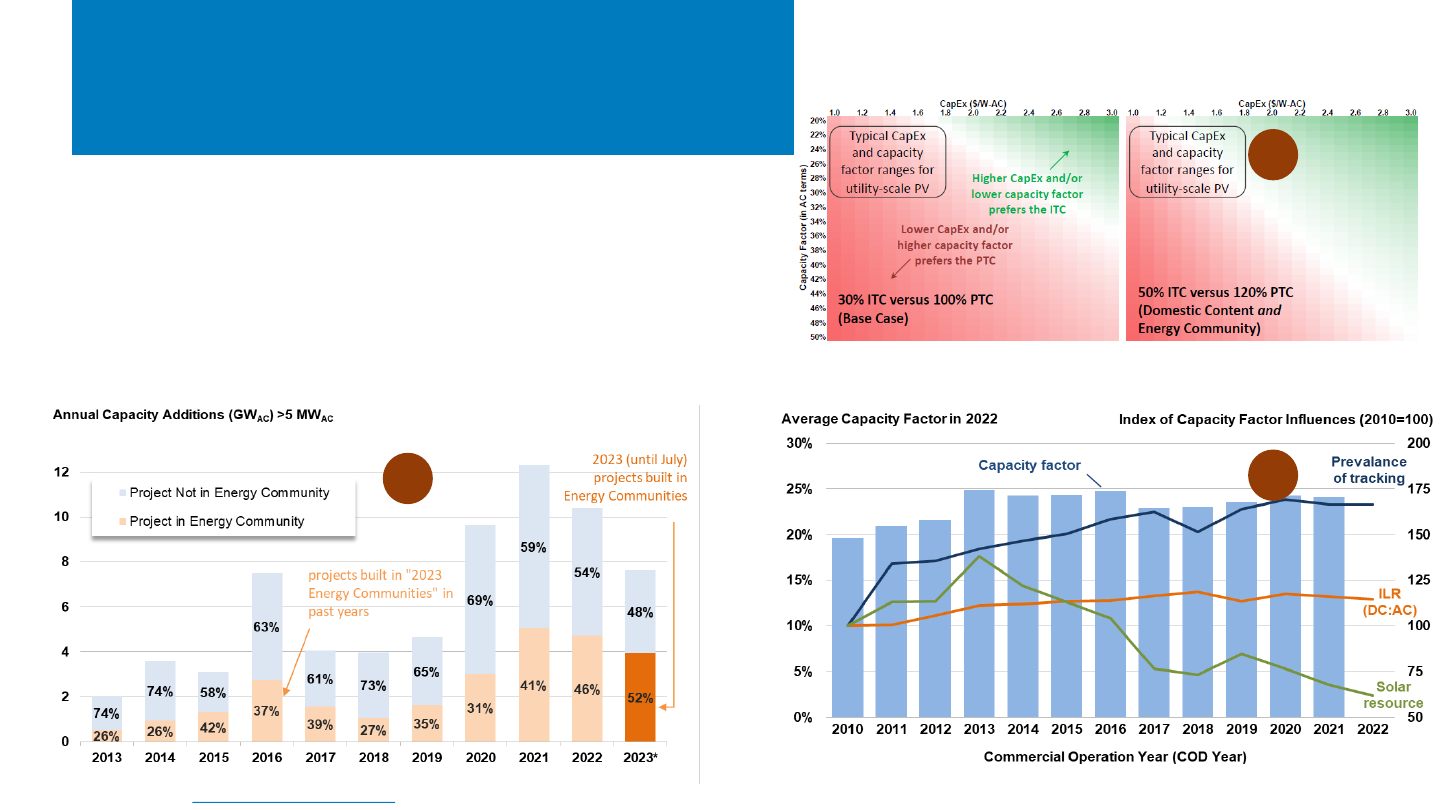

Five Things To Know From LBNL’s

Utility-Scale Solar, 2023 Edition

Source: Bolinger et al. 2023. Utility-Scale Solar, 2023 Edition. Lawrence Berkeley National Laboratory.

1. Half of utility-scale PV capacity built during January–July 2023 is in Energy

Communities and should qualify for the IRA Energy Community tax credit adder.

2. Under IRA, the production tax credit (PTC) is more valuable than the investment

tax credit (ITC) for many utility-scale PV systems, especially without bonus credits.

3. Average capacity factors by plant vintage have been flat since 2014 as installation

in areas with lower solar resource has offset increases in ILR and use of tracking.

4. 94% of utility-scale capacity installed in 2022 used tracking, the highest ever.

5. Because of high electricity prices, the total (energy plus capacity) value of PV

electricity increased 40% between 2021 and 2022, reaching a record $71/MWh.

1

2

3

NREL | 21NREL | 21

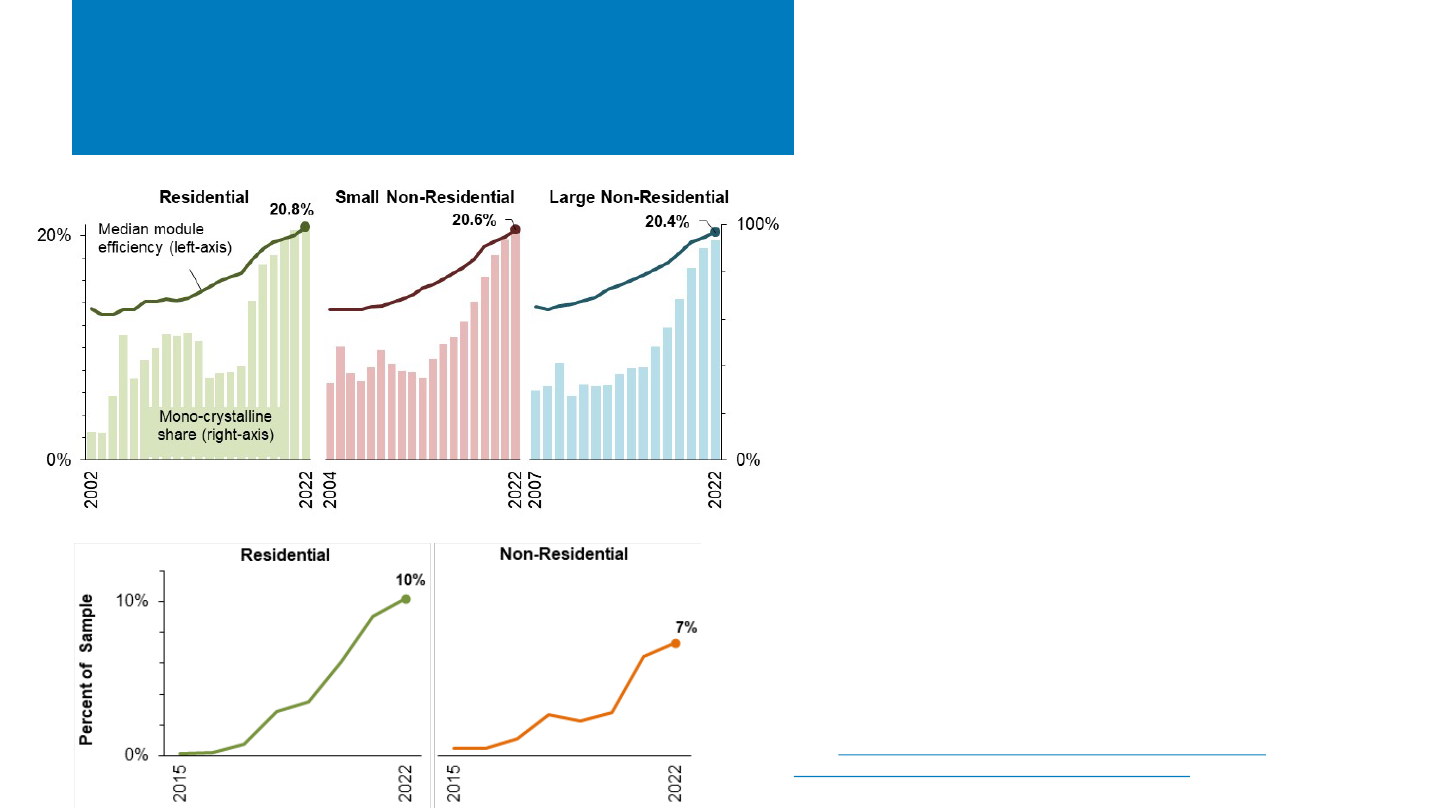

Five New Things To Know From

Tracking the Sun … 2023 Edition

1. In 2022, the median module efficiency of U.S. residential PV

systems was 20.8%, up 0.7 percentage points y/y. 20th/80th

percentile range module efficiencies was 20% to 21.5%.

2. Third-party ownership has declined over time from its

historical high of 59% of residential installations in 2012 to

25% in 2022. Market share varies a lot by state.

3. For the second year in a row, microinverters represented over

half the residential market, beating out DC optimizer systems

53% to 41%. However, for large nonresidential systems, DC

optimizer market share continues to grow, up to 39% in 2022,

compared to 1% for microinverters.

4. Residential attachment rates have steadily risen over time,

reaching 10% of the sample in 2022—approximately eight

states have an attachment rate greater than 10%. 65% of

paired storage had a capacity of 5 kW; however, market share

for larger storage sizes has grown over time, driven by backup

power demand.

5. LBNL performed a regression analysis and found prices are

generally lower in markets with more cumulative PV

installations and areas with higher income. Their modeling also

suggests that prices are $0.6/W lower for systems installed

during new construction.

Source: Barbose, G., N. Darghouth, E. O’Shaughnessy, and S. Forrester.

2023. Tracking the Sun: Pricing and Design Trends for Distributed

Photovoltaic Systems in the United States 2023 Edition. Berkeley, CA:

Lawrence Berkeley National Laboratory. September 2023.

Storage Attachment Rates by Sector (2022)

Module Efficiency and Monocrystalline Market Share

NREL | 22

Global Solar Deployment1

U.S. PV Deployment

2

PV System Pricing

3

Global Manufacturing

4

Component Pricing

5

U.S. PV Imports

6

7 PV Domestic Content

Agenda

• Most data suggest mixed PV system pricing across market

segments, with price increases in nominal terms.

• U.S. PV system pricing, or costs, is estimated and quoted in a

variety of ways, including:

– Reported price (backward-looking)

– Reported costs (backward-looking and may not include profit,

unless incorporating “value”)

– Developer quotes (forward-looking)

– Bottom-up cost benchmarking (forward-looking).

• In 2022, the ranges in average U.S. PV system pricing across

methods were reported to be:

– $3.1/W–$4.2/W for residential solar

– $1.6/W–$3.2/W for nonresidential solar

– $0.9/W–$1.1/W for utility-scale solar.

• In the first half of 2023, the ranges in average U.S. PV system

pricing across a smaller set of methods were reported to be:

– $2.7/W–$4.3/W for residential solar

– $1.8/W–$2.4/W for nonresidential solar

– $1.2/W for utility-scale solar.

NREL | 23NREL | 23

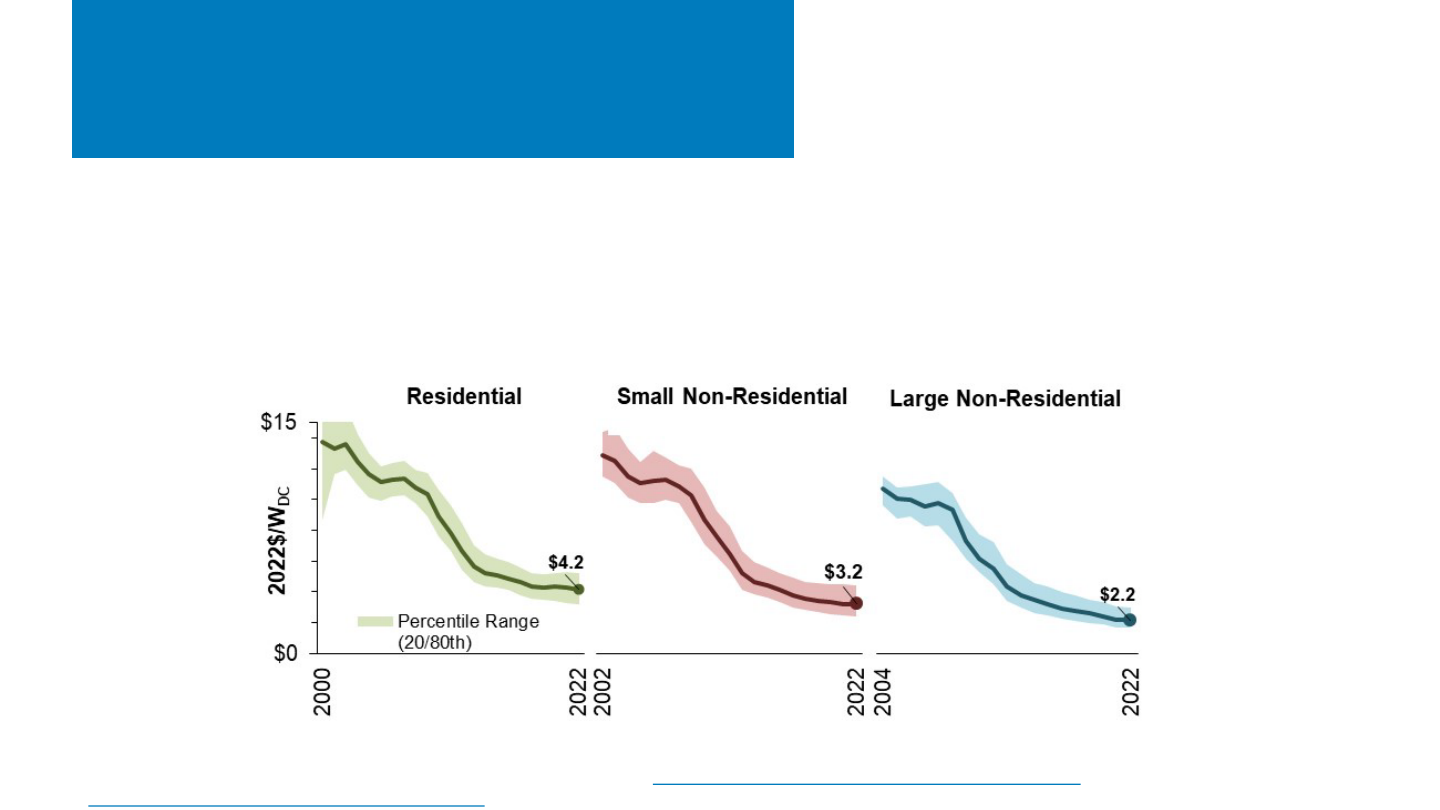

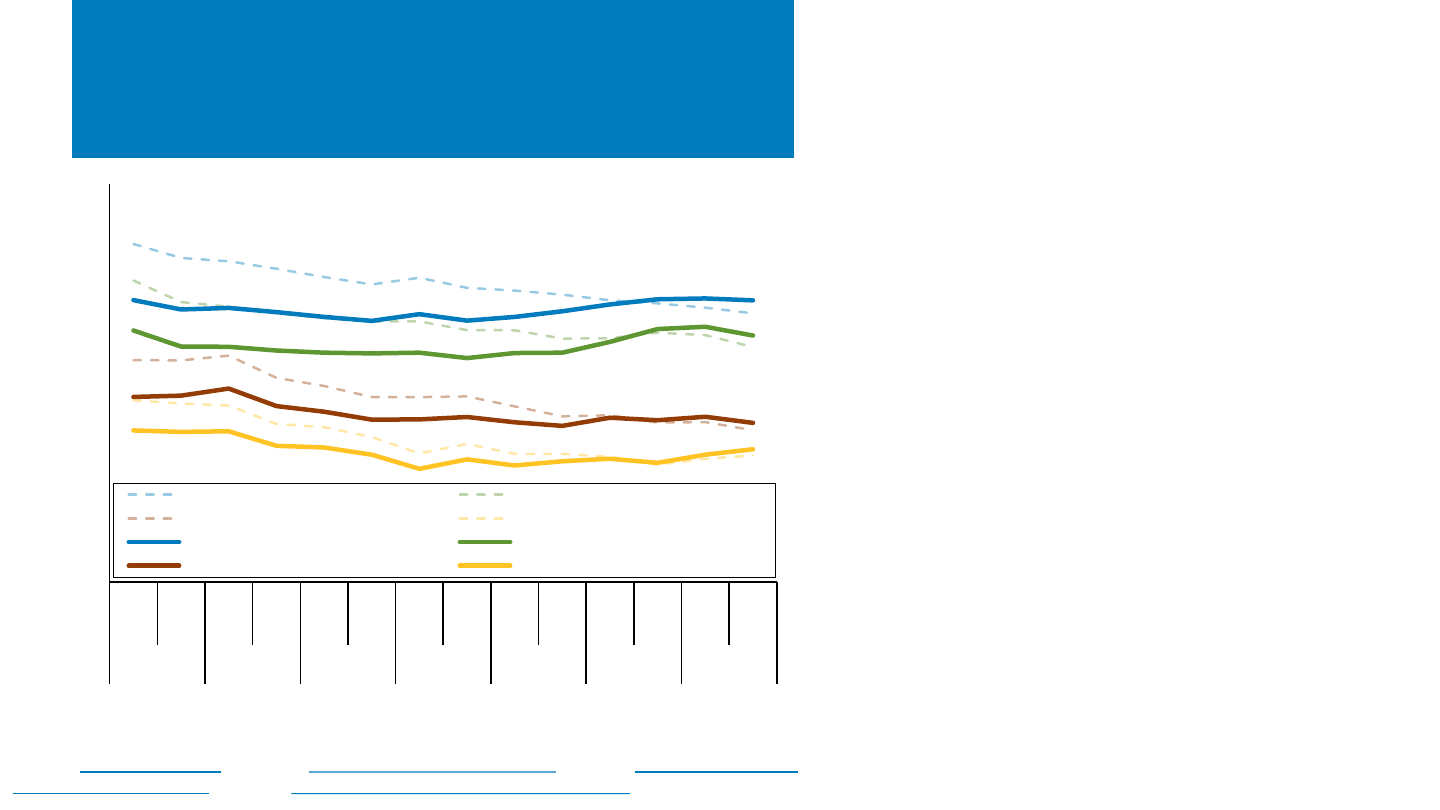

Tracking the Sun: National

Price, 2000–2022

• Over the long term, median installed prices have fallen by roughly $0.4/W per year, on average, but price

declines have tapered off since 2013, after which price declines averaged $0.1–$0.2/W across segments,

following the trajectory of module costs.

• PV system prices rose in nominal dollars over the past 2 years but continued to fall in real dollars.

Source: Barbose, G., N. Darghouth, E. O’Shaughnessy, and S. Forrester. 2023. Tracking the Sun: Pricing and Design Trends for Distributed

Photovoltaic Systems in the United States 2023 Edition. Berkeley, CA: Lawrence Berkeley National Laboratory. September 2023.

NREL | 24NREL | 24

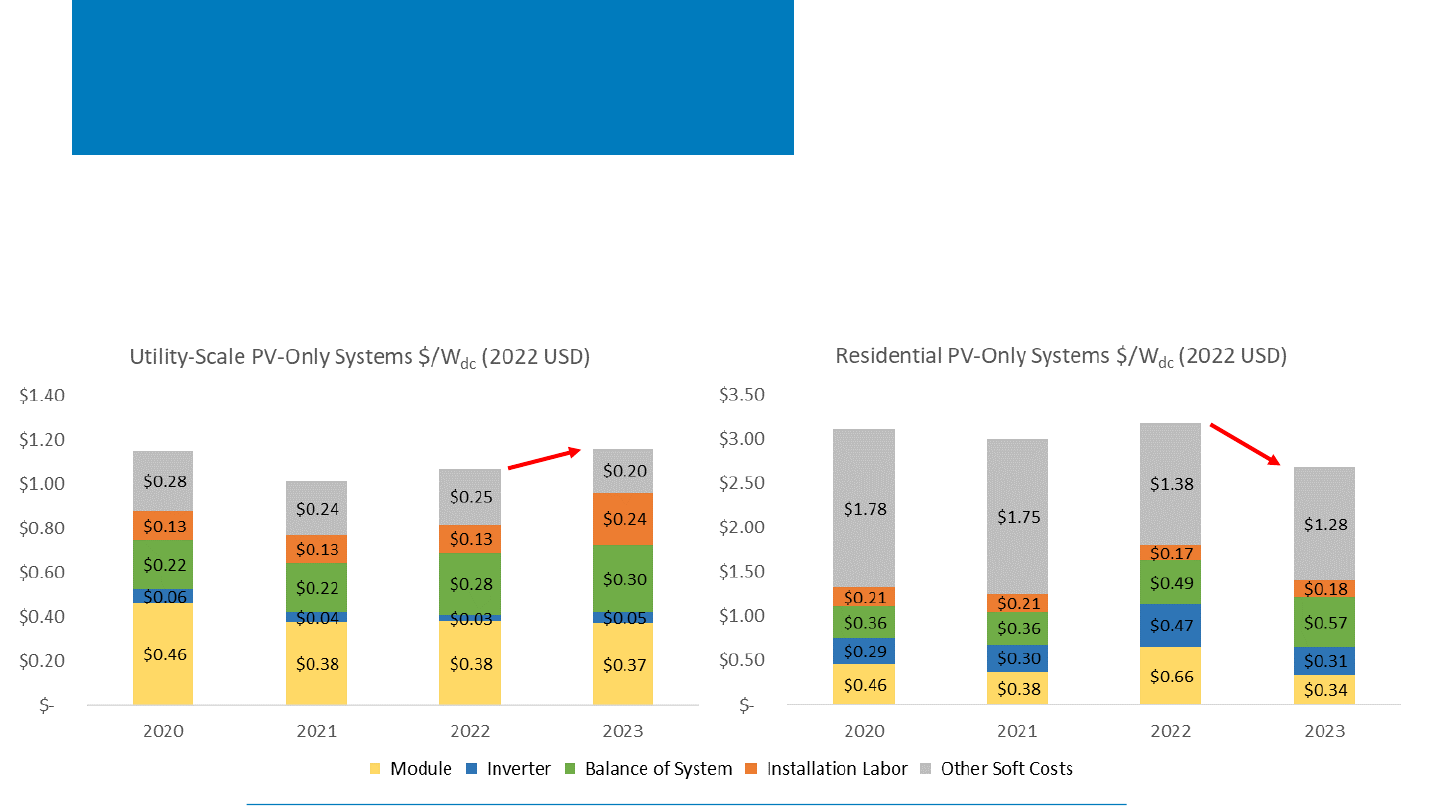

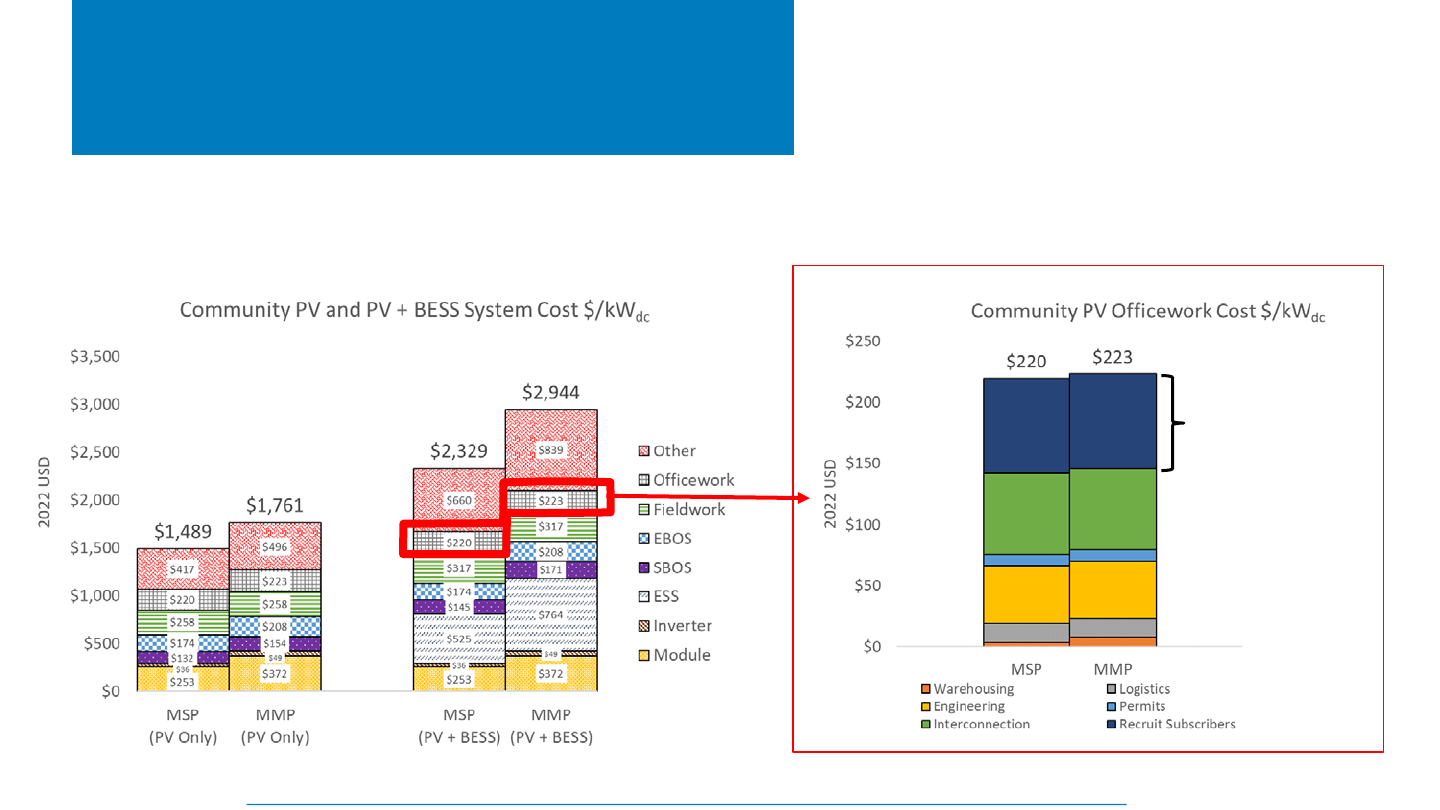

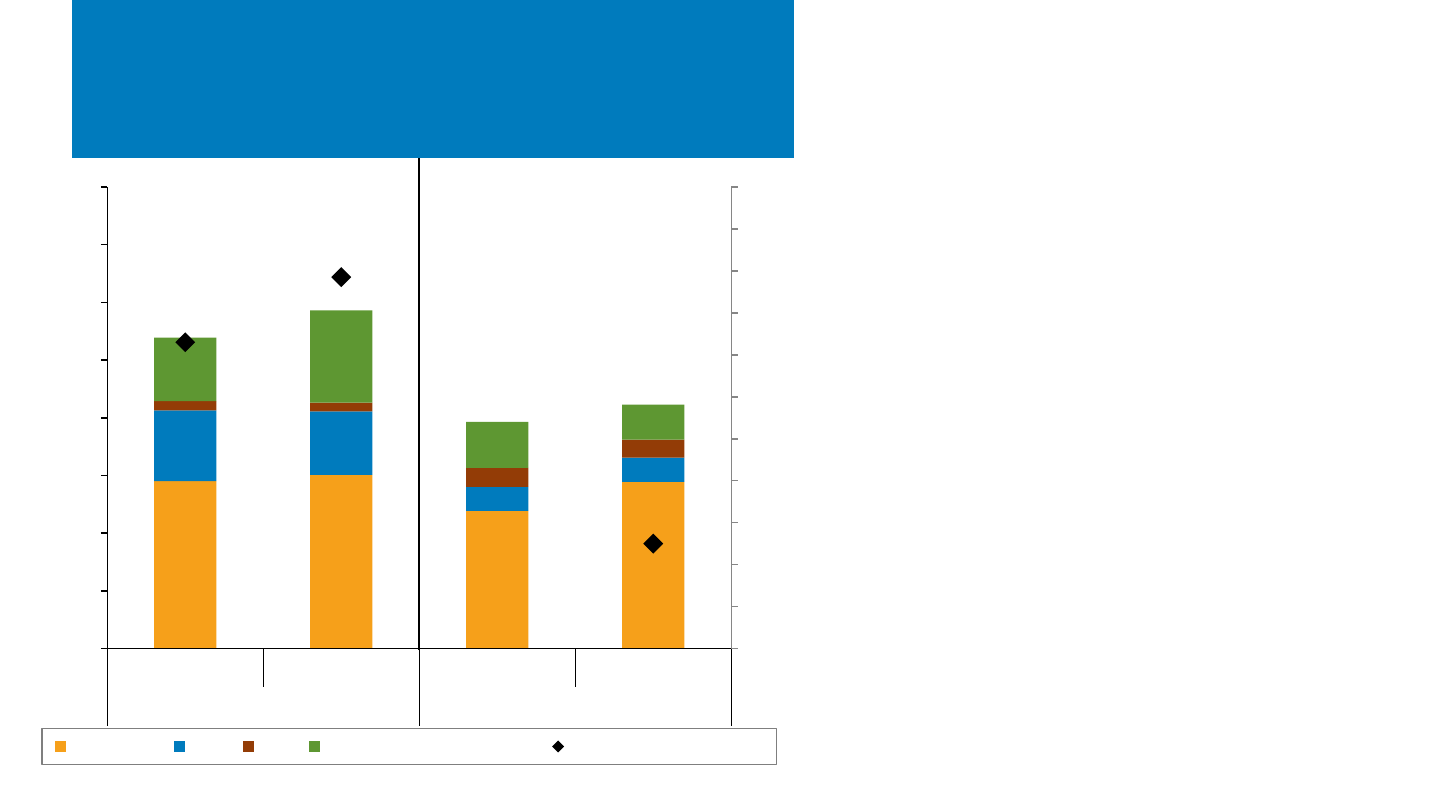

NREL Bottom-Up Cost Modeling:

Q1 2023 Installed Cost Benchmarks

Source: Ramasamy et al. 2023. U.S. Solar Photovoltaic System and Energy Storage Cost Benchmarks, With Minimum Sustainable Price Analysis: Q1 2023

Modeled market price (MMP) benchmarks are

significantly higher than minimum sustainable

price (MSP) benchmarks for PV-only and PV-plus-

storage systems, indicating significant inflationary

market and policy distortion in Q1 2023.

NREL | 25NREL | 25

NREL Utility-Scale & Residential PV-

Only MMP Benchmarks, 2020–2023

$1.15

$1.01

$1.07

$1.16

$3.10

$3.00

$3.18

$2.68

• Residential PV-only MMPs were 15% lower in Q1

2023 than in Q1 2022.

• Higher BOS costs were more than offset by lower

module, inverter, logistics, and customer acquisition

costs.

• Utility-scale PV-only MMPs were 8% higher in Q1

2023 than in Q1 2022.

• Higher inverter, labor, and electrical BOS (including

network upgrade) costs more than offset lower

module, structural BOS, and other soft costs.

+8%

-15%

Source: Ramasamy et al. 2023. U.S. Solar Photovoltaic System and Energy Storage Cost Benchmarks, With Minimum Sustainable Price Analysis: Q1 2023

NREL | 26NREL | 26

NREL Community Solar

Benchmarks, Q1 2023

The cost of community solar systems was benchmarked for the first time, including unique

expenses for subscriber acquisition and management.

Subscriber

acquisition

cost

Source: Ramasamy et al. 2023. U.S. Solar Photovoltaic System and Energy Storage Cost Benchmarks, With Minimum Sustainable Price Analysis: Q1 2023

NREL | 27NREL | 27

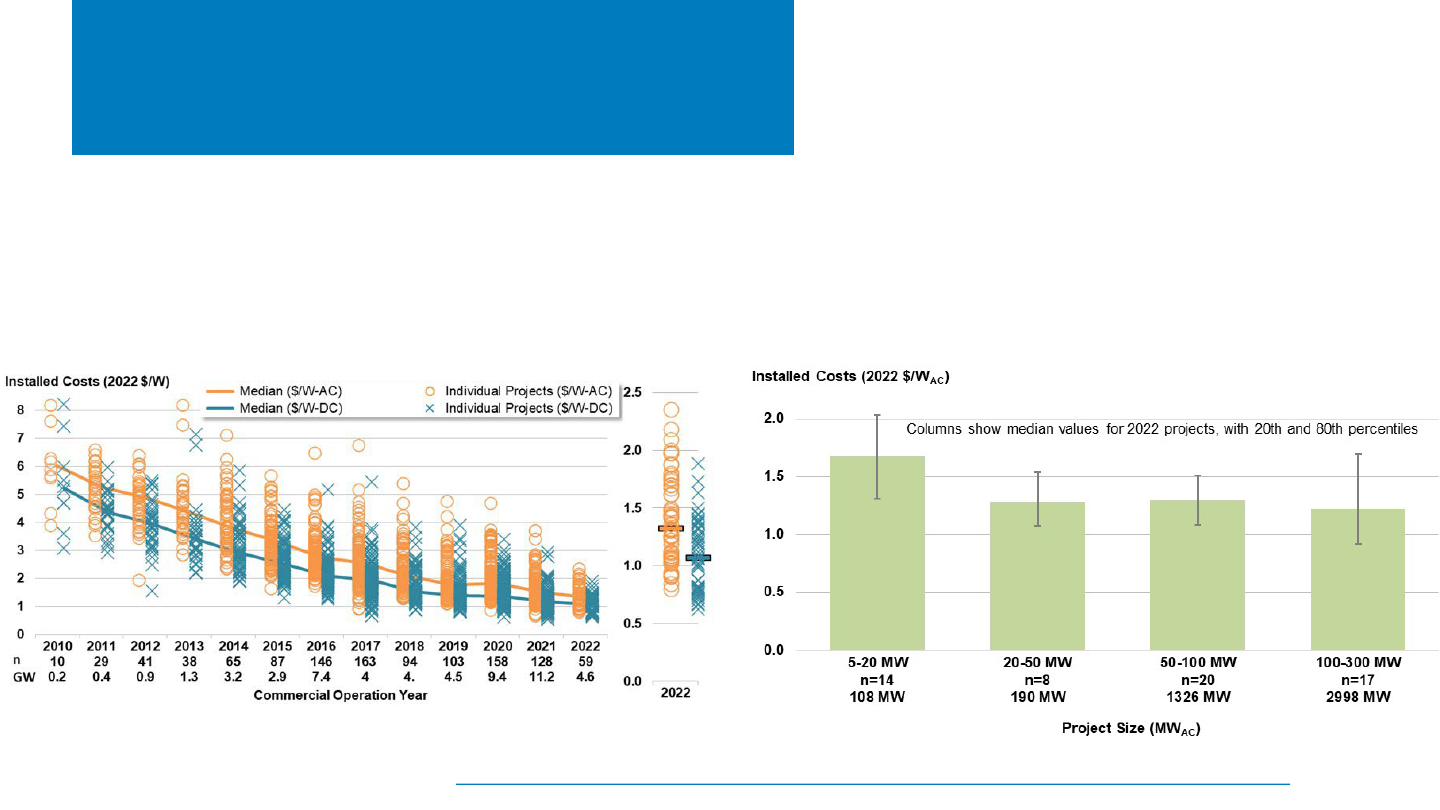

Reported Price of U.S. Utility-Scale

PV Projects Over Time

• The median installed price of PV has fallen by 78% since

2010 to $1.32/W

ac

($1.07/W

dc

) in 2022.

• The lowest 20th percentile of project prices fell below

$1.1/W

ac

($0.8/W

dc

) in 2022.

• Larger utility-scale solar projects (50–100 MW) cost

21% less than smaller projects (5–20 MW) per

megawatt of installed capacity in 2022.

• This sample is backward-looking and may not reflect

the price of projects built in 2023 and 2024.

Source: Bolinger, M., J. Seel, C. Warner, and D. Robson. 2023. Solar Empirical Trends in Project Technology, Cost, Performance, and PPA Pricing in the United States: 2023 Edition.

Berkeley, CA: Lawrence Berkeley National Laboratory.

NREL | 28NREL | 28

$3.1

$3.2

$2.9

$2.6

$2.8

$4.2

$3.3

$4.0

$1.8

$1.7

$1.8

$1.6

$3.2

$2.2

$1.1

$1.0

$1.0

$0.9

$1.1

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

BNEF

WoodMac/SEIA

NREL (MMP)

NREL (MSP)

EnergySage

LBNL

Sunrun Sale Price

SunPower Rev./W

BNEF

WoodMac/SEIA

NREL (MMP)

NREL (MSP)

LBNL (≤100kW)

LBNL (>100kW)

BNEF (1-Axis)

WoodMac/SEIA (1-Axis)

NREL (1-Axis, MMP)

NREL (1-Axis, MSP)

LBNL

Modeled Quote Reported Modeled Reported Modeled Reported

Residential Non-Residential Utility-scale

System Price (2022 $/Wdc)

2022 Modeled, Reported, and

Quoted System Price From Various

Sources

Note: Some sources only report a range, which is represented by the error bars.

Sources: Barbose

et al. 2022; Bolinger et al. 2022; Ramasamy et al. 2022; BNEF, “H1 2022 U.S. PV Market Outlook,” April 2022; : Wood Mackenzie/SEIA: U.S. Solar Market

Insight: 2021 Year-in-Review, March 2022; EnergySage, Solar Marketplace Intel Report H1 2021 – H2 2022.

• NREL and LBNL PV system price ranges

generally overlap other sources.

• Across various sources, reported system

pricing is generally higher than modeled and

quoted system pricing.

NREL | 29NREL | 29

Why is there such price

variation?

• Utility-scale PV

– There is some variation in estimates; however, reported and modeled pricing is

relatively consistent between sources.

• Soft costs are more easily spread out over large projects.

• There are diminishing returns to economies of scale.

• Utility-scale businesses operate under very competitive operating conditions,

where bid-price typically becomes the differentiator.

• Nonresidential PV

– Nonresidential PV contains a large variation in project type from offtaker (industrial,

commercial, nonprofit, government), system size (lots of small projects, but a

significant capacity of larger projects), and project design (rooftop, ground-mount,

carport).

NREL | 30NREL | 30

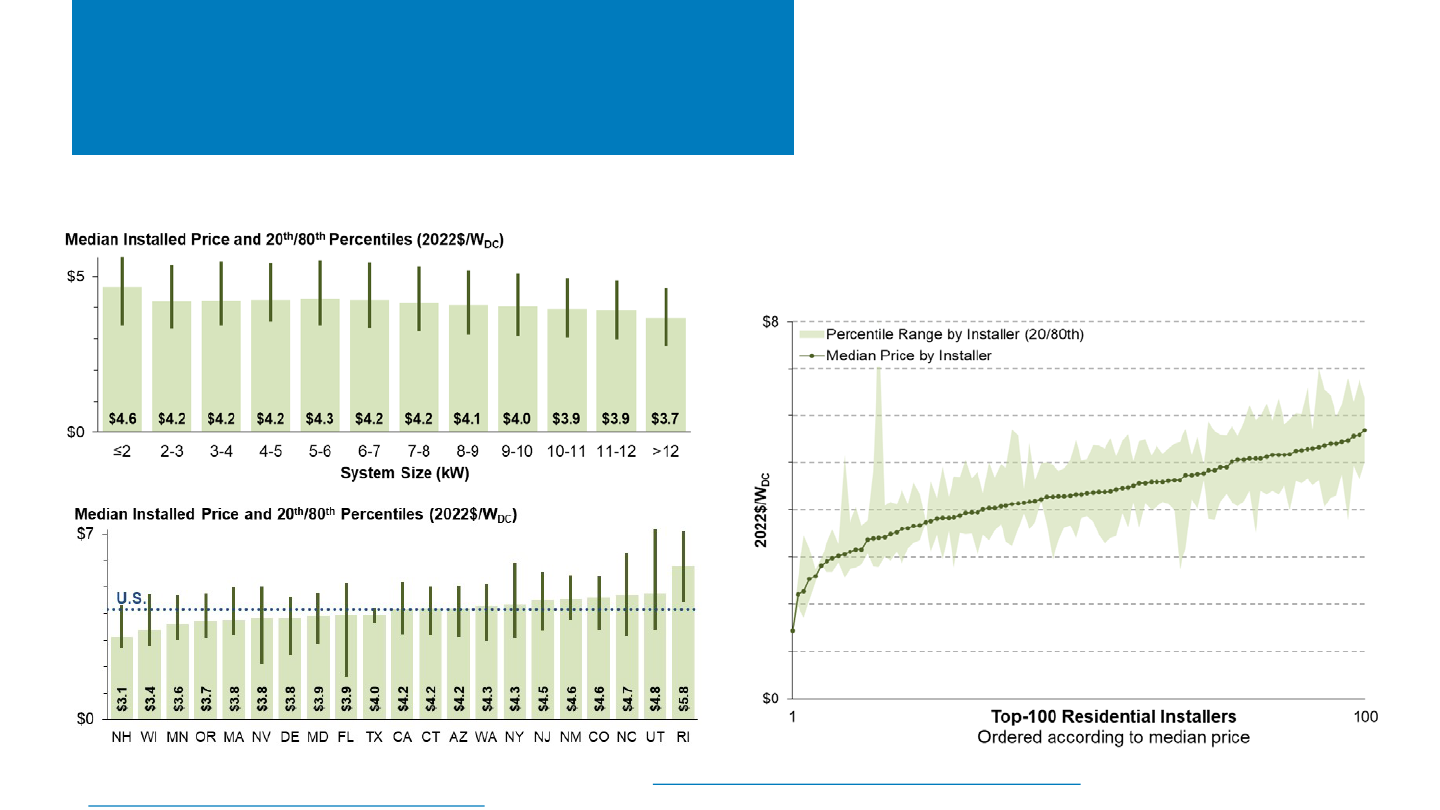

Why is there such price

variation?

• Residential

– Some of the variation in residential pricing can be explained by different installers;

state environments; temporal differences between when a system or component has

a quoted price and when a system is installed; and sizes in datasets.

• 2022 system size: LBNL (7.2 kW); NREL (7.9 kW); EnergySage (10.2 kW); Sunrun (7.2

kW).

– However, when accounting for these factors, large discrepancies still exist.

NREL | 31NREL | 31

Why is there such price

variation?

• Modeled and quoted residential PV

system prices between $2.8/W

(EnergySage) and $3.10 (BNEF)

correspond to some of the lowest state

and installer reported pricing; this

discrepancy cannot be explained by

economies of scale (system size).

Source: Barbose, G., N. Darghouth, E. O’Shaughnessy, and S. Forrester. 2023. Tracking the Sun: Pricing and Design Trends for Distributed

Photovoltaic Systems in the United States 2023 Edition. Berkeley, CA: Lawrence Berkeley National Laboratory.

NREL | 32NREL | 32

Why is there such price

variation?

• Financing and other costs are likely responsible for a larger portion of the additional discrepancies in

residential PV reported price.

– TPO Finance: Sunrun, which finances most of its customers’ systems, reported a 2022 value per

customer of $5.80/W, which represents the net present value of contracted cash flows, tax

credits, and other benefits, including an assumed contract extension. Financing and operating a

PV system for 30 years requires additional costs beyond just installation. Its 2022 “creation cost”

was $4.17/W compared to its average PV system sales price of $3.30/W.

– Loan finance: Loans, which represented most residential PV system installations in 2022, incur

additional costs to set up. Additionally, many loan providers charge “dealer fees” to lower the

interest rate of the loan, which show up in the reported price of a system.

– Other costs not necessarily quoted (or modeled) in a standard PV system, but which may be

reported in a system price, include certain roof repairs, main panel upgrades, and battery

storage (which were attached to 10% of residential PV in 2022).

NREL | 33NREL | 33

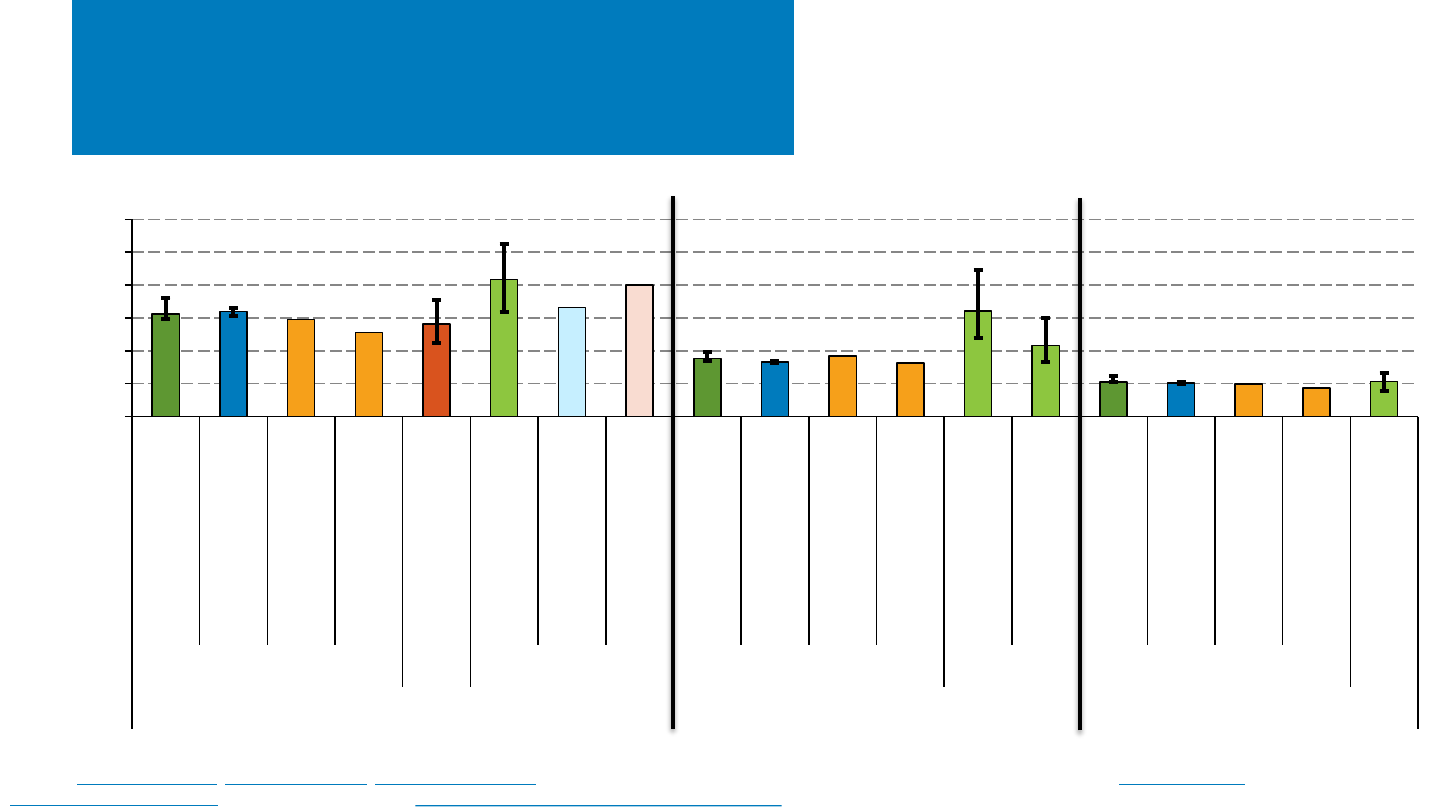

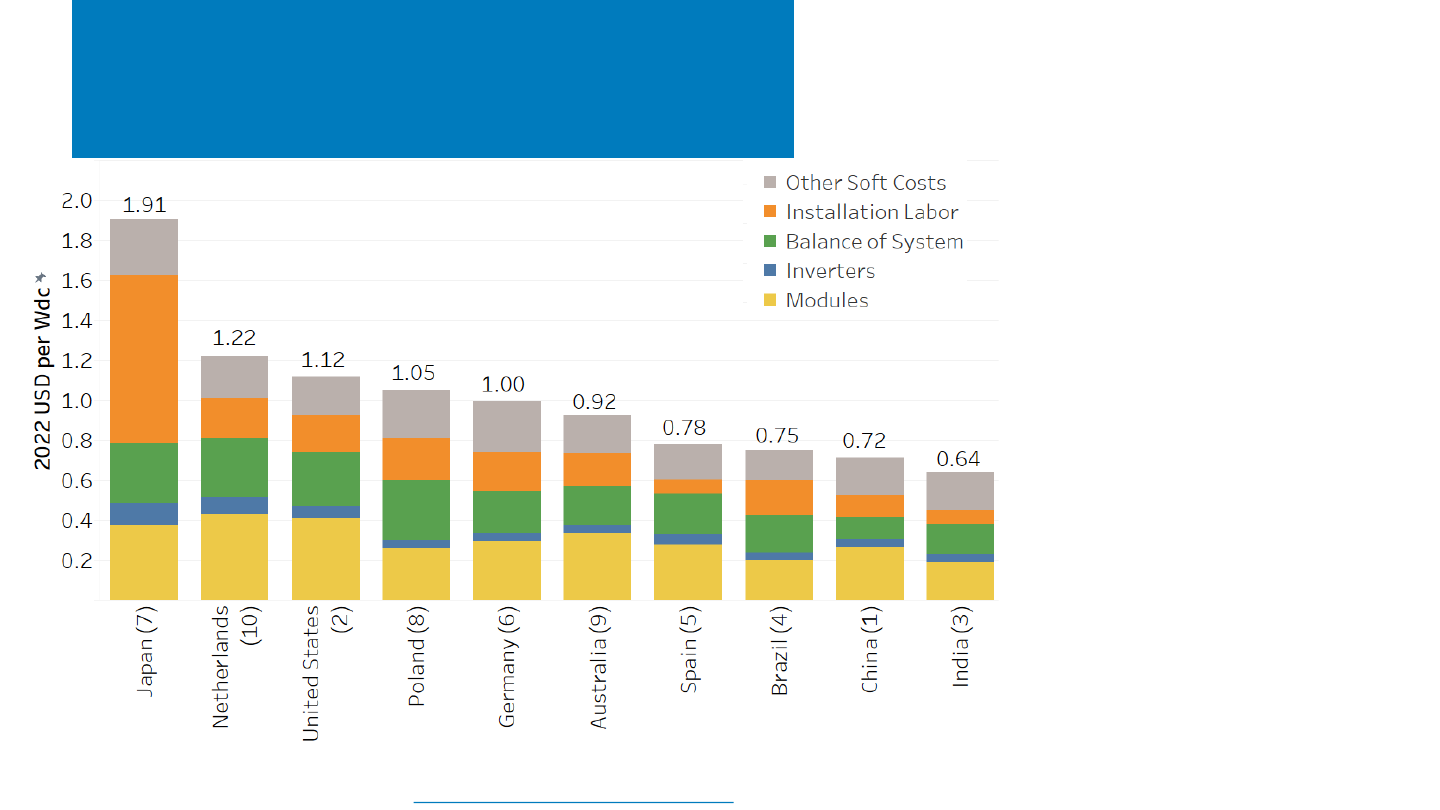

Utility-Scale PV Installed Costs

by Country, 2022

Source: International Renewable Energy Agency. 2023. Renewable Power Generation Costs in 2022

• The global capacity-weighted average

total installed cost of utility-scale

projects commissioned in 2022 was

$0.88 (USD)/W

dc

.

• Average component costs as a

percentage of total costs:

– Module and inverter 37%

– Balance of system hardware 23%

– Installation labor 19%

– Other soft costs 21%.

• Costs and cost components varied

across countries:

– India had the lowest cost ($0.64

(USD)/W

dc

) and Japan the highest

($1.91 (USD)/W

dc

).

– The ratio of highest-cost to

lowest-cost country declined from

3.5 in 2019 to 3.0 in 2022,

suggesting that global PV costs are

converging.

– Labor costs varied the most across

countries.

Top 10 Global PV Markets in 2022

NREL | 34NREL | 34

Residential System Price

Reported by EnergySage

Note: Price based on winning quoted price.

Source: EnergySage, Solar Marketplace Intel Report H2 2022 – H1 2023.

• The median reported price by EnergySage for

residential PV systems increased 4.7% y/y, for the

fourth straight period, after never having done so

before.

– However, EnergySage reported seeing price

declines in July and August.

• Residential system price varied by state. In H1 2023,

the median price of a residential system in New York

was 40% higher than the median price of a residential

system in Arizona.

– Part of the price disparity between states is due to

differences in average system size, though other

factors, such as cost of living (e.g.,

Massachusetts), also play a role.

$2.35

$2.45

$2.55

$2.59

$2.89 $2.89

$2.90 $2.90

$2.95

$3.10

$3.30

$0.0

$0.5

$1.0

$1.5

$2.0

$2.5

$3.0

$3.5

AZ FL NV TX CA NJ GA US VA IL NY

Cost and Tax Credit by State, H1 2023 ($/W

dc

)

3.80

3.74

3.65

3.50

3.35

3.18

3.10

3.06

3.00

2.93

2.89

2.85

2.75

2.67

2.68

2.77

2.85

2.90

$0

$1

$2

$3

$4

$5

H2 H1 H2 H1 H2 H1 H2 H1 H2 H1 H2 H1 H2 H1 H2 H1 H2 H1

2014 2015 2016 2017 2018 2019 2020 2021 2022 23

Median Gross Costs ($/W)

Cost Over Time

NREL | 35NREL | 35

Large Residential Installer

Cost and Value, Q2 2023

Sources: Corporate filings; Personal Communication, Mike Weinstein (Vice President of Investor Relations, SunPower), September 2023

• Large residential installers Sunrun and SunPower

reported system value/cost changes of +8% to

+9% y/y but −1% to +3% q/q.

• Factors reported as supporting higher system

value and/or costs (for Sunrun, SunPower, and

Sunnova):

– Increasing inflation and interest rates

– Increasing retail electricity rates

– Increasing battery attachment rates (batteries

add cost but can yield higher margins)

• Sunrun rate up from 15% to 18% y/y

• Up to 80%+ rate ca. July–Aug. 2023 in

California, under new PV compensation policy

• Up to 100% rate in Hawaii and Puerto Rico.

• Factors reported as supporting lower PV system

costs and/or higher margins:

– Declining equipment prices

• Module and battery procurement costs down

by >20% compared with recent highs

• Cost reductions expected to have impact over

at least the next several quarters.

• Increasing permitting automation (SolarAPP+).

$2.90

$3.01

$2.39

$2.89

$1.23

$1.10

$0.42

$0.42

$0.16

$0.15

$0.33

$0.31

$1.10

$1.60

$0.79

$0.61

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

20%

22%

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

$7.0

$8.0

Q2 '22 Q2 '23 Q2 '22 Q2 '23

Sunrun SunPower

Battery Attachment Rate

Installed Cost ($/W

dc

)

Installation Sales G&A Net Value or Gross Margin Battery Attachment Rate

Mostly system leases—bars

represent subscriber value, including

the net present value of contracted

cash flows, tax credits, and other

benefits, including an assumed

contract extension.

Mostly system sales—bars represent

system costs in Q2 2023, including a

gross margin.

NREL | 36NREL | 36

Distributed PV System Pricing

From Select States

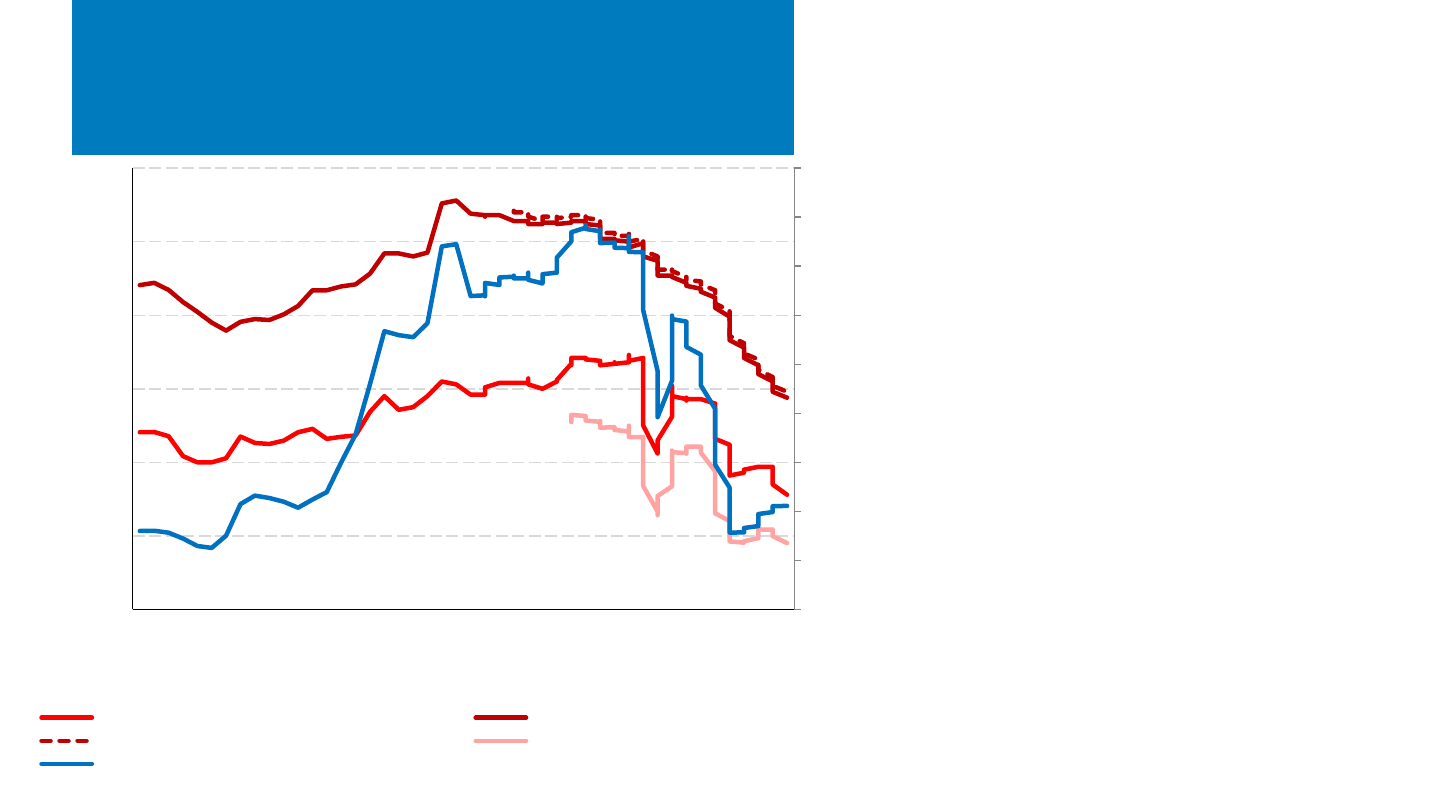

• From H2 2022 to H2 2023 (partial), the median

reported distributed PV system price—in nominal

USD—across Arizona, California, Massachusetts, and

New York:

– Decreased 0.4% to $4.25/W

dc

for systems 2.5 to

10 kW

– Decreased 3% to $3.72/W

dc

for systems 10 to

100 kW

– Decreased 2% to $2.40/W

dc

for systems 100 to

500 kW

– Increased 11% to $2.00/W

dc

for systems 500 kW

to 5 MW.

• From H2 2022 to H2 2023 (partial), the median

reported distributed PV system price—in 2022

(inflation-adjusted) dollars—across these states:

– Decreased 4% for systems 2.5 to 10 kW

– Decreased 6% for systems 10 to 100 kW

– Decreased 5% for systems 100 to 500 kW

– Increased 8% for systems 500 kW to 5 MW.

• Adjusting for inflation reveals the continuing real

distributed PV price reductions over the past several

years of economic volatility.

2023 MW data YTD: Arizona (165), California (1,148), Massachusetts (67), New York (518)

Note: System prices above $10/W and below $0.75/W were removed from the dataset. There were not enough

reported prices for systems above 5 MW in the dataset to show a trend over time.

Sources: Arizona Goes Solar (10/13/23); California Distributed Generation (8/31/23); Massachusetts Lists of

Qualified Generation Units (10/3/23); Solar Electric Programs Reported by NYSERDA (10/19/23).

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

H1 H2 H1 H2 H1 H2 H1 H2 H1 H2 H1 H2 H1 H2

(part)

2017 2018 2019 2020 2021 2022 2023

System Price ($/W

dc

)

2.5–10 kW (2022 USD) 10–100 kW (2022 USD)

100–500 kW (2022 USD) 500 kW – 5 MW (2022 USD)

2.5–10 kW (nominal USD) 10–100 kW (nominal USD)

100–500 kW (nominal USD) 500 kW – 5 MW (nominal USD)

NREL | 37NREL | 37

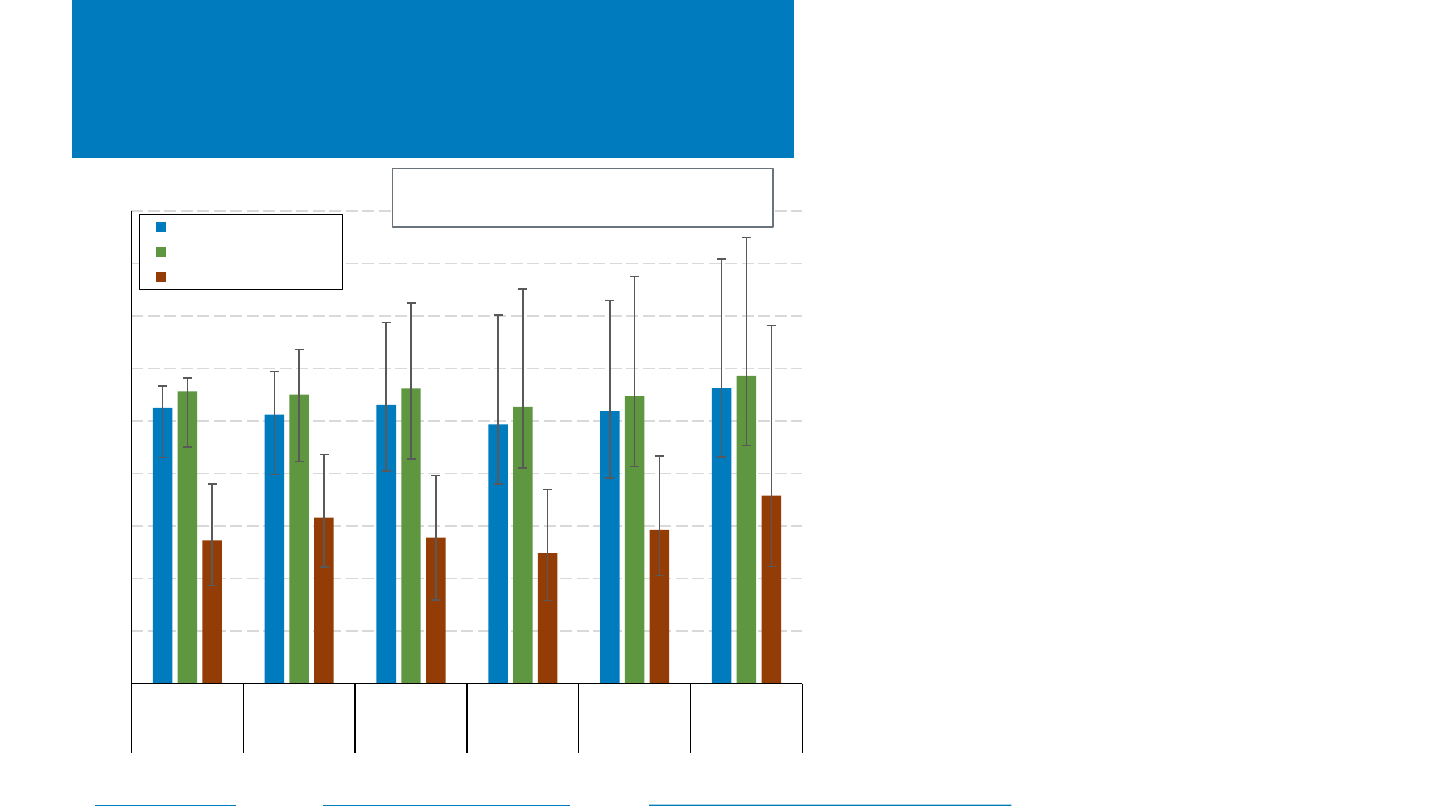

$0

$1

$2

$3

$4

$5

$6

$7

AZ CA MA NY AZ CA MA NY AZ CA MA NY AZ CA MA NY NY

2.5 kW–10 kW 10 kW–100 kW 100 kW–500 kW 500 kW–5 MW 5 MW+

System Price ($/W

dc

)

Distributed System Pricing From

Select States, H2 2023 (partial)

• For systems of 2.5–10 kW, nominal price changes varied

between H2 2022 and H2 2023 (partial):

– −2% in Arizona, − 0.2% in California, +4% in

Massachusetts, −1% in New York.

• Large system prices are based on relatively few systems.

– For example, Arizona only installed one system of

500 kW–5 MW in H2 2023 (partial).

• In addition to price differences based on system size, there is

variation between states and within individual markets.

• Dollar-per-watt prices generally decrease as system size increases.

Bars represent the median, with error bars

representing 80

th

and 20

th

percentiles.

2023 MW data YTD: Arizona (165), California (1,148), Massachusetts (67), New York (518)

Note: System prices above $10/W and below $0.75/W were removed from the dataset.

Sources: Arizona Goes Solar

(10/13/23); California Distributed Generation (8/31/23); Massachusetts Lists of

Qualified Generation Units (10/3/23); Solar Electric Programs Reported by NYSERDA (10/19/23).

NREL | 38NREL | 38

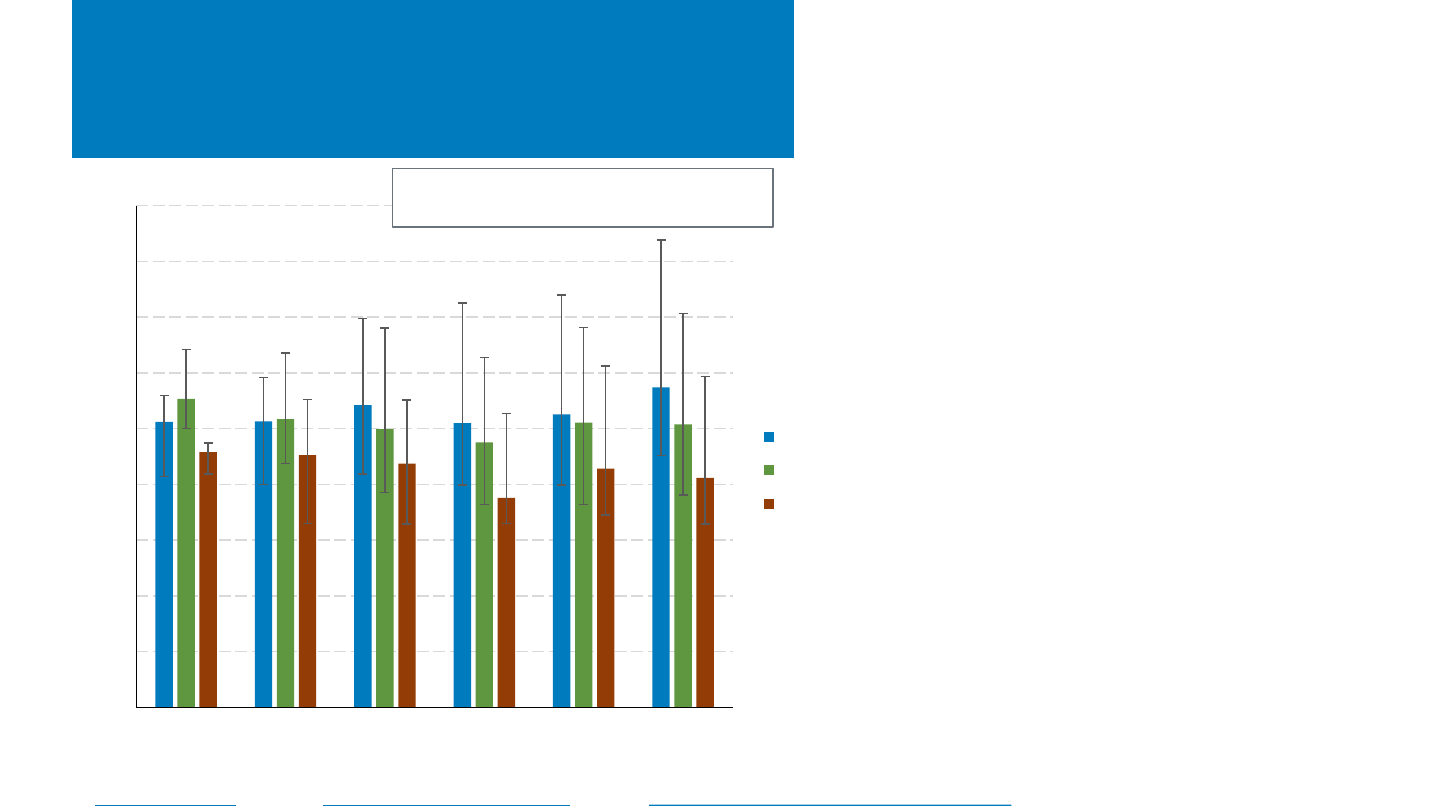

Residential U.S. PV+Storage

Pricing

2023 YTD residential PV+storage sample, after data cleaning (MW

dc

): Arizona (11), California (54), Massachusetts (6)

Sources: Arizona Goes Solar (10/13/23); California Distributed Generation (8/31/23); Massachusetts Lists of Qualified Generation Units (10/3/23).

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

2018 2019 2020 2021 2022 2023

n= 3,380 n= 4,248 n= 7,833 n= 13,226 n= 20,171 n= 8,064

System Price

PV+Storage ($/kWdc)

PV+Storage ($/kWac)

PV+Storage ($/kWh)

• In 2023 YTD, residential PV+storage systems

in Arizona, California, and Massachusetts

had a median system price of $3,580/kWh,

or $5,862/kW

ac

($5,629/kW

dc

)—an increase

of 7%–22% compared with full 2022 median

values.

– Most of these systems offer 2–3 hours of

storage.

– Units represent total system price

divided by the capacity of the battery

(kWh) or the capacity of the PV system

(kW).

Bars represent the median, with error bars

representing the 80

th

and 20

th

percentiles.

NREL | 39NREL | 39

Residential U.S. PV+Storage

Pricing

• During 2023 YTD, residential PV+storage

system prices in Arizona, California, and

Massachusetts varied between states and

internally.

– Prices may vary due to differences in

storage power and capacity, permitting

and interconnection differences, local

competitive factors, and installer

experience.

• Compared with full median 2022 values,

prices (in dollars per kW

dc

of PV capacity)

increased in 2023 YTD in California (9%) while

decreasing in Massachusetts (4%) and Arizona

(1%).

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

2018 2019 2020 2021 2022 2023

System Price ($/kW

dc

)

CA

AZ

MA

2023 YTD residential PV+storage sample, after data cleaning (MW

dc

): Arizona (11), California (54), Massachusetts (6)

Sources: Arizona Goes Solar (10/13/23); California Distributed Generation (8/31/23); Massachusetts Lists of Qualified Generation Units (10/3/23).

Bars represent the median, with error bars

representing the 80

th

and 20

th

percentiles.

NREL | 40NREL | 40

Residential Storage Price

Reported by EnergySage

• The median reported price by EnergySage for

residential PV systems increased 4.8% y/y.

– Despite the median national average pricing

increasing, prices remained flat or dropped in 6

of the top 10 markets.

• Residential storage system price varied by state. In

H1 2023, the median price of a residential storage

system in Massachusetts was 16% higher than the

median price of a residential storage system in

North Carolina.

– In the EnergySage dataset, the median cost of a

battery in the top 10 states ranged from

$13,000 to $19,000.

Note: Price based on winning quoted price.

Source: EnergySage, Solar Marketplace Intel Report H2 2022 – H1 2023.

$1,000

$1,050

$1,100

$1,150

$1,200

$1,250

$1,300

$1,350

$1,400

H2 H1 H2 H1 H2 H1

2020 2021 2022 2023

Median Gross Costs ($/kWh)

Cost Over Time

$1,150

$1,200

$1,250

$1,300

$1,350

$1,400

$1,450

$1,500

$1,550

NC TX FL CA AZ US GA CO MA PA VA

Median Gross Costs ($/kWh)

Cost by State, H1 2023

NREL | 41NREL | 41

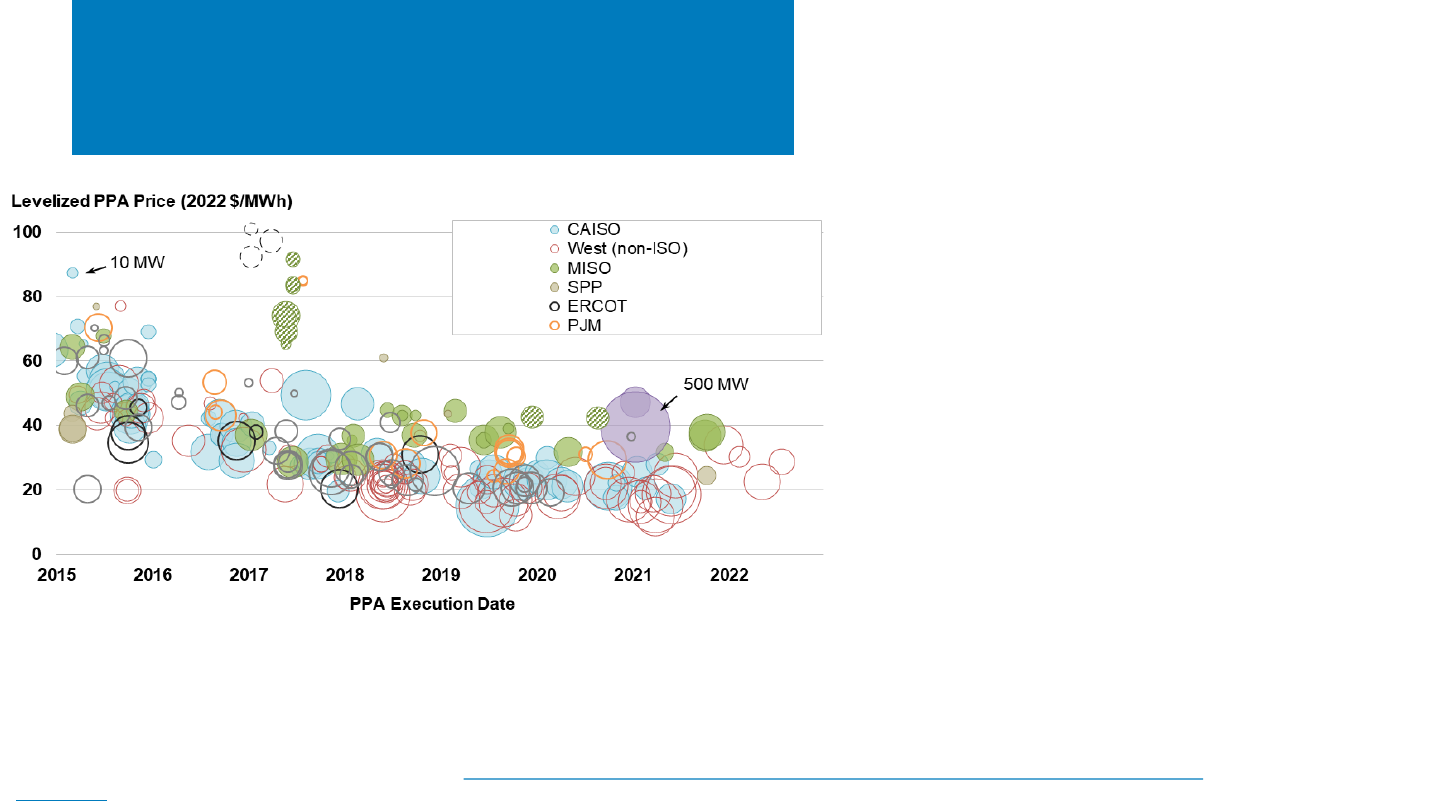

U.S. Utility-Scale PV PPA

Pricing

• Average PPA prices in the Lower 48 fell by

~87% (or ~19%/year) from 2009 to 2019,

but they have been stagnant (or slightly

higher) ever since.

• The most recent PPAs in the LBNL sample

are priced around $20–$30/MWh for

projects in CAISO and the non-ISO West

and at $30–$40/MWh for projects

elsewhere in the continental United States.

• Solar PPA prices are now often competitive

with wind PPA prices, as well as the cost of

burning fuel in existing gas-fired

generators.

Source: Bolinger, M., J. Seel, C. Warner and D. Robson. 2023. Solar Empirical Trends in Project Technology, Cost, Performance, and PPA Pricing in the United States:

2023 Edition

. Berkeley, CA: Lawrence Berkeley National Laboratory

NREL | 42NREL | 42

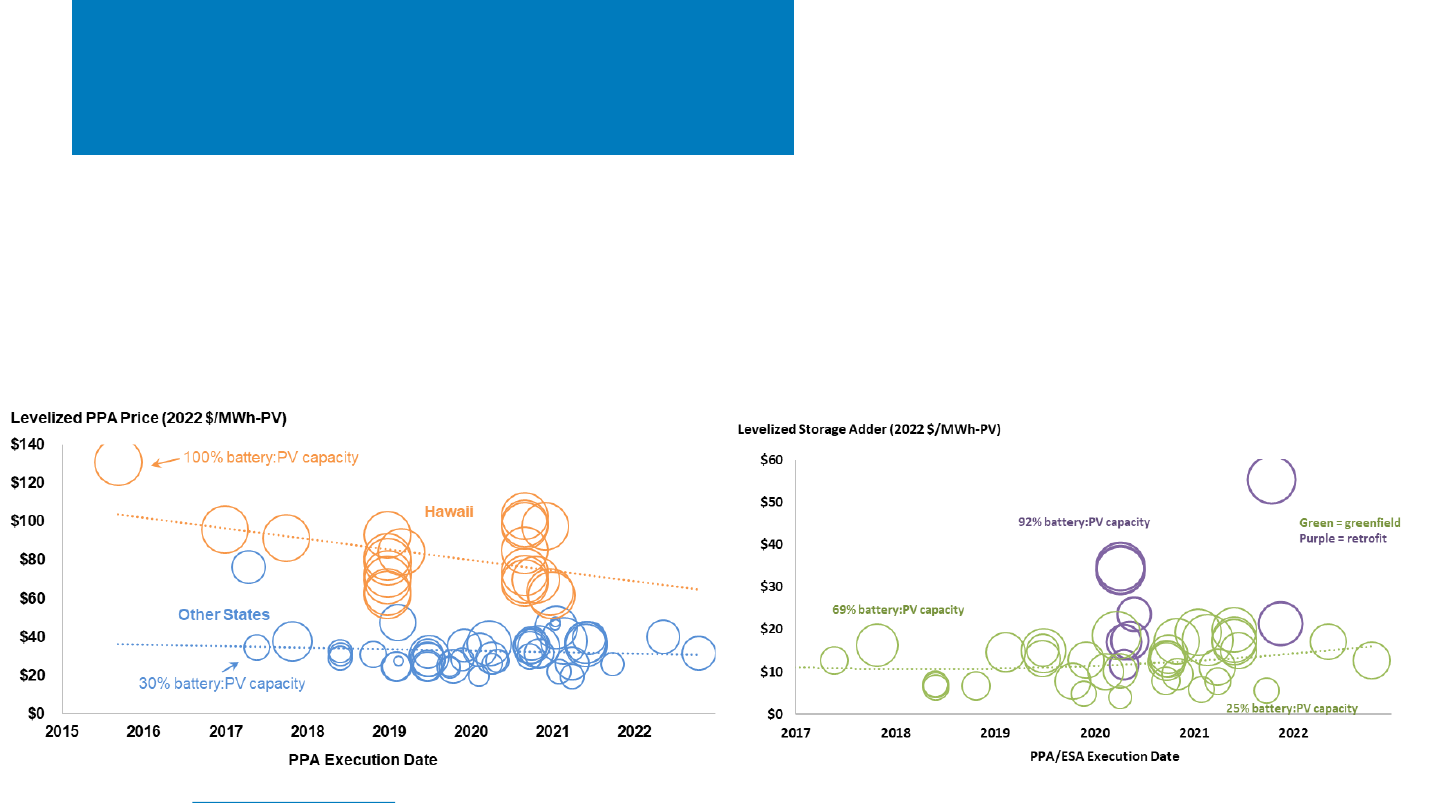

U.S. Utility-Scale PV+Battery

PPA Pricing From LBNL

• The upward trend of “levelized storage adders”

(premiums for PV+battery PPAs relative to standalone

PV PPAs) continued in 2022 despite the year’s modest

battery system sizes.

• Overall, the storage adder increases linearly with

increasing battery-to-PV capacity ratio:

– ~$11/MWh PV at 50%

– ~$18/MWh PV at 80%.

• New PV+battery system capacity reached a record high in 2022 with 26 new

plants (2.2 Gw

ac

PV), plus 9 retrofitted systems (1.4 GW

ac

PV).

• Average combined costs for a sample of PV+battery systems decreased from

$4.15/W

ac

PV in 2021 to $2.19/W

ac

PV in 2022, as the proportion of new builds

increased and the average storage duration decreased (from 3.2 to 2.7 hours).

• Sampled hybrid PPA prices have declined over time but have leveled off

recently outside of Hawaii, where the battery-to-PV capacity ratio is always

100%.

Source: Bolinger et al. 2023. Utility-Scale Solar, 2023 Edition. Lawrence Berkeley National Laboratory.

Bubble area = battery:PV capacity

$/MWh-PV time trend: Answers “how much does

storage add to my standalone PV PPA Price?”

NREL | 43NREL | 43

U.S. Solar PPA Pricing

(LevelTen)

Source: LevelTen, PPA Price Index.

• LevelTen reports that following a modest dip

in prices in Q2, U.S. utility-scale PV PPA prices

increased 4% in Q3 2023 despite many

markets remaining relatively flat or declining

in price.

– LevelTen attributes this change to rising

prices in PJM and SPP and the inclusion of

high-priced ISO-NE in the index.

– PJM prices were likely pushed up by an

overfilled interconnection queue and

permitting challenges.

$0

$10

$20

$30

$40

$50

$60

$70

$80

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2019 2020 2021 2022 2023

25th Percentile PPA Offer Price ($/MWh)

National average across

markets

NREL | 44NREL | 44

SREC Pricing

Source: SRECTrade, https://www.srectrade.com/, accessed 10/20/23.

• Solar renewable energy certificate (SREC) pricing has been relatively flat in 2023, particularly for legacy

programs like New Jersey and Massachusetts, which are not accepting new projects.

• However, potential programmatic or supply/demand changes can still impact markets, likely the reason

for the ~40% price decline of PA SRECs in 2023 or the 140% increase in price for Ohio SRECs in August

2023 before relapsing in September and October.

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

Jan-19

Apr-19

Jul-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Jan-23

Apr-23

Jul-23

Oct-23

Price Per SREC (Simple Average)

Lower-Priced Markets

PA MD OH In-state

$0

$100

$200

$300

$400

$500

Jan-19

Apr-19

Jul-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Jan-23

Apr-23

Jul-23

Oct-23

Price Per SREC (Simple Average)

Higher-Priced Markets

NJ DC MA (SREC II)

NREL | 45

Global Solar Deployment1

U.S. PV Deployment

2

PV System Pricing

3

Global Manufacturing

4

Component Pricing

5

U.S. PV Imports

6

7 PV Domestic Content

Agenda

• According to Infolink (formerly PV Infolink), the top 10

module manufacturers were responsible for 160 GW

(+57% y/y) in H1 2023 and the top 5 cell manufacturers

together shipped 84 GW of cells (+49% y/y).

• Since the passage of the IRA, more than 240 GW of

manufacturing capacity has been announced across the

solar supply chain, representing more than 22,000

potential jobs and more than $12 billion in announced

investments across 72 new facilities or expansions.

• In H1 2023, the U.S. shipped 3.1 GW of PV modules—an

increase of 0.8 GW from H1 2022.

NREL | 46NREL | 46

PV Shipment Rankings

• According to Infolink, the top 10 module

manufacturers were responsible for 160 GW of

shipments (+57% y/y) in H1 2023.

– The top four manufacturers shipped more than

100 GW in H1 2023, widening the gap from other

leading manufacturers.

– Tongwei expanded into module manufacturing

last year, launching into the top 10.

– M10/182 mm and G12/210 mm modules

accounted for 98% of shipments, up from 80% in

H1 2022.

– N-type modules accounted for 18% of sales.

• The top five cell manufacturers together shipped 84.4

GW of cells in the H1 2023 (+49% y/y), accounting for

72% of 2022 annual shipments.

– 87% of top five cell manufacturer shipments in

H1 2023 used PERC technology, and another 12%

used TOPCon.

– M10 and M12 formats represented 75% and 21%

of top five cell manufacturer shipments in H1

2023.

Sources: InfoLink: 2023H1 cell shipment rankings, 2023H1 Module shipment ranking, PVTech (09/01/23, 09/05/23).

Rank H1 2023 Shipments

Cells Modules

1 Tongwei Jinko Solar (30.8 GW)

2 Aiko

⯅

LONGi (26.6 GW)

3

⯅

Solar Space

▼

Trina (27 GW)

4

▼

Runergy JA Solar (24.0 GW)

5

⯅

Jietai Canadian Solar (14.3 GW)

6 Astronergy/

⯭

Tongwei (8-9 GW)

7

8 Risen Energy (8-9 GW)

9

⯯

DAS Solar

10

⯯

First Solar (5.3 GW produced)

NREL | 47NREL | 47

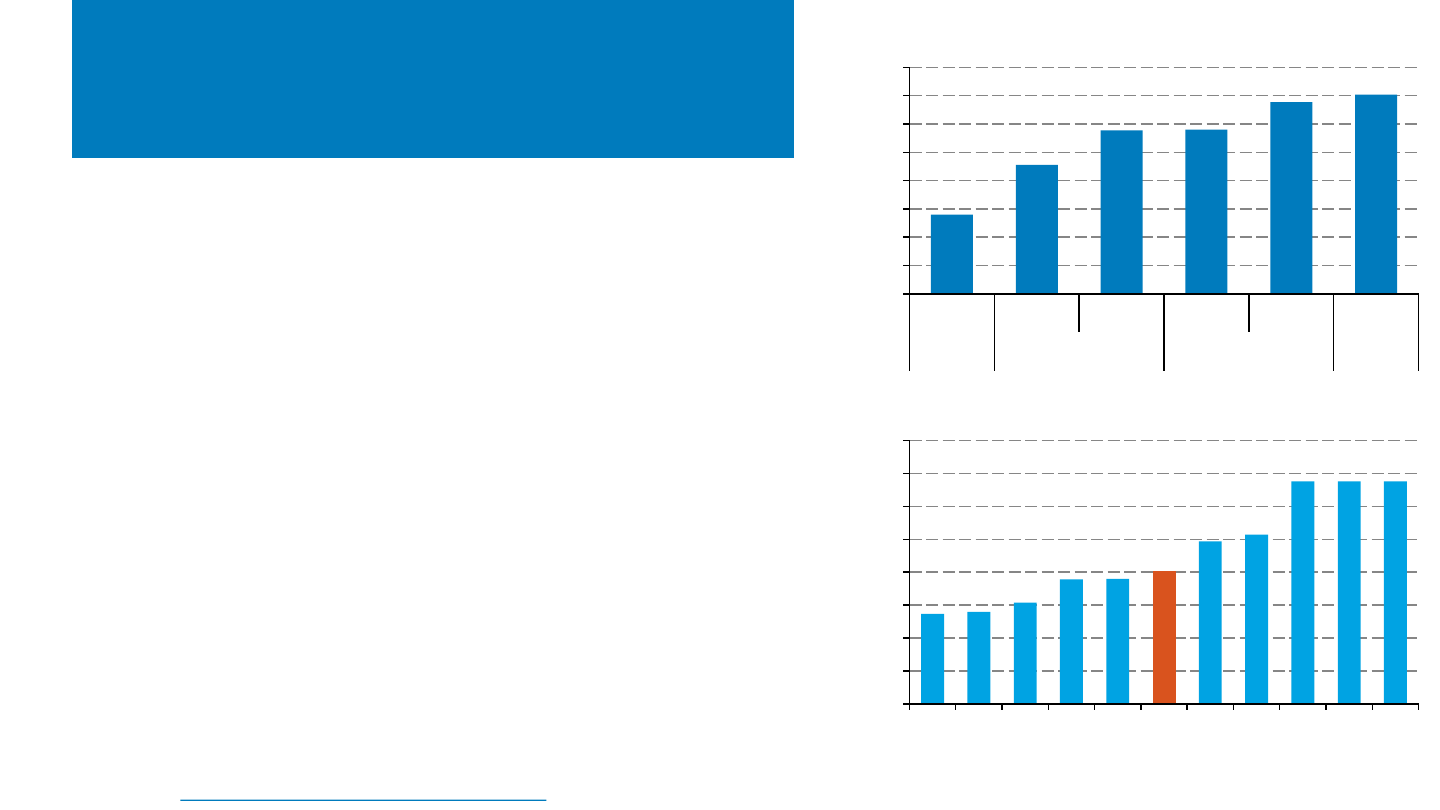

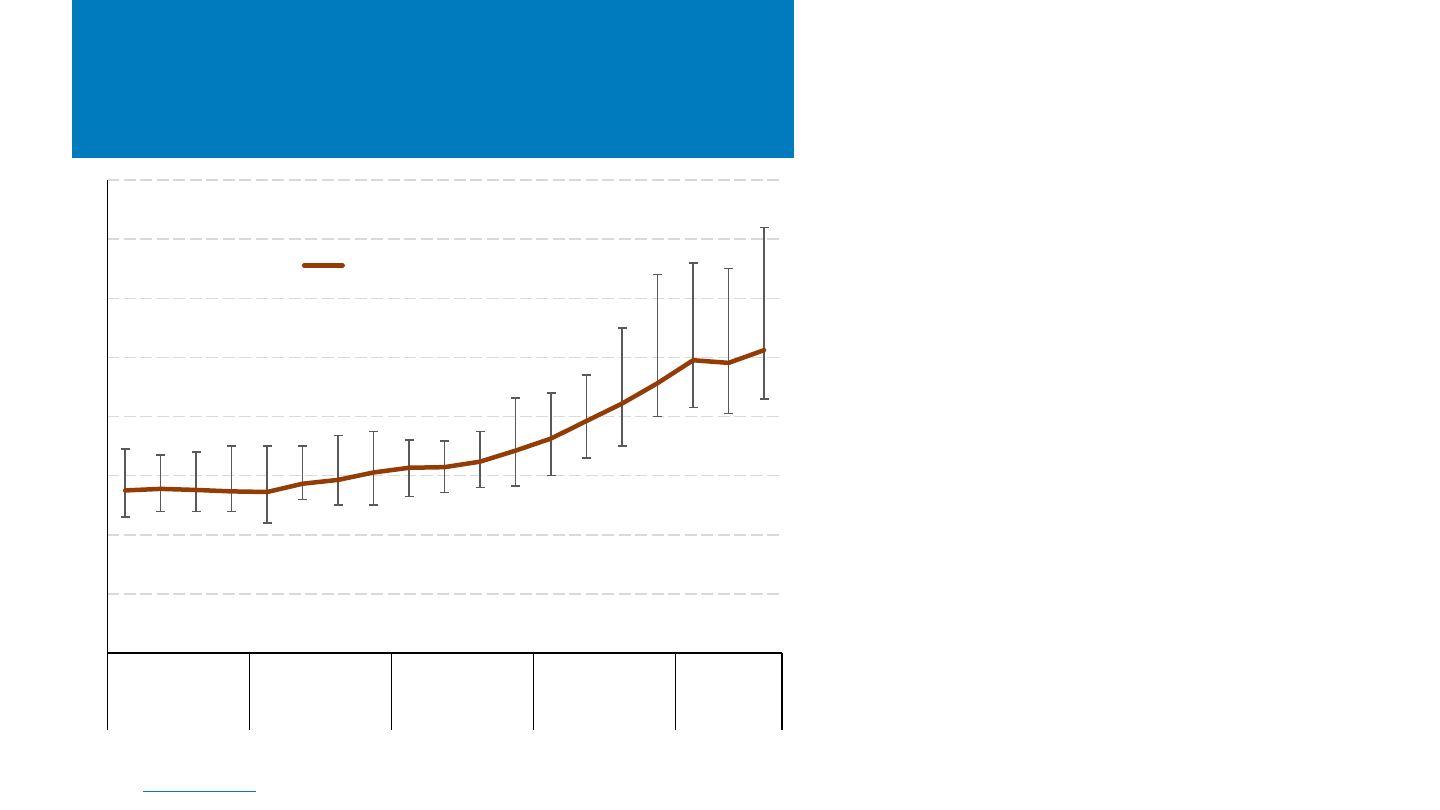

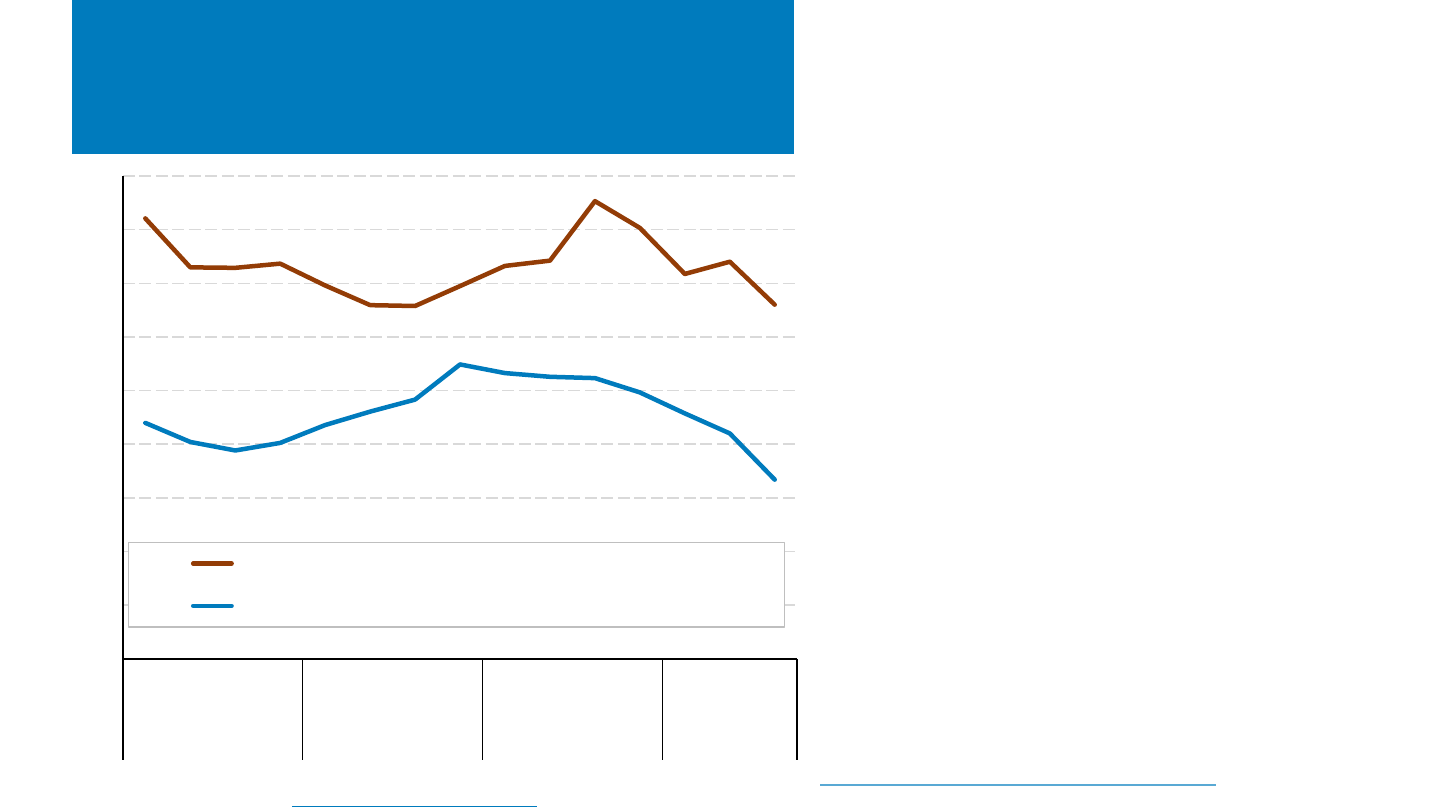

PV Manufacturers’ Margins

• PV manufacturers, mostly Chinese companies,

have generally been profitable since 2019.

• Margins have steadily increased since 2022

due to increased shipments from leading

manufacturers.

– Increased shipments were partially offset

by reduction in ASP.

– The median gross margin of the publicly

traded PV companies represented to the

left was flat q/q, though up 60% y/y. The

median operating margin was up 20% q/q

and 125% y/y.

• There continues to be significant variation by

individual companies as individual factors

come into play, although variation has been

substantially less since 2019.

Lines represent the median, with error bars representing 80

th

and 20

th

percentiles for the following companies in Q1 2023: Canadian Solar, First Solar, JA Solar, Jinko Solar,

LONGi, Maxeon, Motech Industries, REC Silicon, Renesola, Risen, Shanghai Aiko, Shanghai Aerospace, Tongwei, Trina Solar, and United Renewable Energy. Margin data from

Hanwha Q Cells, Sunpower, and Yingli are also included from Q1 2010 to Q2 2020 where available.

Note: Gross margin = revenue – cost of goods sold (i.e., the money a company retains after incurring the direct costs associated with producing the goods or services it

sells); operating margin = gross margin minus overhead and operating expenses (i.e., the money a company retains before taxes and financing expenses).

Sources: Company figures based on public filings and finance.yahoo.com; PVTech (10/11/22).

-40%

-30%

-20%

-10%

0%

10%

20%

30%

40%

50%

Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2

2017 2018 2019 2020 2021 2022 2023

Margins

gross median

operating median

NREL | 48NREL | 48

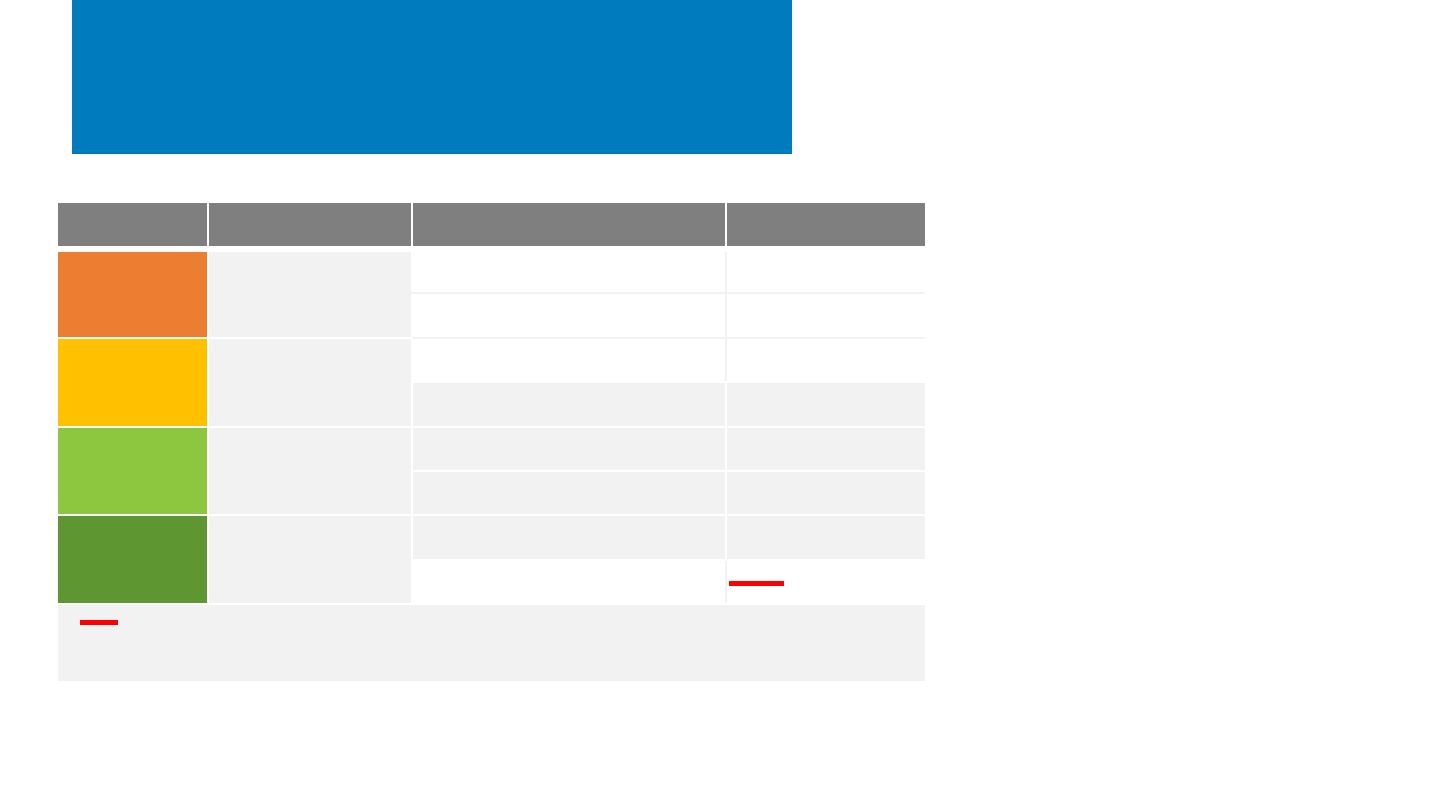

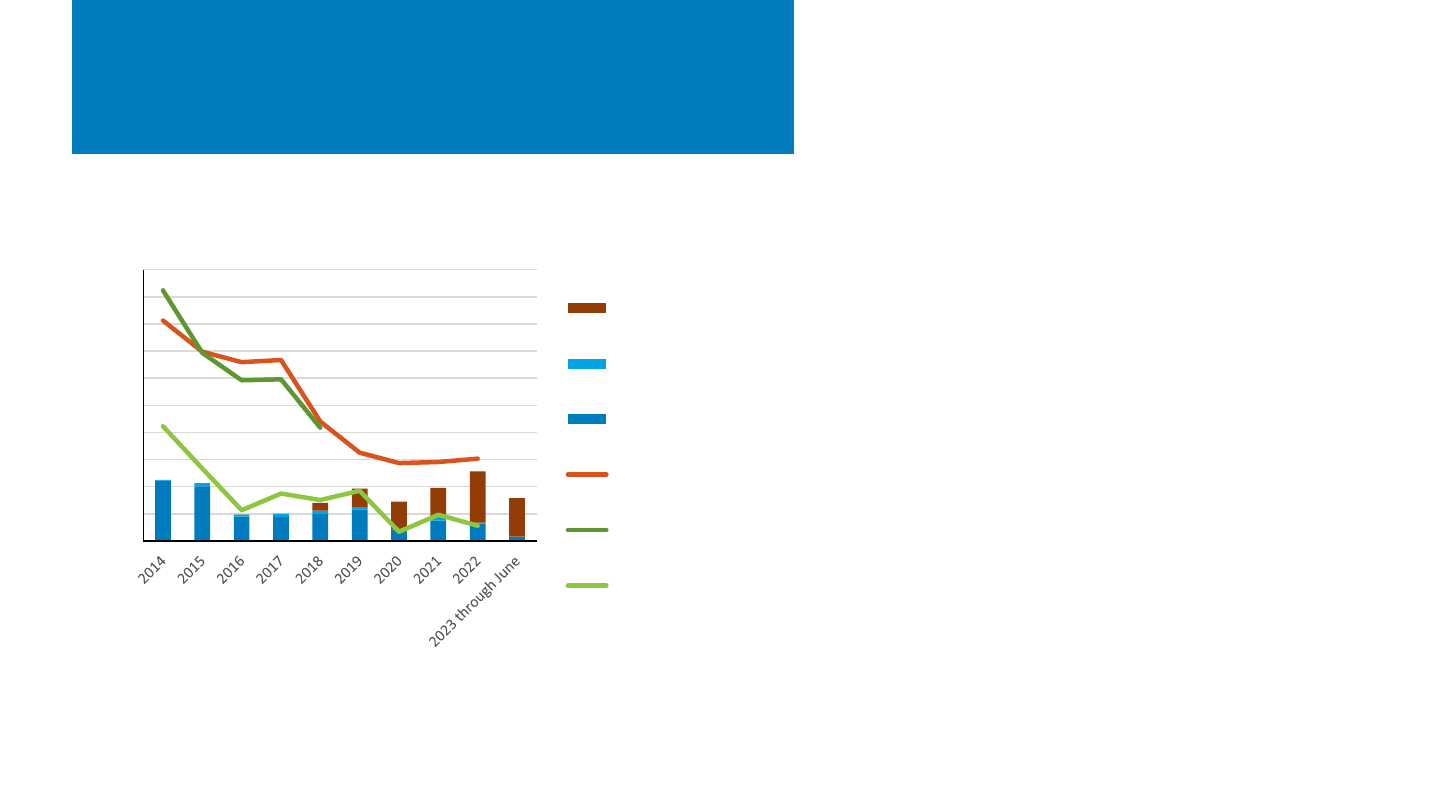

U.S. PV Manufacturing

• In H1 2023, the U.S. shipped 3.1 GW of PV modules—

an increase of 0.8 GW from H1 2022.

• Since 2018, U.S. module manufacturing has increased

by approximately 4X, with the larger growth, both in

terms of production and manufacturing capacity,

coming from thin-film panels.

• Over the past year, c-Si production and capacity has

been the growth leader, with production and capacity

growing 59% and 55% from H1 2022 to H1 2023,

respectively.

– At the end of Q2 2023, the U.S. had an annual

module manufacturing capacity of approximately

10 GW.

– However, this growth is relatively small compared

to the growth expected to come at the end of 2024

and 2025 based on corporate announcements of

domestic manufacturing capacity additions as a

result of the passage of IRA.

• First Solar announced in September that it would

have 6 GW of U.S. manufacturing by the end of

2023—significantly higher than what Wood

Mackenzie and SEIA report for H1 2023.

0

1

2

3

4

5

6

H1 H2 H1 H2 H1 H2 H1 H2 H1 H2 H1

2018 2019 2020 2021 2022 23

U.S. PV Manufacturing (GW)

Excess Thin-film Capacity

Excess c-Si Capacity

Thin-film Production

c-Si Production

Sources: Wood Mackenzie/SEIA: U.S. Solar Market Insight: Q3 2023.

0

20

40

60

80

100

120

140

Polysilicon c-Si wafers c-Si cells PV modules Inverters Module

Parts

Tools Tracking/

Racking

Annual Manufacturing Capacity (GW

dc

)

Manufacturing Announcements by Supply Chain Segment

post-IRA (CdTe modules)

post-IRA

pre-IRA (CdTe modules)

pre-IRA

operating pre-IRA (CdTe)

operating pre-IRA (c-Si)

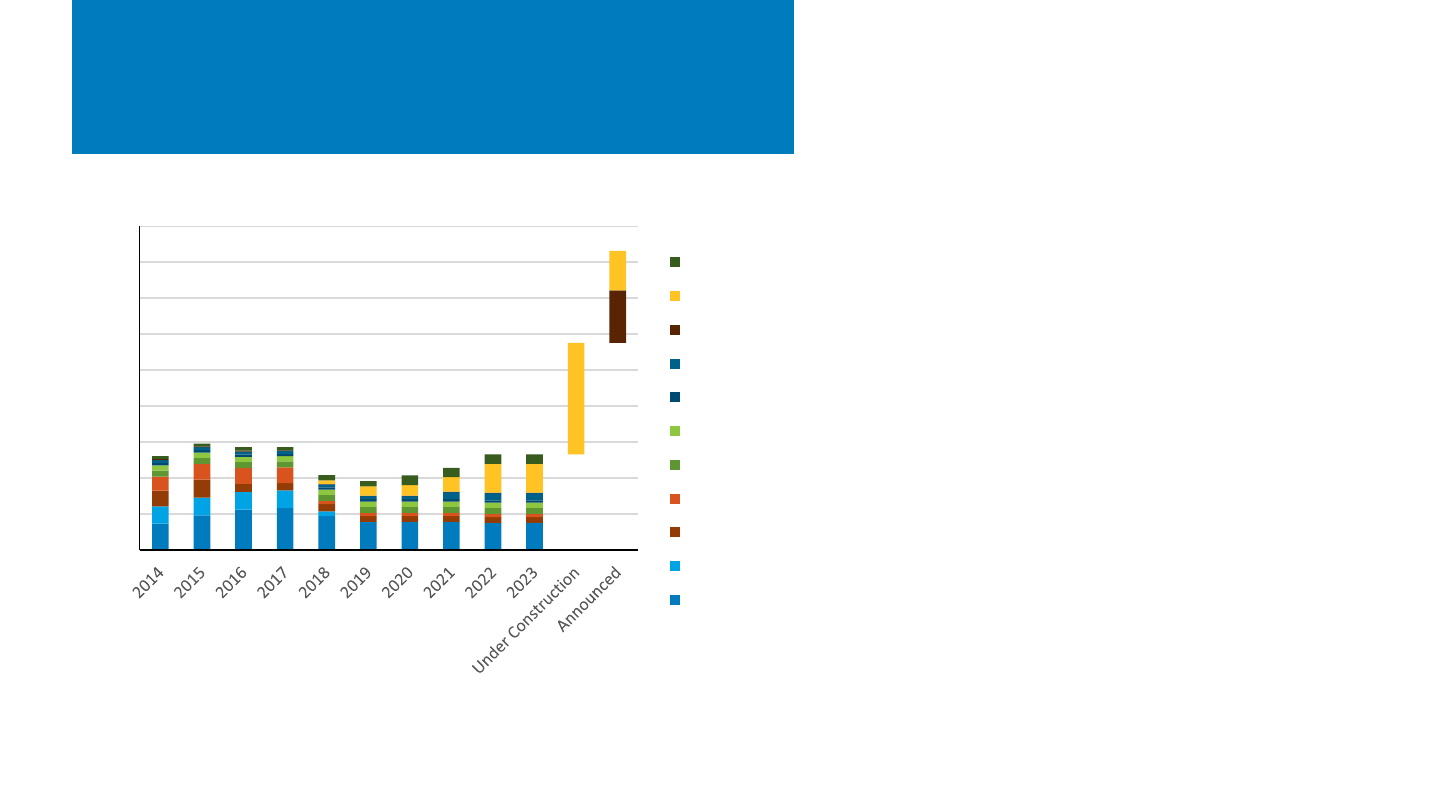

• Since the passage of the IRA, >240 GW of manufacturing capacity has been announced across the solar supply chain, representing

more than 22,000 potential jobs and more than $12 billion in announced investments across 72 new facilities or expansions.*

Sources: Internal DOE tracking of public announcements and BNEF Global PV Market Outlooks and Wood Mackenzie and SEIA Solar Market Insights Q2 2022 and Q2 2023.

*Not all announcements include facility locations, job, or investment numbers. See: Building America's Clean Energy Future | Department of Energy

IRA Impacts on U.S. Solar PV Manufacturing Capacity

These announcements post-IRA represent

potential investment in 23 states and Puerto Rico.

# of facilities* announced post-IRA

0 12

2

1

2

1

2

1

2A

1

12

3

2

2

1

1

3

1

3

2

6

5

2

2

1

DC

1

Projected 2025

U.S. PV Deployment

– 101 GW of solar module capacity (including 11 GW of CdTe)

– 45 GW of c-Si cell capacity

– 29 GW of c-Si wafer capacity

– 62 GW of BOS (including glass, encapsulant, backsheet,

junction boxes, inverters, trackers, tracker components, etc.)*

– Another 35 GW of solar manufacturing capacity had been

announced since the start of the Biden Administration prior to

the passage of IRA.

Recent Manufacturing News

• Notable announcements over the last several months include:

– Amphenol: ~1.2 million junction boxes/yr in Mesa, Arizona

– Fronius: 7 GW/yr of inverters in Portage, Indiana

– Great Lakes Solex: 6 GW/yr of modules in Aguadilla, Puerto Rico

– JinkoSolar: 0.8 GW/yr expansion of module production in

Jacksonville, Florida

– Navitas USA by Colby: 10 GW/yr of modules

– New East Solar: 2 GW/yr of modules in Phoenix, Arizona

– OMCO Solar: racking, tracker components, and frames in Alabama

– Re:Build Manufacturing: wafer production tools in Pennsylvania

– Suniva: 2.5 GW/yr of cells in Norcross, Georgia

– Trina: 5 GW/yr of modules in Wilmer, Texas.

• Qcells also recently announced that their module expansions in

Georgia are online, bringing their total domestic nameplate capacity

to 5.1 GW. First Solar’s new capacity in Lake Township has also been

brought online, bringing their total domestic nameplate capacity to 6.3 GW.

https://www.energy.gov/invest, updated 10-23-23

Facilities

announced

without

locations

2 GW

module

5 GW

module

5 GW

module

1 GW

module

5 GW

module

1.5 GW

cell,

1 GW

module

3 GW

cell, module

2 GW

cell, module

3.3 GW

wafer, cell, module

+ 2 GW

module

3.5 GW

CdTe module

3.3 GW

CdTe module

0

50

100

150

200

250

300

350

400

450

500

JA Solar Illuminate

USA

Trina Hounen Canadian

Solar

Heliene 3Sun USA

(Enel)

Maxeon Meyer

Burger

Qcells AL/LA OH

PRC-owned Companies Other Foreign First Solar

Announced Investment ($M/GW of module)

Domestic Clean Energy Announcements Costs

While announced investment numbers

should be taken with significant skepticism

(as there is no requirement for their

accuracy), there are some trends emerging:

• Module manufacturing on its own is

~$40M/GW.

• Module+cell manufacturing is nearly an

order of magnitude higher, at

~$300M/GW, which is comparable to

CdTe module production.

Sources: Internal DOE tracking of public announcements as of 10-23-23. *Not all announcements include facility locations, job, or investment numbers and announcements

are conditional on financing, funding, site control, and other factors. See: Building America's Clean Energy Future | Department of Energy

NREL | 52NREL | 52

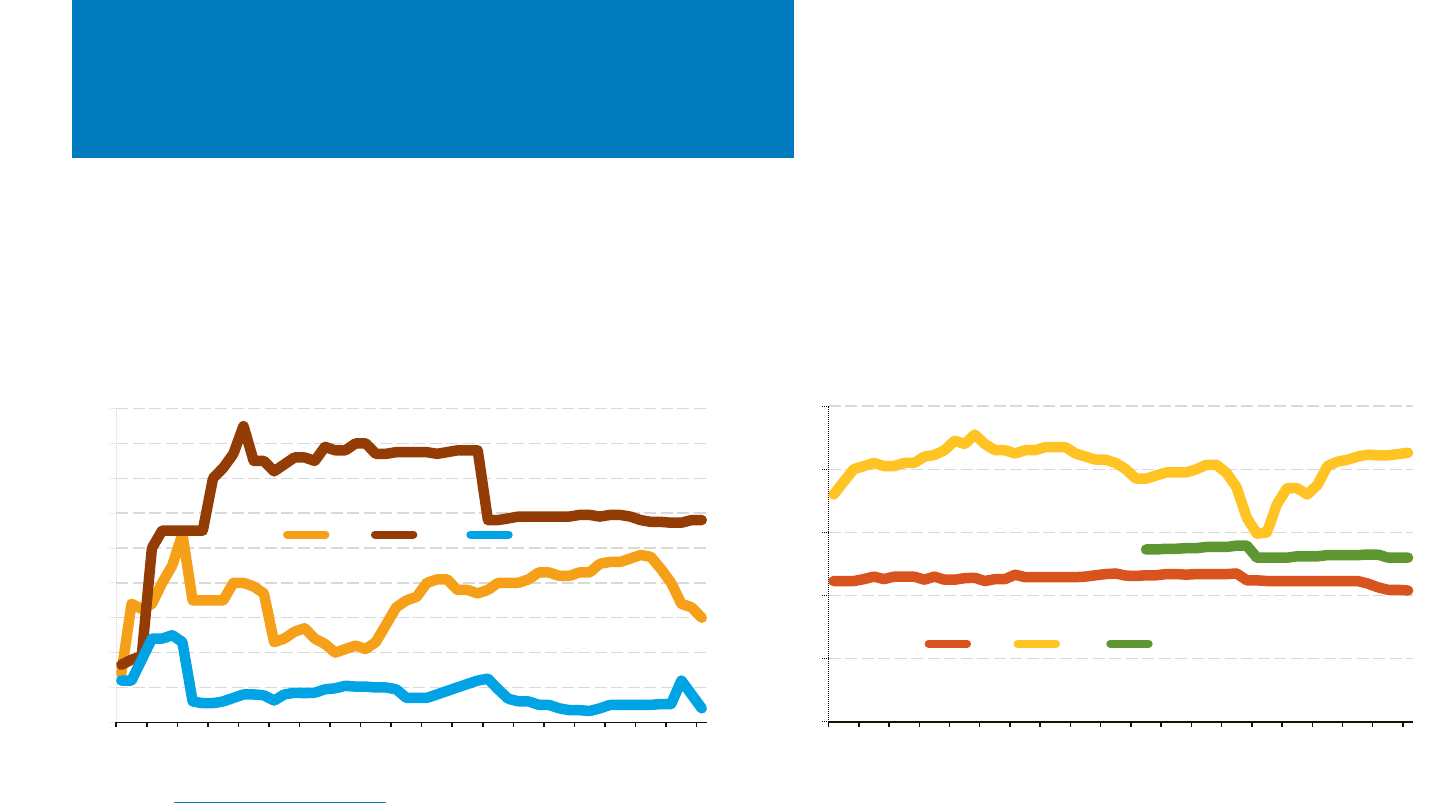

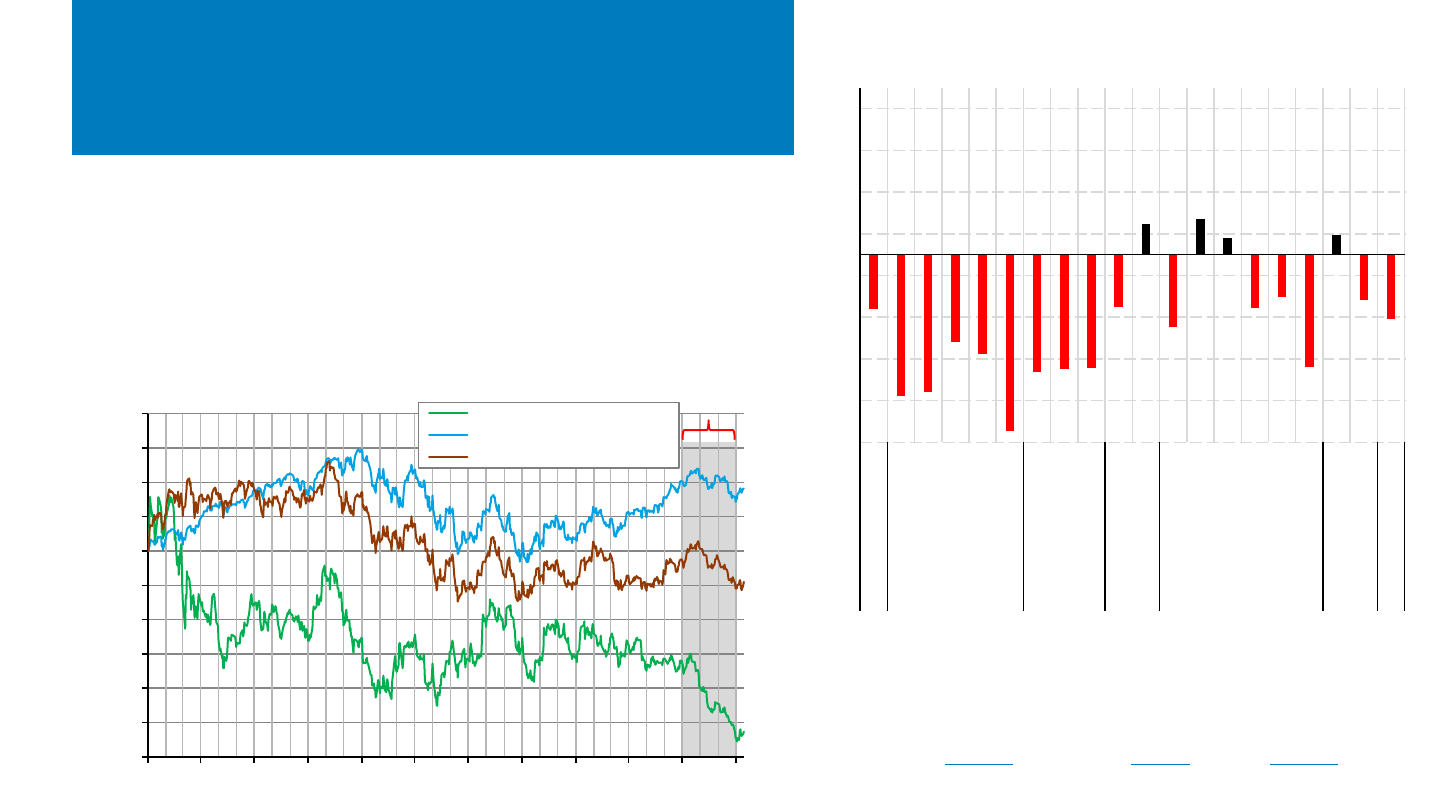

-60%

-50%

-40%

-30%

-20%

-10%

0%

10%

20%

30%

40%

Jan-21 Apr-21 Jul-21 Oct-21 Jan-22 Apr-22 Jul-22 Oct-22 Jan-23 Apr-23 Jul-23 Oct-23

% Change (Index: 01/04/21

Adjusted Close)

Invesco Solar ETF (TAN)

S&P 500 Index

iShares Russell 2000 ETF

Stock Market Activity

The Invesco Solar ETF fell 27% in Q3 2023 vs. a 4%–6% slide across the

broader market. One reason was a net global outflow from renewable energy

funds—which reached a record $1.4 billion in Q3 2023. The profitability of

many renewable energy companies has been reduced by high interest rates

and material costs as well as project delays. Solar companies have also faced

overcapacity across the silicon supply chain, large module inventories, and

intense competition. In addition, climate-related stocks beyond the

renewable energy sector have become increasingly popular.

Note: The TAN index is weighted toward particular countries and sectors. As of

10/17/23, 54% of its funds were in U.S. companies and 20% were in Chinese

companies. Its top 10 holdings, representing 62% of its value, were Enphase,

SolarEdge, First Solar, GCL, Xinyi, Sunrun, Array Technologies, Shoals, Hannon

Armstrong, and Encavis.

Sources: Invesco (10/17/23), PV Magazine (9/12/23), Reuters (10/10/23).

Q3 2023

-90%

-70%

-50%

-30%

-10%

10%

30%

50%

70%

Atlantica Yield

Sunworks

SunPower

Sunnova

Sunrun

Azure Power

Ginlong

Enphase Energy

SolarEdge

Soltec Power

Array Tech.

Solargiga Energy

Tainergy Tech

First Solar

Jinko Solar

Canadian Solar

Shunfeng

Wacker Chemie

Daqo

Meyer Burger

Yieldcos Installers Inverters Trackers PV Manufacturers Poly Equip.

Individual Stock Performance (Q1-Q3 2023)

NREL | 53

Global Solar Deployment1

U.S. PV Deployment

2

PV System Pricing

3

Global Manufacturing

4

Component Pricing

5

U.S. PV Imports

6

7 PV Domestic Content

Agenda

• Global polysilicon spot prices rose 35% from late June

($7.84/kg, below the weighted average production cost

of $8.2/kg) to early October ($10.55/kg).

• Global module prices reached yet another record low,

falling 21% between late June and early October to

$0.14/W

dc

.

• In Q3 2023 (first 2 months), the average U.S. module

price ($0.33/W

dc

) was down 11% q/q and down 23% y/y,

but at a 98% premium over the global spot price for

monofacial monocrystalline silicon modules.

NREL | 54NREL | 54

PV Value Chain Global Spot

Pricing

Source: BloombergNEF, Solar Spot Price Index (10/13/23); BloombergNEF, Bimonthly PV Index (9/19/23).

• Global polysilicon spot prices rose 35%

from late June ($7.84/kg, below the

weighted average production cost of

$8.2/kg) to early October ($10.55/kg).

– China’s polysilicon production increased

91% between H1 2022 and H1 2023.

– Additional polysilicon factories are

scheduled to come online in H2 2023.

• During the same period, global prices

decreased for wafers (3%) and cells (14%).

• Global module prices reached yet another

record low, falling 21% between late June

and early October to $0.14/W

dc

.

– Large module inventories and

expectation of still-lower prices in

Europe and Brazil as well as intense

competition among manufacturers

depressed demand and prices.

– These low module prices threaten the

profitability of many module

manufacturers.

$0

$5

$10

$15

$20

$25

$30

$35

$40

$45

$0.00

$0.05

$0.10

$0.15

$0.20

$0.25

$0.30

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Jan-23

Apr-23

Jul-23

Oct-23

Average Polysilicon Spot Price ($/kg)

Average Wafer, Cell, and Module Spot Price ($/

W

dc

)

Cells, mono ($/Wdc) Monofacial modules, mono ($/Wdc)

Bifacial modules, 210 mm, mono ($/Wdc) Wafers, mono M10 ($/Wdc)

Polysilicon ($/kg)

Monofacial modules

Cells

Wafers

Bifacial modules

Polysilicon (right axis)

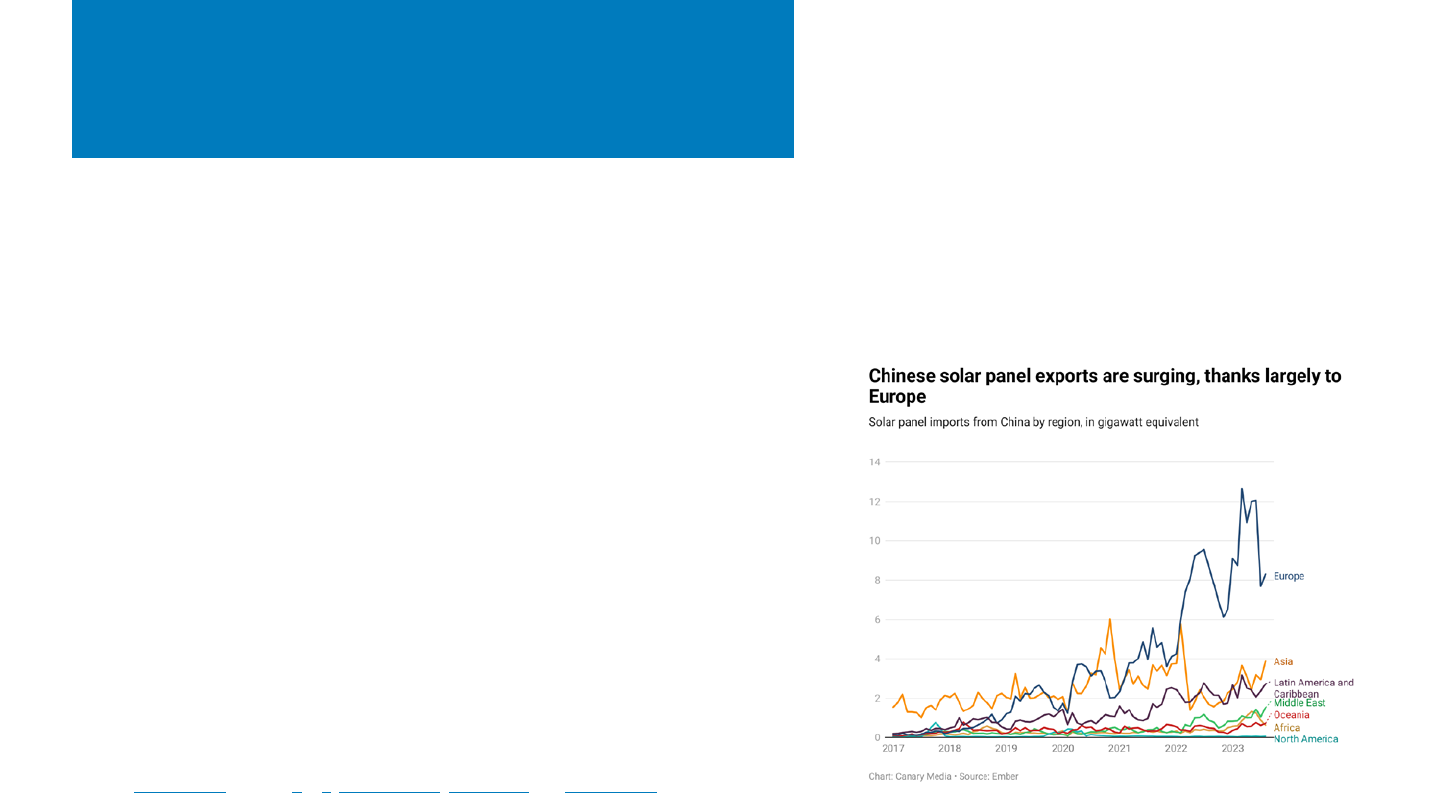

• Between 40 and 100 GW of unsold modules in European stores, mainly in Rotterdam, Netherlands.

• The European Solar Manufacturing Council (ESMC) wrote an open letter calling for the EU to protect European

manufacturers against “intentional and purposeful attack by Chinese PV manufacturers.”

– They called for a ban on forced labor products, incentives for domestic products, and sanctioned

acquisition of European stock.

– European module production has supposedly fallen from

9 GW in 2022 to 1 GW in 2023, and they have more than

500 MW of produced modules in stock that they

cannot sell.

• Germany is considering imposing trade barriers on

Chinese-imported modules and components.

– SolarPower Europe has voiced opposition to such trade

barriers and instead recommended adjusting the EU State

Aid framework, adopting the EU Net-Zero Industry Act,

or creating a Solar Manufacturing Bank.

• Norwegian Crystals went bankrupt in August, and Norsun

announced a temporary halt and layoffs in September.

Sources: pv magazine, PVTech 1 & 2, Canary Media, Bernreuter and pv magazine

Europe PV Module Oversupply

NREL | 56NREL | 56

Module Prices:

Global vs. United States

Source: BloombergNEF, Solar Spot Price Index (10/13/23); BloombergNEF, Bimonthly PV Index (9/19/23); EIA, Monthly Solar Photovoltaic Module Shipments Report

(10/17/23); Wood Mackenzie & SEIA, US Solar Market Insight: Q3 2023 (9/23).

• In Q3 2023 (first 2 months), the average U.S.

module price ($0.33/W

dc

) was down 11% q/q

and down 23% y/y, but at a 98% premium

over the global spot price for monofacial

monocrystalline silicon modules.

• The directional trend in U.S. module prices

realigned with the trend in global module

prices, although the difference between the

two prices remained the same ($0.16/W

dc

).

– U.S. prices were depressed by oversupply

and large distributor inventories.

– Detainment periods for imported modules

under the Uyghur Forced Labor Prevention

Act (UFLPA) have fallen from months to

weeks as major manufacturers have

documented their avoidance of forced

labor, which is freeing up supply and

reducing prices.

$0.00

$0.05

$0.10

$0.15

$0.20

$0.25

$0.30

$0.35

$0.40

$0.45

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 (2

mo)

2020 2021 2022 2023

PV Module Price ($/W

dc

)

U.S. average module value

Global spot price, monofacial monocrystalline modules

NREL | 57NREL | 57

390 MW

720 MW

1000 MW

1250 MW

820 MW

0.15

0.20

0.25

0.30

0.35

0.40

0.45

0.50

0.55

JAN

MAR

MAY

JUL

SEP

NOV

JAN

MAR

MAY

JUL

SEP

NOV

JAN

MAR

MAY

JUL

2021 2022 2023

Imported Module Price ($/W)

South Korea

Cambodia

Thailand

Vietnam

Malaysia

Global Total

$0.00

$0.05

$0.10

$0.15

$0.20

$0.25

$0.30

$0.35

$0.40

$0.45

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Jul-Aug

2020 2021 2022 2023

Calculated U.S. Module Price

Imported value/Watt "Effective" 201 Tarrif Rate

Calculated U.S. Module Pricing

• Based on the reported value and capacity of imported

PV modules, the average price of a PV module in the

United States rose less than a penny q/q in Q2 2023 to

$0.36/W and is on track to fall back to $0.35/W in Q3.

– These price changes have been nonuniform across

countries, with prices declining mostly steeply for imports

from South Korea after a peak at the end of 2022, while

prices from Vietnam, Thailand, Cambodia, and Malaysia

have generally risen over that time.

Note: Manual corrections were made to three values due to suspected data entry errors for HTS code 8541430010: Cambodia (February 2022), Malaysia (June 2020), and Vietnam (July 2019).

Sources: Imports by HTS code: 8541460015(2018-2021)/8541430010(2022-), Customs Value and Second Quantity (watts) from the U.S. International Trade Commission

DataWeb, the U.S. Census Bureau USA Trade Online tool, and corrections page.

NREL | 58

Global Solar Deployment1

U.S. PV Deployment

2

PV System Pricing

3

Global Manufacturing

4

Component Pricing

5

U.S. PV Imports

6

7 PV Domestic Content

Agenda

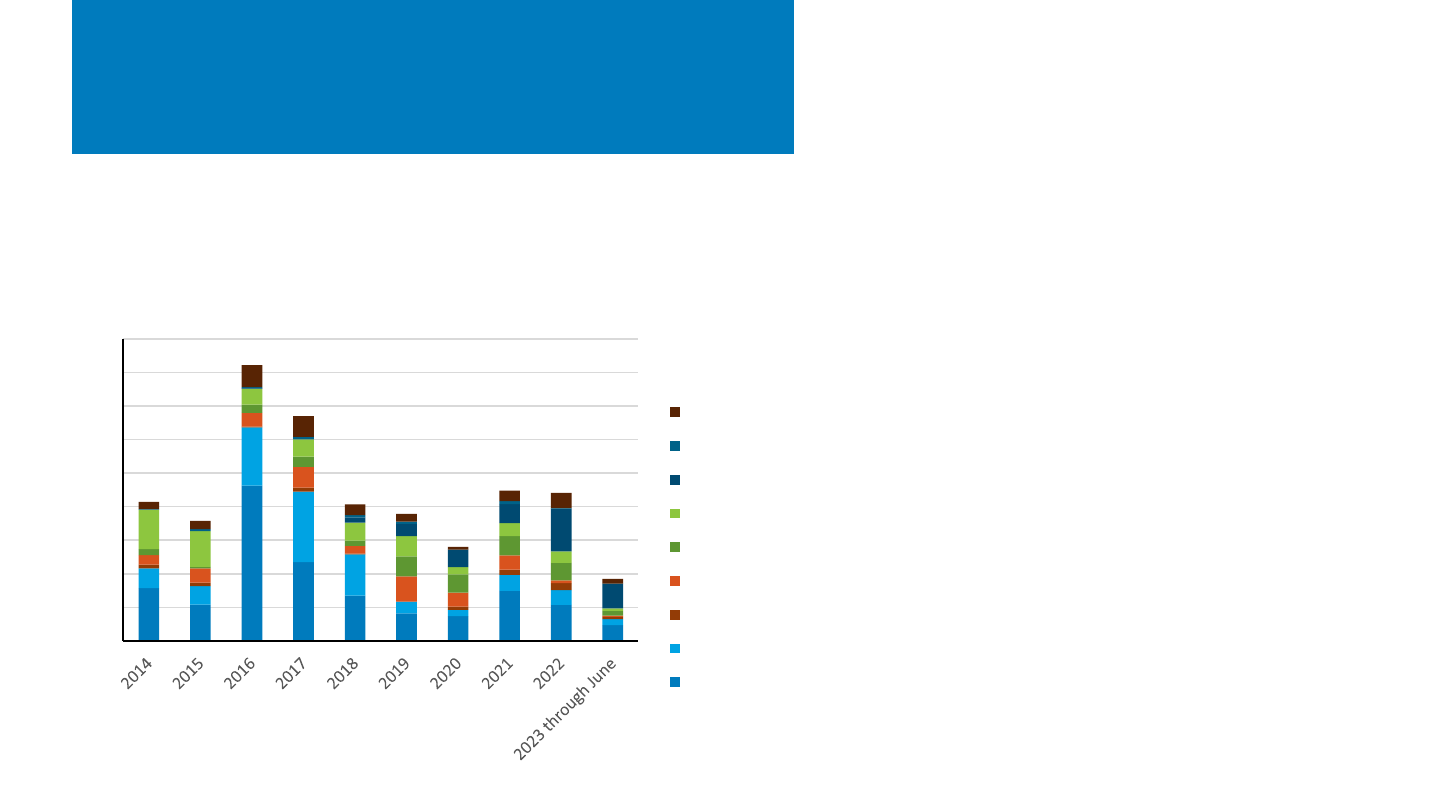

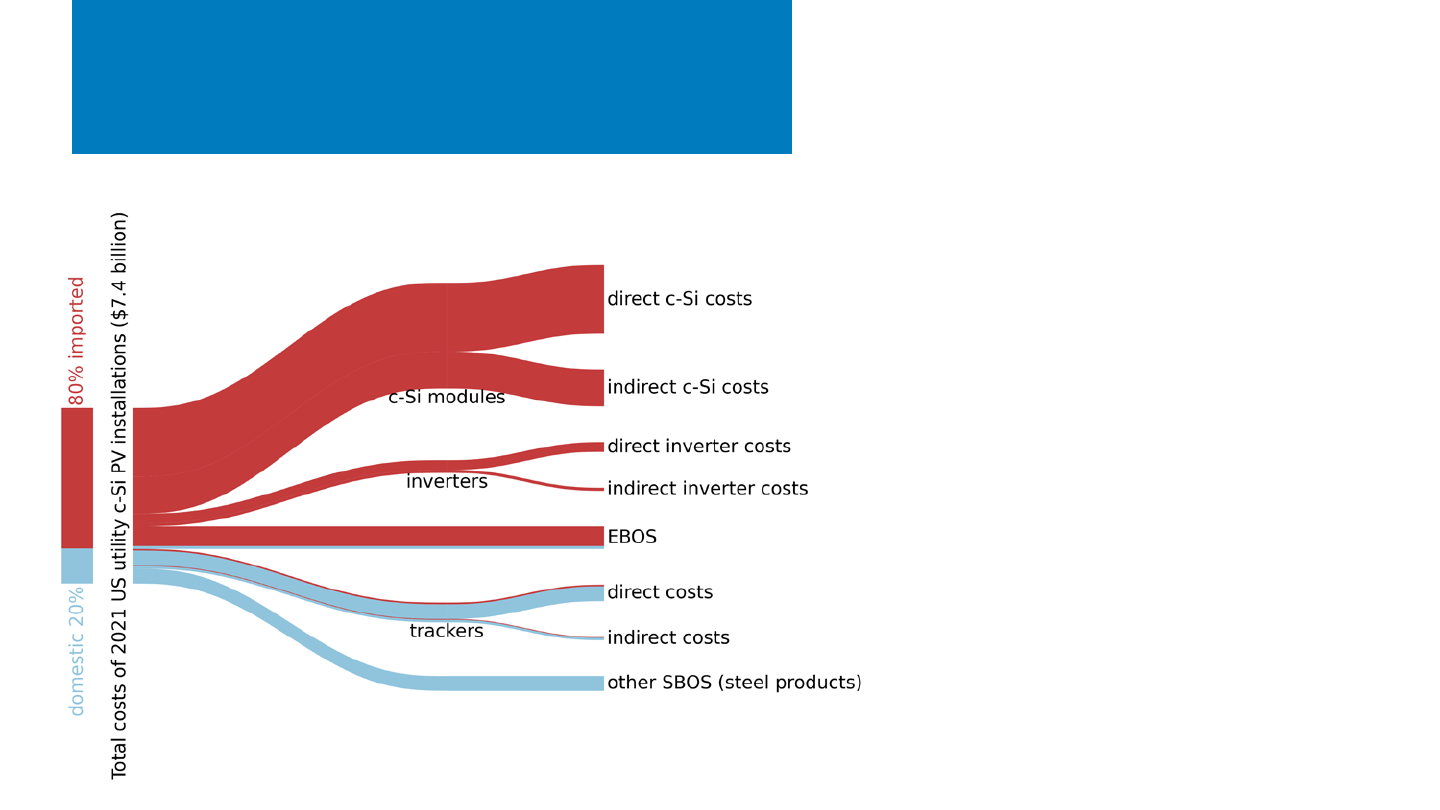

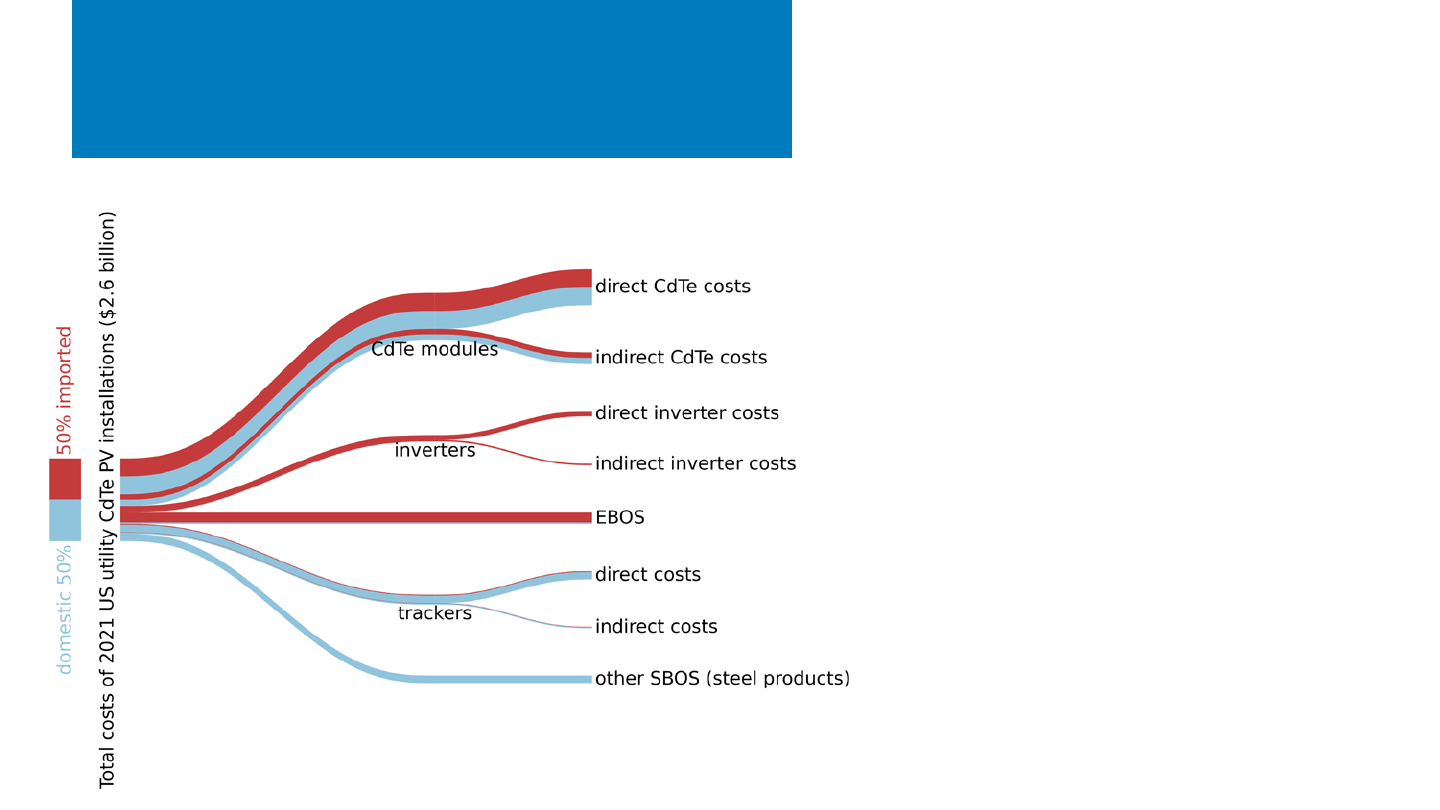

• The United States imported 25.1 GW

dc

of PV modules in H1 2023,

well over double imports from H1 2022.

– Most panels imported were exempt from Section 201 duties

and were therefore likely bifacial. A significant number of thin-

film modules were also imported.

• 1.5 GW

dc

of cells were imported in H1 2023, up 28% y/y.

– The U.S. is not on pace to reach the 5-GW quota exemption

limit for Section 201 tariffs.

NREL | 59NREL | 59

0.0

2.0

4.0

6.0

8.0

10.0

12.0

14.0

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Jul-Aug

2020 2021 2022 2023

Modules Imported (GW

dc

)

U.S. Module (c-Si + CdTe) Imports by Region

Malaysia

Vietnam

Thailand

Cambodia

South Korea

India

China

Rest of Asia

N. America

ROW

Module Imports and

Calculated Prices by Region

Sources: Imports by HTS code: 8541460015(2018-2021)/8541430010(2022-) and 8541460035(2018-2021)/8541430080(2022-), Second Quantity (watts) from the U.S.

International Trade Commission DataWeb as well as the U.S. Census Bureau USA Trade Online tool and corrections page as of 10/25/23. Manual corrections were made to

imports from India in due to suspected data entry errors

• In Q2 2023, U.S. module imports remained near record-

high levels (+200%, or 6 GW y/y), totaling 25.1 GW

dc

in

H1 2023.

– Import levels decreased after the withhold release order

(WRO) on PV cells and modules was announced in late

Q2 2021. Additionally, many manufacturers in Southeast

Asia had reduced production levels earlier in the year

with the announcement of a U.S. anti-circumvention

investigation and when the 2-year waiver was

announced in June; however, the supply chain appears

to be recovering from those disturbances.

– The slight Q2 q/q decrease was mainly the result of

decreased imports from South Korea (−35% q/q, −390

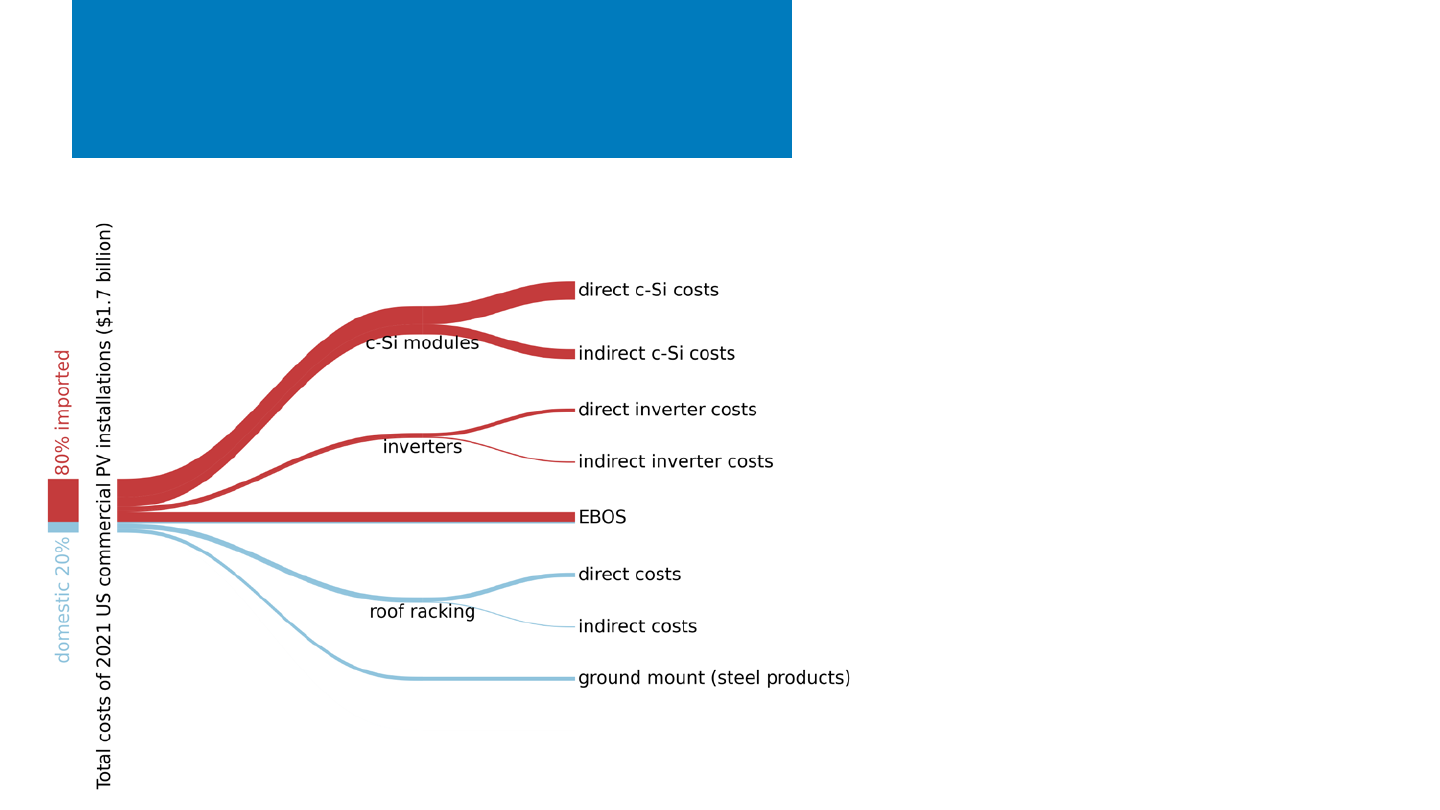

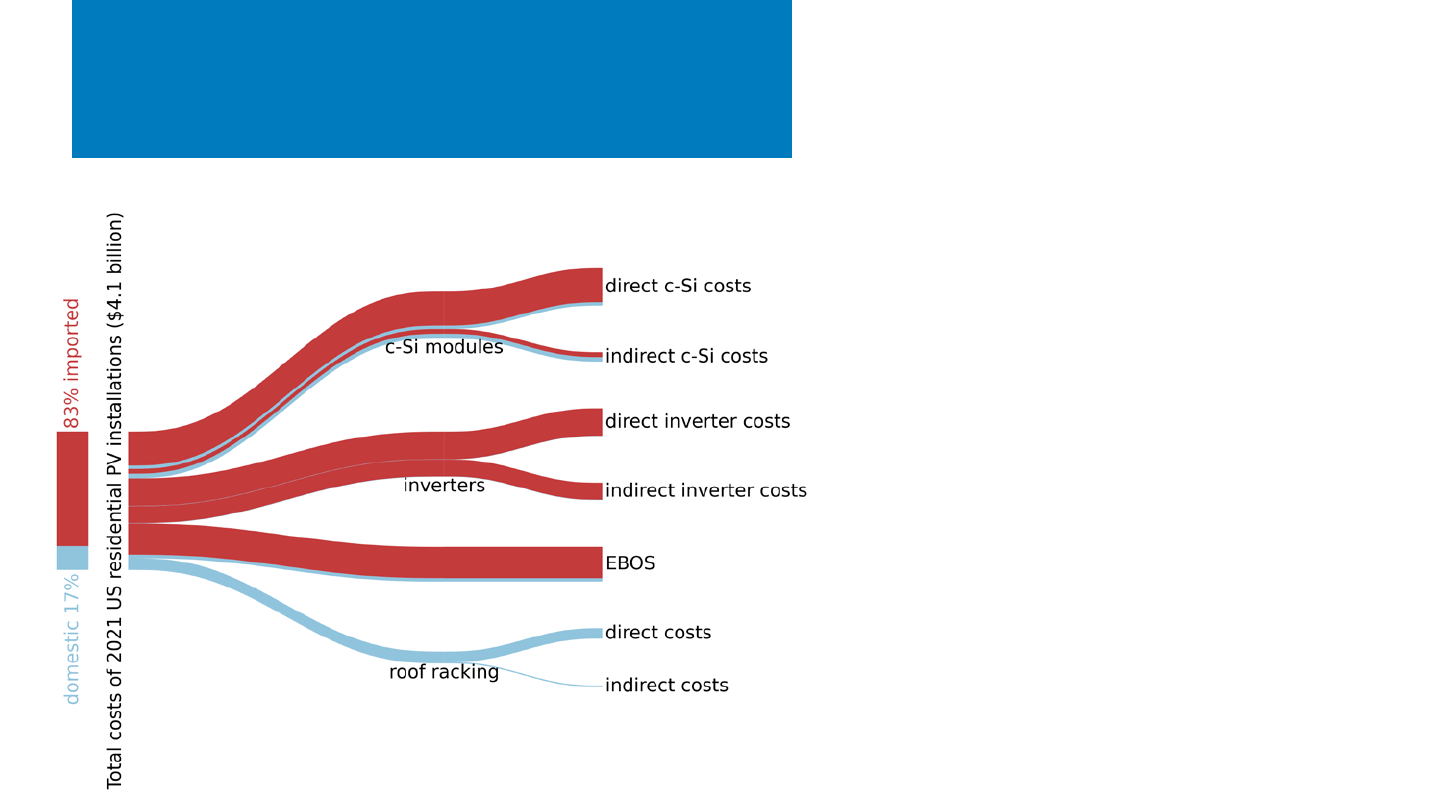

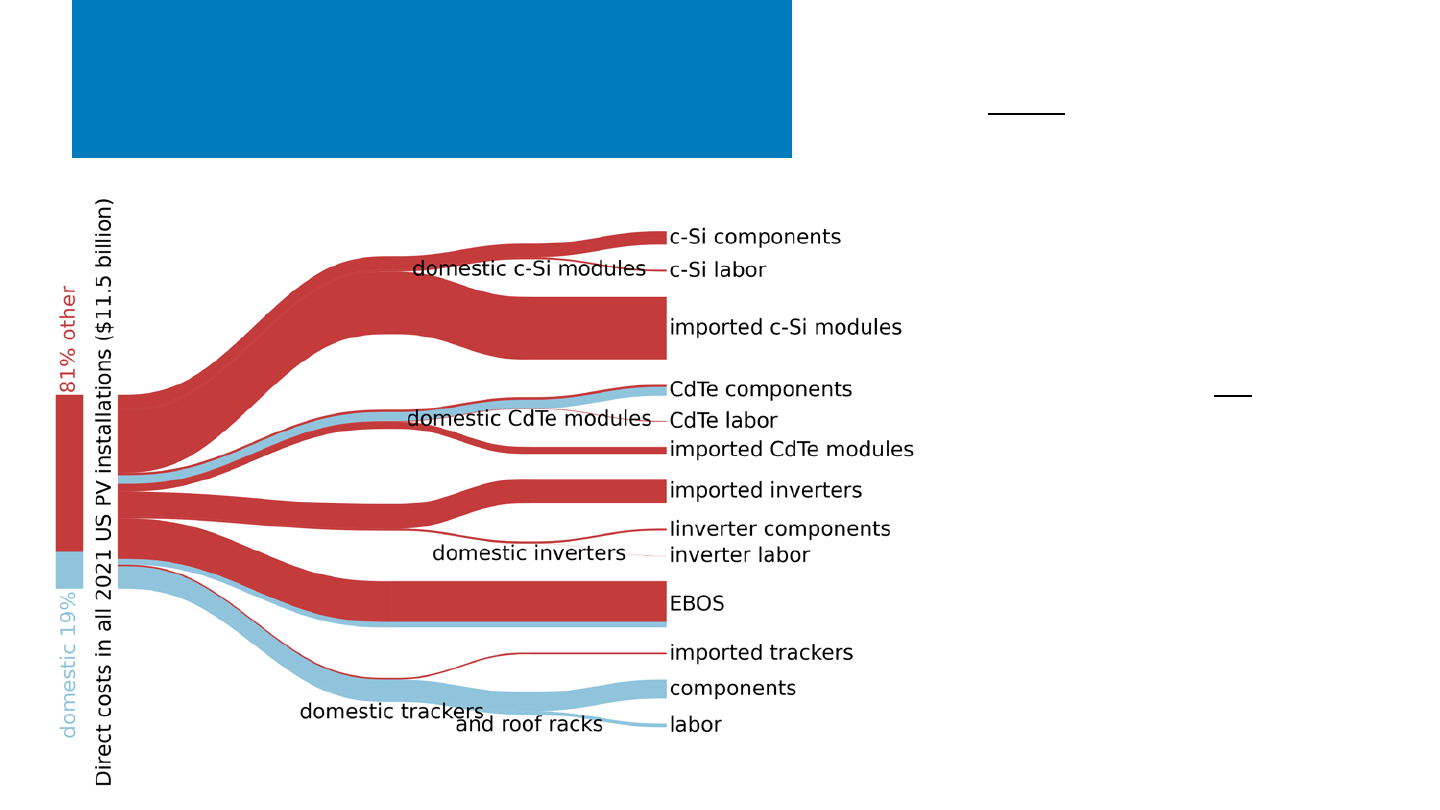

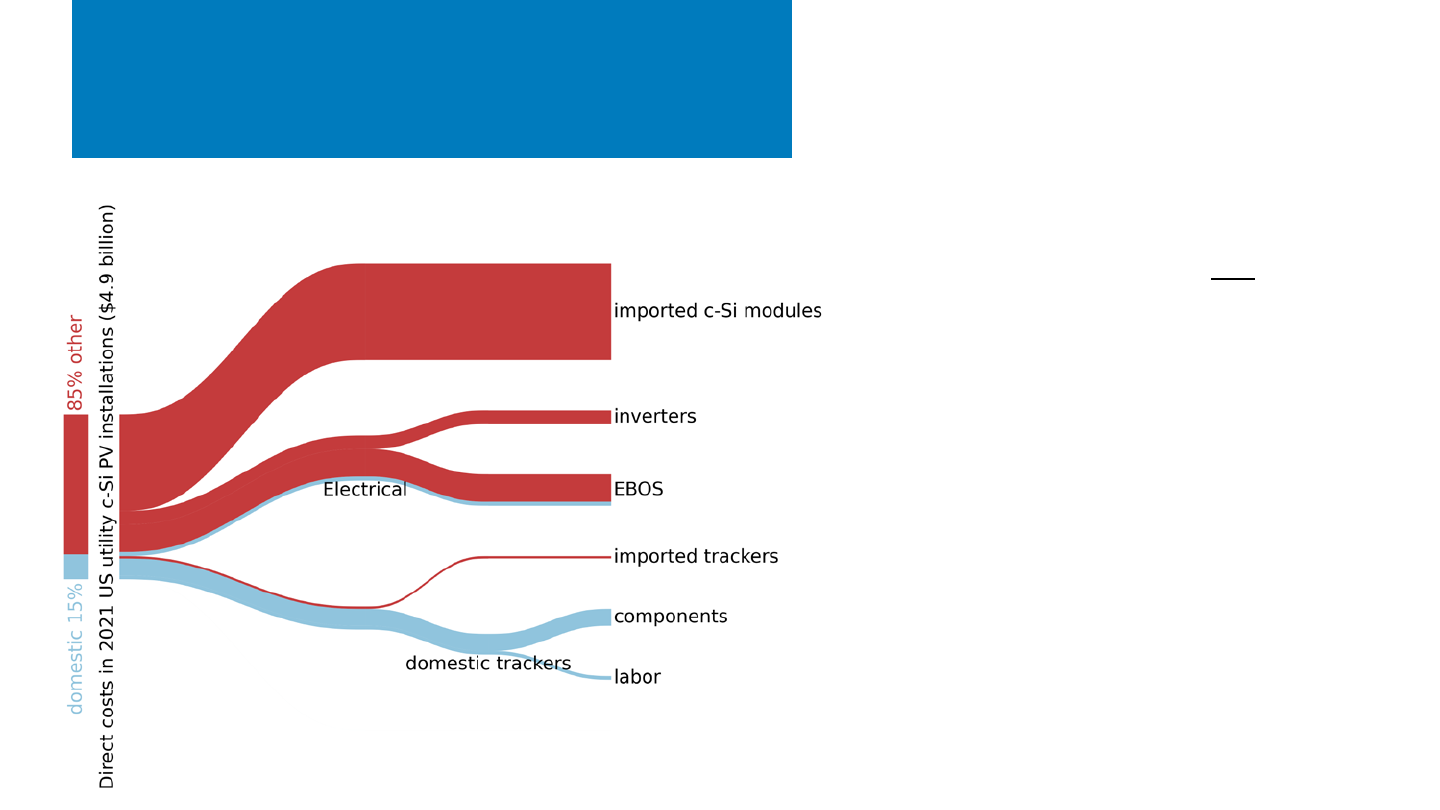

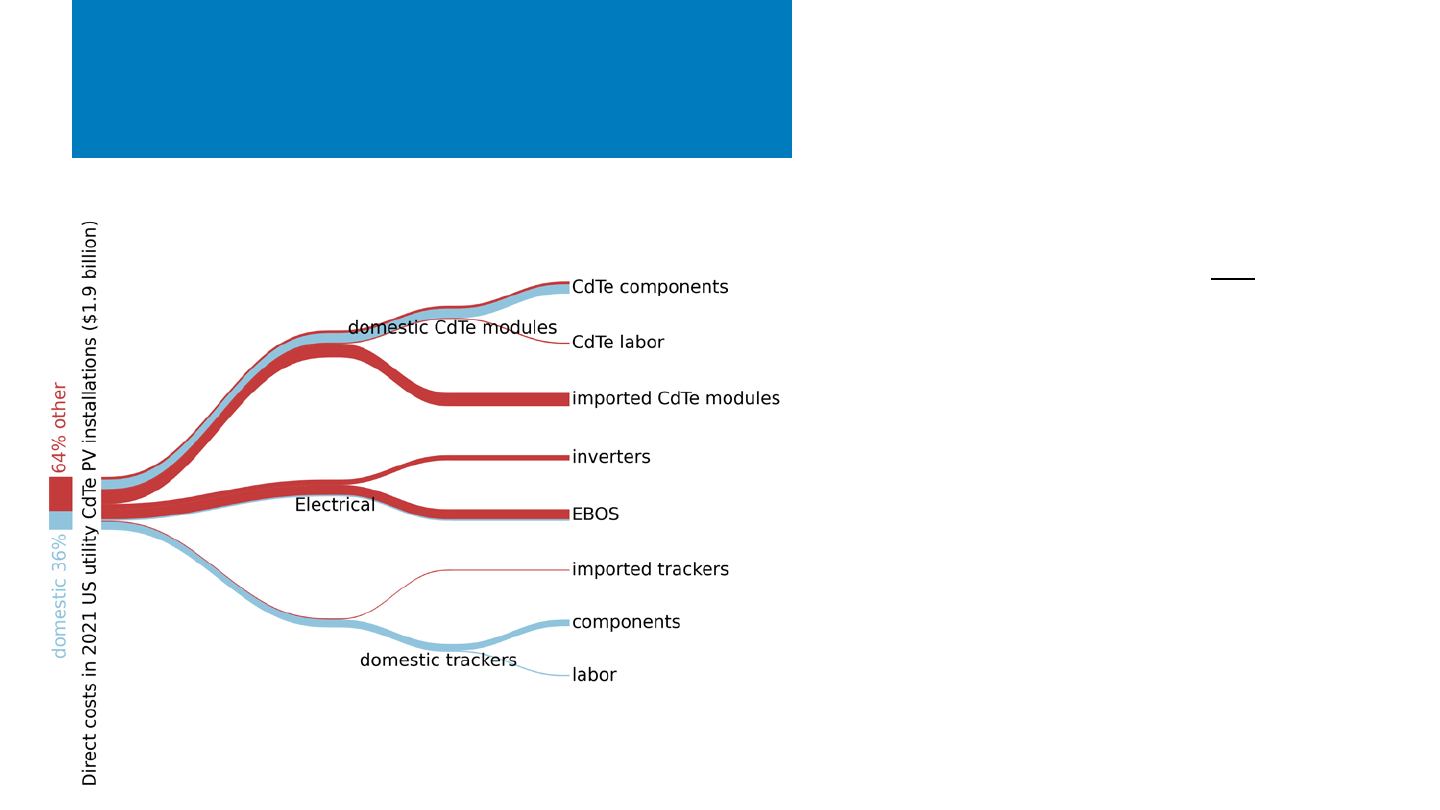

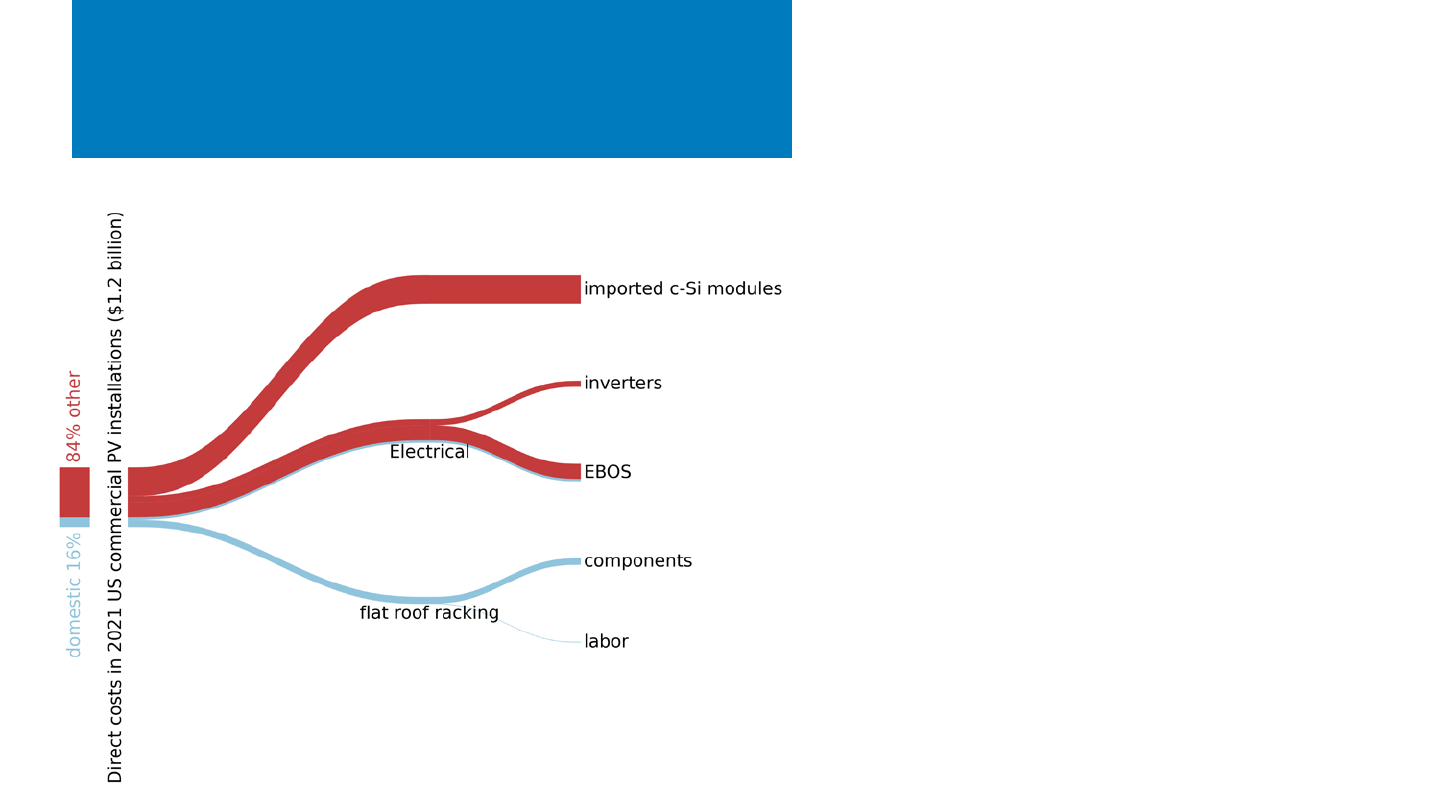

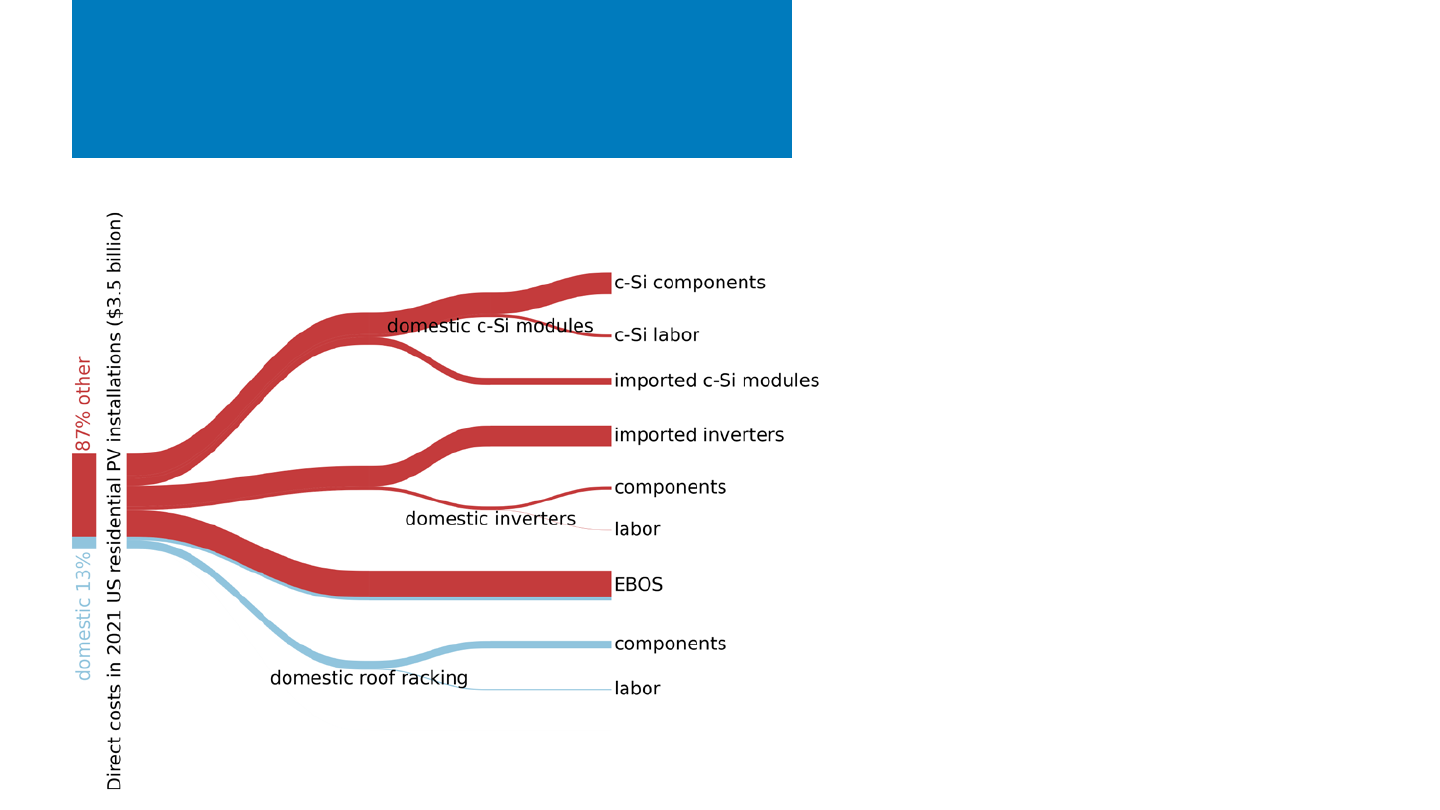

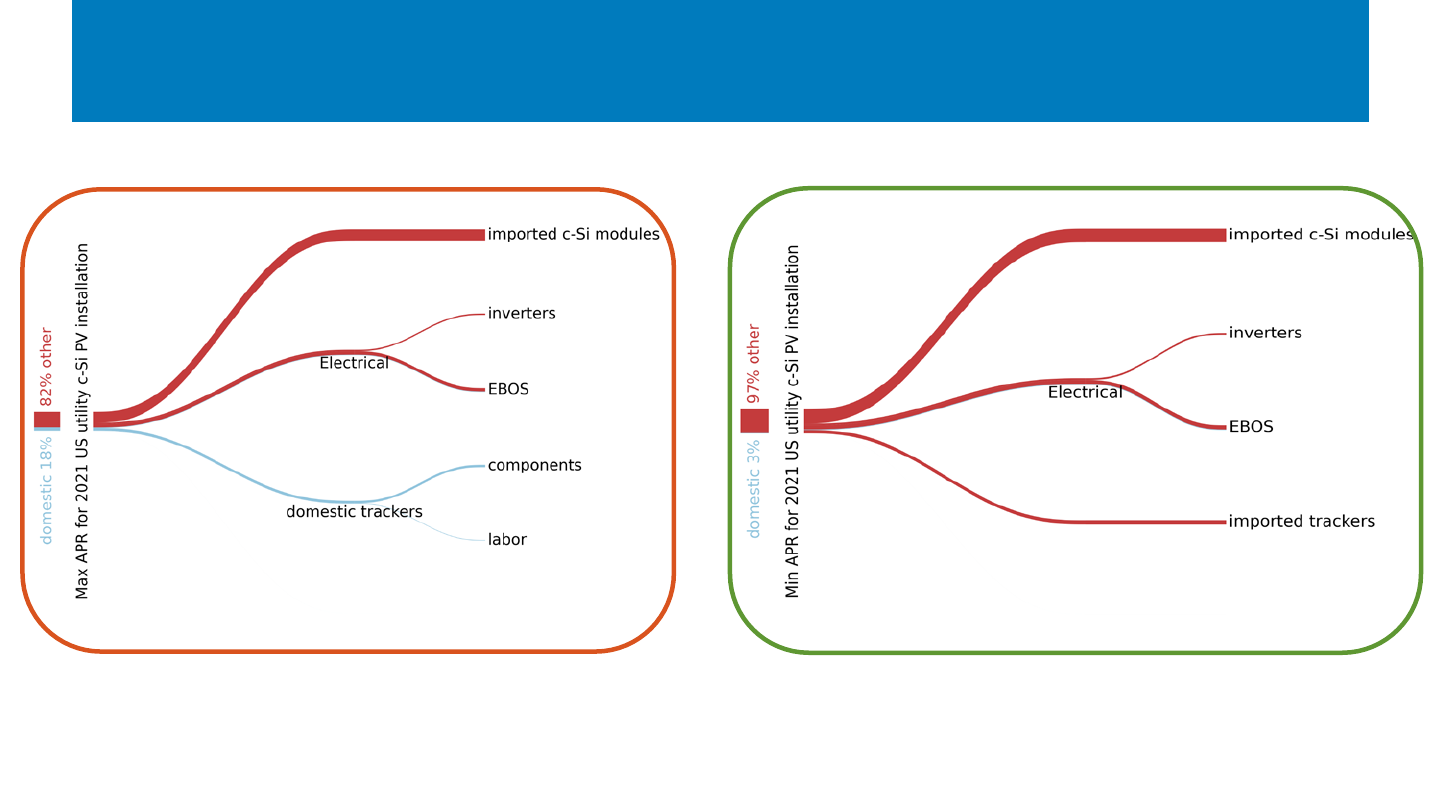

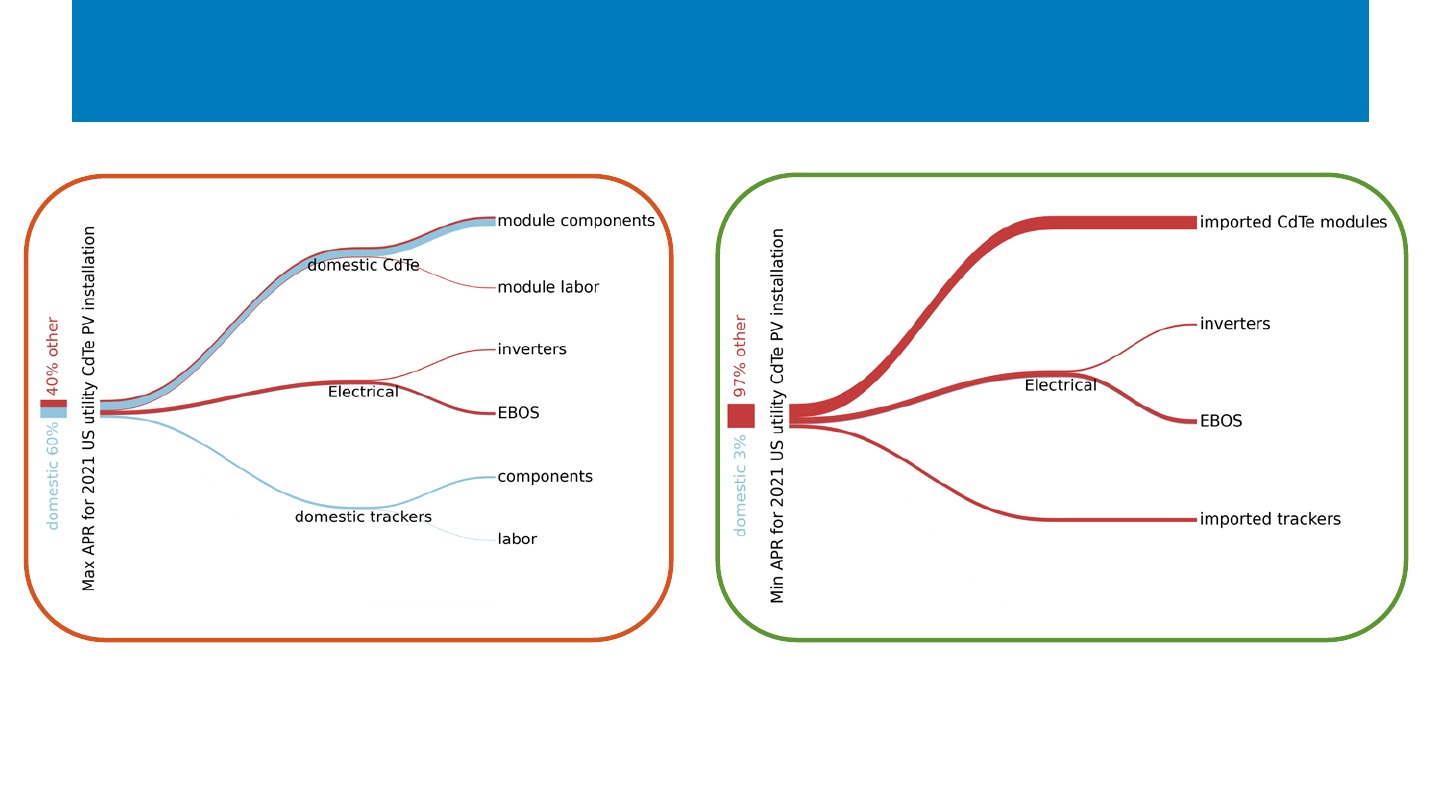

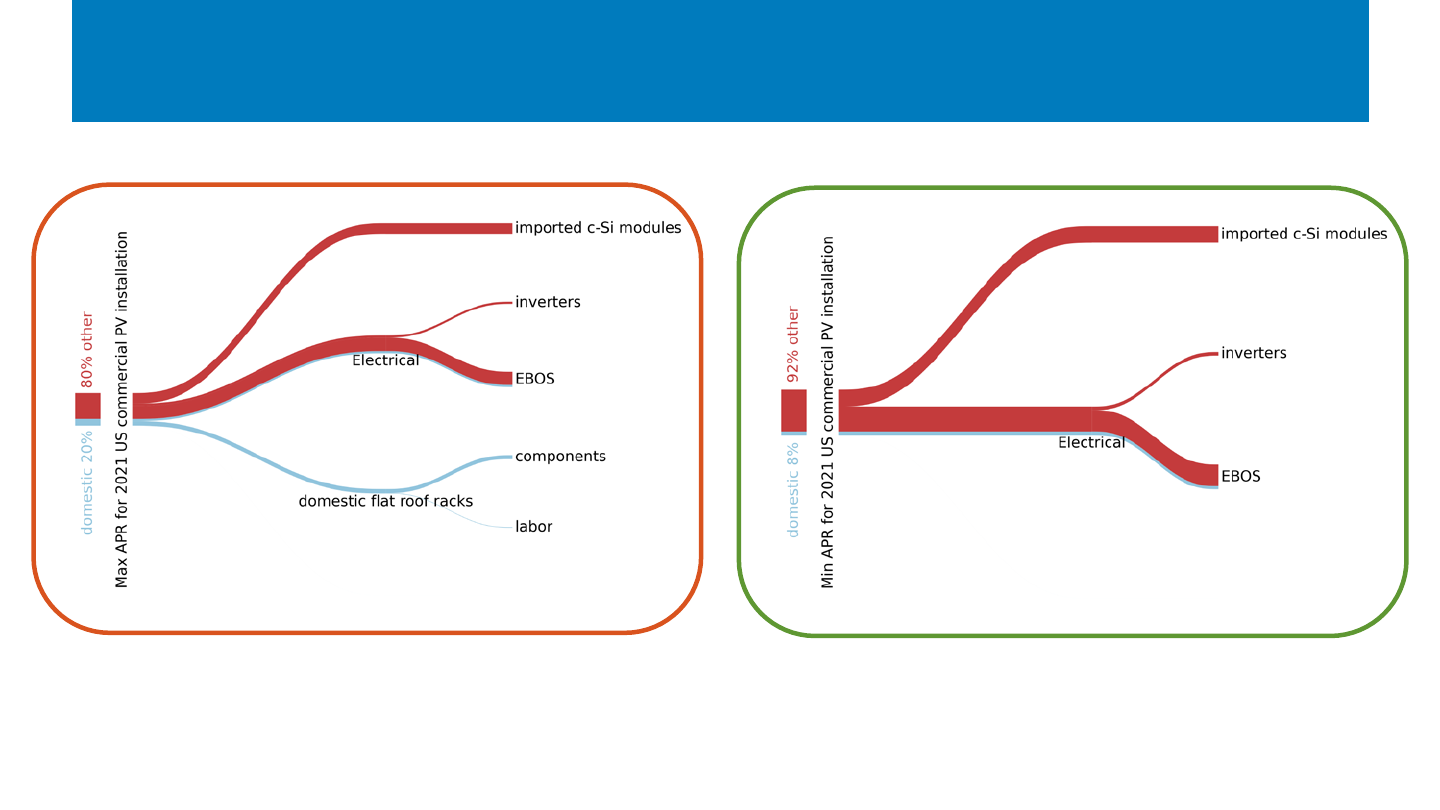

MW), as modest changes across the four main SE Asia