1

Frequently Asked Questions Regarding the New Blended Retirement System

Sections

1. Blended Retirement System

(General)

2. How to Opt-In

3. Auto Enrollment

4. Thrift Savings Plan (TSP)

5. Retirement Annuity

6. Lump Sum Payment

7. Continuation Pay

8. Training & Education

9. National Guard/Reserve Specific

10. Other Resources

11. Index of Questions

1. Blended Retirement System (General)

Q1.1. How has the military retirement

system changed?

A1.1. The National Defense Authorization

Act (NDAA) for Fiscal Year 2016, created a

new military retirement system that blends a

defined benefit annuity with a defined

contribution plan, through the Thrift Savings

Plan (TSP). The primary difference BRS and

the legacy “High-3” system is that BRS

adjusts the years of service multiplier from

2.5 percent to 2.0 percent for calculating

monthly retired pay. In addition, the BRS

includes automatic government

contributions of 1 percent of basic pay and government matching contributions of up to an

additional 4 percent of basic pay to a service member’s TSP account. The law also included a

continuation pay provision, which is a direct cash payout (like a bonus), in return for additional

obligated service. Changes to the Uniform Services’ retirement system went into effect January

1, 2018. Always check with your Human Resource/Workforce Management/Personnel servicing

or visit the BRS Resource website at http://militarypay.defense.gov/BlendedRetirement for the

latest information. National Guard/Reserve specific information can be found in Section 9.

Q1.2. Why was this new blended retirement created?

A1.2. Previously, fewer than 20 percent of service members who joined the military received a

government retirement benefit after they left service. Under BRS about 85 percent of service

members will receive a government retirement benefit if they serve at least two years, even if

they don’t qualify for a full retirement. This expansion of government retirement benefits

ensures a greater number of service members receive government-provided retirement

benefits, previously only available to the 19 percent of active component and 14 percent of

National Guard and Reserve members who served 20 or more years.

As of October 24, 2017

As of March 28, 2018

2

Q1.3. When does the BRS take effect? Who is affected?

A1.3. The BRS went into effect on January 1, 2018. New Service members, who join the

Uniformed Services for the first time on or after January 1, 2018, will be enrolled automatically in

BRS. All members who were serving as of December 31, 2017, were grandfathered under the

legacy retirement system. No member who was serving on, or prior to, December 31, 2017, will

be automatically switched to the BRS. Though they are grandfathered under the legacy

retirement system, active component service members who had fewer than 12 years as of

December 31, 2017, and National Guard and Reserve service members in a paid status, who

had accrued fewer than 4,320 retirement points as of December 31, 2017, may choose to opt

into the BRS. The opt-in window for BRS is from January 1, 2018, to December 31, 2018.

National Guard/Reserve specific information can be found in Section 9.

Q1.4. If I remain in the legacy retirement “high-3” system, how does my retirement

change?

A1.4. Nothing changes for those who choose to remain in the legacy retirement system.

National Guard/Reserve specific information can be found in Section 9.

Q1.5. I am a member of the United States Public Health Service Commissioned Corps

(USPHS) or the National Oceanic and Atmospheric Administration Commissioned

(NOAA) Officer Corps, does the Blended Retirement System pertain to me?

A1.5. Yes, the Uniformed Services Blended Retirement System impacts all seven of the

uniformed services of the United States. While many of the questions and answers in this

document specifically address the military services, many of the same answers are applicable to

USPHS and NOAA. Before making any decision related to the Blended Retirement System,

check with your Human Resource/Workforce Management/Personnel servicing office for the

latest information.

Q1.6. Is the BRS right for me?

A1.6. Possibly, but only you can decide that. Opting into BRS is an individual choice. Each

member’s decision should be based entirely upon his or her own personal circumstances. For

those members who do not intend to serve a full 20-year career, or think they are unlikely to

serve a full 20-year career, BRS is probably a good option because it ensures they will receive

government contributions toward their retirement. Those who do plan to serve a full 20 years

will want to compare their lifetime benefits under both the BRS and the legacy retirement

systems to see which is likely more beneficial. Eligible members should complete the BRS Opt-

In Training, use the BRS Comparison Calculator to compare their individualized results, and

consult with a Personal Financial Manager or Counselor to consider their options before making

a decision to opt-in or not. The BRS Comparison Calculator is available at

http://militarypay.defense.gov/calculator/brs

Q1.7. Do you think that DoD will see a large number of service members leave because of

the new Blended Retirement System?

A1.7. No. DoD’s analysis and experience suggest that reduction in monthly retired pay might

result in fewer members staying for a full career. However, Congress provided DoD the tools

necessary to maintain the necessary force profiles. This includes DoD automatic and matching

contributions to the member’s Thrift Savings Plan and Continuation Pay--a retention bonus

targeted at the mid-career-point.

-Back to Top-

3

Q1.8. Which plan does DoD believe is the best for current service members?

A1.8. DoD has no preference. There is no one-size-fits-all answer. Each member’s decision will

depend entirely upon his or her own personal circumstances. For some, staying under the

legacy system will make sense. For others, BRS will be a better decision.

Q1.9. If I opt into BRS will my previous military service be calculated under the legacy

system multiplier of 2.5 percent?

A1.9. No, if you opt into BRS you move entirely into the new retirement system. For example, if

you had four years under the legacy retirement system and 16 years under BRS, at retirement

all 20 years are calculated under the BRS multiplier of 2.0 percent; you do not receive split

multipliers.

Q1.10. What financial resources will be available to service members at their

installations?

A1.10. Service members can visit their installation’s Personal Financial Manager(s) or Personal

Financial Counselor(s). Other installation resources may include Retirement Service Officers

and Family Counselors. On base resources, such a credit unions and banks are another viable

option. Additionally, Military OneSource has trained Personal Financial Counselors available via

phone or they can refer you to a local resource to assist you in your decision-making process.

National Guard/Reserve specific information can be found in Section 9.

Q1.11. Does BRS affect my ability to participate in the Survivor Benefit Plan?

A1.11. No, service members will still have the option of participating in the Survivor Benefit Plan.

Q1.12. Does BRS affect Veterans Affairs (VA) disability compensation?

A1.12. For most members retiring under BRS, there will be no impact to their eligibility to

receive VA disability compensation, Combat-Related Special Compensation (CRSC), or

Concurrent Retirement and Disability Pay (CRDP). However, if a service member covered by

BRS elects the lump-sum option, there may be an impact to his or her ability to receive some or

all of his or her VA disability compensation due to the law requiring an offset of the retired pay

that has already been received via the lump sum. Those with CRSC-qualifying disabilities will

still be able to receive CRSC even if they elect a lump sum. Those qualified for CRDP will be

able to receive VA disability compensation and military retired pay without offset.

Q1.13. Will CSB/REDUX still be available to service members when BRS is implemented?

A1.13. No, authority to elect the Career Status Bonus (CSB)/REDUX ended on December 31,

2017. No CSB will be offered after this date.

2. How to Opt-In

Q2.1. How will service members be notified if they are eligible for opting in to the blended

retirement system?

A2.1. Eligible service members will know that they are eligible to opt-in to the BRS if the link for

opting-in is available on their pay account on myPay (for members of the Army, Air Force, and

Navy), Marine Online (for members of the Marine Corps), or on Direct Access (for members of

the Coast Guard or NOAA). Officers of the U.S. Public Health Service should contact the

Compensation Branch if they are unsure about their eligibility status.

-Back to Top-

4

Q2.2. When do service members need to make a choice about BRS?

A2.2. Service members who are eligible to opt into BRS will have all of calendar year 2018 to

make their opt-in decision. The enrollment period goes from January 1, 2018 through

December 31, 2018. Members of the Army, Navy, or Air Force who wish to remain in the legacy

system do not have to do anything; Marines will have to affirmatively decline enrollment in the

BRS via Marine Online. National Guard/Reserve specific information can be found in Section 9.

Q2.3. How do I opt into BRS?

A2.3. To opt into BRS, Soldiers, Airmen and Sailors will utilize myPay; Coast Guardsmen and

members of the Commissioned Officer Corps of the National Oceanic and Atmospheric

Administration (NOAA) will opt-in via Direct Access; and Marines will make their decision via

Marine Online (MOL). When opting in via myPay, a Service member must first click a link that

says, "Opt Into the Blended Retirement System." Following that, the member must

acknowledge no less than three times that he or she is aware and fully understands the decision

to opt-in is irrevocable and that he or she is opting into the BRS. Once the member has

completed the opt-in process, he or she will receive a SmartDoc message confirming

enrollment.

Q2.4. Does it make a difference if I opt into the new system at the beginning of 2018 or at

the end of 2018?

A2.4. Eligible service members may opt into BRS anytime between January 1, 2018, and

December 31, 2018. It is important to note, Service members opting into the new retirement

system will begin receiving automatic and applicable matching government contributions

effective the first pay period that begins on after the day the member opts into the BRS. For

active duty, this means the following month unless the member opts in on the first day of the

pay period, in which case the automatic and matching contributions begin with that pay period.

For example, if an active duty member opts into BRS on January 12, 2018, he or she will begin

receiving government TSP contributions with his or her February pay, which will be reflected in

his or her end-of-month Leave and Earning Statement (LES) for February. If an active duty

member opts in on March 1, 2018, he or she will receive government TSP contributions for the

March pay period, which will be reflected in the end-of-month LES for March. Reserve and

National Guard members are paid on a different cycle; members of the Reserve and National

Guard will see government contributions beginning in the first full pay period that begins on or

after when he or she opts in. However, it is important for service members to fully understand

BRS and to take their time to make an informed decision.

Q2.5. If a service member is eligible for BRS do they need to do anything?

A2.5. Yes, eligible service members will need to complete the mandatory BRS Opt-In Course on

Joint Knowledge Online or their services’ Learning Management System (if available) and

physically opt into BRS anytime from January 1, 2018, to December 31, 2018. To opt into BRS,

Soldiers, Airmen and Sailors will utilize myPay; Coast Guardsmen and members of the

Commissioned Officer Corps of the National Oceanic and Atmospheric Administration (NOAA)

will opt-in via Direct Access; and Marines will make their decision via Marine Online (MOL).

When opting in via myPay, a Service member must first click a link that says, "Blended

Retirement System Opt-In." Following that, the member must acknowledge no less than three

times that he or she is aware and fully understands the decision to opt-in is irrevocable and that

he or she is opting into the BRS. Service members joining on or after January 1, 2018,

(meaning those who have a Date of Initial Entry into Military Service (DIEMS)) on or after

January 1, 2018) will be automatically enrolled in the BRS.

-Back to Top-

5

Q2.6. What should service members be most aware of when deciding whether to opt into

BRS?

A2.6. Service members who have no intention of making the military their career and staying at

least 20 years should be aware that BRS would provide government benefits toward retirement

through a defined contribution plan, called the Thrift Savings Plan. This new automatic and

matching government contribution benefit is worthy of careful consideration. Early retirement

savings, dollar cost averaging, and the power of compounding are important life-long concepts

service members will want to pay attention to during the mandatory BRS Opt-In Course.

Eligible service members need to carefully review each retirement system to understand how

their decision to either remain in the legacy retirement system or opt into the new BRS will

impact them and their families.

Q2.7. If I elect to opt into the new Blended Retirement System can I change my mind

later?

A2.7. The decision to opt-in is irrevocable. It cannot be changed at a later date.

Q2.8. I mistakenly opted into the Blended Retirement System and want to change my

election, can I get a waiver of the policy?

A2.8. The decision to opt-in is irrevocable. Following mandatory training, the opt-in process is

a multi-step layered process that requires the Service member to consciously opt-in with intent.

A member must acknowledge no less than three times that he or she is aware and fully

understands the decision to opt-in is irrevocable. Additionally, no Service member can opt-in

without confirming that he or she has completed the mandatory training, which also advises the

member of the irrevocable nature of the decision. While DoD policy is clear that the decision to

opt-in is irrevocable, a Service member always has the option of applying to the Board for

Correction of Military/Naval Records for relief for any matter related to pay and benefits. The

Service member must prove a specific error or injustice. There is no guarantee the Board will

take action to reverse a member's election to enroll in the BRS, although it is within the purview

of such boards to do so.

Q2.9. Does the service member’s spouse need to concur with the member’s decision to

opt into BRS?

A2.9. No, although DoD encourages Service members to make their opt-in decision in

consultation with their spouse, significant other, Personal Financial Manager/Counselor, or other

trusted agent prior to making an opt-in election, the law does not require spousal concurrence

with the decision.

Q2.10. Will cadets and midshipmen at the service academies or in the Reserve Officer

Training Program (ROTC) be given a choice between the BRS and legacy retirement

system?

A2.10. Cadets and midshipmen who were attending a service academy as of December 31,

2017, are grandfathered under the legacy retirement system and will have the option to opt into

BRS upon commissioning. ROTC cadets and midshipmen have the same option as long as

they signed their "contract" on or prior to December 31, 2017. Cadets and midshipmen that are

grandfathered under the legacy retirement system, upon commissioning (or being placed in a –

-Back to Top-

6

pay status) in 2018 will have the remainder of calendar year 2018 to choose to opt into BRS (or,

if not placed in paid status until December 2018, they will have at least 30 days). Those cadets

and midshipmen that are grandfathered under the legacy retirement system who are not

commissioned (or placed in an active pay status) until after 2018 will have 30 days to decide

whether or not they want to opt into BRS. Each individual service member has a deadline,

which is 30 days after their first day of duty following commissioning. Cadets and midshipmen

who enter a service academy, and ROTC cadets and midshipmen who sign their "contract" on

or after January 1, 2018, will automatically be covered by BRS upon commissioning with no

option to opt-in.

Q2.12. I just opted in to BRS… Now what do I do?

A2.12. Your first step should be ensuring your TSP contributions are entered and up-to-date.

Members who opt into BRS are not automatically enrolled at a certain TSP contribution

percentage – the default 3 percent contribution rule ONLY applies to members who are

automatically enrolled in BRS, not those who choose to opt-in. After opting-in, go to the link on

myPay that says, “Traditional TSP and Roth TSP.” On this page you can start, stop, and

change your allocations to TSP from your basic, special, incentive, and bonus pays, and choose

whether to contribute to a Traditional or a Roth TSP account. Once your TSP.gov account is

established, you should visit this website to allocate your contributions to various investment

funds. At this point, it is also a good idea to meet with a Personal Financial Manager/Counselor

to discuss your TSP options and learn more about saving for retirement.

3. Automatic Enrollment in BRS

Q3.1 If I entered the Uniformed Services after January 1, 2018, what do I need to know?

A3.1. The BRS is your retirement plan. Upon entry to service, you are automatically enrolled in

BRS with automatic government contributions of 1 percent of basic pay (or Inactive Duty Pay,

sometimes referred to as Drill Pay in the National Guard and Reserve) and government

matching contributions of up to an additional 4 percent of basic pay to your TSP account. After

you have served for 60 days, a TSP account will be created, deductions of 3 percent of your

basic pay will start, and the government will also begin contributing 1 percent of your basic pay

to your TSP account. You can choose to begin contributing sooner than 60 days, though, by

completing and submitting a TSP-U1 form with your personnel or finance office.

Q3.2. If I want to enter the legacy (High-3) system, can I get a waiver?

Q3.2. No. This option was only available to members who entered a Uniformed Service on, or

prior to, December 31, 2017.

Q3.3. What if I have a break in service—can I still opt into the Blended Retirement

System?

A3.3. If you left the military (prior to January 1, 2018) and rejoin after the opt-in decision year

(calendar year 2018), upon re-entry you will have 30 days to decide whether to stay in the

legacy retirement system or elect the new BRS, so long as you previously met the criteria of

having had fewer than 12 years of service as of December 31, 2017, or, for reservists or

National Guard, had fewer than 4,320 retirement points as of December 31, 2017. However, if

you re-enter military service in 2018, you will have the remaining time in calendar year 2018 or

30 days, whichever is longer, to make a decision to opt into BRS.

-Back to Top-

7

Q3.4. I just joined the service, am I automatically enrolled, or do I need to take specific

action?

A3.4. All new Service members joining on or after January 1, 2018, will be automatically

enrolled in BRS – this is the only option available. You will contribute 3 percent of your basic

pay (or Inactive Duty Pay, sometimes referred to as Drill Pay in the National Guard and

Reserve) to your TSP account starting with the pay period that begins on or after your 60

th

day

of service. The government’s automatic 1 percent of basic pay will also begin with the pay

period that begins on or after your 60

th

day of service, as measured from Pay Entry Base Date.

Any member subject to this automatic enrollment may decline to be enrolled, or may choose to

begin contributing to TSP sooner than 60 days by completing the TSP-U1 form. The

government will also match service member contributions up to an additional 4 percent after two

years of service. The maximum government contribution is 5 percent if you are contributing 5

percent of your basic pay. Both the DoD automatic 1 percent and the matching contributions

continue through the end of the pay period during which you attain 26 years of service.

Q3.5. So, TSP is part of BRS, what is it, exactly, and how does it work?

A3.5. The TSP is a defined contribution retirement savings and investment plan that offers the

same types of savings and tax benefits many private corporations offer their employees under

401(k) or similar plans. Please see the following section for more information.

Q3.6. I was in the Delayed Entry Program (DEP), am I automatically covered by BRS?

A3.6. Not necessarily, if you signed a contract to serve and entered the Delayed Entry Program

in 2017, but did not actually report for duty until 2018, you are still grandfathered under the

legacy retirement plan. While you default to the legacy High-3 retirement plan, you will be BRS

opt-in eligible and will have the remainder of calendar year 2018 to choose to opt into BRS (or, if

not placed in paid status until December 2018, you will have at least 30 days from your Pay

Entry Base Date). The date you signed a contract to enter the DEP is your Date of Initial Entry

into Military Service (DIEMS). DIEMS is the date that determines if you are BRS opt-in eligible

or automatically enrolled in BRS. If your DIEMS is on or before December 31, 2017, you are

opt-in eligible (assuming you also have fewer than 12 years of total service or fewer than 4,320

retirement points for members of the National Guard and Reserves). If you entered the DEP on

or after January 1, 2018, you are automatically enrolled in the BRS once you start receiving

basic pay or inactive duty pay.

Q.3.7. What is the difference between DIEMS and PEBD?

A.3.7. DIEMS is the Date of Initial Entry into Military Service while PEBD is the Pay Entry Base

Date. DIEMS marks the day a member first enters military service by signing a contract or

agreement to serve, even if on that day he or she is in an inactive status such as in the Delayed

Entry Program (DEP), or as a student in one of the Service Academies or ROTC. PEBD is the

day a member first begins earning Basic Pay or Inactive Duty Pay (drill pay). For many Service

members, these days are essentially the same, while for many others DIEMS is earlier than

PEBD. Determining whether a member is grandfathered under legacy High-3 or automatically

enrolled in BRS is based on DIEMS. If DIEMS is on or before December 31, 2017, he or she is

grandfathered. If DIEMS is on or after January 1, 2018, he or she is automatically enrolled in

BRS. Of those who are grandfathered, determining eligibility to opt into BRS is based on PEBD

(as is eligibility for Continuation Pay). Fewer than 12 years of service since PEBD makes an

otherwise grandfathered Active Component member eligible to opt into BRS.

-Back to Top-

8

4. Thrift Savings Plan (TSP)

Q4.1. What is the Thrift Savings Plan (TSP), and what is the Federal Retirement Thrift

Investment Board (FRTIB)?

A4.1. The TSP is a defined contribution retirement savings and investment plan that offers the

same types of savings and tax benefits many private corporations offer their employees under

401(k) or similar plans. The FRTIB is an independent government agency required by law to

manage the TSP. They do so solely in the interest of the participants and their beneficiaries,

which includes federal employees and members of the Uniformed Services.

Q4.2. How does the TSP figure into the BRS?

A4.2. The BRS includes a defined contribution component through TSP. Uniformed Service

members who are covered by the BRS are eligible to receive government automatic and

matching contributions to their TSP accounts. These government contributions to TSP are

portable retirement savings that begin early in a member’s career.

Q4.3. I opted into BRS. When will I be enrolled in TSP?

A4.3. Currently serving members who opt-in will see the government’s automatic 1 percent and

matching contributions up to an additional 4 percent beginning with the first pay period that

starts on or after the day the member opts in—there is no waiting period even for those

members with less than two years of service.

Q4.4. I just joined the service, when will I be enrolled in TSP?

A4.4. All service members joining on or after January 1, 2018, will be automatically enrolled in

TSP to contribute 3 percent of their basic pay (or Inactive Duty Pay, sometimes referred to as

Drill Pay in the National Guard and Reserve) starting with the pay period that begins on or after

the member’s 60

th

day of service. The government’s automatic 1 percent of basic pay will also

begin with the pay period that begins on or after the member’s 60

th

day of service, as measured

from Pay Entry Base Date (PEBD). Any member subject to this automatic enrollment may

decline to be enrolled, or may choose to begin contributing to TSP sooner than 60 days by

completing the TSP-U1 form. The government will also match service member contributions up

to an additional 4 percent after two years of service. The maximum government contribution is

5 percent if the service member is contributing 5 percent of their basic pay (see Chart 4-1).

Both the DoD automatic 1 percent and the matching contributions continue through the end of

the pay period during which the service member attains 26 years of service.

Q4.5. Does the money in the TSP belong to the service member?

A4.5. Members who were serving as of December 31, 2017, and who opt into BRS are

immediately vested in (entitled to) their own contributions and any government matching

contributions, plus the earnings on those contributions. However, Service members must have

at least two years of service in order to be vested in the government’s automatic 1 percent

contributions and associated earnings. This does not mean two years from the date they opted-

in or started with TSP, but refers to total time in service as measured from their Pay Entry Base

Date (PEBD). Those service members who are automatically enrolled in BRS are immediately

vested in (entitled to) their own contributions and earnings. They will begin to receive the

government automatic 1 percent of their basic pay with the pay period that starts on or after they

-Back to Top-

9

have served for 60 days. They must have two years of service in order to be vested in the

government’s automatic 1 percent contributions and associated earnings. After completion of

two years of service, they can begin receiving matching contributions up to an additional 4

percent of their basic pay. Service members are immediately vested in (entitled to) any

government matching contributions and earnings at this point. All DoD automatic and matching

contributions are governed by the existing Federal Retirement Thrift Investment Board

regulations as it pertains to vesting.

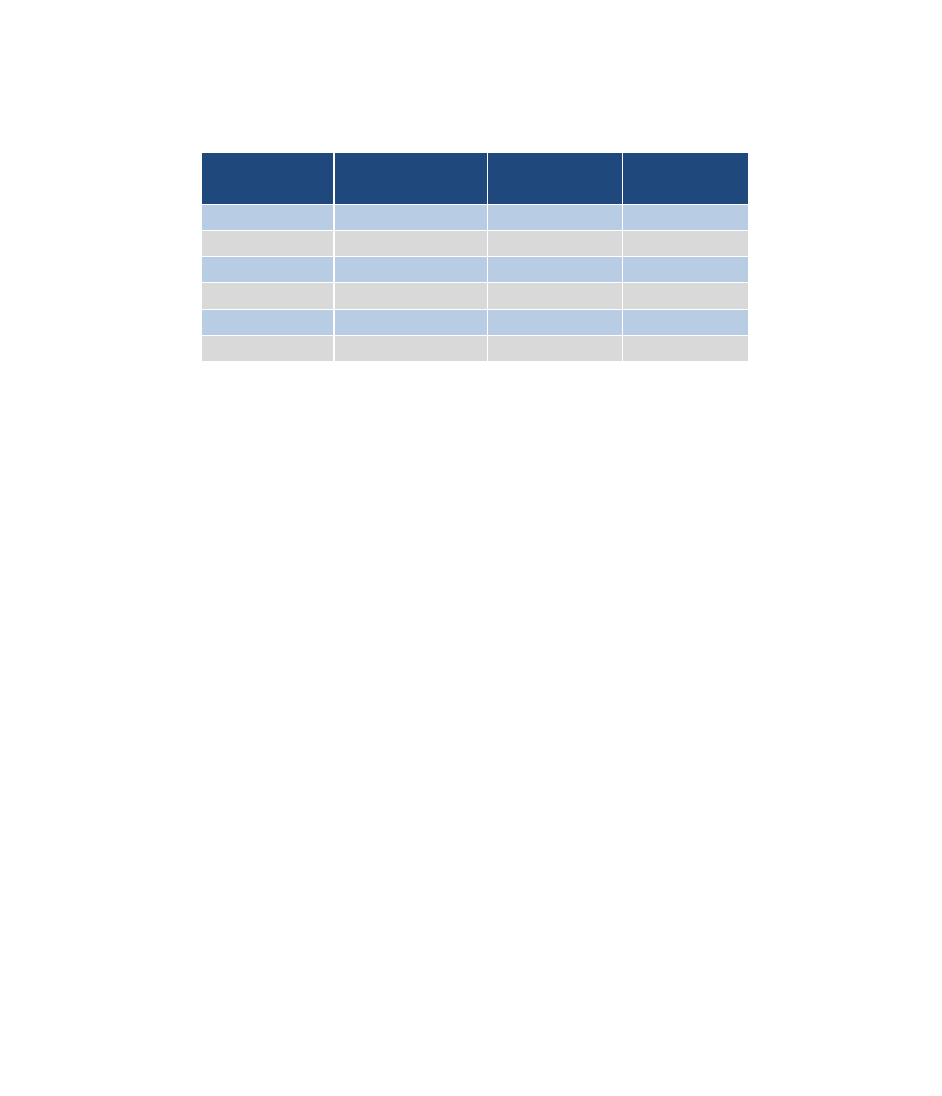

Q4.6. How much will the DoD contribute to my TSP?

A4.6.The following chart (Chart 4-1) identifies the TSP matching component of the Blended

Retirement System.

Chart 4-1: Automatic and Matching Contribution

You

Contribute

DoD Auto

Contribution

DoD

Matches

Total

0%

1%

0%

1%

1%

1%

1%

3%

2%

1%

2%

5%

3%

1%

3%

7%

4%

1%

3.5%

8.5%

5%

1%

4%

10%

Q4.7. Is there a default TSP fund for opt-in eligible service members and can they change

funds?

A4.7. Uniformed Service members who opt into the Blended Retirement System will retain the

last contribution allocation on file with the TSP. If no contribution allocation is on file, a member

who opts-in to the Blended Retirement System will have their future TSP contributions invested

in an age-appropriate lifecycle fund. Remember, though, a member who opts-in who was not

previously contributing to TSP must also select a percentage of his or her pay to contribute to

TSP through myPay (or their Services automated pay system). There is no default contribution

percentage for members who opt-in. Service members can make adjustments to their TSP fund

allocation at any time online at www.tsp.gov. National Guard/Reserve specific information can

be found in Section 9.

Q4.8. If I am a new accession into one of the Uniformed Services after January 1, 2018,

how and when do I elect my TSP contributions?

A4.8. New accessions on or after January 1, 2018, will automatically be enrolled in the TSP.

Their contributions will default to the TSP Lifecycle Fund appropriate for the individual’s age,

unless the service member designates other investment funds. Service members can adjust

their TSP contribution percentage at myPay (or their Services automated pay system) and their

investment funds (current or future contributions) at www.tsp.gov or by calling the Thriftline (1-

TSP-YOU-FRST (1-877-968-3778)).

-Back to Top-

10

Q4.9. Can a Service member put their contributions into the Roth TSP?

A4.9. Service members can elect to put their contributions into a traditional account, Roth

account, or both. Service members can contribute in any whole percentage they choose

subject to Internal Revenue Code (IRC) limits. Service members can make adjustments to their

TSP account online at any time. All government automatic and matching contributions are

based on the total percentage (traditional and Roth) that the service member contributes each

pay period. All government contributions are deposited into the service member’s traditional

account.

Q4.10. What is the difference between a Traditional TSP and a Roth TSP?

Q4.10. The decision whether to invest in a traditional TSP or a Roth TSP boils down to whether

you believe you will be in a higher or lower tax bracket when you take your distributions. With

the traditional TSP, contributions are made with pre-tax money (income which has not been

taxed—it comes directly out of your pay check). With the traditional TSP, you defer paying

taxes on your contributions and their earnings until you withdraw them. If you are making

contributions to a traditional TSP while your pay is subject to combat-zone tax exclusion, your

contributions will also be tax-free at withdrawal, but your earnings will be subject to tax. With a

Roth TSP, you pay taxes on your contributions as you make them (unless you are in a combat

zone or designated support area making tax-exempt contributions), and your earnings are tax-

free at withdrawal as long as you meet certain IRS requirements. For more information visit

TSP.gov for more information.

Q4.11. Can I contribute other forms of pay to my TSP?

A4.11. You can also contribute from 1 percent to 100 percent of any incentive pay, special pay,

or bonus pay to your TSP — as long as you also elect to contribute from your basic pay – up to

the established Internal Revenue Code (IRC) limits. You can elect to contribute from incentive

pay, special pay, or bonus pay, even if you are not currently receiving them. These

contributions will be deducted when you do receive any of these types of pay. However, only

basic pay will be used in the calculation for DoD automatic and matching contributions. For

more information on other forms of contributions visit TSP.gov.

Q4.12. Is there a limit to how much I can contribute to the TSP?

A4.12. Yes, generally you can contribute up to the annual IRS elective deferral limit. Each year

the IRS sets the limit employees can defer from their paychecks. It applies to traditional and

Roth TSP accounts. This includes your basic pay, special pay and bonuses. To max out your

TSP under the current contribution limit ($18,500 for 2018) you would need to contribute

$1,541.66 per month from your pay checks. That is very aggressive, but it is certainly possible,

depending on your rank, pay grade, and living expenses. It is important to note, employer

contributions are in addition to the annual elective deferral limit. Visit TSP.gov for more

information on contribution limits. National Guard/Reserve specific information can be found in

Section 9.

Q4.13. What are TSP catch up contributions?

A4.13. Catch-up contributions are supplemental contributions that a service member age 50 or

older (or turning age 50 during the calendar year), can make to the TSP beyond the maximum

amount they can contribute through regular contributions. You can choose to make catch-up

contributions on a traditional (pre-tax or non-Roth) basis or a Roth (after-tax) basis. It does not

matter what type of regular contributions you are making. There is a yearly IRS cap on the dollar

amount of catch-up contributions. For 2018, the catch-up contribution limit is $6,000.

-Back to Top-

11

Q4.14. Are there any special provisions on TSP contributions if I am assigned to a

designated combat zone or direct support area?

A4.14. If a service member is assigned to a designated combat zone or direct support area,

contributions to their TSP are tax-exempt; that is, the money the service member contributes to

their TSP goes in tax free. For service members contributing to a Roth TSP in a tax-exempt

zone, their money would go in tax free and all earnings can be withdrawn tax free. Additionally,

if you make tax-exempt contributions to the TSP while deployed in a designated combat zone or

direct support area, the sum of your contributions and the government contributions to your TSP

account cannot exceed the IRS annual addition limit ($55,000 for 2018), which is a much higher

limit than the annual elective deferral limit. Member contributions above the annual elective

deferral limit will be placed in the traditional TSP account.

Q4.15. If an existing service member is eligible to opt into BRS, are they able to buy back

previous years of matching contributions?

A4.15. No, TSP matching is not retroactive and there is no “buy-back” option. If you opt into

BRS, you will receive the automatic 1 percent of your basic pay and up to an additional 4

percent government matching beginning the first pay period that starts after you opt-in. If you

already have a TSP account, these contributions can be added to your current account and they

can continue to grow together in the same account.

Q4.16. How do I make changes to my TSP?

A4.16. To change TSP contribution percentages or to update your address, service members in

the Army, Air Force and Navy can make changes using myPay, the Coast Guard can make

changes using Direct Access and the Marine Corps can make changes using Marine Online.

Additional guidance will be provided separately for the U.S. Public Health Service

Commissioned Corps and the National Oceanic and Atmospheric Administration (NOAA)

Commissioned Officer Corps by their respective service. Additionally, all uniformed services

can log on to TSP.gov to review account performance, print statements, make inter-fund

transfers, and submit a new contribution allocation among other TSP/fund-management

activities.

Q4.17. What if I do not have a myPay account with the Defense Finance and Accounting

Service (DFAS)?

A4.17. If you’ve never opened a myPay account, need help changing your myPay password, or

changing your email address visit myPay (http://mypay.dfas.mil). For additional assistance,

service members should consult their chain-of-command or their personnel pay office.

Q4.18. What is the default contribution percentage?

A4.18. Members who opt into BRS are not automatically enrolled at a certain TSP contribution

percentage – the default 3 percent contribution rule ONLY applies to members who are

automatically enrolled in BRS, not those who choose to opt-in. After opting in, members should

go to the link on myPay that says, “traditional TSP and Roth TSP” to choose a contribution

percentage. Members who are automatically enrolled in BRS, because their Date of Initial Entry

into Military Service (DIEMS) date is on or after January 1, 2018, will be automatically enrolled

in TSP to contribute 3 percent of their basic pay (or Inactive Duty Pay, sometimes referred to as

Drill Pay in the National Guard and Reserve) starting with the pay period that begins on or after

the member’s 60

th

day of service.

-Back to Top-

12

5. Retirement Annuity

Q5.1. If a service member ops into BRS and retires after 20 years, will they still get an

annuity?

A5.1. Yes, for those service members who retire after at least 20 years of service (20 qualifying

years for the National Guard and Reserve), their retirement remains predominantly a defined

benefit in which the service member will get monthly retired pay. Under BRS, the service

member’s monthly retired pay will be calculated with a 2.0 percent multiplier (in lieu of the 2.5

percent under the legacy High-3 system), times the average of the service member’s highest 36

months of basic pay. Additional National Guard/Reserve specific information can be found in

Section 9.

Q5.2. If I remain in the legacy retirement system, what happens to my retirement plan?

A5.2. If you remain under the legacy retirement system, nothing about your current retirement

plan changes. You will still need to complete 20 years of service (or 20 qualifying years of

service if you are in the National Guard or Reserve) to receive a military retirement pension.

Q5.3. Is the retirement under BRS divisible in a divorce?

A5.3. A member’s pension under the BRS is similarly subject to a divorce decree as it is under

the legacy retirement plan and subject to state court decisions.

Q5.4. When does retired pay begin?

A5.4. BRS does not change any of the existing rules about when the military retired pay defined

benefit (pension) begins. If you served at least 20 years on active duty, retired pay generally

begins the first day of the first month following your retirement. If you served at least 20

qualifying years of service in the National Guard or Reserve, eligibility to receive retired pay

generally begins when you reach age 60. This age of eligibility for retired pay may be reduced

for members of the National Guard and Reserve who have certain qualifying active duty service

performed after 2008.

Q5.5. If I switch to BRS, will I get retired pay if I leave service after 4 years?

A5.5. BRS offers portable, government-provided retirement benefits to nearly all members who

serve at least two years in the form of contributions to TSP, but it does not automatically

guarantee you monthly retired pay through a defined benefit pension. To earn military retired

pay (meaning a monthly pension) you still have to have 20 years of service (or 20 qualifying

years of service if you are in the National Guard or Reserve). There are, of course, exceptions

such as when a member is retired early due to a disability.

6. Lump Sum Payment

Q6.1 What is the lump sum payment option?

A6.1 The lump sum provision of BRS gives service members choices at retirement. A service

member may choose to receive either 25 percent or 50 percent of the discounted present value

of a portion of their future retired pay, in exchange for reduced monthly retired pay. Monthly

retired pay returns to the full amount when the service member reaches full Social Security

retirement age, which for most is age 67. No such lump sum option exists under the legacy,

High-3 military retirement system. National Guard/Reserve specific information can be found in

Section 9.

-Back to Top-

13

Q6.2. Does an active duty service member have to take a lump sum payout at retirement?

A6.2. No, active component service members will have a choice to receive their full monthly

retired pay upon retirement or to elect a lump sum payment and reduced retired pay. The lump

sum payment will be calculated as either 25 percent or 50 percent of their discounted retired

pay from the date of retirement until the date the member would reach full Social Security

retirement age, which for most is 67 years old. At full Social Security retirement age, all service

members will receive their full monthly retired pay, regardless of their lump sum payment

election. National Guard/Reserve specific information can be found in Section 9.

Q6.3. When do members of the active component need to apply/request the lump sum

option?

A6.3. For active component service members, the lump sum election must be made to your

service no less than 90 days before retirement. The election of the lump sum must be made on

the DD Form 2656, “Data for Payment of Retired Personnel.” This form must be signed and

submitted no less than 90 days before retirement (for regular retirement) or the date of eligibility

to begin receiving retired pay (in the case of a National Guard or Reserve member). The

Defense Finance and Accounting Service (DFAS), will process your request for the lump sum,

which will be paid out no later than 60 days after your date of retirement or date of eligibility to

receive retired pay. National Guard/Reserve specific information can be found in Section 9.

Q6.4. If a service member dies before age 67, does the surviving spouse need to repay

the lump sum?

A6.4. Once the lump sum is elected, any portion of that lump sum that has been distributed to

the service member belongs to the individual – it will not be recouped in the event of death.

However, the residual annuity will end. If the Service member is enrolled in the Survivor Benefit

Plan (SBP), the surviving spouse or dependent beneficiary will begin receiving an annuity

through that program. For more information about SBP visit

https://www.dfas.mil/retiredmilitary/provide/sbp.html.

Q6.5. What "discount rate," will DoD use to measure the value in calculating a service

member’s lump sum payout under the BRS?

A6.5. The discount rate will be published each year and is based on a Department of Treasury

published market rate, plus a factor that accounts for the unique aspects of military service. The

formula for calculating the lump sum discount rate is outlined in the BRS implementation

guidance, found in attachment 2 at http://militarypay.defense.gov/BlendedRetirement.

Q6.6. Can a service member roll over their lump sum distribution to the TSP, in part to

minimize the tax implications?

A6.6. Lump sum payments may not be rolled over into another retirement plan. Only an

"eligible rollover distribution" can be moved to another retirement plan. In order for a distribution

to be eligible to rollover, among other things, it must come from a "qualified trust." To keep it

simple, this is basically an employer-sponsored retirement plan that meets certain requirements

of the IRS tax code. The military retirement fund is not a "qualified trust" and therefore money

that comes from it cannot be rolled over to another retirement plan.

-Back to Top-

14

Q6.7 If I don’t serve for 20 years am I still eligible for lump sum?

A6.7. No. Lump sum refers to a portion of the monthly retired pay a service member receives

upfront after serving 20 or more years (or 20 qualifying years in the National Guard and

Reserve) and retiring with a regular or non-regular (reserve) retirement. Therefore, the lump

sum is only available for those that earn a regular or non-regular retirement. Members who

retire with a disability retirement are not eligible to elect a lump sum.

Q6.8. Does the spouse need to concur if the service member elects a lump sum?

A6.8. While service members are encouraged to discuss the decision on whether or not to take

the lump sum with their family, it is not a requirement the service member’s spouse concurs with

selection of the lump sum.

Q6.9. Can a service member take the lump sum payout across several years to minimize

tax liability?

A6.9. The lump sum is considered earned income and is therefore taxable. Service members

may choose to receive their lump sum payments in up to four installments over four years to

reduce their tax burden.

Q6.10. How do I elect a lump sum?

A6.10. A member may elect either a 25 percent or 50 percent lump sum by completing Part II of

DD Form 2656, “Data for Payment of Retired Personnel.” This form must be completed and

signed no later than 90 days prior to the member’s retirement date, or date of eligibility for

retired pay (for National Guard and Reserves). The form should be turned into the member’s

service, which will then process and submit the lump sum election to DFAS not later than 30

days prior to the member’s retirement.

7. Continuation Pay

Q7.1. What is Continuation Pay?

A7.1. BRS includes a Continuation Pay provision as a way to encourage Service members to

continue serving in the Uniformed Services. Continuation Pay is a direct cash payout, like a

bonus. It is payable between the completion of eight years of service, but before completion of

12 years of service, as determined and announced by your Service. Members receive

Continuation Pay in return for additional obligated service. Active component service members

(including Active Guard Reserve (AGR) and Full Time Support (FTS)) enrolled in the BRS will

be eligible for a cash incentive of 2.5 to 13 times their regular monthly basic pay. Reserve

Component members will be eligible for 0.5 to 6 times their monthly basic pay (as if serving on

active duty). Each service will publish guidance related to Continuation Pay rates. The rates for

each calendar year will be determined by the retention needs of the Military Services and

published. National Guard/Reserve specific information can be found in Section 9.

Q7.2. How is the 8 to 12 years of service calculated for continuation pay?

A7.2. Active duty service members and National Guard and Reserve service members in a pay

status are eligible for Continuation Pay when they complete between their 8th to 12th year of

service, which is calculated from that service member’s Pay Entry Base Date (PEBD).

Continuation Pay may be paid at any time during this time period, as determined by the Service.

-Back to Top-

15

Q7.3. What if a service member is eligible to opt into BRS, but hits 12 years of service

during the BRS opt-in window--is he or she still eligible for continuation pay?

A7.3. A service member’s eligibility to opt into the BRS is based on that member’s status as of

December 31, 2017. If they met eligibility criteria on this date, they have all of 2018 to opt into

BRS even if they eventually go over 12 years of service (active component) or exceed 4,320

retirement points (National Guard and Reserve), during calendar year 2018. However, eligibility

for Continuation Pay is based on a member’s years of service on the day they sign the

agreement to continue serving. If a Service member was eligible to opt into the BRS as of

December 31, 2017, but will soon after go over 12 years of service, they must make their opt-in

decision before reaching the completion of 12 years of service if they wish to receive

continuation pay. For example, if a Service member has 11 years and 10 months of service on

or before December 31, 2017, that member would be eligible to opt into BRS anytime during

2018. However, if that same member wanted to receive Continuation Pay, he or she would only

have two months (e.g.: February 2018) to opt into BRS and agree to the additional obligated

service in order to receive Continuation Pay. Otherwise he or she will be ineligible for

Continuation Pay.

Q7.4. How is Continuation Pay determined?

A7.4. Each service will determine when and at what rate service members will receive

Continuation Pay. The Continuation Pay multiplier may be based on factors such as hard-to-fill

positions, retention rates and specialty skill, among others. The services continue to work on

guidance related to this provision. National Guard/Reserve specific information can be found in

Section 9.

Q7.5. Will a service member be eligible for other bonuses, such as a reenlistment bonus,

if he/she receives continuation pay?

A7.5. Yes, Continuation Pay can be received in conjunction with other bonus if not otherwise

prohibited by law.

Q7.6. Can you receive Continuation Pay more than once?

A7.6. No, Continuation Pay is a one-time payout to a service member, regardless of whether

they change service, component or career specialty.

Q7.7. Can the service obligation for Continuation Pay and other bonuses, such as a

reenlistment bonus, be served concurrently?

A7.7. Yes, the service obligation, as a result of Continuation Pay, can be served concurrently.

Q7.8. Can you receive Continuation Pay in the active component and then complete your

obligation in another service or component?

A7.8. Continuation Pay is designed to retain you in your current occupation, service and

component. Services will provide guidance related to fulfilling the service obligation incurred by

Continuation Pay. National Guard/Reserve specific information can be found in Section 9.

Q7.9. Is Continuation Pay part of the service member’s retirement package?

A7.9. Continuation Pay is not part of a service member’s retirement benefit, but it is essential to

maintaining DoD’s existing rates of retention of experienced personnel for the All-Volunteer

Force. DoD analysis and experience suggests that the reduction in the defined benefit (monthly

retired pay), may result in fewer members staying for a full career. Providing Continuation Pay

as a retention tool will help encourage these members to stay.

-Back to Top-

16

Q7.10. If a service member agrees to receive Continuation Pay and does not complete the

additional commitment, must the service member repay a pro-rated amount of the

Continuation Pay?

A7.10. While all situations are unique, Continuation Pay may be subject to repayment of a pro-

rated amount. The decision as to whether or not to recoup payment is determined by the

service.

Q7.11. Can Continuation Pay be contributed to the Thrift Savings Plan (TSP)?

A7.11. Yes, bonuses (such as Continuation Pay), as well as incentives and special pay can all

be contributed to your TSP. It is important to note, each year the IRS determines the maximum

amount you can contribute to tax-deferred savings plans like the TSP ($18,500 for calendar

year 2018). You should keep the annual contribution limit in mind when deciding how much you

will contribute to your TSP account from your Continuation Pay. If you reach the annual

maximum too quickly, you could lose some government matching contributions, because you

only receive government matching contributions on the first 5% of your basic pay that you

contribute each pay period. If you reach the annual limit before the end of the year, your

contributions (and consequently your government matching contributions) will stop. If you

contribute some or all of your continuation pay to your TSP and go over the IRS limit, be aware

it could result in you meeting the IRS limit earlier in the year, causing you to lose out on

additional government matching contributions.

8. Training & Education

Q8.1. What is DoD doing to educate service members who are eligible to opt-in?

A8.1. The character and substance of the changes to the military retirement benefit requires a

focus on the education of service members to ensure informed decision making about benefit

options. The education courses for leaders, financial and retirement counselors, and service

members who are eligible to opt-in are available online through Joint Knowledge Online (JKO),

Service learning management systems, and Military OneSource.

The BRS Opt-In Course (Course Code J3OP-US1332) is mandatory for all eligible service

members. The course is officially hosted on JKO at http://jko.jten.mil.

In addition to the web based courses, webinars, social media discussions, financial roundtables

and other communication tools are being utilized to educate the total force and external

stakeholders. National Guard/Reserve specific information can be found in Section 9.

Q8.2. Can service members take any of the BRS training courses?

A8.2. All BRS training courses are available to all service members on JKO, the BRS Resource

website or www.MilitaryOneSource.mil. Anyone who is looking for additional information is

encouraged to take any of the BRS course of interest to them.

-Back to Top-

17

Q8.3. How can Service members complete training?

A8.3. The preferred method of completing training is through Joint Knowledge Online (JKO),

which is accessible to all members of the military, with the exception of the . In some cases, the

same training is available on individual service’s learning management system. Additionally the

BRS Leaders Course, BRS Financial Educators Course, and BRS Opt-In Course are publically

available on MilitaryOneSource.mil for access by military families and community entities,

including Veteran and military service organizations. Remote, deployed and afloat commands

can order courses as DVDs from DIMOC for delivering training. To order, visit

www.dimoc.mil/customer/contact.html and complete the form, including the name and number

of the requested course.

Q8.4. How do service members take the BRS Opt-In Course?

A8.4. The BRS Opt-In Course (Course Code J3OP-US1332) is mandatory for all eligible service

members. The course is officially hosted on JKO at http://jko.jten.mil. The course may also be

taken on Military OneSource. In some cases, the opt-in course has been loaded onto individual

service’s learning management system (e.g.: Marine Net). The BRS Opt-In course may also be

delivered in group settings utilizing the BRS Opt-In Course facilitator guide and presentation. It

is important to note, if you take the course outside of JKO or your service’s learning

management system that the course completion certificate be presented to your training

manager or commander to be properly recorded in your training file. For more information on

completing the BRS Opt-In Course, contact your unit training manager.

Q8.5. What training is available for members automatically covered by BRS?

A8.5. The BRS New Accession Course, the fourth course in the series of BRS training, will be

given to all new members who join the service for the first time on or after January 1, 2018. It is

required within a member’s first 365 days of service, and will normally be presented during

accession training. The course will be conducted by a facilitator in a classroom setting. The

focus of this course is to ensure our newest service members have a comprehensive

understanding of their retirement benefits, with an emphasis on investing through TSP. This

course is not available on JKO, but the files to be used by the facilitator may be downloaded on

the BRS Resource website.

Q8.6. What is the Blended Retirement System education strategy?

A8.6. DoD started training military leaders in June 2016. After training leaders, the DoD’s

education efforts, in October 2016, turned to training those experts who provide personal

financial counseling to commanders, service members and their families. In 2017, the primary

effort was to train and educate the opt-in population who will be making a decision regarding

their retirement system in 2018. The mandatory BRS Opt-in Course provides eligible active-

duty, National Guard and Reserve service members an understanding of financial concepts and

an in-depth look at both the legacy retirement system and the new Blended Retirement System.

In addition to the online training, the BRS Comparison Calculator and eTutorial are available.

Q8.7. How long will the BRS courses be made available?

A8.7. Training courses will continue to be modified and updated through the feedback received

from the Joint Knowledge Online (JKO) platform. The BRS Leader Course and BRS Financial

Educators Course will be available throughout the opt-in window. The BRS Opt-in Course will

remain available on JKO for the foreseeable future.

-Back to Top-

18

Q8.8. The BRS Opt-In Course is mandatory for all eligible service members, why isn’t it

also required that service members meet with their installation Professional Financial

Manager/Counselor?

A8.8. The DoD has been positioning military Personal Financial Managers/counselors at local

installations as an important resource in the decision making process. However, we want to

ensure our service members feel comfortable with the individual they are receiving counsel from

and therefore are able to go to any trusted agent, including a PFM/C, parent, spiritual leader,

Military Service Organization or other trusted agent.

Q8.9. What does the DoD BRS Comparison Calculator provide service members?

A8.9. The BRS Comparison Calculator allows service members to compare estimated benefits

under both retirement plans prior to making a decision. The comparison calculator walks

service members through key information needed to make an effective comparison. Users can

adjust 12 data fields to see how changes to their career and savings over time will impact

retirement benefits. The BRS Comparison Calculator is available at

http://militarypay.defense.gov/calculator/brs.

National Guard/Reserve specific information can be found in Section 9.

Q8.10. There appear to be numerous calculators for comparing the two retirement

systems—which calculator does DoD recommend I use?

A8.10. The official DoD BRS Comparison Calculator is the only calculator endorsed by the DoD

for supporting a service member’s Blended Retirement System opt-in decision. However,

service members can use any calculator they feel aids them in the decision making process. It

is important to note, while other organizations have developed and fielded similar calculators,

only the DoD BRS Comparison Calculator has been validated by each of the services, the

Defense Finance and Accounting Service (DFAS) and the Department of Defense’s Military

Compensation Policy Directorate.

9. National Guard/Reserve Specific

Q9.1. How is the retirement system changing for the National Guard and Reserve?

A9.1. The new military retirement system blends elements of the legacy retirement system with

government automatic and matching contributions to a member’s Thrift Savings Plan (TSP)--a

more modern, 401(k)-style portable defined contribution plan that many civilian government

employees enjoy today. Many of the elements of the legacy retirement system remain and both

National Guard and Reserve service members should have a familiarity with how it works. The

Blended Retirement System does not change when a National Guard or Reserve member is

eligible to retire and National Guard and Reserve service members covered by the Blended

Retirement System are still eligible for reduced age retirement if they perform qualifying active

service.

Q9.2. How is eligibility for BRS different for members of the National Guard and Reserve?

A9.2. Eligibility to opt-in is much broader for the National Guard and Reserve than the active

component. Eligibility to opt into BRS is based on retirement points. National Guard and

Reserve members who had fewer than 4,320 retirement points as of December 31, 2017, and

who are in a pay status, will be eligible to opt into BRS, regardless of how many service or

qualifying years they have accumulated.

-Back to Top-

19

Q9.3. Why is DoD using retirement points for the Reserve Component calculation?

A9.3. The different eligibility criteria for National Guard and Reserve members is based on

language in the National Defense Authorization Act of 2016 that mandated use of 10 U.S.C.

§12733 to compute eligibility for Reserve component members; 10 U.S.C. §12733 governs how

years of service is calculated for a non-regular retirement.

Q9.4. What’s the significance of 4,320 retirement points?

A9.4. For retirement, National Guard and Reserve service is converted to equivalent active

service by dividing accumulated retirement points by 360. Remember, the military considers a

month as 30 days for pay purposes, so each day is worth 1/30

th

of a month; 12 months would

then equal 360 days. Thus, a National Guardsman or Reservist with 4,320 retirement points

would have 12 equivalent years of active service.

Q9.5. Does the new BRS change how National Guard and Reserve members acquire

retirement points?

A9.5. No. The Blended Retirement System does not change how retirement points are

calculated for members of the National Guard and Reserve. Points are still earned by

participating in drill, attending annual training and completing active duty, among other eligible

categories. BRS does not affect when a member of the National Guard or Reserve is eligible to

retire. Retirement eligibility and timing remains the same as it is under the legacy retirement

system. National Guard or Reserve members with 20 or more qualifying years are eligible to

receive their monthly retired pay starting at age 60 or earlier based on qualifying active service.

Q9.6. Are members of the Individual Ready Reserve (IRR) or Standby Reserve eligible to

participate in the BRS?

A9.6. Members of the IRR and Standby Reserve are eligible to participate in the BRS.

However, they must be receiving pay to enroll in BRS. Therefore, members of the IRR and

Standby Reserve who are eligible to enroll in the new system (because they were in the IRR or

Standby Reserve as of December 31, 2017), but who do not drill in a paid status or are not on

orders during calendar year 2018, will be allowed a one-time extension of the enrollment

window beyond 2018 if and when they enter a paid status.

Q9.7. How long does a member of the IRR or Standby Reserve have to opt-in once in pay

status?

A9.7. If a member of the IRR and Standby Reserve returns to a pay status in 2018, they will

have the remainder of 2018 to make an opt-in decision. After 2018, all BRS-eligible members of

the IRR and Standby Reserve will have 30 days to opt into the Blended Retirement System

upon the first time he or she returns to a pay status.

Q9.8. How will it work when a National Guard or Reserve service member retires under

the Blended Retirement System?

A9.8. The Blended Retirement System does not affect when a member (either active duty,

National Guard or Reserve) is eligible to retire. It still remains the same; qualified National

Guard and Reserve service members are eligible to receive their retirement pay starting at age

60 or earlier based on qualifying active service.

-Back to Top-

20

Q9.9. I have a civilian 401(k) (or civil service TSP) and a military TSP account. Can I

contribute to both?

A9.9. Yes, however the TSP and similar civilian retirement plans (e.g., 401(k)), share the same

annual contribution limit ($18,500 for 2018) under IRS regulations. This means you cannot

contribute more than the IRS elective deferral limit across both accounts in any given calendar

year. Generally, this will not impact active component service members. However, many

members of the National Guard and Reserve are either military technicians and have access to

both a military TSP and a civil service TSP account, or are traditional members of the National

Guard and Reserve who have another retirement plan through their civilian employment. As

such, service members can make contributions to their TSP accounts and/or a 401(k) or similar

retirement account in the same tax year, but are subject to a single IRS elective deferral limit.

Service members should be careful not to exceed their annual contribution limit across their

retirement accounts. If a service member’s contributions reach the IRS elective deferral limit

before the last pay date of the year, they will not receive all of the matching contributions to

which they would otherwise be entitled. The only time a service member can exceed the IRS

elective deferral limit is when they are deployed to a combat zone or direct support area or

contributing catch-up contributions. It is important to note, this annual additional limit includes

automatic and matching contributions to the service member’s retirement accounts from all

sources. Visit TSP.gov for more on contribution limits.

Q9.10. Does a National Guard or Reserve service member’s Thrift Savings Plan (TSP)

election percentage carry-over when activating or deactivating?

A9.10. National Guard and Reserve service members will not have to re-elect TSP percentages

every time their pay status changes (activating and deactivating) – TSP elections carry-over.

Q9.11. How does the lump sum payment work for the National Guard and Reserve?

A9.11. Like their active duty counterparts, eligible National Guard and Reserve members have

the option of electing a lump sum payment upon becoming eligible to begin receiving retired pay

at age 60, or earlier with creditable active service, in exchange for a reduced level of monthly

retired pay until reaching full Social Security retirement age, which is age 67 for most people.

Upon reaching full Social Security retirement age, the service member reverts to receiving full

(not reduced) retired pay.

Q9.12. When do members of the National Guard and Reserve need to apply/request the

lump sum option?

A9.12. For National Guard and Reserve members, the lump sum election must be made no less

than 90 days before eligibility for retirement pay begins. This is typically at age 60, or earlier

based on creditable active service. The election of the lump sum may be made on DD Form

2656, “Data for Payment of Retired Personnel.” This form must be signed and submitted no

less than 90 days before the date of eligibility to begin receiving retired pay. The Defense

Finance and Accounting Service (DFAS), will process your request for the lump sum, which will

be paid out no later than 60 days after your date of retirement or date of eligibility to receive

retired pay.

-Back to Top-

21

Q9.13. At what rate will full-time National Guard and Reserve members receive for

Continuation Pay?

A9.13. The National Defense Authorization Act of Fiscal Year 2017 clarifies that Active Guard

Reserve (AGR) and Full Time Support (FTS) service members are eligible for the same rates of

Continuation Pay as their active component counterparts. FTS and AGR will be eligible for a

cash incentive of 2.5 to 13 times their regular monthly basic pay.

Q9.14. For Continuation Pay, must National Guard and Reserve service member’s

obligated service be performed in the Select Reserves (SELRES) if they receive

Continuation Pay, or can they be part of the Individual Ready Reserve (IRR) or Standby

Reserve?

A9.14. National Guard and Reserve service members must be able to serve their Continuation

Pay obligated service in the Selected Reserve if they receive Continuation Pay.

Q9.15. How will the training program be shared with the National Guard and Reserve?

For example, will Unit Training Assemblies/drill time be used for financial readiness

training? Will installation and financial counselors/educators be available to Guardsmen

and Reservists?

A9.15. DoD continues to work closely with National Guard Bureau and Reserve Component

leaders who are focused on leveraging curriculum and materials to educate their force and

family. DoD purposefully designed each BRS online course, so it would be available not only

via Common Access Card (CAC) enabled websites, but also available without a CAC on

www.MilitaryOneSource.mil, for access by members of the National Guard and Reserve when

not attending drill. Additionally, the BRS Opt-in Course is available on DVD and PowerPoint for

use by leaders during commander’s calls and other unit formations or musters. Each of the

components (National Guard and Reserve) are responsible for rolling out their own training and

education plan to reach each of their eligible members. National Guard and Reserve service

members will be provided duty time for completing the mandatory online BRS Opt-in Course

and, if they choose, meeting with the installation/state/unit personal financial manager or

counselor.

Q9.16. Will National Guard and Reserve service members earn retirement points under

the Blended Retirement System as they do under the Legacy Retirement System today?

A9.16. Yes, the Blended Retirement System does not change the manner in which members of

the National Guard or Reserve earn retirement points.

Q9.17. How will those points be calculated?

A9.17. The Blended Retirement System does not change how retirement points are calculated

for members of the National Guard and Reserve. Upon eligibility for retired pay, the member's

retirement points are divided by 360 to arrive at an equivalent years of active service, similarly

as under the legacy retirement system. The Blended Retirement System does not change

when a member is eligible to retire. Furthermore, Reserve component members covered by the

Blended Retirement System are still eligible for reduced age retirement if they perform qualifying

active service.

-Back to Top-

22

Q9.18. What BRS resources are available for National Guard and Reserve members?

A9.18. DoD is committed to providing tools and information geared specifically toward the

National Guard and Reserve. This includes focused training, communication products, and

questions and answers tailored to the National Guard and Reserve. Visit the BRS Resource

Website at http://militarypay.defense.gov/BlendedRetirement for the latest products.

Additionally, the National Guard and Reserve have access to State professional financial

counselors. For those remote Guardsmen and Reservists, www.MilitaryOneSource.mil can

answer financial questions or refer you to a qualified counselor.

10. Other Resources

DoD Blended Retirement System Resource Webpage:

http://militarypay.defense.gov/BlendedRetirement

Blended Retirement System Opt-In Course (CAC required):

https://jkosupport.jten.mil/html/COI.xhtml?course_prefix=J3O&course_number=P-

US1332

Blended Retirement System Opt-In Course (non-CAC required):

http://jko.jten.mil/courses/brs/OPT-IN/launch.html

Blended Retirement System Leader Course: (CAC required): https://jkodirect.jten.mil

Blended Retirement System Leader Course: (Non-CAC):

http://jko.jten.mil/courses/brs/leader_training/Launch_Course.html

Military OneSource Website: www.militaryonesource.mil

A myPay account is required to make BRS and TSP elections: https://mypay.dfas.mil

Information on the Thrift Savings Plan (TSP) can be found at www.tsp.gov

Learn more about saving money, reducing debt, and building wealth:

www.militarysaves.org

Social Security Retirement Planner:

https://www.ssa.gov/planners/retire/agereduction.html

11. Index of Questions

1. Blended Retirement System (General)

Q1.1. How has the military retirement system changed?

Q1.2. Why was this new blended retirement created?

Q1.3. When does the BRS take effect? Who is affected?

Q1.4. If I remain in the legacy retirement “high-3” system, how does my retirement

change?

Q1.5. I am a member of the United States Public Health Service Commissioned

Corps (USPHS) or the National Oceanic and Atmospheric Administration

Commissioned (NOAA) Officer Corps, does the Blended Retirement System pertain

to me?

Q1.6. Is the BRS right for me?

Q1.7. Do you think that DoD will see a large number of service members leave

because of the new Blended Retirement System?

Q1.8. Which plan does DoD believe is the best for current service members?

23

Q1.9. If I opt into BRS will my previous military service be calculated under the

legacy system multiplier of 2.5 percent?

Q1.10. What financial resources will be available to service members at their

installations?

Q1.11. Does BRS affect my ability to participate in the Survivor Benefit Plan?.

Q1.12. Does BRS affect Veterans Affairs (VA) disability compensation?

Q1.13. Will CSB/REDUX still be available to service members when BRS is

implemented?

2. How to Opt-In

Q2.1. How will service members be notified if they are eligible for opting in to the

blended retirement system?

Q2.2. When do service members need to make a choice about BRS?

Q2.3. How do I opt into BRS?

Q2.4. Does it make a difference if I opt into the new system at the beginning of 2018

or at the end of 2018?

Q2.5. If a service member is eligible for BRS do they need to do anything?

Q2.6. What should service members be most aware of when deciding whether to opt

into BRS?

Q2.7. If I elect to opt into the new Blended Retirement System can I change my mind

later?

Q2.8. I mistakenly opted into the Blended Retirement System and want to change

my election, can I get a waiver of the policy?

Q2.9. Does the service member’s spouse need to concur with the member’s decision

to opt into BRS?

Q2.10. Will cadets and midshipmen at the service academies or in the Reserve

Officer Training Program (ROTC) be given a choice between the BRS and legacy

retirement system?

Q2.12. I just opted in to BRS… Now what do I do?

3. Auto Enrollment

Q3.1 If I entered the military after 1 January 2018, what do I need to know about the

Q3.2. If I want to enter the legacy (High-3) system, can I get a waiver?

Q3.3. What if I have a break in service—can I still opt into the Blended Retirement

System?

Q3.4. I just joined the service, am I automatically enrolled, or do I need to take

specific action?

Q3.5. So, TSP is part of BRS, what is it, exactly, and how does it work?

Q3.6. I was in the Delayed Entry Program (DEP), am I automatically covered by

BRS?

Q3.7. What is the difference between DIEMS and PEBD?

4. Thrift Savings Plan (TSP)

Q4.1. What is the Thrift Savings Plan (TSP) and what is the Federal Retirement

Thrift Investment Board (FRTIB)?

Q4.2. How does the TSP figure into the BRS?

Q4.3. I opted into BRS, when will I be enrolled in TSP?

Q4.4. I just joined the service, when will I be enrolled in TSP?

-Back to Top-

24

Q4.5. Does the money in the TSP belong to the service member?

Q4.6. How much will the DoD contribute to my TSP?

Q4.7. Is there a default TSP fund for opt-in eligible service members and can they

change funds?

Q4.8. If I am a new accession into one of the Uniformed Services after January 1,